Recently, Mobius has launched many NFT trading reward activities, providing another channel for people to earn box rewards. However, in the practical process, it has been found that many people suffer from trading losses due to a lack of understanding of the AMM mechanism of Defi and not carefully reading the relevant tutorials, which leads to problems with the pool settings. Here, we will explain these settings and mechanisms in detail, hoping to help everyone better experience NFT trading and enjoy the joy of Token Box airdrops.

I.Flash deal mechanism

We all know that there is a mechanism on Souffl3 called "flash deal"

What it means is that you accept the highest bid offered by the buyer to sell your NFT. This price may be lower than the floor price, but it is guaranteed to be a successful transaction without waiting.

However, it is important to note that if your purpose of trading is to receive airdrop rewards from the Mobius Token Box, the Flesh Deal cannot guarantee that your transaction will be completed through the trading pool on Mobius. Therefore, it cannot guarantee that you will receive Token Box airdrop through this selling method. It is also a reminder to everyone to confirm that the trading volume on the Mobius website is for NFTs with the "M" logo in the upper left corner, as shown in the figure below.

So, using this feature to purchase NFTs may result in the purchased NFT not having an 'M' symbol, but instead may have the official logo of Souffl3, which will not be rewarded the $MOB token boxes. Therefore, it is recommended that those who want to increase their trading volume through buying and selling NFTs should use this feature with caution, as it may result in more price erosion and not be worth the investment.

II. Creating the pool

Before explaining how to create a liquidity pool, let me first explain the various settings of the pool.

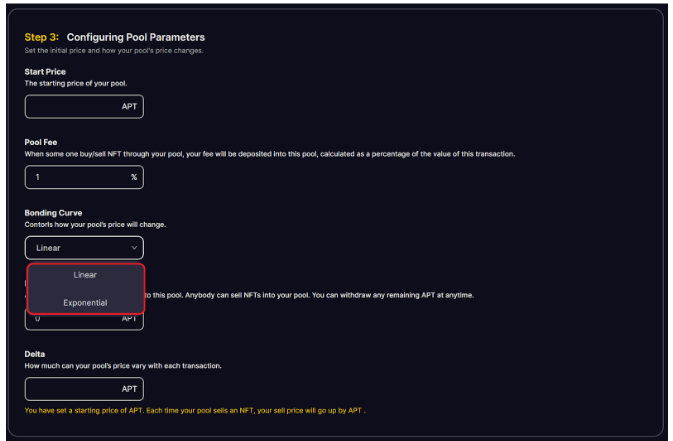

When you click on "create pool," you will be able to select NFT collectibles to add to your pool. This should be clear to everyone, so we won't go into detail. What's important is the third function, which is the pool's setting parameters, as shown in the figure below.

It's worth noting that there are differences between the mechanism of the trading pool and the buy/sell order book. For the trading pool, the "starting price" you set not only affects your selling price but also your buying starting price. So, if you set a price that deviates too much from the floor price, it's like giving buyers or sellers a special price advantage. If you're not careful, this could result in losses in the trading price, causing you to buy NFTs at a higher price or sell NFTs at a lower price.

About Bonding Curve

Mobius offers two bonding curves to suit different market conditions.

Linear

Delta uses a Linear curve to increase the price of NFT by a fixed amount each time you buy an item from the pool. Conversely, each time an item is sold to the pool, the price of NFT decreases by the same fixed amount.

For example, a liquidity provider could create a pool of NFT<>APT with a Start Price of 1 APT and a delta of 0.1 APT. Assuming they provide sufficient liquidity, after purchasing an item from the pool, the price of NFT will rise to 1.1 APT. after purchasing a second item, the price will rise to 1.2 APT, and so on. At any time, if the NFT is sold to the pool, the price will drop by 0.1 APT.

Exponential

Delta uses an Exponential curve to increase the price of NFT by a percentage each time an item is purchased from the pool. Conversely, each time an item is sold into the pool, the price of the NFT decreases accordingly.

To calculate the equivalent decrease, convert the percentage to a decimal exponential (e.g., for 50%, the exponential is 1.5) and divide the price by that number.

For example, a liquidity provider can create a pool of NFT<>APT where aStart Price is 2 APT and adelta is 50%. Assuming they provide enough liquidity, after purchasing one item from the pool, the NFT price will increase to 2 + 50% = 3 APT. after purchasing a second item, the price will increase to 3 + 50% = 4.5 APT, and so on. At any time, if the NFT is sold to the pool, the price will be divided by 1.5.

Examples

Example 1: Create a Pool of Collection A with smooth price fluctuations.

Assume that the floor price of Collection A is 1 APT, each transaction price fluctuations of 0.1 APT, you want the price fluctuations and not too drastic, at this time you can refer to the following parameters to set: Start Price is 1, Pool Fee recommended range 1%-3%, Bonding Curve select linear, if you are ready to follow the set If you are ready to acquire NFT at the set price, you can put APT in the Deposit APT position, if you do not want to acquire, you can set it to 0, Delta set to 0.1 can be. At this point you can see in Step 4 that the data will change according to your parameter settings. The current initial price of your Pool is the floor price you set + the parameter set by Delta = 1.1APT

Example 2: Create Pool with Collection A at a fluctuating price.

Suppose the floor price of Collection B is 1 APT, and the price fluctuation of each transaction is 0.5 APT, you want the price to fluctuate more, at this time you can refer to the following parameters to set: Start Price is 1, Pool Fee suggested range 1%-3%, Bonding Curve selected Exponential, if you are ready to buy NFT at the If you are ready to acquire NFT at the set price, you can put APT in the Deposit APT position, if you do not want to acquire, you can set it to 0, Delta set to 50% can be. At this point you can see in Step 4, the data will change according to your parameter settings. The current initial price of your Pool is the floor price you set + the parameter 1*(100%+50%)=1.5APT set by Delta

Example 3: Preparing to acquire NFTs.

Assuming that the floor price of Collection C is 1 APT and the price fluctuation of each transaction is 0.5 APT, you wish to acquire NFTs, at this time you can refer to the following parameters to set: Start Price is 1, Pool Fee is recommended range 1%-3%, Bonding Curve is selected Linear, you can put the corresponding amount in the position of Deposit APT according to the total price you intend to acquire. You can put the corresponding quantity in the position of Deposit APT according to the total price you intend to acquire, and set the Delta to 0.1. At this point you can see in Step 4 that the data will change according to your parameter settings. The current initial price of your Pool is the floor price you set + the parameter 1+0.1 set by Delta = 1.1 APT

Please note that you should be flexible in configuring these parameters in conjunction with the NFT Collection you choose to trade and the prevailing market conditions in order to reach the best trading strategy.

Once we understand the meanings of these parameters, we can create pools, so the configured pools can be classified into three types:

-

If your pool has NFT but not APT, it will only sell (Sell Pool).

-

If your pool has APT but not NFT, it will only buy (Buy Pool).

-

If your pool has both NFT and APT, it will both buy and sell (Automatic Buy/Sell Pool).

One of our community members, lost 41APT previously, and there may be a second and third case. He set the NFT floor price too high and created a pool that was set at a much higher price than the NFT floor price, and he also added APT to it. This pool can be thought of as a "buying pool," as once it is established, it is like buying the NFT at a high price from the market. Although it will also buy the NFT at the same high price, if a linear curve is chosen, the next transaction will only be more expensive, resulting in a loss of a lot of APT. If you only want to sell, you can create a pool that only contains NFTs without adding APT to it.

In summary, that's pretty much what happened. If there are any further questions regarding the trading activity or any additional explanation regarding the pool mechanism, please feel free to add them. We also encourage everyone to participate in Mobius' trading activities, support Mobius, and thank you!

**

**