2022 marks an year as a turbulent ride for the emerging Web3 industry, with long awaited milestones such as successful Ethereum merge to terrible crypto collapses such as Luna and FTX; we have seen it all this year.

This article summarizes Web3 in it. By including; (1)Collapses, (2)NFT Fails and Wins, (3)Affects of Global conflicts, (4)technical success, (5)Innovation, and (6)Expansion.

1.Collapses

Luna and UST (TerraUSD) collapse:

Luna and UST collapse occurred in mid May 2022. At the time Do Kwon (co-founder of Terraform labs; which made Luna and UST) had a prominent positive figure in the crypto space majorly because of the rise of Luna token making 100s of average investors Crypto Millionaires.

Began: On May 7th, UST lost its peg for the first time and by May 9th it fell to an extreme low of 35 cents, this caused a rapid liquidation of Luna, the token backing UST and the rest is all history.

It is reported to be one of the biggest asset collapses in the history of global economy. At the time of collapse, Luna along with UST had an estimated value of $60 Billion and is said to have wiped a collective $300 Billion from the whole crypto market.

As of today: Do kwon (the founder of Terraform labs) hasn’t been reported and the latest news dates back to early December 2022 of a South Korean judge dismissing Do kwon’s arrest.

“Luna and UST collapse left numerous investors without money; it was a loss for many and win for one.”

The FTX collapse:

Began: On November 2nd 2022, the concerns for Alamada’s (A crypto trading firm founded my SBF, Sam Bankman-Fried, founder and former CEO of FTX) balance sheet report were shared by Coindesk.The report stated doubtful asset management by Alamada, which showed billions and billions of dollars’ worth of FTT (FTX’s proprietary token). This raises concerns for FTX’s inability to provide liquidity If FTT was to fall.

Seeing this, Changpeng Zhao (popularly known as CZ) Founder and CEO of Binance (The world’s biggest crypto exchange based in China) tweeted on November 6th that they are planning to sell their FTT tokens which they received in exchange of the stake they held in FTX earlier. He compared the situation of FTX with Luna and Terra earlier this year.

His sell off caused a dump in the value of FTT token which triggered massive user funds’ withdrawal from FTX. So much so that a day later, SBF comes to twitter and announces that they are halting withdrawal of non-fiat i.e. Crypto funds and the rest is a complete disaster.

In the End, FTX files for Chapter 11 Bankruptcy.

As of today: The collapse caused an estimated fall of 20% in the whole crypto market; from $1.02 Trillion to $824 Billion. FTX itself has said to have made users’ loose upto $10 Billion and some of the top creditors are said to be owed more than $1 billion each.

All this happened because of three problems; Terrible Accounting, asset management and SBF.

“FTX took a big bowl but the part we must fight, is of our own.” We must learn from such incidents and seek to support builders that build with obsession and not greed.

2.NFT Fails and Wins:

FAILS;

Pixelmon’s $70 Million rugpull (Well, Kinda):

Pixelmon is an NFT game still in existence, in which players are to catch other Pixelmons (Pokémon knock-offs) in an Open-world game in other words, Pokemon Go but not AR. The mint was a staggering $70 Million.

The fall began when the artwork was released, which was bad – Really Bad. It was nothing like what was shown during the mint and bad enough that the founder himself said that it was a “horrible mistake”. Now, even after another artwork release, the nfts are trading lower than the mint price itself and was all kinda like an opposite of a rug pull.

Axie Infinity’s $625 Million hack:

Axie Infinity, the most famous crypto game since 2020 until its terrible hack. Axie Infinity suffered a massive hack of $625 Million by anonymous hackers (said to be related with North Korea).

The hack was done with the help of a security breach in the Ronin network.

It left millions in a state of shock. Later, Sky Mavis the parent company of Axie Infinity raised $150 Million to pay back to players, token holders and investors who suffered in the hack. At present, active monthly players have reduced drastically by 62% and there seems no quick way back to the peak number of 2.78 Million.

Wins;

BAYC buys Crypto Punk:

Bored Ape Yatch Club and Crypto Punks are two of the most influential NFT projects ever and were even considered to be in rivalry by the majority of NFT community.

Up until, Yuga Labs Creators of BAYC announced that they have bought IP right for Crypto Punks, and Meebits [Larva Lab’s (creator of Crypto Punks and Meebits) metaverse oriented avatar project].

Following this several Crypto punks’ holders came forward and shared their disappointment with how Larva was running it. Soon Yuga grants IP commercialization rights to holders which made them happy and Meebits are seen in use in Yuga’s Metaverse; Otherside.

Successful launch of Apecoin and Otherside (BAYC’s Metaverse):

Apecoin launch: Apecoin is an Ethereum based token from BAYC’s ecosystem. It was launched with much anticipation; and laid foundation for BAYC’s Metaverse.

On day one, BAYC or MAYC holders were grabbing upto $80k worth of tokens. But now (10 months later); the price has fallen 85% from its peak and is more of just a voting token.

Otherside’s launch: Otherside, metaverse of the most successful and influential NFT PFP project; BAYC.

Otherside was launched in form of deeds’ (nfts of parcels of land) minting. Much like Apecoin BAYC and MAYC holders were to only claim their deeds early on whilst the rest of Nft collectors were to fight in a raging mint. Let me explain, after the original mint of Bored Apes and Mutant Apes Otherside was the next big opportunity for the rest of Nft collectors.

The mint was named “explosive” (and even disastrous); it had more than $900 million worth of primary and secondary sales in the first few days. But there’s a catch, a mint this size was sufficient to ramp the gas prices.

It burnt a staggering $157 Million worth of Ethereum in gas prices, alone! One particular minter spent $14k in gas fees just to have a failed mint. This chaos was well informed to the whole community for which, Yuga refunds a (mere) total of 90.57 Eth ($256,000).

Starbucks launches NFT loyalty program:

Starbucks’ rewards program is well known for getting people onboard their coffee experience and, Points. Now, starbucks introduces Odyssey, a web3 reward program as an extension of their industry-leading loyalty program (Starbucks reward).

The Odyssey program has ‘Journeys’; a bunch of interactive activities such as games and fun quizzes about starbucks which when completed will give players an NFT (Journey Stamp). It consists of an In-app marketplace as well for buying these stamps. Each Stamp (NFT) consists of point value.

Note for the average customer: all of this doesn’t require a Crypto wallet.

Conclusion: Starbucks’ Loyalty program has been an industry-leader for the food and beverage industry and many has launched their own inspired from it. The web3 ‘tech’ is what the whole buzz is about; NFTs, Tokens, Coins, Smart Contracts and much more can make experiences on and off internet way better. Starbucks opting it can redefine its use cases and will make the average consumer familiar, this is a great start for Web3 in the real world use cases.

3.Reaction to Global Conflict (Russia-Ukraine war):

Between both fails and wins in 2022, Web3 won the lives and hearts of many in the tough times for Ukraine as it played a key and needful role in the biggest headline of this year, The Russian-Ukraine war. The war uprooted millions of Ukrainians instantly and with Ukraine being the poorest country in Europe cause’ of lowest per capita income, it had to seek help from other means (Donations) and there came Crypto and Web3 in the picture.

The Ukrainian government began accepting donations in Crypto, both Bitcoin and Ethereum and tweeted the links to their wallets from their official accounts. With no time spared people were ready to help and began donating instantly.

- Approximately $100+ Million worth of crypto is donated till date.

Second comes The UkraineDao, A DAO that looked up to launch NFTs to raise funds to then pass forward to charities working on ground for 10 Million+ refugees. And it got its fare share of support instantly as well. The UkraineDao launched an NFT of the flag of Ukraine and it was sold for;

- $6 Million and is counted among the top 20 most expensive NFTs ever sold.

4.Technical Success (Ethereum’s Successful Merge):

Ethereum is the most versatile and used Cryptocurrency. It is the second largest Cryptocurrency to Bitcoin. For a long period of time it was criticized for high gas fees (transaction fees) and energy consumption because of the Proof of Work protocol. The P.o.W consensus (transaction validating method for a blockchain) mechanism required miners to solve a block (a collection of transactions) through numerous trials and errors from where the name comes, Proof of “Work”. This is a fairly basic consensus mechanism for blockchain but its drawbacks include high gas fees and energy consumptions (due to the “work”).

This has to be changed in order to make Ethereum expandable; with the Proof of Stake (P.O.S) consensus mechanism. P.o.S requires miners to prove that ‘they have capital at risk’ by staking capital in a smart contract on Ethereum. For a Validator to begin, it would have to stake 32 eth into a deposit contract and run three separate softwares.

Now that we have caught up with what P.O.W and P.O.S are, let’s head to the first stage of this transition, The Merge.

Merge:

Merge Carries out the ‘merge’ between two chains; Ethereum mainnet (main chain, running P.o.W) and the beacon chain. The beacon chain (running P.o.S) was a parallel running chain to the main chain, started back on December 1, 2020. The beacon chain was made to run to test the usability and effectiveness of P.o.S mechanism with Ethereum’s blocks and transactions.

The merge was carried out successfully on September 15, 2022!

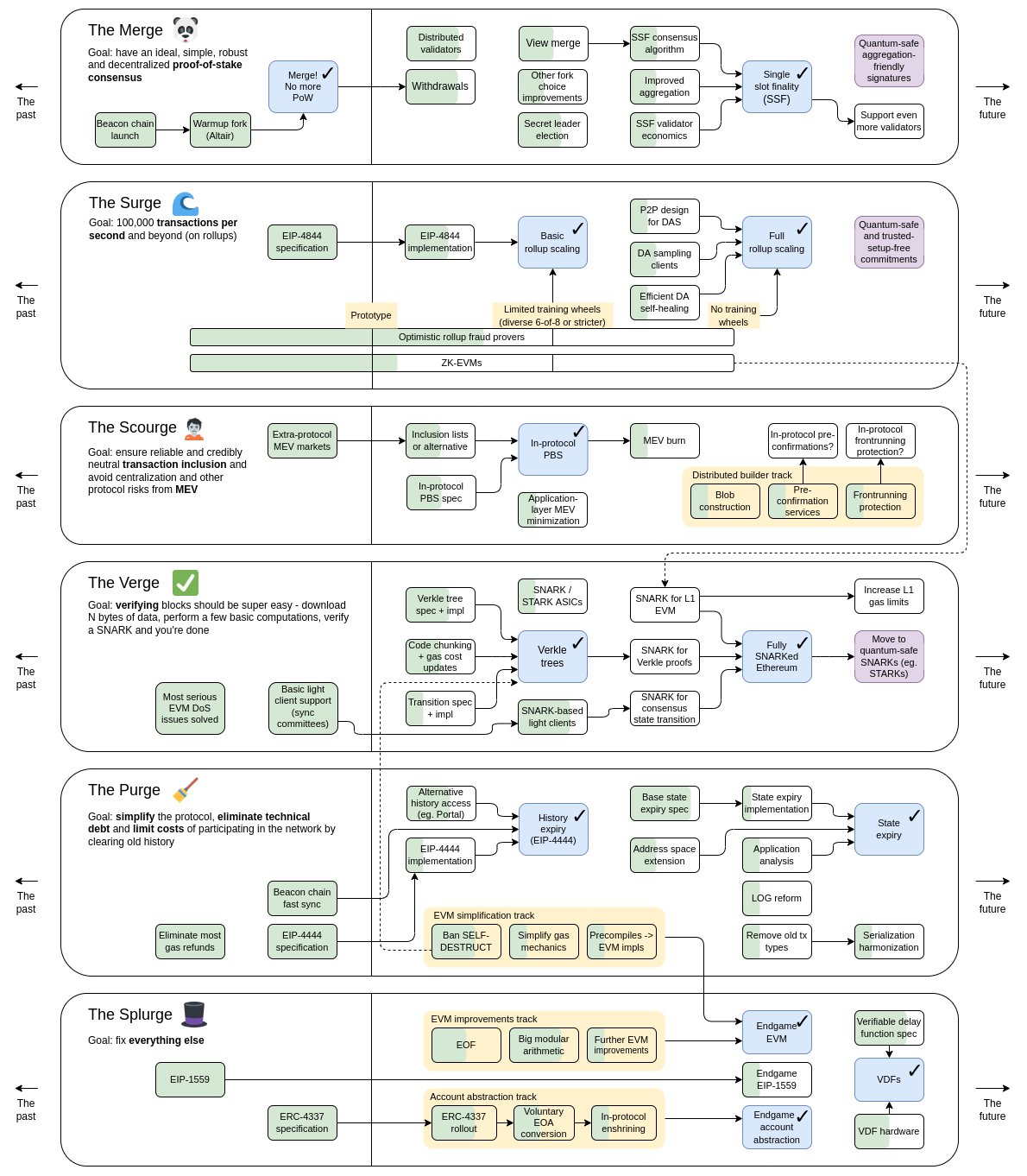

To have an overview of other stages that are headed our way, have a look on the infographic (shared by Vitalik Buterin) below:

5.Innovation:

Web3 Music:

Among dozens of fails that Nfts saw in 2022, Music stood out. The music streaming services that we all use are popularly criticized because of their poor incentives for the Artist itself, with most giving a mere 1% from every stream. This has had artists in a state of reliance and vulnerability on them.

In 2022 Web3 music, took a turn and showcased the huge possibility of ‘songs and albums as NFTs’ for both artists and fans with creator royalties and fans’ able to buy their favorite artist’s song, respectively.

And, these are the biggest moments;

-

Coachella launched a lifetime pass NFT collection

-

Snoop Dogg released first Death row mixtape nfts

-

Grammy announces NFTs integration

-

Warner Music group announces platform to make music nfts

-

Pharrell Williams joined Doodles (3rd biggest PFP NFT project) as Chief Brand Officer

6.Expansion:

Web3 is Expansive, and 2022 bought it in practice. With institutional investors and users avoiding Crypto and Web3 for the majority of last 5 years, 2022 showed their interest sinking in.

Big corporations such as; Twitter, Blackrock, Meta, Nike, Stripe, JP Morgan, PayPal, American Express, Apple, Nasdaq and many more, launched some kind of their product line in Web3 this year such as;

-

Twitter launched NFT verification and added eth tipping

-

Blackrock started offering crypto to its institutional clients

-

Meta bought NFTs with Polygon

-

Nike launched a Web3 platform called Swoosh to sell polygon-based NFTs

-

Stripe enables USDC Stablecoin payment

-

JP Morgan partnered with TRM (A blockchain intelligence company) to better secure blockchain transaction

-

PayPal began offering crypto support

-

American Express launched a product to earn crypto rewards

-

Apple with Block and Square integrated “Tap to Pay” with iPhone

-

Nasdaq launched a service for Crypto Custody

Conclusion:

Web3 is a growing and developing iteration of the internet aiming to enhance user experience, interaction, and connectivity through various bits and pieces such as NFTs, Cryptocurrencies, DAOs, Tokenomics, etc.

In 2022, Web3 went through a series of fails such as collapses but in-between them; it also met with great accomplishments that lay the ground for a better experience 10 years into the future. With several big corporations establishing their branches into web3 indicates growth opportunities for both entrepreneurs and investors.