What a week for on-chain assets. ETH is up ~16% over the last seven days, DeFi blue chip tokens are up, and the token incentives offered to depositors across DeFi are now worth more, which means higher APYs for depositors.

The base rate for DeFi yields is now well above 10%, with top yields between 14–37%, as shown on Vaults FYI. The yield opportunities highlighted on Vaults FYI are primarily stablecoin related, with Yearn v3 and Yearn's Juiced Vaults still dominating the leaderboard. Ethena has quickly climbed the leaderboard and the backlash they received last week doesn't seem to have impacted their growth.

Less complicated strategies are offering low double-digit APYs, and the more complicated ones are offering far more (with far more risk, as well).

Let's breakdown yields between stablecoins and ETH by category.

Stablecoin Yields

Stablecoin Base Rate: 11–12%

There's a significant appetite for leverage in DeFi lending markets, which is boosting rates for lenders on Aave v3, Compound v3 and Spark Protocol. The best rates for lenders are on L2s, and that's where we'll see more activity move over time. Those with significant capital will choose to stay on Ethereum mainnet for quite some time, but the average DeFi user is moving from one L2 to the next farming stablecoin yields wherever they can the best APRs.

Aave v3 and Compound v3 Markets

Aave v3's Optimism market has seen consistent demand for stablecoin deposits, with sUSD supply and borrow rates spiking this week. It’s highly likely some SNX stakers on Optimism needed to borrow sUSD to improve their c-ratio on Synthetix since it's been a profitable week for traders. Largely, though, the demand for stablecoins has been caused by people going levered long on ETH and more folks are borrowing stables to farm higher yields elsewhere.

While Aave v3 has a variety of stablecoins you can borrow, Compound v3 only lets you borrow USDC or ETH. Because the borrowable assets on Compound v3 markets are limited, the borrow utilization is often quite high. This attracts more USDC Rates for USDC on Compound v3, which has helped Compound v3 markets more than double since last May when Gauntlet first introduced the interest rate curve changes to incentivize migration from v2 to v3 and drive growth in the v3 markets. Let's not forget that Aave v3 has grown their TVL by a factor of four in the same timeframe.

Utilization in lending markets on L2s and mainnet have been hovering around 90%, as the interest rate adjustments made in November 2023 in Aave v3 markets has also created a larger jump in interest rates during times of excessive demand. These market forces will attract more stablecoin capital into Aave v3 and Compound v3. Anyone building on top of Aave v3 and/or Compound v3 will benefit greatly, and Aave and Compound will see revenue growth as interest rates climb in Q1 2024.

Looking Toward Future Lending Market Yields

Unless we see signs of the market cooling, low double-digit APYs on lending markets is likely the norm for a while. It's a simple strategy, but it does come with risk. The good news: platforms like OpenCover allow you to protect your deposit on Aave v3 or Compound v3 with Protocol Cover, which is an insurance alternative designed to protect your crypto assets against hacks/exploits, oracle manipulation/failure, liquidation failure, and governance takeovers.

OpenCover is on Optimism, Arbitrum, and Base, so you can protect yourself against hacks, exploits, oracle failure and manipulation, severe liquidation failure, and governance takeovers, while enjoying low transaction fees.

A Friendly Reminder: If you're not familiar with leverage or have never used leverage before, I would recommend exercising caution, or just don't take on any leverage. Don't take on market risk if you can't afford it. If you ever find yourself tethered to your computer because you're afraid you'll be liquidated if you leave home, it's time to unwind your position and improve that health factor. Remember to get outside and live during the bull market, too.

Stablecoin LP Yields

Liquidity providers take on the risk of suffering impermanent loss when they LP volatile pairs, but acting as an LP for stablecoin pairs on decentralized exchanges essentially eliminates this risk since they are like-kind assets. For stablecoin pairs, Aerodrome and Velodrome have been offering the highest APRs due to each protocol's incentives system.

People providing liquidity for Native USDC and bridged USDC in Aerodrome on Base can earn ~21% APR. The DAI and USDC LP on Aerodrome is earning 18.54% APR based on current incentives, as well.

There's still great stablecoin LP yields on mainnet, though they come with higher transaction fees than you'll find on L2s. Maverick's boosted GHO-USDC LP is currently incentivized to offer 31.46% APR. For those unfamiliar, GHO is Aave's stablecoin backed by assets in the Aave markets. Service providers and the wider Aave community have been working to maintain the GHO peg. With recent initiatives to offer greater yield to GHO holders, it seems to be working. For more on the GHO stablecoin, see TokenLogic's GHO dashboard.

Of course, you can LP on Balancer v2, Uniswap v3, and others, but the highest yields I found were on DEXes with boosted incentive systems. While Balancer v2 does have their BAL incentives, most of those are directed toward ETH, staked ETH, and liquid restaking token (LRT) pools.

Aerodrome, Maverick, Uniswap v3, Balancer v2 and other DEXes are listed on Nexus Mutual and OpenCover, as well, if you want to buy cover for your LP.

Yield Optimisers

Yearn's been live since 2020 and offering some of the best yields around. Depositors in Yearn vaults can passively earn, while Yearn’s vault strategists ensure they're optimizing the strategies to get the best APR for depositors. This week, the Yearn v3 Polygon vaults have been offering USDT, USDC, and DAI holders APRs between 16–20%.

Yield optimizers like Yearn can boost your returns, but they also add additional smart contract risk exposure, since Yearn strategists are deploying assets into other protocols. Take the Yearn DAI-A vault on Polygon:

-

Most of the funds are in the Aave v3 DAI Lender strategy

-

A small portion is deposited in the Stargate DAI Staker strategy

Meanwhile, the vaults on Beefy Finance make it easy to deposit and earn yield. The vaults with the highest yields look to be on Curve and Compound v3, especially the three boosted stablecon vaults:

-

USDC (Compound v3) vault with 24.41% APY on Arbitrum

-

crvUSD/USDC vault with 24.37% APY on Optimism

-

crvUSD/sUSD with 37.38% on Optimism

The crvUSD vaults above are both "zapable" strategies, which means you can simply use a single asset like USDC and Beefy will automatically swap for some crvUSD, provide liquidity on Curve, and stake the LP token in the Beefy vault without the need for you to do any of those things. It happens automatically when you deposit into the vault. When you "zaps" in, you turn your USDC into a Beefy vault token, which earns an APY from the underlying Curve strategy.

Using yield optimizers and acting as an LP can generate double the base rate for stablecoins, but be sure to do your due diligence before deciding to deposit into one of these more complex strategies.

Depositing into these vaults can maximize your yields, but it's not without added risk. Again, you can buy Protocol Cover for Yearn v3, Beefy, Aave v3, Curve, and other protocols on Nexus Mutual and OpenCover.

ETH Yields

ETH Base Rate: 3–4%

ETH yields have been tied to staking reward yields since the Beacon Chain launched. In 2024, we'll see more ETH flowing into liquid staking and liquid restaking protocols. You'll see ETH yields on lending markets hover around 1.5–2%, which is due in part to people taking leverage on LSTs.

Nonetheless, to be competitive on ETH yields, you need to beat the base rate.

Lending Markets

Aave v3 markets offer 1.4–1.8% APY and Compound v3 markets offer 2.8–5.2% APR on ETH. MetaMorpho markets managed by Block Analitica/B.Protocol and RE7 Labs offer 4.3% to 9.1% with additional incentives, as well. More mature markets within Aave and Compound are settling around the low end of the base rate, while MetaMorpho + Morpho Blue are able to offer about the base rate with added incentives. We'll see how Morpho's lending markets mature in the coming months.

Unless you're planning to take out leverage on ETH, yields within DeFi lending markets will likely trend below or at the low end of current base rates for yield.

Liquid Restaking

No doubt you've at least heard about the rise of liquid restaking within the EigenLayer ecosystem. Year to date, EigenLayer's TVL has grown by ~900% from an impressive $1.01b to an astounding $9.8b. Everyone wants to farm EigenLayer points, which many believe will lead to the largest airdrop of 2024. This wild speculation has allowed other liquid staking and restaking protocols to grow alongside EigenLayer, like Etherfi, Puffer Finance, KelpDAO, Renzo, and others.

All of these protocols are offering users points, as well, which has created a points economy where you can earn points on points on points, as degens and everyday users alike farm points in the hopes of lifechanging airdrops. While the speculation has been fascinating, it's worth noting that EigenLayer and all of the protocols built on top aren't actively securing any networks at the moment. EigenLayer has yet to launch and the "yield" I'll touch on is based on pure speculation. Be sure to keep that in mind before deciding to farm.

Now, how much yield can be squeezed out of the points frenzy?

Yield Optimisers

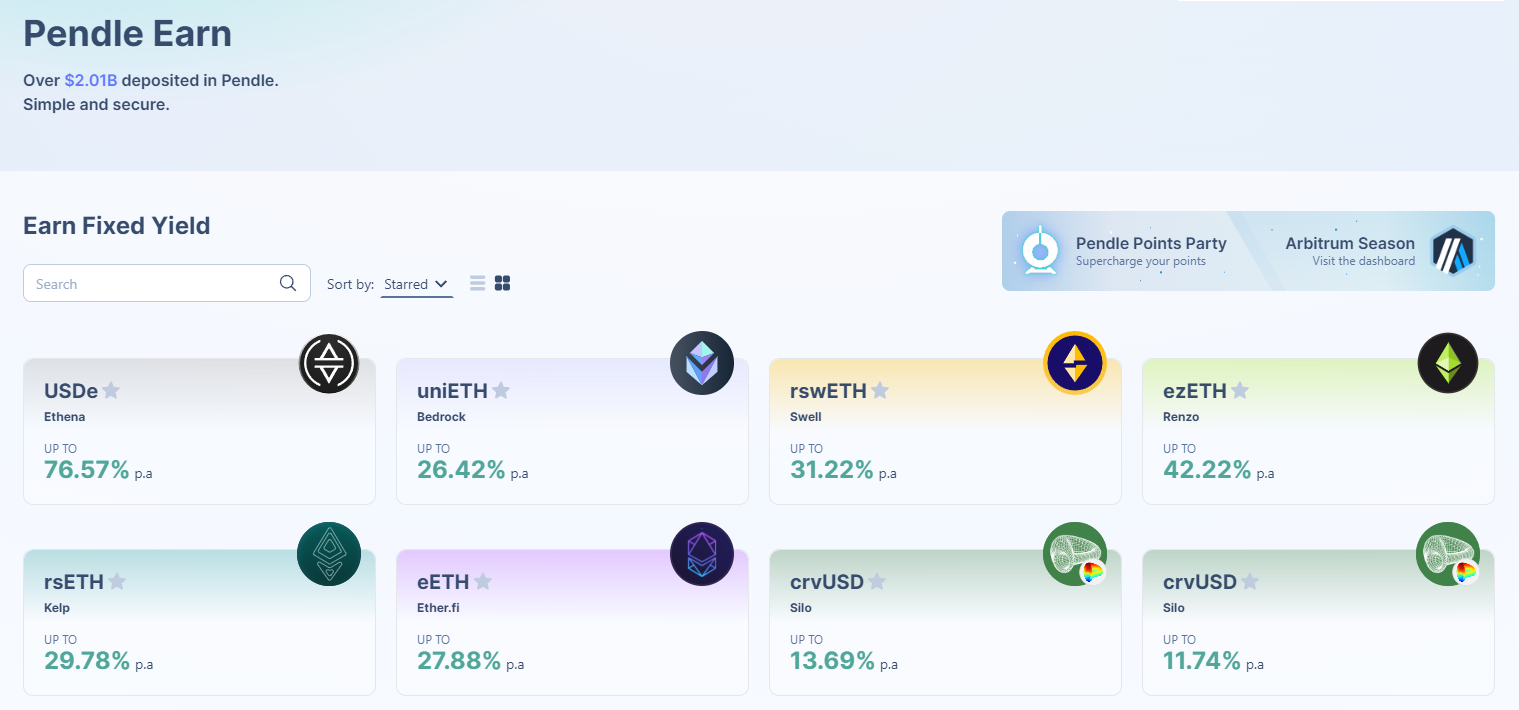

As it turns out, quite an awful lot. Pendle, a protocol that allows people to separate their principal token from the yield it generates, is another that has grown their TVL alongside EigenLayer. Pendle's TVL has grown by 754% year to date, and it's all because people can deposit liquid restaking tokens like Etherfi's eETH on Pendle and split the token into two positions:

-

Principal Token (PT). People can deposit their eETH, select a maturity date for their principal token, and get paid a fixed APY by people willing to buy the eETH Yield Token. Current fixed rates on eETH are around 28%.

-

Yield Token (YT). The Yield Token represents the right to claim the points generated by the eETH deposited in Pendle. When someone buys the eETH Yield Token, they're paying a fixed APY to earn EigenLayer and Etherfi points for the duration of the Yield Token's maturity. People buying eETH Yield Tokens are paying a high fixed rate in hopes that the value they gain from potential EigenLayer and Etherfi airdrops will exceed the cost to hold YTs and farms points.

Pendle has been around since 2021, but they've established strong product market fit with the rise of liquid restaking on Ethereum. If you're a liquid restaking token holder, you can sell your points for 27–42% fixed APY on ETH.

Pendle sends ETH yields far above the base rate, but there are other protocols that allow you to farm these yields with leverage. Of course, this comes with another dimension of risk.

Gearbox v3, a composable leverage protocol on Ethereum, has introduced a strategy that allows people to farm Etherfi's eETH and Renzo's rzETH points on Pendle. People can deposit an initial amount of ETH and leverage their ETH to borrow additional ETH from Gearbox v3's passive market to use anywhere up to 9x leverage to farm points on Pendle. This gives people access to substantially more points, but, again, this comes with added risk.

LP Yields

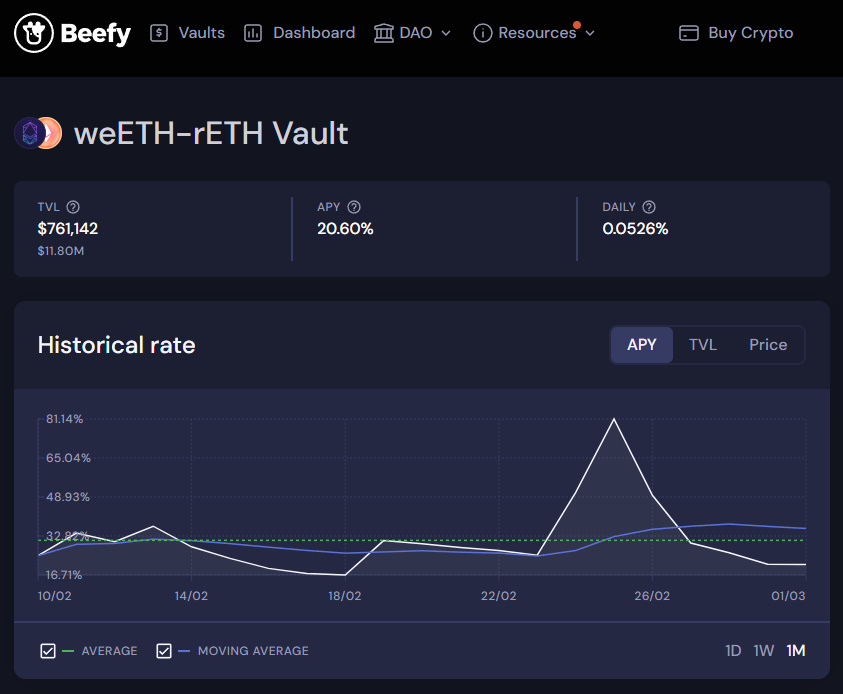

Liquid staking and liquid restaking token holders can earn yield on ETH above the base rate by acting as a liquidity provider on Balancer v2 and other decentralized exchanges. Yield aggregators like Aura Finance and Beefy allow you to get the maximum veBAL boost if you're LPing in the Balancer ecosystem.

The weETH-rETH vault on Beefy uses a Balancer v2 + Aura Finance strategy, which autocompounds the AURA and BAL incentives to offer users ~20% APY.

If you're planning on LPing liquid restaking tokens, the Balancer v2 ecosystem is the place to do it. There's significant depth on LRTs within Balancer than anywhere else on chain.

Takeaways for this Week's DeFi Yields Report

More people are onboard with the bullish narrative and the market is acting accordingly. Stablecoin and ETH yields are both available well above the base rates you can find on the largest lending markets. We're closer to a yield environment that's competitive with TradFi markets, so it won’t be surprising if we see more funds moving capital back on chain to farm yield.

More leverage in the market means there's more risk and a higher chance for drawdowns if mass liquidations occur. If you're using leverage, make sure you're not overexposed and you're keeping an eye on those health factors.

As I've highlighted throughout, smart contract risk shouldn't be written off. The more protocols you're exposed to in any given strategy, the more risk you take on. Last year, there were $1.7b in losses related to on-chain hacks and exploits. You can buy Protocol Cover from OpenCover on L2s or Nexus Mutual on Ethereum mainnet. The majority of the protocols I highlighted in this report are available on both OpenCover and Nexus Mutual. Below, I've included links to those listings.

There's yield out there for everyone. You can farm safely, manage your risk, and grow your portfolio. I'll be back next week with an updated look at the state of DeFi yields.

Until next time, stay safe out there.

P.S. - For the first time in any bull market, Alameda Research isn't there to dump on you. Much cause for celebration

🥳