AC thinks: Crypto is following the same path as monetary policy in the early years, repeating the same mistakes it made before. The dragon slayer may be slowly turning into the dragon. Wave after wave of Crypto has iterated it into something else. Crypto culture has killed the Crypto spirit.

Indeed, it's as if that's really the case. We no longer prioritize our core values (decentralization, security, privacy, ownership, innovation), but rather focus on the excitement of short-term greed (fomo and hype). This is a sad state of Crypto.

These are just a few of the darker sides, but:

- More and more blockchains love stablecoins, which are ponziized and have simple and brutal mechanisms (this article was written in April '22, when Terra did not crash). The theoretical TPS is very high, but the TPS per second is lower than Ethereum in production.

- Most DeFi projects are increasingly embracing regulation, defeating the original purpose of fewer intermediaries and permissionless.

- Most GameFi is not fun at all, and the unresolved economy system issue always ends in a death spiral.

- Most NFTs are basically altcoins, speculating on useless or largely useless community concepts, the more expensive the art, and the air-dropped tokens are just nothing to feed the Ponzi, unable to be a real product, just to keep the story going.

- Most DAOs are useless. A slogan can make people deposit with confidence. Everyone has joined no less than 10 DAOs. DAOs are more than people. Also, DAOs do things very inefficiently.

- Most project’s tokens are useless, and while they are said to be useful for governance. Is the staking process really about voting? Do a few votes really give the user a part of ownership of the protocol?

Decentralization

Centralization equals lower price, decentralization equals value. The high gas you pay represents the value added by decentralization. Blockchain has many levels and areas of decentralization: hash power decentralization, governance decentralization, token decentralization, application decentralization, storage decentralization ......

As a blockchain or Crypto project, it is common for projects to be built as centralized and then slowly decentralize aspects of the roadmap as they are implemented. But as good as the future looks, there is no such thing as a completely decentralized project. A complete decentralization is not the best state either.

No one really cares about decentralization, so if you really want to build a truly decentralized protocol, you have to make a vow of decentralization from the beginning, otherwise you'll just keep compromising over a long period of time until you lose track of the right direction.

We'll start with the decentralization of Bitcoin development to explore Crypto's vision of decentralization and the need for decentralization in certain areas.

1. Whose Law is Code?

One of the oft-repeated ideas of the Web3 era is that code is law, and code can refer to the code of a protocol, smart contract, or "recommendation system". The essence of code as law is actually a new world of social consensus (the scary kind), and we focus here on code and the decentralization of development, and the role of non-code-savvy users in the world of cryptography and computing.

Web3 natives have a lot of direct interaction with "the law". Web3 natives are also more knowledgeable and familiar with Code Law than they are with real laws. But just like the law, code modification, governance, and facilitation are also very difficult and more centralized.

a) Bitcoin's P2SH battle

The first battle of bitcoin code changes was recorded on Bitcoin Magazine: the P2SH battle. This is the first network upgrade since Satoshi Nakamoto left.

In the years that Satoshi Nakamoto was around, Bitcoin made a lot of protocol changes under his leadership without much discussion. Of course this was a more centralized manifestation, but Satoshi Nakamoto himself did a very decentralized thing later on, in that he disappeared, but also created the decentralized problem we're talking about at the development level.

Andresen, a core contributor to Bitcoin, has become Satoshi Nakamoto's chosen leader. He pushed for the OP_EVAL opcode involved in P2SH, and wanted to get it on the network as soon as possible so it could be functional. But the introduction of OP_EVAL caused some problems, and the developers split into several groups, with one group arguing for a quick release and the other arguing for a delayed release, or another alternative. So the developers decided to let the miners vote with their power, but the problem was that if the miner client didn't upgrade, it would vote for it by default. There were countless debates among the developers afterwards.

Such debates have been occurring in the development of the network, but as ordinary users, we don't see these conflicts and disagreements. How should a decentralized digital currency be developed, how should decisions be made, how should direction be decided?

b) The debate continues to rage

Behind the scenes, the disparity between users and developers also results in users often only listening to the loudest ideas. For example, many people probably didn't know that Bitcoin was going to activate the BIP-42 soft fork in 2262(right), and didn't know that Bitcoin was talking about using SNARK to scale in 2013. This is all very interesting from a story perspective, but when you think about it, it's not as if the average user or miner is involved in Code Law. The story is about the core developers and people who know the technology.

Something like P2SH happened again recently. A developer pushed an update without consensus with others, or going through the Bitcoin Core update process (this happened with the Taproot update, but people trusted the developer enough to not fire him). Such a change is considered by some developers to be an attack on the Bitcoin network, just like the BCH one.

Bitcoin Core is not the Bitcoin network. It is not the command and control point of the Bitcoin network. It is the focal point of Bitcoin, and nothing more. The Bitcoin network is not controlled by Bitcoin Core, which means that in a de facto sense, the problems of centralized development and lack of rigorous processes do not directly affect Bitcoin.

But Bitcoin Core can be controlled by these people: internal GitHub employees (who surreptitiously tamper with it), and a few developers' keys (not the developers themselves). Some of these developers have experienced quitting due to public opinion, or being kicked out by others. When a developer's push doesn't go through, they may just go hard fork it.

We need to focus more on Bitcoin Core or other development teams, to make sure that at least the focus of the Bitcoin network is right.

d) Facing the Law of Code

There are over a dozen versions of the Bitcoin node, all created due to various development differences. The version that currently dominates is Bitcoin Core, because Core code usually means the best performance, the most secure, and the best.

The status of Bitcoin Core doesn't matter, it's not a monolith. It doesn't matter who controls Bitcoin Core, because in the end it's all about consensus. Most of the node operators or users give the power to the developers, and that is their consensus, their choice. In this case, the centrality of the development of Bitcoin Core may not really matter, because no one is forcing nodes and users to run Bitcoin Core. Your Node Your Code. Of course any changes to the code will need to be reviewed to ensure that it is the best solution.

Bitcoin does not really require a "vote" either. No ordinary user participation in the development process, no democratic dictates, and no pure decentralization of development. Bitcoin is anarchic, but requires rules, governed, defined, and enforced from the top down by the nodes of the network.

Decentralization is not as effective as centralization at some levels, for example, decentralization at the development level, which is needed for the team, but perhaps not for the network...?

**e) **Code is Law was violated

We've gone into great lengths about why we can actually trust the Bitcoin Core development team if we want to, but while Bitcoin Core is our consensus, are they necessarily right?

- 2010’s overflow error caused a fork, violating the longest chain principle, and 53 blocks were rolled back (btw 0 blocks were rolled back in the DAO event).

- The problem involved in BIP-50 led to at least one double-spend transaction. Another violation of PoW.

- BIP-42 fixes the problem that bitcoins can have an infinite supply due to overflow. White papers are Law, Code is not.

All of this is the fault of the development team, which violates Code is Law and the idea of a decentralized network. It's not that code and law can't be changed, but some development teams sometimes have a monopoly on making the network fix their mistakes. In the case of Bitcoin Core, we've chosen to forgive them time and time again.

Is Bitcoin still the wonderful decentralized currency it was imagined to be?

2. Trustless?

While Bitcoin Core is the consensus, does everyone have to believe in the consensus, or defer to the majority opinion?

There are many vivid examples of recent projects like this:

- We have high APY (this article was written in April '22, before Terra crashed), excellent investment background, advanced technology. We are revolutionary.

- Our mechanism is super secure, but we don't know what could go wrong in the implementation.

- Our funds are managed by a secure multi-signature wallet.

- We are temporarily based on a centralized service with better performance.

- Our contract code may have inadvertent or intentional bugs.

People rush in when they see the first few words, not DYOR, which is a common misinterpretation of the trustless feature. If you don't know code, don't know technology, don't know finance, then you need to be careful. Blockchain is a scary dark forest... Anyone who abandons judgment and submits to "authority", could suffer tragic consequences.

THORChain does a particularly good job of this, but we still have to check if that's the case, but it's much better than just mentioning about security verbally while relying on a few multi-sigs with unknown risks.

In the blockchain or the Internet world, we must treat every day like April Fool's Day and think about whether it's real or not.

3. Permissionless

While most people don't want to, some users very much want and need to run their own nodes. And while many blockchain networks are outright discouraged to them by the configuration requirements, the true ultimate decentralized network is one that can be run by the average user on their home device.

Remember the section on trustlessness? Users running a node or service on their own actually removes a lot of the additional and perhaps risky assumptions attached to the network (e.g., centralized sequencer). Regardless, allowing users to join the network is a huge plus for the overall diversity of the network, as well as for their own security and privacy use. This is typical of Solana, where a node may actively review to "rule out suspected malicious transactions" during downtime. By contrast, Ethereum's Danksharding scheme is very user-friendly. Mina is also very good, and can even be run in the browser.

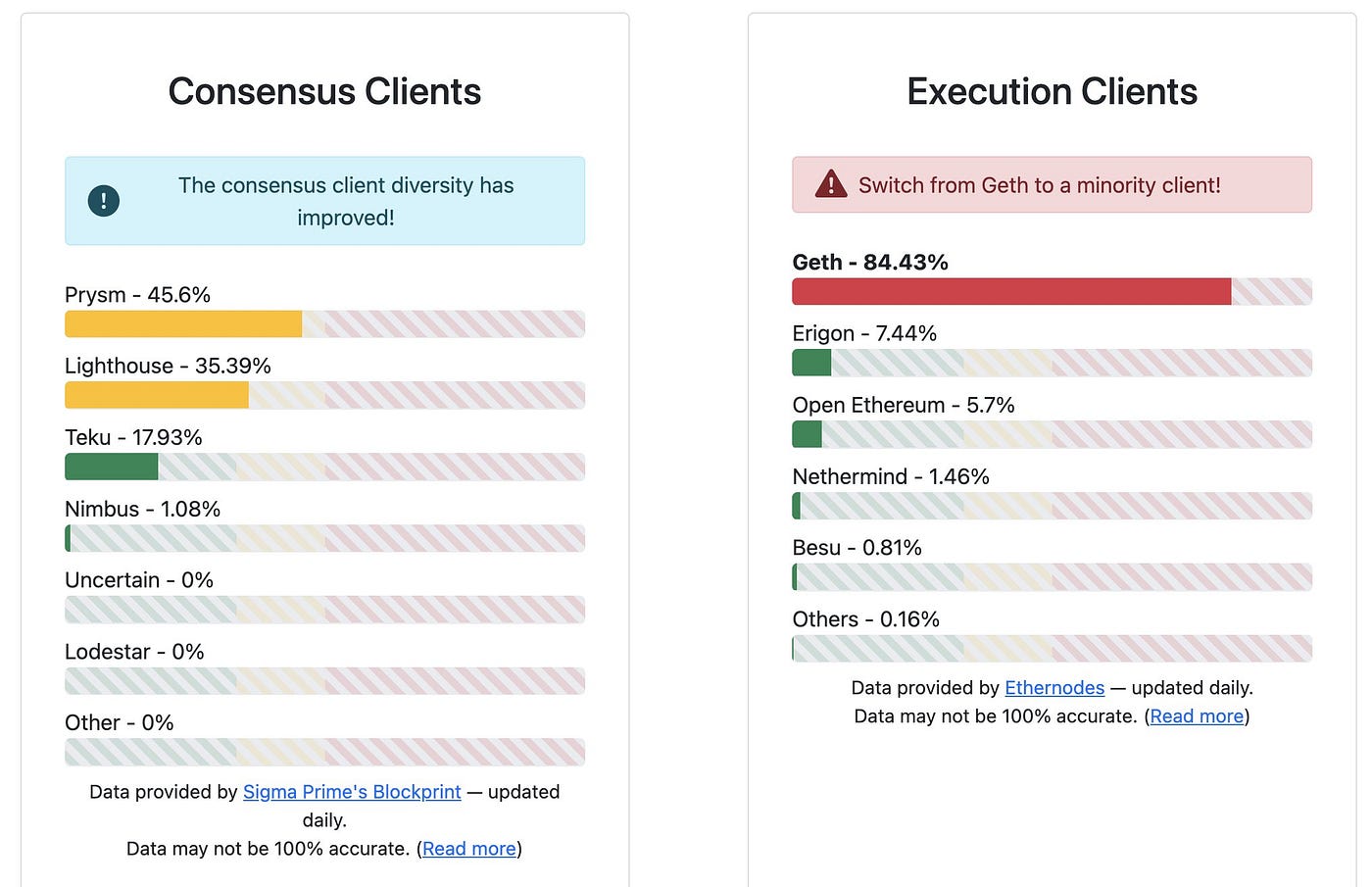

Even Ethereum doesn't do well with client diversity. Of course, taking the browser example, it will be difficult to break Chrome's monopoly, and it will take a long time.

Users also need to run their own application front-end. In many cases now, the protocol is decentralized and neutral, but the application front-end is mixed with a lot of other content (Tornado.cash, Uniswap, dYdX, some bitcoin wallets), leading to censorship. While this may indeed have a positive effect, it has an impact on the decentralization of the application. Applications need to provide a decentralized open source front-end, which can be hosted by users or the community itself, in order to ensure that the application is censorship-resistant, neutral, and decentralized. We need Arweave.

For the free and open Web3, any redundant licensing and censorship need to be removed, otherwise it's not decentralized.

Privacy & Ownership

Web3 = Read + Write + Own. To have true ownership, we must find a balance between privacy and publicity.

In real life, ownership mostly means home ownership, which means the right to deny access to others. In the Web era, from Web1 to Web3, everything, i.e. data, adds value based on sharing and distribution. We use NFT to find a balance between publicity and ownership.

In the Web2 era, we "sold" our data to Internet companies, creating value for them directly. In the Web3 era, the data we have creates value for ourselves. We want this data (meme, NFT, whale transactions) to be more widely distributed, and to represent our own identity. But this distribution puts us at greater risk of privacy exposure.

We need cryptography to ensure our privacy, while making our ownership of the value creation process more secure. Cryptography is the only way to enter the Web3 world with true privacy.

Innovation

The boom of blockchain and Web3 is based on innovation, which includes: open source 2.0, composability, decentralization, ownership. Innovation is a necessary condition for success in any new field.

Higher stablecoin APYs (which will be halved next week) and carefully "calculated" higher TPSs (which are lower than Ethereum in actual use on the mainnet) are not innovation, but rather a race in a meaningless direction.

The essence of innovation is to solve problems that others have not solved, and of course to create new problems that cannot be solved at present.

1. Solving problems that others have not solved

A truly great innovation can be described in one sentence, and here are a few typical blockchains:

- Avalanche: The first working low gas EVM chain.

- Arweave: A permanent storage network without any censorship.

- BSC: Fast and cheap centralized blockchain.

- Solana: Super throughput, contracts can be written in Rust.

- Cosmos: New blockchain network architecture.

- Arbitrum: Cheap, while borrowing the security of Ethereum.

- Luna: The first blockchain to print money on 20% APY (this article was written in April '22, before Terra crashed).

And in the process, if these problems are solved by someone else, then the innovation is likely to lose its meaning. Polkadot and Near, for example, are both working on roadmaps for the previous version of ETH2, which has come up with entirely new solutions for the next generation of the Rollup universe (only Bitcoin and Ethereum seem to have the stability and ecosystem to hold up to Layer2). They're both good innovations, but over time, a bit dated. Indeed it is creation, but not innovation.

2. Creating new and unsolvable problems

Each branch of innovation may solve one problem and then create more problems. As blockchains are created, issues of scaling, consensus, and security emerge. That's how the process of collapse and convergence came about. Computers were created to build better computers. It's hard to explain why an innovation is useful, but when it creates more problems, we know that at least we'll reap more progress.

Every everyday thing that is taken for granted is an innovation that has been optimized by the minds of those who came before us. Right now, Web3 is the best place to innovate, and we need to value every potential paradigm innovation and ignore the meaningless innovations.

Whether the goal is really quality innovation can be distilled down to two questions:

- Is the first aim to enhance the technology/model/industry? (Can be a mild Ponzi-like structure, but not a Ponzi scheme.)

- Is it a good new meme? (New Kind of Money, Rely on Math not Validators, The Internet of Blockchain)

Key Research Dimensions

1. Next-Gen Infrastructure

Every year is a year of building the Web3 infrastructure. This is a good thing, and it means we realize that the industry needs a stronger foundation. Infrastructure will inspire new applications, and applications will inspire new infrastructure. But be aware that infrastructure that doesn't solve problems and doesn't evolve into applications is still meaningless.

Infrastructure encompasses a myriad of directions:

- New chains: The chain is the network layer of the application, which is the basis for the operation of the application.

- New Bridges: Bridges are the necessary facilities to communicate across networks.

- Developer Resources: Next generation developers, more researchers.

- Infra for Developers: Better development tools, more readable data, faster and more meaningful build tools.

- Facilities for users: Better wallets, better applications, especially for Web2 users, which will represent an overall expansion of Crypto.

- Public Goods: Providing value to Web3 and the world at large.

The role of infrastructure is critical and deserves constant attention.

2. Next-Gen Innovative Technology

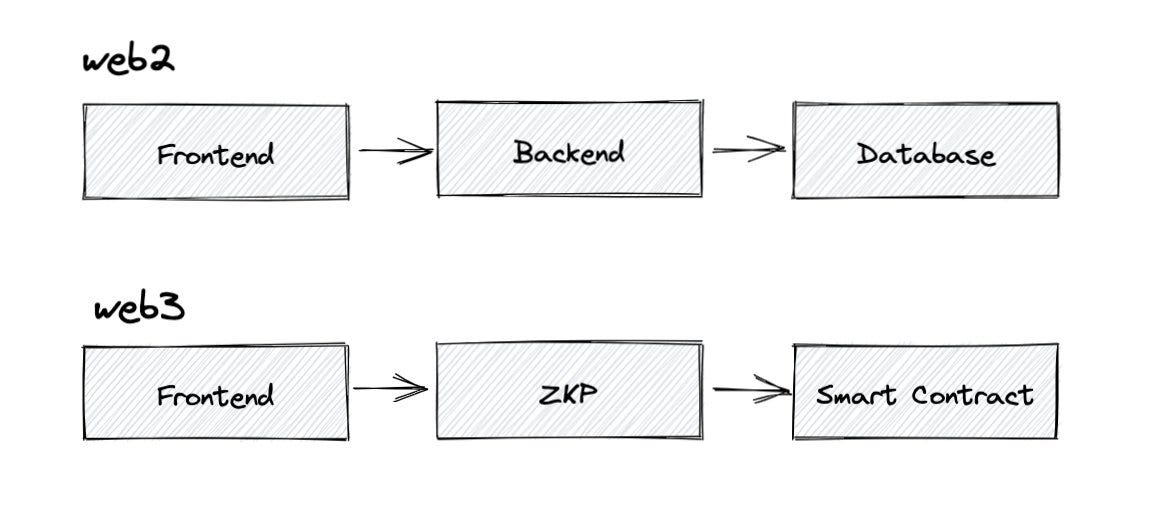

We need to look for innovation at the surgical level, not at the pharmaceutical and plaster level. My personal idea of the next generation of innovative technology is typically zero-knowledge proof.

The first era of Crypto was Bitcoin, the second era was Ethereum and Smart Contracts, and the third era will be Zero-Knowledge Proofs.

Web3 will be revolutionized by the existence of zero-knowledge proof technology, which will lead to a more standardized, efficient and comprehensive development approach.

Zero-knowledge proofs will satisfy all the decentralization (mining in the browser), trustlessness (additional trust assumption is mathematics), innovation (alien technology combined with cryptography), privacy (zero-knowledge is privacy), Meme (cryptography and mathematics is the biggest "meme" ever created in human history) and other Web3 characteristics should have.

In addition, I am also looking forward to the convergence of mature Web2 technologies with Web3 to create a new generation of innovative technologies, such as the true convergence of machine learning with Web3, and the innovation of hardware that will allow technologies such as zero-knowledge proofs to be more powerful.

3. Next-Gen Business Model

- DAO: More exploration of the DAO model is needed in the future. What can DAO do? What is the right thing to do? How do you do it? The DAO is at the heart of the Web3 and Crypto spaces, and is tightly focused on communities and users. We will continue to investigate how the DAO can improve on the traditional system, and how the DAO itself can evolve.

- Creator Economy: The creator economy, much like DAO, is a very familiar concept, but one that doesn't really run the gamut of value. Art creators have their own community and economy through NFT, but creators in music, video, and other fields still seem to have a rejection reaction after countless interactions with NFT, and are unable to truly integrate and innovate. The true realization of the creator economy, perhaps need more Web3 social and NFT innovation together.

- Guild 2.0: Guilds have been evolving since the advent of gaming, and the emergence of the Play-to-earn model has given them a new lease on life. Guilds are playing an increasingly important role in the Crypto Gaming space, playing a management, operational, and integration role. I believe this model will move more into the mainstream in the future, allowing the Crypto gaming industry to mature even more.

- NFT 2.0: We all love PFP, but in the end it's probably just a consumer product (for now). What exactly is the role of NFT? We all have some hazy ideas, is it Pass, is it Link, is it Art, or is it Meme?

Conclusion

Remember the opening thoughts of AC? Still, we are entering a new era, and we are a new generation that can do better. Blockchain may have temporarily entered the wasteland, with less "easy" innovation, but the foundation of Crypto has not become profit-seeking greed, but may have shifted from being trustless, to being partially trustless. Nevertheless, we are still on the right path.

We should not be Maxi of decentralization. The existence of these core values is not black and white. We just need to keep them at the forefront of our minds. For example, the less necessary decentralization of development and governance at the start of a project can be partially compromised, so that the entire Crypto and Web3 domains can be built and developed fast.

Optimistically: Web3 is already very good. There are countless young and talented people migrating into Web3, using and building it. We're on a fast hype train, which is a very good thing actually. This is the land of new opportunities, where you can build the future, have ownership, merge digital identities, enable open finance, assemble open source Lego, and have a new generation of global work models.

Technically: Crypto brings unlimited innovation. Consensus: Satoshi Nakamoto Consensus, Avalanche Consensus; Cryptography: STARK, PLONK, Halo2; Computation: RISC Zero, Zexe, Cairo; Privacy: Zcash.

Pessimistically: Sometimes, you have to let it break. As absurd as Web3 is now, it will collapse and converge, and then enter a new life. In a fast-changing Web3 world, the biggest risk is not taking any risks, and we need to identify the real value in the chaos.

Even if you don't care about getting crypto in the right direction for a rebirth, at least some people do ......

Related Links