revolutionizes

Gyroscope revolutionized Maker DAO Peg Stability Mechanism (PSM) to improve its resilience!

Let's discuss in detail!

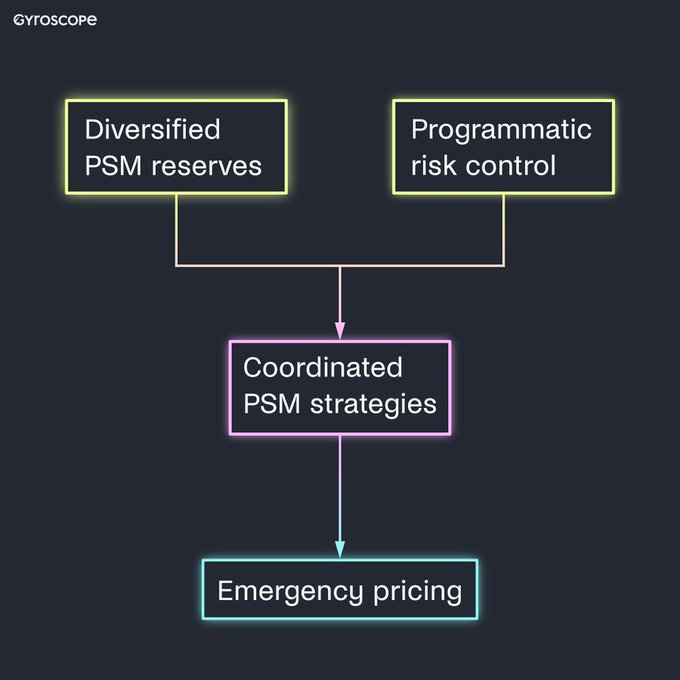

Gyroscope's Dynamic Stability Mechanism (DSM) is an innovation that consists of four key components:

1⃣ Diversified PSM reserves

2⃣ Programmatic risk control

3⃣ Coordinated PSM strategies

4⃣ Emergency pricing

Now lets investigate into each one!🔍

-

Diversified PSM Reserves:

A diversified reserve is not depended to a single asset. A well-rounded PSM includes a variety of high-quality assets and reduces overall risk. Don't put all your eggs in one basket!

Gyroscope "all-weather" reserve of assets designed to cover all major known risks that could destabilize the system. This is achieved by storing reserve assets in a series of separate "vaults".

If any of the assets within a particular vault were to fail (i.e., go to zero) or the infrastructure or smart contracts holding the assets in that vault were to be exploited (i.e., hacked), the failure of that individual vault would not affect the entire system!

By spreading risk between vaults in this way, the protocol protects itself from what is known as contagion or composability risk and seeks to eliminate single points of failure in the system.

2.

Programmatic Risk Control:

When a PSM asset drifts from its peg or gets stuck, the entire protocol is at risk. Gyroscope promotes programmable risk control, reducing reliance on governance for updates! (Code is always faster than human!)

I will describe this risk control policy in detail in the next episodes of "Why Gyroscope is a Revolution" series But for now I would like to draw your attention to Gyroscope Founder Ariah:

3. Coordinated PSM Strategies:

Different static PSMs do not talk to each other Isolated PSMs lead to lost opportunities. A more sophisticated mechanism stays informed about the overall health of all PSM assets and adjusts redemption quotes accordingly.

It is a problem because a good risk control strategy should know the global state of all PSMs to adjust policies accordingly ELI5: We need different PSM strategies for different market conditions! and we call this "dynamic" PSM the Gyroscope Dynamic Stability Mechanism (DSM)

4. Emergency Pricing:

Unforeseen shocks to reserves can trigger a currency run. Rather than depleting reserves, Gyro's Improved PSM skillfully manages reserves through principled monetary policy, giving stablecoin a better chance of survival and stability.

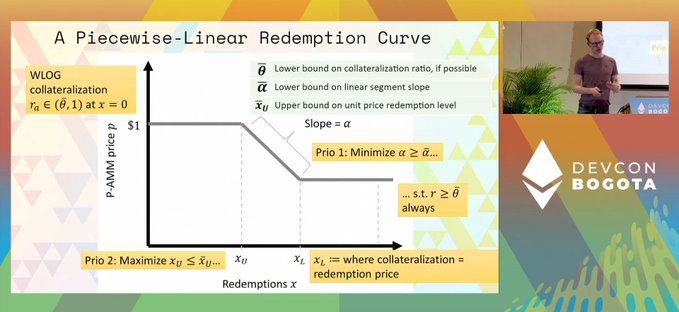

ELI5: We concluded we need different policy for different conditions. One of these conditions which DSM use in crisis is "Emergency pricing" To deepen the topic, let's take a look at the "redemption curve" Note: I'll explain "more" details about this innovation later!

As Steffen explained here, in seigniorage shares, all assets are redeemable at $1 under "all conditions" and they are backed by endogenous assets (like ETH, BTC, etc) In crises, this shares will lose all of their liquidity (as we saw in UST-LUNA, IRON, TITAN, etc)

The main reason for creating the "Redemption curve" is to avoid consuming all the liquidity by changing the redemption price based on the redemption level, which is calculated by many complicated mathematical formulas. You can see the simplified result in the chart below.

and for more details, this is the full youtube video of Steffen lecture:

Lets have a quick recap: We need a diversified reserve for our PSM (all-weather design) that has specific plans for critical conditions (programmatic risk control) and specialized policies for all market conditions (coordinated PSM strategies) that include emergency pricing.

Gyroscope made "DSM" to achieve:

-

Protect reserve ratio

-

Maintain GYD peg

-

Protect GYD holders

-

Reduce quote volatility

-

No incentives to group or subdivide transactions

-

Slow reserve drawdown

-

Support recovery

-

Efficient EVM implementation

An interesting note: The idea of DSM (improvement of PSM) was discussed by Gyroscope core team on 2021 in proposals on MakerDao forum:

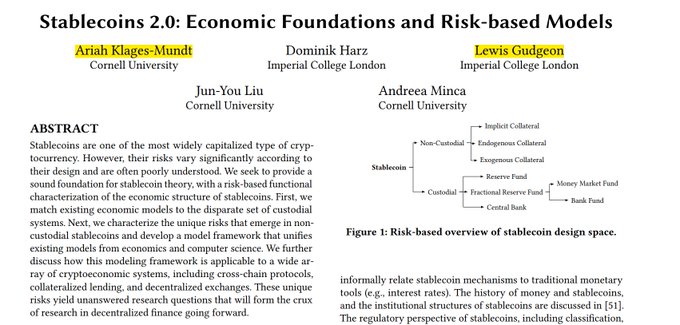

And the points mentioned in this thread about stablecoin risks and solutions were discussed in the article "Stablecoins 2.0" on 2020:

You can have all of this article as a X thread here: