Aave is a decentralized finance protocol that offers a platform for overcollateralized loans, allowing users to deposit assets as collateral to borrow other assets.

What you will find in this article:

Essentials for Getting Started:

-

A wallet: to connect and interact with Aave.

-

Asset to supply: for instance, ETH.

Opportunities on Aave:

-

Supply an asset: earn growth through APY.

-

Utilize as collateral: borrow other assets, simultaneously growing your original asset through APY.

How to supply on Aave:

1)Access Aave and connect your wallet.

2)From Aave’s Dashboard, select “Supply”. Remember, supplying an asset is necessary for it to be used as collateral.

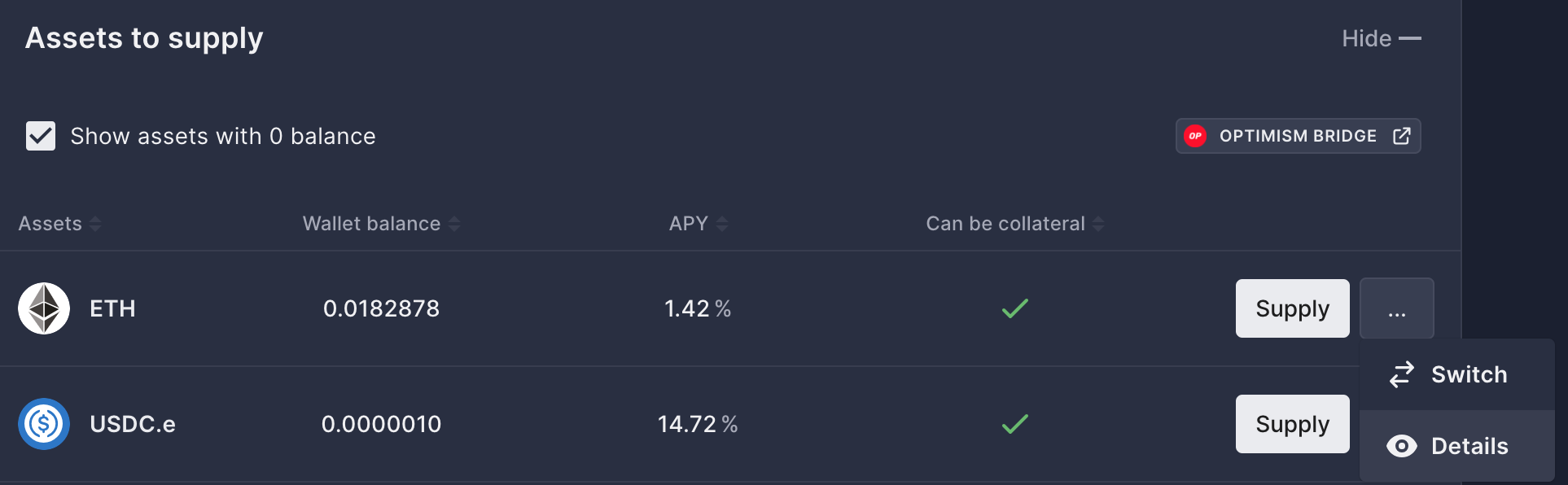

3)Choosing an asset:

- Ensure the asset is eligible for use as collateral (indicated by a tick).

-

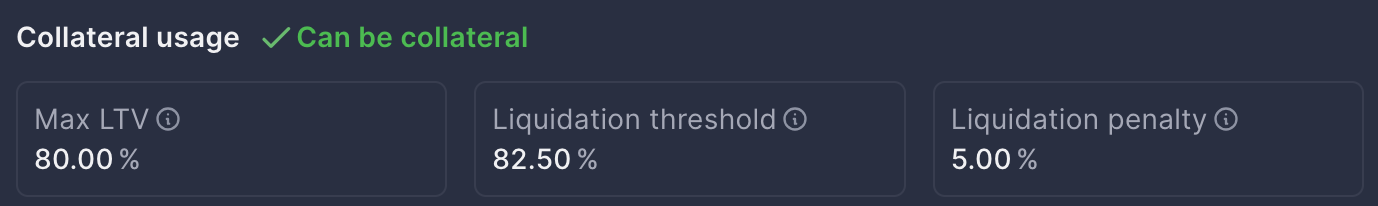

Click on “Detail” for desired assets to view:

-

Max LTV (%): Maximum Loan-to-Value (LTV).

-

Liquidation Threshold (%): determines how much you can borrow relative to your supply.

-

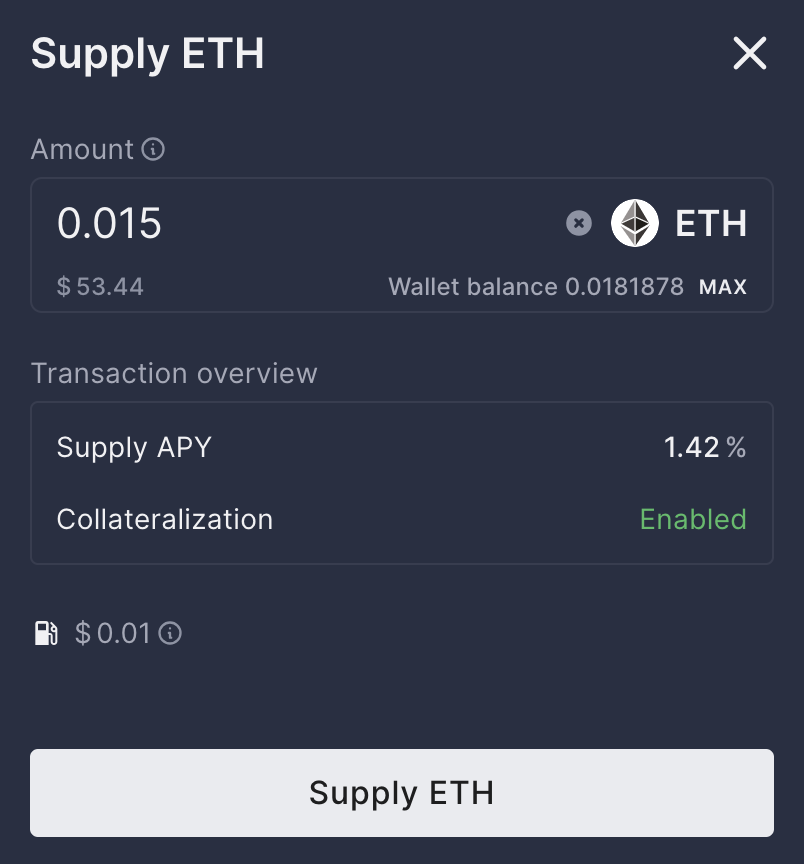

4)Suplying asset:

-

Enter the amount, noting Aave’s display of your wallet balance and the USD equivalent.

-

Review the transaction overview for deposit details, including APY.

-

Finalize by clicking “Supply [Asset]”.

Post-Supply Actions:

-

Earn APY: let your supplied asset grow.

-

Borrow: use your supplied asset as collateral to borrow others, incorporating the growth benefit.

Borrowing assets on Aave:

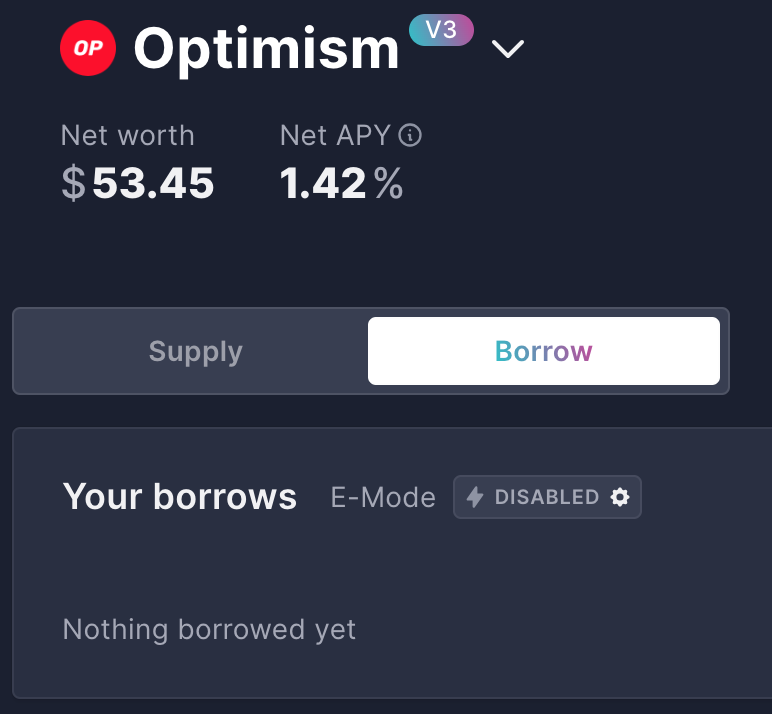

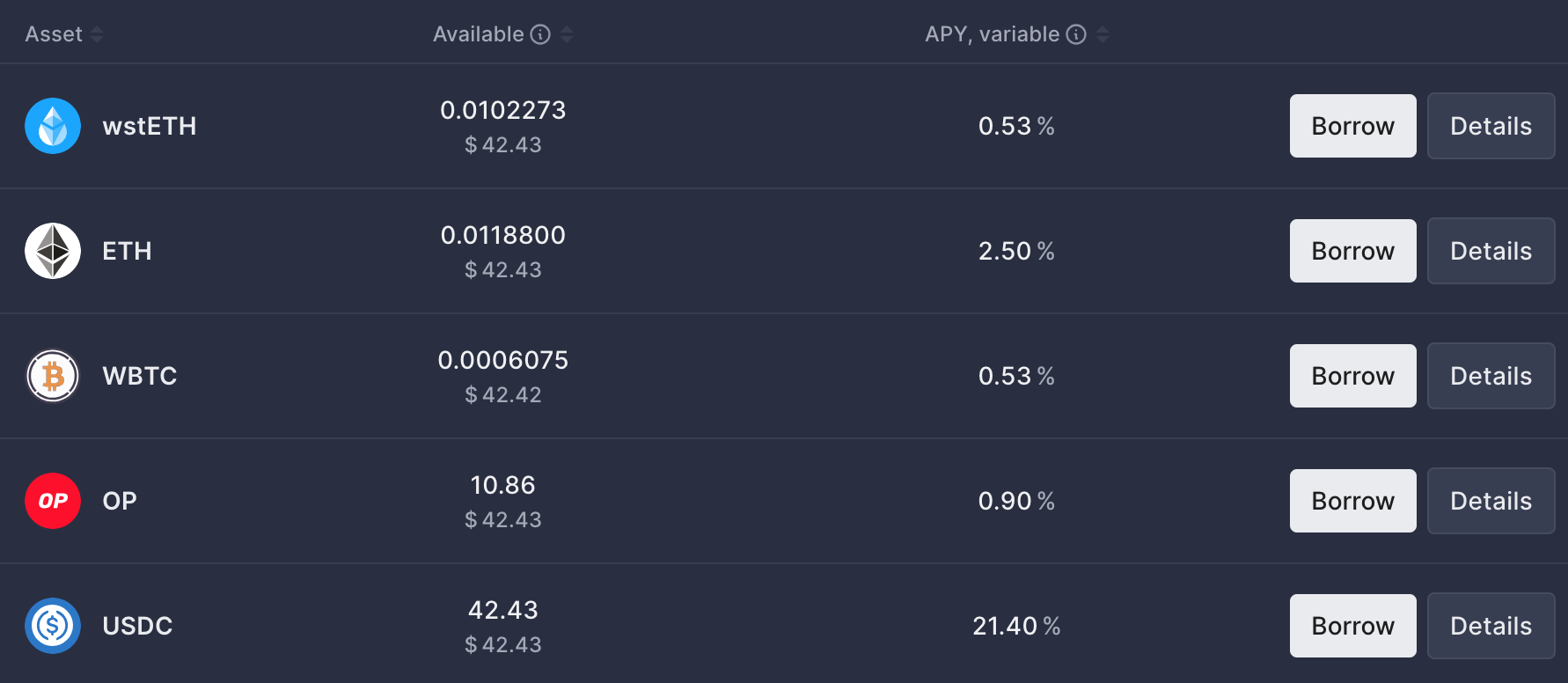

1)From the Dashboard, select “Borrow” to view available and their debt APY.

2)Aave indicates how much you can borrow based on your supplied asset in the “Available” column.

3)Initiating a Borrow:

-

Select an asset and click “Borrow”.

-

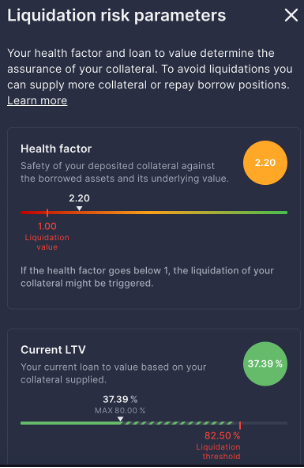

Input the amount to see how it affects your Health Factor, crucial for avoiding liquidation.

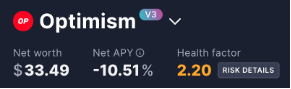

Dashboard insights:

-

Net Worth: the balance between your supplied and borrowed assets.

-

Net APY: the combined effect of all your positions.

-

Health Factor: a key indicator of liquidation risk.

-

Risk details: additional insights including your current Loan to Value (LTV) ratio.

Key Notes:

1) APY Variation: market conditions influence APY, with stable assets typically offering higher APY in bullish markets due to demand.

2) Liquidation management: aim to keep Health Factor well above 1 and LTV below Liquidation Threshold is essential for preventing liquidation.

This guide outlines the straightforward steps for supplying assets on Aave and leveraging them as collateral for borrowing, offering a pathway to maximize your digital asset strategy effectively.

Lynn Brooke

This article serves educational purposes and is not financial advice. We encourage you to do your own research and be responsible for your actions in the financial space.