Lately, collecting points with @eigenlayer using @ether_fi + @pendle_fi is becoming very popular. I just tried it out myself and found that it's not the best combo, so I withdrew.

👉Let's see how to collect @eigenlayer @ether_fi for maximum efficiency.

Today's content:

-

How many eigen points can you get for 1 ETH?

-

Why is Pendle less interesting?

-

The newest strategy for earning the most points.

-

Which option do I prefer?

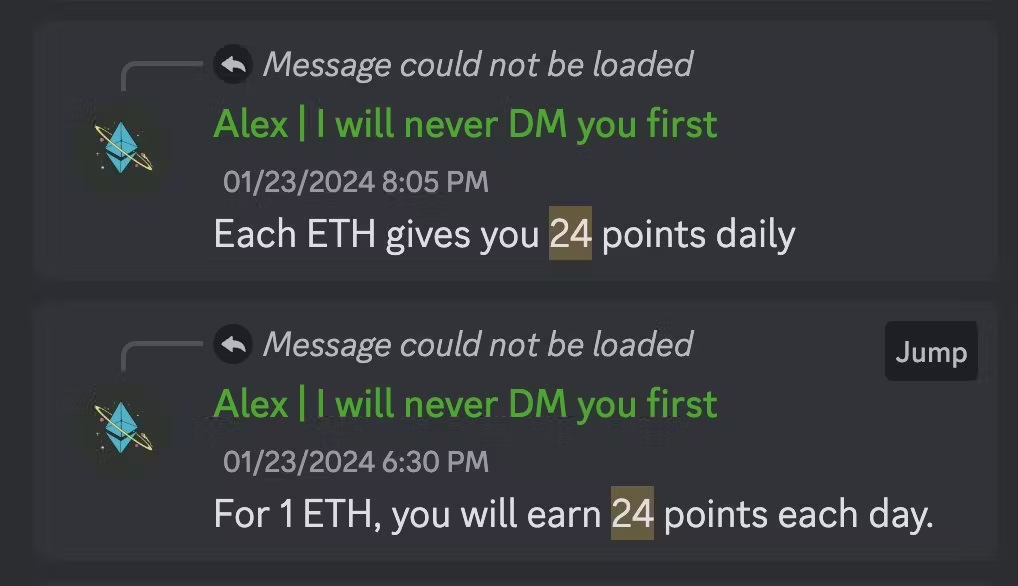

1. If you restake 1 ETH directly with Eigenlayer, you will earn 24 eigen points per day.

However, According to theory, depositing with Etherfi should yield 24 eigen points per day, but these points are divided among all users, including new stakers who haven't deposited ETH into Eigenpod yet.

So if you stake it with Etherfi, you'll receive approximately 20 eigen points along with Etherfi loyalty points.

👉 This results in approximately 20 eigen points per day per person. Nanobro thinks it's okay since you also gain Etherfi loyalty points as a trade-off.

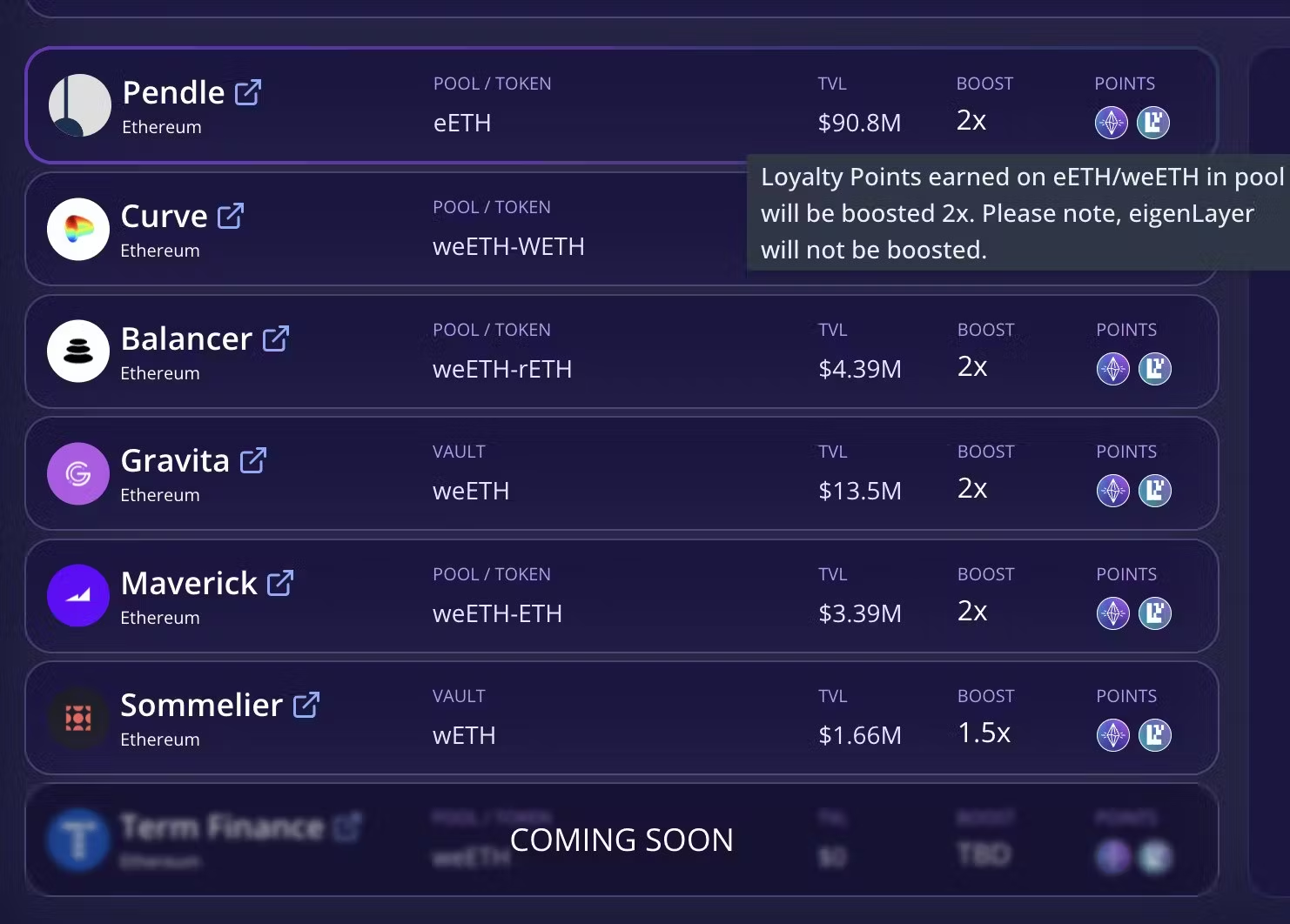

2. So why isn't Pendle LP the best option?

It might seem like a good choice since you get Etherfi points 2x, Eigen points 1x, and yield from LP around 20%.

👉 But the reality is different. When we deposit LP, we get eETH 50%: PT-eETH 50%.

⚠ The PT-eETH portion doesn't give Eigen points to anyone.

This means you get Etherfi points 2x but Eigen points only 0.5x of your investment (from eETH in the LP).

It's not too bad because we have a higher chance of getting airdropped Etherfi tokens instead of Eigen points. But maximizing profit is more important.

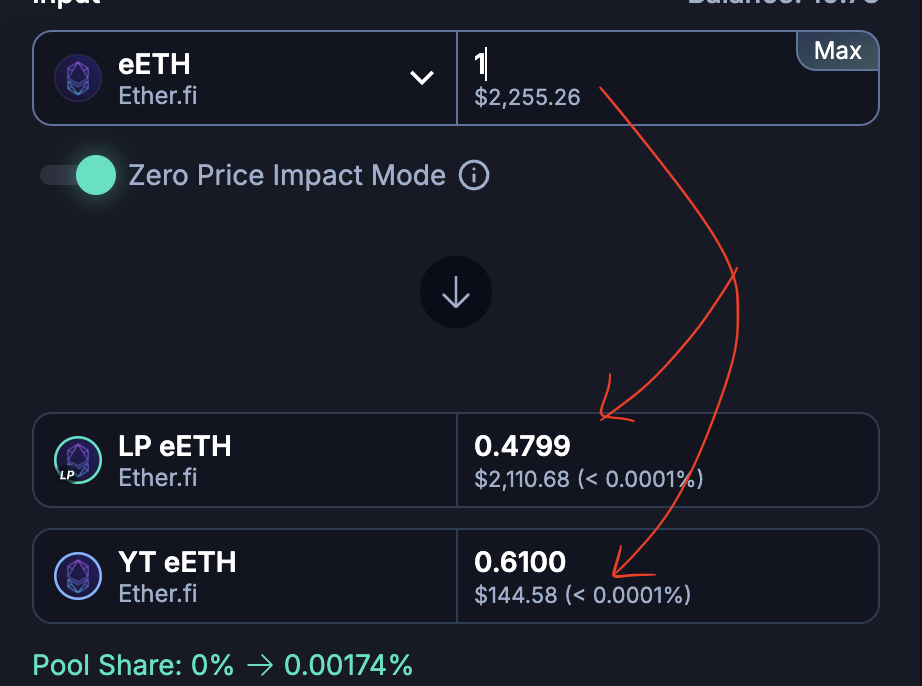

You can also LP with 2x etherfi point + 1x eigen points with “Zero price impact mode”

Instead of all LPing, some of your eETH will be exchanged for YT-eETH which will give you the points. But you will incur some loss if you exit before maturity date.

Following the same principle, those who provide Curve LP will get Etherfi points 2x and Eigenlayer 0.5x as well. The option I suggested before is not the best one, on the other hands the advantage is that we get more Etherfi points than others. 😂

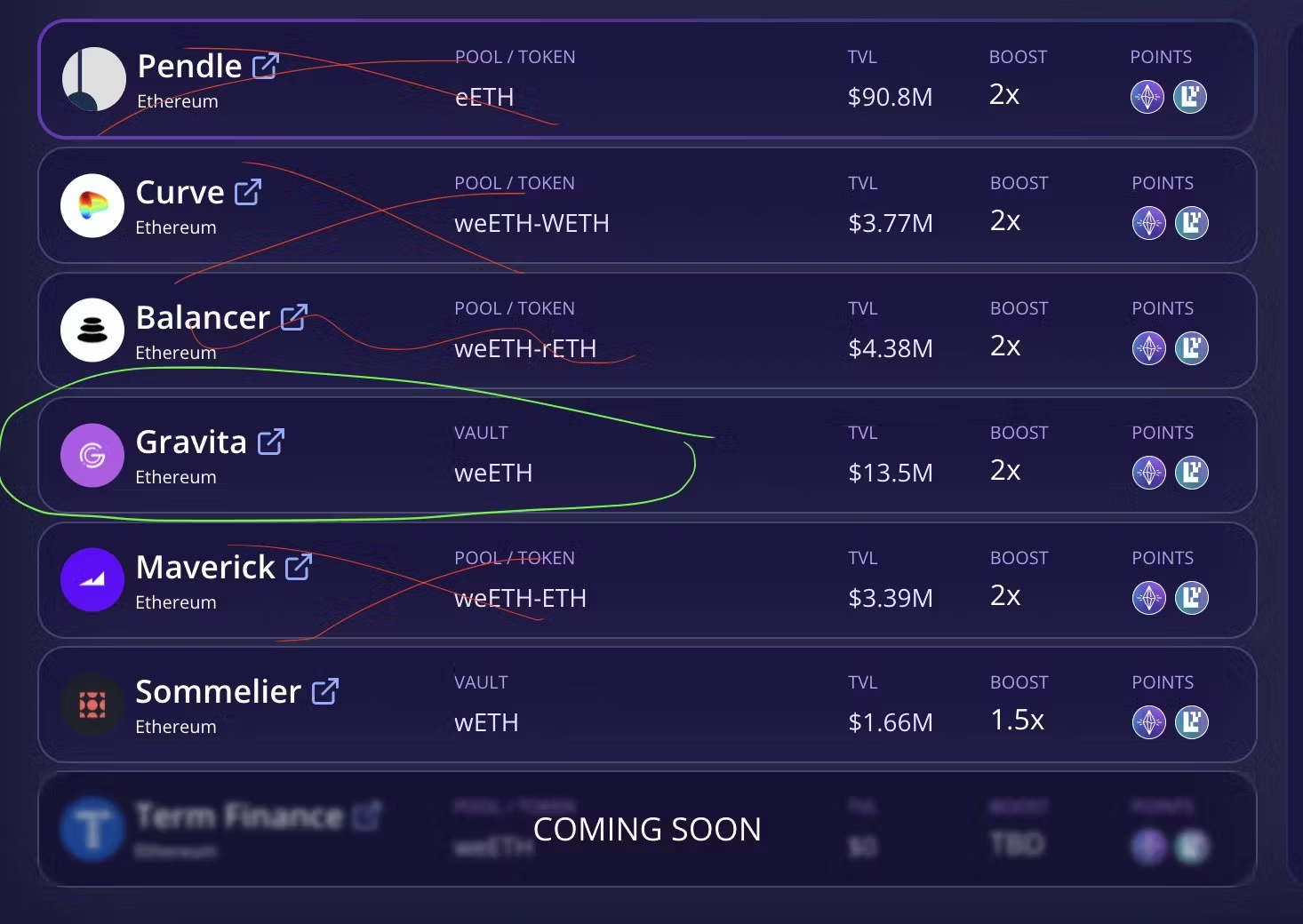

3. New direction: get the most Eigen point + Etherfi out of our budget

Gravita and Sommelier are not LP deployments, so all our funds will be in ~eETH, resulting in full points.

@gravitaprotocol earns up to 2x etherfi point + 1x eigenlayer point.

Gravita is a lending service similar to Liquity.

Users can deposit $weETH and borrow $grai, which is a stablecoin pegged to ~$1.

The process is:

-

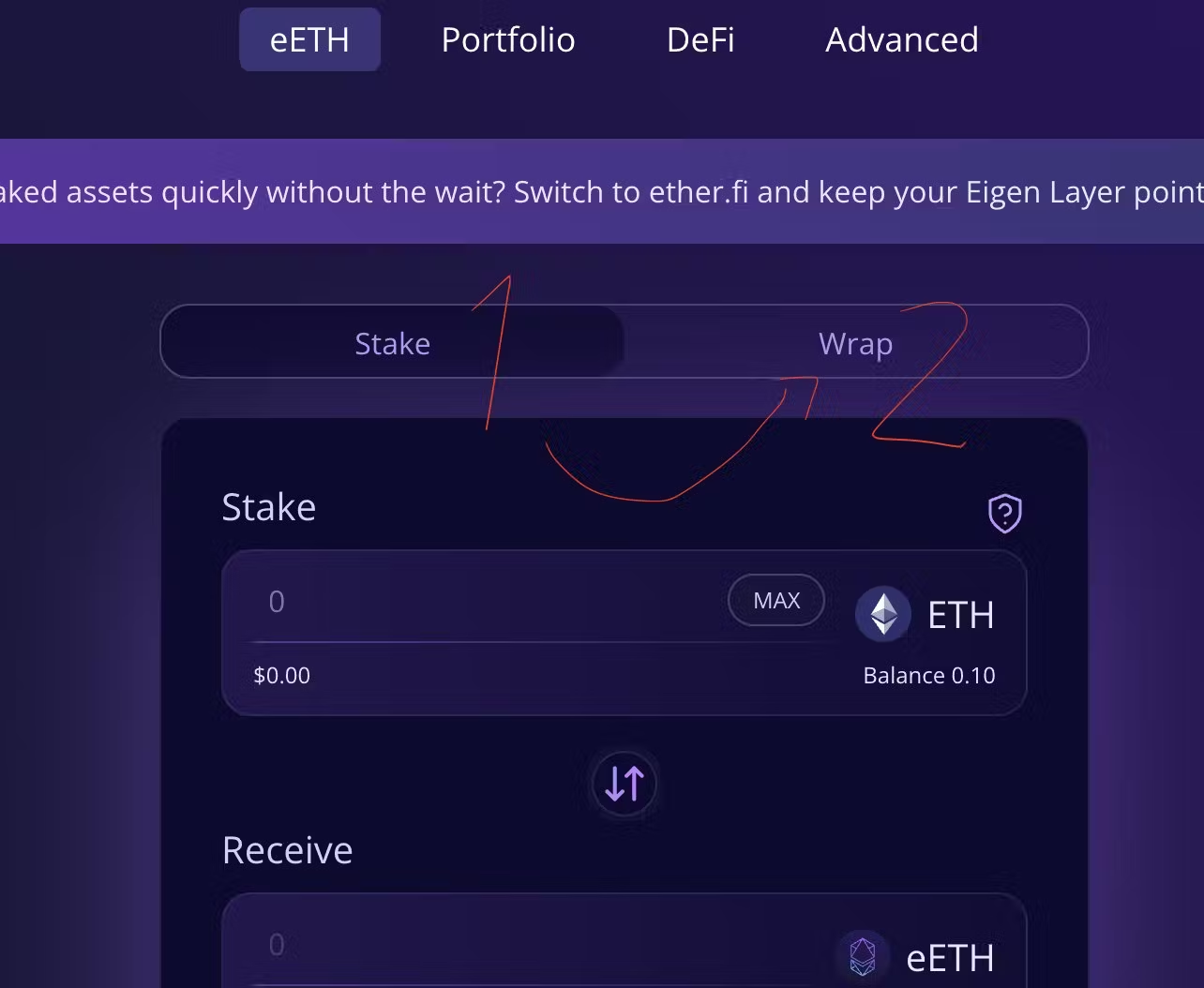

Swap ETH > eETH > wrap to weETH at https://app.ether.fi/eeth

-

Deposit weETH at Gravita https://app.gravitaprotocol.com/vessels/weeth

-

To loop swap $grai > ETH, visit https://swap.defillama.com/?chain=ethereum&from=0x15f74458aE0bFdAA1a96CA1aa779D715Cc1Eefe4&to=0x0000000000000000000000000000000000000000

Borrowing incurs a one-time 2% interest rate. You can borrow for as long as you want. It's advisable to borrow conservatively to avoid excessive risk.

🚨 For those not experienced, refraining from borrowing might be safer.

However, for the experienced who can seize opportunities and have solid collateral, using $grai to buy ETH and then looping can increase the amount of weETH deposited.

👉 If ETH rises, wealth grows, but if it falls, there's a risk of loss.

4. Which strategy does Nanobro choose?

Nano focuses on flexibility. So I prefer holding regular eETH.If the market experiences a severe downturn, I will consider looping within Gravita.

That’s it!

All of this covers financial risk but not smart contract risk.

Dont forget to DYOR, and this is not financial advice.

Additionally, how does Pendle work? Why doesn't Pendle's PT-eETH provide eigenpoint to us?

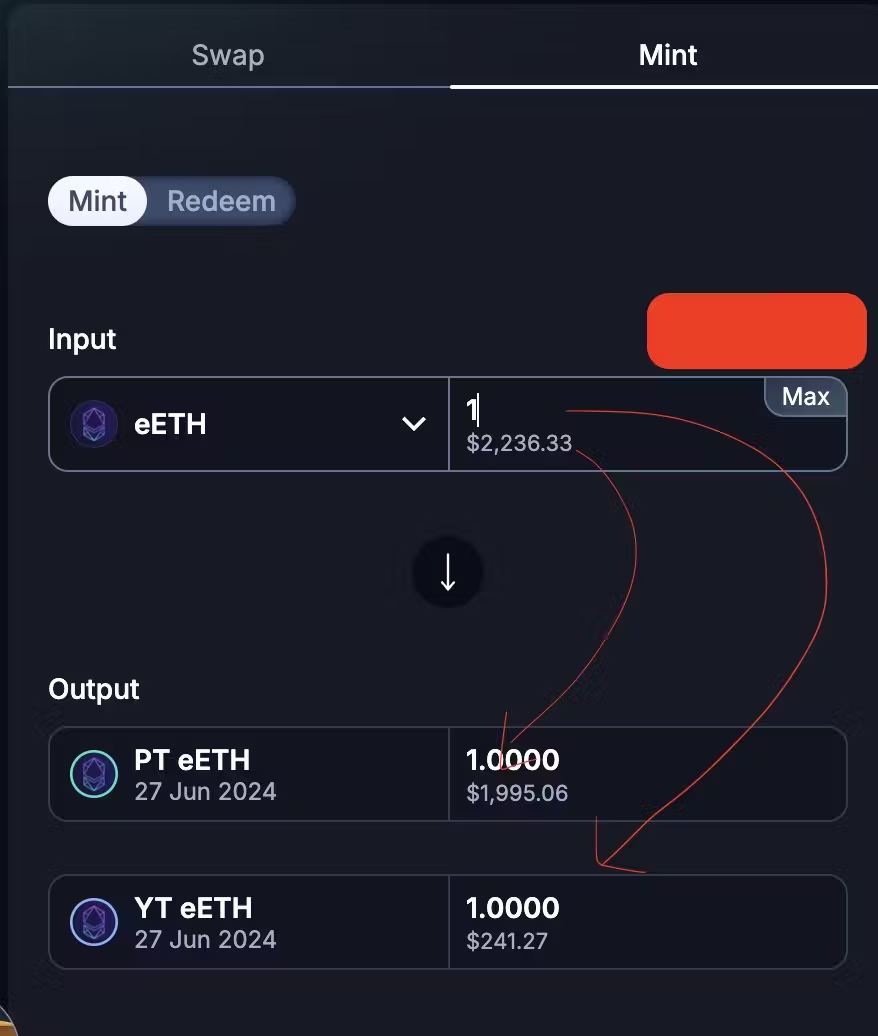

Because depositing assets into Pendle, such as depositing eETH, divides eETH into two parts:

PT-eETH is the principal, fixed-yield-bearing asset. It matures on a fixed date (June 27) and will have a value equal to our eETH.

YT-eETH, on the other hand, is purely yield-bearing. Various eigen points will also be in this. On June 27, it expires and its value approaches zero.

Holding PT-eETH will therefore increase our eETH holdings but won't earn any points.

Enjoy this? follow for more at @gadgeteerth @0x_nanobro