The Dencun hardfork and the arrival of blobs, ETH's rise over $4,000 and back down to $3,600, MakerDAO's rate and DSR hikes, and the ETHFI token launch announcement dominated the news this week. But what does it all mean for DeFi yields?

DeFi's Base Rate, Courtesy of Vaults FYI (15 March 2024)

MakerDAO's decision to increase their stability fees and the DAI Savings Rate (DSR) to 15% has bolstered yields across DeFi. This unprecedented decision moved stability fees (i.e., interest rates) on Maker’s Collateralised Debt Position (CDP) Vaults to 15–17.25%, which will encourage lenders to pay back their loans and increase Maker's revenue. This is intended to have a net positive impact on the DAI peg and help stabilize the DAI supply. If you want to learn more about this change, I recommend reading PaperImperium's summary on Twitter.

With this increase to Maker's DSR and interest rate (IR) curve changes across lending markets in DeFi, we're still seeing high degrees of borrow utilization across lending markets. High utilization means higher interest rates for lenders, which is why we're seeing the base rate increasing again this week.

It's worth noting that this yield environment is unprecedented, as far as I'm aware. While yields were high during DeFi summer and in the last bull market, this was largely driven by liquidity mining (LM) incentives. Currently, we're seeing native demand to borrow stablecoins and ETH across markets, while liquidity mining is largely absent from these mature lending markets.

As I shared last week, strategies with minor and moderate complexity are now offering attractive double-digit yields. Strategies for intermediate to advanced DeFi users are yielding far more (with exposure to far more risk, as well). With the Dencun hardfork complete and EIP-4844 live, it's also substantially cheaper to transact on Ethereum L2s. Good news for lenders and yield farmers on L2s like Base, Arbitrum, and Optimism.

Let's breakdown yields between stablecoins and ETH by category.

Stablecoin Yields

Stablecoin Base Rate: 18–25%

The changes implemented by MakerDAO have spurred further IR curve discussions in other lending markets, and it's fair to say that stablecoin yield is stabilising between a 20–30% vAPY across the major lending markets. Many yield optimisers use lending strategies to maximise yield, so lending rates play an important role in determining the base rate.

While the market has pulled back this week, the funding rate on Kwenta for ETH longs is still ~90%. There's substantial appetite for leverage and traders are still optimistic about the market outlook.

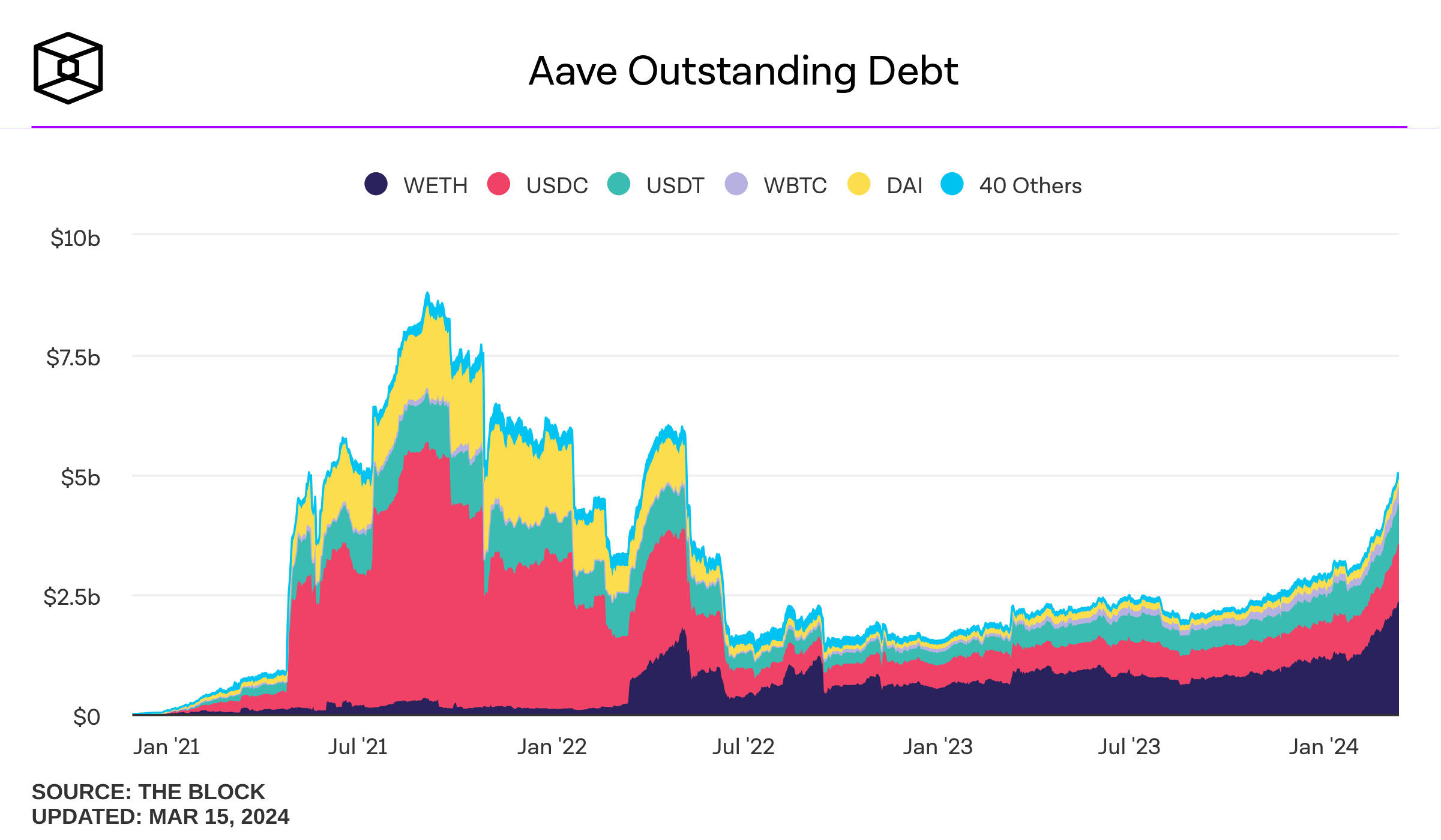

Looking at data from The Block on Aave's outstanding debt shows borrows are increasing to levels correlated with the beginning of the last bull market cycle. This core money lego continues to generate double-digit rates for lenders, as AaveDAO earns more and more revenue as people borrow against their crypto assets.

Lending Markets

Rates across lending markets are holding strong. There's been some rate arbitrage across L2s since MakerDAO's changes were implemented. Look at these tweets from PaperImperium and lito.eth for a couple examples.

What's the state of yield on the mature and more junior lending markets in DeFi?

Aave v3

In the last week, rates across Aave v2 and Aave v3 markets have held from 15–20%, with two outliers. The LUSD and GUSD markets on Aave v2 Ethereum were quite high. Currently, the vAPY for GUSD lenders is 128% and for LUSD lenders it's 17.25%.

The Aave v3 markets on Arbitrum provided the highest APYs, with 17–20% APYs on DAI, USDC, LUSD, and USDT. While sUSD was in high demand last week, its average 7d APY is hovering around 15%.

If you're planning to lend your stables in Aave v2 or Aave v3, you can protect your assets against smart contract risk, losses created by oracle manipulation/failure, and severe liquidation failures with Protocol Cover from Nexus Mutual.

Aave v2 Protocol Cover is very affordable at an annual cost of 1.16%. Aave v3's annual cost is at 5.6%, and cover is available on L2s through OpenCover.

StkGHO Yields

While gas fees on mainnet are high, you can buy GHO through a DEX and stake your GHO in Aave's Safety Module to earn a 35.60% vAPR in AAVE tokens. This is attractive, but it should be noted that bad debt created in the Aave markets can trigger a vote to slash Safety Module depositors to cover some of all of that bad debt. While stkGHO provides an attractive yield opportunity, it does carry the risk of having 99% of your stkGHO balance slashed to cover losses.

Compound v3

The Compound v3 markets on Polygon and Arbitrum earned USDC lenders 18–24% vAPY. The v3 markets only allow users to borrow WETH or USDC, so it hasn't seen as much growth as Aave v3 to date, but Compound v3 continues to grow. The rate arbitrage between these markets is a large factor in anchoring rates very close to one another, as the Aave v3 and Compound v3 USDC rates on each network are quite close.

Coverage options:

Gearbox v3

I've featured Gearbox v3 before, and it's hard to miss their parabolic growth in the last month. This growth has been fuelled by Gearbox v3's leverage strategies to farm USDe strategies on Pendle, where borrowers using leverage are farming Ethena's shards (i.e., points).

The USDe leverage strategy launched on 11 March, and demand for USDC in Gearbox v3's Passive Earn lending market has exploded. If you're looking for a place to lend your USDC, you can currently earn 31.8% on USDC in the Passive Earn market. Leverage traders will borrow your USDC and use it to farm Ethena Shards. Keep an eye on Gearbox markets for yield opportunities.

Coverage options:

MetaMorpho + Morpho Blue

The MetaMorpho markets have seen more traction, and the Spark team recently launched a new market within Morpho for DAI. The B.Protocol/Block Analytica markets have seen some outflows in the last seven (7) days, but this has shifted the APYs up to 17–23% when you include incentives. Gauntlet's USDC market is earning 20%, as well, and the Steakhouse USDC market is earning 17.5%. These rates are attractive but still below other lending market rates or rates available in other markets, which may be the reason for some minor outflows this week.

I expect to see more growth within the MetaMorpho markets as more time goes on and more risk management firms create their own markets on top of Morpho Blue.

Instadapp Fluid

Instadapp's new lending market launched in the last month, and Fluid has seen TVL grow to $178m. The INST token incentives plus the high lending APYs have created an attract place to deposit USDT and USDC. I should note that this is a new protocol and there are no audit reports publicly available at this time. While Fluid has been audited, I haven't seen any audit reports at this time, so use with some caution.

That being said, Fluid has a nice interface and provides stats on usage in the app. Lenders can earn 43% on USDC and 36% on USDT right now. Be sure to do your research and consider the risks but keep your eye on Fluid. It will definitely grow through this bull market. Kudos to the Instadapp team.

Stablecoin Yield Strategies

Yearn v3 and Yearn's Juiced Vaults are still dominating the stablecoin yield landscape, but there are some others that provide nice APYs on your stablecoins. Let's take a look.

Yearn v3 and Yearn Juiced Vaults

If you hold USDC, DAI, or USDT, Yearn v3 vaults on Polygon might be a place to consider depositing.

These Yearn vaults use a strategy underneath to optimise your yield, and you can review the strategies on the Vaults tab within the UI on each vault page. All of the stablecoin vaults are running strategies on Aave v3 markets, with the USDC vault using Aave v3 and Compound v3 to maximise yields.

For more info on the Yearn v3 vaults, see the USDC, DAI, and USDT vault pages.

Juiced Vaults

On Ethereum, Yearn's Juiced Vaults are also yielding high APRs. With Yearn's Juiced Vaults, you earn interest as a lender on Ajna, a permissionless lending market, and you also earn added token incentives, which represent the "juice" added to your APY. In the Juiced DAI Vault, you can earn a base 0.28% APR plus 27.69% APR for a total of 27.97% APR. In the Juiced USDC Vault, you can earn a base 2.77% APR plus 24.17% APR for a total of 26.94% APR.

These Juiced Vaults have consistently outperformed most of the stablecoin market, and I'm glad to see Yearn using Ajna as a money lego for growth.

If you're apprehensive about using a permissionless lending market for yield, you can benefit from a little alpha and check out the Yearn Juiced Vaults Bundled Protocol Cover from Nexus Mutual, which protects against smart contract risk for both Yearn and Ajna.

Beefy Strategies

If you're a fan of Beefy's auto-compounding vaults, then there's several pools with high APYs.

The Beefy USDC vault that deposits into Compound v3 on Arbitrum has a current APY of 25.39%. Bundled Protocol Cover is available for Beefy + Compound v3, as well.

There are several Beefy vaults with a Curve strategy underneath that may be attractive as well, though some use newer stablecoins like crvUSD(Curve) and mkUSD (Prisma). Be sure to read up on those before making any deposits.

The crvUSD/sUSD Vault is earning 36.65% APY on Optimism; the mkUSD/crvUSD Vault is earning 68.08% APY on Ethereum; and the crvUSD/USDC.e Vault is earning 40.88% APY on Optimism. You can also explore other Beefy vaults in their UI, but these are some of the higher APYs I found this week

If you want, you can also purchase Beefy + Curve Bundled Protocol Cover to protect your deposits.

dHedge

Recently, I've been looking at the dHedge vaults shown in the Toros UI. It's been a while since I check in on dHedge, and their team is building interesting and profitable strategies on Optimism, Arbitrum, and now Base, as well.

The vault that stood out the most was their Perpetual Delta Neutral Yield (USDpy) vault on Optimism, which has been printing high APYs. The annualised APY based on the last 30 days performance is 63.39%.

On OpenCover, you can buy dHedge Protocol Cover on Optimism to protect your deposits. Toros is the user interface that lets you access the vaults built on the dHedge smart contracts.

Hyperliquid

This stablecoin yield strategy is a little more complicated and not for anyone who is unfamiliar with perpetual exchanges. If you've done your research and understand the risks, then you can look at the vaults available on Hyperliquid on Arbitrum.

The largest vault is the Hyperliquidity Provider (HLP) vault, which provides liquidity throughout the exchange. Depositors in the HLP vault can earn triple digit APRs, with the last month of performance clocking in at 164%. You're exposed to market risk as an HLP vault depositor, as well as smart contract risks.

Coverage options:

ETH Yields

ETH Base Rate: 2.5–5%

Available ETH staking yields are largely the same, though there are new staking solutions offering higher yields. In the last week, I've found some up-and-coming protocols that are built on sound ideals and offer nice returns on ETH. Lending markets are largely unchanged, though I've included a few more in this issue.

While everyone argues about whether or not an ETH ETF will be approved in May and where we're at in the cycle, you could be earning yield on your ETH well above the current base rate. From simple to in-depth strategies, I've got enough alpha for you to dig through.

Let's see where users like you can beat the base rate.

Lending Markets

Looking across lending markets, yield available on ETH is primarily on mainnet and it's below or on par with the base rate. Notable standouts are in the Compound v3 WETH Base market and two of the markets on MetaMorpho. Not pictured are rates on Fraxlend, which provide higher yields than above.

Let's look at WETH rates on lending markets.

Aave v3

Across Aave markets, rates on WETH are still below the base rate. If demand rises for recursive strategies on LSTs to boost staking yields, these rates may rise. One of the factors that may impact Aave's mainnet rates is the recent update from Index Coop that they deposited ~$170m in wETH, wBTC, and USDC to Aave v3. The Index Coop folks will be launching their new ETH and BTC leverage tokens, which may bring up demand on those assets, but this large inflow of core assets will likely impact rates for lenders in the next week.

The AaveDAO passed the Merit Program through governance and those incentives have begun on ETH mainnet. Over the next three (3) months, we'll see what impact the Merit program has on the mainnet WETH rates for lenders.

And I highlighted the interest rate curve changes proposed by Chaos Labs last week; they've been updated since to reflect the changes MakerDAO made to their stability fees and the DSR. If approved, these changes will increase rates for both lenders and borrowers in the Aave v2 and v3 markets.

Coverage options:

Compound v3

According to Gauntlet's updates on the Compound governance forum, lending and borrowing on mainnet hasn't seen significant growth and rates are lower than the Comet deployments on L2s. For WETH lenders, Base has seen a big jump this week.

- WETH Borrows are up 62.87%, from 0.87k ($1.42M) to 1.42k ($2.3M)

These rates for WETH on Compound v3 (Base) have outperformed the base rate.

Coverage options:

Fraxlend

The Frax community's native lending market have provided double digit yields for WETH and sfrxETH depositors this week. Folks lending WETH can earn 22.39% vAPY; folks lending sfrxETH can earn 28.20% vAPY.

Coverage options:

Gearbox v3

Gearbox v3's Passive Earn market is still providing lenders with 22.65% vAPY, which has been driven by the appetite for leverage on LRT strategies, where traders are farming points on EigenLayer, Etherfi, and other LRT protocols. I imagine rates will be above 20% for as long as points are offered on LRT protocols.

Coverage options:

Liquid Restaking

Since Etherfi announced their token launch this week, the eETH-based strategies have cooled somewhat and the focus is now on other LRT protocols like Renzo, Kelp, and Swell. This week, I don't have as many LRT strategies to share, but there are still opportunities for yield on LRTs.

Pendle

On mainnet, you can sell your yield on the following LRTs and earn high fixed APYs:

-

29.98% fAPY on Swell ETH (rswETH) | 102 days left in maturity

-

40.65% fAPY on Renzo ETH (ezETH) | 39 days left in maturity

-

23.79% fAPY on Kelp ETH (rsETH) | 102 days left in maturity

-

18.06% fAPY on Etherfi ETH (eETH) | 102 days left in maturity

All of these strategies, except for Renzo ETH, have another 102 days left in their maturity.

On Arbitrum, you can sell your yield on the following LRTs and earn high fixed APYs:

-

33.7% fAPY on Renzo ETH (ezETH) | 102 days left in maturity

-

37.61% fAPY on Kelp ETH (rsETH) | 39 days left in maturity

-

24.97% fAPY on Etherfi ETH (eETH) | 39 days left in maturity

Coverage options:

ETH Yield Strategies

If you're looking for more passive yield on your ETH, then some of these strategies may be a better choice for you. Here are a couple highlights.

pxETH

The Redacted Cartel team launched Dinero, a protocol that allows you to stake ETH and choose between apxETH, an LST, or pxETH, an ETH derivative that can be used to earn yield throughout DeFi.

apxETH provides a 9.31% staking APR, while pxETH provides quite few double-digit yield opportunities across DeFi.

By acting as an LP on Curve or Balancer, you can earn 10-123% vAPR on your ETH. Not bad.

Coverage option:

fx Protocol

The fx Protocol allows you to deposit your ETH and choose exposure to a low volatility stablecoin (fxUSD) or a high volatility leveraged version of ETH (fETH). If you're an fETH holder, you can stake your fETH into one of fx Protocol's stability pools to earn 23-51% vAPR.

The stability pools are used to protect against extreme market conditions, so there's additional risk to staking in these pools.

It is possible that the f(x) system will enter stability mode for various assets in volatile market conditions. Your staked assets may be redeemed for ETH, an ETH Liquid Staking Derivative or an X-token depending on which stability pool their tokens are deposited.

If you do choose to deposit and want protection against smart contract risks, you can buy cover on Nexus Mutual for fx Protocol.

Takeaways for this Week's DeFi Yields Report

The price of ETH has dropped from its high last week, and I imagine it may bounce around in the $3200–$4000 range for the next two months until there's an update on the ETH ETF. Personally, I'm still bullish on ETH. For me, nothing has changed since I first go into crypto. I'm not a trader; I'm a farmer.

If you're a farmer, there are still plenty of opportunities to earn on stablecoins and ETH. LRTs continue to drive high rates for ETH yields, but we're seeing more innovative approaches to ETH staking and ETH liquidity as a service with protocols like Asymmetry Finance and Opal, which will be covered in future issues.

Changes across DeFi lending markets will continue to boost stablecoin rates and yield opportunities for lenders, though there will be more rate arbitrage across markets. If you're looking to borrow stables for a longer term time frame consider looking at Notional v3 on Arbitrum. If you're earning, be sure to manage your risk.

As crypto yields increase, and the market continues this bullish trend, it's highly likely we'll see some large exploits in DeFi. IntoTheBlock published "Decoding DeFi Risks: Exploring the Data Behind $50B+ in DeFi Losses" in early February on The Defiant, where they highlight the different technical and economic risks DeFi users are exposed to.

Don't dismiss these risks. I'm a firm believer in Nexus Mutual's Protocol Cover, which protects against the major risks in DeFi: smart contract hacks/exploits; oracle manipulation/failure; liquidation failure; and governance takeovers. Protecting your productive crypto only costs a portion of your yield. Don't let a hack wipe you out in this bull run.

You can buy Protocol Cover from OpenCover on L2s or Nexus Mutual on Ethereum mainnet. The majority of the protocols I highlighted in this report are available on both OpenCover and Nexus Mutual.

Yield is everywhere around us. You just need to reach out and grab it without losing your balance and dropping your bag. I'll be back next week with an updated look at the state of DeFi yields.

Until next time, stay safe out there.