NFTmemo by Mattbullish - synthesis of NFT news & investments, interesting projects, overview of NFT activity on Ethereum and Solana blockchains and weekly analysis: ooksRare NFT marketplace after a month - the past, present and the way ahead.

Since it´s launch in January earlier this year LooksRare captured a lot of attention in the NFT space, mainly because you could say that unlike VC-backed OpenSea it truly adheres to the web3 principles giving back to the users with rewarding them for activity and staking its own token $LOOKS. It quickly attracted attention in terms of both trading volumes (a lot of noise coming from wash trading) and protocol profitability.

First of all, I have two notes to disclose. Firstly, my ambition is not to look at the price action of the token & short term dynamics, I am more interested in the used go-to-market approach of the project, fundamentals and what LooksRare could become. Secondly, fundamentals aside, I think that LooksRare certainly brought some value to the web3/NFT space solely by airdropping tokens to OpenSea users. I have seen a lot of statements on how others gained their very first experience with staking because of the airdrop.

Go-to-market approach - “vampire attack”

“Vampire attack” as Coinbase likes to put it is “a method for sucking users out of an existing platform into a competing one by offering some kind of incentive (typically tokens)“. For better understanding I recommend a nice summary from Jordi Alexander on the game theory aspects in the LooksRare ecosystem.

LooksRare applied approach can be summarized in the following few points:

- choose a market leader with high user base i.e. OpenSea, airdrop tokens to the users;

- establish the amount of airdropped tokens based on traded volume in last X months x the no. of transactions executed (with certain coefficients);

- set the condition to claim the airdrop a listing on NFT so that you incentivize the user to overcome the friction of learning the process;

- introduce web3 inspired trading activity and token-holding rewards to incentivize activity and in the meantime intensively work on the product, strong marketing campaigns & improve user experience to try to take advantage of the network effect;

- start with steep incentives to attract attention and acquire the user base followed by decreasing the incentives in phases to achieve sustainability.

Staking

As staking $LOOKS rewards the user from part of the trading fees, LooksRare naturally needs to incentivize trading. Two days ago, LooksRare entered a Phase 2 of LOOKS Emission.

The staking and trading rewards of $LOOKS were both to decrease by cca 53%. APR on LooksRare is however composed of both $LOOKS and $WETH and $WETH rewards generation is mainly based on the trading activity (i.e. largely wash trading). You could therefore argue that if the wash trading ceased without significant increase in organic activities on the platform, it could have significant negative effect the staking incentives and indirectly on the model. I think that rewards in both $LOOKS and $WETH is a nice touch as the user´s exposure is diversified between the token but also Ethereum. It is also very convenient that the rewards in $LOOKS are automatically added to the staked amount and you let the compounding to do the magic.

MoonCat2878 nicely summarized arguments on why the wash traders are likely to stay. Interestingly enough, the appreciation of the $LOOKS token could have an interesting multiplier effect on the $WETH rewards provided $ETH maintains similar price levels.

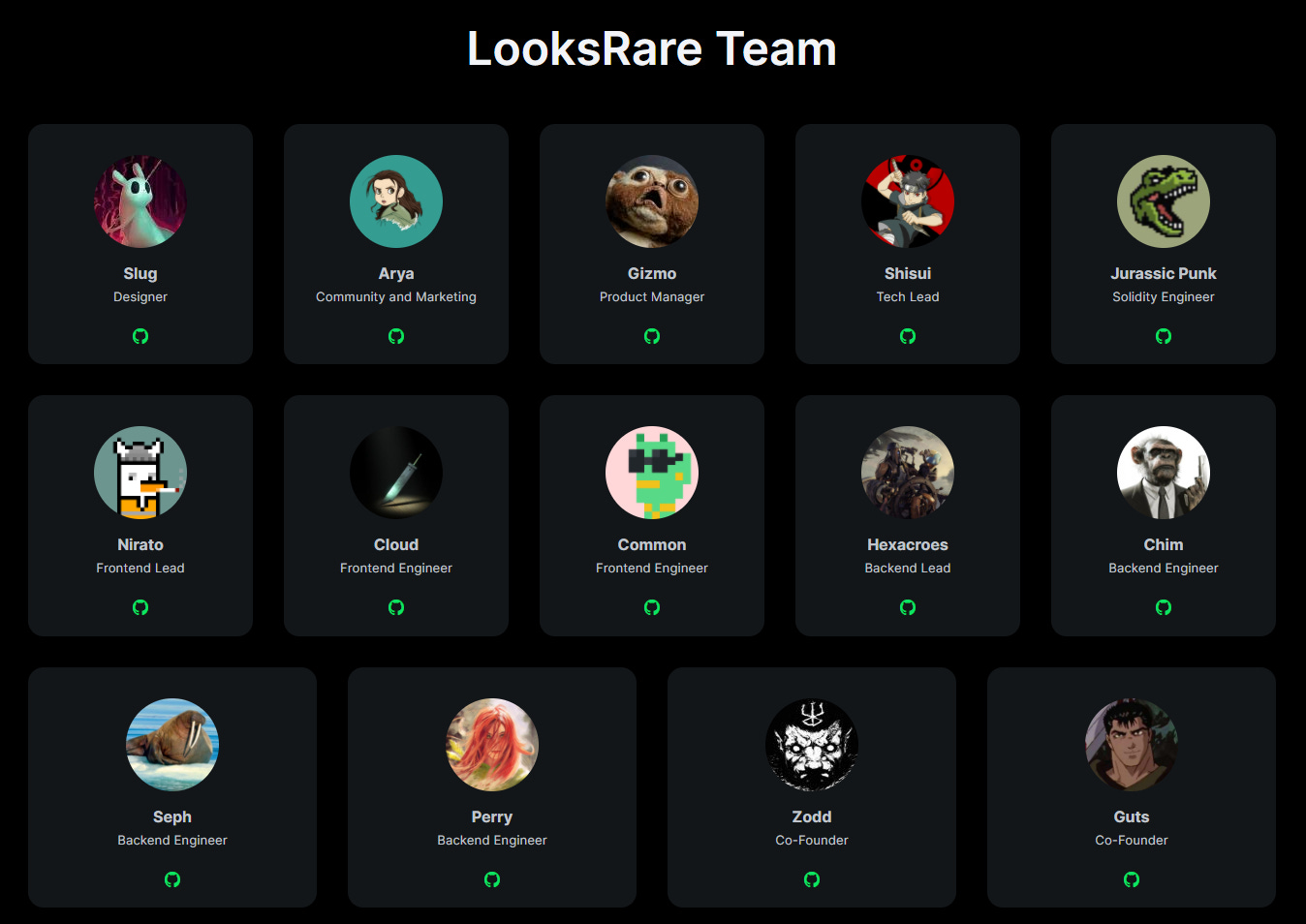

Team

Two anons known as Guts and Zodd have built the platform only in (currently) 14 people team. According to the interview with The Block the co-founders are “NFT nerds” that are active in the NFT space for a long time under different pseudonyms. They could not fork OpenSea to achieve what they wanted and they created LooksRare based on their frustration with current NFT marketplaces. The team said that they coded the marketplace’s smart contracts in modular way that will allow them to make big changes at rapid pace. They also have an intention to support L2 networks that would allow for cheaper and faster transactions.

What I like is that the team is very active, does a lot of polishing in terms of UX and makes a steady progress.

Product

I will touch upon the website only very briefly. I like the simple, clean and user-friendly interface. I must say that LooksRare went a long way but still has a long way to go. I do hope that they also plan to soon develop a mobile app for Android/iOS as that is a must nowadays.

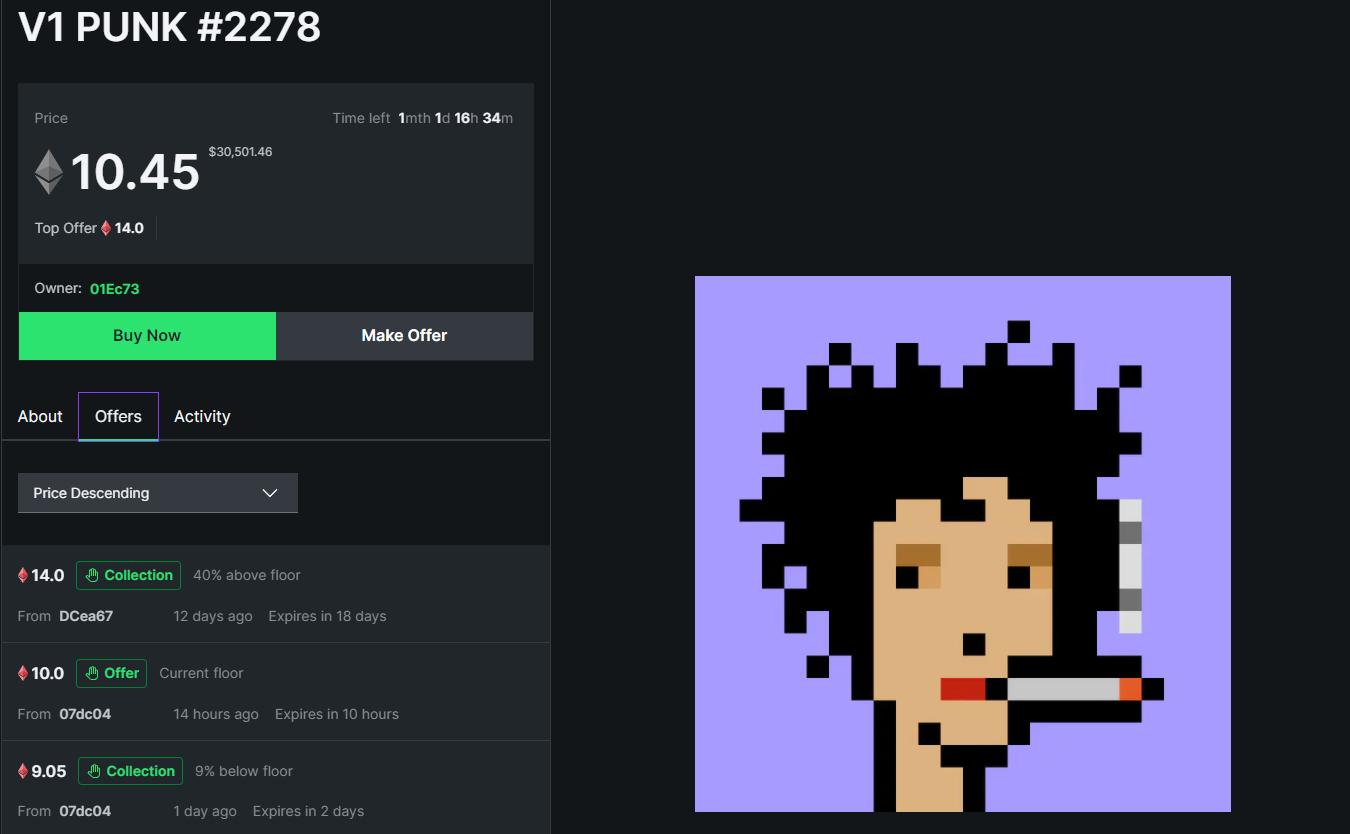

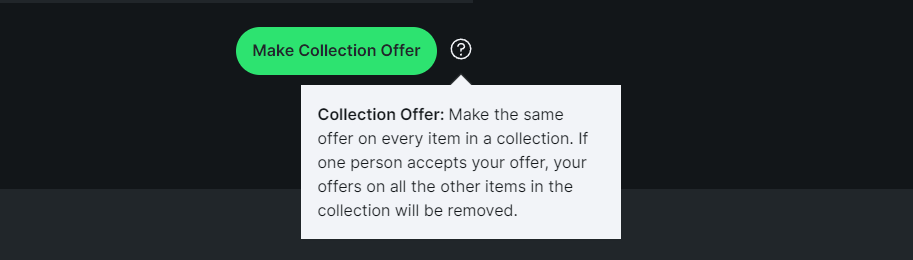

I like that on the UX level LooksRare introduced several quite unique features. As one of the reactions to wash trading issue, there has been an interesting suggestion to incentivize floor bid buyers only. Technically bidding on floor price is now possible with the Make Collection Offer, where the offer will be applied across the whole collection.

Numbers game and the wash trading story

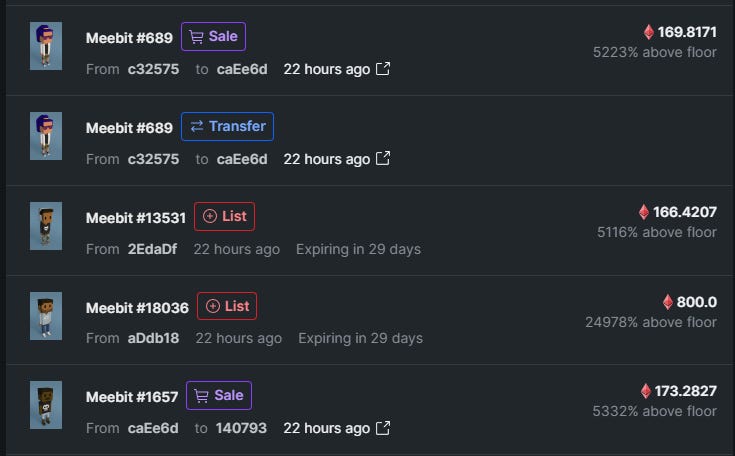

The natural downside of trading rewards i.e. the daily 2.8M $LOOKS given out for activity is that it incentivizes wash trading. For wash trading the users target collections, where there is no royalty fee set (currently mainly Meebits & Terraforms). The wash trading is painfully obvious as e.g. Meebits are listed for a huge multiple of market price.

In that case only 2% fees are paid on each transaction toward the platform and back to $LOOKS stakers. The traders simply With this tactic NFT traders accumulate volume to earn a share of the daily 2.8M $LOOKS given as trading rewards.

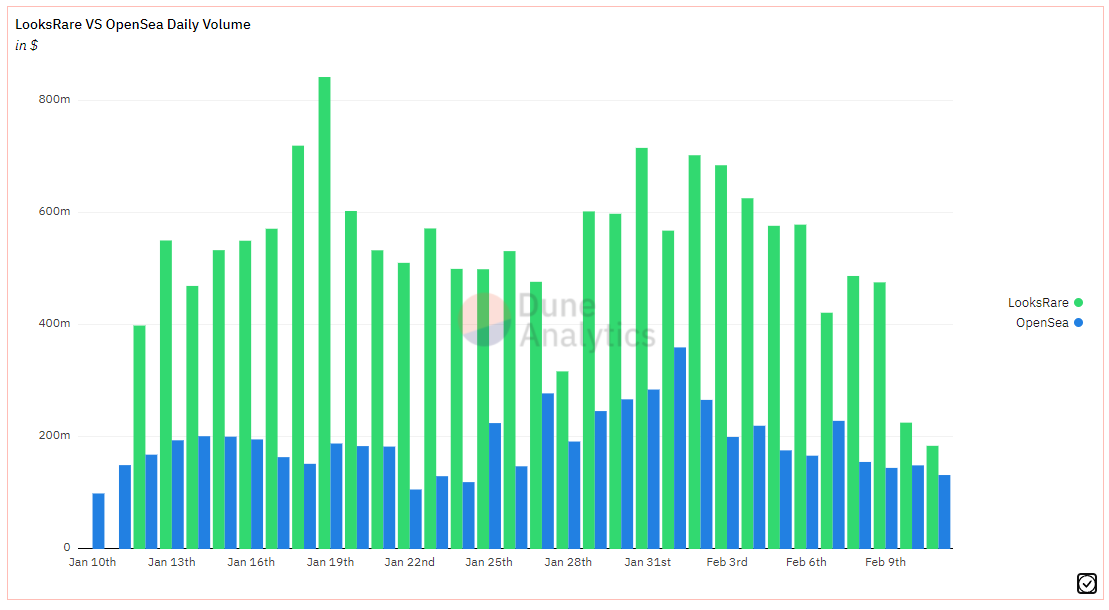

Lets have a look at the numbers. From the daily volume graph, it is apparent LooksRare statistics point to significantly higher volumes than on OpenSea, but…

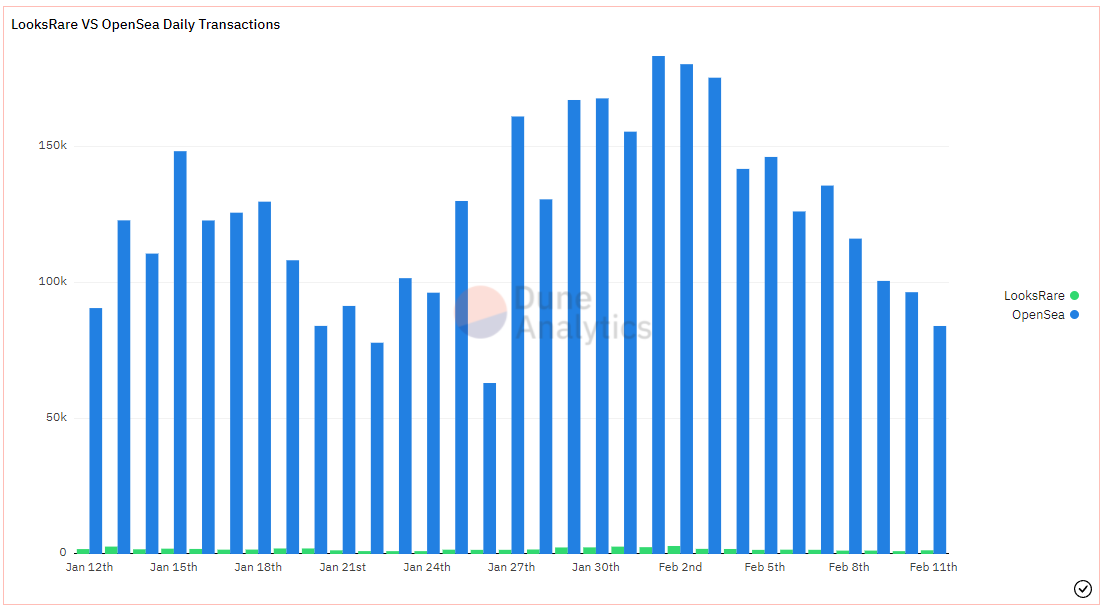

…when we compare the daily volumes with the number of daily transactions, you can clearly see that LooksRare disposes of microscopic amounts of transactions compared to OpenSea.

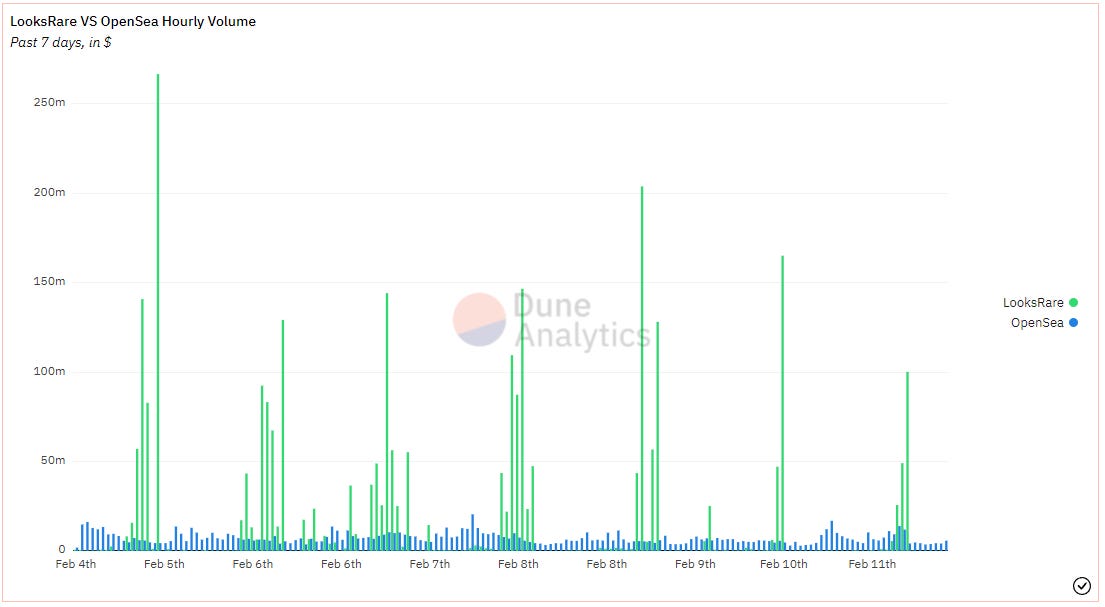

Based on the hourly volume we can see inconsistent volumes on OpenSea with few high-value transactions.

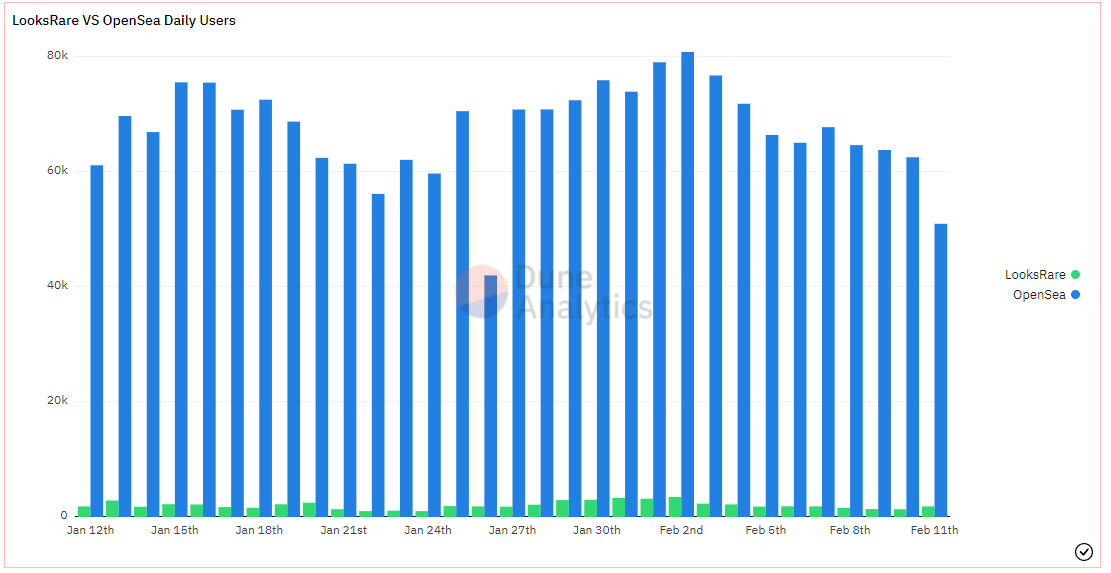

The overall picture is confirmed by the amount of daily users with OpenSea having cca 20–40 times more active users than LooksRare.

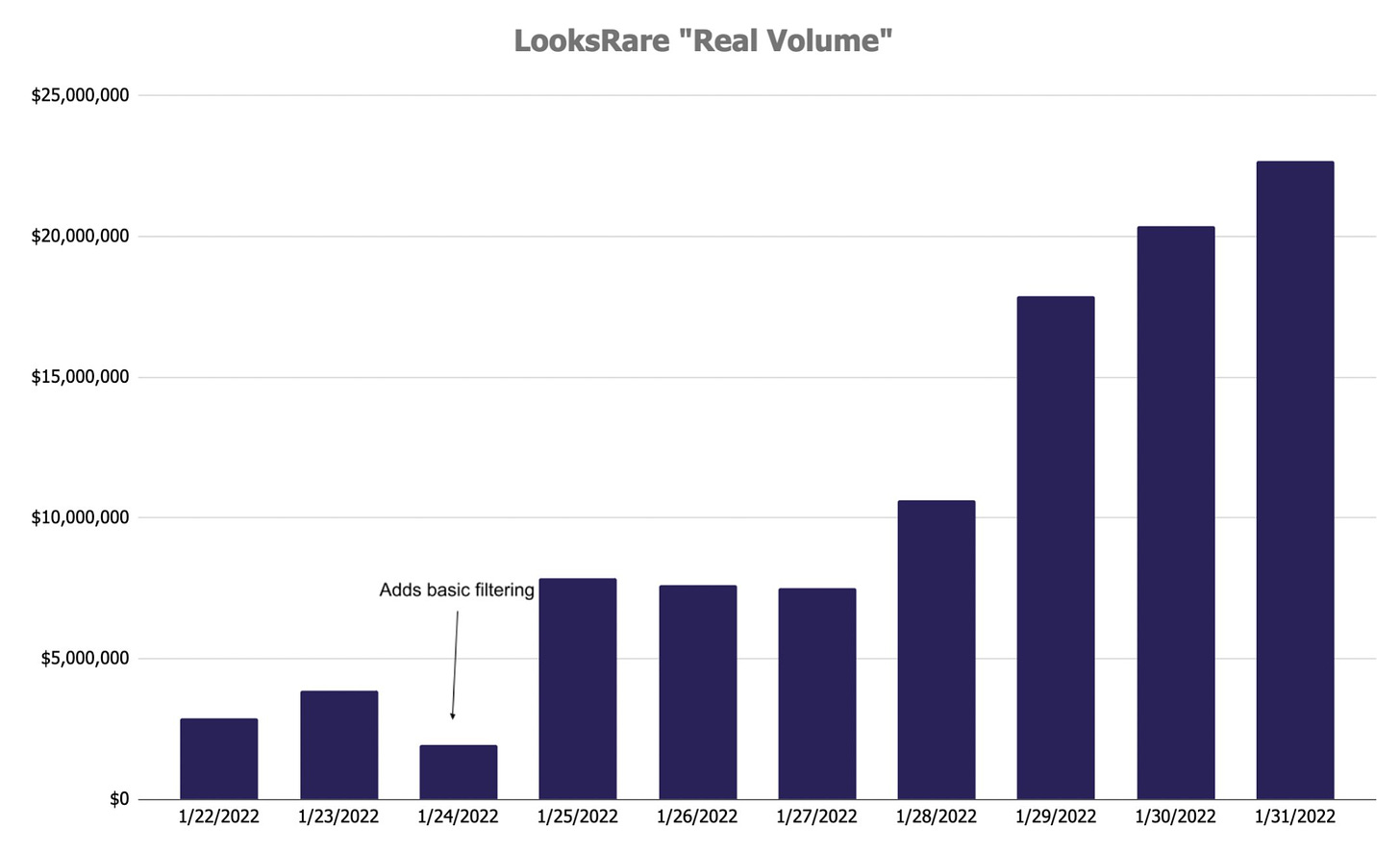

For a comparison here is the real LooksRare daily volume for January 2022. According to Steven LooksRare´s organic volume continued to grow during January after LooksRare added basic filtering to their UI/UX.

There are multiple problems caused with wash trading from setting the wrong incentives for the users to distorting the numbers, however I agree with the argument that such mechanic if temporary in nature is proportional to vampire a network effect and take a chunk of OpenSea volume that daily generates millions of USD in fees. LooksRare approaches the wash trading as risky for the traders as they do not know how much volume other traders are going to make. Looksrare also added in the interview that they intend to make such practices unprofitable in the future without any further details.

Wrap-up

Surely one could question the sustainability of LooksRare model that is largely dependent on the liquidity powered by wash trading. There is a long road to utilizing the network effect and would in my opinion have to go hand in hand with stellar development of the platform. It is also questionable whether LooksRare is worth the current $560M market cap, but as the OpenSea valuation is $13B, there certainly is some space for growth.

Due to the combination of proactive and responsive team, good UX & technical stability (unlike OpenSea), lower fees, enlarging the team, the concept of trading rewards and upsides originating from the “web3 compliant model” I remain bullish on the project. It will be interesting to observe, whether LooksRare will be able to use the web3 narrative to their advantage and grow their community around it. I perceive this as a key advantage towards other marketplaces as it is likely to remain the only NFT marketplace built on web3 principles on Ethereum chain for a while. Devin Finzer, founder & CEO of OpenSea stated in the interview by Bankless that centralized teams can build faster. In comparison due to US securities laws, I believe it would be very hard for OpenSea to issue a community token, so it may never tap into the full power of web3.

I also think that those who remain staking also in the 100-200% APR zone are driven by the usability and web3 narrative rather than opportunism. In such strongly interconnected communities as the ones in the NFT space, adhering to the web3 principles could provide a strong advantage.

LooksRare establishes an interesting precedent on how to launch a web3 platform with a significant userbase from day 1. As with everything it is faced with mixed responses from the community. It remains to be seen whether the platform can compare in long-term with incoming giants such as Coinbase or Gamestop. In case of Coinbase I perceive the upcoming NFT marketplace more as a gateway for the public with little to no experience to enter the NFT space from where they may move further down the NFT rabbit hole to more powerful platforms such as OpenSea or … LooksRare.

BONUS: Plot twist - in true web3 ecosystem no marketplaces at all?

Update 14th Feb: there was bit of a drama due to LooksRare team cashing out cca 10,500 ETH through Tornado Cash. The team reacted to this, Cobie had a thorough look on the incentive structure LooksRare uses.

Update 15th March: LooksRare partially on Github, intention to be fully open source. I think that is certainly a step in the right direction as it would provide more transparency and legitimacy that may be lacking now due to team composed of only anons.

🔗 Want to dig deeper?

Articles:

- LooksRare halving imminent, but Wash Traders are here to stay?

- Why two 'NFT nerds' built LooksRare — and where they want to take it next

- [LIVE] The $LOOKS Token by The First Mint (audio)

- Coinbase blog: Vampire attack! LooksRare vs. OpenSea

- Bankless: LooksRare analysis

- From Airdrop to $307M in Revenue in 30 Days — LooksRare Surges Past OpenSea in Torrid Month

Tweets:

- Crunching the number on LooksRare incentives, by Yuga Cohler

- A Twitter thread on the game theory of LOOKS by Jordi Alexander

- LooksRare’s growing organic volume, by Dogetoshi

- Why LooksRare’s launch was a success despite washtrading, by AllNick

- LOOKS Emission Phase 2, by Mooncat2878

📰 Recent updates in NFT space

- Salesforce announced to employees that it is working on NFT cloud service

- Sotheby´s plans to organize a sale of 104 CryptoPunks in a single-lot auction, that were bought by 0x650d in August and who explained his rationale behind it the cooperation, there are opinions that this could be rather bearish for the floor price

- Anchain put together a list of most influential Twitter profiles and created an interactive map with categorized communities such as BAYC and CryptoPunks, shared a short write-up with the 100 Twitter accounts list

- Gala Games only reconfirmed their NFT-focused commitment with 5 billion USD allocation

- A new NFT platform may be on the horizon called Quantum co-founded by Justin Aversano creator of NFT photo project Twin Flames, raised $7.5M, backed also by Flamingo DAO or Gary Vaynerchuk

- NFT Ethics Twitter account (a moral compass in the NFT space) was down for several days after reporting a scam ring around NFT Collection Squiggles, in their opinion someone was paid to take them down

- NFTs and DAOs once again found an interesting new use case, when 55M was raised by 10k AssangeDAO contributors in defense of Julian Assange (WikiLeaks publisher)

🛠️ Web3 tools & projects worth a note

- zk.money - nice tool on how to anonymize ETH/DAI and especially payments such as anonymous donations, check out their detailed how-to

- Disperse - useful tool on how to send cryptocurrency to multiple addresses in one transaction

✏️ What are your thoughts on this? Are you working on a project in web3 space? Feel free to drop me a comment under the memo or reach out to me on Twitter. Happy to discuss & connect. WGMI. Circus Matt