This post focuses on the Layer2 Rollup universe of Ethereum (only including Secured Rollup), and will explore the good and bad of the current Rollups from the core concepts and mechanism design in an easy-to-understand way, and think about the potential routes and advantages and disadvantages of each of their future solutions in terms of decentralization, further scaling, composability, and additional features such as privacy.

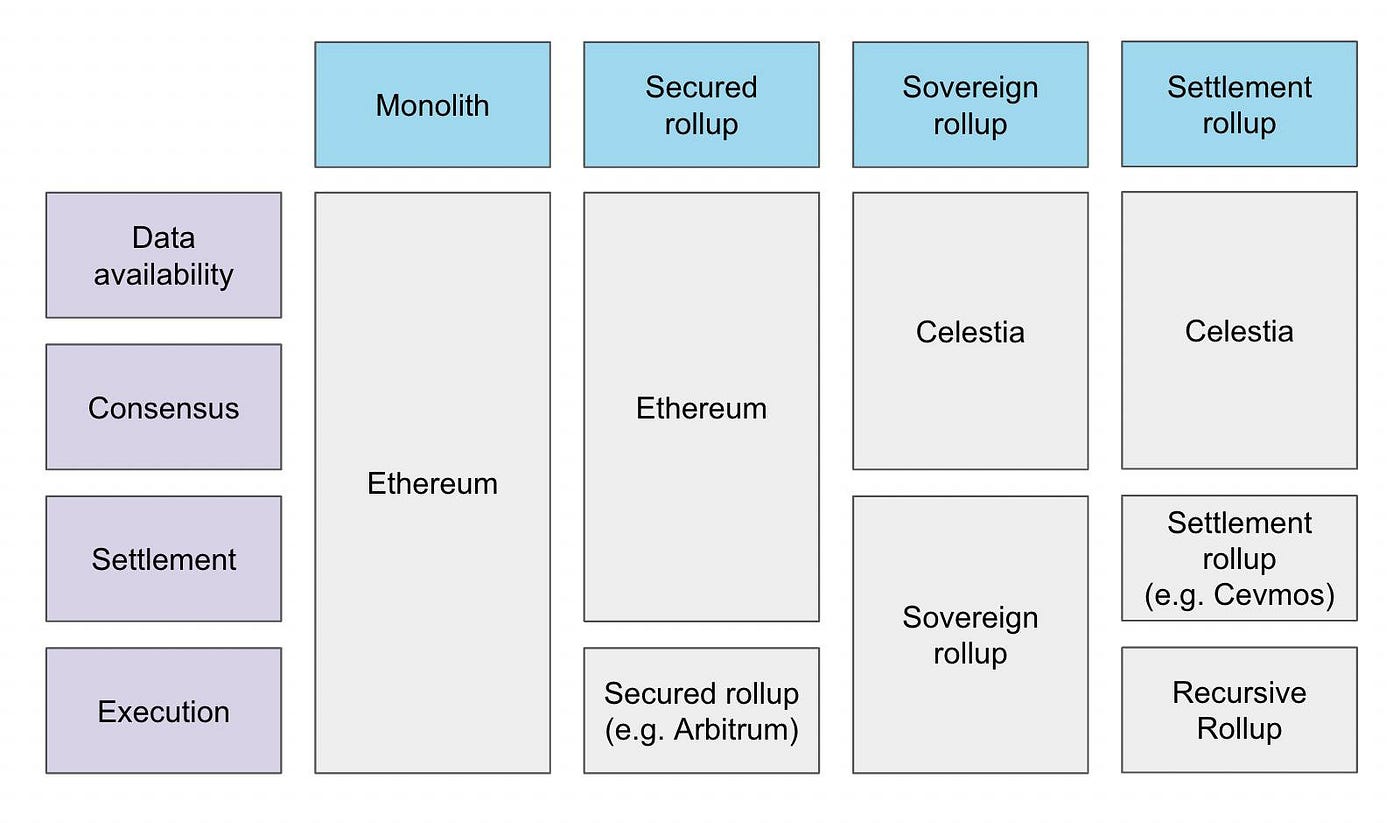

A Secured Rollup is a Rollup model like Arbitrum or Optimism, where settlement, consensus, and data availability all rely on L1s like Ethereum, and only handle the execution itself.

If a Rollup uses a scheme other than L1 for settlement, consensus, or data availability, then it is not a pure Secured Rollup, and it is not in our narrow definition of Rollup.

0. Essence and Principle of Rollup

a) Essence of Rollup

There are two ways to scale a blockchain: one is to optimize the blockchain itself, and the other is to use the blockchain in a better way.

Rollup is the second type, and its real essence is simple: faster, cheaper and “trusted” use of the blockchain, to scale the blockchain (basically referring to Ethereum in particular).

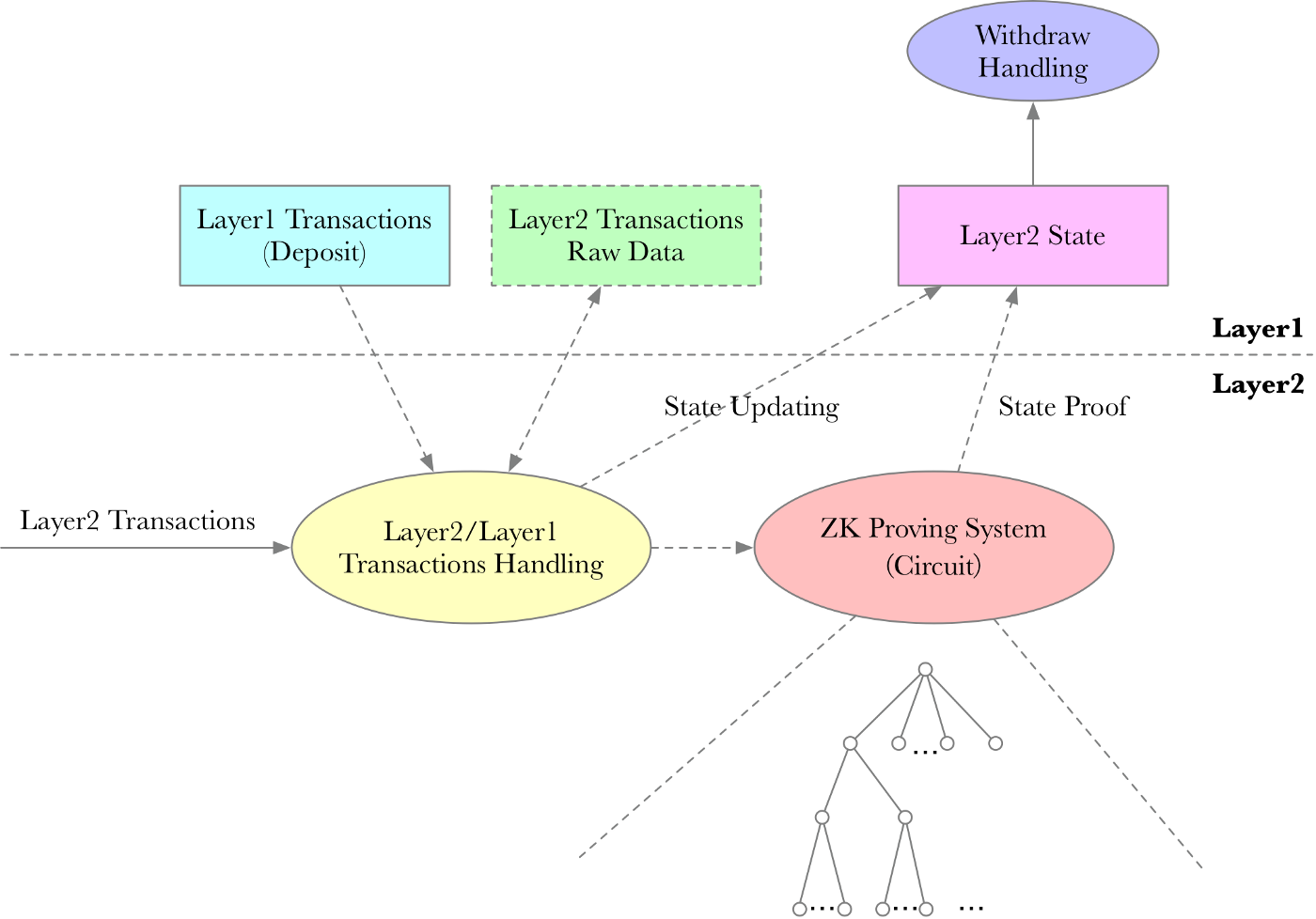

Rollup is: an on-chain smart contract + an off-chain aggregator.

It’s as simple as that. The combination of these two features defines Rollup and fleshes out its concept.

-

On-chain smart contract, which means that its trust model is a smart contract on Ethereum, that borrows the security of Ethereum, rather than requiring a new trust consensus like other Alt L1. We can trust Arbitrum’s protocol in the same way that we trust Uniswap’s protocol (which is a smart contract at its core).

-

Off-chain aggregator, which means it will execute and aggregate transactions off-chain, compressing large volumes of transactions and eventually putting them on the Ethereum mainnet for the purpose of making transactions faster and cheaper.

The mechanism of Ethereum is that each node stores and executes every transaction submitted to it, so such a decentralized network is very expensive.

The mechanism of Optimistic Rollup represented by Aribitrum and Optimism, and the mechanism of zk Rollup represented by zkSync and StarkNet are shown later for the reader to understand briefly.

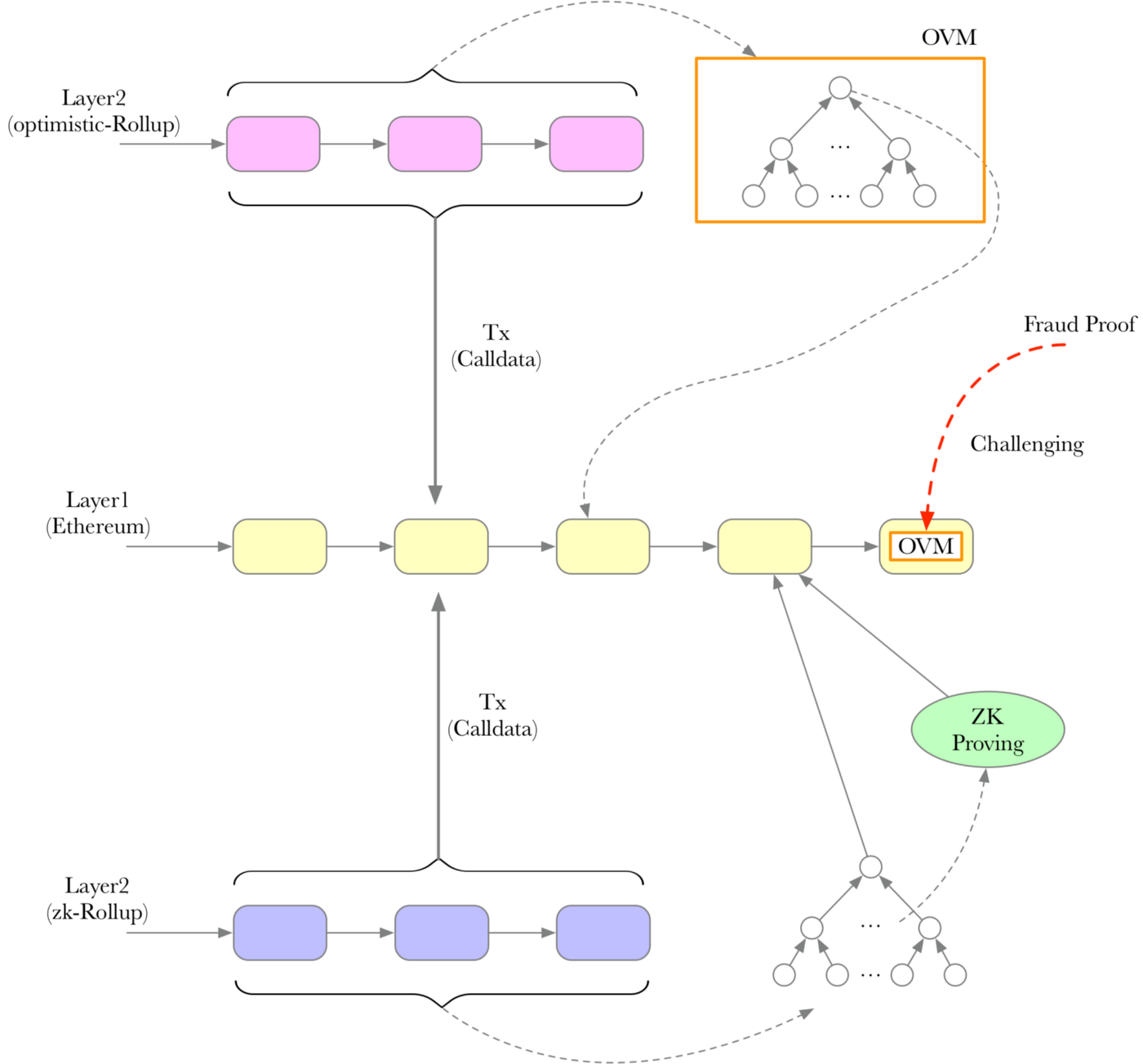

b) Mechanism of Optimistic Rollup

Optimistic Rollup is, as the name suggests, optimistic. It uses a presumption of innocence, where everyone will believe by default that each execution is correct, and security is ensured by the fact that each batch state can be challenged by fraud proof.

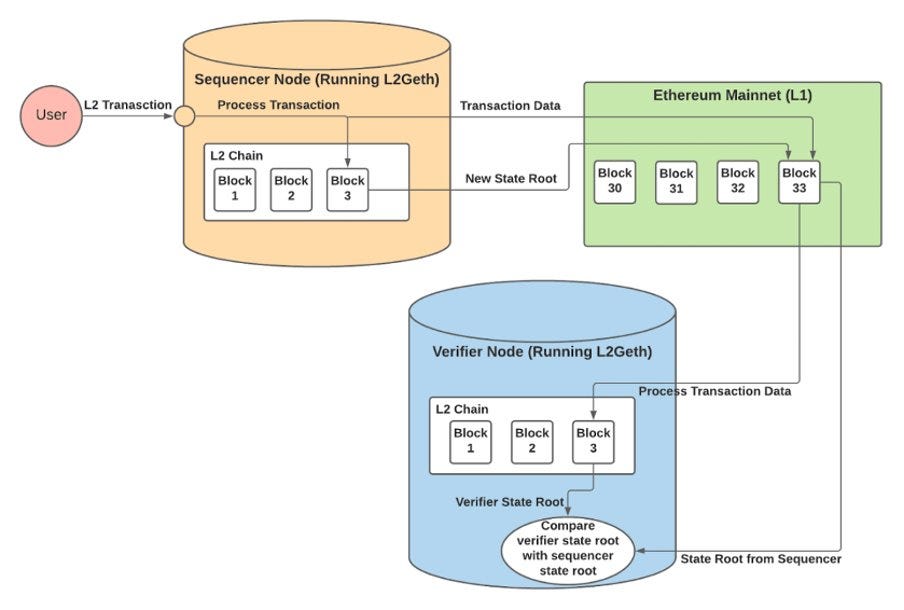

Users submit transactions in Arbitrum network, and Arbitrum’s sequencer executes the transactions, submitting the complete state root and transaction data in batches to a smart contract on the Ethereum mainnet.

What if the Optimistic Rollup execution generates errors?

- Optimistic Rollup has a dispute validation cycle, which means that the data will not be finalized until, say, a week after it is uploaded, during which time anyone can challenge it and prove that the batch is incorrect.

c) Mechanism of zk Rollup

zk Rollup, as the name implies, uses zk zero-knowledge proof technology (actually Validity Proof). It uses the presumption of guilt, where people will default to questioning that each execution is wrong, and security is ensured by the proofs contained in each batch.

Users submit transactions in zkSync, the sequencer of zkSync executes and stores the transactions, and submits the proof of state and the new state in batches to the smart contract on the Ethereum mainnet in full.

How can zk prove that execution is not wrong?

- Prover (or sequencer in most cases) generates unforgeable proofs of the execution of transactions, proving that these new states and executions are correct. Sequencer compresses the proofs and other data and submits them to the smart contracts in the Ethereum mainnet for verification.

How do they compress data, thereby reducing gas fees?

- Rollup can be compressed in terms of the number of bytes per transaction, including nonce and signature, etc. For zk Rollup, it can further compress the data that is not relevant to the state update, because zk proofs can already prove the correctness of the state update, while Optimistic Rollup cannot ignore this data because it needs to be able to be challenged.

Why do the data uploaded to mainnet need to be in full (for a Secured Rollup)?

- Because in order to prevent sequencer escapes, we can rebuild the entire Layer 2 from data on Ethereum. This relates to the concept of data availability.

d) Differences of Two Types of Rollups

If you still can’t understand it, you can check the diagram below.

Optimistic Rollup is designed more like Arweave, using economics and game theory to design a mechanism that performs well but is not really guaranteed to be 100% correct.

zk Rollup design is more like Filecoin, which uses cryptography and mathematics to design a mechanism that is guaranteed to be 100% correct but always has additional computational and time overhead.

The difference is that one uses a challenge period to ensure that errors can be corrected, and the other uses cryptography to ensure that errors cannot occur.

We will compare them in detail later by their end-game performance.

1. Rollup, the Good

Let’s start by taking about what is great about the Rollups as a whole:

-

Ecosystem: Arbitrum had the NFT and Metaverse ecosystems; Optimism has issued the token, and had the governance and community; StarkNet has a variety of GameFi innovations in the works; zkSync has a number of new DeFi projects. Each Rollup stands on its own.

-

Scaling: Their TPS is indeed excellent, though not as high as the theoretical peak, but the fast confirmation of L2 provides a fast and almost feeless Web3 experience.

-

Experience: Switching to Rollup is a simple task for developers and users, and the experience is almost identical to that of Ethereum. Various cross-chain bridges, wallets, Uniswap and other infrastructures also serve for a smooth user experience. This is also supported by a good ecosystem.

-

Innovation: Rollup is already an excellent ground for innovation in EVM applications, and is also more imaginative than Polygon’s “test network” style network.

Besides, if you are interested in the comparison between subnets and Rollup, you can refer to our previous study, and Toghrui’s view.

In more detail, the performance of the major Optimistic Rollups and zk Rollups are given below:

-

Arbitrum: TVL is around $2.4 billion. The Nitro upgrade is now live on the test network, and will replace Arbitrum’s existing VMs with WASM-Geth, optimizing performance and adaptability. (We can talk more about the potential of WASM in a later article)

-

Optimism: launched token, on which many “groundbreaking and incredibly optimistic experiments” have been made (with all sorts of missteps, concealed facts and indifference, and recently often questioned by frustrated users as “the abolitionist prince of the Ethereum Foundation”). The Bedrock upgrade will make the VM MIPS-Geth, doing the same thing as EVM. Optimism developers have also been talking about the zkMIPS concept, so I wonder if they’ll work in that direction later?

-

StarkNet: The cross-chain bridge is not fully open yet. Cairo and StarkNet have built a good development ecosystem, and the game ecosystem is worth watching. StarkEx’s Validium model has also made applications such as dYdX, ImmutableX. StarkNet can also serve as a settlement layer and build L3 on top of L2.

-

zkSync: The first to make a more complete zkEVM. 2.0 version of Volition mode gives users the flexibility to choose between zkPorter or Ethereum data availability options.

-

Aztec: Privacy zk Rollup for the UTXO model, soon to support the privacy DeFi ecosystem (but additional optimizations are needed due to the large transaction data size). Although it does not support universal computation, it is one of the few zk Rollups that is truly zk.

-

Fuel: V1 is an Optimistic Rollup, and very decentralized. Instead of adapting EVM, V2 is a high performance VM with a UTXO model to support parallel tx processing, aiming to build the fastest execution layer.

In addition to Rollup, which is an Ethereum-based network, there are these:

-

everPay: A Layer 2 on Arweave based on SCP Paradigm.

-

Milkomeda: EVM Rollup on Algorand.

-

Orbis: Validium Rollup on Cardano.

The different designs of the Rollup solution have many unique features that have truly served countless users and brought about a better crypto and blockchain experience.

2. Rollup, the Bad

After the praise in the previous chapter, we will point out in this section some of the issues that Rollup needs to address:

a) Centralization😱

The silky smooth user experience of the Rollup network is obtained by compromising security, and many components of the network are centralized, although there are three points that can be made to “weasel” around this issue:

-

zk proofs in zk Rollup cannot be falsified mathematically.

-

Users can reconstruct all states by DA on L1.

-

The trust model itself is always a smart contract that can be centralized.

However, the centralization of Rollup still leads to problems of censorship and low security. Currently its centralization is mainly reflected in:

-

Centralized sequencer: Most of the sequencer for Optimistic Rollup and zk Rollup are centralized. This means that the execution of tx, sequencing, and production of blocks are all supported by a centralized server. Previously Arbitrum was down because of sequencer hardware problems…

-

Centralized upgrades: Most Rollup networks are upgraded centrally, meaning that the cost of actually hacking an entire Rollup is negligible compared to the billions of TVLs on the network. For example, zkSync is a security council that manages upgrades. Thinking back to the Ronin hack, it is definitely not safe to have billions of dollars depending on the multi-signature of a few people.

- Closed-source components: Some of Rollup’s key components are closed-source. For example, almost all key components of StarkNet are not open source, and are still developed centrally, without an open source license. This is not so Web3.

In my vision, a network or protocol must ultimately be decentralized and open source, otherwise it goes against the spirit of Crypto and Web3.

b) Real Performance😱

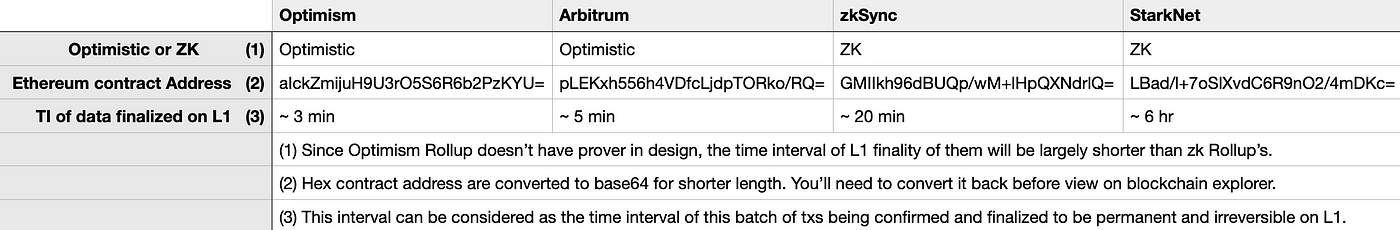

Rollup’s current demonstration of super performance is “fake”, the real “finality” is not that good, and there is still room for performance improvement. This is a double-edged sword.

When a user submits a transaction on L2, he/she will immediately get feedback on the success or failure of the transaction, but this immediate user experience is only the finality on L2.

The data does not achieve L1 finality while it is not submitted to L1 or while prover is still in the proof or it is still in the fraud proof window. That is why Rollup has such a great user experience, because the user actually borrows time through Rollup, allowing the user to get a soft confirmation first.

As a result of the above design, the following problems arise:

- Fake Finality: The real finality is when the data is on a real blockchain like Ethereum, so how fast is Rollup’s real finality. In other words (of course if you really want to count TPS, the number of tx’s contained in a batch of data should also be taken into account), how often do they submit data to Ethereum? Here’s a real analysis with on-chain data.

- Inflated TPS: I personally believe that TPS is an extremely bad metric and should be eliminated now. All kinds of Rollup or blockchains show their power by calculating a super high or at least higher TPS than their competitors by countless pre-conditions and confusing concepts. But in practice, their performance is still not that “Web3”. My ideal true Web3 experience would need to be completely senseless, and the entire network would have to be decentralized.

c) Economics😱

Using Optimism’s tokens as an example, we examine the business and economic mechanisms of Layer 2 Rollup, the token model, and MEV.

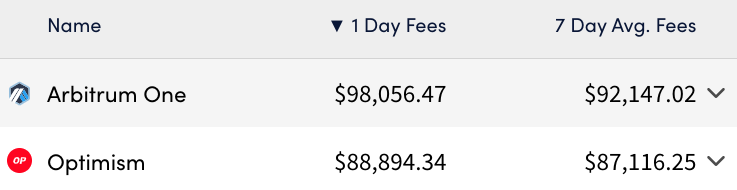

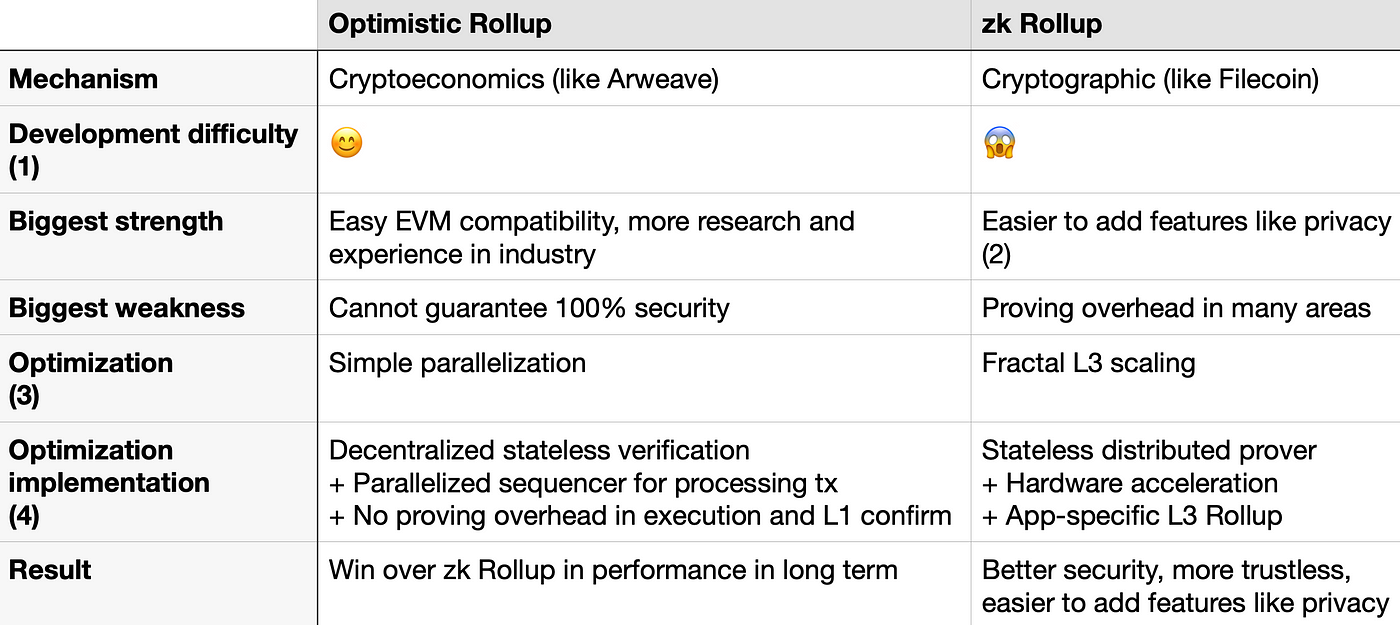

- Business model: Rollup’s profit = Layer 2 fees — Layer 1 block space fees (security costs for storing and verifying data on L1, etc.) — computational costs such as node servers. Where, Layer 2 fee = gas fee + MEV + some premium charged by Layer 2. But this business model does not allow users to participate as nodes, only Rollup dev team can earn it. Here are the benefits and costs of Arbitrum and Optimism in terms of Layer 2 fees and Layer 1 block space fees.

-

Token model: Optimism’s network is good, but the token economy is still weak. OP has three fatal problems: 1. no utility, such as the inability to pay for network gas or PoS staking (which of course are not good Rollup utilities though). OP is only for governance. 2. no way to capture the value of network revenue and block space. Sequencer’s profit is not related to the holder. 3. the number of liquidity is very low, and the selling pressure is very high, which is exacerbated by market-making accidents. These problems are not only for Optimism, but other Layer2 Rollups are likely to face these as well.

-

MEV: Since Rollup is now run on centralized sequencer, all these gains can be captured by Rollup. MEV is a two-sided thing. On the bright side, the Rollup network can embrace the value of MEV to the network, making it an important part of the economic mechanism and incentive for miners after the network is decentralized; on the dark side, the Rollup network needs to eliminate any MEV, as it is often considered an additional tax on users. Arbitrum chooses to “ignore” MEV by adopting a first-come, first-served mechanism, but this places higher hardware requirements on the nodes and reduces the cost of DDoS.

Making the network’s business model decentralized, improving the token mechanism, and dealing with MEV will be the three major obstacles on the way to the Rollup network in terms of token launch and decentralization.

3. Endgame Comparison of Optimistic Rollup and zk Rollup

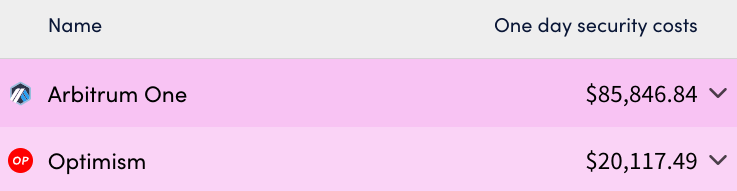

I don’t want to compare the TPS and other numeric performance of the Optimistic and zk Rollups like other posts (read more references at the end of this article if you’re curious), but rather compare them in terms of their nature and characteristics, as well as their long-term end-game performance:

A detailed interpretation of this chart and points of interest are as follows:

-

Development difficulty: In fact, zk Rollup is harder to be built than Optimistic Rollup in terms of EVM compatibility, node configuration requirements, and optimization. This is actually a way to justify the extra proof overhead… Not only does the extra proof overhead perpetuate an extra burden on the performance of the network, but it is also a huge impediment to the technical implementation of EVM compatibility.

-

Easier to add features like privacy: Since we are already using zk, it is much easier to develop a truly private zk-zk Rollup than a zk-Op Rollup. Of course, there are zk-Op Rollup projects like ZKOPRU that are already live.

-

Optimization: For Optimistic Rollup, parallelized tx processing is a straightforward and efficient optimization, while zk Rollup with the same scheme (StarkNet’s next version of sequencer can do parallelized execution) will still lose to Optimistic Rollup in the long run (again due to the extra proof overhead). Therefore, zk Rollup will adopt the alternative of Fractal L3 scaling, i.e., continue to build Rollup on top of Rollup. The recursive superpower not only allows L2 to verify that L3’s proof is correct, but also allows L1 to verify that L2’s verification of L3 is correct or not.

-

Optimization implementation: These are derived from the roadmap and the envisioned design solutions, and are not currently in practice. Personally, I think it will take a long time to complete these upgrades. Some of these upgrades have side effects, such as introducing a new mechanism that requires additional trust assumptions.

Although this graph concludes that Optimistic Rollup will outperform zk Rollup in the long run, the trust guaranteed by the math is stronger. I think the endgame for Rollup performance is Optimistic, but the real overall endgame is zk.

The design is perfect, but the engineering challenge is still huge, and the comparison above is still the same as the TPS comparison, but on paper. We still need to look at the security, decentralization, and actual performance and ecosystem of a Rollup network from a practical point of view.

4. Future of Rollup

By comparing Optimistic Rollup with zk Rollup, we actually have a comprehensive view of their future performance optimization options. So what does the future of Rollup look like from other perspectives?

a) Decentralization

In the decentralized perspective, we focus on the sequencer and contract upgrade problem, in the future, a Rollup must be decentralized, then the following decentralized design is needed:

-

Decentralized sequencer: The consensus mechanism of Optimistic Rollup’s sequencer will basically be a variety of PoS (leader election, MEV auction, rotation mechanism); and zk Rollup’s Hermez-like Proof of Efficiency or Proof of Validity Proof or Tendermint PoS. Of course if the network is a PoS mechanism, then there is actually an additional capital cost.

-

Decentralized contract upgrade: Contract upgrades should not be managed by multi-sig, but by decentralized governance (involving tokens) or by giving up contract upgrade control (e.g. a non-mandatory upgrade like Uniswap V2 to V3).

-

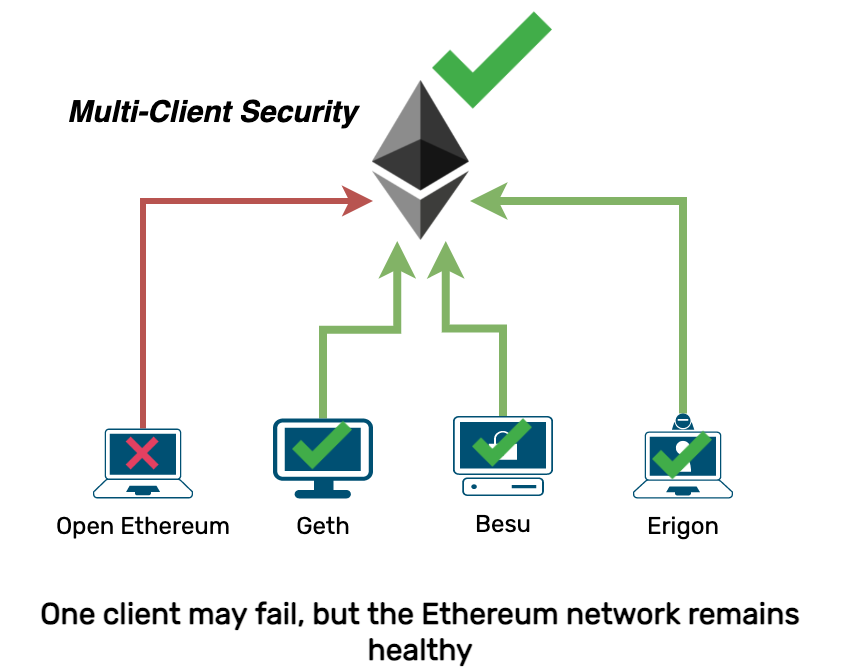

Multi-lang clients: Like Ethereum, multi-lang clients are necessary in decentralization to ensure 100% uptime of the network.

As a small side note, a comparison of the Arbiturm and Optimism docs shows that they have slightly different attitudeto decentralization.

b) Composability

The composability of Rollup is the ability of smart contracts on different Rollups to read and write directly to each other.

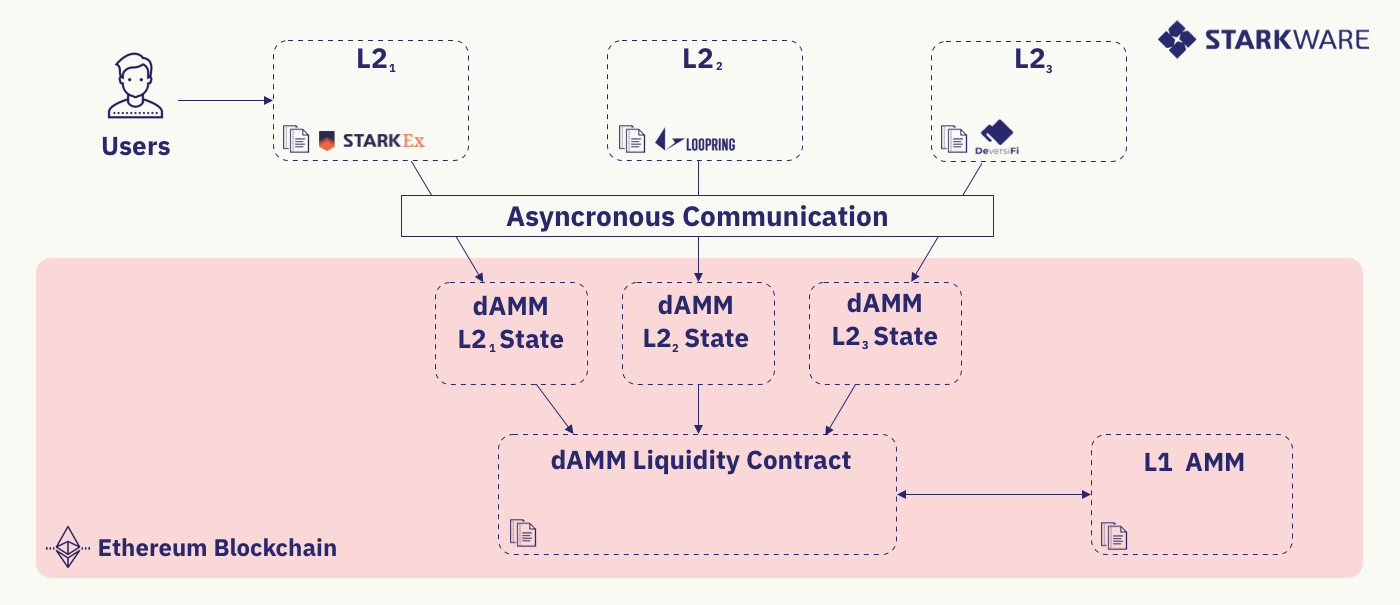

For Rollups on Ethereum, Ethereum as a settlement layer is a shared bridge between Rollups. The future composability between Rollups is likely to be mostly through L2 ⇒ L1 ⇒ L2 to form a call (like the dAMM design by StarkNet).

The real combinability is difficult to achieve due to the different mechanisms between Rollups, which make the tx cannot be verified against each other. This needs to be explored more.

c) Feature

For feature expansion, zk Rollup has even more potential. The concept of L3 makes App-specific Rollup particularly attractive, and Immutable X has announced that it will deploy additional protocols on StarkNet to enable it to exist as an L3.

The appeal of L3 is:

-

Let the application become a protocol, make its interfaces and services open, and achieve greater composability

-

L1 as the hour hand, L2 as the minute hand, and L3 as the second hand. Further improve the overall network performance without affecting the L1 pulse.

The most interesting feature I foresee in L3 will be:

-

Privacy L3

-

Payment-only L3

-

NFT Marketplace L3

-

Game Engine L3

-

DEX and DeFi L3

But the challenge with L3 is how DA is actually handled. We may use several different models:

-

Secured Rollup: Still a Rollup, puts DA on L1 like L2, but may involve more complex exit mechanisms.

-

Validium/Optimistic Chain: Have an additional DA layer like L2 or Celestia, which requires additional trust assumptions.

5. Conclusion

This is what we need to understand about Rollup.

Beyond that, Rollup has created a myriad of new topics: L3, modular blockchains, data availability solutions, UX enhancements due to account abstraction, new technology stacks, new programming languages, new developers, new auditors…

Everything about Rollup is new, shiny, and yet so early…

How to “use” blockchain better, like Rollup, is a question worth exploring.

Related Readings:

0a:

0b:

0c:

0d:

1:

2:

3:

3graph:

4a:

4b:

4c: