Written by your friends at NeptuneCircle (Stephen, Mike, and Kris)

Subscribe to @neptune_circle for more updates. We will post on Mirror and Twitter.

First things first

Market right now has been extremely volatile - we could be getting a lot of mixed information and be reactive in many things.

TL;DR? - Too bad.

Some thoughts on the economy and the crypto market

Recent Crashes. U.S. Dollar Index (DXY) is at the highest level – this means that investors are selling off their assets and flock to USD as a safe haven despite high inflation, due to uncertainties in:

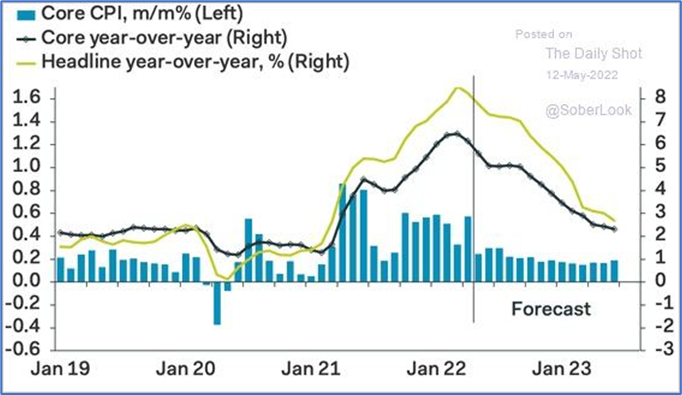

- Interest Rate Uncertainty Continues to Haunt the Crypto Sector. Inflation number [again, higher than expected, meaning peak has not arrived yet] will likely determine the course of action from the Fed as that will show whether “peak inflation” has been reached. If “peak inflation” is reached, Fed will reverse course in their interest-raising policies.

- Possible U.S. Recession. In the Q1 of 2022, U.S. economy shrunk by 1.4%, when investors expected a gain of 1%. But this GDP could be because of “technical calculations,” and it does not represent the actual market.

- Pandemic, Worsening Ukraine Situation, and Supply Chain Issues.

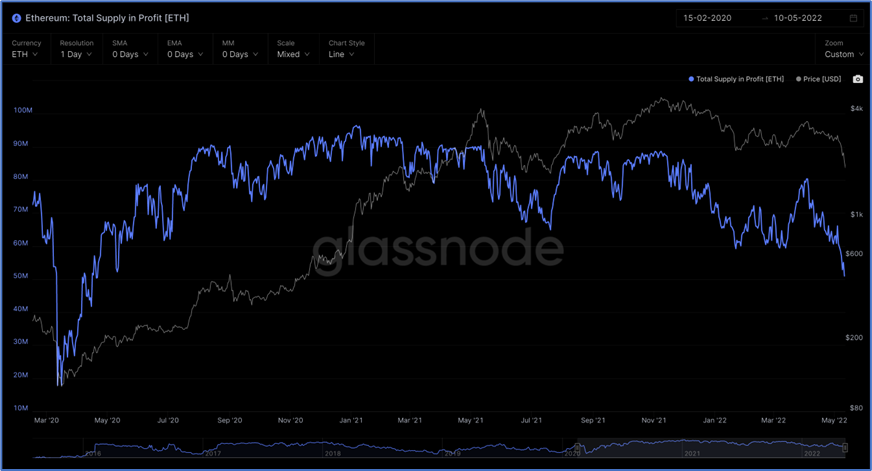

- Terra Ecosystem at the Brink of Collapse. The withdrawal of funds from the Anchor Protocol which accounts for more than 60% of the Terra ecosystem has led to the panic about the algo-backed UST stable coin. In the next day or so, de-pegging started to happen, and this led to Luna Foundation to sell off its ETH and BTC holdings. Due to the significant sell pressure, the prices for ETH and BTC continue to drop

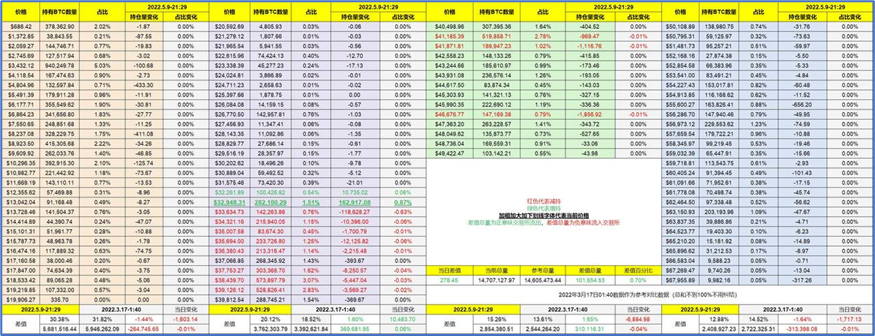

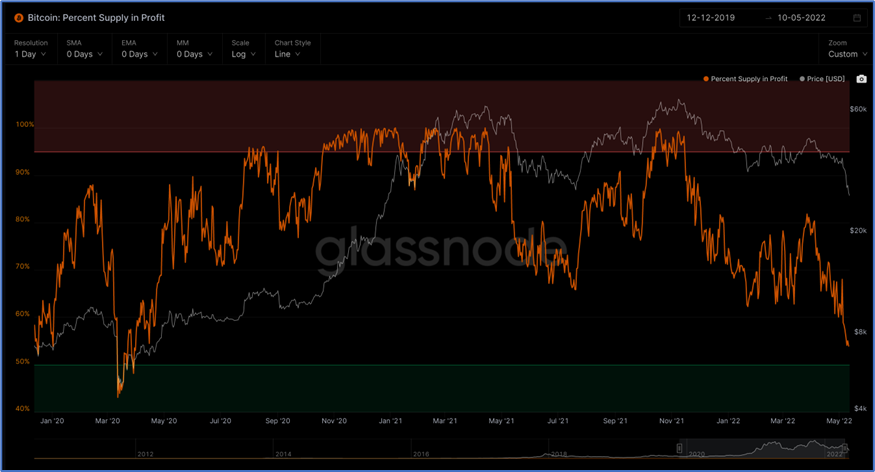

BTC’s Price Points: $34,000, $30,000, and $20,000. At $34,000 price point, many bitcoin miners will be forced to sell their BTC to cover operating expenses and production costs. This has happened six days ago: Riot blockchain sells nearly half of April’s bitcoin production. But this will likely have less impact because those will be sold at OTC. At $30,000 price point, there is where most of the trading/swapping happened. Currently, there is not a lot of movement for holders below $30,000 and above $40,000. See chart below. At $20,000 price point, MicrosStrategy (owns 129,200 bitcoins, which is $4.5Bn BTC out of $52Bn daily trading volume) would be subject to a margin call if Bitcoin dropped to $21,000.

Whales are Buying Up BTC. Wallets holding 10k to 100k BTC have been on a buying spree since April 30. However, Bitcoin’s futures premium has been lower than 5% since April 6, indicating that futures market participants are reluctant to open leverage long positions. A neutral market should present a 5% to 12% basis rate, reflecting market participants’ unwillingness to lock in Bitcoin for cheap until the trade settle.

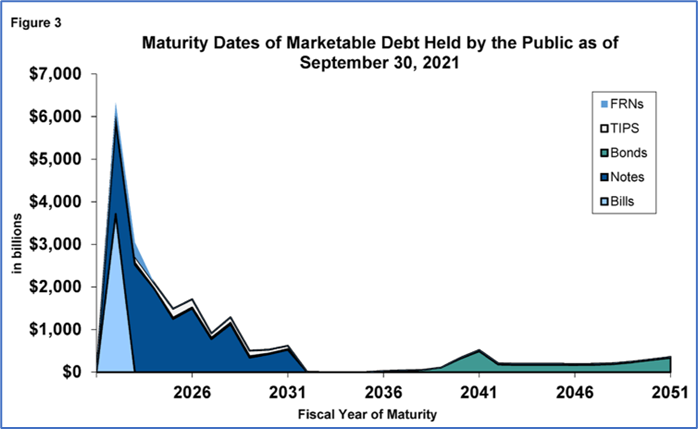

BTC Bottom & Long-Term Economic Cycle. Based on past cycles, the expected bear market bottom is around summer or fall of 2022. On the other hand, based on the long-term debt cycle, government debt faced a maturity wall in 2022 to 2023 (see below chart), where the government could face a reduction in spending.

Inflation (Ughhhh). We do not expect the inflation peak until this summer or fall. The fund has put limit orders in accordance with this timeline. Inflation is expected to remain elevated, averaging 5.5 percent in Q4 2022. The Fed’s preferred inflation measure, the core PCE deflator, is forecast to be 4.3 percent by the end of the year, before slowing to 2.8 percent by the end of 2023 as economic activity also slows.

Is there any hope left?

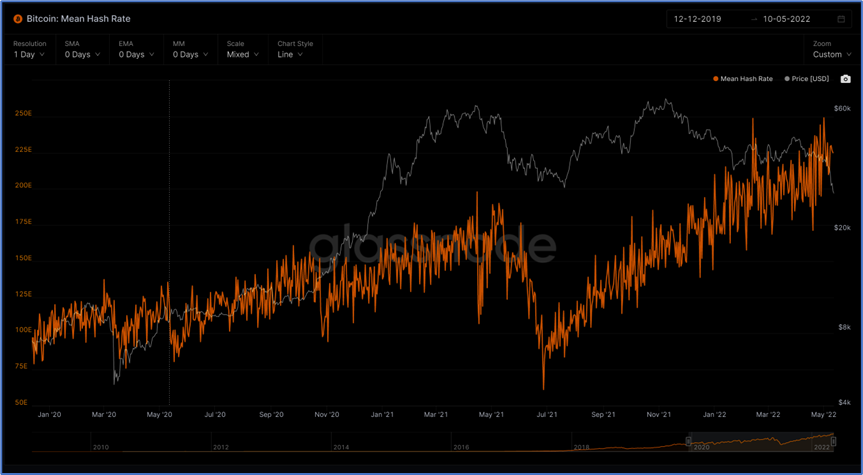

Community Message: We Have Seen This Before! Numerous sources on Twitter Space, Whales, and Discord sources have conveyed the same message: “we have seen this before.” When we look at the market, very little people are making money similar to 2020. Hash rate (i.e., the more miners mine = higher mining difficulty = higher hash rate) is still going up.

What about the NFT market?

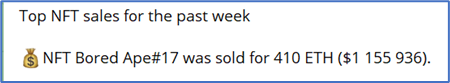

Yet, NFT Market Remain (Relatively) Strong. Because: (1) NFTs are held by high-net-worth individuals, who are “diamond hands.” See below chart; (2) historically, artworks are inflation-hedged; (3) there is less speculation/price earning mind-set in NFTs – “NFTs are for fun.” Blue-chip NFT floor price YTD increased by 18%, and in terms of dollar value (because of ETH decrease) decreased by 25%. In comparison, ETH decreased by 48.6%, S&P 500 YTD decreased by 19% and NASDAQ downed by 30% YTD.

Despite market downturn, top NFTs are sold at high:

Blue-chip NFT index gained 18% YTD and downed 25% in terms of USD.

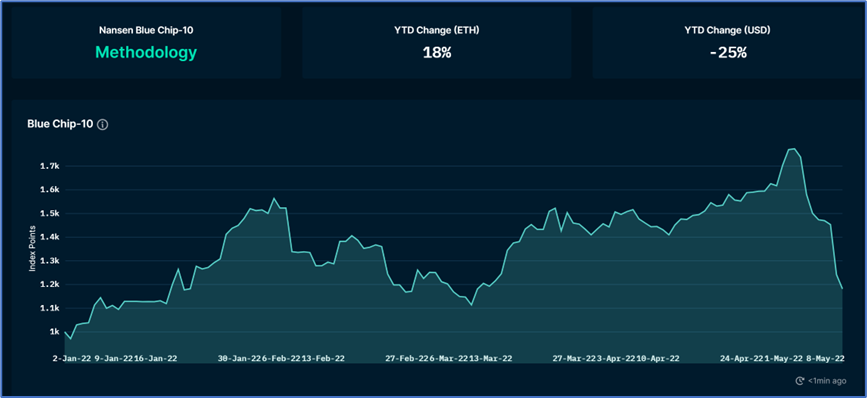

We could see this trend in comparison with others: BAYC, Azuki, CloneX, Doodles & now Moonbirds separating themselves from everyone else. Of course, this chart has not been updated to show the recent drama with Zag at Azuki.

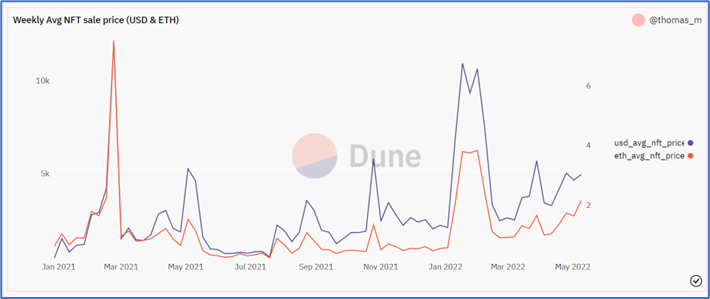

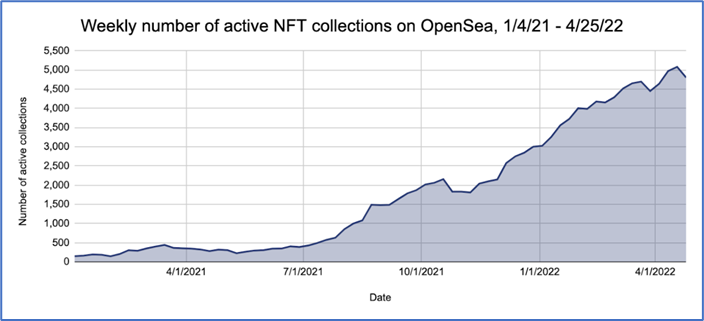

Weekly average NFT sale price even increased during this crazy time. Since the beginning of 2021, NFT transaction volume has grown significantly, but this growth fluctuates. NFT activity ebbs and flows month to month — in 2022 thus far, the value sent to NFT marketplaces continued its 2021 growth in January, entered a downturn in February, and then began to recover in mid-April.

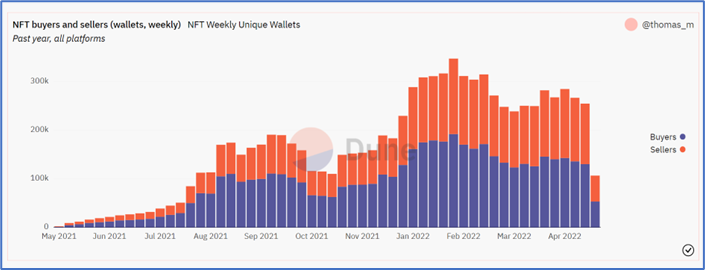

Still people out there hunting? Despite these fluctuations in transaction volume, the number of active NFT buyers and sellers continues to grow. The number of active NFT buyers and sellers has increased each quarter since Q2 of 2020. Chainalysis noted that: it appears that this quarter is on pace to continue that streak. As of May 1, around 491,000 addresses have bought or sold NFTs in the second quarter of 2022, which could easily top first-quarter numbers, according to the report.

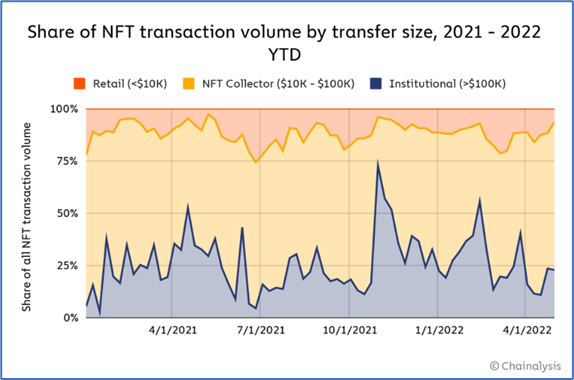

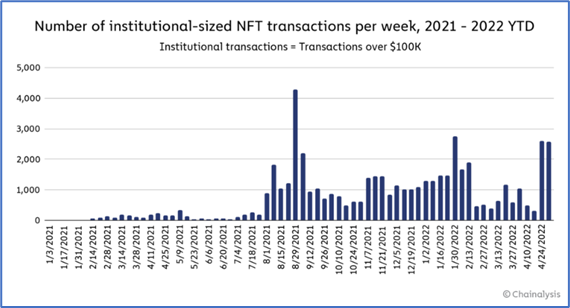

Who Buys NFTs? Institutional Investors and Whales. Diamond hands make up large portion of the market shares.

Institutional investors are nipping at their heels, and even make up the majority of activity in certain weeks when extremely large purchases have been made. For instance, during the week of October 31, 2021, institutional transfers made up 73% of all activity, largely due to the purchase of several NFTs in the Mutant Ape Yacht Club collection. More institutional-sized transfers followed in subsequent weeks, and since then, institutional transfers make up 33% of all activity. (Chainalysis)

Between late November and mid-February, institutional NFT purchasing grew each week, reaching 1,889 transactions the week of February 13, after having spiked to 2,739 two weeks prior. Institutional NFT activity fell abruptly after that, dropping to just 473 transactions during the week of February 20. As of April 17, 2022, institutional NFT activity has yet to reach the levels it did in the winter of 2021. This period of reduced institutional activity also roughly coincides with what appears to be an overall decline in interest in NFTs generally. (Chainalysis)

Some additional thoughts on blue-chip NFTs

Market Crash = Inability to Make Money from Crypto = Less Desire to Learn About Crypto = Less Crypto Adoption. This is the traditional logic to enter crypto: to make money and make speculations. However, this is NOT the driving force during a recession. ~30% of the reason why people got into crypto is because of gaming and NFTs. This applies to both institutional and retail investors regardless of their crypto knowledge status. (Bitstamp)

Decoupling of NFTs From the Rest of the Token Markets. It is impossible for institutional investors to hold blue-chip NFTs at scale because of liquidity and the limited number of NFTs available. This means that blue-chip NFTs are much less correlated to S&P 500 or even ETH.

“There are three major layers of the stack to think about, and we are investing in two of them,” Multicoin Capital said. Those two layers are the 'primitives or infrastructure layer,’ and the second is in NFT exchanges or marketplaces directly. The third layer, outright ownership of NFTs, Samani doesn’t currently see as being viable enough for Multicoin Capital to invest in [NFTs] at scale.

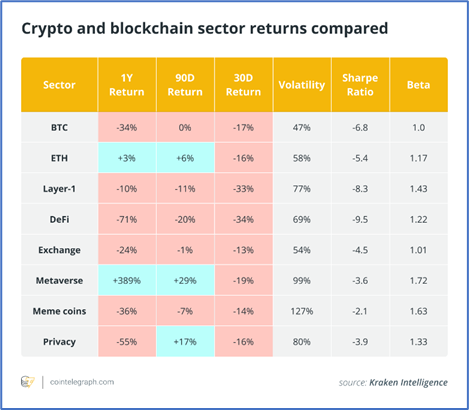

NFTs/Metaverse Continue to Outperform the Rest of the Crypto Market. See chart below.

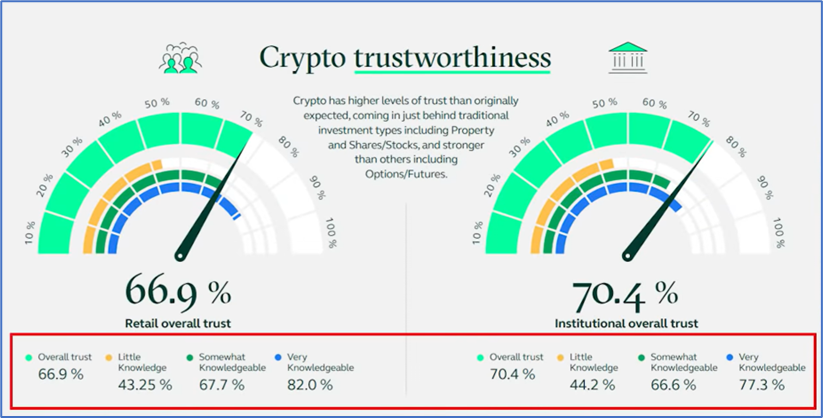

Fundamental Trends Driving the Adoption of Cryptocurrencies. The following trends will drive additional institutional and retail adoption of cryptocurrencies: (1) central banks buys bitcoin as a part of “foreign exchange diversification strategy” and increased institutional adoptions (71% of institutional investors plan to increase crypto investments and 73% already trades crypto); (2) countries adopting cryptocurrencies: Central African Republic (maybe), Cuba, Brazil, Panama, Switzerland, and India; (3) Goldman Sachs offer BTC-backed loans; (4) U.S. Congress proposing bills to regulate stable coins, especially UST; and (5) significant cryptocurrency “trust” among retail and institutional investors (see chart below).