Discover how MakerDAO, MKR Tokens, and DAI are reshaping the world of decentralized finance

Overview

The Maker Protocol, also known as the Multi-Collateral Dai (MCD) system, is like a smart financial system. It lets people create Dai, a digital currency that aims to always be worth about one US dollar. To make Dai, you need to provide some valuable stuff as collateral (which can be forfeited in the event of default) like certain cryptocurrencies such as ETH. A special community known as the MakerDAO, often referred to as "Maker Governance," makes the rules for this system and ensures everything runs smoothly. Dai is a stable and secure currency, so it doesn't lose value quickly like some others, making it a great choice for all sorts of financial activities in the world of decentralized finance (DeFi).

The Maker Protocol

The Maker Protocol stands on three solid pillars: Dai, the Maker Token (MKR), and MakerDAO. Let's break it down.

-

Dai — A cryptocurrency designed to stay close in value to the US dollar. Imagine having a digital dollar that's not controlled by any government.

-

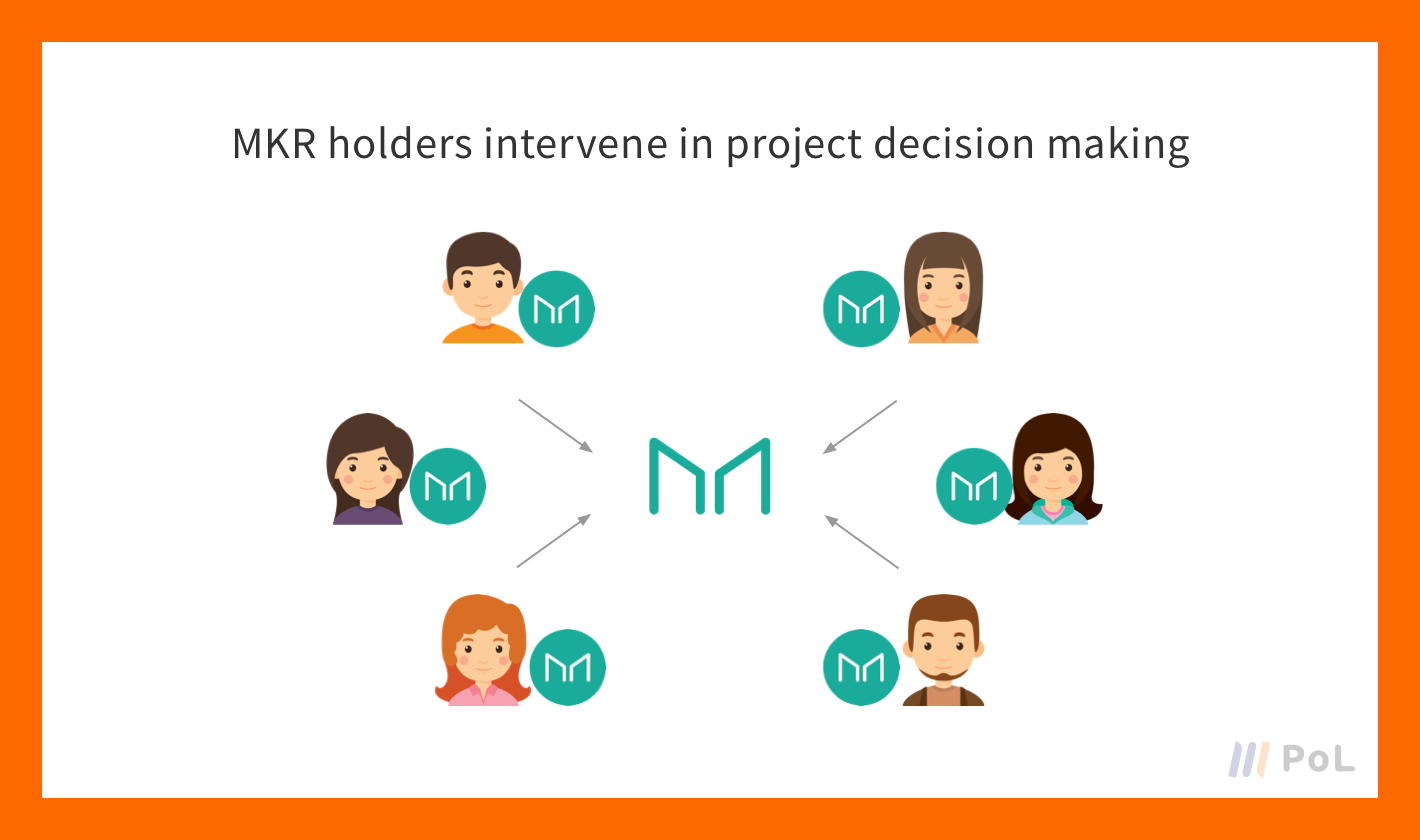

Maker Token (MKR) — It's your ticket to participate. The more MKR you own, the more say you have in decisions about the system. It's like having a VIP pass in this blockchain world. For the majority, these are bought, sold, and traded on exchanges.

-

MakerDAO — A bit like the board of directors for the whole system. They're in charge of making sure everything runs smoothly. It's not a traditional company but more of a decentralized organization run by people worldwide.

Within the Maker Protocol, there are some other essential components as well, such as: Collateral Vaults, Oracles, and Voting. Think of it like the engine room of a big ship. MakerDAO, a decentralized group (DAO: Decentralized Autonomous Organization), manages this engine room, making important decisions like interest rates and which assets to use as collateral. These choices are made through the power of MKR token holders.

This decentralized system, operated by people worldwide, is a pioneer in the DeFi ecosystem. It's a bit like the United Nations of crypto, but for creating a fair and reliable financial world.

Background

The Maker Protocol, originally introduced as Single-Collateral Dai (SCD), offered a groundbreaking approach to generating Dai, a stable cryptocurrency, by leveraging Ethereum as collateral. This was achieved through unique smart contracts known as Collateralized Debt Positions (CDPs). In those early days, Dai generated using only Ethereum as collateral was referred to as Single-Collateral Dai (SCD). Fast forward to today, and the Maker Protocol, now known as Multi-Collateral Dai (MCD), has evolved to accept a broader range of Ethereum-based assets as collateral. The inclusion of these assets is subject to approval by MKR token holders, who also have the responsibility of voting on Risk Parameters for each collateral asset.

Dai stands out in the crypto world as a decentralized and unbiased cryptocurrency, uniquely soft-pegged to the US Dollar. While other organizations have created stablecoins, MakerDAO's Dai aims to uphold the core principle of decentralized blockchains – global adoption without a central authority. Its primary value lies in its stability, minimizing the price volatility that is commonly associated with many other cryptocurrencies.

Since the launch of Single-Collateral Dai in 2017, the adoption of Dai has witnessed remarkable growth. It has become a cornerstone for decentralized applications that are driving the DeFi movement. In a broader context, the success of Dai aligns with a larger industry trend centered around stablecoins – cryptocurrencies designed to preserve their value and function as digital money. As the cryptocurrency industry continues to expand, it is expected that various entities, including banks, financial services companies, governments, and organizations outside the traditional financial sector, will explore and create their own stable digital currencies, such as Central Bank Digital Currencies (CBDCs). Some notable entities like JP Morgan, Circle, and Facebook have already ventured into this arena.

The Maker Protocol itself plays a pivotal role in the Ethereum ecosystem. It is among the largest decentralized applications (dapps) on the Ethereum network. The governance of the Protocol, along with managing the financial risks associated with Dai, is entrusted to MKR token holders. This governance structure involves a combination of Executive Voting and Governance Polling, with each MKR token locked in a voting contract representing one vote. This approach ensures the stability, transparency, and efficiency of the Dai ecosystem.

Governance

The Maker Protocol relies on a special token called MKR for decision-making. Holders of MKR have the power to propose and vote on changes to the protocol. But here's the catch: it's not just MKR holders who have a say. Anyone can suggest changes, making the process inclusive.

To ensure decisions are well-considered and have broad support, there are two key steps. First, there's a "poll" where the community shares their opinions on proposed changes. This acts as a kind of rough consensus to understand what most people want. Then, there's an "Executive Vote" to make the final decision.

MKR holders also have the ability to increase the supply of MKR tokens when the system has too much debt. This is done through a process called a "Debt Auction" and helps maintain the balance of the system. It's a way to make sure that MKR holders are incentivized to manage the Maker ecosystem responsibly.

The decisions that MKR holders can make are quite extensive. They can introduce new types of collateral that can be used to generate Dai, modify the rules of the system, change the interest rates, select the sources of information, take emergency actions if there's a problem, or upgrade the system to make it better.

Furthermore, MKR tokens can be used to allocate funds from a pool called the Maker Buffer. This pool holds money collected from fees, like Stability Fees and Liquidation Fees, and it can be used for various purposes, such as maintaining the Oracle infrastructure and conducting research.

Now, all these decisions are tied to various parameters, like how much debt the system can handle for each type of collateral, the fees users need to pay, how much collateral is required, and the rules for different types of auctions. These parameters, crucial for the stability and safety of the Maker system, intricately guide decisions, forming the backbone of a resilient and secure decentralized financial ecosystem.

The DAI Stablecoin

Dai is a cryptocurrency tied to the US Dollar, and it's created and managed in a unique way. People can either mint (make) Dai by putting assets into special accounts called Maker Vaults or buy it from exchanges. Once you have Dai, you can use it for all sorts of things like buying stuff, sending it to others, and even saving it to earn some extra via interest.

What's special about Dai is that every single one of them is backed by assets worth more than the Dai itself, and all the Dai transactions can be seen by everyone on the Ethereum blockchain.

A critical feature(s) of Dai is that it posses all of the four major functions of money:

-

A store of value

Dai is a stablecoin, it is designed to function as a store of value even in a volatile market

-

A medium of exchange

Dai is used around the world for all types of transactional purposes

-

A unit of account

Dai a standardized measurement of value used to price goods and services as it is used within the Maker Protocol and some across other DApps

-

A standard of deferred payment

Dai is used to settle debts within the Maker Protocol

Additionally, Dai has a universal setting known as the Dai savings rate (DSR) that decides how much interest Dai holders can earn on their savings. The DSR enables any Dai holder to earn savings effortlessly by locking their Dai into the DSR contract within the Maker Protocol. There's no need for a minimum deposit, and users can withdraw their Dai whenever they wish.

Understanding Maker Vaults

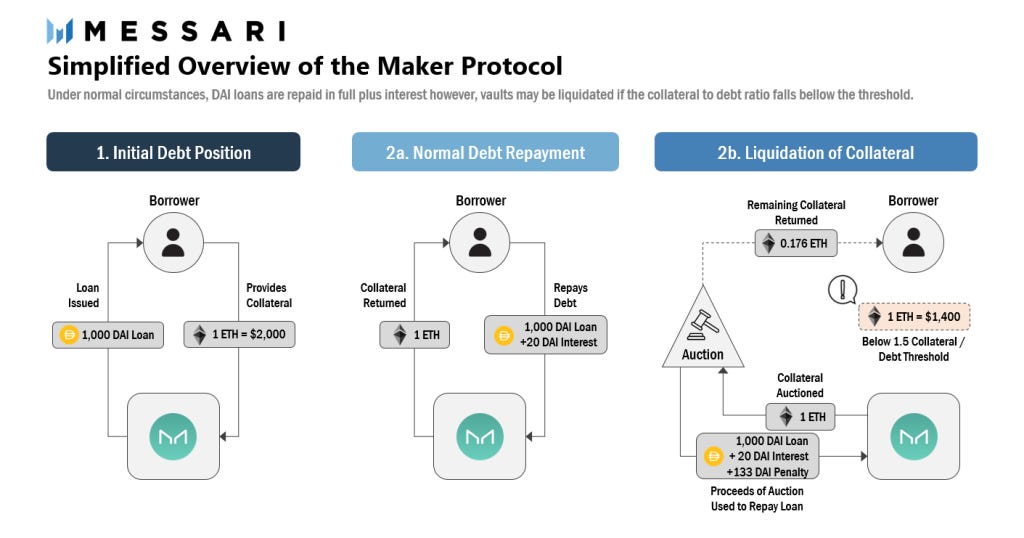

In the Maker Protocol, approved collateral assets (such as ETH) can be used to generate Dai through Maker Vaults, which are managed by smart contracts. Creating a Vault is straightforward, but it comes with the responsibility to repay the borrowed Dai and a Stability Fee to unlock the collateral within the Vault.

Notably, Vaults are non-custodial, meaning users have direct control over their deposited assets. As long as the value of the assets doesn't drop below a certain level, users maintain independent control and access to their collateral.

There are four steps to interact with a Maker Vault:

-

Create a Collateralized Vault: Start by funding a Vault with a specific type and amount of collateral. This Vault becomes collateralized, meaning it's backed by the deposited assets.

-

Generate Dai: Once your Vault is funded, initiate a transaction to generate a certain amount of Dai. This process involves keeping your collateral locked in the Vault.

-

Repay Debt and Stability Fee: To retrieve your collateral, you must repay the Dai you generated along with the continuously accruing Stability Fee, which can only be paid in Dai.

-

Withdraw Collateral: Once you've returned the Dai and paid the Stability Fee, you can withdraw your collateral back to your wallet. Your Vault will be empty until you decide to deposit again.

Keep in mind that each type of collateral requires its own separate Vault. Some users may have multiple Vaults with different collateral types and levels of collateralization.

To ensure there's always enough collateral in the Maker Protocol to cover the Dai value, risky Vaults, as determined by Maker Governance parameters, are liquidated through automated auctions. This is decided by comparing the Liquidation Ratio to a Vault's current collateral-to-debt ratio. Different Vault types have their own Liquidation Ratios set by MKR voters based on the collateral's risk. The target price is a 1:1 peg to the USD.

Maker Protocol Auctions

In the Maker Protocol, when a Vault is too risky, it gets liquidated. This means the system sells the collateral from that Vault in an auction to cover any outstanding debt and penalties.

In this auction, someone pays Dai to buy the collateral. This Dai goes to settle the debt and penalties, but there might be some collateral left over. If there's enough Dai to cover everything and some collateral is left, they have a special auction to give the Vault owner a chance to get back some of their extra collateral. But, if the auction doesn't raise enough Dai, the system goes into something called protocol debt.

Protocol debt is covered by the Dai in the Maker Buffer, however if there is not enough Dai in the Buffer, the Protocol triggers a Debt Auction. To cover this debt, they make more MKR tokens and sell them to the market for Dai. This increases the overall supply of MKR — the token used in Protocol governance.

The Maker Buffer is like a savings account. It holds Dai from auctions and fees. When it has too much, they hold an auction to buy MKR tokens and reduce the total supply.

So, these auctions help keep everything in balance and ensure that the system always has enough collateral to cover its debts.

Conversely, when the earnings from auctions and Stability Fees surpass a certain limit set by Maker Governance, they hold a Surplus Auction. In this auction, bidders compete by offering more MKR tokens to get a fixed amount of Dai. After the Surplus Auction, the Maker Protocol automatically destroys the collected MKR, reducing the total supply. This process reduces the amount of MKR tokens in circulation, helping maintain balance.

Important Elements

The Maker Protocol relies on various external groups and community members to operate smoothly:

-

Keepers are independent actors, often automated, who profit from price differences. In the Maker Protocol, they help maintain the Dai price at $1. When Dai's market price is above $1, Keepers sell it, and when it's below $1, they buy it. Keepers also participate in auctions when Maker Vaults are liquidated.

-

Price Oracles are crucial for the protocol to know when to trigger liquidations. They provide real-time data on the market prices of collateral assets. MKR voters select trusted oracles to feed price information into the system.

-

Global Settlers (Emergency Oracles) serve as a final defense against attacks on governance or oracles. They have the authority to freeze individual oracles to prevent a rush of users withdrawing assets during an emergency shutdown.

-

DAO Teams are groups of individuals or service providers who offer specific services to MakerDAO. They operate independently and can be contracted through Maker Governance.

In a nutshell, Keepers maintain Dai's price, Price Oracles provide real-time data, Global Settlers act as a safety net, and DAO Teams offer various services, all contributing to the functioning of the Maker Protocol.

Conclusively, the Maker Protocol not only exemplifies the cutting edge of blockchain technology but also signifies a transformative step towards democratizing financial access, underscored by its adaptive governance, meticulous parameters, and unwavering commitment to fostering a more inclusive and resilient financial landscape.

If you liked what you read please subscribe, share, and follow us on X!