Key Takeaways

- With GameFi players have custody of their own assets. Users can start creating profits from buying and selling items.

- Token’s value depends on the growth of Daily Active Users (DAU) and the burn/minting ratio.

- The utility is correlated with the burn/minting ratio.

- GameFi has become the top 4 in the NFT industry by Market Capitalization.

- Investors are holding P2E NFTs for a mid/long period.

GameFi refers to Gaming Finance, also known as Play-to-earn. Basically, P2E are video games on the blockchain, where users can earn in-game tokens that can be exchanged for FIAT or other cryptocurrencies/digital assets. Currently, most of them are on the Ethereum and Solana networks.

Unlike conventional games, in a P2E video game, the in-game assets are owned by the players, not by the company. This is one of the main reasons why GameFi is revolutionizing the gaming space.

For example, most of us played Counter-Strike or Fortnite, when you got an item dropped or bought a skin for your weapon you depend on the company’s existence. Not only in the aforementioned games but in all traditional games, you rely on the company: GTA, FIFA, LOL, etc. What I mean by dependence is that the custody of your assets depends on the studio and they can do whatever with them.

Additionally, most casual players do not make “real” money from selling their assets or creating new items, there are only a few community markets to make profits from in a conventional game, for instance, the Steam community market.

Tokenomics

Since players can earn tokens, create their own digital assets (some P2E have some kind of “breeding” systems), and have custody of them, new economies are developing in the digital world. This is where “Tokenomics” takes place, it makes reference to a token that has a supply and demand but is also useful for players and investors in the game’s environment, in other words, an economy based on tokens on the blockchain.

Most GameFi platforms have two or more tokens that help their economy to grow. Sometimes one is a governance token or used for breeding; the second one is used like a “FIAT Scheme,” where the main purpose is to spend it or use it to upgrade your in-game avatar. Here are some parameters to consider when you’re performing due diligence for a P2E video game token:

- Market Cap & Supply

The market capitalization will show you the total value of the token in USD. This metric is based on the pool of capital that has been invested in the project. It is calculated by multiplying the circulating supply by the token’s current price. Looking at these metrics will give you a better understanding of the future value of the token.

A high token price doesn’t necessarily mean that it’s more valuable than other tokens in terms of market cap. For example, the “A” token has a price of $1 USD with a circulating supply of 100 tokens, some might say that is extremely low compared with “B” which has a price of $2 USD and a circulating supply of 25 tokens.

Market Cap = Token’s price x # outstanding tokens

MARKET CAP

A token - $1 USD x 100 tokens: $100 USD

B Token - $2 USD x 25 tokens: $50 USD

“A” is more valuable because of its market cap. So, these metrics could help you to determine the growth potential of the cryptocurrency and whether or not it’s safe to invest in. The most common ways to divide the size of a token’s market cap are:

- Large Market Cap: Greater than 10B

- Mid Market Cap: 1B to 10B

- Small Market Cap: Less than 1B

Independent of its market cap, it’s important to note that most cryptocurrencies' market cap can fluctuate dramatically due to their volatility.

Here are two good websites to take a look at the Market Cap & Supply of a token: CoinGecko and CoinMarketCap. Most tokens are listed on these websites but if you’re looking for a token not yet listed, you should only consider the circulating supply because tokens can also have a lock-up or burning wallets, which are tokens held in a smart contract/wallet, which are not circulating in the market.

- Token

Cryptocurrencies have two different economic setups, inflationary and deflationary.

Inflationary token: In GameFi, as we mentioned before, one of the two tokens can be used as a “FIAT Scheme.” Meaning that a token is used in an inflationary way, in other words, the inflationary token does not have its maximum supply capability on the market’s circulation and will be released back into circulation by the players when playing the video game, like in the “real world,” where the central bank prints money and inflation occurs, the same happens here in the virtual world, the only difference is that the community is “printing” (minting) and not a central institution (central banks).

Sometimes a token can be uncapped, meaning that the token has an unlimited supply, so as long as the players keep playing the video game, the token will be continuously minted by the users.

Deflationary token: A deflationary token is an opposite of an inflationary token. Perhaps the most important difference between the two of them is that the deflationary token at the moment of its launch has a maximum supply capacity; all of the coins don’t necessarily have to be released to the market on the launching day. Furthermore, some tokens may have a decreasing supply over time through burning mechanisms, most of the time the mechanism employs a burning wallet, taking a percentage of the supply out of the market at a determined time.

- Allocation

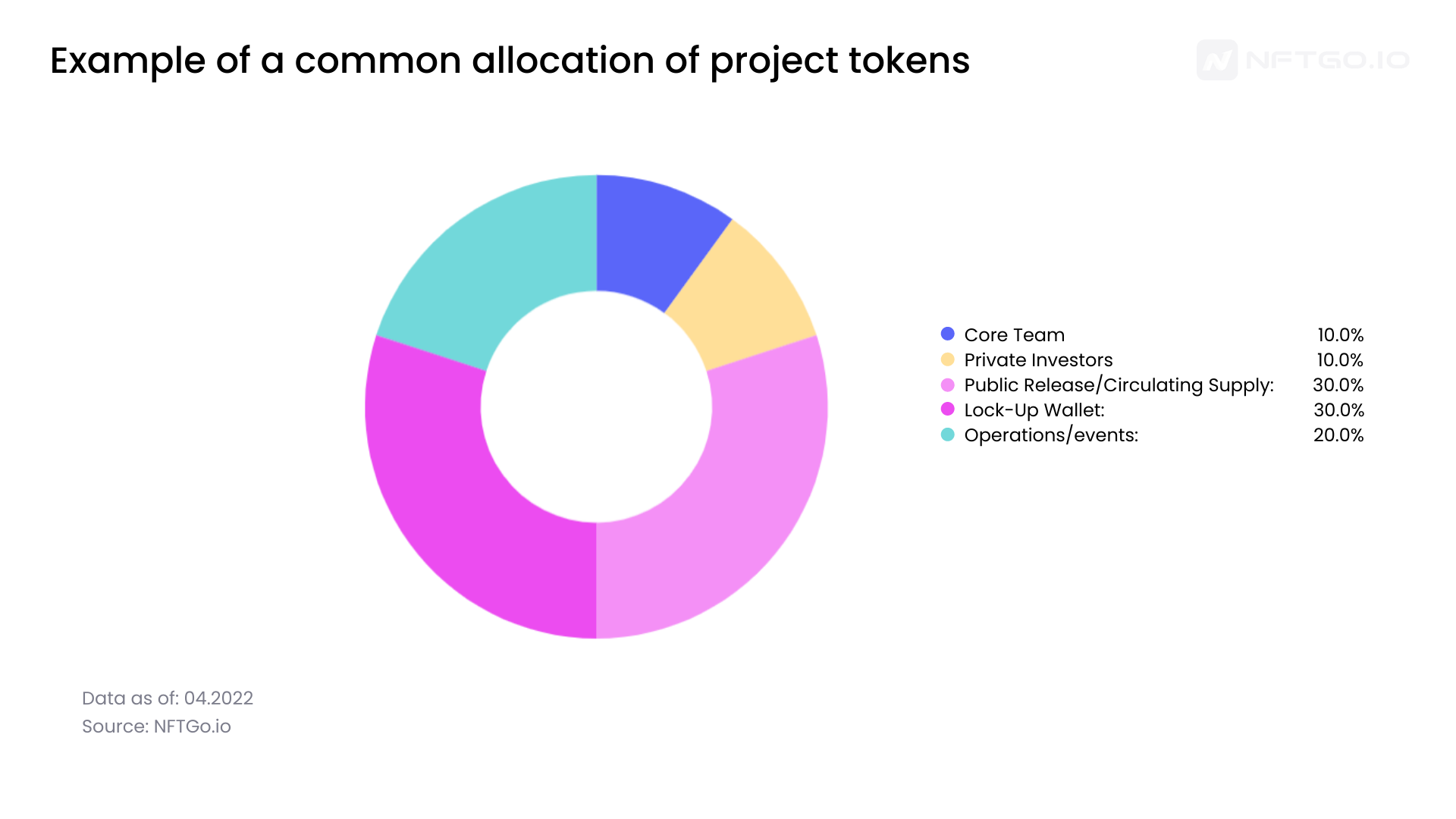

When a project is about to launch there is a key aspect to check: allocation. The allocation will determine how many tokens will be distributed between the core team and the private investors in the project.

Each project has its own allocation models, there is no one-size-fits-all model. Oftentimes, the core team (founders) takes around 5% to 20%, private investors can range from 3% to 32%, this depends on how much is the team looking to fundraise for the development of the project. Only 10% to 20% percent goes to the circulating supply which is where conventional people will start trading, eventually, all the supply will be released; the remaining percentage goes to two wallets, one to lock up the funds and the second one for operative uses: marketing, promotion, and general operations. You have to double-check if the wallet has some tokens yet to be released or check what its purpose of it is for the project’s future.

- Utility and growth

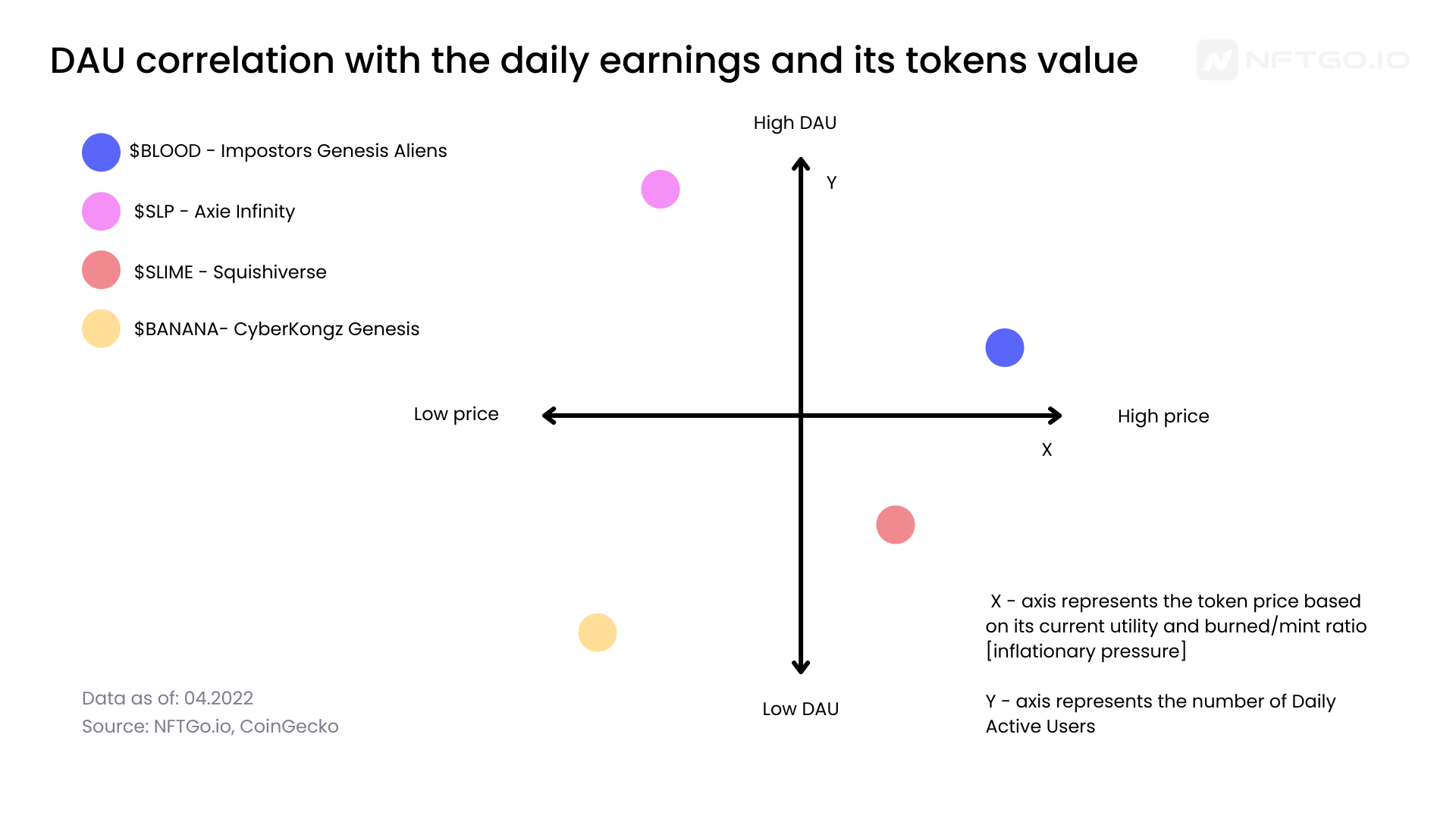

The value of the token also depends on the utility and growth of the Daily Active Users, also known as DAU. There is a correlation between DAU and the token price. If a token has a lot of players, which means that there is a high ratio of DAU- token mint/burning, if it does not have enough utility, the price of the token will eventually fall because the mint and burn ratio puts high inflationary pressure on the coin.

The most common token utilities that decrease inflationary pressures in the P2E ecosystem are:

- Breeding

- Parts upgrades

- Staking

- Liquidity Pool

So, as long as the coin has utility and the burning/minting ratio maintains steadily, it will decrease its inflationary pressure. Some projects may use capital (profits) to pump the coin, this is considered a red flag because it is not sustainable in the long run and instead they use those funds to keep building/developing for the good of the project and use it to create an artificial price. For example, Imagine that the United States government begins to subsidize gasoline (a short-term solution). They allocate an amount to carry out this operation. As soon as this fund runs out... the cost of fuel increases exponentially, which will result in many unhappy consumers.

DAU correlation with the daily earnings and its token value shows some GameFi token examples that are currently in the market and how its DAU is correlated with the token price and its current utility.

High DAU and low prices are a result of inflation pressure caused by the burning/minting ratio. So, if the ratio is high, eventually the coin will drop because of its lack of utility (burn mechanisms). Some collections prefer to have low price and high DAU and a high burning/minting ratio for a short period of time because it allows them to have more circulating supply and, after a period of time, the circulating supply will drop with the new burning mechanisms: skins, upgrades, lands, features for your NFT, etc. and the price might eventually stabilize.

Having low daily earnings and low DAU, is not the worst-case scenario at all, because most of the time when this happens, NFT collections are relatively cheap compared with other projects.

In order to have a better metric of the collection’s token performance, you should consider other external factors like:

- Macroeconomy tendencies: cryptocurrency market, stocks market, NFT general sentiment, current game tendencies, etc.

- Current floor price

- ROI

- Market liquidity

- Future token utility

P2E NFTs market overview

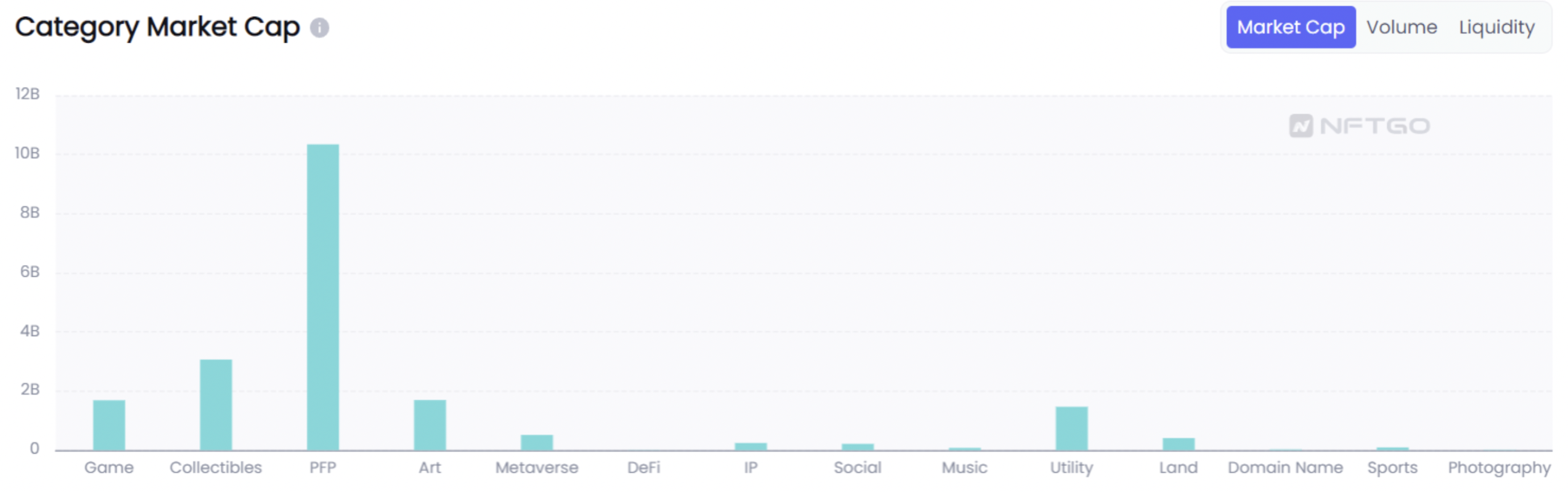

The video game industry is attracting new people to web3 because of its enjoyability and its utility. Play-to-earn video games have become 4 highest in Market Capitalization of the NFT industry with an estimated valuation of $1.69B dollars.

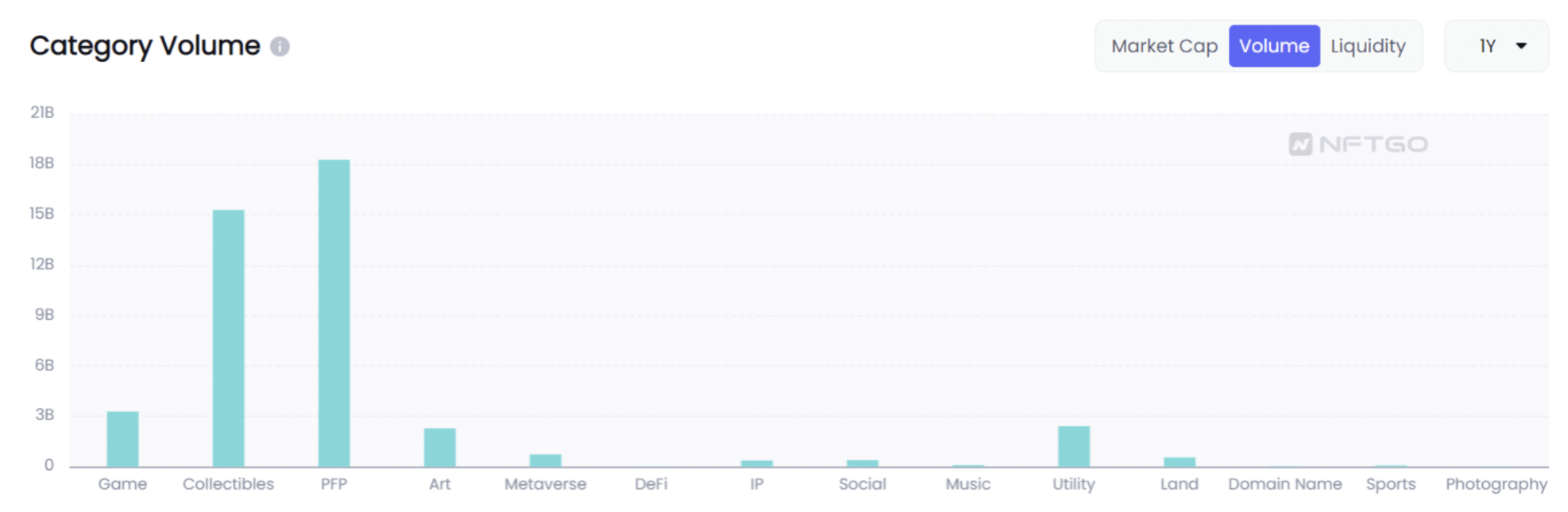

Due to the explosion of GameFi in 2021 and the recent popularity of P2E, the industry is 3rd highest in volume with an estimated volume of $3.29B dollars.

Holding trends

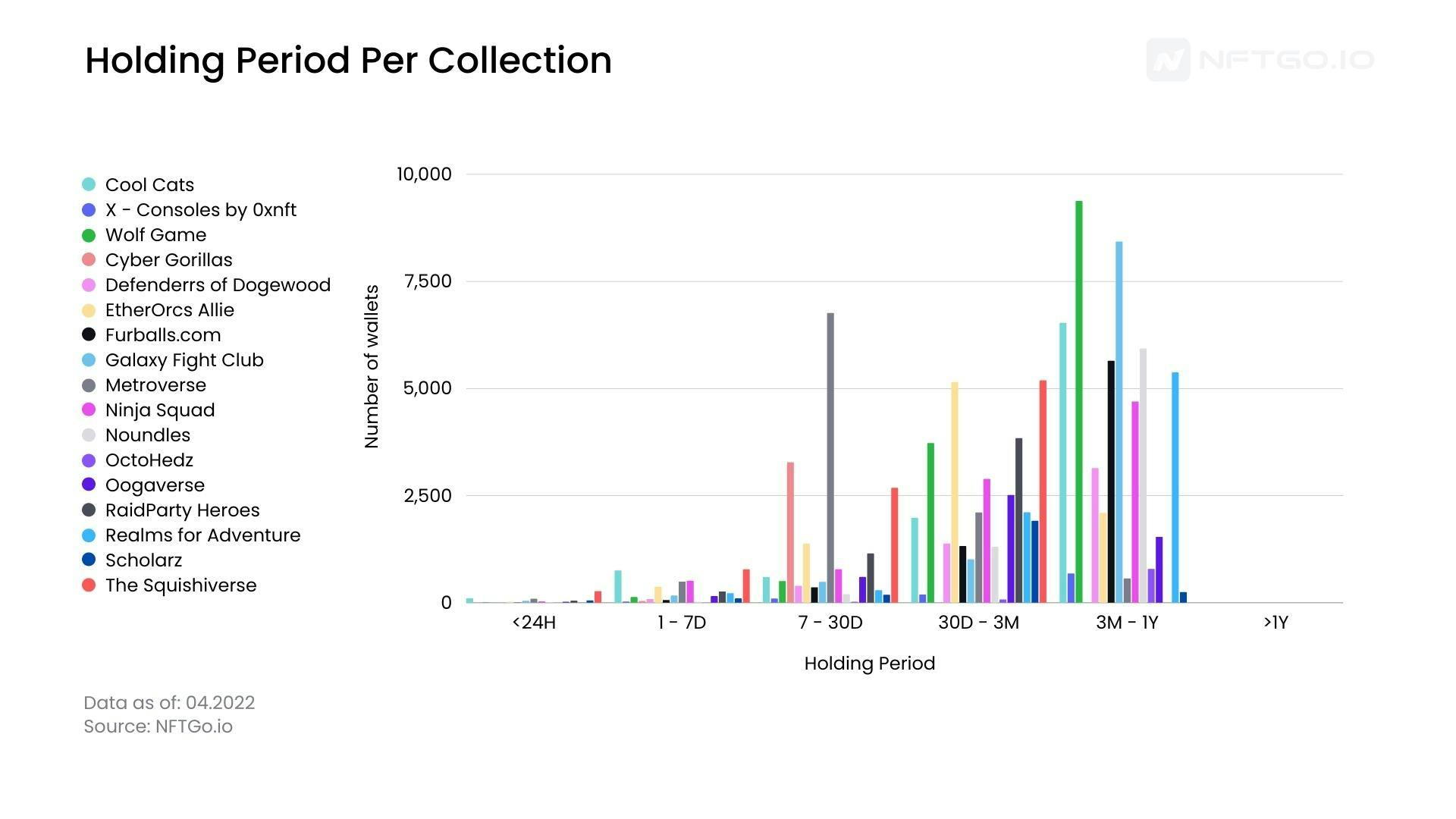

To determine the holding period trend in the P2E industry, we analyzed 18 P2E collections on the Ethereum network to find a holding pattern. Holding Period Per Collection shows the 18 collections and their holding periods.

Holding the asset between 3 months to a year is the most common. Holders are investing for the mid and long term. This is because of the passive income and the probable appreciation of the asset in the future.

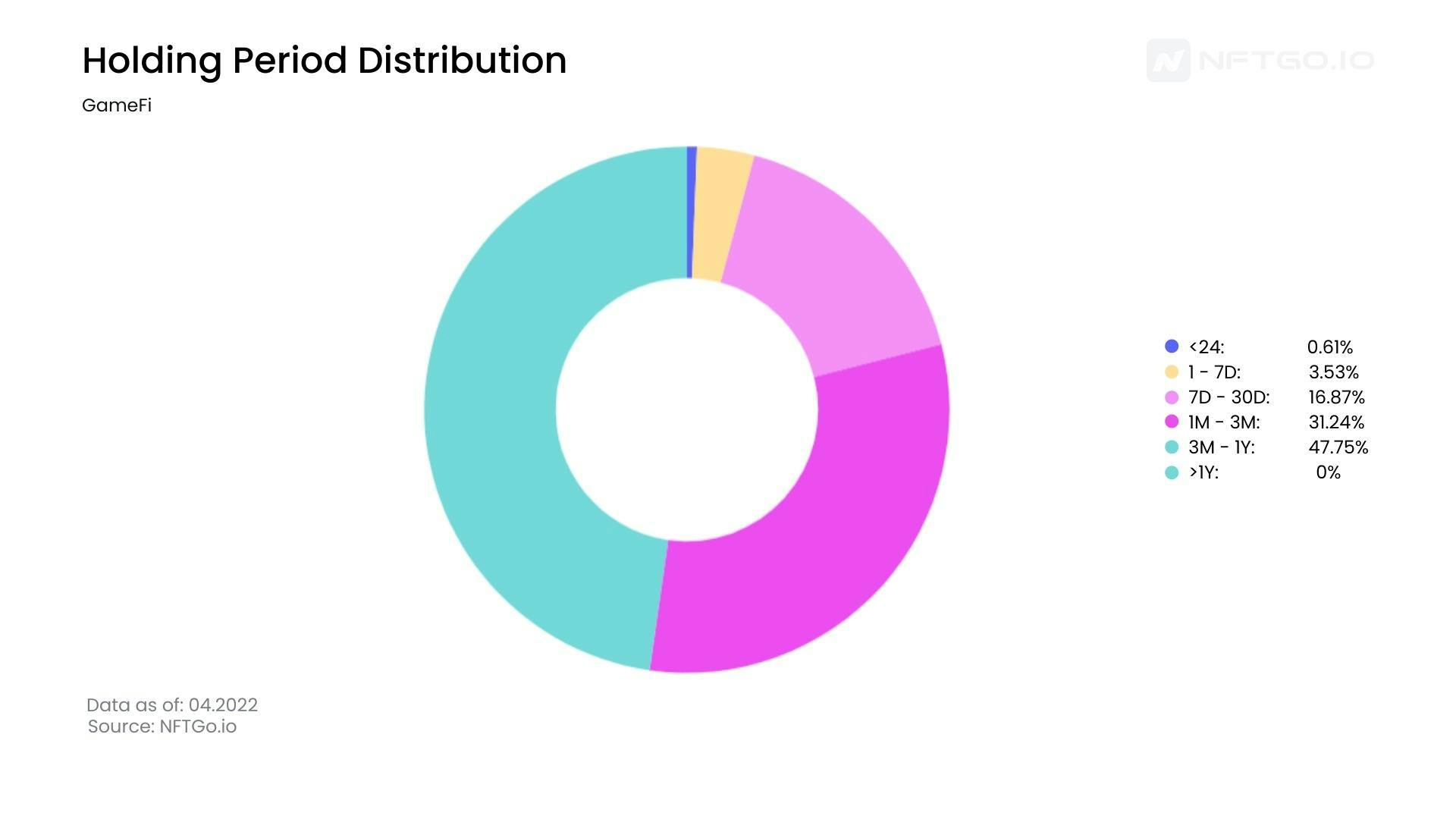

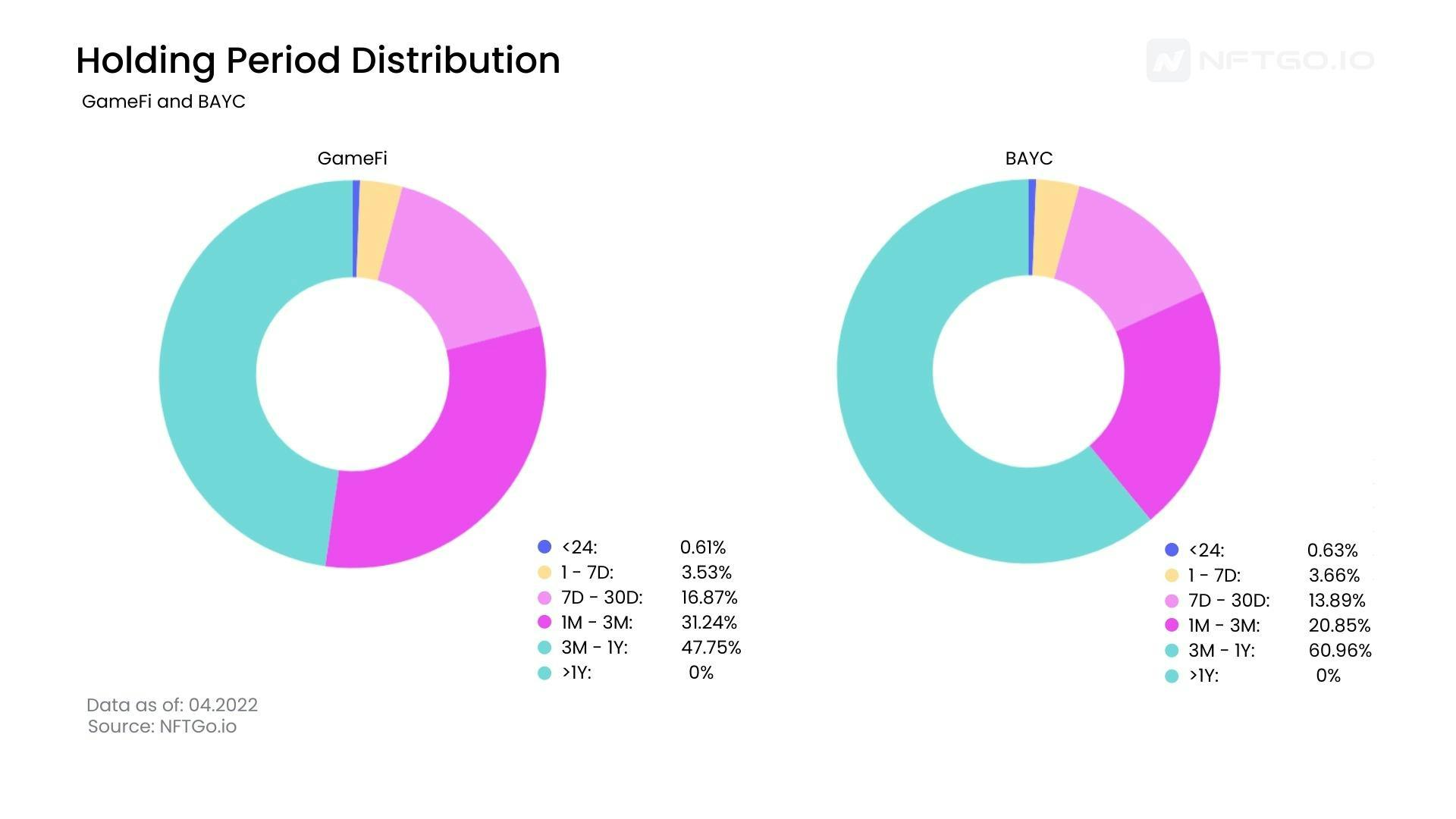

Comparing the GameFi industry and the BAYC holding period distribution we have some similarities:

- Almost no quick flippers (intraday traders)

- Less than 4% sell their NFTs in a 1 - 7D range.

- 1M - 3M traders: Midterm investors

- Most investors are looking to hold their assets for 3M+

Bored Ape is a trusted and well-known project with a successful track record. Investors are holding it because of the current value and its future utility and the social recognition it might have, it’s like the Rolex of NFTs. On the other hand, GameFi is like an Apple Watch, not that fancy but very usable. It brings fun to users and passive earnings, this is why we are seeing similarities with BAYC, “same watch but different utility.”

GameFi ROI

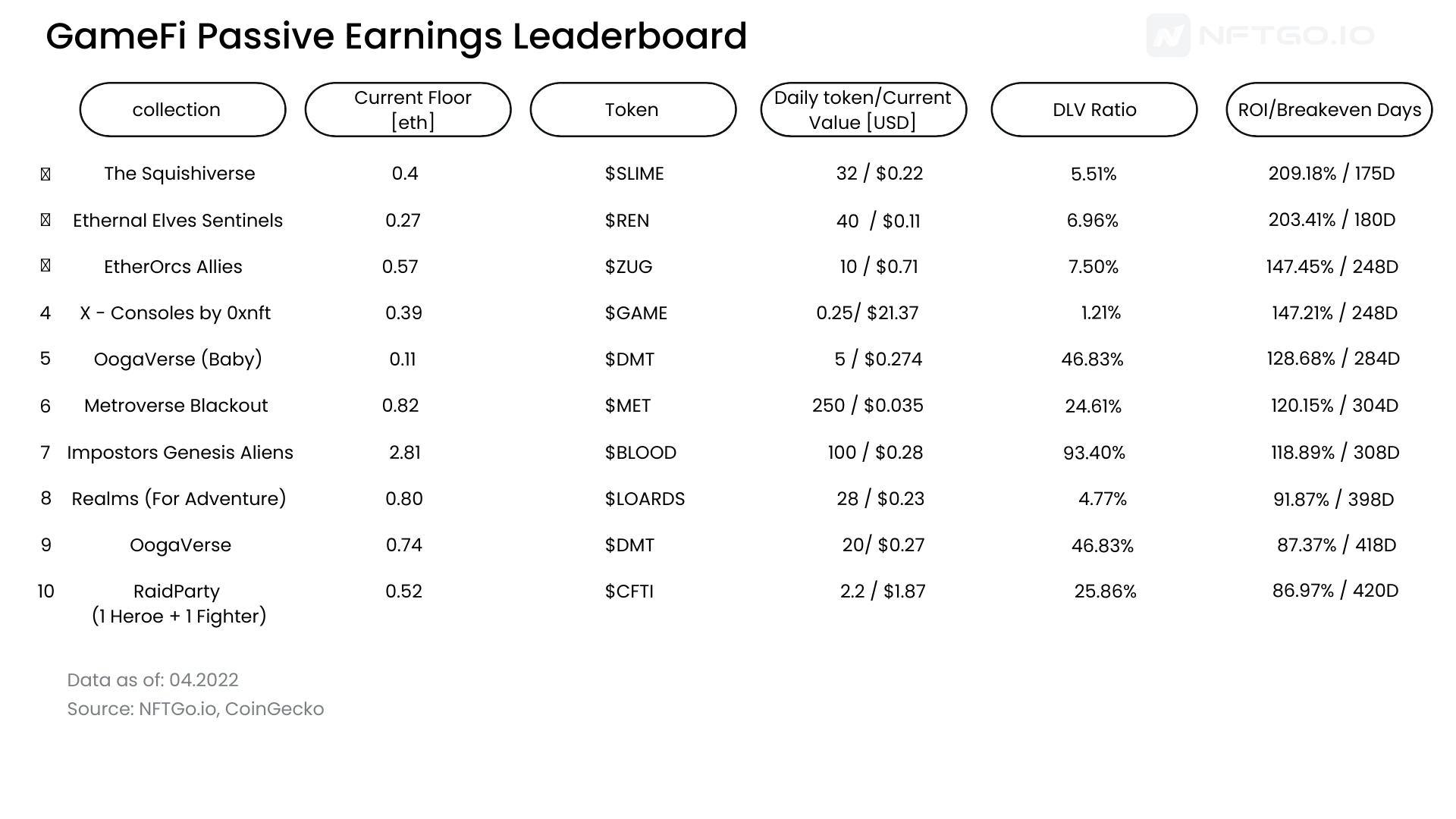

So, how can I calculate my ROI in p2e? You should always consider:

- Gas fees from buying the NFT on a marketplace.

- Stacking and unstacking, gas fees.

- DLV ratio.

DLV means the Daily Value to Liquidity Ratio. It is calculated by:

(Daily Value * # of Supply) / liquidity

The higher the DLV is, the more volatile the asset.

- Liquidity

- Market Cap/TLV

Market Capitalization to Liquidity Ratio. If the result is above 1: the token is overvalued. If the result gets closer to 0 it means that it has room to grow. It is calculated by:

Market Capitalization/liquidity

GameFi Passive Earnings Leaderboard shows the top P2E with the best ROIs in the Ethereum network.

Note: The above information is for informational purposes only. Investing in digital assets such as NFTs and cryptocurrency brings with it a high degree of risk. Please consult with a financial advisor before making any investment decisions. NFTGo does not provide financial advice and is not responsible for any losses incurred as a result of investing in digital assets.

Conclusions

So, GameFi comes with the Web3 mentality, a videogame and marketplace for and by the community, where players can earn and trade tokens for whatever digital asset they want. And most importantly, have the custody of their own assets.

It’s worth mentioning that you should always see GameFi as a “game” which you can make profits from but don’t look at it as a job, why? Because games are made to be enjoyed and that should remain their main purpose. Recently, people have been getting rekt because they think that the main purpose of GameFi is to feed their pockets, which it's not. If you’re a top player and you get rewards from it, good! But if not, take this into consideration.

Hopefully, this article helps you find out the next alpha and keeps you away from scams.