Influencers, news sources, or investment advisors (both professional and amateur) when they have results, will naturally “claim” them for progress and reputation.

Claiming is important; followers benefit because following someone with good results often leads to better outcomes, or at least, they know there’s experience.

💡 However, I’ve noticed that the way professional investment advisors claim versus crypto influencers is very, very different.

👉 Professional investment advisors find it much harder to claim than crypto influencers. Let’s see why.

✅ Investors like us should read and compare sources to make better-informed decisions.

This thread is written to serve as a guide for strengthening our ecosystem (helping investors assess news better and influencers create better content).

Disclaimer:

-Poor examples can be commonly found from foreign influencers, and no one is being singled out.- Some people who act like the bad examples might actually have good intentions. -The content comes from my own experience (I know a bit about finance, but I don't work in this field). If there are any mistakes or anything to add, feel free to contribute. Many of you probably already know these points.

1️⃣ Claiming by individual assets instead of by portfolio

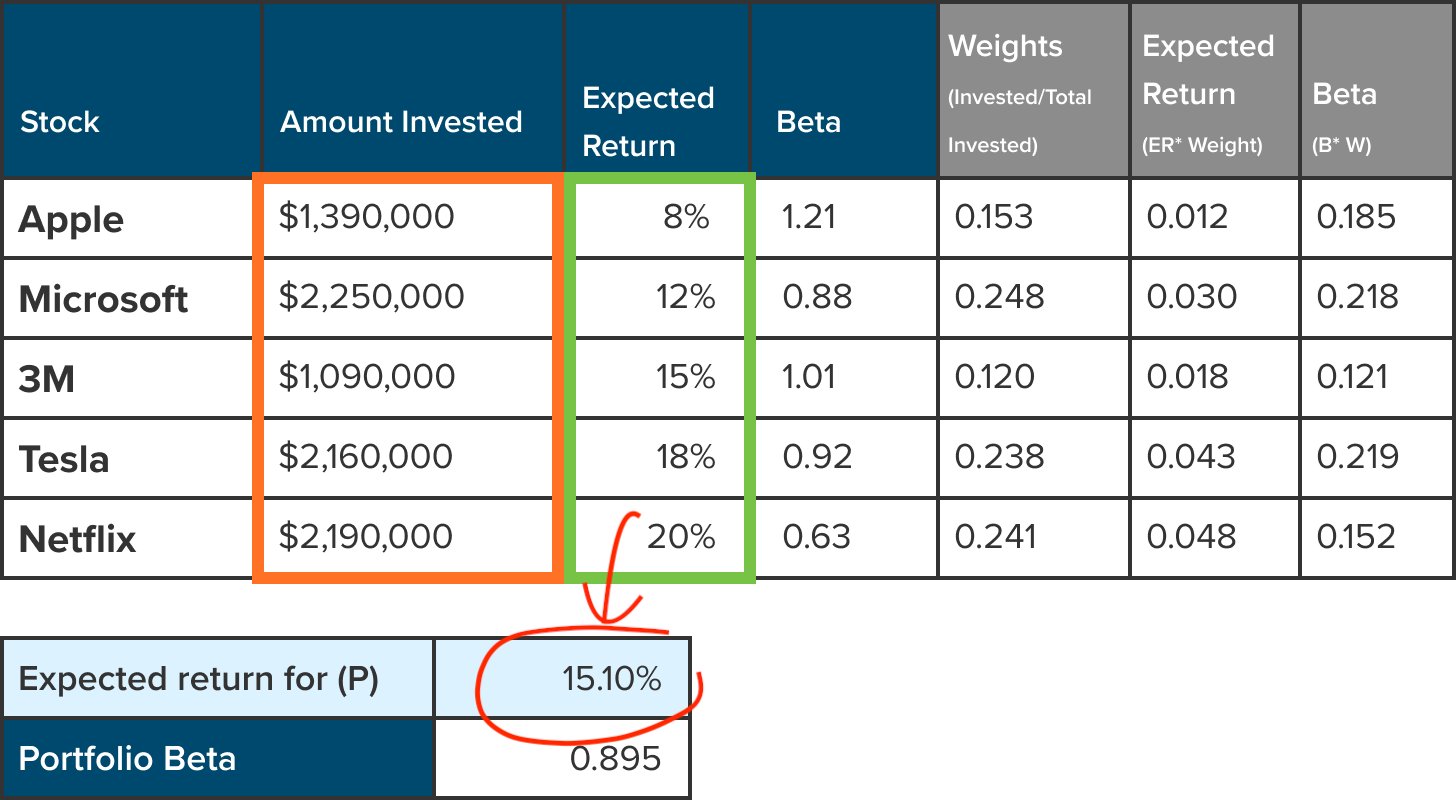

Professional investment advisors usually analyze the risk and investment goals of each individual (obviously, influencers don’t do this, which is understandable).

✅ They create a portfolio, and when they claim results, they claim them as a whole portfolio. ❌ They don’t claim individual assets.

Each asset has different risks, so they aim for different expected returns. ✅ When claiming results, they look at the overall portfolio performance, like in the example of 15%. ❌ It’s not about bragging that Netflix made 20% while ignoring Apple’s 8% (or skipping the losing ones).

In contrast, with crypto influencers, we often see the opposite.

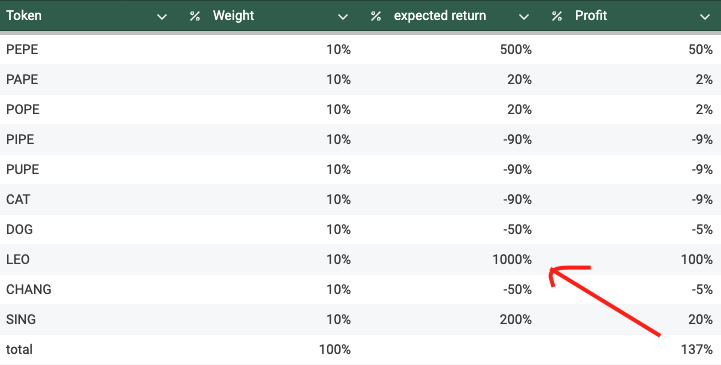

In the example, the portfolio gains 1.37x overall. ⚠️ But they’ll brag, “Told you to buy LEO, it made 10x, how about that?” ⚠️ While skipping over the other assets that lost or made smaller gains.

2️⃣ Too many targets to claim

A financial advisor may allocate fewer than 30 assets in a portfolio with a specific purpose, such as:

-A portfolio for funding a child's overseas education, usually made up of low-risk stocks.- Then, there may be a separate portfolio for higher-risk investments.

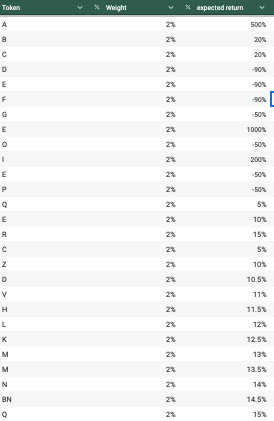

Even 10 assets might already be a lot to track. If there are too many assets, even if one moons, it won't have much impact on the overall portfolio.

Stock investors often encounter numerous stock recommendations every day because sources like influencers and news outlets continuously provide insights and highlight the strengths of each project (which is a good thing, offering knowledge 📕📚🙇♂️).

👉 Crypto investors, however, are stimulated even more, as we have countless projects, including a flood of memes popping up all the time.

👉 Notice that the more knowledge is shared, the more claims can be made. The crypto world moves fast, so if you point out 10 projects a week, that’s 520 in 52 weeks — there’s an overwhelming number of things to claim.

The knowledge influencers/news outlets provide is valid. It’s more about how to adjust the content to benefit followers as much as possible. 🙏

3️⃣ Giving targets without specifying buy or sell prices

Doing this allows claims to be made at any time.

For example, selling at 2) and even without buying back, they can still claim results.

Some may actually buy back and sell everything at 4),but tell followers they only sold half.

This way, they can still claim at 5).

👉 If an influencer sells at $0.5 and the coin skyrockets to $10, they shouldn't be claiming success at $10.

4️⃣ Vague price analysis that leaves you unsure whether it’s going up or down (hedging both ways)

This is my personal opinion (and I’m not a big believer in technical analysis, so I might not fully understand it).

⚠️ But influencers who chart and speak ambiguously—where after reading, you can only conclude that the price will either go up or down—end up never being wrong (winrate 100%) and can claim success in both directions.

Many people make wrong predictions about whether the price will rise or fall and end up being ridiculed (there must be some, haha), but I respect these people more than those who speak vaguely. The more detailed someone is, the greater the chance of being wrong. Some even provide exact buy/sell points in advance. ✅ In the end, they might be wrong, but followers who track them closely will know their true winrate.

5️⃣ Giving a price target but changing the reasoning when the situation shifts

For example, during a bull market, they might say the FDV can reach $20B, but in a bear market, they lower it to $1B.👉 In this case, the fundamentals remain exactly the same; only market sentiment has shifted. 👉 It's not because the project was hacked or anything like that.

It’s important to evaluate whether the explanations they give are reasonable.

6️⃣ Misaligned incentives

For example:

-Revenue from advertising- Revenue from selling courses

The income from these sources might not perfectly align with the profits of followers. While this isn’t necessarily wrong and sometimes might align with followers' interests, it’s important to scrutinize carefully.

For example of moral hazard: Goldman Sachs invested money deposited by people into high-risk ventures. If things went wrong, the government would bail them out.

In this case, if Goldman Sachs knew that they would be bailed out by the government if they failed, they might take on more risk than they should.

Similarly, a fund that earns a 10% bonus on profits but incurs no loss if they fail is an example of moral hazard.

The content in this thread is related:

Here's the translation:

"That's about it. If anyone thinks of any more points, feel free to add them.

Just to reiterate: Some people exhibit the behaviors mentioned in the examples, and they might be doing so with good intentions. They also include NFA warnings. 😇

👉 What I wrote is based on foreign influencers.

The key points of the thread are: 👉 Followers should be aware when they see the term "claim."👉 Influencers could improve their content."

"All of the above can be difficult to implement, such as making a claim as a portfolio.

Influencers might need to create a simulated portfolio, which could be too challenging."

"An interesting way to claim performance:

Open a new wallet, provide the address to followers, and then build it up with real activities without adding or withdrawing money.

This way, it's easier to measure. Doing this, no one can argue with the claims. It makes good use of blockchain and can build a solid reputation."

Enjoy this? follow for more at @gadgeteerth @0x_nanobro