In recent years, Decentralized Autonomous Organizations (DAOs) have emerged as a revolutionary concept in the realm of digital governance and community-led decision-making. As we delve into 2023, the financial underpinnings of these entities, particularly their treasuries, warrant thorough examination and analysis. This paper aims to dissect and understand the complexities and dynamics of DAO treasuries, offering insights into their structure, management, and impact on the broader blockchain ecosystem.

DAOs represent a paradigm shift in organizational management and decision-making processes. By leveraging blockchain technology, they offer a level of transparency, inclusivity, and efficiency that traditional organizations struggle to match. DAOs operate on democratic principles, where decisions are made collectively by stakeholders, ensuring a decentralized form of governance. This structure not only democratizes power but also fosters a sense of community and shared purpose among members.

At the heart of a DAO's operational efficacy is its treasury. This critical component acts as the financial backbone, supporting the organization's initiatives, projects, and sustainability. In 2023, as the landscape of Web3 and blockchain evolves, DAO treasuries have become increasingly complex and significant for several reasons:

-

Resource Allocation and Governance: The treasury is the epicenter of a DAO's functionality, determining how resources are allocated. Understanding its mechanics is crucial for assessing a DAO's governance quality and long-term viability.

-

Risk Management: With the volatile nature of digital assets, understanding the risk management strategies employed by DAO treasuries is crucial for evaluating their resilience and stability.

-

Sustainability and Growth: DAO treasuries are pivotal in funding innovation and growth within the ecosystem. Analyzing their ability to generate profit provides insights into the future direction and potential of the DAO.

-

Transparency and Trust: In an environment where trust is paramount, the transparent nature of DAO treasuries fosters greater confidence among stakeholders. Analyzing these treasuries offers a clear view of the organization's health and governance practices.

The report is structured to explore several crucial dimensions. After clarifying the database and methodology, we examin the Long Tail effect in DAO treasuries. Following that, the report covers the composition and implications of various tokns held by DAOs. Next, we delve into critical discussions around the classification and role of native tokens in DAO treasuries, their liquidity positions, risk management strategies, and the overall financial health and structure of these treasuries. Finally, there is a conclusion.

Data and methodology

The basic database is originated from DAOBase(https://daobase.ai/)'s collection of top 2000 DAOs in treasury. The time period is from Jan 1, 2023, or the launching date, depending on which comes earlier, to Dec 31, 2023.

After testing the long tail effect, a more detailed structure analysis is conducted by labelling every token in the top 60 DAOs in treasury, using Debank(https://debank.com/) and treasury addresses. Trading data is integrated from CMC(https://coinmarketcap.com/) , Coingecko (https://coingecko.com/) and NFTgo(https://nftgo.io/).

When testing the relation between daily trading volume, native token ratio and standard deviation of daily returns, two linear regressions are employed, with p value as the threshold.

To determine whether 100% NTR DAOs are significantly different from non 100% NTR DAOs, Mann-Whitney U test is deployed.

Long Tail effect

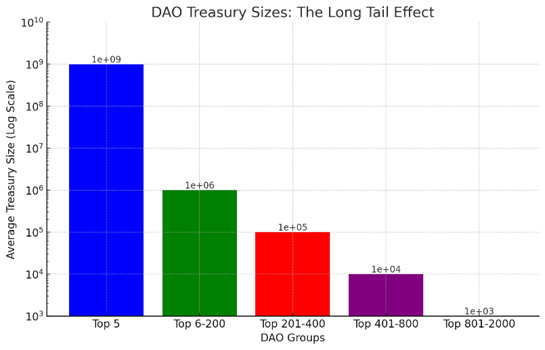

Many researches ( Mayson Nytorm, Messarri, Jul 2, 2020; Dulude & Fakhoury) have mentioned the existence of long tail in DAO treasury distribution. This report reexamine this effect with a sample of 2000 DAOs and proves that it still dominates the DAO ecosystem.

Here's the logarithmic scale bar graph with each bar represents a group of DAOs. And the height of the bar indicates their average treasury size on a logarithmic scale. This visualization clearly shows the significant disparity in treasury sizes among different groups, highlighting the long tail effect.

Asset Structure

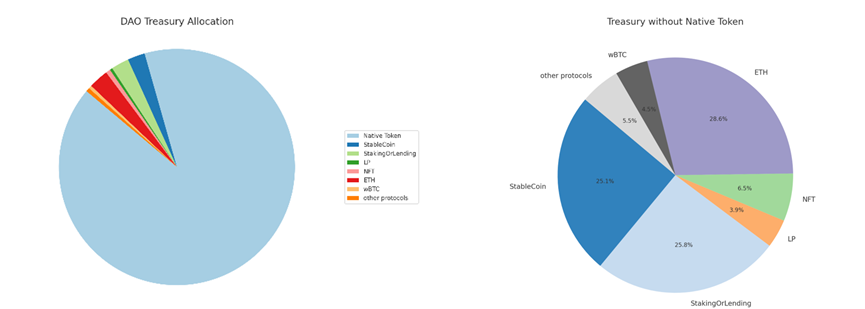

Another concern might exist in the concentration of native token in treasury management (Talamas & Nystrom, 2021). Our sample furthers their research by covering all the tokens in 60 Top DAOs' treasuries and labeling each token with native token, stablecoin, staking or lending, liquidity provider token, ETH & BTC and other token. (Definition in appendix)

The left pie chart visually represents the distribution of the Top60DAOs' treasury across "asset" categories. The largest portion (90%) is attributed to the native token, indicating it as the primary "asset", while smaller slices represent the rest 10% shared by stablecoin, LP, etc.

While the right pie displays the distribution of the Top60DAOs' treasury assets excluding the native token. ETH, StableCoin, and StakingOrLending each command approximately a quarter of the portfolio, indicating a strategic emphasis on these assets. The remaining quarter is divided among four smaller categories: 'LP', 'NFT', 'wBTC', and 'other protocols', each representing a more modest portion of the treasury.

Native token

It actually concerns about how to define token.

-

Currency. If so, a DAO is similar to a country or central bank, and the name "treasury" is also inherited from that of a country or central bank. For a country, currency is a lability for a country which represents a promise or obligation of the government to uphold the value and trust in that currency, while, the nature resources or human resources which generate goods and services are true assets of the country. As for a DAO, native token is not an asset, its code and contributors are. And DAOs, which holds a "purified" strategy managing their treasuries, are more likely to view themselves as a digital country or central bank.

-

Equity. As Hasu (2021) mentioned, token in the treasury is actually unissued stock. Under this circumstance, DAO is viewed as an enterprise, while token represents ownership and voting power as equity does in a company. In that case, native token is still not an asset, while those tokens excluding native token are. Therefore, a more diversified treasury would appear in a more firm-like DAO.

-

Other things. Some views might be "token is token", commodity, or it's still in its early stage. But to accelerate clarity and accountability, making DAO a more massive adoption, this report would temperately leave these concepts for now and wait until their maturity.

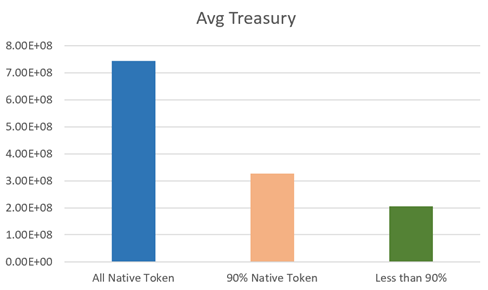

This bar chart demonstrates the average treasury value when the top 60 DAOs are divided into 3 groups: 100% native token DAOs, over 90% native token DAOs and under 90% native token DAOs.

The results shows that bigger DAOs are more likely correlated with higher percentage of native token ratio (NTR).

Liquidity: native token and diversification

Theoretically, there are at least 4 pros for keeping a healthy level of liquidity for DAOs.

-

Treasury's liquidity represents the ability of the DAO to meet its short-term financial obligations and operational needs (i.e. paying for ecosystem growth grants). A high liquidity level indicates that the organization can readily convert assets into stablecoins or L1 tokens (ETH & BTC), ensuring smooth operations and resilience in the face of market volatility.

-

It reflects the health and stability of the DAO, attracting potential investors and members by demonstrating sound financial management.

-

Additionally, it aids in risk management, as liquidity challenges can lead to solvency issues, impacting the DAO's reputation and longevity.

-

In the context of DAO, which operates on principles of transparency and decentralization, maintaining optimal liquidity is essential for member trust and engagement, as it showcases responsible governance and financial stewardship.

Empirically, DAOs's liquidity management tends to allocate their major resources on two aspects: 1) native token's market making, 2) and the distribution of "cash" (stablecoins) or "currency" (stablecoins + ETH + BTC).

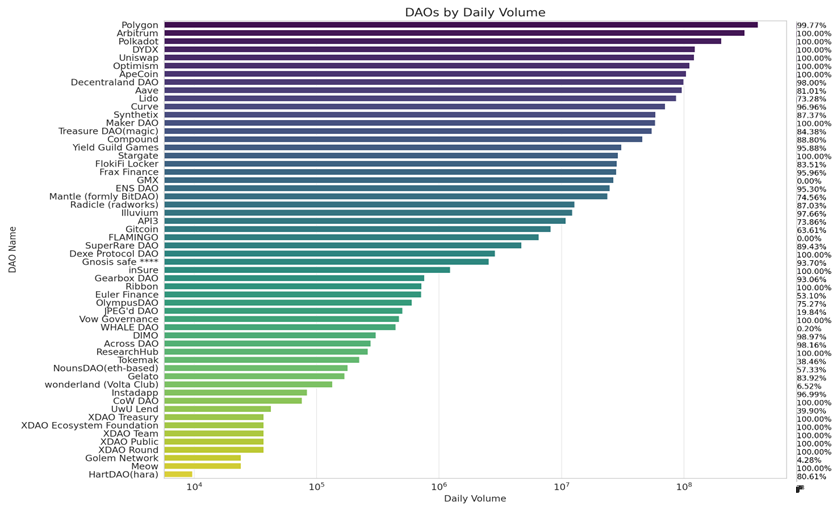

Native token is the core for many DAOs, if it's not everything. Many would hire professional market-making teams, or pass a proposal to establish trading pairs on AMM DEXes. The following chart show the top 56 DAOs ( 2 have no native token, and 2 have no valid transaction data) by daily volume in 2023, with the right column as NTR at the end of 2023.

An instinctive hypothesis would arise that since native token's liquidity is so vital for every DAO, those 100%-native-token-ratio DAOs should put more emphasis on it, which means their native token would have higher daily trading volume.

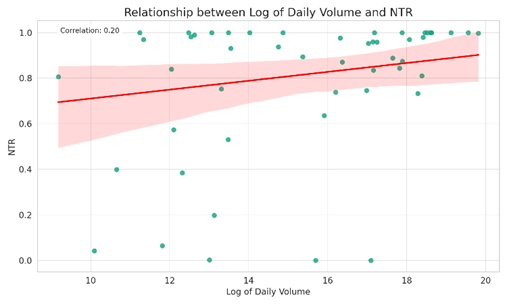

To test that hypothesis, a scatter plot chart with the regression line is employed, illustrating the relationship between the log of the daily volume and NTR. The correlation coefficient is approximately 0.20, indicating a slight positive correlation.

The result shows some evidence that DAOs with higher NTR tend to increase their native token's trading volume as to maintain treasury's liquidity.

Another concern about native token is its stability for DAO treasury management. For grantees, the last thing they want to see is those tokens given couldn't cover their budget after a sudden market dump. On the contrary, grantors wouldn't want to overpay projects due to market pumps which would lure arbitragers instead of true builders.

Researches like Lamoureux&Lastrapes (1990) demonstrate that volatility is highly related with trading volume on the traditional markets. However this effect has rarely tested on the crypto market.

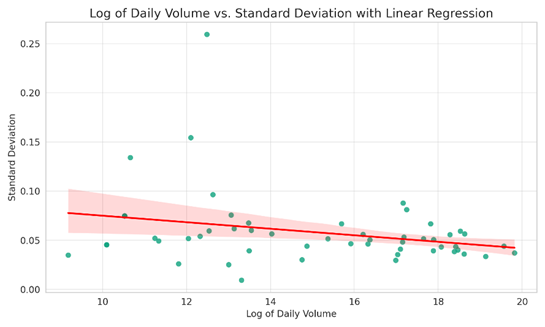

This upper scatter plot illustrates the trend between the logarithmic transformation of daily volume and daily return's standard deviation across all DAOs. And a linear regression line is added to show the relation between these 2 factors.

The slope (beta) of the regression line is approximately -0.00332. and the p-value of the slope is approximately 0.03505, which is less than the conventional alpha level of 0.05. This suggests that the relationship between the log of daily volume and the standard deviation is statistically significant.

Since high volume does bring more stable native token price, it is evidential that DAOs could achieve both liquidity and stability by increasing volume, which is essential for DAOs holding 100% native token in their treasury.

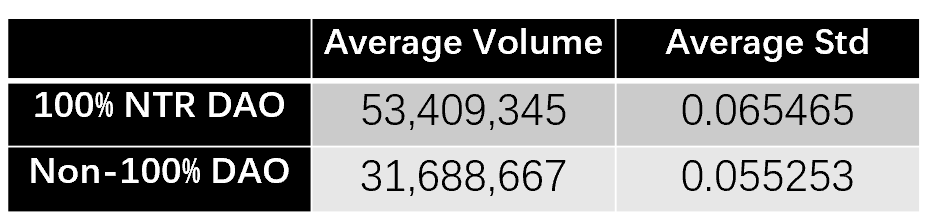

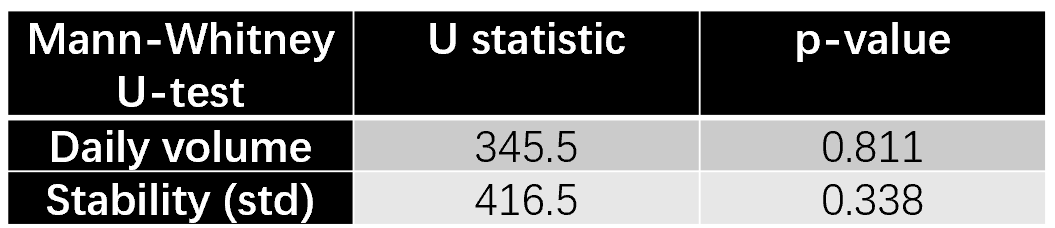

Considering that even non-100%-NTR DAOs still hold a massive percentage of native token, the section starts with dividing our 56 TopDAO sample into 2 groups: 100% NTR DAOs (20) vs non-100% DAOs (36).

Since these two sets of data is neither paired nor normally distributed, Mann-Whitney U test is run to determine if there's a significant difference between the data in two groups.

The results of U-test show that neither p-value is lower than the threshold 0.05, which means there is no statistically significant difference between the data in the two groups.

In other words, though 100% NTR DAOs seem to have larger trading volume at the cost of only slightly less stability (which might lead to healthier treasuries), they are actually at the same level of native token market-making as those which diversify their treasury.

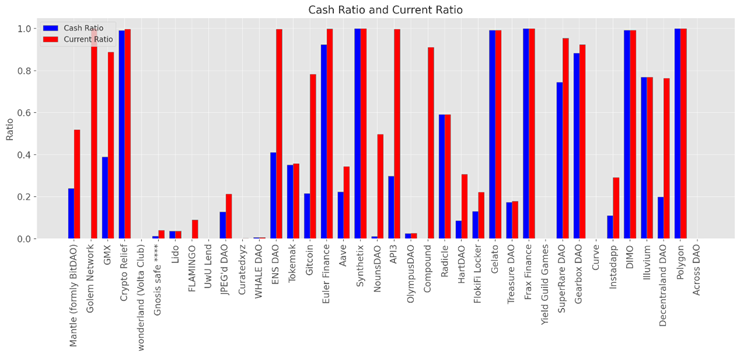

“Cash” ratio

Deploying "cash" or "currency" into the treasury, on the other hand, is commonly mapped out by many almost-top DAOs. In our sample, 38 DAOs have tokens other than native token, leading to the average cash ratio of 34%, and average current ratio of 51.8%, where

"cash" ratio = stablecoin ratio = Stablecoin / (treasury-native token)

"current" ratio = (Stablecoin + ETH + BTC) / (treasury-native token).

Stablecoin, BTC and ETH, are undoubtably the most liquid and less volatile assets in the crypto world. In that case, almost-top DAOs do perform better on treasury's stability and liquidity by keeping native token's high trading volume and diversify their treasury.

Risk Assessment: treasury as a "portfolio"

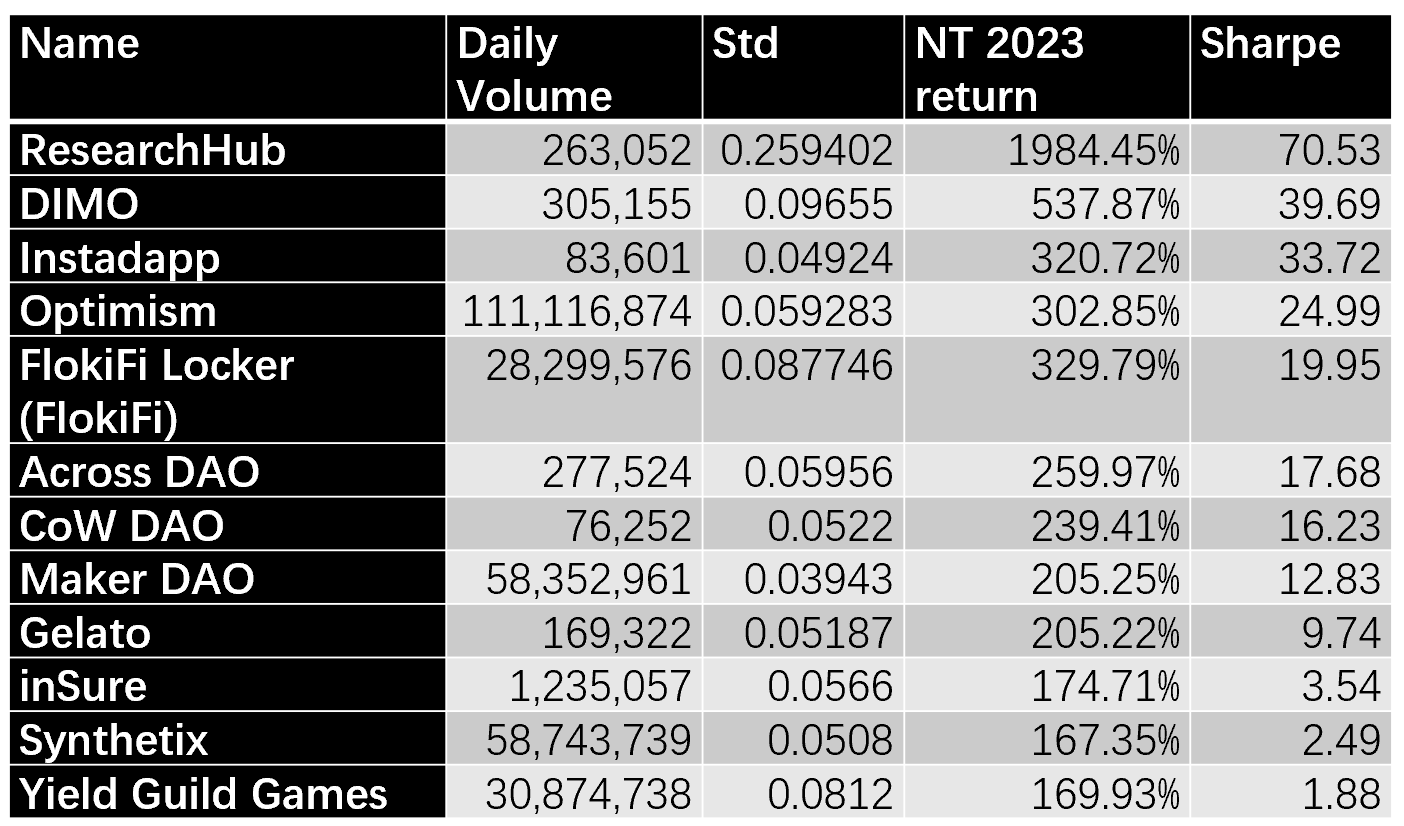

Though native token is not viewed as an asset in this report, "issuing" new tokens to incentive the ecosystem is still commonly used in most DAOs. As a result, the performance of each DAO's native token is the key of treasury management.

However, of the 56 DAOs in our sample, only 12 has positive "Sharpe" ratio when taking BTC as the "risk-free" asset in crypto, with only 1 (Optimism) in the Top5 club.

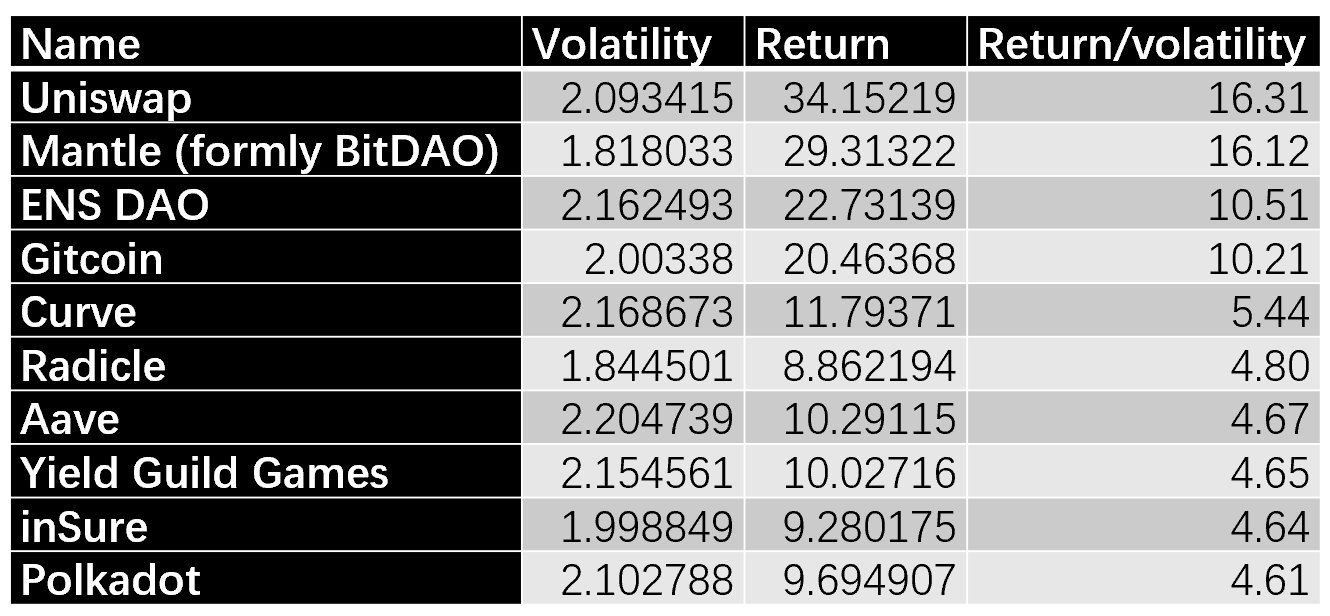

Following the same logic, this report further take treasury as the "portfolio" and take the ratio of return and volatility as an indicator to measure DAO's ability to expand its payment ability with certain risk control.

23 of 56 DAOs have gained a positive treasury return in 2023, with the top 10 listed above. With the volatility of different DAOs fluctuates around 2, the key factor turns to be the return. Uniswap, mantle and ENS are the Top 3 in this list, which is no surprising because, they are also among the most profitable DAOs. (details in the section after next)

As most DAOs take liquidity as the priority of treasury management, less than half in our sample focus on treasuries' profitability, which leads to better treasury management.

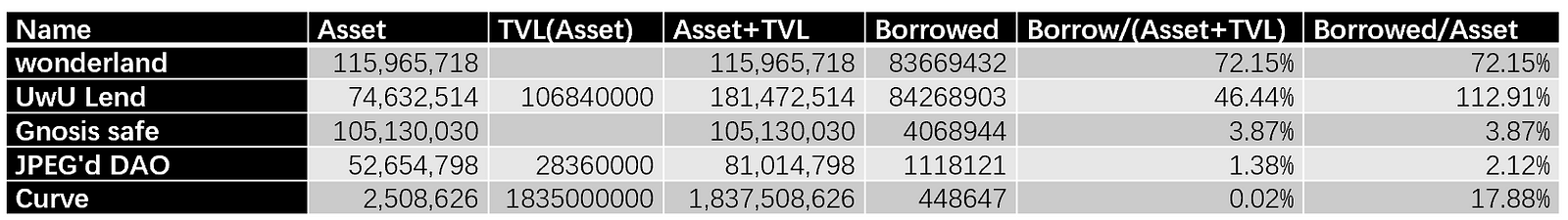

Treasury Structure: Borrowed, TVL, and Liability/Asset ratio

In this section, this report digs the structure of treasury structure in a balance-sheet's view. As native token is not included in the asset part, asset is defined as the difference between Treasury and Native token value (Treasury-Native token value). The liability for a DAO is mainly from 2 sources: borrowing from lending protocols and TVL which DAO members deposit for all kinds of reasons.

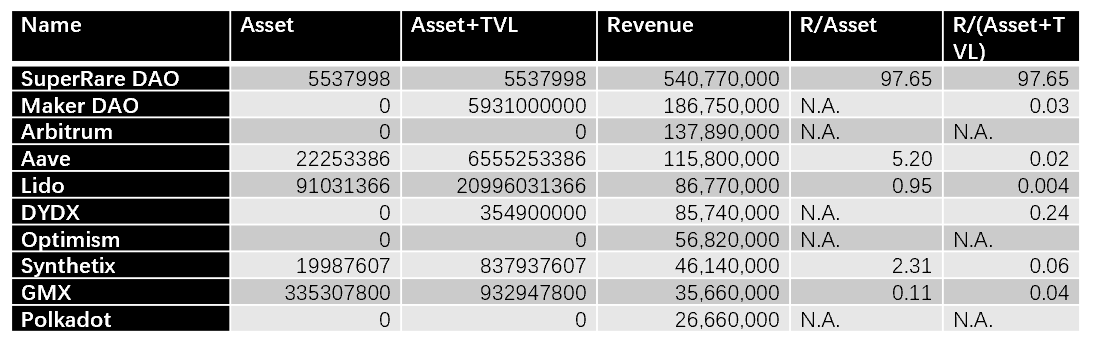

The following table shows the 5 DAOs holding the most borrowing amount. Even with overcollateralized design, DAOs could still be over-leveraged. Generally, high Borrow/Asset ratio might cause a crisis when facing market downturn.

Total value locked, or TVL, in DAOs (esp. Defi) might be similar to deposit, which is an asset in financial institutions. It is counterintuitive at first, as deposits are money that the DAO owes to its owners. However, in banking and financial accounting, deposits are classified as assets because they represent funds that the bank can use for various purposes.

The above table shows all 5 DAOs in our sample which have loans from lending protocols. When TVL included, wonderland has a relatively high borrow/(asset+TVL) ratio.

Nonetheless, considering DAOs have no control over TVL like banks, it is also reasonable to exclude it from the liability/asset measurement. The results demonstrate that UwU has a more dangerous financial structure.

Return on Asset: the seen and unseen part of the iceberg

Profitability in a DAO is essential for its sustainability, member confidence, effective resource allocation, market reputation, talent attraction, resilience to market fluctuations, and fulfillment of its core purpose and objectives.

This report imports data from TokenTerminal as the annual DAO revenue. For example, DYDX’s revenue is the share of trading fees that goes to the protocol (native token holder), while Optimism’s revenue is the share of transaction fees that goes to the Sequencer.

SuperRare in the table above is far ahead of other DAOs, indicating an extraordinary ability of generating value for its native token holders.

Conclusion

In conclusion, our exploration into the complexities of DAO treasuries in 2023 has revealed their pivotal role in the blockchain ecosystem. DAOs, with their unique blend of democratic governance and blockchain technology, are reshaping organizational structures and decision-making processes. The treasury, as the financial cornerstone of a DAO, not only supports operational and strategic initiatives but also reflects the organization's resilience and stability in the volatile digital asset landscape. Our findings underscore the importance of resource allocation, risk management, and transparency within these treasuries. As DAOs continue to evolve, their treasuries will undoubtedly play a crucial role in shaping the future of decentralized governance and the broader Web3 landscape.

Reference:

Mason Nystrom, Jul 2, 2020, DAO-off: Moloch vs. DAOstack, https://messari.io/report/dao-off-moloch-vs-daostack

Dulude & Fakhoury, The Future is DAO: A Primer on DAOs and Their Explosive Growth, https://underscore.vc/blog/the-future-is-dao-a-primer-on-daos-and-their-explosive-growth/

Talamas & Nystrom, May 13, 2021, A Crisis in Protocol Treasury Management And How to Solve It, https://messari.io/report/a-crisis-in-protocol-treasury-management-and-how-to-solve-it

Hasu, October 28, 2021, A New Mental Model for Defi Treasuries, https://uncommoncore.co/a-new-mental-model-for-defi-treasuries/

Lamoureux & Lastrapes,1990, The journal of finance, https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1540-6261.1990.tb05088.x

Appendix Definition of tokens in treasury:

Native token (FT or NFT): It refers to the token, either fungible token (FT) for most DAOs or non-fungible token (NFT) for DAOs like Nouns, issued as a governance tool, granting holders voting rights on organizational decisions, providing access and membership benefits within the DAO, and acting as a reward mechanism for contributions. Additionally, these tokens have economic value, being tradable on exchanges and used for transactions within the DAO's ecosystem.

Stablecoin: those tokens anchored USD and stay an acceptable low volatility around $1/each token, i.e. USDT, USDC, DAI, etc.

Staking or lending assets: similar to traditional deposit, those assets gains negative rewards, including staked token in a protocol like stETH, and net value of (deposit - borrowed) in a lending protocol like Aave.

Liquidity provider token: those LP tokens representing providing trading pair liquidity, mostly used by DAOs to increase liquidity of its own native token, but also a method to earn trading fees.

L1 (ETH & wBTC): the most fundamental native assets on blockchain, for blockchain purists, these are true currency.

Non-native NFT: NFT from other protocols.

Other token: FT from other protocols.