Disclaimer: Not financial advice, DYOR.

I’ve been thinking a lot about the merge lately -- largely since the beacon chain launched in Dec. 2020 but especially now that we’re progressing through devnets and testnets. Even though the merge event is highly anticipated and well hyped, it’s hard to overstate it’s importance and impact on the Ethereum ecosystem.

I think there are a number of factors that are either not being taken into account due to obscurity or are heavily discounted due to perceived execution risk. Here I wanted to share a few thoughts on what I think are the most interesting or unexpected theories that I have for the merge, and specifically what that means for the Ethereum ecosystem, ether the asset, and related products like Rocket Pool and Lido.

Narrative Change

First, a brief shpiel on on why I think the merge carries so much significance. There is little-to-no original content here; it’s just to set the stage.

Successfully landing the merge carries more weight than just the change itself. It marks an important moment where I think a few narratives will change in meaningful ways.

- Economical: Likely the most obvious and well understood thanks to memes like “triple halving” and “ultrasound money”. Ethereum will be the first blockchain that can confidently secure itself while also being credibly neutral and with zero net emissions. As a result of the merge, ether will have quantifiable value by establishing a risk-free rate and enable value predictions through a variety of different financial modeling techniques. It’s a Big Deal™.

- Technological: Ethereum and the EF have long been subject to skepticism around their product timeline and ability to meet those targets. Vitalik famously announced a target expectation for the merge in 2016. As a result, there is an unfairly large expectation that either the merge won’t happen at all, or won’t happen this year. Because of the heavy discount on probability, the results of the merge are primarily not priced in or factored in.

- Ecological: While this is still a fairly inconsequential concern for the most part, there is a growing concern of the sustainability of PoW chains and their ability to survive regulatory pressures. It was only last week that PoW narrowly avoided a wholesale mining ban by the EU. My theory is that this will continue to grow as climate concerns take the center stage and political pressure grows. Even absent this pressure, companies and people will want to use products that are sustainable over those that aren’t. PoS is more “sustainable” in every sense of the word.

Theories

Now, some theories. Let’s go in order from what I think are the most obvious to most obscure.

Tailwind effect on ether and staking

The merge event (also separately, withdrawals) will be massively de-risking for ether the asset. Execution risk will fall to near-0, APR on ETH will 2-3x, and trust in the beacon chain will soar. This will give rise to ether having quantifiable value, most notably by providing a “risk-free” rate of return to anchor the ecosystem. Speculation and media coverage will also layer on top.

Fairly straight forward -- hopefully there’s nothing too controversial here (yet).

Related reading would be the excellent DCF valuation model by Ryan Allis:

Miners → Stakers

Miners hold a healthy war chest of ether, and it’s a certainty that a percentage of them will use that supply to participate in staking. They are perfectly positioned to do so given their familiarity with hardware and security.

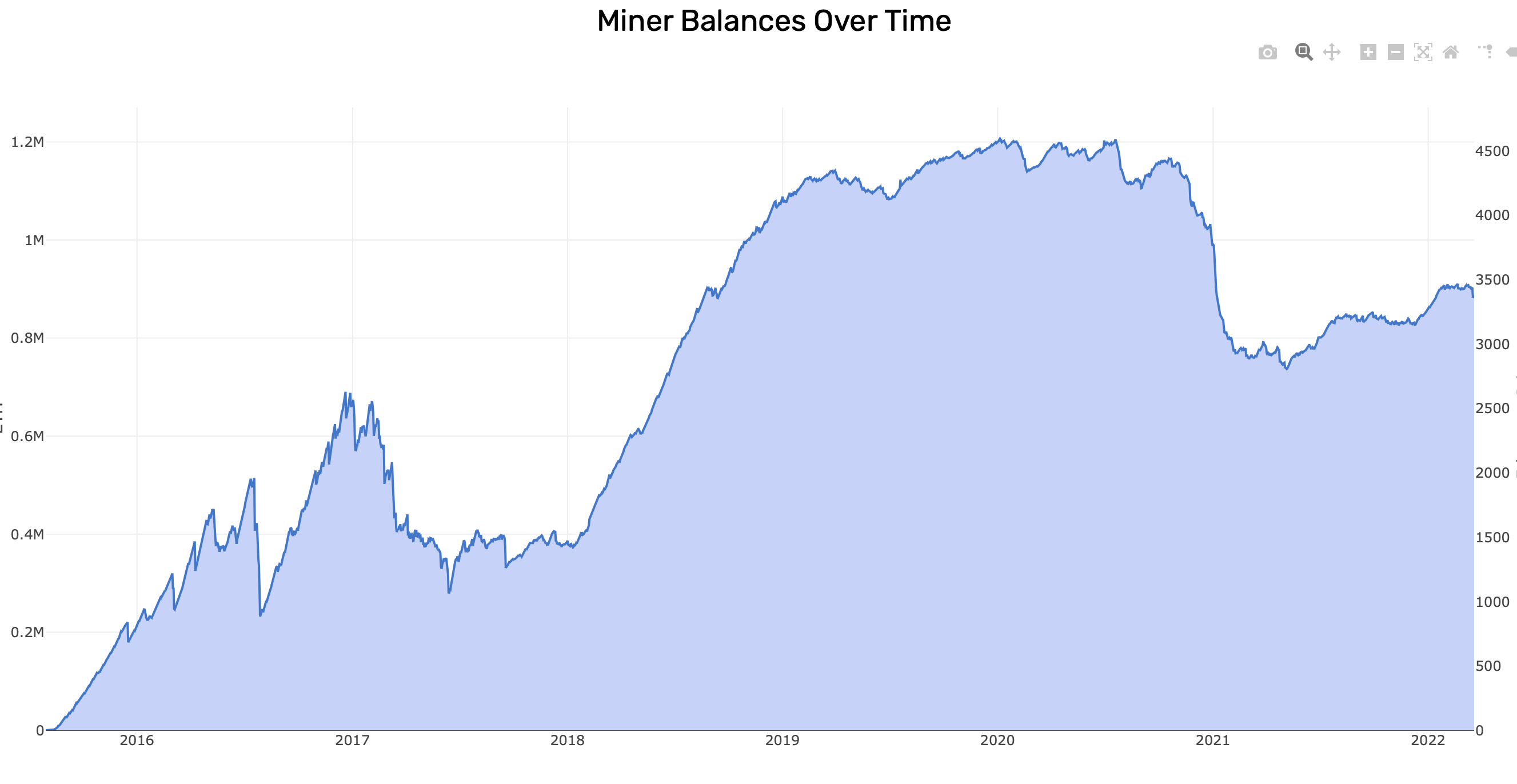

There is currently ~900k ETH held by miners, which could be quickly looking for a place to be put to productive use once the PoW revenue stream ends.

Queue space will be hugely scarce, leading to months+ long times for activation

Ethereum can only onboard 900 validators (28.8k ETH) per day, with a slight but effectively ignorable sliding scale upwards.

With many other L1 PoS blockchains having 70+% of their total supply staked, it is widely expected that Ethereum will trend upwards toward 50+% staked, with a significant spike in demand for staking immediately pre- and post-merge.

Simple math indicates that we can currently only onboard 10 million ETH per year into the beacon chain (accelerating every 65k validators). Assuming full saturation of the validator queue, it will take Ethereum several years to go from 10% to 50% supply staked. If even 10% of ETH decides to stake post-merge it will push the queue to a full 12 months.

Most importantly, securing a spot in the activation queue will be a “scarce” thing to have that will create significant FOMO around it. This perception of scarcity that will amplify the rush, and likely already is as we’ve seen the queue grow to 14 days long after a successful Kiln merge event.

Additionally, staking derivative tokens such as rETH and stETH will also amplify this, where there is so little friction to staking and their returns are immediately enabled, subsidized by existing validators.

This thread from Ryan Berckmans is required reading on the topic:

Lido will continue to benefit from incumbency

Both the leading staking platforms -- Rocket Pool’s (rETH) and Lido’s (stETH) -- have an interesting way of dealing with assets in the validator queue. The way they work in practice is to socialize the staking income across all validators, whether or not those validators have been activated. This means that validators in queue act as a drag on the overall performance of the staking token, since at any given time less than 100% of the provided ETH is validating.

In most cases this is fairly negligible, since the inflows of new ETH is nominal and the validator queue is ~days long. However, post-merge when we have a surge of ETH inflows and a months+ long validator queue the drag will become meaningful. This will have the effect of taking yield from earlier stakers and giving it to new stakers. Great for new customer acquisition, terrible for existing stakers!

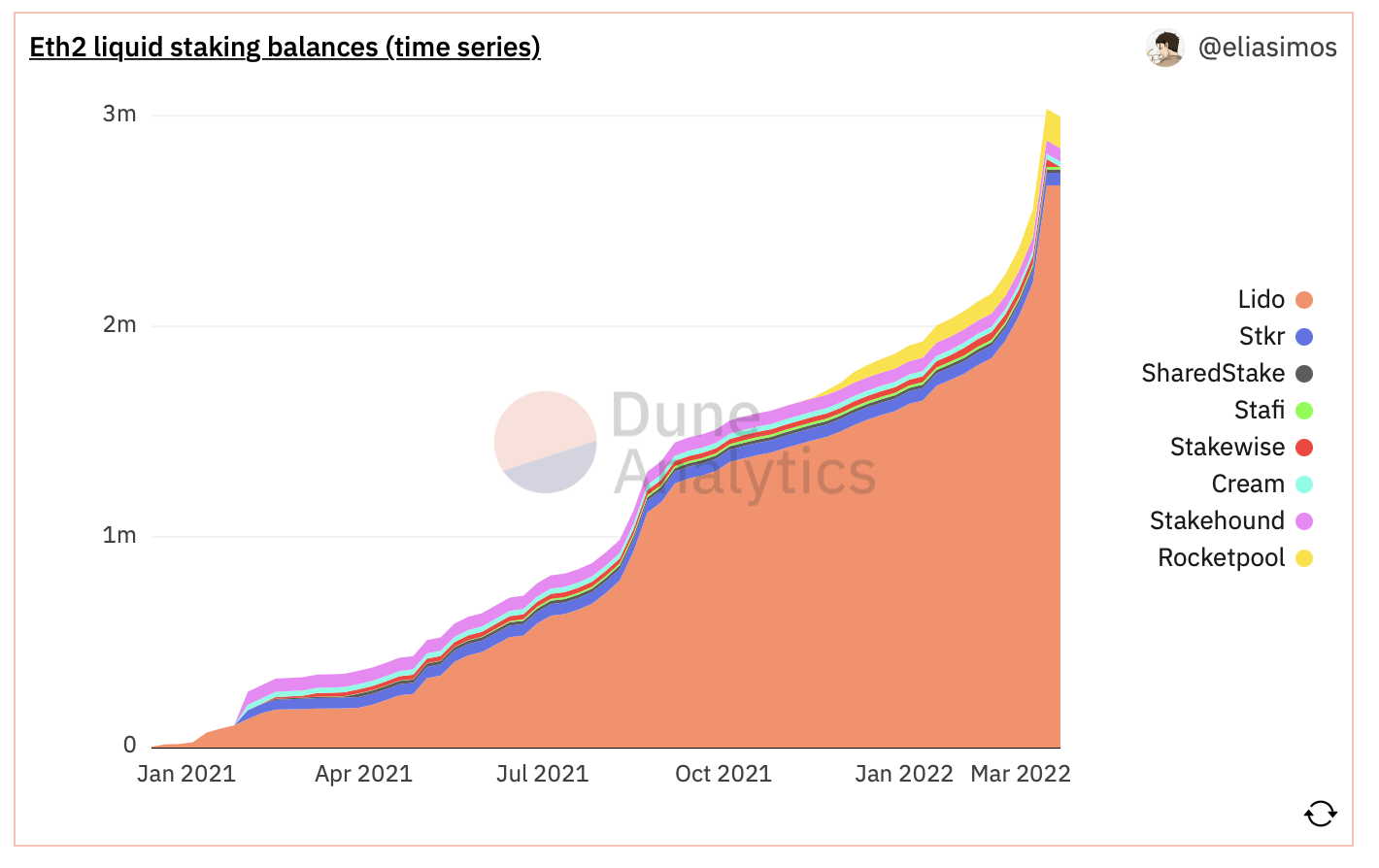

However, the dilution will happen proportionately to the total rETH or stETH supply, and it’s likely that many depositors will likely choose the platform that has the least percentage dilution. Projecting this forward would mean that Lido could onboard much more fresh ETH at the same dilution than Rocket Pool can, because it has roughly 20x more ETH locked already.

Incumbency has benefits… but in any case, a rising tide lifts all boats and I expect the merge will benefit all liquid staking platforms.

Dilution of staking rewards will rotate would-be stakers to node operators

Because of the dilutive effects of staking on liquid staking tokens, the rETH/stETH yield is expected to come down. As a result, potential stakers will have a few options:

- Participate in liquid staking and accept the reduced APR.

- Create solo validator(s) in order to get the “full” yield, trading off time to activate for a higher yield.

- Create minipool(s) on Rocket Pool, where RPL rewards will accrue immediately and effectively subsidize the activation queue, leading to some immediate rewards and a period of time before the full yield is realized.

Being fairly intolerant to a lower yield, I think we’ll see more and more people decide to participate in staking directly by creating solo validator(s) and/or Rocket Pool minipool(s).

Rocket Pool

Enter Rocket Pool. RPL is Rocket Pool’s native token, which is used as a collateral bond for enabling permissionless node operation. Collateral ranges between 10-150%, and is locked (removed from supply) until the validator is exited and withdrawn after the Shanghai fork.

For most people it’s hard to actually participate in the merge’s unique circumstances of economic change. Smart hodlers will likely decide to frontrun the queue by staking pre-merge and secure a spot for full rewards. Rocket Pool and RPL specifically offer an interesting alternative.

A few RP-specific theories:

Rotation from rETH to node operators

Partially mentioned above, I think we’ll see a headwind effect on rETH the token and a tailwind effect on willingness to operate a node. This is because of:

- The higher absolute returns given the commission/rewards structure (currently base ETH yield + 15% commission + RPL rewards).

- The non-dilutive effects of operating a node, provided the operator can make it into the queue or is willing to wait.

- The fact that part of the reward structure (RPL) accrues immediately after staking, and does not need to wait for the validator to active.

This will be net-positive for Rocket Pool the protocol, since current growth is heavily bottlenecked on the side of node operators and much less so on rETH demand.

ETH APR will be > RPL APR

Currently RPL has a staking yield of 13.6%, whereas ETH has a staking yield of 4.7%. As a result, many stakers decide to go heavy on the collateral to maximize their yield. However, because staked RPL continues to climb quickly (reducing RPL APR) and the ETH yield is expected to double or triple, I expect that immediately post-merge ETH will be a higher yielding asset.

This will have the net effect of incentivizing each new node operator to enter at minimum collateral (~10%) for the same reason -- yield optimizing. Since new node operators are likely not early adoptors of Rocket Pool, this lower incentive is desirable anyway, since they want to keep a high ETH allocation.

In effect, node operators will be “paying” for the 15% ETH commission by taking a 10% position in RPL, which makes sense numerically for those willing to do the math.

Average collateralization is likely to go up

Counterintuitively, I expect the average collateralization rate to go up, despite a wave of new node operators entering at minimum (~10%) collateral. The reason why may not be obvious at first -- it’s because new node operators necessarily need to buy RPL in order to participate, which will push the RPL/ETH price up and increase everyone’s overall collateralization.

Let’s take an example using some real-world numbers. Rocket Pool has been onboarding about 7% of validators since inception. It seems reasonable to project that forward. Let’s assume:

- 5 million ETH is staked in the run up to the merge and immediately post-merge. RP captures 7% of that, for 350k ETH.

- Roughly 50-60% of the total supply of RPL will eventually be staked. The rest will exist as float, or is held by the team or Patricio, or is simply dormant/lost.

Now, some quick math:

- As a consequence of 350k ETH inflows, a minimum 10% of that demand will need be purchased as RPL for the minipool half of the validator, or 17.5k ETH worth of RPL.

- At current valuation, that is 1.6 million RPL that needs to purchased. There is only 670k RPL currently available on the secondary market, which alone would push RPL/ETH well into price discovery.

- By itself, adding 1.6 million RPL + 350k ETH would reduce the average collateralization from 67% (current) to 28%. However, the demand for so much RPL would necessarily increase the RPL/ETH price many times, leading to a net-increase in average collateralization.

- After the 670k secondary market supply is consumed, the RPL/ETH ratio would be at 0.015 (+36% from today) with no available upside liquidity.

- (Note: I’m intentionally ignoring OTC trades, available liquidity from >150% collateralized nodes, and inflation. Those may be meaningful factors.)

The reason why I focus on collateralization so much is that it’s an important piece to RPL’s valuation. More on that below.

The merge is a hugely bullish catalyst for RPL

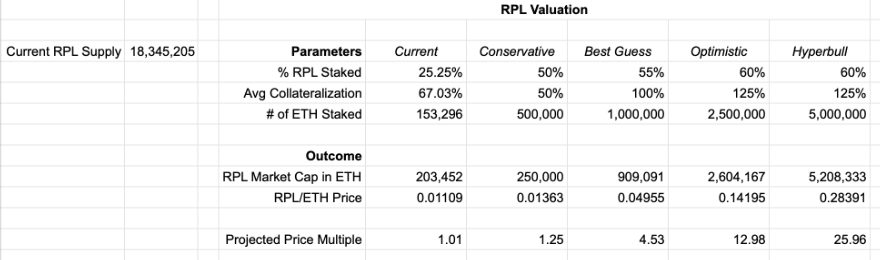

Because of the interconnected relationship between ETH and RPL, it’s possible to project the RPL price based on a few simple parameters.

Taking a few “reasonable” assumptions on growth and future collateralization, you get the following:

In a “best guess” scenario using “reasonable” assumptions, RPL has a 4.5x upside vs. ETH. This intentionally avoids secondary value from speculation, governance, or alternative use cases such as DeFi.

RPL is a unique token that carries very ETH-like properties. In many ways, it acts a form of leveraged ETH where the leverage factor is dependent upon Rocket Pool growth, with a protected downside due to the minimum 10% collateral requirement.

Because staking is such a fundamental property of PoS Ethereum, and the required validator bond is priced in units of ETH (i.e. minimum 1.6 ETH worth of RPL to start a minipool), I believe this token will benefit significantly from the merge narrative and a surge in appetite for staking.

tl;dr

- However bullish you are on RPL, you are wrong. You are insufficiently bullish.

- The merge changes everything.