In this article, we’ll walk through the process of depositing assets on Silo Finance, enabling you to participate in its secure lending markets.

What you will find in this article:

Introduction:

Silo Finance offers a unique structure in DeFi by creating isolated lending markets, which provide enhanced security by containing risks within individual “silos” (or markets). This setup allows users to deposit assets as collateral for borrowing, ensuring exposure is limited to the specific market they engage with.

What you need:

-

A connected wallet.

-

Assets you wish to deposit.

How to deposit on Silo Finance

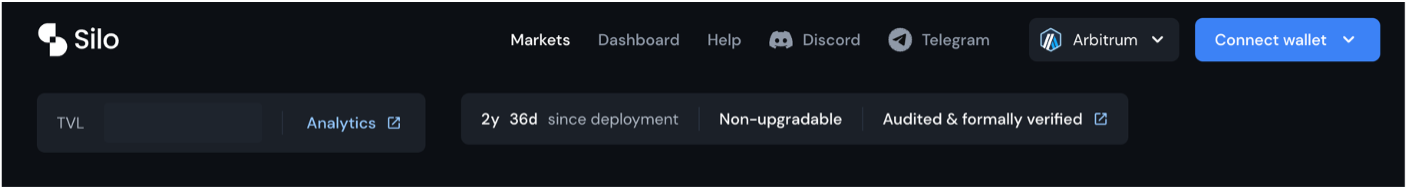

1)Access the dApp: go to app.silo.finance .

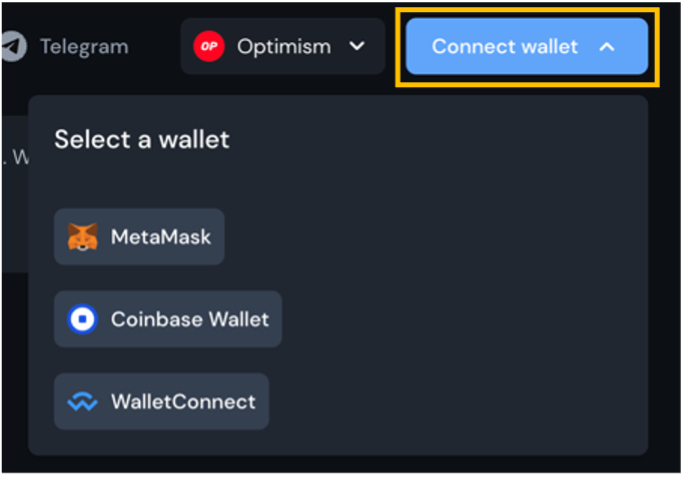

2)Connect your wallet: click on the “Connect Wallet” button in the top-right corner and select your preferred wallet provider. Follow the prompts to connect.

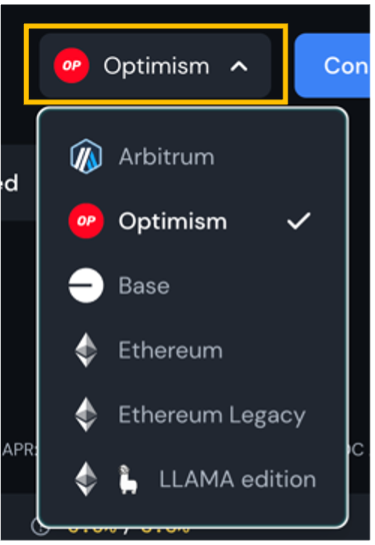

3)Select your Silo deployment: choose the network you want to operate on by using the drop-down menu in the top-right corner.

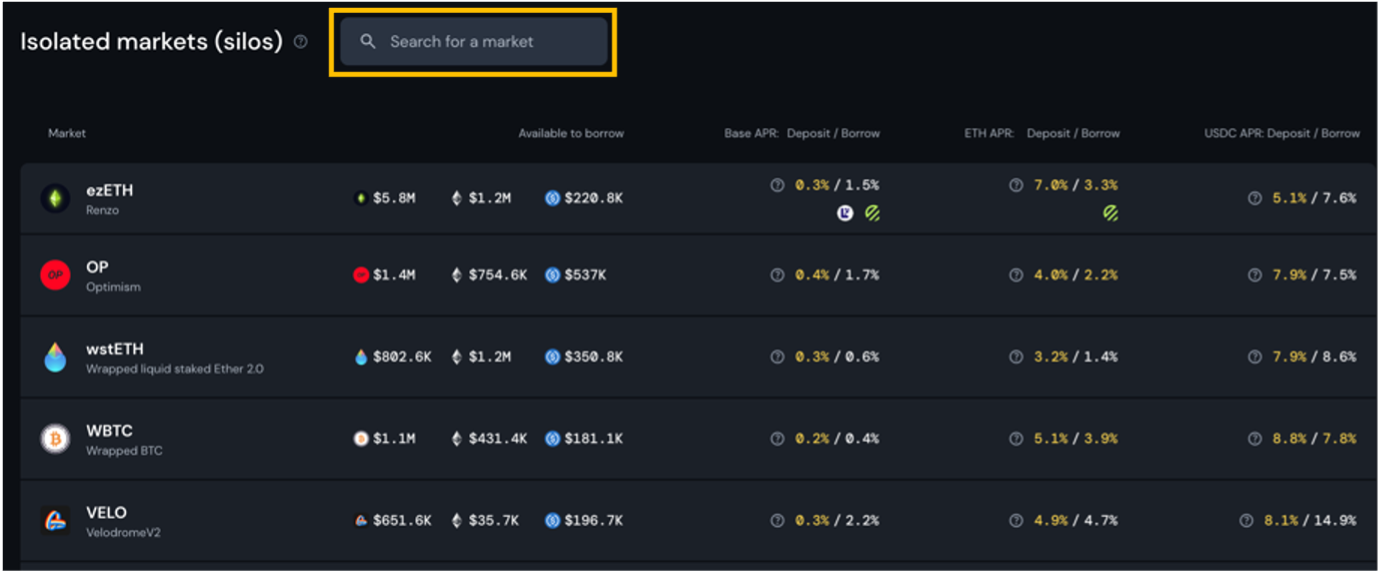

4)Navigate to “Markets”:

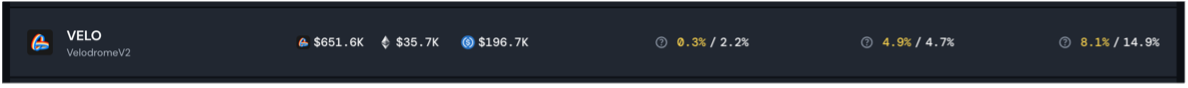

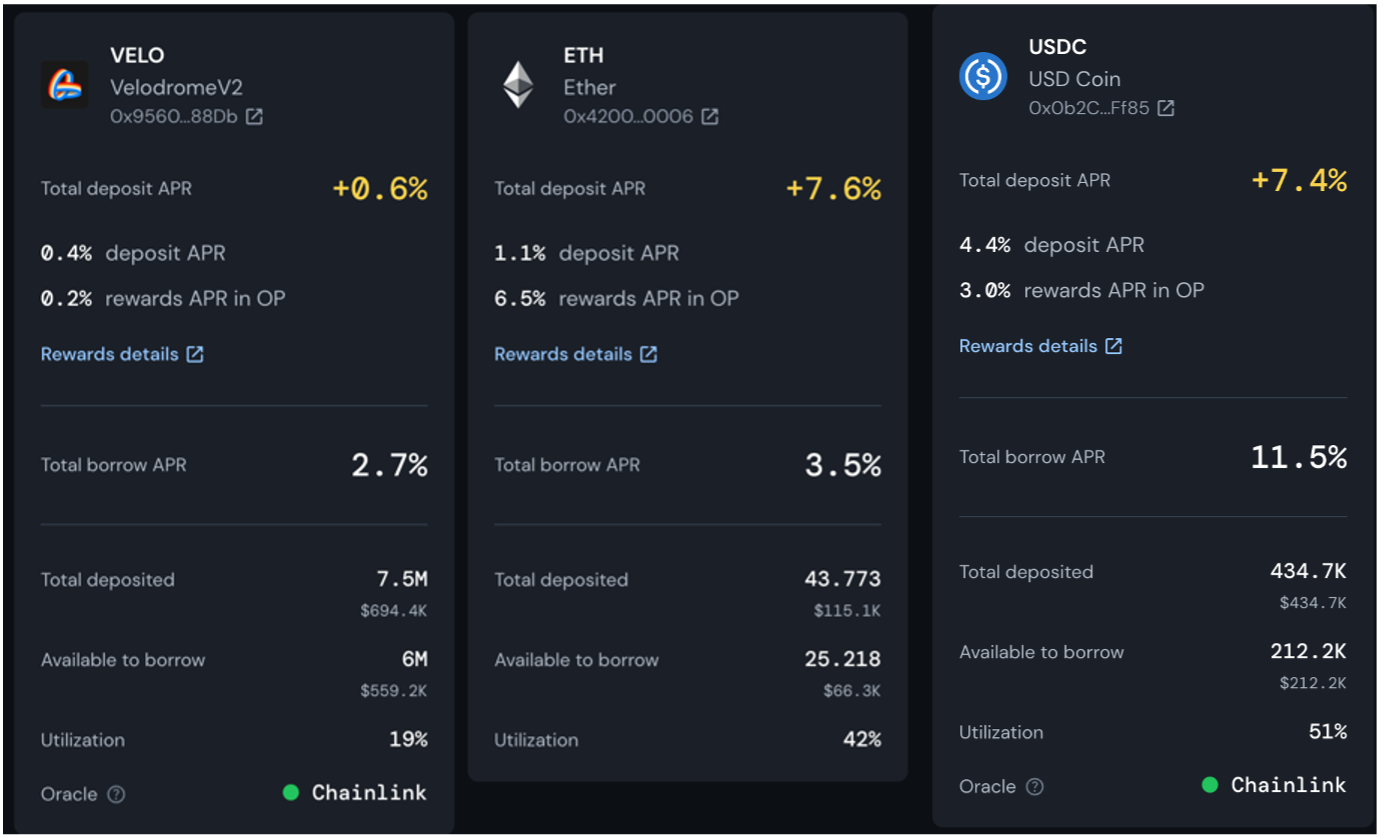

- On the top navigation bar, click “Markets” to view available lending pools.

- Use the search function or scroll to find the market you wish to interact with.

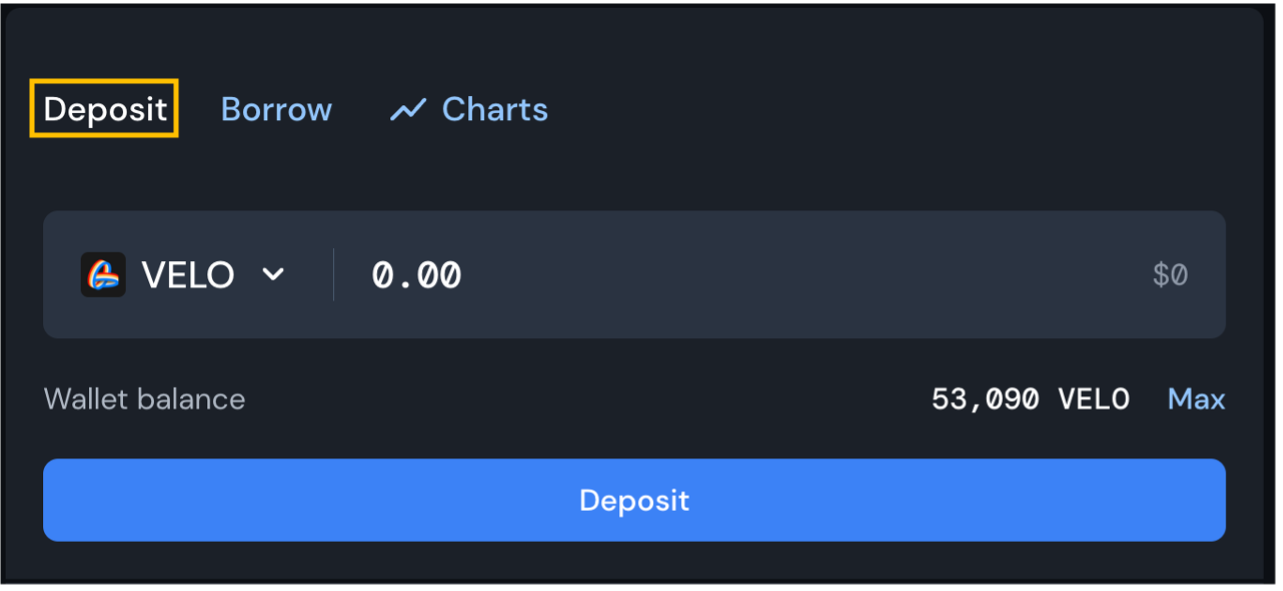

5)Deposit into a Market:

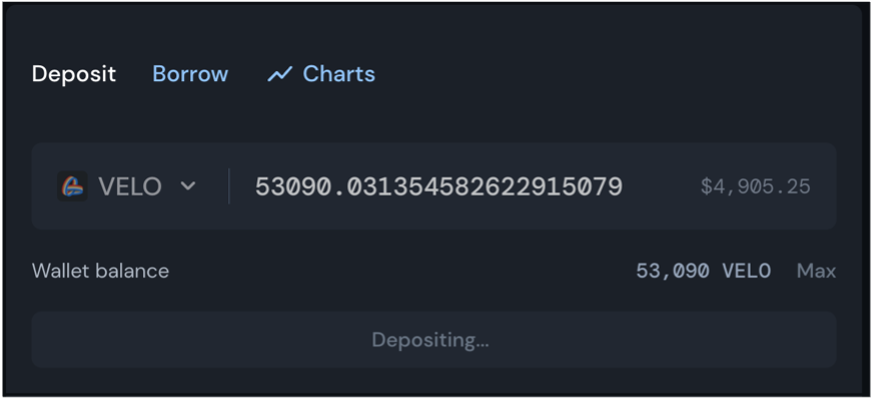

- Once you have selected your market, you will be redirected to the “Deposit” section.

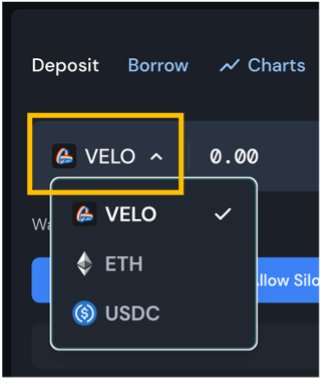

- Select the token: from the drop-down menu, choose the token you wish to deposit.

- Enter the amount: input the amount of the token you’d like to deposit, or click “MAX” to deposit the full amount available in your wallet.

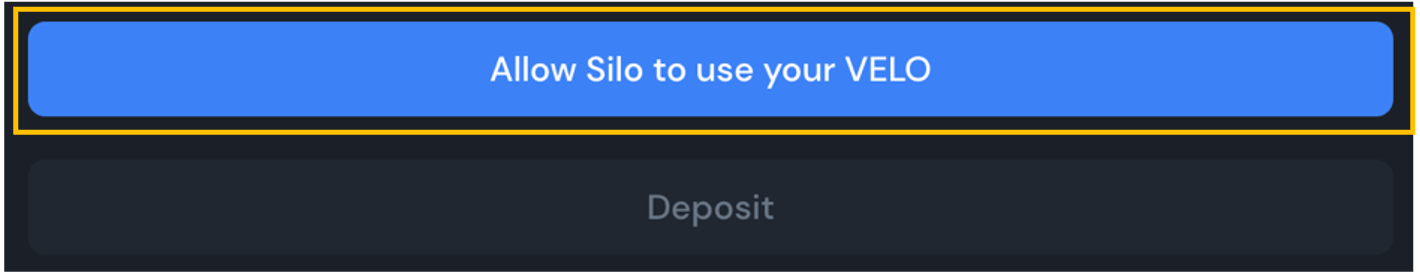

- Allow token usage: confirm that Silo Finance has permission to use your tokens by signing the transaction in your wallet.

6)Choose your deposit type:

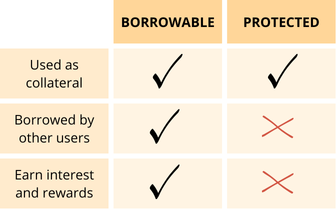

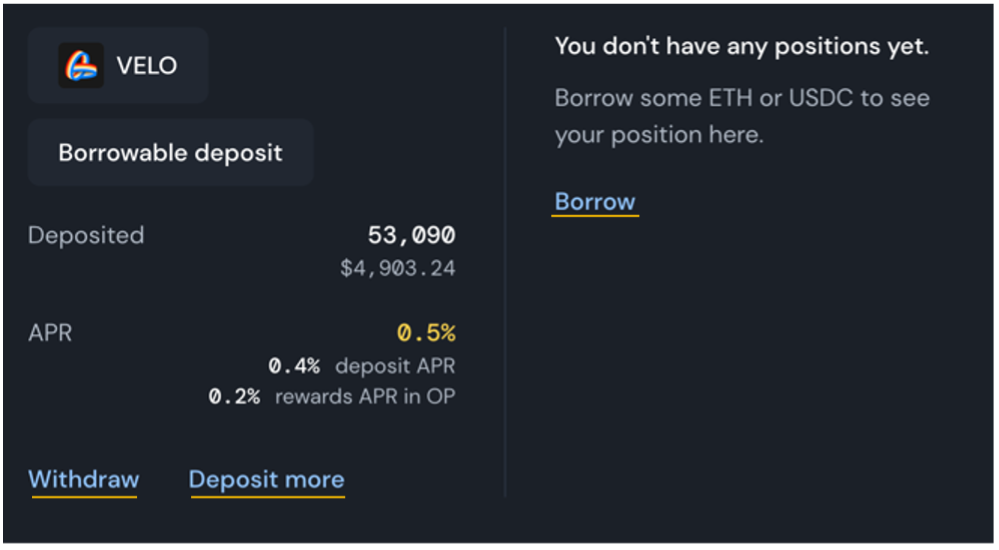

-

Borrowable deposit: set to “YES” if you want your deposit to be available for others to borrow. This will allow you to earn interest and rewards.

-

Protected deposit: set to “NO” if you do not want your collateral to be borrowed. This will prevent earning interest but guarantees liquidity access.

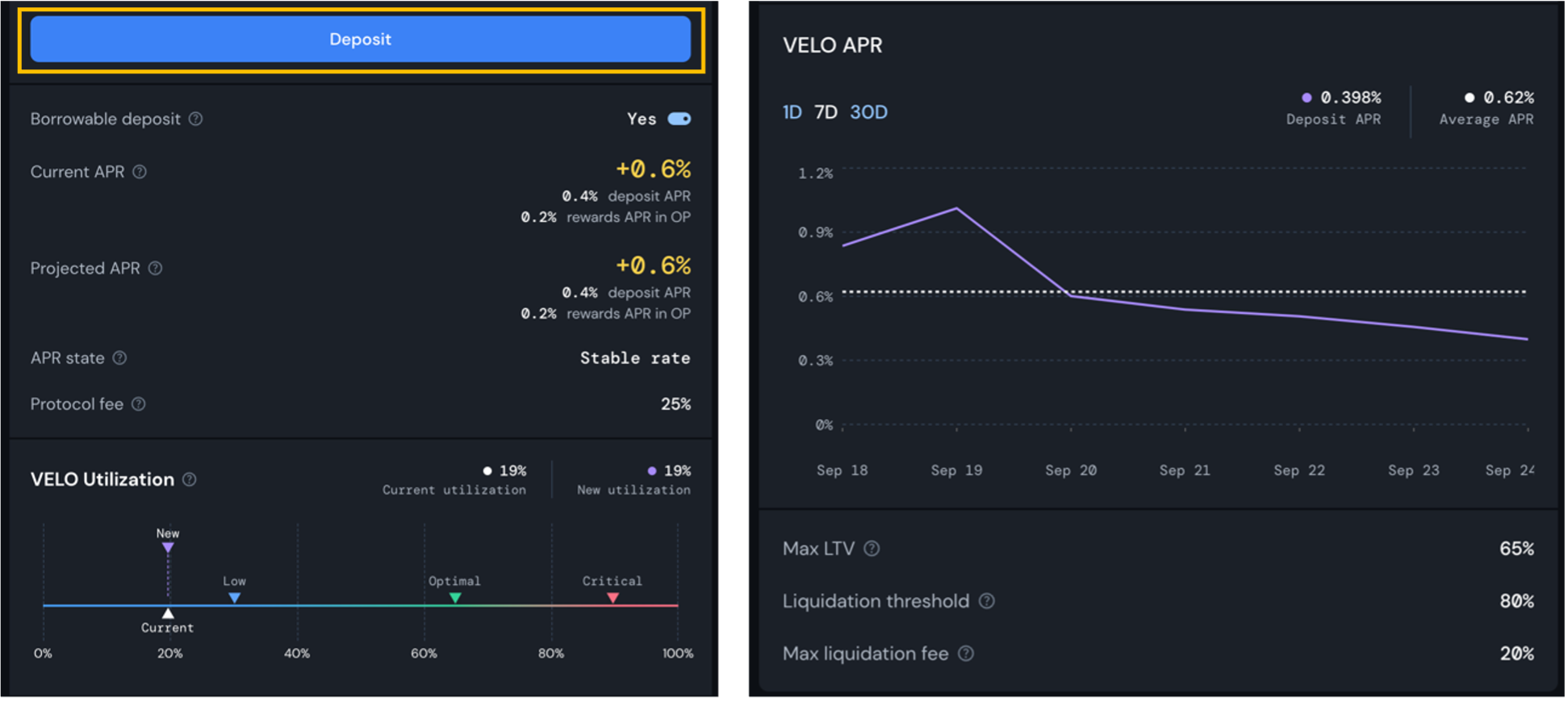

7)Complete the deposit: once your selections are made, click “Deposit” to proceed. Check all the information related to your deposit in the selected market below the “Deposit” button. After confirming the transaction in your wallet, the process will be complete.

8)Review your deposit: once the deposit is confirmed, you will see your balance and additional options like “Withdraw”, “Deposit more”, and “Borrow” appear on the right side of the page.

By following these steps, you have successfully deposited your assets into a Silo market. Whether you want to borrow against your collateral o simply earn interest, you are ready to explore more of Silo’s Finance’s features, like borrowing, which is explained in the next article.

Lynn Brooke

This article serves educational purposes and is not financial advice. We encourage you to do your own research and be responsible for your actions in the financial space.