In the previous article “Extra Finance farming: Elevating Leverage”, the focus was on how to increase leverage for farming deposits on Extra Finance. Equally crucial is for users to understand how to decrease leverage to increase the safety margin between the asset’s current market price and the liquidation price set in their farming deposit according to their leverage level. This understanding is vital because if the asset price fall to the liquidation price, the deposit would be liquidated, resulting in the user losing their deposit.

What you will find in this article:

Reducing leverage in Extra Finance is straightforward:

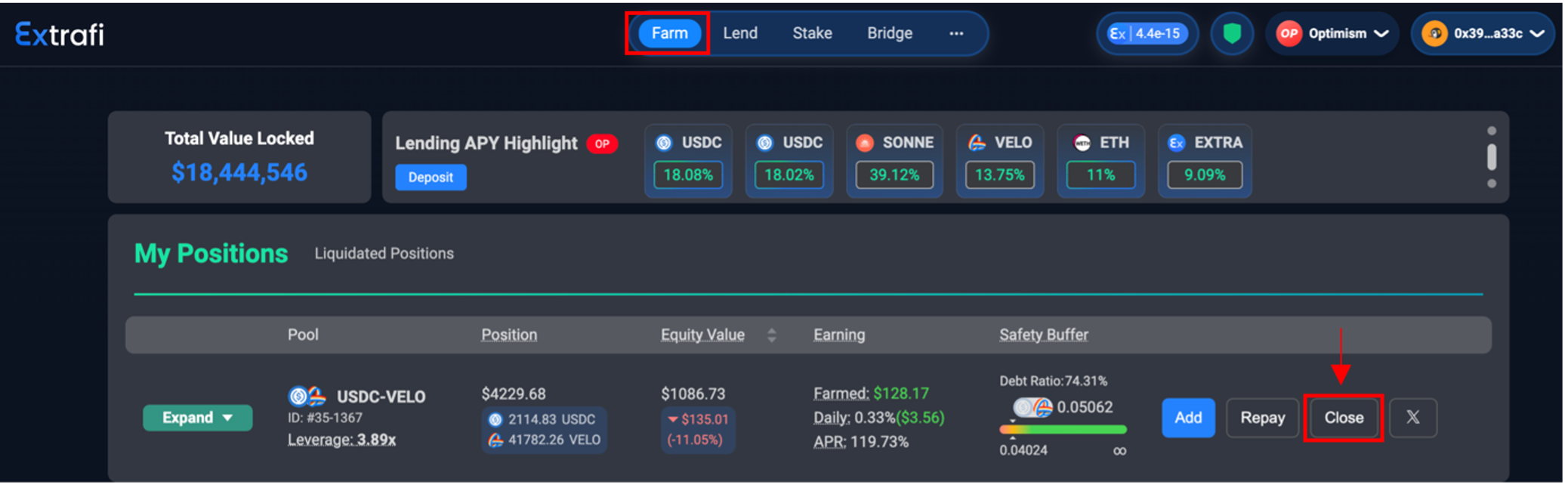

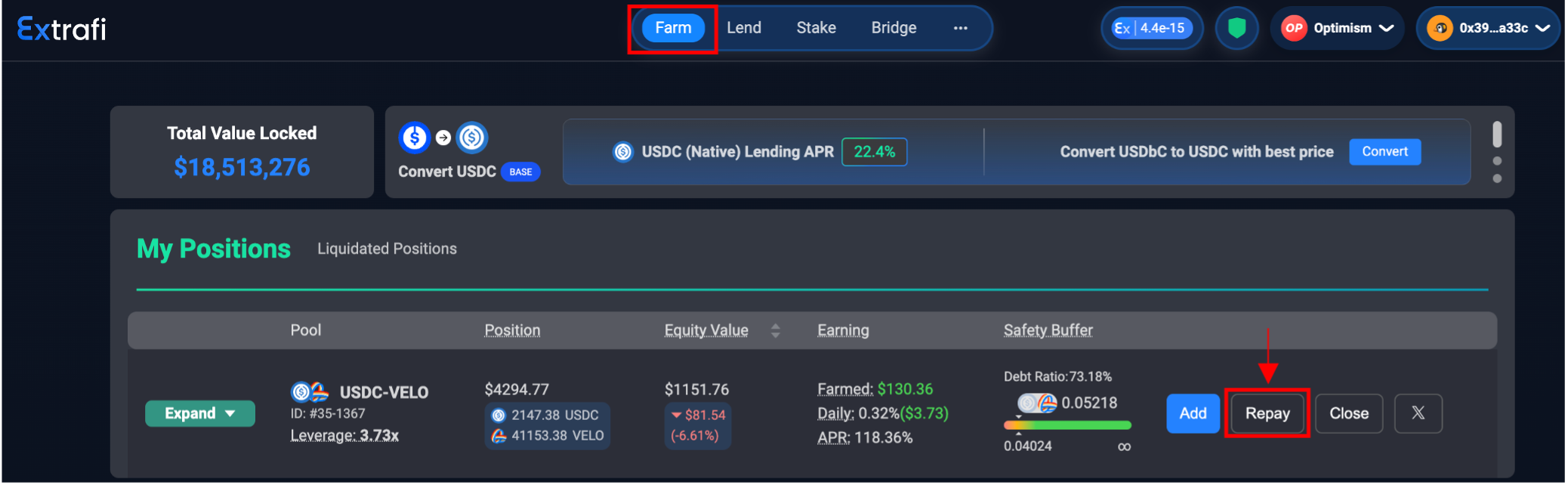

1) Initiating a position close: on the “Farm” page, which displays all information related to the user’s deposit, the user finds the “Close” button.

This button is for closing the position, and upon clicking, a popup window appears, allowing the selection of the percentage of the deposit the user wishes to remove from the position and transfer to their wallet.

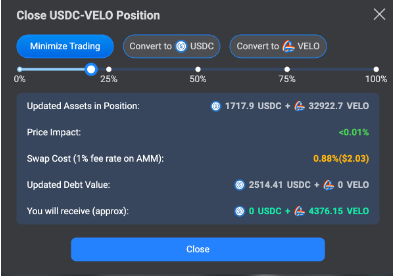

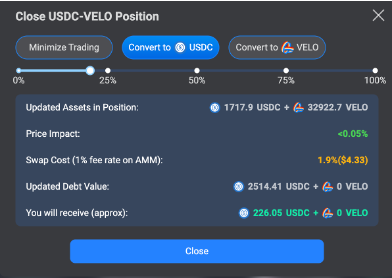

2) Choosing the withdrawal option: in this window, Extra Finance will indicate the most convenient withdrawal option, namely, in which token the transaction fees would be lower, thus allowing the user to recover more from that percentage of closure.

💡 Note: when dealing with non-stable tokens, which do not correlate with a fiat currency like the dollar, it can be challenging for the user to gauge exactly how much they are withdrawing. If farming involves a pair of assets and one is a stablecoin, simulating choosing to withdraw the deposit in stablecoins is advisable. Nevertheless, the user should continue selecting the most favorable option as indicated by the Extra Finance protocol, as shown in the image.

3) Repaying the debt: the next step involves repaying the debt using the percentage of the deposit that has been withdrawn. This is done using the “Repay” option in the “Farm” menu of the Extra Finance protocol, where the deposit information is displayed.

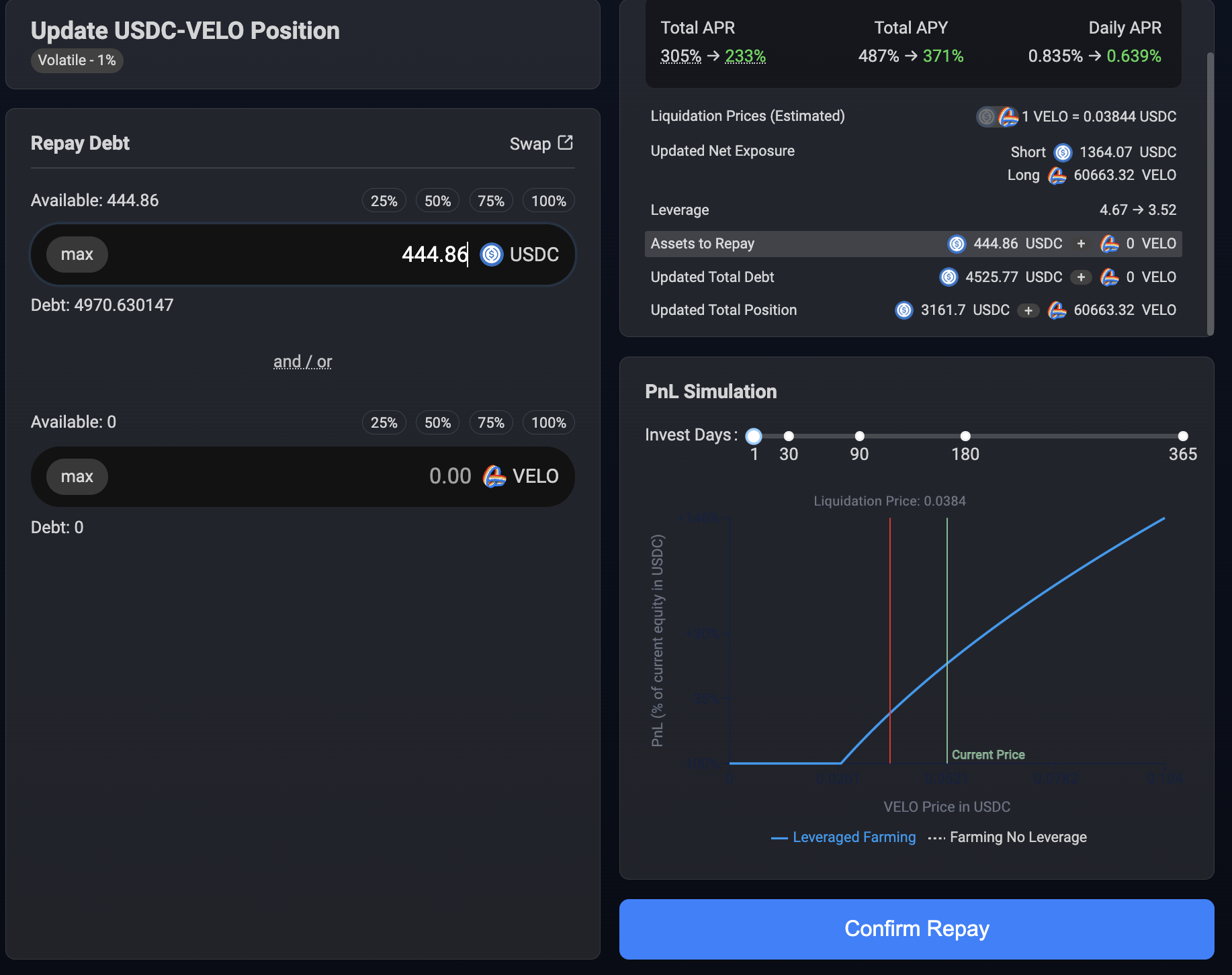

4) Debt repayment page: this page allows the user to enter how much they want to repay and in what form of asset. In the provided example, the debt must be repaid in USDC, a stablecoin, ensuring the debt is paid with a precise and stable value, devoid of the price fluctuations characteristic of other cryptocurrencies.

5) If swap is needed: in cases where the asset to be repaid is not the one you have on hand, a swap through the Velodrome protocol might be required. For a step-by-step guide on how to conduct swaps on Velodrome, check out our article on Velodrome swapping.

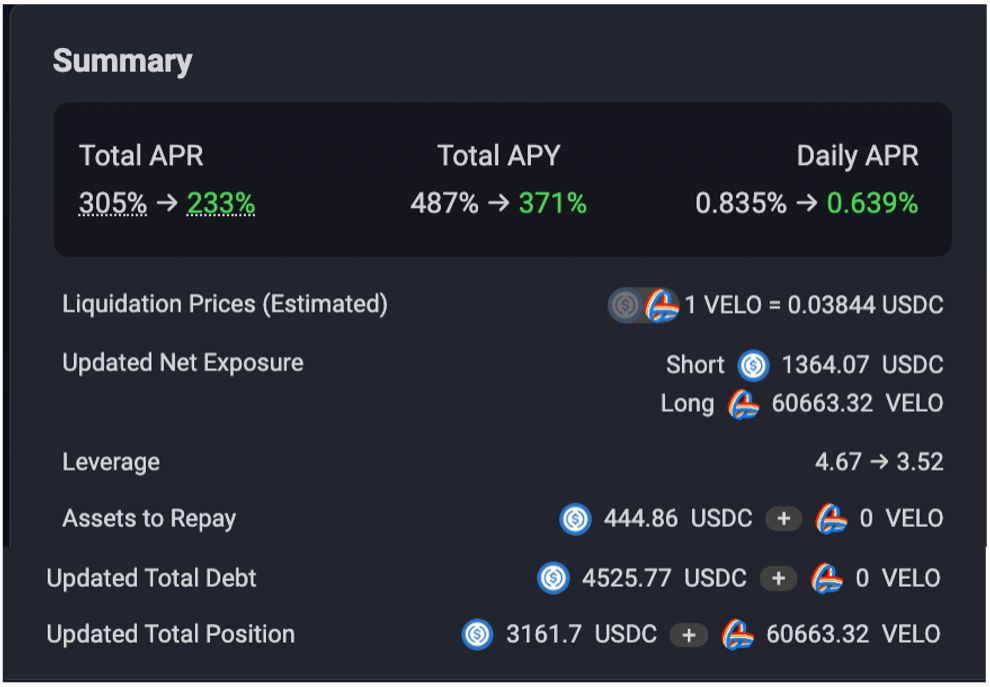

6) Confirming debt payment: the user deposits the extracted percentage and confirms the debt payment. Updated deposit data, inclusing the amount of debt decided to be paid, will appear on the right side of the page:

a) Updated APR, APY and daily APR.

b) Updated liquidation price.

c) Updated leverage.

d) Updated total debt and total position.

By following these steps, the user has managed to reduce not only the leverage and the liquidation price (thereby increasing the safety margin from the current asset price and enhancing the deposit’s security) but also the debt. The position and equity value have been reduced, but this is preferable to losing the entire deposit due to reaching the liquidation point. It is essential dor users to adjust to market conditions.

Lynn Brooke

This article serves educational purposes and is not financial advice. We encourage you to do your own research and be responsible for your actions in the financial space.