This article is for educational purposes only and is not financial advice

Crypto markets embody the profound shifts in human behavior and the philosophy underpinning market dynamics. Let’s look at the intricate interplay between memetics and reflexivity within both crypto and traditional finance.

We will explore how memes function as units of cultural transmission that influence investor behavior, market sentiments, and ultimately, economic realities. Just like financial institutions, memes attain "too big to fail" when collective belief and institutional pressures converge to reshape collective dogmas and financial systems.

Intro

The financial landscape is undergoing a transformation, propelled by the influence of digital culture and mass communication platforms. Old models of market behavior, grounded in the assumption of rational actors and efficient markets, are increasingly inadequate frameworks. Central to this paradigm shift are the concepts of memetics—the study of how ideas propagate within a culture—and reflexivity, describing the bidirectional feedback loop between perceptions and realities in markets.

The interplay between memetics and reflexivity can provide an understanding of how collective beliefs and narratives shape, and are shaped by, market dynamics. Additionally, we explore how certain memes become so entrenched in societal consciousness and market structures that they attain a "too big to fail" status. This occurs when widespread belief and institutional adaptation create a dependency on the meme's perpetuation, leading to systemic implications should it falter.

Let’s explore these concepts, and examine their roles in both crypto and tradfi driving profound, lasting changes in global human behavior and the philosophical foundations of markets.

First, Definitions…

Memetics in Economic Context

For those living under a rock Memetics, introduced by Richard Dawkins in The Selfish Gene (1976), conceptualizes ideas as replicators that spread and evolve within a cultural ecosystem. In the economic realm, memes function as units of information that influence investor behavior and market trends. They encapsulate narratives, heuristics, and biases that propagate through social networks, both online and offline.

Economic agents are not isolated decision-makers; they are embedded within a complex web of social interactions where memes disseminate rapidly. This dissemination influences collective behavior, leading to emergent phenomena such as bubbles, manias, and crashes. Memetics provides a framework for understanding these phenomena beyond traditional quantitative models.

Reflexivity and Market Dynamics

Reflexivity challenges the classical notion of equilibrium in financial markets. It posits that market participants' perceptions and actions influence market fundamentals, which in turn alter perceptions—a self-reinforcing feedback loop. This loop creates a dynamic where cause and effect are circular, not linear.

In reflexive markets, biases and misconceptions can lead to protracted deviations from equilibrium, as self-reinforcing trends become detached from underlying fundamentals. This theory emphasizes the impact of collective psychology on market behavior.

Synthesizing Memetics and Reflexivity

The intersection of memetics and reflexivity offers a lens through which to examine financial markets. Memes act as carriers of perceptions and biases, which, through reflexivity, influence market realities. This synthesis underscores the importance of narratives and shared beliefs in driving market dynamics, highlighting the complex, adaptive, and nonlinear nature of financial systems.

Memetics and Reflexivity in Traditional Finance

Historical Manifestations

Memetics is interwoven through historical bubble events like the Tulip Mania (1636-1637) and the South Sea Bubble (1720) demonstrate how narratives and collective beliefs can drive asset prices far beyond “intrinsic values”—and after these demise their memetic life transforms into analogy. Today, these are memes about memes—lessons, rather than analyses, about greed and collective naivety.

Behavioral economics provides insight into how cognitive biases—such as overconfidence, herd behavior, and loss aversion—affect financial decision-making. These biases are often transmitted memetically, as individuals observe and emulate the behaviors of thought leaders and in-groups.

Institutions and Memes Becoming "Too Big to Fail"

In traditional finance, certain institutions and the memes they embody have become "too big to fail," a term popularized during the 2008 financial crisis. Large financial institutions, whose failure could trigger systemic collapse, are supported by government interventions to prevent widespread economic fallout. The meme that ‘house prices always go up’ is so entrenched into the fabric of society that the economic establishment prioritized it over everything else— the money printer went brrrr for a decade and any downstream effects were worth the juice.

"Too Big to Fail" is now a meme in itself, influencing market perceptions and behaviors. It creates a moral hazard, where institutions take on excessive risk under the assumption of government support. The collective belief in the indispensability of these institutions reinforces their market position, again, making the meme self-perpetuating.

Disrupting such foundational memes would require significant shifts in collective belief and could provoke substantial resistance from entrenched interests, and likely mass civil unrest.

Memetics and Reflexivity in Crypto Markets

Platforms like Twitter, TikTok, Reddit and Telegram, act as a sandbox allowing memes spread at unprecedented velocity influencing investor sentiment and behavior in real-time.

HODL characterized the 2021 bullmarket taking various forms like ‘3,3’ ‘we like the stock’ ‘supply shock’ etc. – essentially memetic belief of an infinite imbalance to demand vs supply. Ironically, this meme was likely cemented in global consciousness from traditional markets when DeepFuckingValue held GameStop call options from $3 to $350.

In the years since its conception, HODL has met some severe stress testing but prevails in Bitcoin Maxi circles with each all-time high acting as the next reinforcing rallying cry.

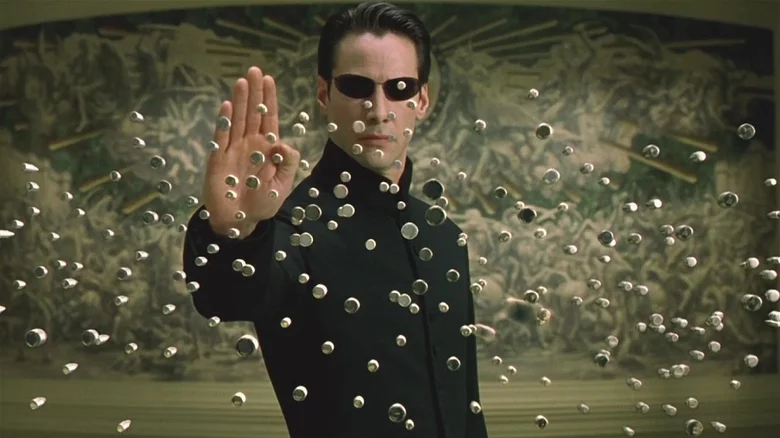

Dogecoin's rise to a multi-billion-dollar asset exemplifies memetic influence and reflexivity. The coin's value surged due to widespread dissemination of memes, access to retail liquidity, and regular endorsements by the internet's richest and smartest and most handsome man. At the time of writing $DOGE is more valuable than half of the companies in the S&P500, and this isn’t over…

Is Bitcoin entering the "Too Big to Fail" club?

When a meme like Bitcoin's "Digital Gold" narrative (gold itself being an prevailing tradfi store-of-value meme) becomes deeply embedded in both investor psychology and institutional strategies. Additional social pressure towards this outcome is perpetuated by the wealth divide from a younger generation shaped by the events post 2008 which views the opportunities of traditional market participation as buying the top of another ponzi— a view savvy political operators like Trump have been happy to tap into.

Institutional adoption of cryptocurrencies, influenced by prevailing memes, leads to significant capital allocation and infrastructure development. This institutional commitment creates pressure to maintain the meme's validity, as failure could result in substantial financial losses and undermine trust in emerging technologies.

For instance, the integration of Bitcoin into corporate balance sheets and the development of financial products like futures and ETFs based on Bitcoin hinge on the continuation of the meme that Bitcoin is a store of value. The collective belief in this meme, reinforced by institutional endorsement, contributes to its resilience, making it increasingly "too big to fail."

Comparative Analysis of "Too Big to Fail" Memes in Crypto and Traditional Markets

Mechanisms of Institutional Pressure

In both crypto and traditional markets, when enough people believe in a meme, it exerts pressure on institutions to adapt or conform. This can occur through:

-

Market Forces: Significant capital flows toward assets associated with the meme compel institutions to participate to remain competitive.

-

Social Pressure: Public opinion and investor expectations can drive institutional behavior, especially in the age of social media activism.

-

Regulatory Influence: Collective lobbying efforts and the demonstration of economic impact can lead to favorable regulatory changes.

The Role of Collective Belief in Solidifying Memes

In crypto, the widespread acceptance of blockchain technology and DeFi concepts are pressuring (at least socially) traditional financial institutions to integrate or adapt these innovations to varying degrees – payments and treasury reserves are the fastest horses to date.

The price reflexity of these assets through adoption propagate their memetic potency. Over time this evolves into the meme of their indispensability, reinforced by policy decisions and regulatory frameworks that favor their continued adoption.

Macro Risks and Implications of "Too Big to Fail" Memes

The elevation of memes to "too big to fail" status carries significant risks:

-

Moral Hazard: Entities may engage in reckless behavior, assuming they will be bailed out due to their importance – see 2008.

-

Systemic Vulnerability: Overreliance on certain memes or institutions can create fragilities within the financial system – see 2008.

-

Resistance to Innovation: Entrenched memes may hinder the adoption of new technologies or paradigms that could improve efficiency or resilience – see everything since 2008.

Understanding these risks is crucial for policymakers, investors, and society at large to navigate the complexities of modern financial systems.

Philosophical Considerations and Market Philosophy

The Social Construction of Financial Reality

The phenomenon of memes becoming "too big to fail" is a testament to the socially constructed nature of markets. Markets are not the aggregations of rational actors seeking to find fair value, but are shaped by collective beliefs and narratives with widely shared acceptance.

This perspective aligns with social constructivism, which posits that reality is constructed through human interaction and shared meanings. In finance, this means that the value of assets and the functioning of markets are contingent upon collective belief systems.

Power Dynamics and Institutional Legitimacy

The entrenchment of certain memes reflects underlying power dynamics. Institutions that successfully propagate and embody dominant memes can shape market structures and influence regulatory environments to their advantage. Markets become a battle of ideas as much as they are commercial arenas.

As memes become institutionalized, they can perpetuate existing power structures or, conversely, enable new entrants to challenge the status quo, as seen with the rise of crypto.

Cultural Shifts and Identity Formation

Memes contribute to the formation of cultural identities and communities. The shared belief in certain financial memes fosters a sense of belonging and purpose among participants, influencing lifestyle choices and worldviews.

The integration of financial participation into personal identity has implications for global human behavior, affecting consumption patterns, social interactions, and even political affiliations.

Conclusion

The virality of memes is not a fleeting phenomenon but a transformative force with enduring implications for market structures and participant behavior. As units of cultural transmission, memes possess the unique ability to encapsulate complex ideas into digestible, shareable content that resonates on a mass scale. This virality accelerates the dissemination of narratives that can redefine market perceptions, behaviors, and even the fundamental architecture of financial systems.

The permanent implications of memetic virality on market structures are multifaceted:

-

Redefining Information Flows: Traditional hierarchies of information dissemination are being upended. Memes spread laterally across networks, bypassing conventional gatekeepers like institutional analysts and media outlets. This democratization of information challenges existing power dynamics and necessitates new models and frameworks for information analysis from market participants.

-

Altering Market Dynamics through Reflexivity: The rapid spread of memes amplifies reflexive feedback loops. As perceptions influence realities at an accelerated pace, markets become more volatile yet more adaptive. Participants must navigate an environment where collective beliefs can swiftly alter market fundamentals, requiring heightened awareness and agility.

-

Evolving Participant Behavior: The viral nature of memes create immediacy based on mass collective action in markets. Investors are increasingly influenced by social sentiment and community-driven narratives, shifting from individualistic decision-making to a more networked approach. This behavioral shift has profound implications for investment strategies, risk assessment, and market engagement.

-

Institutional Adaptation and Integration: Institutions are compelled to integrate memetic influences into their operations. Failure to adapt to both demand and risks can lead to obsolescence in a landscape where memes can drive significant capital flows and reshape market opportunities. This adaptation includes embracing new technologies, revising communication strategies, and re-evaluating traditional metrics of value and performance.

-

Shaping Regulatory Frameworks: Regulators face policy challenges that account for the speed and impact of memetic virality. Traditional regulatory frameworks may not be sufficient in addressing the systemic risks posed by rapidly spreading narratives.

At a philosophical level, the virality of memes in crypto underscores a paradigm shift in markets in general:

- Markets as Complex Adaptive Systems: Recognizing markets as ecosystems influenced by cultural, psychological, and social factors challenges old frameworks of purely rational actors operating in equilibrium. Memetic virality exemplifies the non-linear, emergent properties of markets that must be embraced in theoretical and practical frameworks by participants.

The ability of memes to shape collective consciousness highlights the power of shared narratives in constructing economic reality. This phenomenon demands a reevaluation of value, trust, and legitimacy within financial systems, emphasizing the role of human cognition and social interaction.

The virality of memes represents a fundamental force that is reshaping the contours of financial markets and participant behavior, in our view permanently. It challenges traditional economic theories and institutional practices, and forces participants to embrace a more holistic understanding of market dynamics.

Crypto stands at the intersection of technology, culture, and finance, where the forces of memetics and reflexivity rage at their most violent. Success in navigating these waters necessitates an approach integrating elements of economics, psychology, sociology, and technology.

We are the subjects of an experiment shifting wider markets not only to be more dynamic but also more reflective of the collective aspirations and values of global society.

Memetic Digital is a venture builder and research team