Note to readers: This article is more analysis and explanation rather than a ‘you’re-itching-to-read-about- this-topic-and-I’m-itching-to-write-it’ article. Truth be told, I’m not all that big on decentralized autonomous organizations (DAOs) - we’ll get into why that is below - but they are still a slice of the web3 pie, and I would be remiss if I didn’t present them and give you my take. My hope with this blog is to present a broadly comprehensive understanding of web3 and decentralized finance, therefore it’s useful to understand the role DAOs play. And, as will be elaborated, it’s useful for would-be investors in DAO projects or various crypto tokens to learn about DAOs in order to make informed risk assessments before taking the plunge.

Let me take you back in time.

It’s 2021.

I’m at a crypto conference in Miami. I’m attending in order to learn more about the overlap between blockchain, crypto, and the metaverse. One thing that stands out is the excitement around something called DAOs: decentralized autonomous organizations. The name evokes excitement and curiosity, and the enthusiasm around me promised that DOAs would be the future. Of work, organizational structure, company formation, digital community, and maybe even a key piece of a whole new take on capitalism…

We fade out on 2021… and in on 2024…

… and the DAO revolution has not materialized. In fact, I’d bet there’s a decent chance that this article may be the first you’re hearing of them. Not to impune your web3 worldliness, but DAOs have become a relatively low visibility aspect of web3, so you’d be forgiven for never having encountered them.

That said, it would be a mistake to categorize DAOs as a flop completely. At one point last year, $25 Billion sat in DAO treasuries, with that number growing since then. Some of the biggest DAOs are key to DeFi (Decentralized Finance, a topic we’ll cover soon), and it is key to note that the money locked up here is tied to the product offering, not the actual DAO structure. The majority of these DAOs would have billions locked up in their treasuries if they weren’t DAOs and just continued to operate their current product offering; they just happened to have great products and be DAOs. While $25 Billion is nothing to sneeze at, the number doesn’t really speak to the success of the DAO organizational structure.

So…

What are DAOs? What do they do? What do you do with them? Why didn’t they become the next big ‘it’ thing?

And should you invest or participate in one?

In this article, we’ll address all of that… with a heavy dose of sensible caution. Let’s dive in.

Let’s start with a definition:

DAOs might be tricky to wrap your mind around, so let’s use a couple of definitions to triangulate the beginnings of an approximate understanding.

According to Chain Analysis, DAOs “are a staple of web3. Internet-native and blockchain-based, DAOs are intended to provide a new, democratized management structure for businesses, projects, and communities, in which any member can vote on organizational decisions just by buying into the project.”

An article by Gail Weinstein, Steven Lofchie, and Jason Schwartz published by The Harvard Law School Forum on Corporate Governance offers another take: “DAOs (pronounced “Dows”) are a new kind of entity, regarded by their enthusiasts not as “companies” at all but as collections of individuals organized around the decentralization, autonomous functioning, transparency, and bottom-up principles that characterize the digital universe. DAOs have been created for varied purposes, both charitable and profit-making.”

They go on to say:

“It is essentially an internet community with a shared purpose and the equivalent of a shared online bank account. Through a DAO, people can raise money (potentially large amounts) and organize energy aimed at a joint project, without a formalistic corporate overlay. DAOs have no physical headquarters, offices, or bank accounts; there are no directors, hired managers, other leaders, or employees. A DAO’s governance rules and the parameters for its decision-making are encoded into the blockchain software on which it runs, making management essentially self-executing (through so-called “smart contracts” created by the coding); and all of the DAO’s transactions are immutably recorded on the blockchain, providing transparency to its members. Once a DAO’s purpose and rules are established and the code reflecting them is created, there is no need for human involvement unless a member wishes to propose for a vote of the members any change to the DAO’s purpose or the encoded rules (such as those governing how the DAO’s funds are to be spent).”

One word we see consistently associated with DAOs is governance, so let’s define it here to ensure we are all on the same page. Governance can refer to running a country, an organization (for-profit or non-profit), or even a project you are working on. Regarding DAOs, think of governance (possibly analogous to corporate governance) to mean the methods through which decisions are made, rules are created and enforced, and the general management of an organization.

Basically, DAOs can be simplified down to a club that you pay to join (by purchasing tokens in that DAO), and when the club makes decisions, you can vote. These tokens can be purchased or sold on the market like any other cryptocurrency. The more you pay to join (the more tokens you purchase), the more votes you get. And regardless of your ownership stake, you can propose things for members to vote on that shape the direction of the club. In theory, everything should be above board because these governance principles are tied to and executed by smart contracts.

Since DAOs operate on a blockchain platform through smart contracts that execute automatically and autonomously, this off-loads various tasks and procedures an organization is responsible for, thus, theoretically, upping the organization’s efficiency (and if the organization is a business or a company, greater efficiency equals greater profit). This also removes the need in many cases for third-party involvement on many day-to-day operations, ie, banking institutions. All parties can be counted on to perform their obligations through the trusted, non-fungible nature of blockchain and smart contracts.

The increased presence of (safe, secure, vetted) DAOs could have a number of positive impacts.

-

Improved trust and transparency via enhanced security

-

Make smart contract use more common and accelerate web3 adoption

-

Buyer/investor has a say in how the organization functions/the direction the organization goes in (if the DAO is established that way)

Many enthusiasts frame these aspects of how DAOs function as moral innovations in how organizations can be run: an opportunity for fresh blood, new decision-makers, and a broadening of who’s ‘invited into the tent.’ Their transparency and autonomous nature suggest a limit on the wild, reckless, and sometimes illegal actions or decisions of volatile, risk-prone managers and CEOS. Given the era we live in, when corporations’ dirty laundry airs regularly in public, dissatisfaction with them is high and trust in them is low, a structure that seems to push a company towards toeing the line in terms of ethics, sustainability, equity, inclusivity, and every other thing - isn’t that the type of form we want a company in the 21st century to be?

If you offer a service and are looking for another revenue stream, I completely understand why you are a DAO. You are essentially monetizing your current users by allowing them to have a say in the next service offering - pretty much a win-win as you get some serious voice-of-customer data while allowing these customers to pay to make their voice heard. This is a bit cynical, but I stand by it.

If we are to believe the hype, a new technology with a potential to change the paradigm of corporate structures and how we interact with companies, work, voting, capitalism, all that - why didn’t the DAO revolution materialize?

To answer that, let’s consider a few things.

The Name

In 2024, the acronym can be confusing - Decentralized Autonomous Organization. Decentralization in terms of web3 can refer to decentralized server architecture, which impacts data ownership, censorship, and immutability. In regards to DAOs, it primarily refers to the fact that governance is done via voting. One central power can’t make a decision unilaterally. This is very important, but still not the same as what it means in other web3 contexts. The other issue with the name is a uniquely 2023/2024 issue, the autonomous part. In DAO’s this refers to the smart contracts that automatically execute without human oversight and intervention. In current times, ‘autonomous’ brings to mind AI. A large amount of what AI is used for is automation, but with the onset of generative AI, there is a chance that people can think a DAO is somehow tied into the AI space and that you might be getting an AI CEO. It isn’t, and you aren’t. (Let me repeat that: AI doesn’t have anything to do with DAOs.)

The Hype

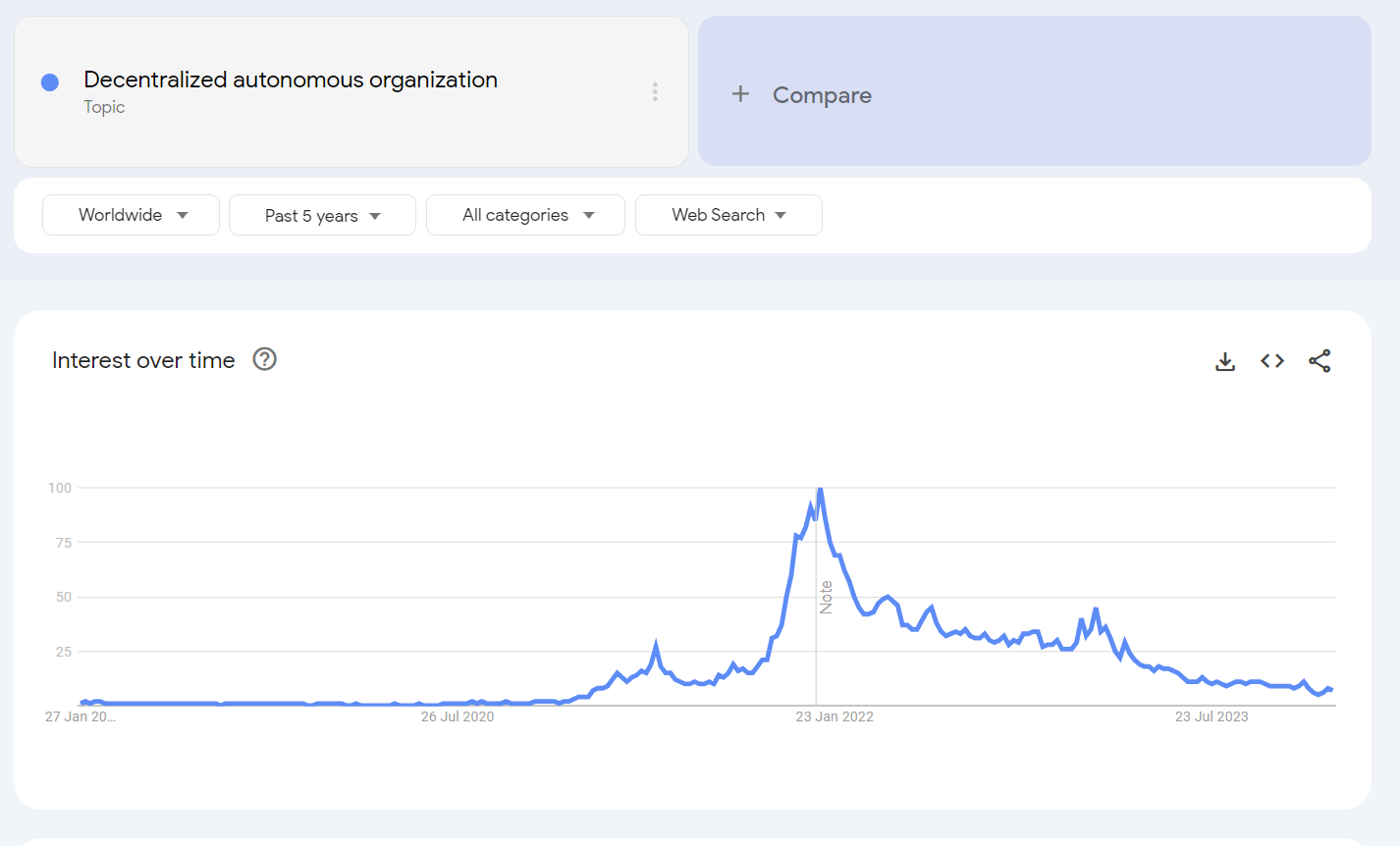

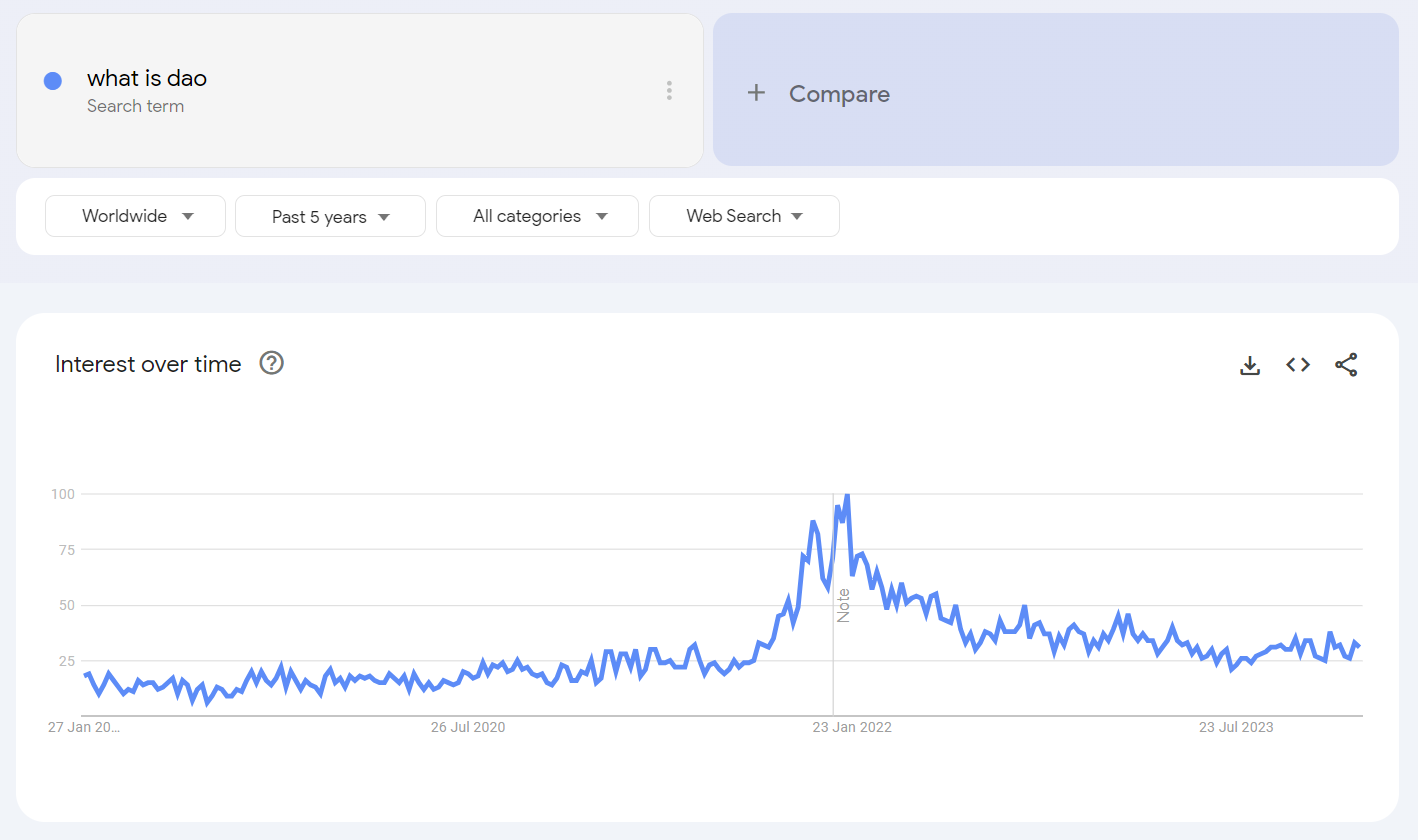

Around the same time, NFTs became the buzziest of buzzwords. According to Google Trends, a useful barometer of general interest, Google searches for DAO's peaked in early 2022. The hype surrounding NFTs centered around that technology existing as a new way to own digital art as a commodity that could become enormously valuable. (The bubble burst on art NFTs, but that doesn’t mean NFTs don’t have a lot to offer.)

After mid-2022, the interest in DAOs dipped and has yet to rebound. Perhaps the die-off of interest and curiosity around DAOs has to do with the fact that there were few substantial DAO offerings in the vein of what enthusiasts promised they would be.

It’s easy to imagine a community coming together around something that evokes passion for those involved. Consider a project for some sort of charity, or fans of a music akin to Taylor Swift: these draw a crowd and form a community. It’s hard to rally the same enthusiasm around the idea of a company. After all, when was the last time you got together to exclaim your enthusiasm for Amazon or Coca-Cola?

Evangelists make the claim that DAOs lead to a more egalitarian work structure. I am not totally sold on that, as this argument relies on people changing the way they compensate employees and value employee input. A mechanism itself cannot produce that change. Much of what is presented as novel and transformational about DAOs compared to other structures is possible in those structures - it just isn’t used. (Check out this Forbes Article on LLCs and S-Corps to learn more about traditional structure) And the fact is, most DAOs aren’t structured in this idealistic format, either. As there have yet to be any standout examples of DAOs worthy of moral praise, it’s no wonder that enthusiasm and curiosity have dipped.

The Liabilities

Volatility of DAO Supporting Components

DAOs function through the interplay of blockchains, smart contracts, oracles, decentralized exchanges, and cryptocurrencies and tokens. While some of those components are highly stable, they do come with challenges that make them somewhat challenging. The energy requirements of blockchain, for example, are a sustainability issue that will get resolved but are currently noteworthy (note this issue is not just unique to blockchain but applies to most tech we use.) Decentralized exchanges involve some vulnerabilities around smart contracts and wallet security. And, of course, cryptocurrencies themselves are notoriously volatile. When you stack all of these elements together, the volatility at hand can be sizeable, and the only risk mitigation available is the expertise and thoroughness of the DAO managers and their ability to surf the volatility wave.

Limited Pool of Knowledgable DAO Managers and Investors

Donald Rumsfeld said in 2002, “There are known knowns. There are things we know we know. We also know there are known unknowns. That is to say, we know there are some things we do not know. But there are also unknown unknowns, the ones we don’t know we don’t know.”

The investing world is still in the getting-to-know-you phase concerning DAOs, and this applies to the people managing and operating DAOs and the investors considering hopping on board.

When you start a company or organization, you have an understanding of what that means, what’s required, and the liabilities to anticipate – or you can find help answering these questions. But with a DAO, it’s not so simple. Have you researched adequately to risk your assets or your investors? Do you know the pitfalls, the risks, the spectrum of what could go wrong? There are a myriad of liabilities and risks associated with DAOs - points of contact where hackers can jump in or where predatory investors can leverage the ignorance of an enthusiastic startup to legally bleed it dry. Are you as a founder aware of all of them? (Given the newness of DAOs, would you know if you were or weren’t?) Have you and your team assessed those risks and built-in safeguards for those liabilities in the smart contracts that operate your DAO? (Do you know how to evaluate your smart contracts for these liabilities?)

As an investor, should you trust someone who runs their business as a DAO? Ultimately you are banking on the venture the person has pitched, you don’t need to be worried about issues with their bank or where there money is stored. Is this the same with a DAO? No. Outsiders and speculators can buy into a DAO and make quick sales to manipulate the value, sell it, and crater the company. As an investor, there is no way to protect against this. And even though you have voting rights through your tokens, the form and function of the DAO are set before you get there - so if those vulnerabilities have not been addressed, you may have an issue.

(Note the two issues mentioned above were perfectly encapsulated in the problems surrounding “The DAO”, this CoinDesk piece on the Tornado Cash hack is also a fascinating read)

Furthermore, the fact that most DAOs are typically start ups means that they don’t have the operational history of a stable, long standing company to deal with a problem around DAO aspects should they arise, let alone have the resources available to do so. Picture this: some crisis occurs within your DAO that you (as a founder) have never encountered before and which you don’t have the liquid assets to manage. What then? What do you do if you’re an investor in this situation?

Uncertain Legal Framework Around DAOs

Like crypto and other web3 components, the legal framework around them is still und settled and fixed. Only three states legally recognize DAOs (what??), which conceivably means a founder or an investor is exposed to (possibly unlimited) liability, and the state, federal, and international frameworks have yet to come into focus. The SEC may decide one thing today and a different thing tomorrow, and suddenly, you are at risk of losing your investment or having violated the letter of the law without even realizing you had done so. If you don’t know what you don’t know, is it possible to know if you’ve exposed yourself to liabilities and legal exposure?

What is a DAO at its core? An organizational structure. Yes, it is novel that it lives on the blockchain, and yes, it offers certain efficiencies that are attractive and useful, but many (essentially all) of its most exciting features are ones that conventional structures could implement.

Perhaps the main issue with DAOs is that we never had a chance to come to understand them before the wave of hype washed ashore, creating a dynamic in which the actual utility of a DAO could never be enough to meet the hype in our minds.

They involve an enormous degree of legal and formal uncertainty, exposure to all of the worst volatility and fluctuation of web3 components, and vulnerability to bad actors, hackers, and scammers. They themselves aren’t inherently bad - but when they are pushed towards eager investors before the safety rails are in place, it’s a bit like a Formula 1 race car being operated by a student driver on their first day of class. How do you think that will go?

Before taking the plunge as a founder, investor, or consumer, really educate yourself on DAOs. Learn as much as you can about how DAOs function in general, about the companies or projects you are interested in buying into, and how skilled the founders are in constructing the smart contracts that define and protect them. The odds are, whatever organization you want to start or join, it doesn’t need to exist as a DAO to do everything those founders aspire to do or to be a moral version of itself. All of this goes double if you are a founder of an organization.

One day, once the world becomes more web3 literate, DAOs will be a less risky enterprise to be a part of. For now, I cannot overstate the caution you should proceed with. To learn more about DAOs, their legal frameworks, their history, and what’s happening in the DAOsphere in 2024, check out these helpful sites for more information.

-

CoinMarketCap list of DAO tokens by market cap - given what we have explained about DAO it makes sense that these are all service providers or blockchains and not art platforms or non-profits

-

This article by CoinMarketCap breaking down some major DAOs explaining how they work and how holders can participate in governance

-

Cointelegraph article on DAOs - Are DAOs overhyped and unworkable?

-

Coinbase piece on the value and risks of governance token