DeFi has created an alternative, inclusive financial system, replicating & innovating beyond traditional finance. However, DeFi trading products can be complex.

In this guide, we'll delve into how trading work in DeFi, essential terms, and the associated risks and benefits. By the end, you'll be well-equipped to engage confidently in DeFi trading, setting the stage for your DeFi journey.

Wave 7 Timeline and Point

-

Duration: Dec 08 - Dec 16, 2023

-

Point: 300

-

Link to join: intract.io/linea/quest/6572fc0bef415b56fd67608f

Knowledge to obtain

Unraveling Complex Trading Products

DeFi reimagines finance with its modular "money legos" allowing for novel and inclusive financial products. Yet, with innovation comes complexity. It's crucial to grasp these DeFi products before diving in

Order Book, RFQ, and OTC DEXs

-

Order book DEX: An order book DEX uses an order book—or, a list of buy and sell orders—to match buyers and sellers at prices they are both willing to accept. An order book DEX displays the buy and sell orders, by price level, with the details of price and quantity. When there is a match, the DEX executes the trade.

-

RFQ DEX: An RFQ DEX is similar to an order book DEX in that buyers and sellers are matched for trades. However, with an RFQ DEX, there is no order book. Instead, a trader requests a quote for a specific amount of the asset. Market Makers then respond to that request with price quotes. The original trader can accept one of the quotes, and then execute the trade. An RFQ DEX can offer “personalized” pricing on an asset.

-

OTC DEX: One variation on the RFQ DEX is the OTC DEX. An OTC DEX has a similar trading model, but with OTC the trades are more focused on direct, one-to-one private negotiations between parties with no public order book and less market transparency.

Derivatives in Crypto

Derivatives in crypto, pegged to underlying assets, include leveraged perps for open-ended trades, futures for future-dated buying/selling, and options granting the choice to transact in the future. These instruments are vital for managing investment risks tied to market fluctuations.

Risks Associated with Complex Trading Products in DeFi

DeFi trading carries risks, like liquidation from poor risk management and leverage misuse, amplifying gains and losses. Beyond personal control, there are smart contract flaws, protocol failures, and market instabilities like regulatory changes and volatility to consider.

Don’t take these risks lightly, always execute proper risk management.

Task to do

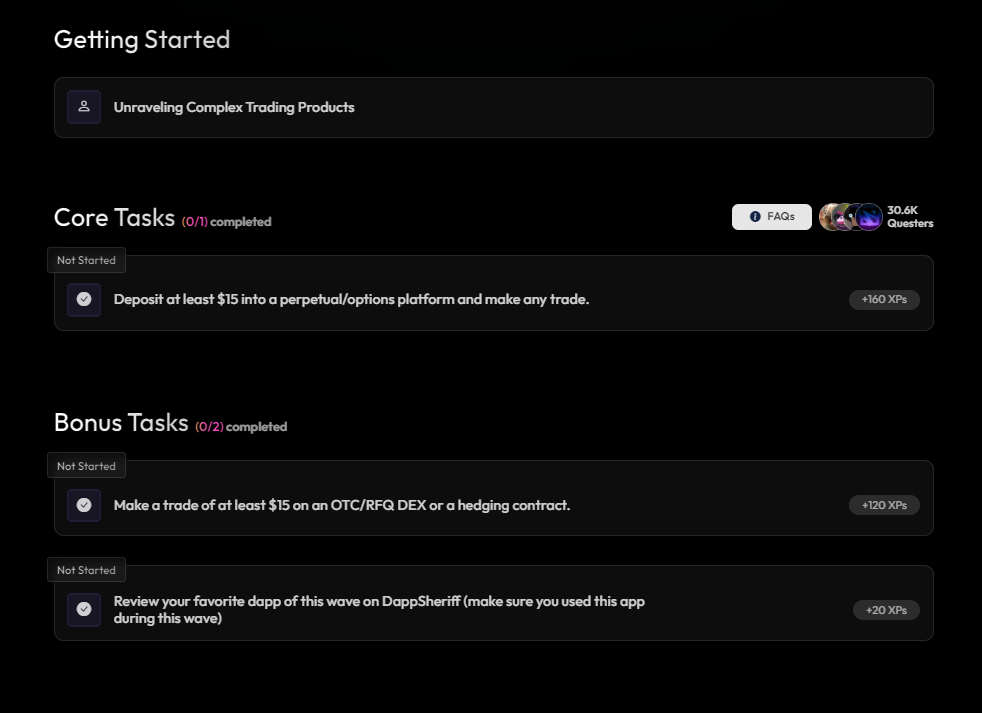

Core task: Deposit at least $15 into a perpetual/options platform and make any trade.

Task Instructions

The core task for this wave is focused on engaging with a perpetual/options trading platform. Begin by selecting a platform from our list of DEX partners, deposit a minimum of $15, and then execute any trade of your choice. It's essential to follow the trading guidelines and protocols of the chosen platform. Do not use >2x leverage, unless you are an experienced trader.

Step-by-Step Guide

-

Choose the partner app of your choice & click “Continue”

-

Watch the walkthrough video to learn how to use the app

-

Click on “Go to project now” to go to the app of your choice

-

Make sure the selected network is Linea.

-

Deposit atlest $15 worth of token on the platform

-

Wait for the deposit to succeed and the balance to be reflected in your account

-

Once your deposit is successful, use this amount to make a trade on the platform

-

Make sure you carefully look at the leverage and the liquidation value to avoid any unwanted losses.

-

Once the trade is successful, come back on Intract and click on verify and wait for 50 minutes for the task to succeed.

-

Don't forget to close your position and withdraw back the amount to your wallet if neccessary.

Bonus Tasks

-

Make a trade of at least $15 on an OTC/RFQ DEX or a hedging contract.

-

Review your favorite dapp of this wave on DappSheriff (make sure you used this app during this wave)

Conclusion

The race to the finish line is on! Wave 7 of the DeFi Voyage is officially live. Be sure to subscribe to receive our latest articles.

You can also support us by minting our articles. We truly appreciate it!