It is often said that the future of cryptocurrencies is multi-chain. But so far, all we've seen are a bunch of bridges between different blockchains that cost a lot of time and money to use. Cosmos is a cryptocurrency project that aims to create a multi-chain future that is fast, affordable, user-friendly and truly interoperable.

Today, I'll give a brief introduction about Cosmos so that you could learn some of the most important updates of this project.

What is Cosmos?

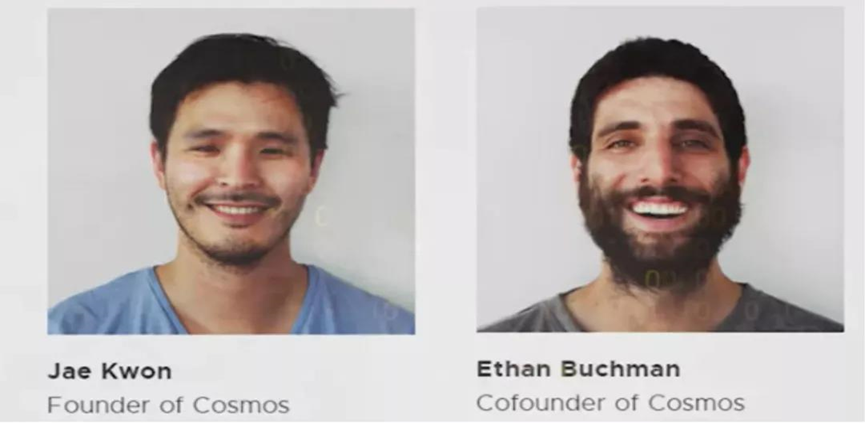

If you've never heard of Cosmos before, here's what you need to know. Cosmos was founded by Jae Kwon and Ethan Buchman in 2014.

Cosmos was built by the for-profit software company Tendermint Inc. In the U.S.

The development of Cosmos is coordinated by the nonprofit organization Interchain Foundation in Switzerland. Cosmos raised $17 million through three token sales in 2017.

The Cosmos mainnet went live in March 2019 and has had no security issues since its launch. This is because the Cosmos blockchain uses a new proof-of-Stake(POS) consensus mechanism called Tendermint which is very fast and very secure. But it comes at the cost of centralization, as the Tendermint chain is limited to about 130 validators, while Cosmos itself has only 150 validators. ATOM is the Cosmos blockchain's native token, used for staking governance and to pay transaction fees

The annual ATOM staking bonus for principals and validators ranges from 14% to 15%; there is no minimum limit, but a 21-day lock-in period. Validators must also stake enough ATOM to be in the top 150, and any misbehaving validators will see their stakes cut.

As for governance, a minimum of 512 ATOM tokens must be locked up in order to submit a proposal. At least 40% of staking ATOMs must participate in the vote, with at least 50% of participating ATOMs voting yes and less than 33.4% of participating ATOMs voting no.

Any ATOM in a proposal that fails to meet the minimum number of ATOMs within two weeks or is rejected during the voting period will be destroyed.

Cosmos stake and governance can be accessed using the Keplr Wallet, which acts as a Web wallet, browser extension wallet, and even has mobile apps for Android and IOS devices.

Besides Cosmos, Keplr Wallet supports over 16 cryptocurrencies. It’s blockchain are built by using Cosmos SDK, a development tool created by Tendermint Inc. which makes it easy to build fast and secure cryptocurrencies from scratch.

Over 50 cryptocurrencies have been built by using the Cosmos SDK, including Binance Coin (BNB), Terra (LUNA), crypto.com coin (CRO) and Thorchain (RUNE).

Since all these cryptocurrencies use the same consensus mechanism, they can interoperate seamlessly, which means you can transfer tokens in seconds for a few cents. Because Cosmos' Inter Blockchain Communication Protocol or IBC serves as an interoperability standard, it is compatible not only with Cosmos-based blockchains, but also with any proof-of-stake cryptocurrency with fast determinism, such as Solana and Polkadot.

Iterations of Cosmos

It's been a few months since I last covered Cosmos, and a lot has happened ever since. In mid-October, Cosmos announced a partnership with a blockchain gaming company called Forte, which showed the integration of Cosmos ATOM tokens into the Forte wallet and opened the door for any game that wants to run a Cosmos-based blockchain for NFT.

Cosmos also confirmed a new cryptocurrency called Sagan, which will serve as a live test network for the Cosmos’ upgradation, similar to Kusama's upgradation to Polkadot.

In late October, Terra integrated IBC, bringing its decentralized stablecoin UST to other blockchains via IBC integration.

A Malaysian bank also announced a partnership with an enterprise-oriented Cosmos project called Irisnet, which will leverage Cosmos technology as part of its business.

Another big announcement in October was the raising of $2,100 by Osmosis, the largest DEX in the Cosmos ecosystem, which is currently locked up for a total value of over $1.2 billion.

In early November, Forte announced a huge round of funding, 0.725 billion dollars, from investors including Andreessen Horowitz, Animoca Brands and even Warner Music Group.

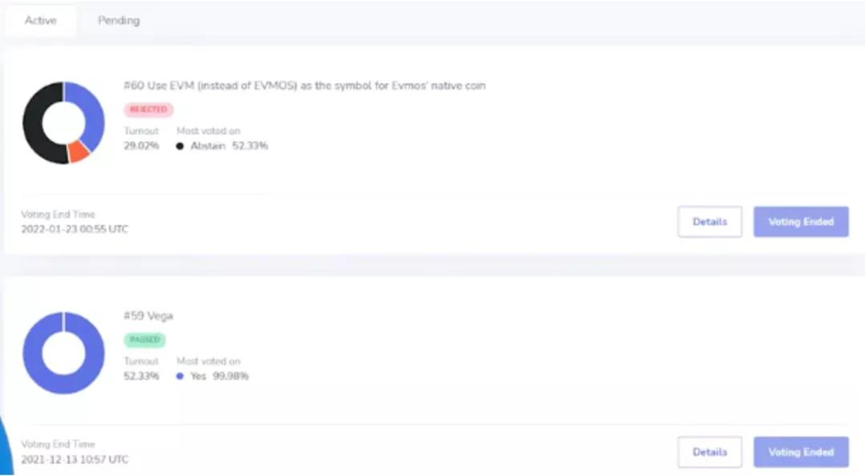

Cosmos also started the Vega upgrade, which was completed in December. Vega introduced new features to Cosmos, such as transaction fee delegation and some performance optimizations.

In mid-November, a Cosmos project called Persistence raised $10 million from different crypto VCs, including Three Arrows Capital, Galaxy Digital, Coinbase Ventures, Kraken Ventures and Alameda Research, which is closely associated with the FTX exchange.

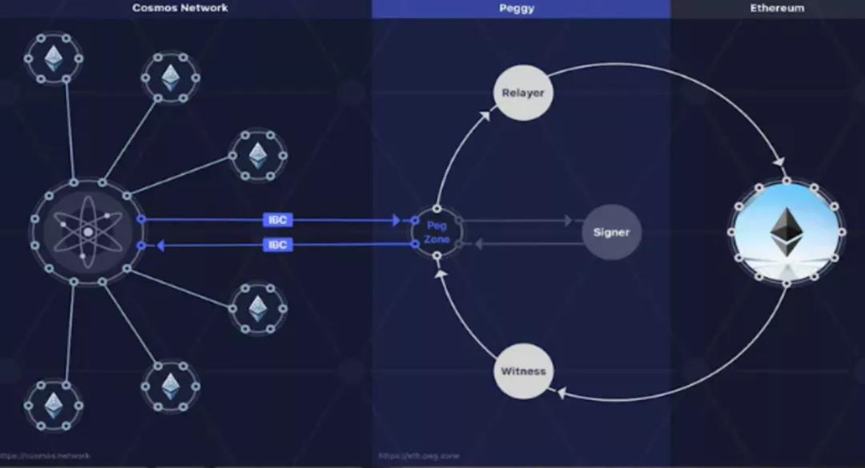

In mid-December, Cosmos announced the completion of the much-anticipated Gravity Bridge, which will enable seamless interoperability between Cosmos' blockchain and Ethereum. Note that the Gravity Bridge is not yet connected to any Cosmos chains. However, it looks like the first one will be Osmosis.

A Cosmos project called Sentinel also launched its latest decentralized VPN mobile app to earn cryptocurrency by sharing bandwidth or paying for decentralized VPN services with fiat currency or sentinels native DVPN coins.

At the end of December, Cosmos announced the winners of its Million Dollar Hackathon, three of which are worth mentioning.

The first is Evmos.me, which enables the use of Metamask and Keplr with Evmos, an upcoming Cosmos project that deploys smart contracts using an ethereum virtual machine.

The second is an exchange feature called Cosmos Omnibus, which enables validators on the Cosmos-based blockchain to deploy their nodes on the decentralized storage Cosmos Project Akash network.

The third is a decentralized application called Nymdrive, which is essentially a decentralized cloud storage platform built on NYM like Google Drive or Dropbox. About that, Coinlist recently announced the NYM token sale, which is a pretty good token given that Coinlist only offers token sales for high quality crypto projects.

Another Cosmos project called Umee actually raised $32 million from over 63,000 investors at the end of December, and Umee will apparently become a DeFi project similar to AAVE.

ATOM's Price Analysis

All of Cosmos' announcements, upgrades and developments have been good for ATOM. However, it has only risen about 50% since I last reported this project in September.

Besides the general weakness we have seen in the cryptocurrency market since last December, ATOM has failed to reach the $45 mark in three attempts in the last few months. This means that if the price approaches these levels again, it could encounter a lot of resistance.

It's not just the cryptocurrency market or technology that is keeping ATOM down. For newcomers, ATOM is highly inflationary. It has an annual inflation rate of between 7% and 20%, depending on the percentage of ATOM that is staked to the network.

This high inflation is intentional and intended to discourage speculation and incentivize active participation in staking, either through the use of ATOM pledges or participation in other Cosmos blockchains.

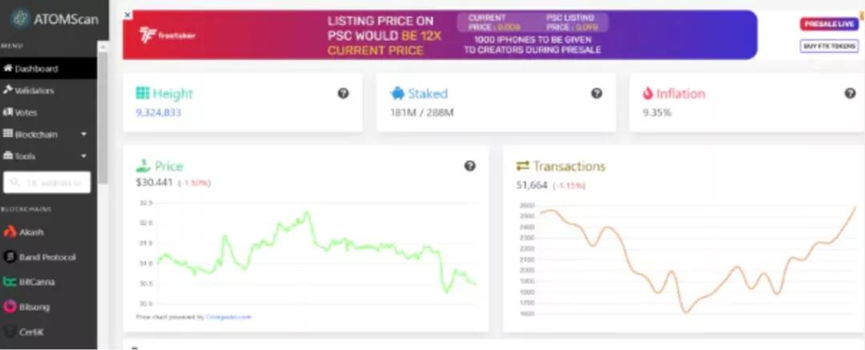

Cosmos' target stake percentage is 67%, but as you can see, only about 63% of ATOM is staked. According to ATOMScan explorer, the small deviation from the ideal stake percentage corresponds to an ATOM inflation rate of over 9% per year.

Curiously, the circulating supply of ATOMs has actually increased by about 25% since August, suggesting that more ATOMs are coming from elsewhere.

I suppose that these extra ATOMs are coming from Tendermint Inc. and Interchain Foundation, whose ATOM allocations were completed last spring. This means they can technically spend their ATOM, and the million dollar hackathon totally indicated that they are ready to leave no stone unturned to expand the Cosmos ecosystem.

Assuming that the other 66 million or so ATOMs entering circulation are sold at an average price of $25, such $1.65 billion selling is under great pressure, although I think the bulk of this ATOM is staked rather than sold.

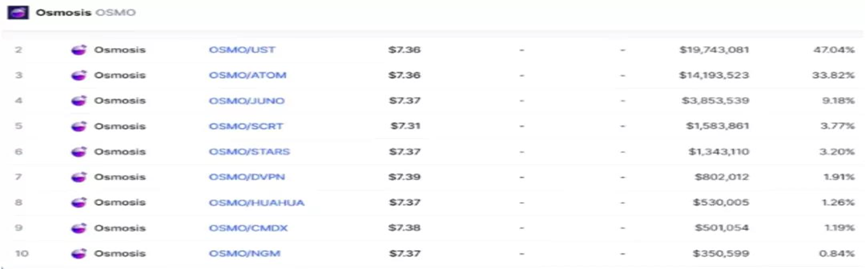

Demand for ATOM has been quite large since the launch of IBC last year, and as far as I can tell, most of the demand has come from the aforementioned Osmosis DEX. This is mainly because you can't access Osmosis without ATOM because the OSMO coin itself is not available on any centralized exchange, which means if you want to access the emerging Cosmos project, you have to buy ATOM and transfer it to Osmosis.

Interestingly, there are exchanges offering to list OSMO coins. But Osmosis founder Sunny Agarwal told them that if your users want to own OSMO tell them to go to Osmosis DEX.

In addition, some Cosmos projects with initial DEX offerings on Osmosis only accept ATOM as an investment, and some Cosmos projects also airdrop their tokens to ATOM stakeers or liquidity providers.

Upgradation plan Part 1

It's hard to tell ATOM's price potential. Cosmos itself is a large-cap cryptocurrency, which means it will be hard for ATOM to pull up more than 3 or 4 times before the end of the bull market.

As usual, it ultimately depends on the Cosmos’ upgradation. This was released last July and it includes seven upgrades. There are five upgrades left, each with a different milestone.

The first is the Theta upgrade, which is expected to process by the end of this quarter. the Theta upgrade will allow for modified liquidity through governance, i.e. token pairs in Cosmos' Gravity DEX, which will be able to execute transactions in other blockchains connected to the IBC.

For example, you can sign transactions in the Osmosis wallet from the Cosmos wallet, thus eliminating the need to switch chains in wallets such as Keplr to sign transactions.

More importantly, the Theta upgradation will enable you to allow other users or applications to sign transactions in any of your wallets on other chains, opening the door to interoperable and decentralized applications.

The second upcoming upgrade for Cosmos is called Row and is expected to be completed by the end of the second quarter of this year, which is of course the end of June. The upgrade will enable Cosmos' governance module to interact with dApps and IBC-enabled blockchains. It introduces NFT to the Cosmos blockchain, as well as mobile stakes. Without much blockchain technology, mobile stakes will enable the use of staked ATOMs in decentralized applications.

Row will also introduce the option to redirect some ATOM inflation to the community vault, another IBC-enabled blockchain or even directly to the decentralized application to provide liquidity. This sounds very similar to Tezos' own liquidity banking business.

Upgradation plan Part 2

The upcoming third upgrade to Cosmos is called Lambda and is expected to be completed by the end of third quarter, which is the end of September. lambda will be huge project because it contains three important things.

The first important thing in Lambda is called exchange security, which will allow Cosmos verifiers to protect other Cosmos-based blockchains. This is important because one of the biggest barriers to entry into new Cosmos projects is not having enough money to protect their blockchain. This is because the security of a proof-of-stake blockchain essentially comes from the total value of the coins being stacked. This is why even large Cosmos projects like Osmosis plan to use its exchange security when Cosmos emerges. The total value locked up on Osmosis DEX is actually greater than the value stacked to obtain those funds.

The second important thing in Lambda is that it allows Gravity Bridge and Gravity DEX to stay on their own blockchain. This is important because it will take the pressure off the Cosmos blockchain and minimize the risk of congestion.

The third important thing in Lambda is the introduction of a chain name service, which I think is a decentralized digital identity. This is important because it creates a stronger governance structure in the Cosmos ecosystem and opens the door for things like decentralized credit scoring, allowing you to borrow more from the DeFi protocol.

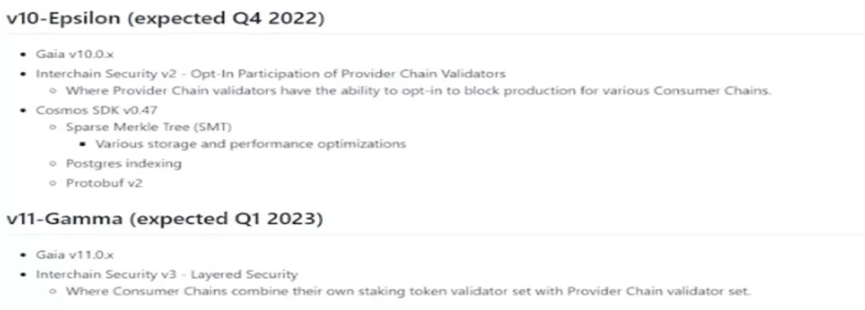

The fourth and fifth upgrades to Cosmos, called Epsilon and Gamma, are expected to process at the end of this year and in the first quarter of 2023, respectively. The goals that need to be accomplished in these upgrades are not very detailed at this point, and I think they will change as we get closer, so keep an eye out for that.

Other Cosmos considerations are recorded at the bottom of the upgradation plan, which are privacy, smart contracts, and rollups. Unfortunately, no dates or more details are provided for these milestones

Other Cosmos considerations beyond the upgradation plan include the release of Sagan, the live test network I mentioned earlier, the Alpha version of emeris, which is the front edge of Gravity DEX, and the Emeris Web wallet, this will be the “cross-chain block portfolio”.

Simply put, the Emeris web wallet will be able to interact with multiple cryptocurrency blockchains at the same time, not just the Cosmos-based blockchain.

Speaking of which, Peng Zhang, the CEO of Tendermint Inc. also expects ETH to enable IBC once it transfers to PoS, which is currently not possible due to the slow finality of proof-of-work transactions.

Problems with COSMOS

My concerns about Cosmos, let me start by saying that Cosmos is one of my favorite cryptocurrency projects and I hold ATOM as part of my cryptocurrency portfolio.

Even so, there are certain parts of the project that need some major improvements, starting with development.

Many of the goals on the Cosmos upgradation plan I mentioned earlier should have been completed in the last year. While I'm inclined to say it may be caused by the shortage of developers, a recent report on cryptocurrency developers found that the Cosmos ecosystem has over 1,000 developers, making it actually the third largest project in terms of developers after Ether and Polkadot. The only problem is that this number seems to apply to the entire Cosmos ecosystem, not just the Cosmos blockchain itself.

In other words, many Cosmos developers may be working on other crypto projects, such as Osmosis, which is generating a lot of attention and liquidity in the Cosmos ecosystem.

This is related to my second concern, which is a competition coming exclusively from Cosmos' own ecosystem. As Osmosis founder Sunny Agarwal admitted in an interview, the Cosmos ecosystem would probably continue to exist without the Cosmos blockchain, due to the fact that none of the other Cosmos blockchains need Cosmos to run and ATOM doesn't need to pay transaction fees for those blockchains.

This is my biggest concern with Cosmos, the value capture of ATOM. Basic economics dictates that for prices to rise, demand must exceed any new supply, and ATOM seems to have a hard time maintaining that dynamic. Currently, the primary use of ATOM is as the key needed to open the door to the kingdom of Cosmos. But this role could easily be filled by another Cosmos token backed by an exchange. This means that Cosmos developers need to create more demand drivers for ATOM.

Alternatively, the Cosmos community could adjust the token economics of ATOM to minimize the source of new supply, which is a hot topic on the Cosmos Governance Forum. For what is worth, I believe Cosmos will find a way to add value to ATOM both inside and outside of its ecosystem, although from my perspective it seems to be focused on Vega updates. I really believe that 2022 will be an important year for Cosmos as long as we don't enter another crypto winter. Way to go!

Twitter: @ma1long