F-NFTs are a type of NFT that enable people to own part of an NFT that would, otherwise be unaffordable. This process of fractionalization allows to share the ownership of an NFT, through a set of fungible tokens tied to the original NFT.

From the artist or owner perspective, an NFT is a unique digital asset that lives on the blockchain — such as art, music, or collectibles — that allows an artist to monetize their creations. Fractionalization has allowed users to decompose NFTs into smaller fungible shards with a variety of use cases.

The NFT fractionalization landscape is still relatively new and also still at extremely early stages of NFT adoption, but there’s no doubt that clearly, fractionalized NFTs are a revolutionary concept and ever-changing world of NFTs.

In this article:

-

fNFT Introduction.

-

What is a fractionalized NFT ( fNFT).

-

How to fractionalize a NFT.

-

fNFT Platforms and comparisons.

-

Pros and Cons. Fractionalized NFTs.

-

Fractionalization vs Secondary NFT collections.

-

What is coming with real examples.

. DAOs as a vehicle in NFTs investments.

. Social media posts converted to NFTs.

. NFT personalization.

-

Real-world f-NFT uses cases.

-

Endnote.

1. fNFT Introduction

New types of NFTs are pop in with freshly uses cases, NFTs started off as digital collectibles, gaming items, music and art. However, that is just the beginning. Financial NFTs are finding new use cases such as representing insurance policies and liquidity provider positions.

One of this new types are fNFTs, here you will find all you need to know about them. It is an article for anyone, it does not matter if you are tech or non tech, you just have the curiosity to learn.

As I mentioned before, F-NFTs are part of the new NFT financial ecosystem, let´s go to fully understand them!.

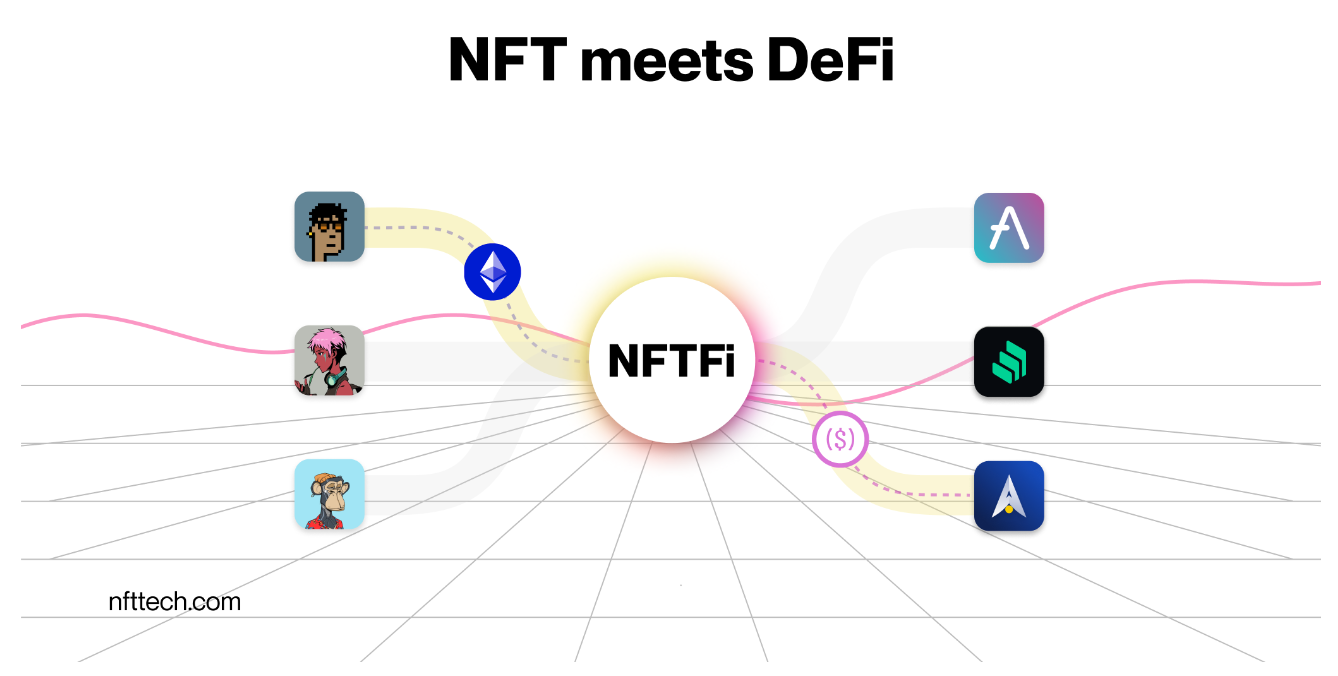

NFT-Fi stands for decentralized finance (DeFi), is simply DeFi applied to NFTs and NFTs ( Non Fungible Tokens is a record on a blockchain linked to a digital or physical asset), NFT differs to other tokens like coins tokens, that they are unique digital assets built on a blockchain like Ethereum, and fNFT stands for fractionalized NFT, and they are a NFT-Fi type.

In this article you will fully understand what fNFTs are, How they work, the benefits and the inconveniences, and to land better all these concepts, you will go, along the article, though some examples.

2. What is a fractionalized NFT or fNFT?

NFT-Fi unlocks a large actions for collectors, one of these new actions are fNFT´s, they bring a new way to access and own a NFT.

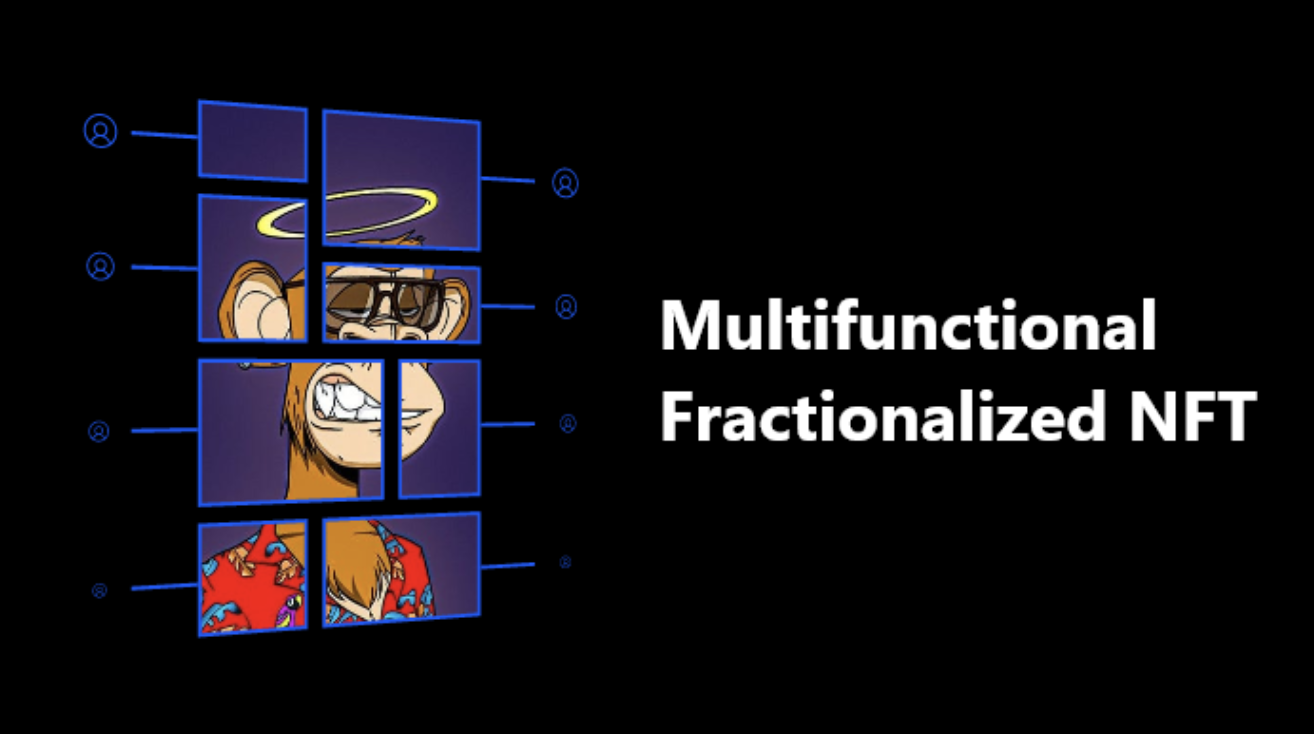

Fractionalized NFTs are NFTs split into smaller pieces by their original owner. Through fractionalized NFTs the ownership is collectively as a community, or co-ownership. Therefore, A fractionalized NFT is an NFT broken down into smaller fractions to be sold individually. Each fraction represents a portion of the NFT’s ownership, enabling a community of people to own a single token.

So from the buyer perspective, that type of NFT enable people to own part of an NFT that would otherwise be unaffordable, as NFTs rise in value, fractionalization enables individual investors to acquire a smaller stake in a high-value NFT or a basket of NFTs.

And for the Author, Artist or owner perspective, enables to release some of the value in their NFT without selling it fully. When your assets are valued very high, thousands of euros, is the ability to split them up into more liquidity therefore you can use them as collateral elsewhere.

3. How to fractionalize a NFT.

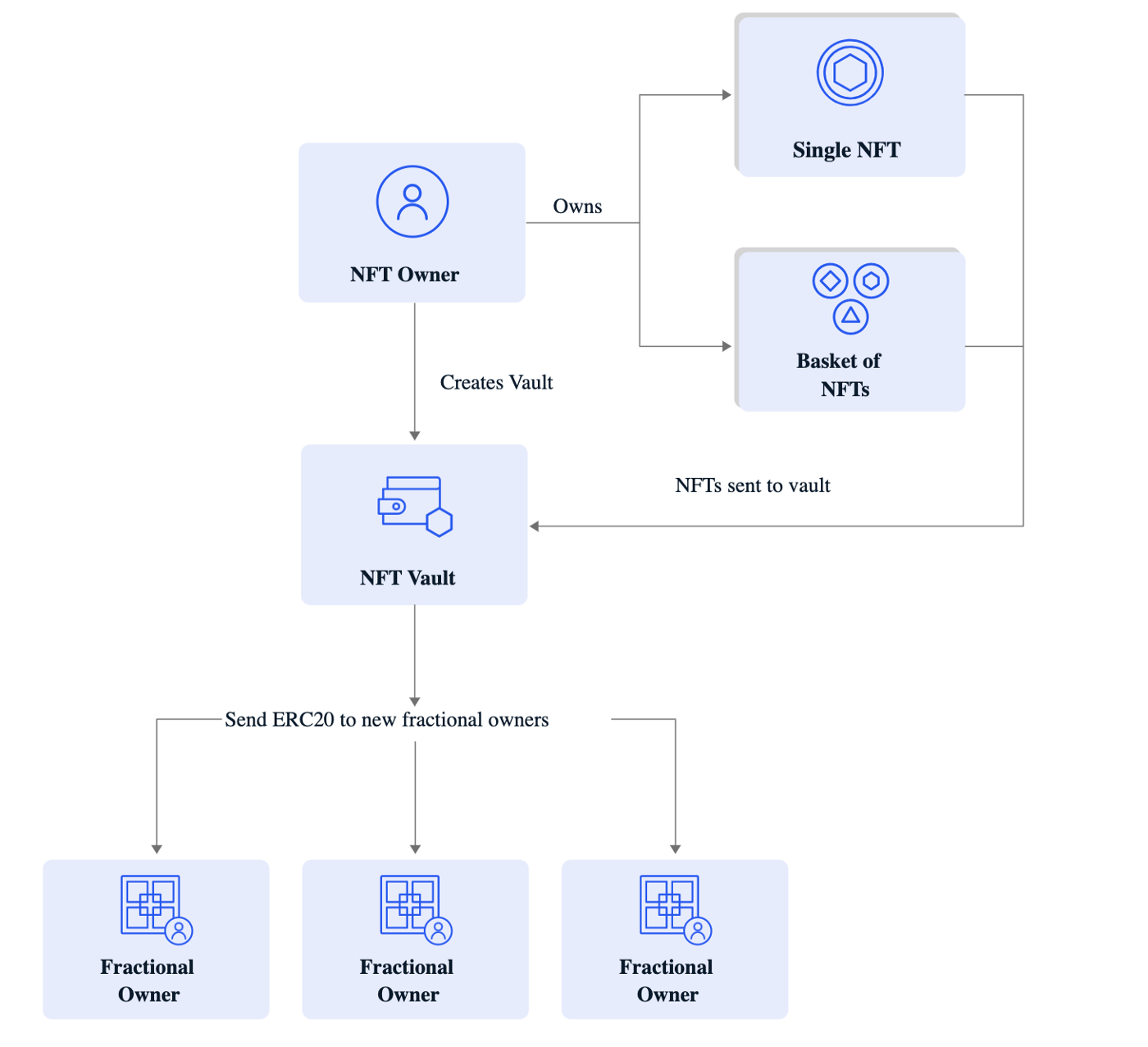

When a NFT is fractionalized, the original NFT is locked up in a vault.

Despite ERC-721 and ERC-1155 are the two most common ethereum’s standars, however to create altcoins or other homogenized tokens, the ERC-20 standard is the one that is used.

ERC-20 tokens representing ownership of the NFT are then minted, each of which represents a share of ownership in the original NFT and a limited supply of fungible tokens representing fractions of the NFT’s ownership is issued.

You will need to deploy a smart contract with instructions for generating a certain ERC-20 ( fungible standard ) from an ERC-721 ( non-fungible standard).

Therefore the process of fractionalization involves generating multiple fungible tokens out of a single non-fungible token. Anyone holding an ERC-20 token can fractionally own the associated NFT.

The process of NFT fractionalization:

-

The NFT must be secured in a smart contract. This smart contract needs to have instructions that breaks this Non fungible token (ERC-721 or ERC-1155) into several fungible tokens(ERC-20) smaller parts.

-

Each ERC-20 token represents partial ownership of the NFT.

-

After the owner of the NFT sells it, holders of the ERC-20 tokens can redeem their tokens for their share of the money received from the sale.

-

The owner of the NFT makes all major decisions regarding the fractionalization process, like deciding on the number of ERC-20 tokens to be created and also will fix each token’s price.

-

Sale. An open sale is then organized for the fractional shares at a fixed price for a set period or until they are sold out.

If you are wondering if the can be restored, indeed they can, as fractionalization is a reversible process. Akash Takyar ( CEO LeewayHertz ) says:

The answer to this question is, “Yes!” Fractionalization of an NFT is a reversible process; that is, the fractionalized NFT can be put back together to form the whole. Every F-NFT smart contract has a buyout option. This buyout option powers each NFT shard holder with the capability to buy all the fractions of an NFT to unlock its original version.

To trigger the buyout option, shard holders must transfer a certain amount of ERC-20 tokens back to the smart contract. A repurchase auction will be held within a set time after the trigger. Other NFT shard holders have a time limit to make a decision. Once that time is over, all the fractions of the NFT will automatically be transferred to the smart contract, and the entire NFT will be granted to the buyer.

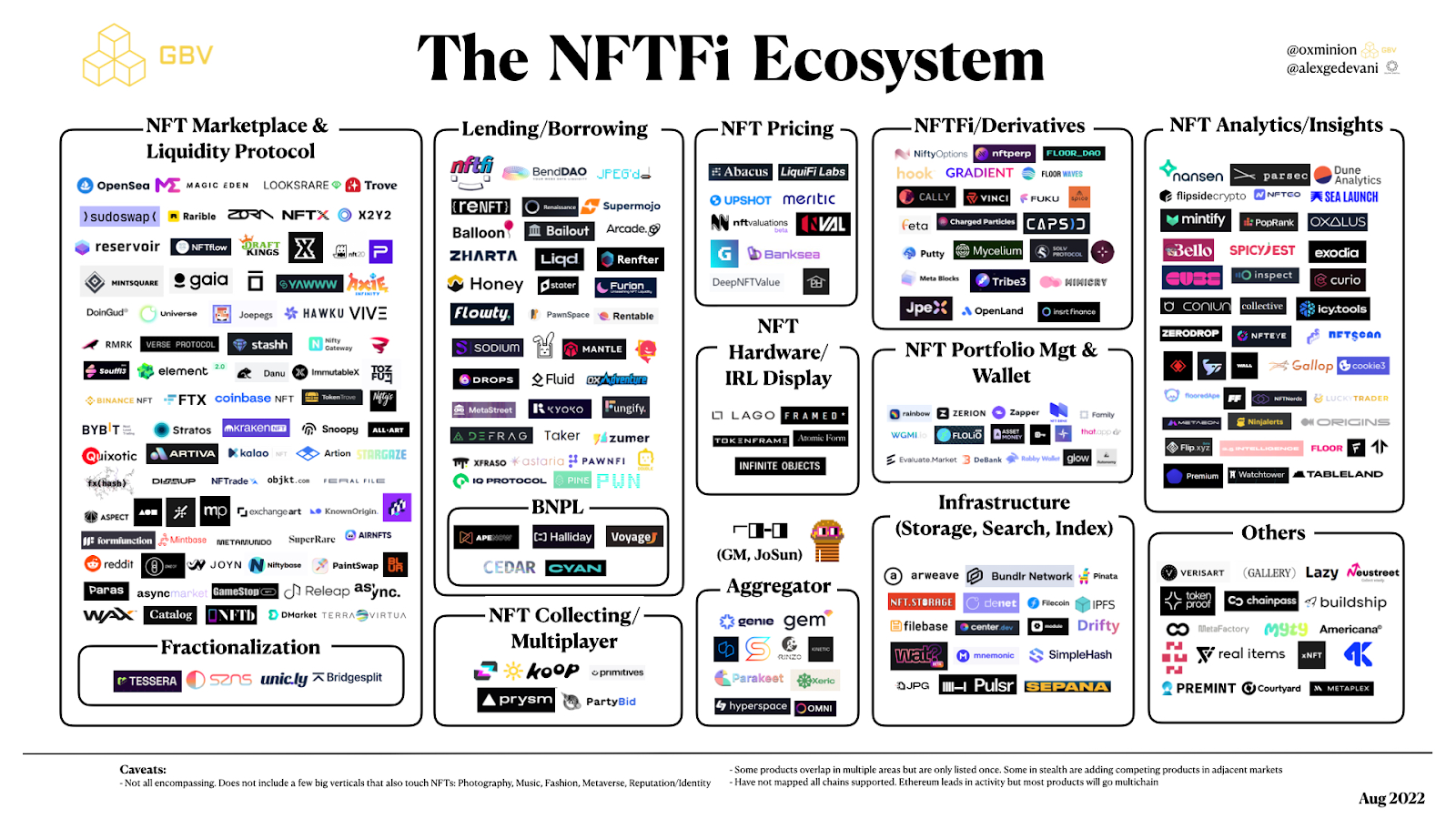

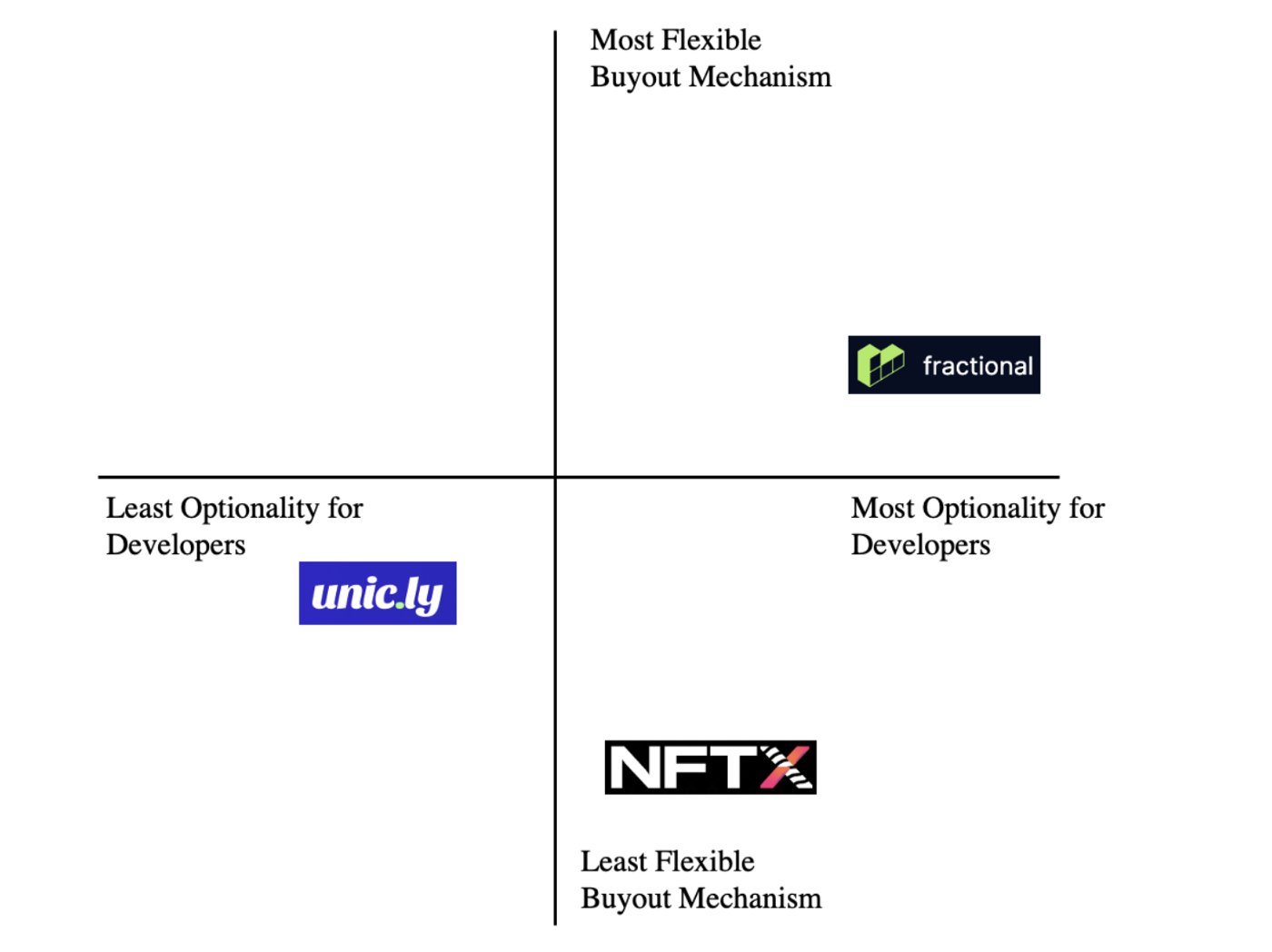

4. f-NFT Platforms and comparisons.

Allows users to fractionalize NFT by connecting their wallets, depositing their NFTs into a vault, and minting new ERC-20 tokens (uToken).

Unicly has its own token called $UNIC and will be a governance token capped at 1M total supply, and the inflation rate will decrease approximately once a month.

Unicly will be governed by UNIC token holders.

If you want to create a collection at Unicly:

If you are a creator, collector, and/or NFT enthusiast with a lot of amazing NFTs, you should make your own collection! You can do this by going to the uToken page, and creating a collection with your own settings and the NFTs of your choice. You can provide liquidity for the uTokens issued in order to distribute it to your audience. UNIC holders can vote to whitelist your collection if the community likes it. (Unicly Wesite).

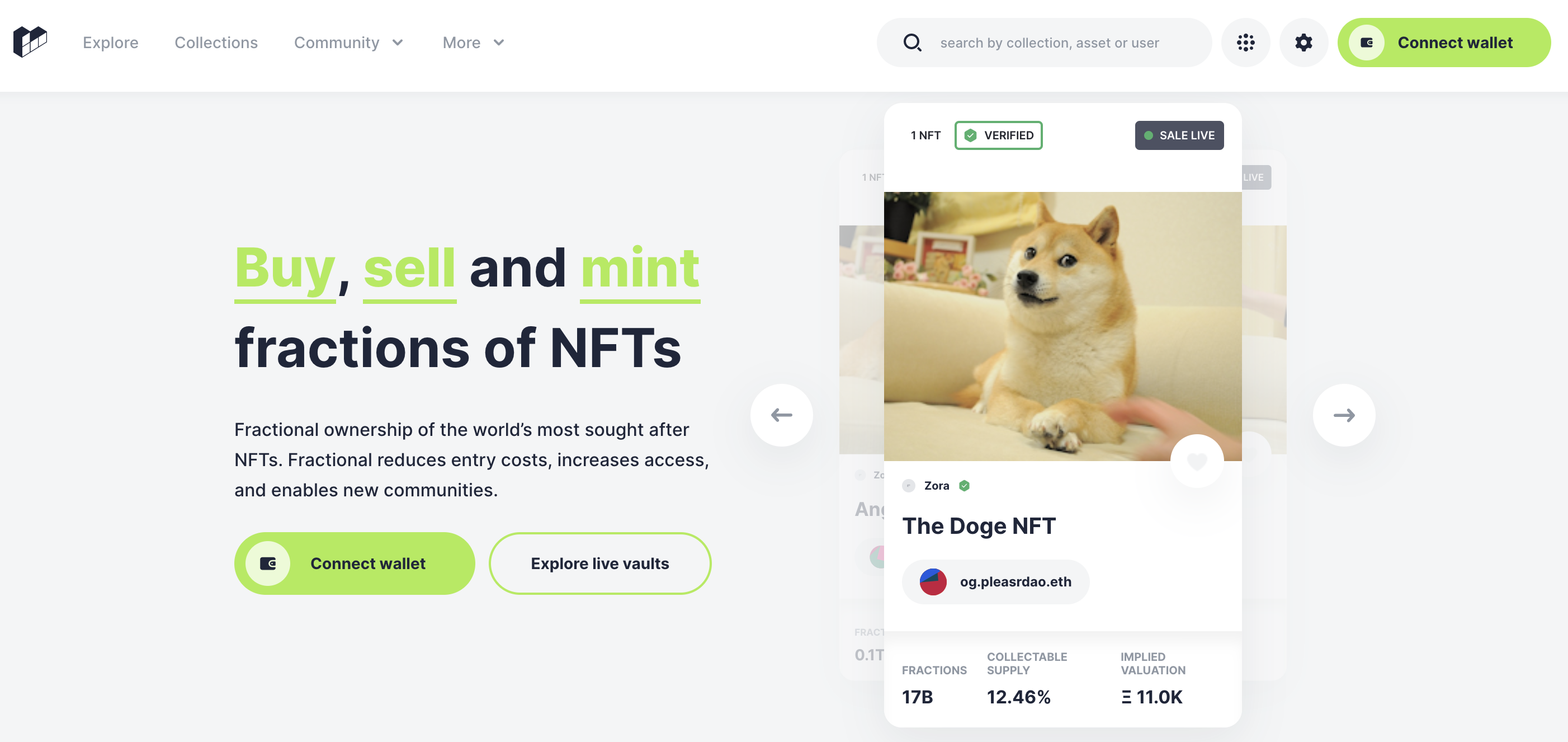

It is a decentralized protocol that enables NFT holders to fractionalize tokens individually or on a pooled basis. Both are quite similar, despite Fractional.art does not have an option for investors to stake to earn yields.

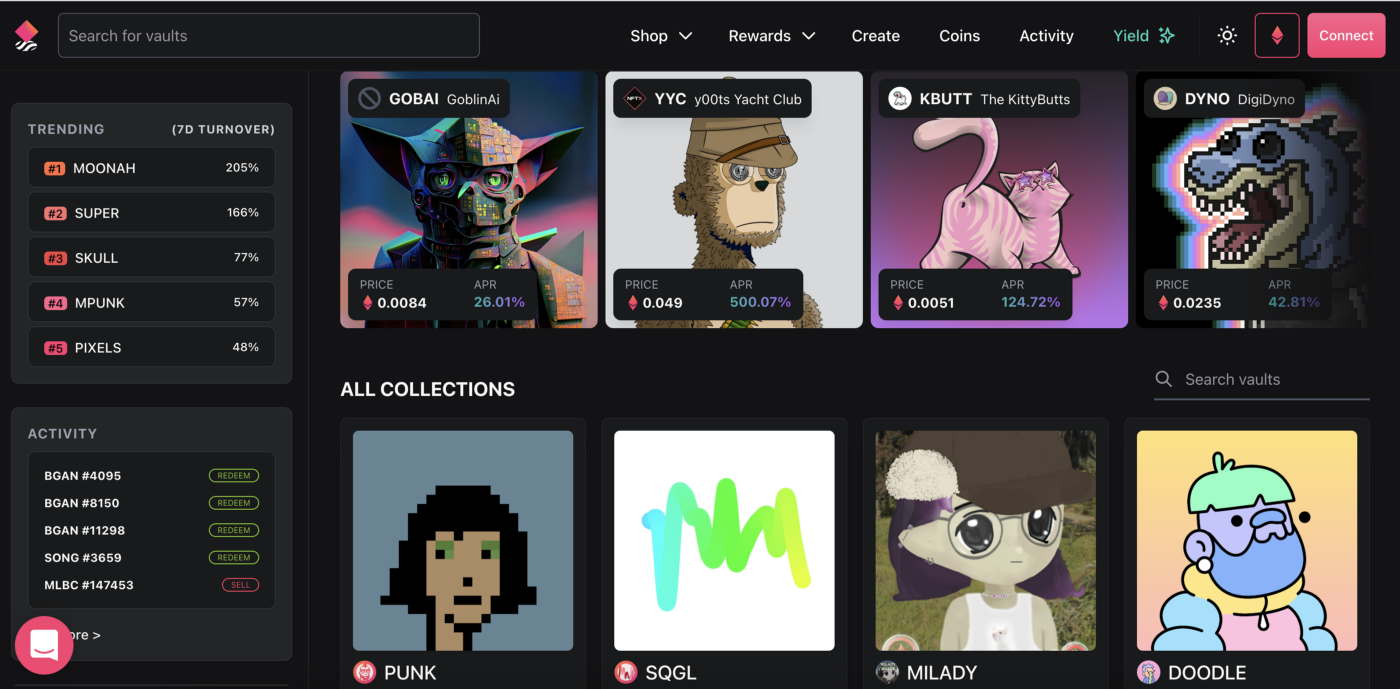

3. NFTX.io.

A NFT marketplace platform that lets users deposit their NFTs into a vault to create a fungible ERC20 token (vToken).

The newly minted token represents a 1:1 claim on any random NFT within the vault. Users can pool the ERC20 tokens in Automated Market Makers (AMMs) like SushiSwap to create liquidity and trade.

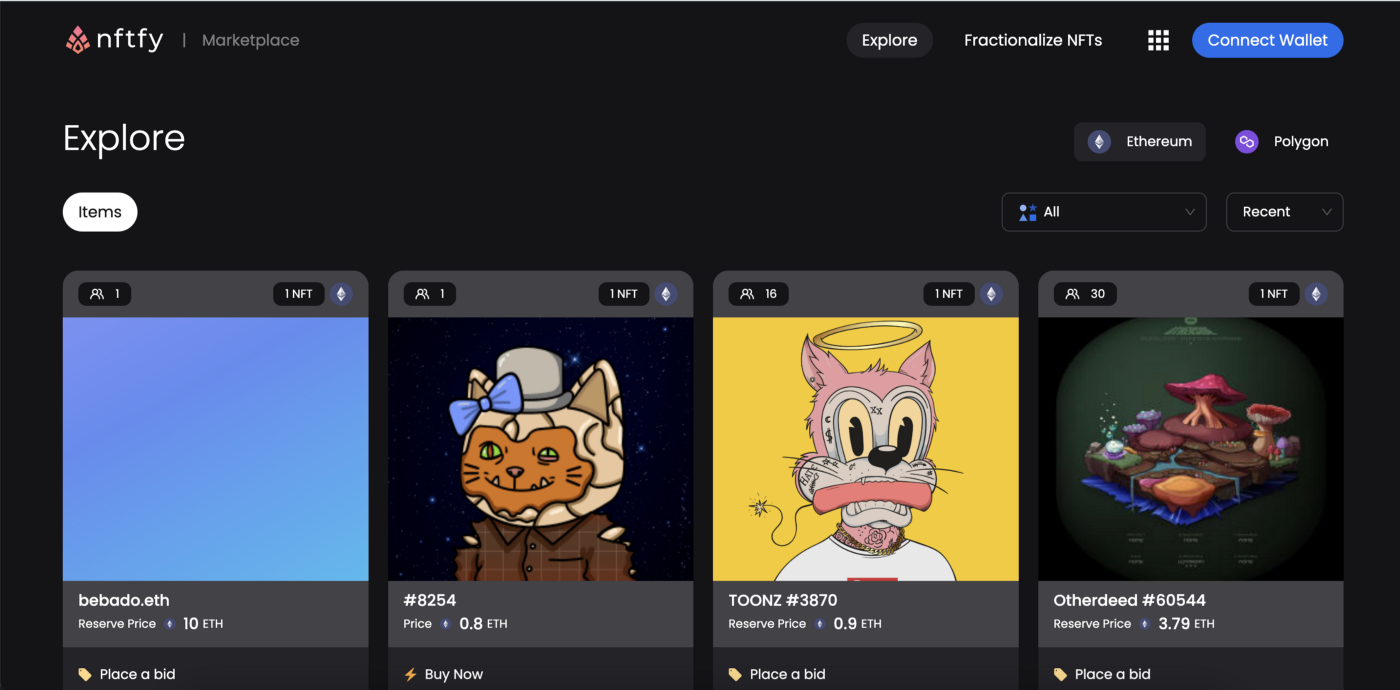

4. NftFy.

Nftfy is a Decentralized Application (DApp) that fractionalizes Non-Fungible Tokens (NFTs), generating Fractions ERC20 compliant fully backed by the NFTs. Nftfy is an Ethereum-based and open source platform that runs autonomously.

How to fractionalize NFTs in Nftfy Protocol?

-

Log in via wallet (Metamask and Portis);

-

Visualize your NFTs on Nftfy Dapp;

-

Select the NFT to be fractionalized;

-

View the complete NFT metadata and establish your contract rules: determine the exit price by choosing a cryptocurrency and the respective amount;

-

Confirm the blockchain transaction via wallet;

-

Fractionalization completed: you receive 100% of Shares (ERC20 tokens) in your wallet.

Here Nftfy User’s Guide

Comparisons among the first 3 platforms:

In a Bankless’ article they also pointed out this:

The obvious problem here is that of a whale being able to outbid an entire community of token holders. Another fractionalization project Unicly tries to improve on this by bundling the fractionalization of multiple NFTs in one vault, as opposed to a single NFT like on Fractional. This allows users to hold a fractionalized asset of a collection of NFT assets. While this does not technically make it harder for whales to sweep a whole NFT, it preserves the fractionalized ownership of the average user.

These four concepts, will help you to manage in these marketplaces:

- Buyout

A buyout auction is similar to a regular auction; the only difference is that it involves trading F-NFTs instead of physical assets.

Current fraction holders can keep their fractional ownerships if they want to. However, a buyout occurs when an external party deposits an amount higher than or equal to the reserve price, which initiates an auction.

Holders will have to beat the potential buyer by outbidding the potential buyer’s bid amount. If they fail to do so, then all individual fractions will automatically come together and reconstitute the NFT to be transferred to the buyer.

When the auction ends, the NFT is withdrawn, and the fractional owners exchange their tokens for cryptos earned from the sale.

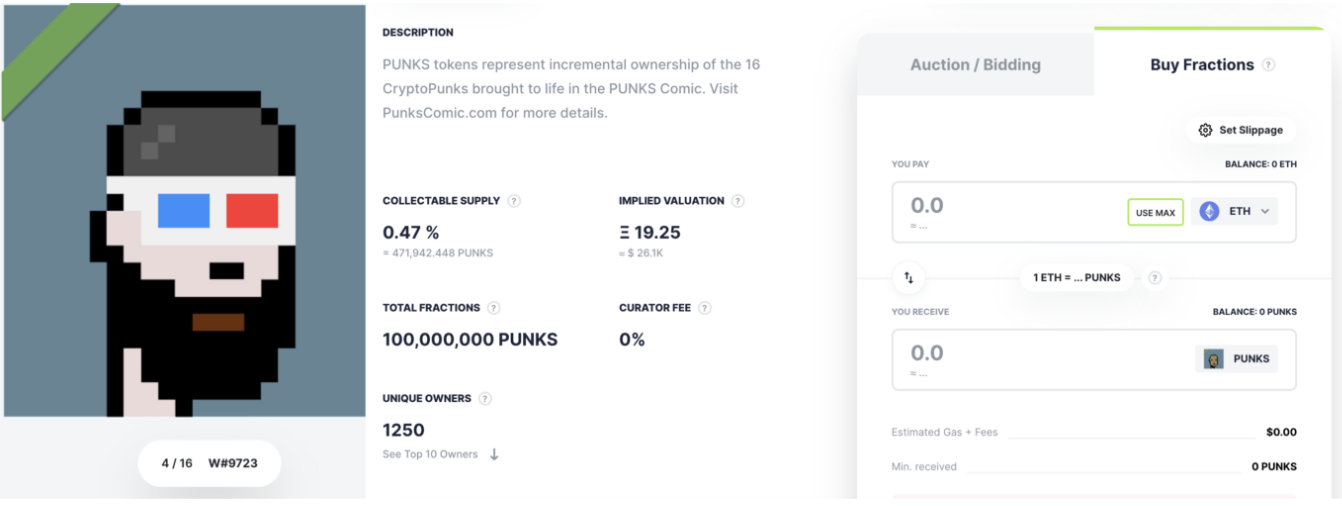

- Collectible supply

The shares of a fractionalized NFT that are available for purchase are referred to as collectible supply.

If the collectible supply is at zero percent, it implies that no fraction of that NFT is now available for purchase.

- Implied valuation

It is the price an NFT is currently valued at. It can be used as a reference to determine your “entry price.” A recommendation, if the implied valuation is equal to or lower than what you believe the NFT is worth, it is a good time to invest in that NFT.

- Reserve price

Auctions only begin when the reserve price is set, so the reserve price may consider it the lowest price an NFT could sell for.

5. Pros and Cons. Fractionalized NFTs.

Pros.

Access to high class assets.

Traditional finance uses fractionalization to deal with high-value assets, such as vacation homes and aircraft. An investor can, thus, expose his investment portfolio to a high-value asset without necessarily owning it.

lowering risks.

This means that fractionalizing an asset reduces the investment costs and risks associated with it. NFT fractionalization offers the same benefit to NFT investors.

More Liquidity.

NFT fractionalization allows smaller investors to gain exposure to expensive NFT collections. This enables more liquidity to enter the market, since an expensive NFT can be divided into shares of its worth using fungible tokens.

Community.

Fractionalization allows artists to onboard community members while maintaining the scarcity of their NFTs. Web 3 is all about community, in whatever you might end in web 3 a community is there; consensus algorithms, DAO´s, web 3 marketing, and now fNfts.

Curator incentives.

An NFT owner who divides their asset into fractions receives a curator fee from their chosen NFT marketplace. Although the owner can set and update the amount of this fee, it is subject to a maximum price limit to prevent reckless pricing.

Cons.

Reconstitution. “Putting it back Together”.

It is possible as I mentioned before, but indeed difficult. A difficulty that arises from NFT fractionalization is the process of “putting it back together.” For the whole NFT to be removed from the vault, all of the holders must sell their shares, meaning all of the fractions have to be put back together.

6. Fractionalization vs Secondary NFTs Collections.

Fractionalization, as I have been explained, allows artists to onboard community members while maintaining the scarcity of their NFTs.

However, we need to distinguish between secondary NFT collections and Fractionalization.

Secondary NFT collection, is when the artist or creator may decide on releasing another collection with similar traits to the previous one. Meanwhile fractionalization is when the artist break an NFT into fungible tokens, making it possible for multiple people to own a single NFT.

To understand their main differences and pros and cons, go to this article.

7. What is coming?

1. DAOs as a vehicle in NFTs investments.

Web3 and therefore NFTs, are all about community, and community is equal in web3 to DAOs.

Recently, Vitalik tweeted about Decentralized Autonomous Organizations, a wonderful and very detailed pice of writing about DAOs.

DAOs are gaining traction, thanks to a community around a piece of artwork that few singular individuals could afford, is possible the accessibility to rare and expensive NFTs.

Here a top 3 examples:

1. PleasrDAO

It is said in its official web site

In essence, the DAO’s modus operandi is to buy and fund culturally significant pieces and then create something fundamentally additive to the soul of the piece before sharing it back with the community.

It is said in its official web site

We at Jenny DAO aim to build the most amazing NFT collection in the world and fractionalize it on Unicly.

You’ll find 1 of 1 NFT digital art collectibles, some of which have already caused a stir since their launch, such as:

BAYC, Crypto Punks, Meebits, CyberKong VX, Tom Sachs Rocket Factory and many more…

A new DAO with a Unicly token — provides benefits to members such as access to exclusive research, group chats, and NFT leaders. The funds raised will be allocated to purchasing NFTs chosen by the DAO-governing token holders.

. Partybid

Is the protocol for buying NFTs as a team. Start a party on any NFT, contribute ETH with others and win together.

Party bid make it easy for supporters to collectively bid on NFTs as a group and create community around the piece.

Users can create a PartyBid, and with these cohesive communities forming around pieces, more attention is drawn to the artist and more fans are able to get directly involved in supporting them.

What happens after a Party buys the NFT?

The NFT is automatically fractionalized. Users claim fractional tokens proportional to the amount of ETH they contributed to the winning purchase. Fractions allow users to vote on the NFT’s new reserve price.

What marketplaces support PartyBid?

Parties can only buy NFTs that are available on:

Zora auctions

Foundation auctions

OpenSea Buy Now

Nouns

2. Social media posts converted to NFTs.

Social media posts may be converted to NFTs and distributed among original supporters of an individual, leading to a community-based reward to fans.

For example, the first likers of a very well-known spoken person in a specific topic, his or her first-ever Instagram post or tweet could be rewarded for their initial support with fractions of that post.

Here a top 5 Platforms list that will let you to convert your social media content to NFT

Is a platform that allows users to mint their social media posts as NFTs, and create a digital identity around content that’s able to be monetized.

This puts the power back into the hands of content creators, and allowing their community to better support their creations, without any middleman platform taking the biggest benefits.

Social media NFTs empower fans to get more involved in the content the artist posts, and lets the artist himself generate extra income.

2. CocoNFT

CocoNFT makes NFT creation very easy for social media content creators. Created and founded by Susan Randon, you can use the online tool CocoNFT to convert any social media posts into NFTs, fast and easy. Once converted, you can go on to start selling your NFTs on the marketplace.

3. BlogToNFT

Even your web content like blogs can be converted to NFTs, That’s exactly what BlogToNFT was created for. To help users convert theirs blogs into NFTs. All you need to do is sign up and have blog of your own to convert.

Through this platform, you can buy and sell tweets that have been autographed by their authors. The purpose of this platform is to make tweets mintable and convert them to NFTs.

Buy & sell tweets autographed by their original creators. Valuables is a great platform created by the San Francisco based company, Cent. Jack Dorsey the CEO of Twitter sold his original first tweet on Valuables.

5. GitNFT

On their website, at the top of the page is the straightforward “Mint” button that allows you to dive into minting straight without any delays. GitNFT also directs you to an NFT marketplace to sell your NFT after minting. You can also vote for other contributors’ NFTs and invest in promising ones.

3. NFT Personalization.

Due to the Metaverse existence, digital representations of individuals will require more individuality and uniqueness.

This could be achieved through accessorizing your NFT with certain defining characteristics that set your image in the metaverse apart from others.

. Filta

Is a face filter NFT marketplace. We are still at extremely early stages, but there is no doubt that these concepts anticipate exciting solutions, that will fallow the NFT ecosystem to be in our daily lives.

TechCrunch two months ago published that,

According to a report from Financial Times, Snap is set to start this experiment with a limited set of creators in August. In this test, artists will be able to create and mint NFTs on another platform and then import them into Snapchat as Lenses. FT’s report noted that Snap doesn’t plan to take any money from creators to show off their digital collectibles — just like Twitter, Instagram and Facebook. Rather, it is thinking about ways those artists can monetize their work.

In May, Instagram said it would allow a limited set of creators to show off NFTs in their Feeds, Stories and Messages. Last month, Facebook started testing a similar set of features for a limited number of users in the U.S. Last week Reddit launched its own NFT marketplace where you can buy digital avatars for a fixed price through fiat currency.

8. Real-World FNFTs Uses cases.

Fractionalized NFTs are a great to provide exposure to the NFT market. Yet is not the only role fractionalized NFTs play.

Here the top six real-world use cases that make them even more valuable.

Real estate

By replacing intermediaries with smart contracts, NFTs can significantly speed up the process of property buying.

Real estate investments need a lot of upfront capital to purchase any property, which means that only a handful of people can invest in the real estate sector. NFT fractionalization is here to help to resolve this, by putting fractional shares of real estate NFTs on sale, making real estate investment affordable.

art space

This use case it has been developed in the article, as it is the most common use case.

From the creator and investors sides, with the emergence of fractionalized NFTs now, even small investors, can invest in expensive art and creators can reap great rewards when their creations are sold.

I tweeted as a very recent example, Sir Anthony Hopkins launched a few days ago his first NFT series, *The Eternal Collection in collaboration with *Orange Comet.

The Eternal Collection conceptualizes an interpretation of the vast character archetypes Sir Anthony Hopkins has portrayed over his illustrious film career drawing its potent energy from his stimulating body of art.

The NFT series will also feature an exclusive once-in-a-lifetime IRL event for collectors, giving them access to engage with one of Hollywood’s greatest icons.

Music

Canadian rapper, singer, and record producer Tory Lanez unveiled his first-ever NFT collection, they released their NFT digital album directly to fans by selling out 1 million digital units in less than one minute.

Artists started experimenting with hybrid events as a way to bridge the gap between physical events and online participants, thanks to NFTs and fNFTS are used to help them to get resources to build and broadcast them.

They are no just VR or AR or even music company. Artists create experiences that connect artists to their fans. So this type of hybrid experience just makes sense.

Here a video of the most recent NFT from Anyma. Anyma is the solo project of Matteo Milleri from Tale of Us, and visual artist Alessio De Vecchi. Anyma is bridging the gap between live music and NFTs through showcasing NFTs in immersive and massive ways at their live Afterlife performances.

Gaming

Play-to-earn games, unlike other types of crypto games, allow players to earn, buy, sell, and even gift in-game digital assets.

Such multiplayer games can use F-NFTs to allow players to come together and buy and sell expensive in-game assets by investing in their fractionalized shares.

Multiplayer games like Star Atlas and Axie Infinity, which feature NFTs, use this technology to enable players to come together and purchase more expensive items.

Star Atlas site and trailer.

Axie Infinity site and marketplace

Collectibles

Had CryptoPunks not been fractionalized, the average investor would not have been able to invest in them, considering their high price.

Fractionalized NFTs have only made buying NFTs as collectibles easier for NFT enthusiasts. The CyberPunks fractional NFTs, for instance, were a great commercial success.

Domain name

Domain names such as .crypto and .eth have been a huge success in the web3 space. Fractionalizing domain name NFTs and putting them out for sale could also be a huge business.

Here my nft .eth domain, as an example from Opensea:

9. Endnote.

The NFT fractionalization landscape is still relatively new, and if a winner is to emerge in the space, factors such as curator fees/incentive structures for NFT owners, artists, and investors alike will decide the champions in this space.

Despite the NFT fractionalization landscape is still relatively new, there’s no doubt at all that fractionalized NFTs are a revolutionary concept and ever-changing world of NFTs and are here to stay strong.