What’s the secret to enduring success in any organisation?

Skin in the game.

When enough established and reputable actors in the DeFi space want a business to succeed, something remarkable happens: a self-reinforcing system emerges. The KPK token is the financial expression of that alignment. It invites risk-takers like protocol operators, risk underwriters and asset managers to share in both upside and exposure. Over time, this social-financial construct forms a moat: a network of stakeholders with reasons not just to participate, but to protect, iterate, and defend the system they’re part of.

KPK

KPK is a utility token, designed to deliver alignment across kpk DAO’s stakeholders. In that sense, the primary utility of the token will unlock the ability to participate in strategic decision-making across all our activities, from operation of our products, to overall strategy and allocation of resources.

Governance will focus on the core financial activities of the DAO and its treasury, including:

-

defining the investment policy and parameters of the DAO’s treasury;

-

selecting and approving large-scale treasury transactions including mergers and acquisitions (M&A), token swaps, buybacks and over-the-counter (OTC) deals; and

-

allocating and approving budgets for the DAO’s various teams and activities.

Over time, our DAO's activities will evolve organically. However, this will be a gradual and careful process to ensure consistency of service for our network of DAOs.

Token Dynamics

The key details of the token include:

-

a total supply of 1 billion KPK tokens;

-

2-year Hedgey vesting plans for initial token holders;

-

limited transferability between pre-approved parties; and

-

public token transferability can be allowed through a governance mechanism.

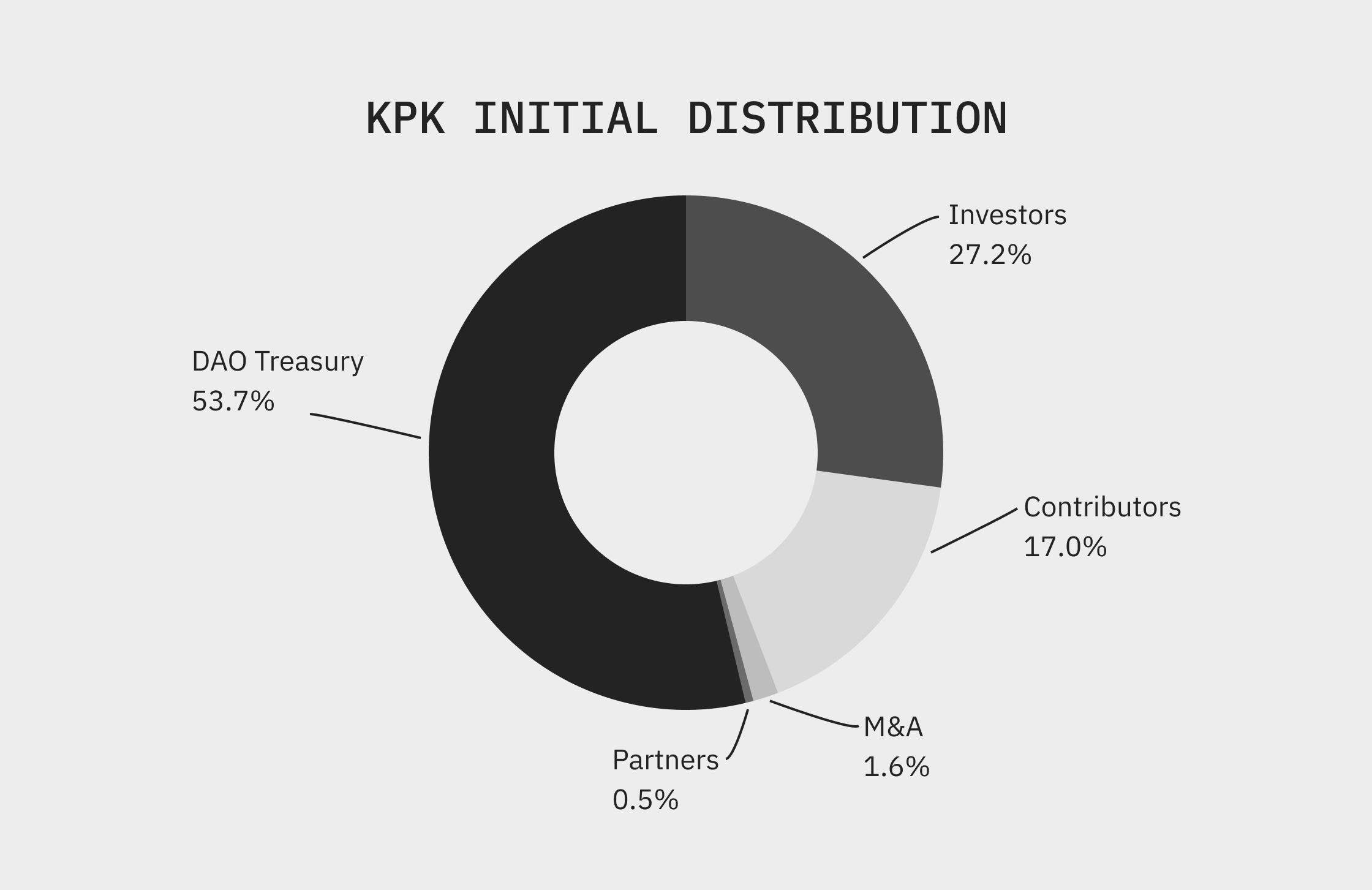

The pie chart below shows the initial distribution at the token’s public launch.

As described above, the token will have limited transferability at launch. This means that transfers can be facilitated by the DAO foundation between holders who comply with applicable legal and compliance obligations. Full permissionless transferability can be enabled with DAO approval at a later stage. This is a key step to ensure that the decentralisation and maturation of our organisation can take place the right way—through genuine participation and public action, without the pressures of market activity or speculation.

Before transferability is enabled, we must ensure the DAO has reached a stable governance structure, audited financial statements, and a clear picture of transferability's compliance and regulatory implications. We are also committed to distributing the token promptly and minimising the non-circulating supply held in the DAO treasury.

Stakeholder Community

A key element of kpk’s token generation event will be the launch of our open and public community. This will include our Governance Forum, Snapshot Space and Tally Page, and a Discord server and Telegram group for informal discussion.

Through our recent fundraising round, we have also taken the opportunity to grow our community by seeking support from key founders, leaders and investors across the industry. This includes many of the key figures from our DeFi Treasury Network, which unlocks incremental value through collaboration among industry-leading organisations. KPK, therefore, is not only an opportunity to coordinate with our existing community, but also to build alignment across the broader industry.

Our key investors include:

-

Joe Lubin, co-founder of Ethereum and founder of ConsenSys

-

Martin Köppelmann, Stefan George & Friederike Ernst, co-founders of Gnosis

-

Stani Kulechov, founder of AAVE

-

Nicholas Johnson & Alex Van de Sande, co-founders of ENS

-

Konstantin Lomashuk, founder of Lido Finance

-

Fernando Martinelli, founder of Balancer

-

Anna George, founder of CoWSwap

-

Hugh Karp, founder of Nexus Mutual

-

SAFE Foundation

By each acquiring a stake in kpk DAO, we achieve a closer level of alignment with these projects and communities. And, with a significant amount of KPK remaining unallocated at launch, the token unlocks significant flexibility to expand and further align our growing community.

The Future

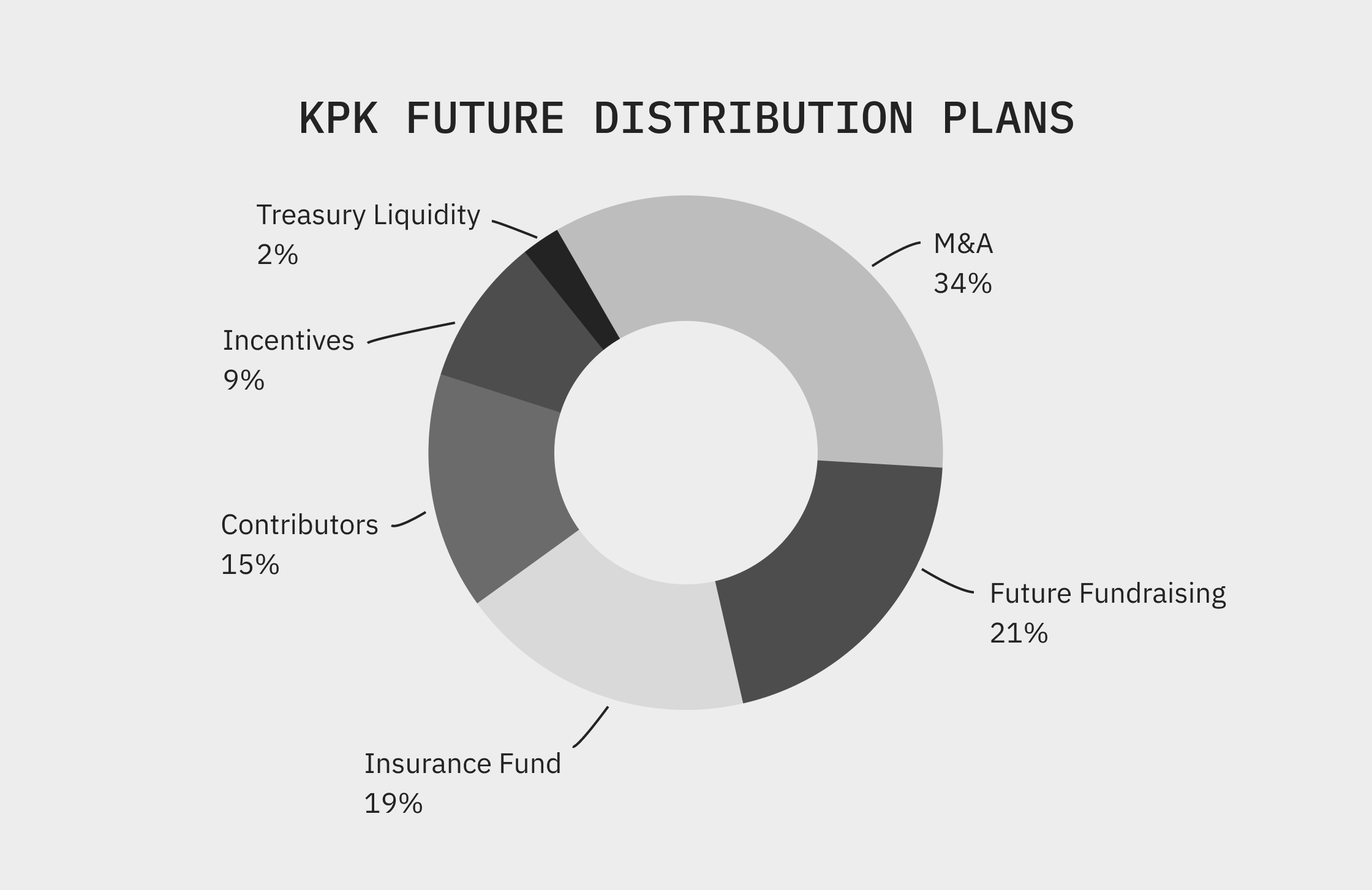

As we complete the public launch of our KPK token, the future of the token, DAO, and project remains open and exciting. However, with the majority of the tokens not-yet-distributed at launch, there is still a long way to go in our decentralisation journey.

We believe that the distribution of our token ownership must be undertaken promptly throughout 2025 and 2026. The second chart below maps out an indicative budget reflecting the leadership’s current view of roughly how the remaining distributions should be divided.

Alignment

The KPK token sets the foundation for an asset management system where operations, responsibility, and long-term outcomes are linked. As capital allocators, we are building an organisation where performance is measured not only in financial results but also in the quality of decisions, the rigour of processes, and the integrity of the people involved.

Scaling DeFi responsibly requires more than technical progress. It requires shared accountability, ethical commitment, and aligned incentives across a broad set of contributors. This launch reflects our belief that meaningful participation starts with having something at stake.

This is a shortened abstract of the original article on our website. Read the full version at kpk.io/kpk-token-launch.

Disclaimer

This article is provided for informational purposes only and does not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities, financial instruments or other investment products. Recipients are solely responsible for conducting their own due diligence and obtaining independent legal, financial, or other professional advice prior to engaging with the KPK token or participating in kpk DAO-related activities.