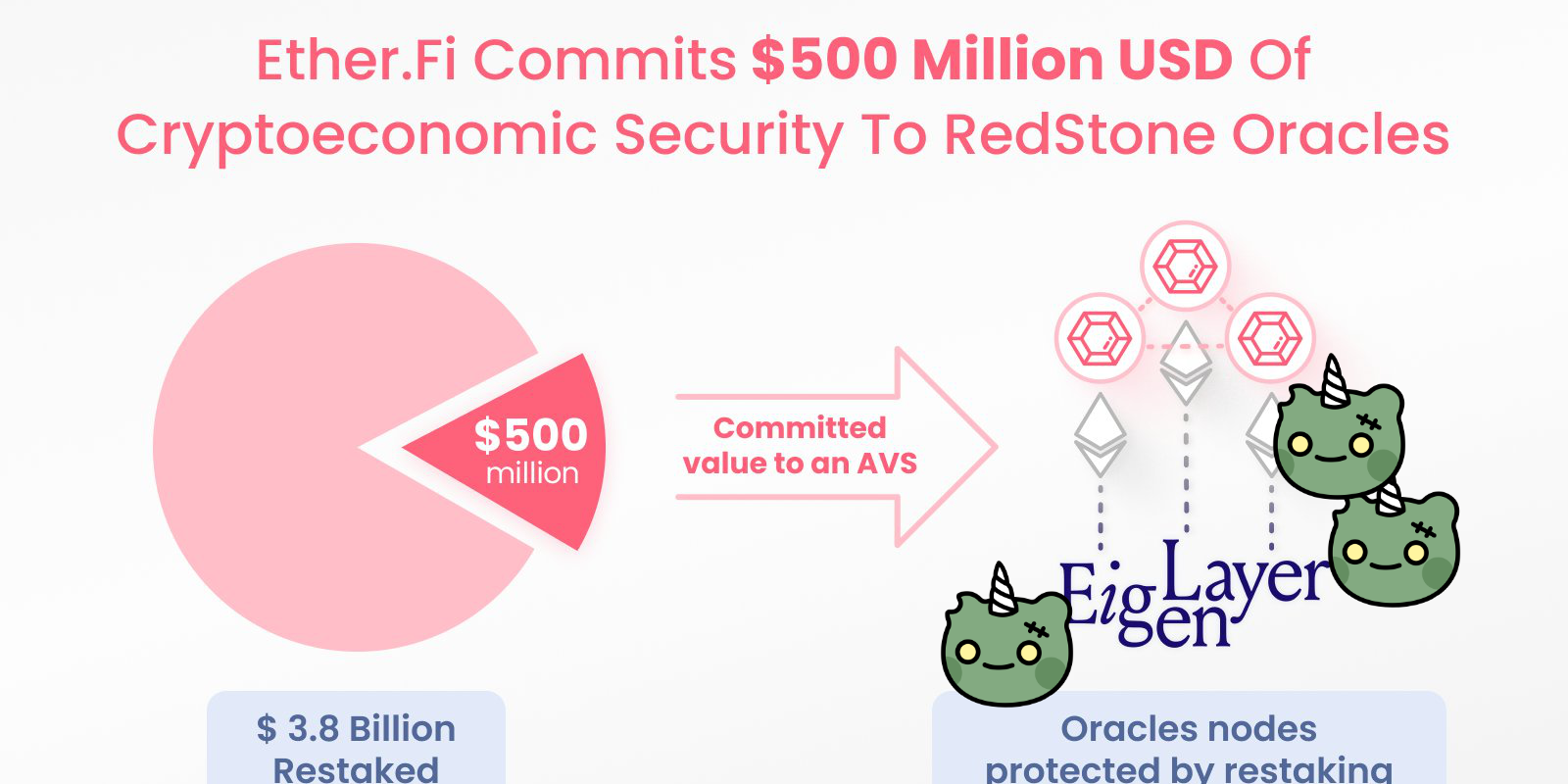

In a monumental stride forward for the cryptocurrency sphere, EtherFi has recently announced a substantial commitment of $500 million in restaked Ethereum to fortify the security infrastructure of RedStone Oracles. This landmark partnership not only signifies a significant investment but also marks a watershed moment for RedStone as it becomes the pioneer oracle network to benefit from the LRT restaking delegation. This infusion of restaked Ether, expertly converted into $eETH by EtherFi, is poised to play a pivotal role in bolstering RedStone's network resilience against potential liveness failures and nefarious attacks perpetrated by node providers.

This synergistic collaboration is underpinned by the deployment of the Actively Validated Service (AVS) infrastructure, strategically built atop EigenLayer, thereby enabling infinite sum games. In the wake of the triumphant mainnet launch of EigenLayer, led by the visionary Sreeram Kannan and the adept EigenLayer team in conjunction with EigenDA, the excitement surrounding the integration of AVS into RedStone's data validation process is palpable.

The partnership not only cements RedStone Oracle's position as a stalwart in the industry but also ensures that it benefits from the most secure crypto collateral available, meticulously verified by a diverse cohort of validators. This strategic move directly addresses one of the primary challenges faced by emerging networks – the need to enhance security measures in tandem with the growth of Total Value Secured (TVS).

However, beyond the immediate implications for RedStone, this collaboration also underscores the broader implications for the crypto ecosystem. EigenDA, often heralded as the epitome of data availability solutions, is poised to tackle some of the most pressing bottlenecks confronting the industry, including issues related to data availability, throughput, and storage. Positioned as the ultimate solution to Ethereum's blockspace constraints, EigenDA represents a quantum leap forward for the entire blockchain community.

The benefits afforded by EigenDA extend far beyond mere scalability and efficiency. Its revolutionary features, including hyper scalability, cost flexibility, and seamless integration with various protocols, promise to usher in a new era of cost-effective rollup scalability. Moreover, EigenDA's versatility opens up a myriad of possibilities for innovative applications, ranging from on-chain order books to real-time gaming experiences and atomic data swaps.

As EigenDA continues to gain traction within the community, with numerous rollups already expressing interest in deploying on the platform, the future looks increasingly promising. With each passing day, the potential for EigenDA to unlock previously unthinkable services and applications becomes more apparent. From facilitating real-time gaming experiences to empowering AI coprocessors, EigenDA represents a transformative force in the realm of decentralized applications.

In light of these developments, the EigenDA team extends a warm invitation to all stakeholders to explore deployment opportunities and engage with the EigenDA community. By embracing EigenDA, stakeholders can play an active role in reshaping the landscape of application-specific rollups and unlocking the full potential of decentralized applications. The paradigm shift begins now, and EigenDA stands at the forefront of this revolutionary transformation.

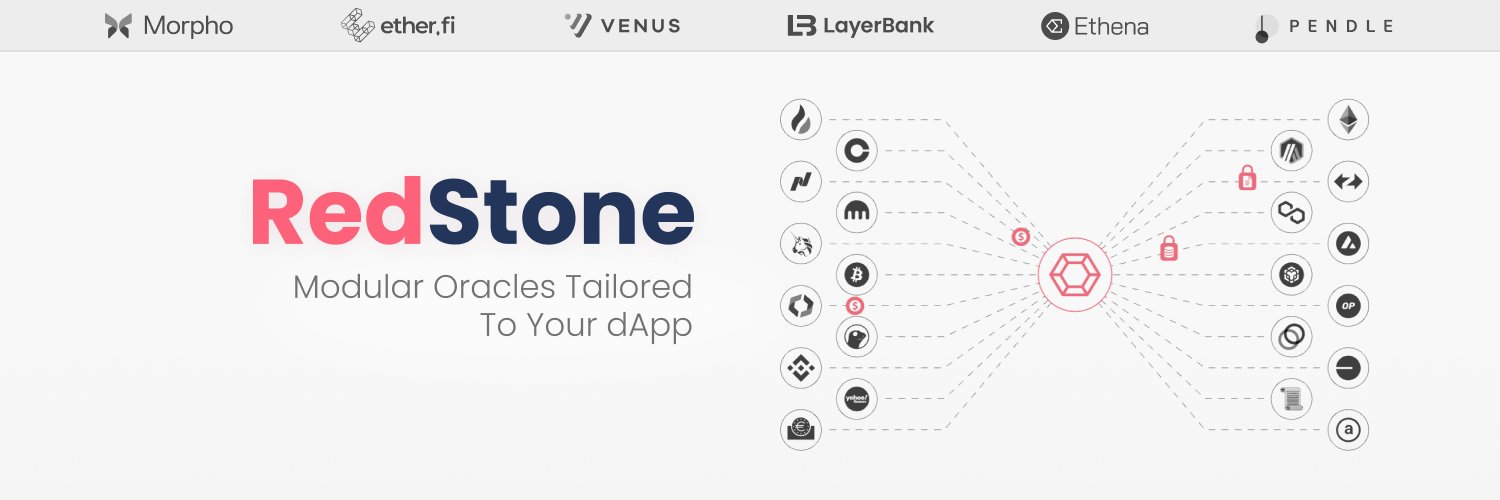

The Leading Crypto Projects Trusted by RedStone Oracles

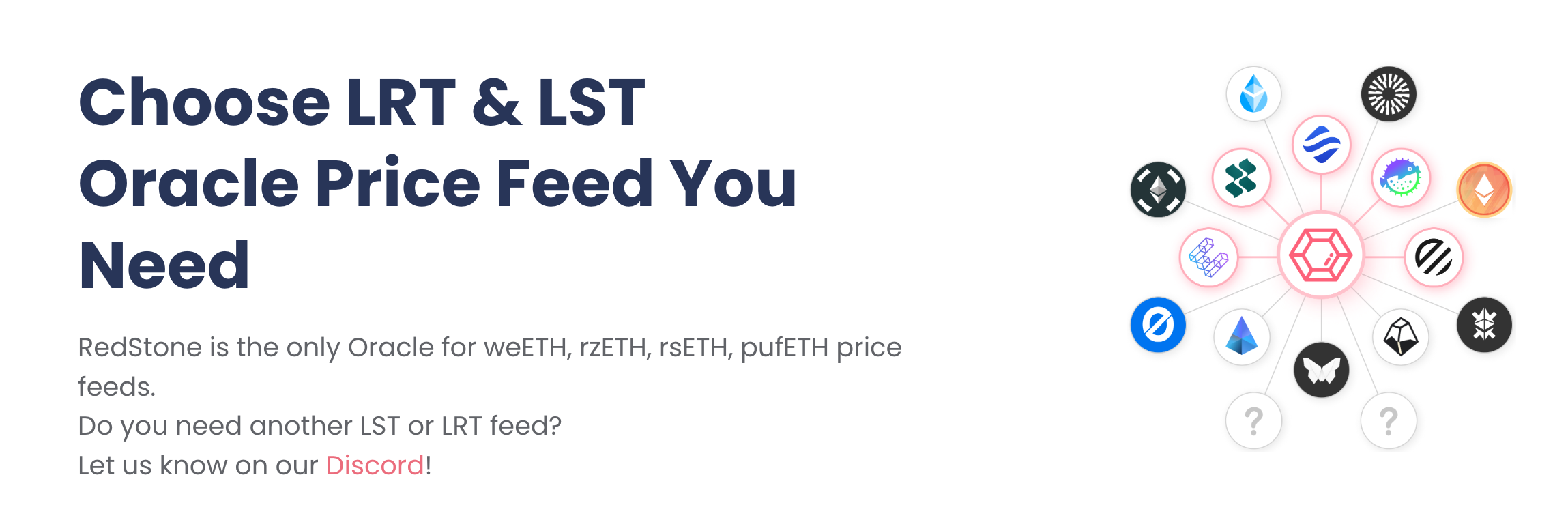

Modular Oracles for LSTs & LRTs

Feeds Not Available Elsewhere

Picture this: You're diving into the world of lending markets, and you need some seriously juicy price feeds for those yield-bearing collaterals. Look no further, because RedStone's got your back! Redstone’s all about those LSTs & LRTs, and Redstone’s got the secret sauce for discovering prices that'll blow your mind. Redstone's constantly updating our modular pricing engine to keep things fresh and on point. You won't find these feeds anywhere else, folks!

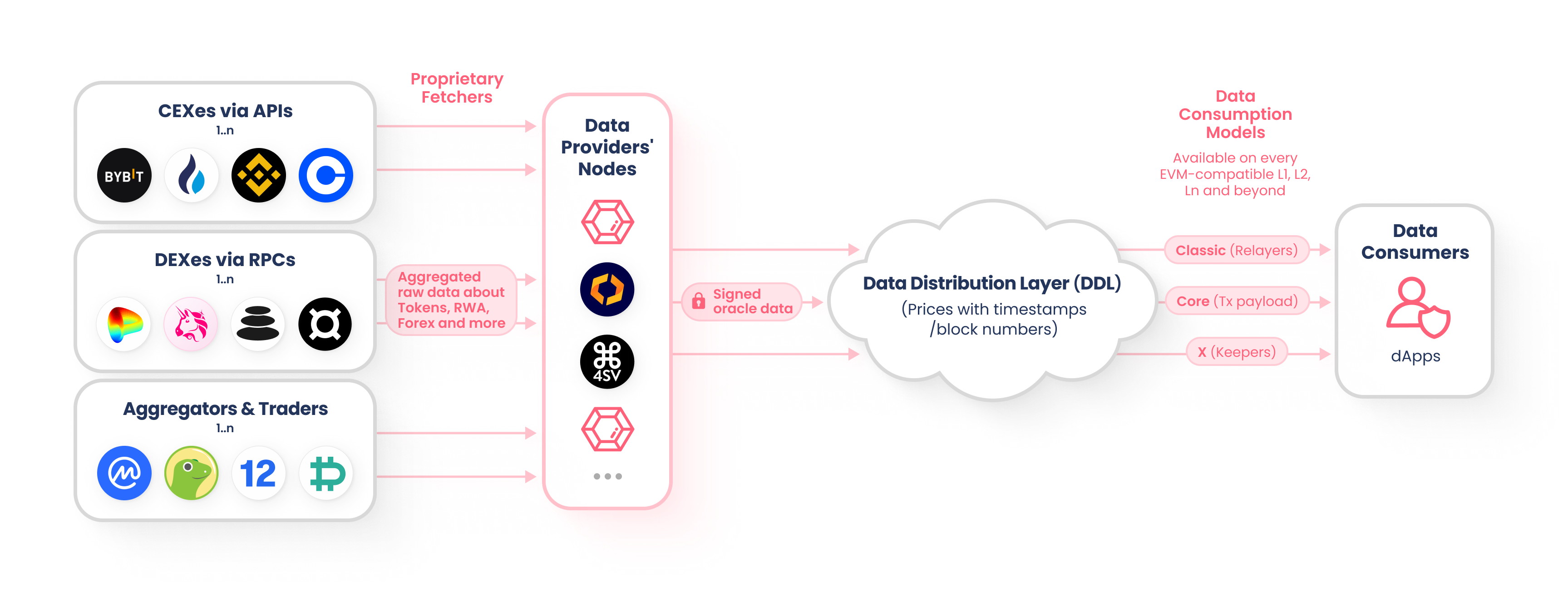

Everywhere: Deployable Everywhere

Guess what? Our price feeds are like the Energizer Bunny - they just keep going and going! We're chain agnostic, which means we can sling data to multiple ecosystems like it's nobody's business. EVM, non-EVM, rollups, appchains - you name it, we've got it covered! Redstone’s the perfect wingman for Rollup-as-a-Service Providers and EigenLayer AVSs. So go ahead, deploy that new chain and be oracle-ready with RedStone right out of the gate!

Support: Supporting All DeFi dApps

Got a wild and crazy use case? No problemo! Redstone're here to support your wildest dreams with our modular data consumption magic. Choose our Core (Pull) model for lightning-fast data updates and a smorgasbord of assets to play with. Or go for the Classic (Push) model if you're all about that tried-and-true oracle interface. Whatever you need, Redstone has got the solution waiting for you!

Our modular oracle design allows RedStone to adjust data flow to clients' needs using both the Pull and Push Oracle models. Explore how Redstone power our clients below!

Featured Clients:

-

VenusTVL: $1,647,986,565

-

Morpho BlueTVL: $759,873,962

-

LayerBankTVL: $225,411,093

-

SommelierTVL: $66,451,732

-

EnzymeTVL: $157,058,300

-

DeltaPrimeTVL: $35,237,632

-

EtherFiTVL: $4,453,775,984

-

SiloTVL: $131,277,743

-

KelpDAOTVL: $829,266,818

-

RenzoTVL: $3,266,382,884

-

PendleTVL: $4,290,337,652

-

EthenaTVL: $2,342,359,065

-

ZeroLendTVL: $227,651,878

-

ShoebillTVL: $23,209,271

-

Redacted CartelTVL: $47,602,629

-

SwellTVL: $1,406,822,636

-

PufferTVL: $1,391,008,832

-

BalancerTVL: $1,075,013,482

-

FraxlendTVL: $195,362,917

-

GearboxTVL: $329,950,899

Additional Clients:

-

MentoTVL: $82,584,310

-

CIAN

-

GravitaTVL: $19,603,276

-

StaderTVL: $569,872,065

-

LidoTVL: $29,706,476,763

-

AngleTVL: $32,221,305

-

AbracadabraTVL: $128,899,047

-

PremiaTVL: $3,005,056

-

Gearbox

-

Sturdy V2TVL: $45,732,521

-

Term FinanceTVL: $21,577,717

-

StakeWiseTVL: $333,930,139

-

Curvance

-

ZKX

-

Moola MarketTVL: $4,091,895

-

Y2KTVL: $82,282

-

FloatTVL: $147,167

-

Yield YakTVL: $32,232,417

-

CadenceTVL: $2,002,280

-

LoanSharkTVL: $63,103

-

Vesta FinanceTVL: $20,456

-

VoltzTVL: $368,963

-

RaftTVL: $34,425

-

Interest protocolTVL: $90,600

-

ReserveTVL: $71,004,925

-

JuiceTVL: $417,113,910

-

DolomiteTVL: $38,543,463

-

StakeStoneTVL: $604,622,920

-

ArrakisTVL: $136,020,118

-

IonicTVL: $95,854,547

-

OrbitTVL: $172,925,992

-

KinzaTVL: $109,571,804

-

Puffer

-

IronCladTVL: $18,871,009

-

Ion Protocol

-

SynonymTVL: $2,597,443

-

LogXTVL: $6,461,333

-

WandTVL: $3,196,147

-

BlastOffTVL: $300,580

-

PhutureTVL: $2,113,854

-

BitPerp

-

Lyve FinanceTVL: $571,562

-

Fraxlend

-

Opal

-

Merchant MoeTVL: $52,520,368

-

EulerTVL: $97,830

-

GHO

-

NativeTVL: $50,846,766

-

Goku MoneyTVL: $242,079

-

TokemakTVL: $25,365,057

-

Hubble ExchangeTVL: $95,112

-

Balancer

-

SynfuturesTVL: $52,859,990

Key Points :

Redstone’s modular architecture ensures data integrity from source to smart contracts. Redstone offer three customizable integration methods to suit your requirements. Redstone supply feeds for over 1000 assets by integrating approximately 50 data sources. Our presence extends to more than 20 chains. RedStone has supported DeltaPrime since March 2022, with live deployment on mainnets starting January 2023. Our code underwent rigorous audits by security experts, including ABDK, Peckshield, and L2Beat Co-Founder. As a launch partner for DeltaPrime on Avalanche, RedStone provided exclusive data feeds, contributing to DeltaPrime's recognition as one of the top three fastest-growing dApps by DefiLama.

Which chain can use Redstone

-

Ethereum

-

zkSync Era

-

Polygon zkEVM

-

Arbitrum

-

Polygon PoS

-

Optimism

-

Avalanche

-

Celo

-

Canto

-

BNB Chain

-

Fantom

-

Kava

-

Evmos

-

Gnosis

-

Rootstock (RSK)

-

Klaytn

-

Cronos

-

Elrond

-

Metis

-

Boba network

-

Stacks

-

Harmony

-

Moonbeam

-

Dogechain

-

Mantle Network

-

Base (Coinbase L2)

-

Linea

-

Scroll

-

Aurora

-

OKC

-

Oasis Network

-

Velas

-

Caduceus

-

Telos

-

zkLink Nova

-

Blast

-

Points Operator Address - 0xBf30EB3D420568Ac44ca04B247D674fFd7168cD5

-

Points Operator Contract - 0x4aaf2844c5420BF979d5bC2Cf883EF02Db07e590

-

-

Mode

-

Manta

-

Story Protocol

-

Cyber (by CyberConnect)

-

opBNB

-

BOB

-

X Layer

-

And many more...

Redstone also support a few non-EVM-compatible chains

-

TRON

-

Stacks

-

StarkNet

-

Near

-

Fuel

-

TON

-

Casper

Tokenomic

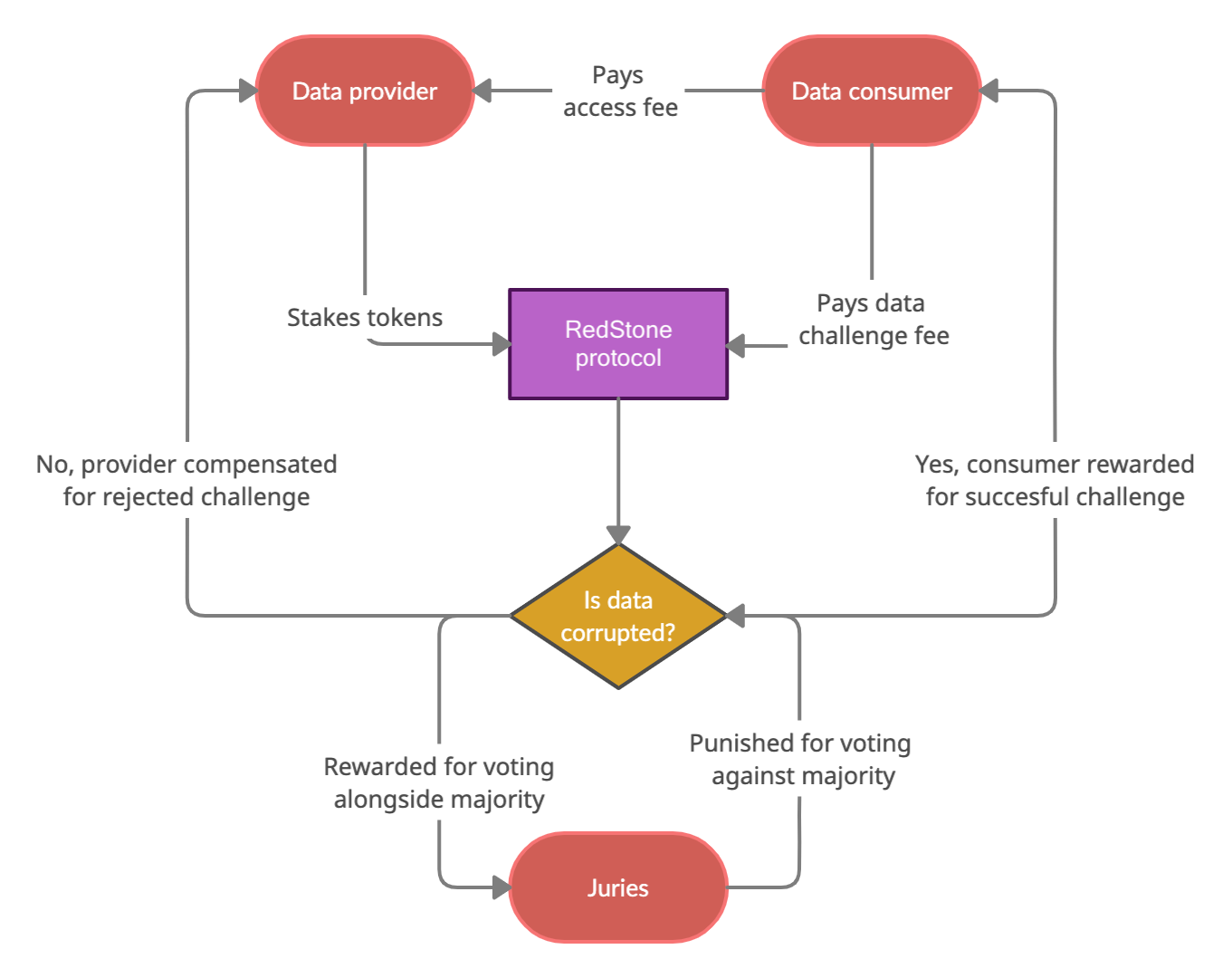

Token Utilization The token serves as a conduit for delivering reliable and precise external information to blockchain networks.

Token Usage Tokens are instrumental in fostering coordination within distributed systems and aligning incentives among stakeholders. RedStone fosters a data-sharing environment by incentivizing participants to consistently and diligently produce, publish, and validate data.

Data Access Fees End users who benefit from accessing valuable information utilize tokens to reward providers who publish this data. The specific fee and subscription terms are determined by the provider, based on factors such as effort, data demand, and potential competition.

Locking Mechanism Providers are required to publish a Service Level Agreement outlining the data scope, information source, and update frequency. In case of a breach, providers face token-based penalties. To instill confidence in users, providers must reserve tokens and lock them for a designated period. These locked funds serve as a crucial assurance for users when selecting reliable providers.

Dispute Resolution Given the diverse nature of provided data, resolving disputes regarding data quality may require a fallback procedure. Token incentives may facilitate this process, with juries rewarded for majority-voting and penalized for siding with the minority.

Market Bootstrapping During the early development phase, tokens may be distributed to providers to incentivize their participation and bootstrap the market until there is sufficient demand from data users.