NFTs were promised to be, the future of art or digital media, ownership, and creator compensation. And in a lot of ways, that is true - or least, it could turn out to be true over time. But like most things web3, confusion and off-base salesmanship have clouded what could be an extremely useful and valuable technology, driving away those who could truly benefit from its incorporation into various regions of daily life, and flooding the space with marketers and speculators hoping to cash in on prospective investors’ and the FOMO that provokes them to leap without looking.

NFTs have been in the news recently following a report that 95% of NFT projects are now worthless. The cynic in us might say “DUH, clearly they are worthless. They never had any value.” And that perspective is reasonable, given that most people think of NFTs as monkey pictures used as profile pics by the most annoying people they know, elements of a game (or scam) shilled by Logan Paul, or weird art that infringed on brand copyright shilled by Soulja Boy. It would seem natural to conclude NFTs are a waste of time and not worth the space they take up in the cultural conversation.

But once the confusion and hype boil away, we are left with technology with the potential to rewrite how brands operate, how artists engage with their audience, and how we all relate to our own data. In short, NFTs are worth your time, are worth understanding, and aren’t the nuisance many of us have come to imagine them to be.

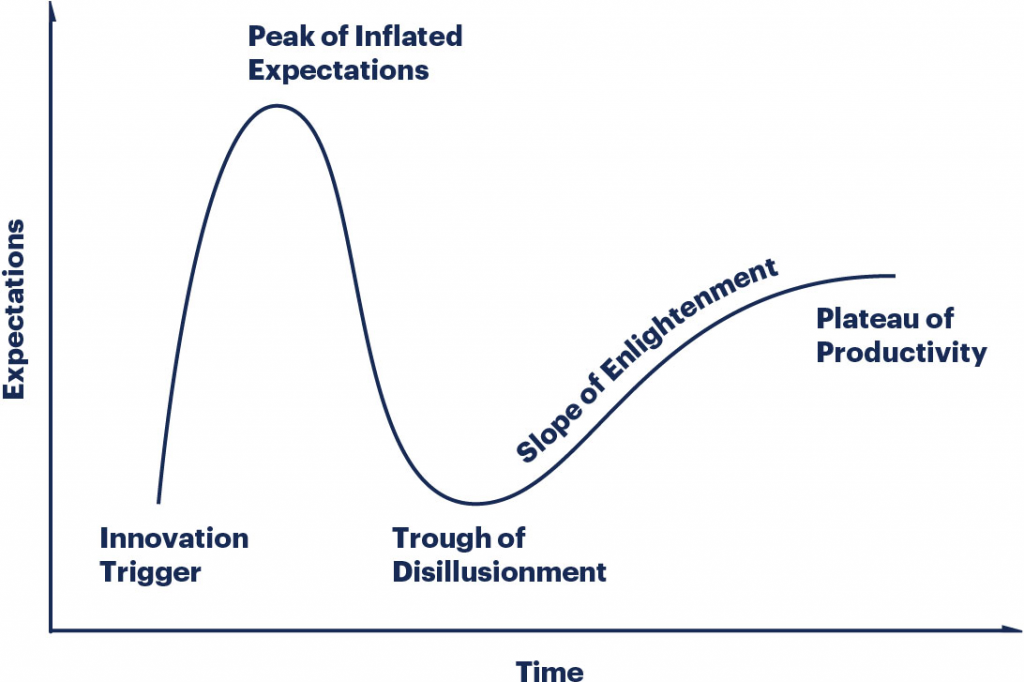

We’ll break down what NFTs actually are, how we got to this point of confusion and disillusionment, and how NFTs are being used and can be used moving forward. Before we do, let’s consider two things. 1) Where we are in the hype cycle and 2) the underlying technology supporting NFTs.

As relates to NFTs, we have taken a nose-dive off the peak of inflated expectations and are mid-bellyflop in the trough of disillusionment. This is where the market is ripe for fraud, discouragement, and disengagement. People who have caught a whiff of an exciting, possibly valuable technology may want to invest in projects (even if they are not technically possible, think Nikola Truck) because they don’t want to miss a window of opportunity. Wired wrote an old but interesting article on Theranos and how the hype cycle infects industries where it doesn’t necessarily make sense. NFTs are a perfect example of this phenomenon.

If you haven’t been tracking NFTs over the past few years, they appeared just to be digital art, but many claimed they had much more utility. The simplest was that they allowed holders access to private discords where they could access events, parties, marketplaces, merchandise, and pre-sales. NFTs were also sold as adding utility to video games, with the NFT representing something in-game that provided some benefit to players (an upgraded weapon, better armour, etc.). The idea of NFTs being used as avatars, where you could buy clothes for their gaming avatar to allow you to represent yourself in the digital world as you would like to be seen, was also top of mind.

But for the non-gamers among us, or those not interested in private discords to access events, parties, marketplaces, merchandise, and pre-sales, the question persists: what are NFTs for, and how are they used?

Let’s dive in.

First, let’s start with an explanation of what a NFT is.

A great explainer from Investopedia breaks down what NFTs are and how they differ from other tokens.

Non-fungible tokens (NFTs) are assets that have been tokenized via a blockchain. They are assigned unique identification codes and metadata that distinguish them from other tokens.

NFTs can be traded and exchanged for money, cryptocurrencies, or other NFTs—it all depends on the value the market and owners have placed on them. For instance, you could use an exchange to create a token for an image of a banana. Some people might pay millions for the NFT, while others might think it [is] worthless.

Cryptocurrencies are tokens as well; however, the key difference is that two cryptocurrencies from the same blockchain are interchangeable—they are fungible. Two NFTs from the same blockchain can look identical, but they are not interchangeable.

That may be a lot to unpack, so let’s break it down a little. NFTs are singular and unique, both in their existence and purpose. While cryptocurrencies are interchangeable (in the same way in which one dollar is the same as another and can be traded for a Euro, a Yuan, a Peso, or a Bitcoin, for that matter), an NFT is singular and distinct (a Rembrandt is not a Van Gogh, for example). The initial purpose and function of an NFT (broadly speaking) were to tokenize an asset (be it a real-world asset or a digital asset) using blockchain’s secure and constantly updated processes in order to ensure clarity around ownership and make the exchange of assets (through sales, trade, inheritance, etc.) more efficient, trustworthy, and immune to fraud or hacking.

Practically speaking, the technology surrounding NFTs is far less flashy than the eye-popping artwork it is known for. Remember: NFTs are not the artwork themselves but the token that verifies the terms of ownership related to the artwork. To put it in musical terms, NFTs are less like a rock band and more like a signed vinyl record by the band with a certificate of authenticity.

In this article, our focus lies within the realm of digital media, specifically exploring how NFTs empower brands and artists to understand and connect with their audience deeply. We will not be touching on real-world assets; more info on that topic can be found here.

Note, that some of the things mentioned in this article may seem like they only benefit enterprises, and to be clear, brands really could be the biggest winners in adopting this technology. But the big picture here is that NFTs are a win-win for everyone.

NFTs - What they were meant to be and what happened

If we are willing to use the definition of NFTs stated above for this piece, it’s important to look at what they were meant to be and what they became. For starters, they were sold to the public as a way for an artist to begin monetizing their work - an artist who may not be mainstream but had a devoted following. (Note the actual proposal doesn’t give use cases like this…) The process of producing art that fans could own as an NFT is much cheaper than owning it as an actual physical item. Think about the difference between viewing pictures on your computer and then getting them printed to hang up. One option is free (right-click, save, done), and the other requires printing or going to a print shop. Free compared to anything else is a wide discrepancy. On top of that, artists could enable innovative, exciting things via smart contracts. For instance, the idea of launching an album where NFT holders who theoretically put money behind the album to fund the costs of making and marketing it would then receive a part of the profit share.

The concept of "A Thousand Fans" or the "1,000 True Fans" theory was popularized by Kevin Kelly in 2008 and played a significant role in shaping the early vision of NFTs and generating enough momentum to initiate the groundswell that brought NFTs into general awareness. This theory posits that a creator or artist can sustain a viable career by cultivating a dedicated fanbase of just 1,000 true fans who are willing to support their work financially.

The initial idea behind NFTs and the 1,000 True Fans theory aligned in the sense that NFTs offered a way for creators to directly connect with their most devoted supporters. Creators could mint NFTs of their digital art or content and sell them to their fans, who would then have provable ownership and bragging rights as the original owner of a digital item. This was seen as a democratizing force in the creative industries, providing an alternative route to steer past the traditional gatekeepers (cloistered galleries in the visual arts industry and studio systems in the music and entertainment industries, for example) and allowing artists to receive fair compensation for their work. (I personally believe there is more to it than just bragging rights; I think it could be game-changing to fund something you believe in and then make some of that money back. In this way, a contributor becomes a type of benefactor of an artist, but beyond that, they become something of a producer, too, which could change the nature of the relationship between the artist and the audience.)

However, the NFT space evolved rapidly, arguably too rapidly, and expanded beyond the original vision. The "Bored Ape Yacht Club" (BAYC) is a prime example of this evolution. BAYC is a collection of 10,000 unique, hand-drawn, generative art NFTs of anthropomorphic apes. While it began as an art project, it morphed into a cultural phenomenon, with owners of these NFTs gaining social status and influence within the NFT community and even in the wider world of social media. This is where we really see the idea of NFTs as a status symbol beginning to pop up.

Here are a few key ways NFT projects, including examples like Bored Ape Yacht Club, evolved:

Status and Identity: NFT ownership became a way for individuals to signal their social status and identity in the digital world. Owning rare or valuable NFTs became a form of digital conspicuous consumption, where individuals used their NFT collections to showcase their online presence. Check out this article on the rise of virtual status symbols.

Virtual Real Estate: Some NFT projects extended beyond art and collectibles to offer virtual real estate or virtual worlds. These digital spaces, like Decentraland and The Sandbox, allowed users to buy, sell, and develop virtual land and assets, further blurring the line between the digital and physical worlds.

Social Clubs and Communities: Projects like Bored Ape Yacht Club created exclusive clubs or communities for NFT owners, fostering a sense of belonging and community among members. This sense of belonging could come with privileges such as access to exclusive events or networking opportunities.

Utility and Integration: Some NFTs started to have utility beyond mere ownership, with owners gaining access to special features or experiences within associated platforms or games.

Investment and Speculation: As the NFT market exploded in value, many people began buying NFTs as investment assets, hoping that their value would appreciate over time, similar to traditional art or collectibles. Cointelegraph literally published a beginner’s investment guide.

NFTs got zeitgeisty over the last handful of years, and a belief grew that they were going to become white hot. This led to thousands and thousands of NFTs being minted. A gigantic influx of energy, marketing, and hype prompted significant buy-in, and then… the fad popped and fizzled. The reality of highly valuable digital art has yet to truly ferment. No one can put an exact price on the value of the Mona Lisa, but everyone agrees its value lives somewhere in the hundreds of millions of dollars. This approximate valuation feels logical based on the Mona Lisa’s agreed-upon place in art history, its quality, its… it’s the Mona Lisa! We all get it. But when it comes to digital art, how do you price something that lives online in the same way every single gif, meme, or AI-generated image lives? No clear, definitive answer has emerged. Yet. An answer will be determined, but it will take time, experimentation, debate, and a stable, consistent market. Early adopters jumped in while the market was awash in art projects that could not yet have an accurately defined value, which effectively means they had no value.

Cut to the present day, and 95% of NFTs are said to be worthless. Investors own images of next to zero (financial) value, and the term “NFT” now brings to mind products like Nintendo’s Virtual Boy, the Ford Pinto, and the John Carter film series.

And it would seem like the NFT story ends (or should end) there… but it doesn’t.

The story that’s been told about NFTs has been incomplete and arguably off-topic from the start. Yes, NFTs can be used as a way to buy, trade, sell, and socialize around digital art - but that is not its main or most impactful ability. NFTs hold the potential to revolutionize the way enterprises and brands engage with their audience. They serve as the ultimate tool for tracking engagement beyond financial metrics by allowing you to choose to share information with an organization or brand. It's a convenient way to log into a private platform without making an account, and on top of that, your digital wallet can provide information that a normal account login cannot (An interesting overview can be found here ). With an NFT, you get a more holistic picture through a wallet as opposed to just an account, as you can see where an NFT ends up.

Brands can now identify and target key evangelists in a manner unparalleled by traditional methods like Instagram campaigns, which can only track ‘traditional’ data insights (likes or reactions, time spent on a page, clicks, etc.). NFTs offer rich, non-anonymized data that can be harnessed to gain profound insights into user behavior, all while rewarding the users whose activity generates the data in the first place.

You asked yourself, ‘How is Facebook worth $10 billion? What produces that value?’ The answer was your, my, and our data, taken with our limited understanding of what we were giving away, who it would be sold to, and how much it was worth. With brands using NFTs to collect data and insights, users play an engaged role, have higher control and visibility of their data, and the authority to withhold or sell it themselves.

Furthermore, NFTs open the door for cash-strapped projects to flourish, providing early stakeholders with the opportunity to share in the revenue if the project achieves success, thereby fostering innovation and collaboration in unprecedented ways.

These types of changes to the status quo promise to reverse trends that have been ingrained in the internet-of-things for the past decade. This will likely generate opportunities for new companies and services to enter the arena (possibly becoming the next eBay or Meta) and for customers/users to leverage their data and value for themselves instead of simply giving it away (or having it taken from them without their awareness).

Status symbols and flashy, fun artwork are no bad thing, and I have nothing against them. After all, this tendency and interest is just as common in the real world as it is in the digital one. But I hope that you’re beginning to see that this is only a small feature of what NFTs are capable of. (This would be akin to being enamoured by the small video monitors in the back of airline seats… and forgetting that it’s in a plane flying over the planet!)

Check out part two for an exploration of some use cases that demonstrate how NFTs could be incorporated into various sectors of the economy and the impacts that could be triggered, as well as a discussion of how to rehabilitate the technology’s reputation in the current moment.