TLDR

-

Lyra V2 has officially democratized capital efficiency — portfolio margin, cross-asset collateral, and multiple accounts are live on Lyra V2 for all traders

-

This is novel for options and perps — a first-of-its-kind feature offering in DeFi

-

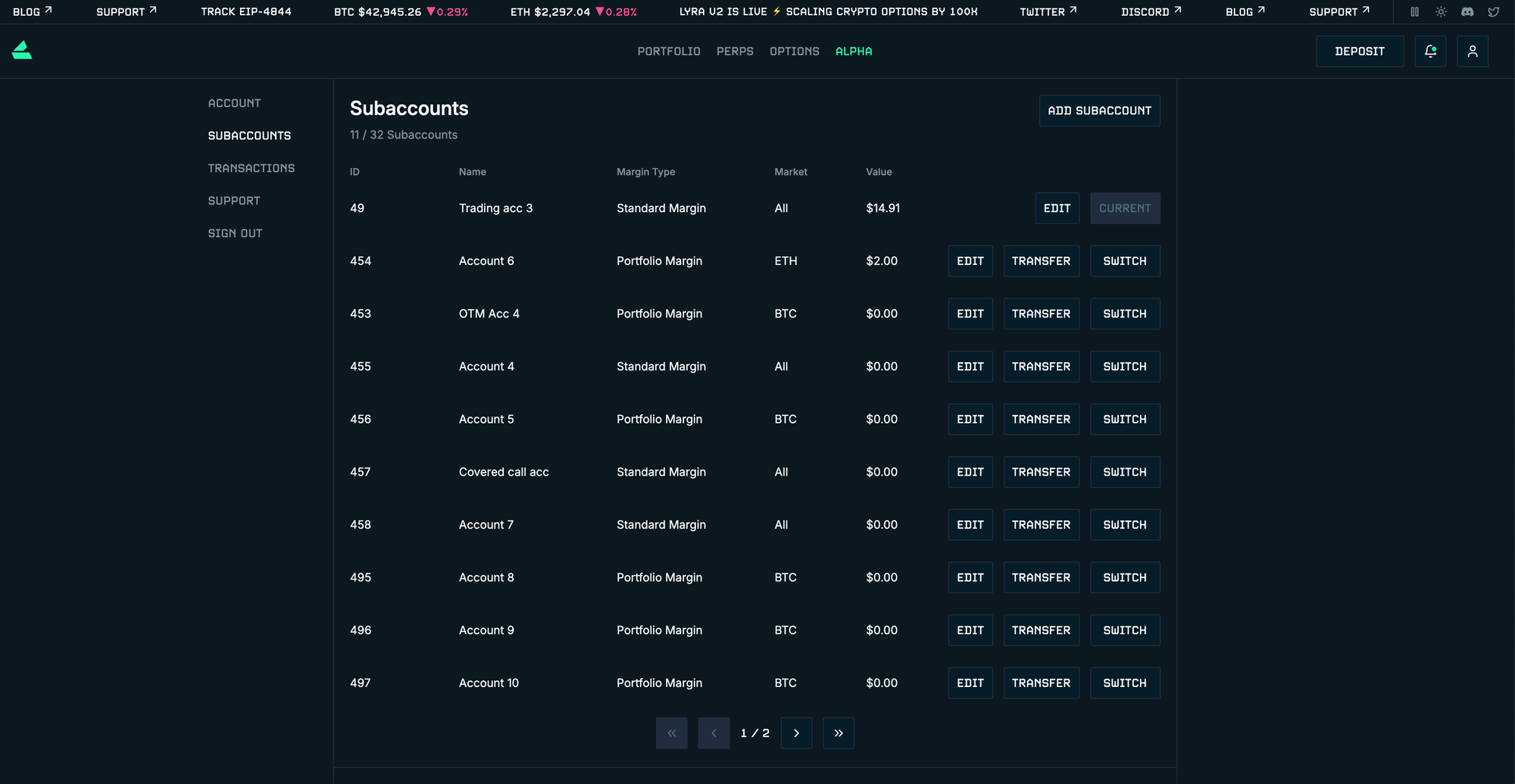

Users can now create up to 32 subaccounts to compartmentalize risk

-

-

Portfolio margined subaccounts on Lyra V2 facilitate extreme capital efficiency by netting positions and considering the overall risk in your portfolio, affording you:

-

Up to 5x more buying power and leverage

-

More strategies and enhanced risk-management capabilities

-

-

Alongside portfolio margin, the introduction of cross-asset collateral puts Lyra V2 in a league of its own when it comes to feature-richness. It gives you the ability to:

-

Start trading without converting your base assets into stablecoins

-

Monetize your assets by using them as collateral

-

Streamlined trading of pairs and cross-asset volatility

-

Diversified collateral pooling

-

Lyra V2 Portfolio Margin Risk Engine

Portfolio margin on Lyra V2 offers you unparalleled capital efficiency by assessing the risk of your positions holistically rather than in isolation. This translates to more buying power and leverage, lower margin requirements, and ultimately — more optionality.

Portfolio-margined subaccounts on Lyra V2 allow you to characterize the health of your portfolio with an exactness previously reserved for institutional TradFi players. With turbocharged risk-management capabilities, you can craft complex payoffs with multi-leg option structures, dynamically hedge risk, and hand-craft your exposures with the control and precision of an Amish woodworker. Some noteworthy strategy unlocks include:

-

Multi-leg strategies like butterfly spreads and iron condors can be deployed on Lyra V2 with 50% of the margin required on a standard margin exchange, as the Portfolio Margin Risk Manager (PMRM) recognizes that losses can only be realized on one of the strategy’s two wings

-

Similarly, short straddles and strangles can also only lose in one direction and as such, can be traded with drastically reduced margin requirements

-

Horizontal spreads like calendar and diagonal spreads can be established for much cheaper than they could be on an exchange with standard margin, as the V2 PMRM acknowledges the relationship between options with different strikes and expiries

-

Deploying hedging strategies such as protective puts results in increased buying power as the V2 PMRM recognizes the resulting decrease in your theoretical max loss

In a previous blog, we likened Lyra V1 to the Wright Flyer, a pioneering innovation in the world of aviation, while analogizing Lyra V2 to the F-35, alluding to its feature-rich sophistication. We weren’t kidding:

-

Compared to Lyra V1, a Standard Margin (cross-margin) subaccount on Lyra V2 offers up to 15x more capital efficiency

-

A trader utilizing cross-asset collateral and a Portfolio Margined subaccount on Lyra V2 will realize up 5x more capital efficiency gains than a Standard Margin subaccount would offer

-

All in all, the combination of portfolio margin and cross-asset collateral on Lyra V2 allows users to trade with up to a 75x increase in capital efficiency relative to Lyra V1

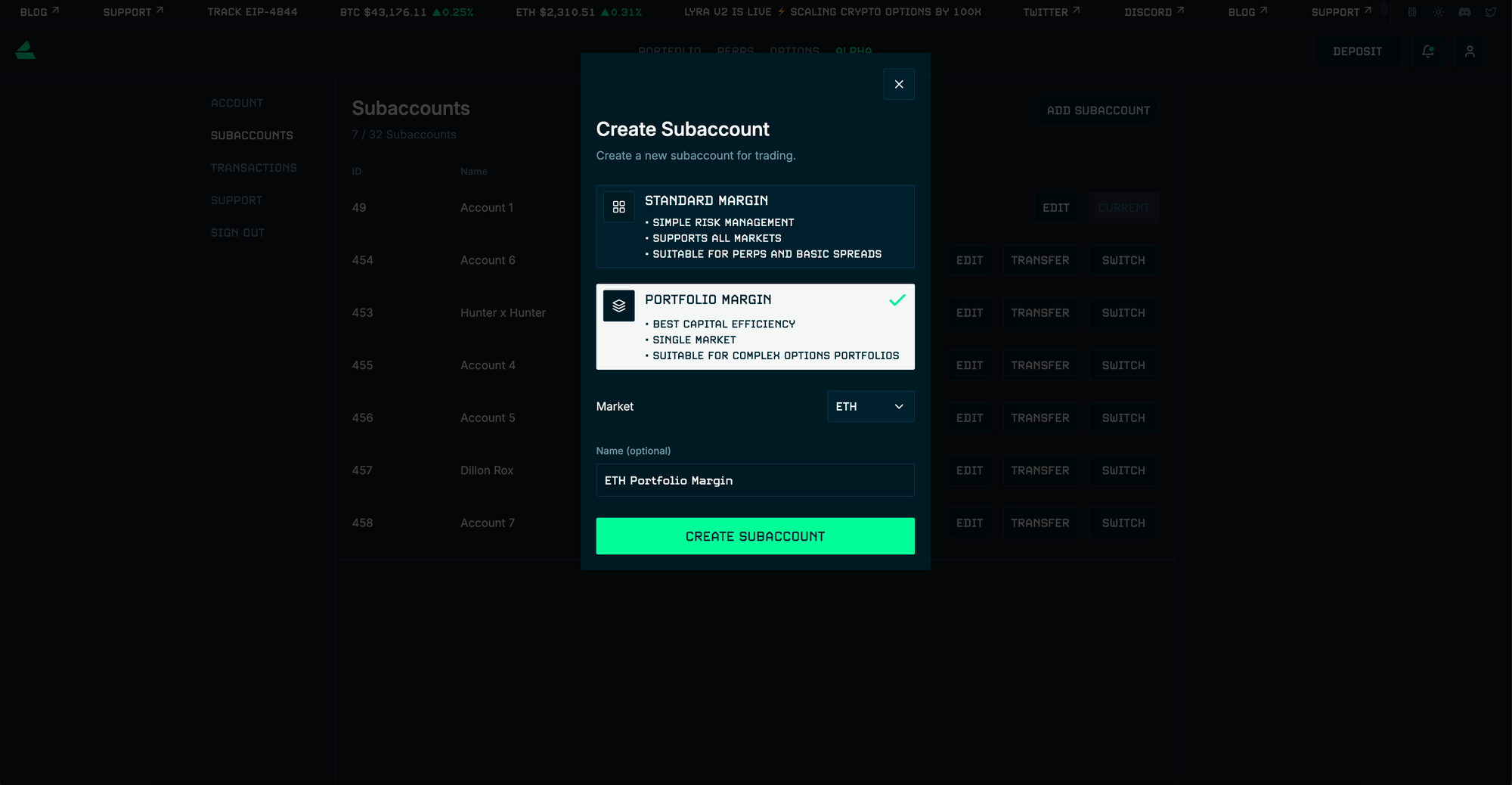

Subaccounts

Most DEXes tell you that if you want multiple subaccounts, you can achieve them by creating new wallets. Is that a real solution? We don’t think so. On Lyra V2, you can create and label up to 32 subaccounts. Subaccounts enable you to compartmentalize your risk and tailor strategies based on your trading objectives, offering utility to traders and market makers alike. Creating a new subaccount is easy and can be completed in the following steps:

-

Create Subaccount

-

Select Your Margining Style

-

Standard Margin (simple risk management, multi-market, basic strategies)

-

Portfolio Margin (advanced risk management, single-market, complex option strategies)

-

-

Select Market (if opening a portfolio margined subaccount)

-

BTC

-

ETH

-

Lyra V2 Cross-Asset Collateral

The implementation of cross-asset collateral on Lyra V2 enables you to collateralize your options and perpetual positions with a multitude of base assets. This is novel for options and perps in DeFi — a first-of-its-kind feature offering and the lynchpin of a robust trading experience. With cross-asset collateral live on V2, you can begin trading and preserve the productivity of your spot holdings without converting them into USDC. Diversified collateral pooling allows traders to increase the durability of their portfolios.

Carefully calibrated asset margin discounts ensure the sanity and accuracy of collateral values, providing the foundation for a secure and reliable trading environment. The asset margin discounts employed on V2 are as follows:

-

Initial Margin-

ETH: 80% of fair market price -

BTC: 75%

-

-

Maintenance Margin-

ETH: 75% of fair market price -

BTC: 70%

-

Another key benefit of cross-asset collateral is the ability to trade asset correlations such as perp pairs and the volatility profiles of different options and options structures. The shipment of cross-asset collateral to Lyra V2 unlocks a laundry list of strategies that were not previously possible, some of which include:

-

Longing ETH perps with spot BTC as collateral

-

Selling BTC calls with spot ETH as collateral

-

Buying an ETH call spread and selling a delta-matched BTC call spread to trade asset-vol correlations

-

Buying BTC puts to hedge your spot ETH holdings (cross-hedging)

V2 Portfolio Margin Risk Manager: Under the Hood

In Lyra V2 portfolio-margined accounts, collateral is adjusted according to the spot price shocks used in the PMRM’s maxLoss calcs, with the aforementioned asset margin discounts applied to ensure security and reliability.

The PMRM calculates margin requirements by performing a comprehensive risk assessment to determine the maxLoss a portfolio might incur under a myriad of spot and volatility shock scenarios. This maxLoss is augmented with an additional margin buffer to cover risk factors extraneous to the primary calculation.

The margin equation is thus defined as: Margin = mfactor × (contingencies + maxLoss), where the mfactor is typically set at 1.0 for maintenance margin calculations and is increased for initial margin to reinforce the risk buffer. The contingencies integrated into this calculation include:

-

Base Asset Contingency:a modest percentage of the spot price for each base asset held. -

Perpetual Asset Contingency:a minor percentage of the spot price for every perpetual contract in possession. -

Option Contingency:for each option's strike, the net quantity of short options is identified. A percentage of the spot price is then allocated to the margin requirement for each net short option. -

Oracle Contingency:a substantial percentage of the spot price is appended to the initial margin requirements for each base, option, and perpetual position if the data feeds exhibit low confidence scores. -

Basis Contingency:the basis contingency is an estimation based on the max-loss scenario your portfolio could incur if the forward basis moves against you across all expiries. If greater than the maxLoss, the basis contingency replaces maxLoss in the margin formula.

Conclusion

These features cater to the sophisticated needs of smart money without sacrificing trust assurances, as the Lyra V2 risk engine is fully on-chain. This aligns with our vision of bolstering DeFi as a whole by increasing the breadth and complexity of payoff functions traders can employ to grow and preserve their holdings without sacrificing self-custody. The introduction of cross-asset collateral, portfolio margin, and multiple subaccounts on Lyra V2 marks a critical milestone on our path to scaling crypto options by 100x.