This article is for educational purposes only and is not financial advice.

Hit subscribe to be notified of future publications.

Introduction: The Evolution of Value Creation

In the history of technology, moments of transformation redefine how value is created, captured, and distributed. The internet revolutionized communication and commerce. Social media democratized attention. Blockchain introduced decentralized trust. And artificial intelligence has begun reshaping decision-making and productivity.

Yet, the forces shaping the digital economy are entering a new phase. The focus is shifting from expanding human networks to scaling autonomous systems. The defining question for crypto becomes: what will matter more—one billion users or one billion AI agents?

For investors, this isn’t a philosophical musing but a practical framework to understand where markets are heading. Human networks have been the cornerstone of Web2 and Web3 success, but their limitations are becoming stark. Meanwhile, AI agents—autonomous, scalable, and tireless—are emerging as a transformative force. This article explores the impact of these changes, focusing on the forces driving industry transformation and strategies investors can use to capitalize on this paradigm shift.

The Legacy of 1 Billion Users: The Network Effects That Built Web2 and Web3

Key Drivers of Value Creation

The growth of platforms like Facebook, Google, and Ethereum illustrates the power of network effects. In these systems, each new user increases the platform’s utility for others, creating compounding value. Social platforms thrived by connecting users, generating data, and monetizing attention. Similarly, DeFi platforms rely on users to provide liquidity, drive governance, and ensure market adoption.

Ethereum’s rise as the dominant smart contract platform exemplifies these dynamics. Its user base—including developers, investors, and applications—created a flywheel of adoption, security, and innovation that solidified its position as the leading blockchain ecosystem.

Network effects also underpin governance in decentralized systems. As more users participate in voting, staking, and decision-making, protocols become more decentralized, secure, and resilient.

Structural Limitations

However, the network effect model is not without its flaws. Platforms inevitably reach saturation, and competition for user attention becomes zero-sum. This phenomenon, often referred to as “enshittification,” occurs when platforms prioritize profit and growth over user experience, leading to diminishing returns for all stakeholders.

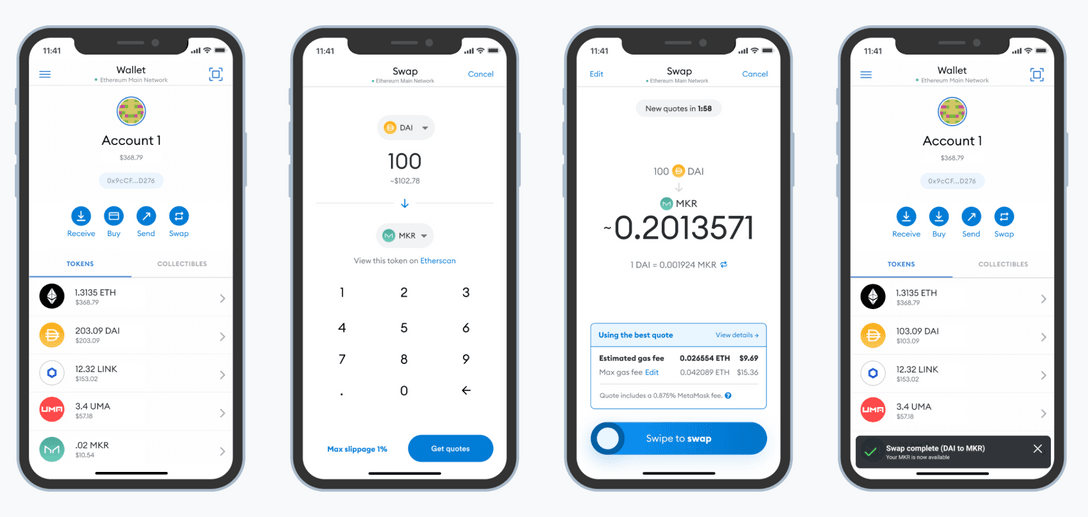

In Web3, technical complexity, poor user interfaces, and fragmentation has to date limited scalability. While the potential offered from decentralization remains appealing, it has been a challenge to scale of one billion users.

Investor Implications

For investors, the implications are clear: user-centric platforms may continue generating returns, but the pace of growth is slowing. The limitations of scaling human networks signal a need to identify new value-creation paradigms.

The Emergence of 1 Billion AI Agents: Scaling Beyond Biology

AI as Infinite Participants

AI agents redefine the concept of “users.” Unlike humans, agents can operate 24/7, scale infinitely, and adapt dynamically to new challenges. They don’t merely participate in ecosystems—they enhance them.

In DeFi, for example, AI agents can act as liquidity managers, optimizing yields, detecting arbitrage opportunities, and even participating in governance votes. They offer the potential contribution in ways that no human user could replicate at scale, transforming the dynamics of decentralized markets.

Transforming Market Dynamics

The rise of AI agents fundamentally alters how markets function. By removing inefficiencies like cognitive biases, time constraints, and manual errors, agents create faster, smarter, and more efficient systems.

Even at the coordination level, consider DAOs. Traditionally reliant on human input, DAOs can now integrate AI agents to automate tasks such as treasury management, proposal evaluation, and enforcement of governance rules. This enables DAOs to scale in ways that were previously impossible.

Investor Implications

The agent economy is still in its infancy, but the potential is vast. Early adoption of agent-driven systems presents an opportunity for exponential growth. Investors should look for projects that integrate AI into finance, governance, logistics, and other domains, as these will likely become the foundational ecosystems of the future.

Building the Infrastructure for Agent Economies

Blockchain as the Backbone

The agent economy requires robust infrastructure, and blockchain provides the necessary foundation. Decentralized trust, composability, and interoperability make blockchain uniquely suited to support agent-driven ecosystems.

For example, AI-powered DAOs leverage blockchain for secure data sharing and autonomous decision-making. Logistics networks use tokenized credits to coordinate resource allocation. In DeFi, agents utilize smart contract events to manage liquidity pools and execute trades programmatically.

Challenges to Solve

Scaling from thousands to billions of AI agents presents significant challenges:

-

Scalability: Current blockchain infrastructure struggles with throughput and latency.

-

Interoperability: Agents must seamlessly interact across multiple chains and ecosystems.

-

Ethical Guardrails: Addressing concerns about misuse, alignment, and accountability is critical.

Investor Implications

There is an edge for investors who look for infrastructure projects that solve these challenges. Layer-1 and Layer-2 blockchains optimized for agent use cases, decentralized identity solutions, and agent-friendly dApps represent key opportunities.

The Forces Transforming Industry: New Rules of Value Creation

Human Disintermediation

AI agents will disrupt industries reliant on intermediaries. In finance, for example, agents can handle trading, compliance, and underwriting, bypassing traditional gatekeepers. In supply chains, they can optimize logistics, track assets, and automate transactions.

These disruptions create opportunities for investors to target industries where agents eliminate inefficiencies and unlock new value.

Memetic Influence

AI agents are poised to dominate global communication channels as disseminators and aggregators of information. By curating and amplifying content, they will shape cultural trends, market sentiment, and public discourse.

In decentralized ecosystems, agents can amplify narratives to drive adoption, influence governance decisions, and create liquidity for emerging projects. This makes them powerful players in the attention economy. We’ll come back to this point…

Redefining Labor as a Crypto Tailwind

AI agents are already redefining the nature of work. As they take over routine tasks, human labor will shift towards creativity, governance, and data ownership. Tokenized ecosystems can enable individuals to monetize these contributions, creating new revenue streams.

Industries ripe for disruption—such as finance, media, and supply chains—present significant opportunities for investors. Additionally, platforms enabling tokenized incentives and agent-driven productivity will likely capture substantial value.

Governance and Power Dynamics: A Decentralized Counterbalance

Centralized vs. Decentralized Futures

Agent economies raise critical questions about power dynamics. Centralized systems risk consolidating control over data and AI, while decentralized models offer a counterbalance by distributing ownership and governance.

DAOs represent a decentralized alternative, allowing communities to govern agent-driven ecosystems transparently. However, ensuring effective governance remains a challenge.

Investor Implications

Investors should back ecosystems that prioritize decentralization, transparency, and community engagement. These systems are more likely to attract long-term users and developers.

From Users to Agents: Navigating the Tipping Point

Hybrid Economies

The near future will likely blend human users and AI agents in symbiotic systems. Platforms that enable collaboration between humans and agents—such as augmented intelligence tools—will play a crucial role in this transition.

For example, tools that allow humans to train, deploy, and manage agents can enhance productivity while maintaining oversight. Similarly, agent-assisted applications can bridge the gap between human-centric and agent-driven systems.

Actionable strategies

To adapt to this transition, investors should look at:

-

Collaborative Platforms: Tools that facilitate human-agent interaction.

-

Agent Ecosystems: Tokenized networks where agents are already active.

-

Infrastructure Investments: Technologies that enable agent integration at scale.

Agents as Memetic Influencers: Dominating Global Communication

Shaping Cultural Trends

AI agents are becoming dominant memetic influencers, capable of shaping cultural trends, refining marketing strategies, and driving public discourse. They operate at the intersection of content creation, aggregation, and dissemination, leveraging real-time data to tailor narratives that resonate globally.

For example, agents can curate personalized news feeds, craft viral marketing campaigns, or amplify specific social movements. Their ability to synthesize vast amounts of information and deliver targeted content makes them unparalleled in shaping public opinion.

Implications for Decentralized Systems

In decentralized ecosystems, agents can play a pivotal role in accelerating adoption. By spreading narratives highlighting decentralisation benefits, they can drive user engagement and liquidity for emerging platforms. However, this influence also comes with risks, such as the potential for manipulation and misinformation.

Investor Opportunities

For investors, the rise of agent-driven memetic influence opens opportunities in media, branding, and influence markets. Platforms that enable no-code programmable agents for cultural and commercial impact will likely capture significant value.

Conclusion… Adaptiation

The rise to one billion AI agents is already in motion and, in our opinion, will be achieved more quickly than one billion ‘real’ human users. This will represent a significant paradigm shift in value creation. While human networks have defined the past two decades, the future will be shaped by autonomous, scalable, and intelligent systems.

For investors, the message is clear: embrace the agent economy. Align with decentralized infrastructure, invest in agent-driven ecosystems, and position your portfolio to capitalize on this transformative era. As the line between human-centric and agent-driven systems blurs, those who adapt early will be best positioned to thrive.

The question is not whether agents will reshape the economy, but how—and who will be ready to capture the opportunities.

Memetic Digital is a venture builder and research team