Learn about Amkor’s story, the largest semiconductor OSAT in the US, and the way they are revolutionizing chip production

*Disclaimer: This analysis was done using Q12 2023 data*

The Overview

Summary

Company: Amkor Technology, Inc. (NASDAQ: AMKR)

Sector: Technology

Industry: Semiconductor Equipment & Materials

Founded: 1968

IPO: 1998

HQ: Tempe, AZ

A global leader in semiconductor packaging and test services, Amkor specializes in enclosing and protecting semiconductor devices, such as integrated circuits (ICs), and ensuring their functionality and reliability through testing. Amkor offers advanced packaging technologies that enable smaller and more powerful electronic devices. Additionally, Amkor also provides design and engineering support, helping semiconductor manufacturers optimize their packaging solutions.

Industry

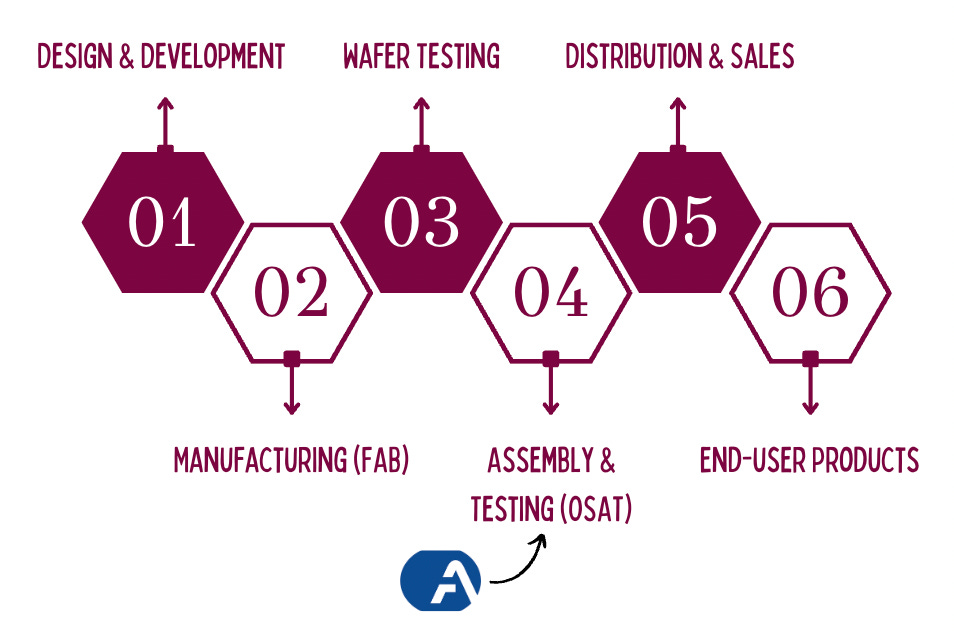

Semiconductor Supply Chain

Pieces of the Pie

Semiconductor Fabrication (FAB, aka Foundry)

-

FABs manufacture semiconductor wafers, which contain multiple chips (dies)

-

The chips produced in FABs are essentially the raw, un-packaged semiconductors

Examples: TSMC, GlobalFoundrie

Fabless Semiconductor Companies

- Fabless semiconductor companies are those that focus on the design and development of semiconductor chips but do not own or operate their own semiconductor fabrication (FAB) facilities. Instead, they focus on chip design, research and development, and marketing and outsource the manufacturing process to third-party semiconductor foundries

Examples: AMD, Nvidia, Qualcomm

Outsourced Semiconductor Assembly and Test (OSAT):

-

OSAT companies take the chips (dies) produced by FABs and perform the assembly, packaging, and testing. This includes adding protective packaging, connecting the chips to external pins, and ensuring they meet quality and performance standards

-

OSAT services make the chips functional and ready for integration into electronic devices

Examples: ASE, Amkor

Integrated Device Manufacturer (IDM)

- A large-scale semiconductor company that has the means to do everything from designing to producing products (e.g., all of the above)

Examples: Intel, Samsung, Texas Instruments

Why use an OSAT?

The semiconductor industry is highly driven by outsourcing. The two significant examples of semiconductor outsourcing are FABs (Pure-Play Foundries) and OSATs. More than designing, the manufacturing aspect of semiconductor product development relies on the services provided by external vendors. Thus OSATs can provide the following benefits to their customers:

-

Cost Efficiency: OSATs offer cost-effective semiconductor assembly and packaging solutions, reducing capital expenditures

-

Focus on Core Competencies: Semiconductor companies outsource to OSATs to concentrate on chip design and innovation

-

Scalability: OSATs can handle high-volume production runs and adjust production levels as needed

-

Access to Advanced Technologies: OSATs invest in cutting-edge assembly and packaging technologies, benefiting semiconductor companies

-

Speed to Market: Outsourcing to OSATs accelerates time-to-market for semiconductor products

-

Production Bottlenecks: IDMs and other semiconductor companies may encounter production bottlenecks which may require them to outsource assembly to hit deadlines and quotas

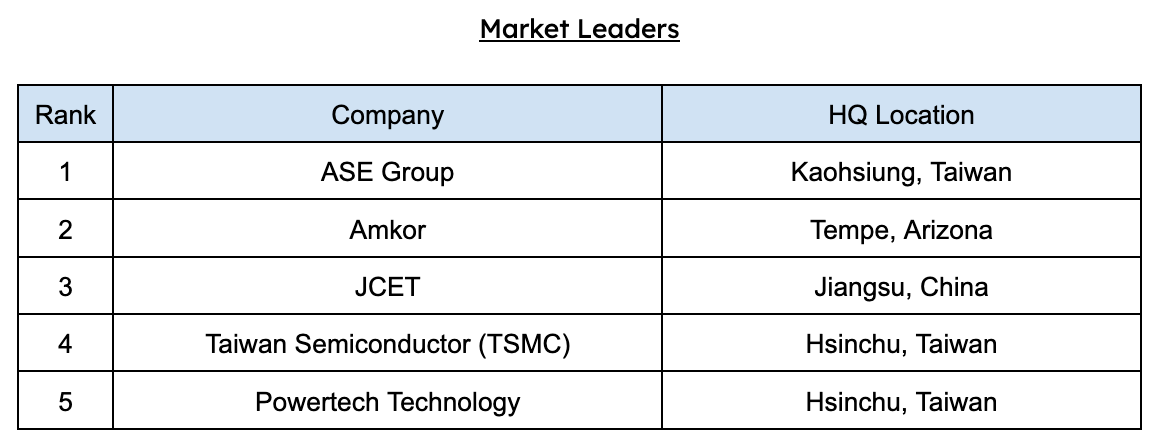

Market Analysis

Compound Annual Growth Rate (CAGR): 9.15%

Market Concentration: Medium

Largest Market: Asia Pacific

The need for semiconductor chips has surged dramatically in recent years, driven by a relentless wave of technological advancements. From smartphones and data centers to computers and IoT devices, semiconductor chips are the unsung heroes powering our digital age.

Additionally, here has been a large increase in demand for semiconductors to be used in automotive applications – to be utilized in things such as advanced driver-assistance systems (ADAS) and electric vehicle (EV) applications. A report by IEA states that EV car sales globally amounted to 14% of all passenger car sales in 2022 and is expected to grow 5.3% YoY.

The Narrative

The Future Outlook of Amkor Technology: A Pioneer in Semiconductor Packaging and Testing

Amkor Technology, a stalwart in the semiconductor industry, stands at the forefront of innovation and excellence, setting its sights on a promising future. With over five decades of experience in semiconductor packaging and test services, the company continues to push the boundaries of what's possible in the world of technology.

Driving Innovation: Smaller, More Powerful Electronics

Amkor's unwavering commitment to excellence is evident in its relentless pursuit of smaller yet more powerful electronic devices. In the ever-evolving landscape of consumer electronics and semiconductor technology, Amkor plays a pivotal role in enabling groundbreaking advancements. The company's advanced packaging technologies have not only ensured the protection and functionality of semiconductor devices but have also contributed to the development of cutting-edge products.

As technology continues to shape our daily lives, Amkor stands poised to be a driving force in shaping the future. The world is increasingly reliant on compact, high-performance electronic devices, from smartphones and tablets to smart appliances and automotive technologies. With its focus on innovation and technology leadership, Amkor is well-equipped to meet these growing demands.

Strategic Collaborations: Strengthening Global Presence

Amkor has consistently demonstrated its ability to adapt and evolve. A significant development in this regard is the company's strategic collaboration with GlobalFoundries (GF), aimed at establishing a holistic semiconductor supply chain spanning European and U.S. regions. The transfer of GF's advanced manufacturing lines to Amkor's facility in Portugal signifies a significant step towards expanding its global footprint. By extending its reach into these key regions, Amkor can tap into new opportunities and strengthen its presence in an increasingly competitive market.

Market Dynamics: Meeting Evolving Demands

The semiconductor industry is continually evolving, with growing demands for products used in automotive applications such as advanced driver-assistance systems (ADAS) and electric vehicles (EVs). As per the International Energy Agency (IEA), EV car sales accounted for 14% of all passenger car sales in 2022, with a projected year-on-year growth of 5.3%. This substantial shift towards electric mobility has generated increased demand for semiconductors, a trend that Amkor is well-positioned to capitalize on.

Market Leadership: A Trusted Partner

Amkor's global leadership in semiconductor packaging and test services is undeniable. The company's continued success is underpinned by its unyielding commitment to providing cost-effective and high-quality semiconductor assembly and packaging solutions. As a trusted partner to major corporations like Apple, Broadcom, Cirrus Logic, NVIDIA, and Qualcomm, Amkor plays a pivotal role in the development of end-user products across various sectors, including 5G communications, automotive electronics, high-performance computing, and the Internet of Things (IoT).

Financial Resilience: A Strong Foundation for Growth

In the realm of finance, Amkor has exhibited both resilience and growth. Despite challenges posed by the COVID-19 pandemic, the company rebounded in the post-pandemic era, with a near doubling of net income in 2020. The surge in demand for semiconductor products has created a cascading effect along the supply chain, with Amkor witnessing a surge in demand for its assembly and testing services, a testament to the company's adaptability and reliability.

The future outlook for Amkor remains exceptionally promising, characterized by a strong financial foundation, global expansion, and an unwavering commitment to innovation. The company's strategic partnerships and collaborations position it to meet the evolving demands of the semiconductor industry, while its dedication to providing cost-efficient and high-quality solutions ensures its place at the forefront of technology. As Amkor continues to shape the future of semiconductor packaging and testing, it will undoubtedly remain a trusted partner and industry leader, driving progress in technology and electronics.

External Pressures: Evolving Politics and Laws

The CHIPS Act aims to boost the U.S. semiconductor supply chain, creating growth opportunities for Amkor as it fosters demand for domestic semiconductor packaging and testing services. Diversifying the supply chain and reducing reliance on overseas manufacturing makes Amkor's role in domestic production vital, particularly as the Act allocates substantial funding for domestic semiconductor manufacturing and research. This funding is expected to drive an uptick in domestic semiconductor production, benefitting Amkor as a leading service provider.

Political developments concerning global trade relations, especially U.S.-China dynamics, pose significant impacts on the semiconductor industry. Amkor, with its global operations, must navigate political complexities, adapt strategies, and potentially expand facilities to mitigate risks and seize opportunities. Geopolitical tensions can disrupt the semiconductor supply chain through trade wars, export bans, or diplomatic conflicts, introducing unpredictability.

Furthermore, Moore's Law, which posits that the number of transistors on a semiconductor chip will double approximately every two years, drives chip miniaturization and complexity, increasing demand for cutting-edge semiconductor packaging and testing solutions. Amkor's expertise positions it well to thrive through collaboration, innovation, and adaptability in an ever-changing landscape.

Conclusion

Amkor has consistently demonstrated its resilience and adaptability in the dynamic semiconductor packaging and test services industry. The company's focus on innovation, customer-centric approach, and strategic partnerships has positioned it well for the future.

Amkor's financial performance has shown steady growth in recent years, driven by the increasing demand for advanced packaging solutions in the semiconductor market. With a diverse customer base and a strong global presence, the company has successfully navigated through various economic cycles.

The semiconductor industry is poised for substantial growth in the coming years, driven by emerging technologies such as 5G, artificial intelligence, and the Internet of Things (IoT). Amkor is well-equipped to capitalize on these opportunities with its extensive portfolio of advanced packaging and testing services.

Amkor's long-term outlook appears promising. The expansion of its advanced packaging technologies, expansive CapEx investments — such as the development of its new state-of-the-art facility in Vietnam — ongoing investments in research and development, and strategic acquisitions position the company to remain at the forefront of innovation in semiconductor packaging. The growing demand for advanced packaging solutions in the automotive, consumer electronics, and industrial sectors provides a robust growth trajectory for Amkor. It's worth noting that the semiconductor industry can be cyclical, and Amkor may face challenges related to global economic conditions and supply chain disruptions. However, its diversified customer base and extensive manufacturing footprint can help mitigate these risks.

In conclusion, Amkor Technology, Inc. presents a favorable outlook for the future. Its solid financial performance, commitment to innovation, and strategic positioning in the semiconductor industry could make it a promising investment opportunity. However, investors should remain vigilant and monitor industry dynamics and economic conditions to make informed investment decisions.

The Company

Amkor

#1 Automotive OSAT (Amkor August 2023 Investor Presentation)

Services Provided

End-Product Markets

📱 5G Communications

🚗 Automotive Electronics

💻 High Performance Computing & AI

💡 Internet of Things

End-Product Market by Revenue Contribution

-

44% Communications – Smartphones & Tablets

-

**20% Automotive & Industrial **– Advanced Driver Assistance Systems (ADAS), Safety Electrification and Infotainment

-

20% Consumer – A/R, Gaming, Wearables, Connected Home, and Home Electronics

-

16% Computing – Data Center, Storage Infrastructure, and PC/Laptops

Top Customers

🔵 Apple 🔵 Broadcom 🔵 Cirrus Logic 🔵 NVIDIA 🔵 Qualcomm

Locations

6 Locations – Mainstream Packaging and Testing

5 Locations (not incl. Vietnam) – Advanced Packaging and Testing

- Most manufacturing is located in Asia, with only 1 plant in China (not incl. Taiwan)

Other Information

59.52% – Percent of Shares Held by All Insider

38.82% – Percent of Shares Held by Institutions

-

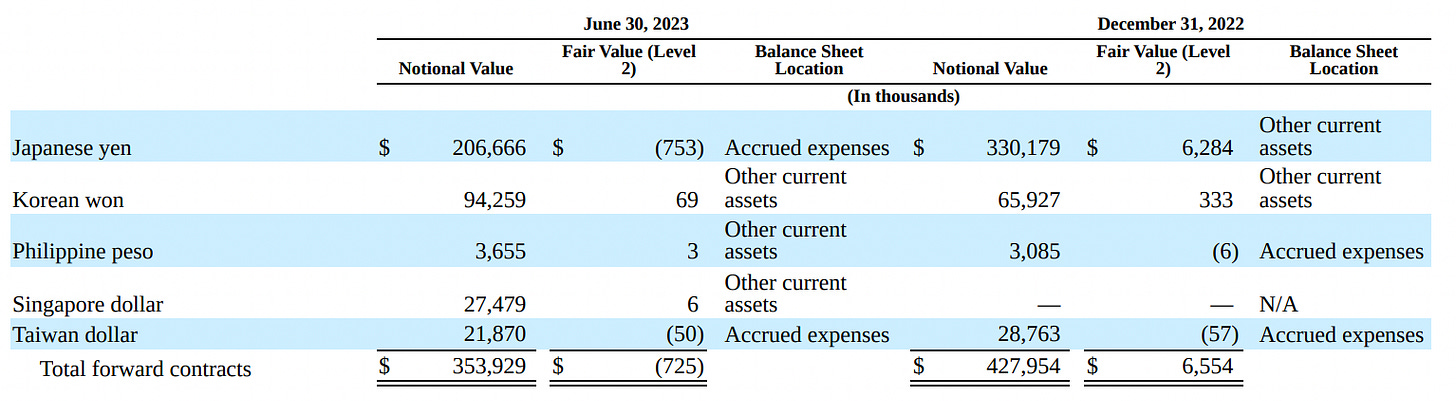

90% of Net Sales were denominated in US dollar, while the residing 10% was mainly denominated in Japanese Yen.

- Approximately 55% of cost of sales and operating expenses were denominated in U.S. dollars and were largely for raw materials and costs associated with property, plant and equipment.

In February 2023, Amkor Technology Inc. unveiled a strategic collaboration with GlobalFoundries (GF) aimed at facilitating a holistic semiconductor supply chain spanning the European and US regions. This partnership entails the transfer of GF's 300mm Bump and Sort lines from its Dresden facility to Amkor's facility in Porto, Portugal. This move represents a significant step in establishing the inaugural large-scale back-end facility in Europe.

Financials

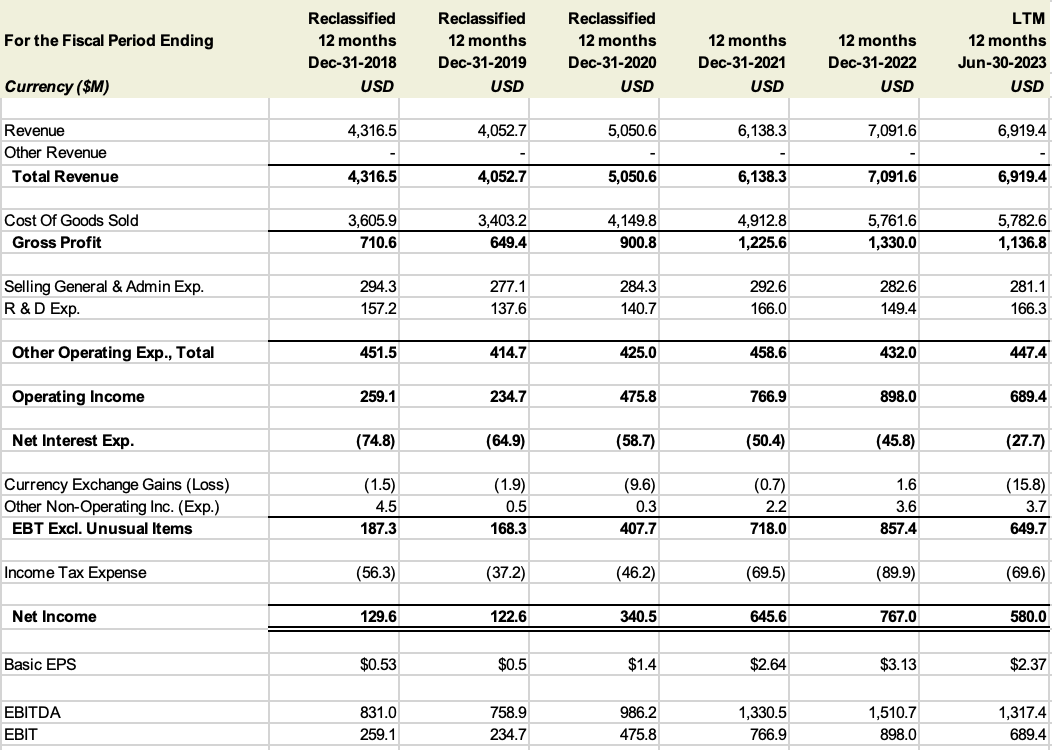

Income Statement

⬆️ Operating Income up consecutively YoY (excl. 2019)

⬆️ EBIT & EBITDA up consecutively YoY (excl. 2019)

⬆️ Net Income up consecutively YoY (excl. 2019)

Shock waves in the global supply chain due to COVID-19 caused ripple effects worldwide. As such, Amkor saw a decline in Total Net Income in 2019. However, immediately after the pandemic in 2020, Amkor saw a near doubling of their Net Income largely due to the reawakening of the world economy and global shift to widespread computational adoption (e.g., computers, AI, cloud storage, etc.).

In 2022 & 2023, the semiconductor market has seen a huge increase in demand from customers, requiring more & faster production of their next gen products. By nature this affects all parts of the semiconductor supply chain, and with major Amkor customers such as NVIDIA and Apple ramping up production of their chips to meet market demand, translating to an increase in demand for assembly in testing of those chips – an Amkor speciality.

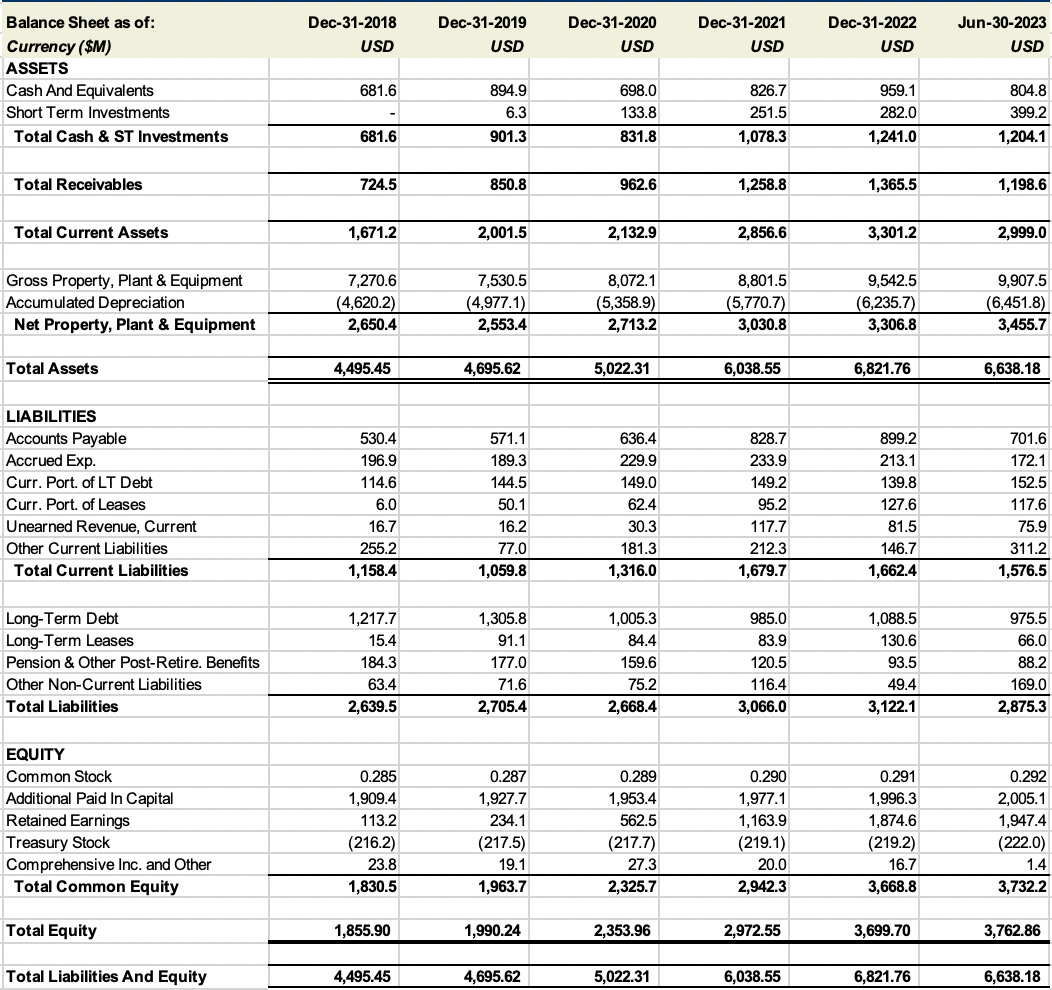

Balance Sheet

Assets

⬇️ Total Cash & Short Term Investments down 3% YTD (⬆️ up 15% YoY)

- Cash and Equivalents down 16% YoY while Short Term Investments up 42%

⬇️ Total Current Assets down 9% YTD (⬆️ up 16% YoY)

⬆️ Net Property, Plant, & Equipment up 4% YTD (⬆️ up 9% YoY)

⬇️ Total Assets down 3% YTD (⬆️ up 13% YoY)

Amkor has been able to show a constant influx of Cash and Short-Term investment YoY. Coupled with an increase of Accounts Receivables, Amkor’s Total Current Assets have proven to rise consistently YoY as well. As Amkor continues to build out its global operations (e.g. Vietnam) their Net PPE has increased 25% since 2018, showing an organization ripe with reinvestment and future outlook.

Liabilities

⬇️ Accounts Payable down 22% YTD (⬆️ up 9% YoY)

⬇️ Total Current Liabilities down 5% YTD (⬇️ down 1% YoY)

⬇️ Long-Term Debt down 10% YTD (⬆️ up 11% YoY)

⬇️ Pension & Other Post Retirement Benefits down 6% YTD (⬇️ down 22% YoY)

⬇️ Total Liabilities down 8% YTD (⬆️ up 2% YoY)

Amkor’s Total Current Assets is nearly 2x their Total Current Liabilities; with Total Assets being 2.18x Total Liabilities. Even if we assume all of Amkor’s short-term investments turn sour, the company would still be able to pay all current liabilities. Additionally, in a black swan event that all payees of Accounts Receivable are unable to pay their debt, Amkor would be in the hole $400M – a substantial amount, but one able to be renegotiated or collateralized with debt from current PPE.

While Amkor does hold a substantial Amount of long-term debt (most likely attributed to expansion efforts), long term liabilities see a decline in pension & retirement obligations due to cheap labor and other labor laws abroad. Amkor’s Debt-to-Assets ratio sits at a cool 0.18 – a very low ratio indicating an enterprise that is not highly leveraged.

Low debt load, with long-term debt fixed at low rates (e.g., 1.5%)

-

December 2022 – $1.088B

-

June 2023 – $976M

- Resulting in a $112M decreased in long-term debt in 6 months

Equity

⬆️ Retained Earnings up 4% YTD (⬆️ up 61% YoY)

⬆️ Treasury Stock up 1% YTD

⬆️ Total Equity up 2% YTD (⬆️ up 26% YoY)

While it appears Amkor has issued new shares YoY, such as the Sep. 2023 issuing of 10M shares by the Kim Family, a steady increase in the stock price and retained earnings indicate a strong operating business that is coupled with investor confidence.

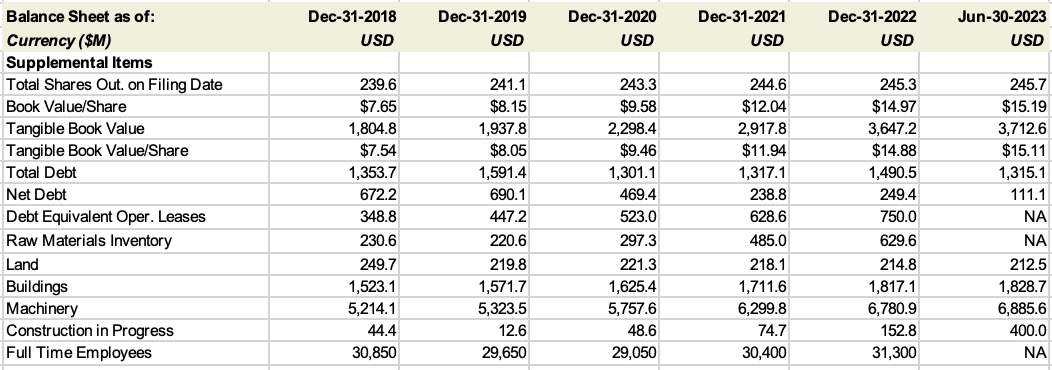

Balance Sheet Supplemental Items

⬆️ Tangible Book Value up 2% YTD (⬆️ up 25% YoY)

⬇️ Total Debt down 12% YTD (⬆️ up 13% YoY)

⬆️ Raw Materials Inventory up 30% YoY

⬆️ Land, Buildings, and Machinery 1% YTD (⬆️ up 7% YoY)

Over the past five years, the company has exhibited steady growth in key financial metrics. Total shares outstanding have shown a slight increase, indicating potential equity dilution but not to an alarming extent. The per-share metrics, such as book value and tangible book value, have shown a consistent upward trend, reflecting the company's ability to increase its asset base and shareholder value. On the debt front, while total debt has fluctuated, net debt has decreased significantly, indicating improved debt management and potentially lower financial risk. Additionally, the company has invested in fixed assets, including buildings, machinery, and construction in progress, reflecting its commitment to expanding its production capacity. However, it's essential to monitor the recent increase in raw materials inventory for potential supply chain implications.

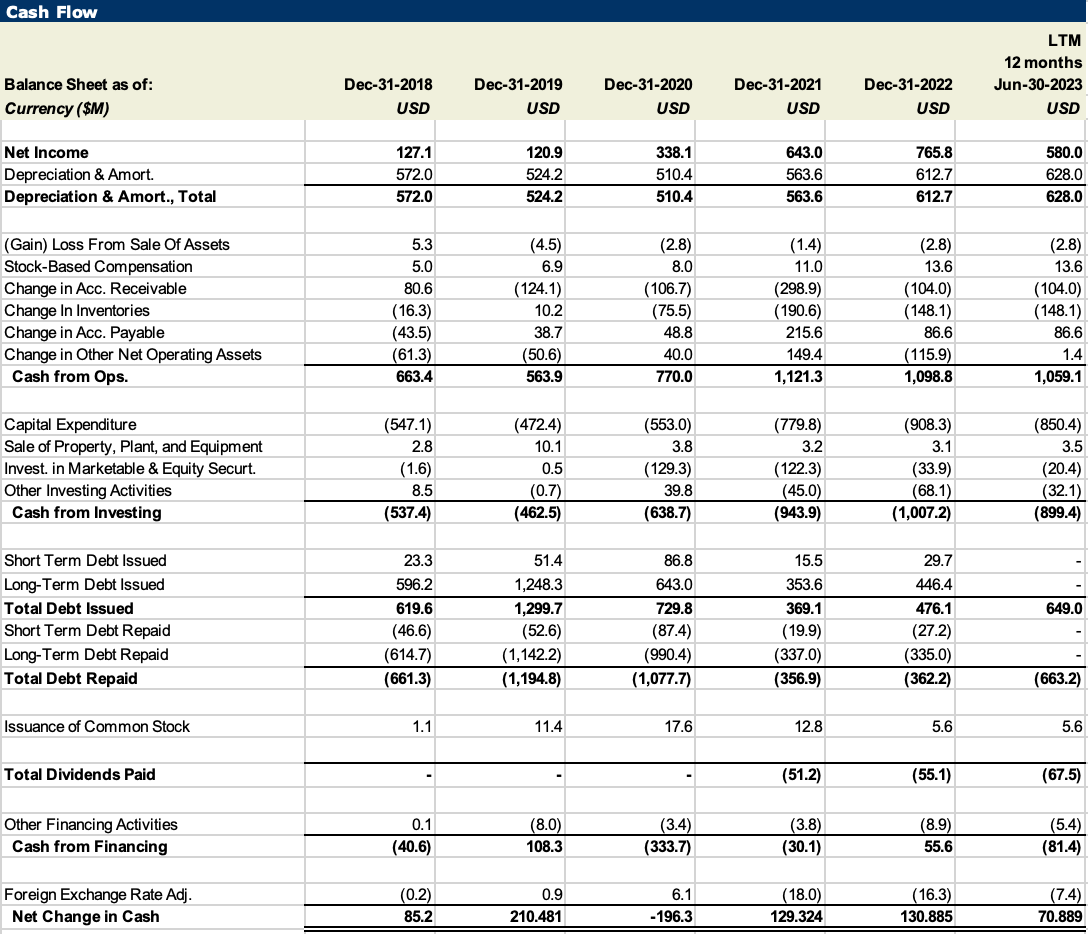

Cash Flow

⬇️ Cash Flow from Operating Activities down 2% YoY

⬇️ Cash Flow from Investing Activities down 7% YoY

⬆️ Cash Flow from Financing Activities up 285% YoY

-

⬆️ Total Debt Issued up 29% YoY

-

⬆️ Total Debt Repaid up 1% YoY

⬆️ Net Change in Cash up 1% YoY

Amkor’s financial performance has demonstrated a consistent increase in net income over the past five years, culminating in an LTM (Last Twelve Months) figure of $580.0 million as of June 30, 2023. This upward trend suggests a positive growth trajectory for the organization.

In terms of cash flow from operations, there has been steady growth, reaching $1,059.1 million in the LTM ending June 30, 2023. This reflects the company's ability to generate substantial cash from its core activities.

Regarding financing activities, the company has been actively managing its debt and equity. It issued a substantial amount of long-term debt in 2019 and 2020, likely for expansion or other strategic initiatives. There has also been a repurchase of common stock, indicating capital allocation decisions aimed at enhancing shareholder value.

Lastly, fluctuations in foreign exchange rates have affected the net change in cash, with a modest increase of $70.89 million in the LTM ending June 30, 2023. This suggests some exposure to currency risk, which should be monitored, however due to the geography of Amkor’s operations (East Asia & Europe) foreign exchange rate and currency risk is assumed.

In summary, the company has experienced growth in net income and cash flow from operations, managed its financing activities strategically, and made substantial investments in its operations. The positive trends in these financial indicators suggest a healthy financial outlook, but careful monitoring of capital expenditures and foreign exchange risks remains crucial.

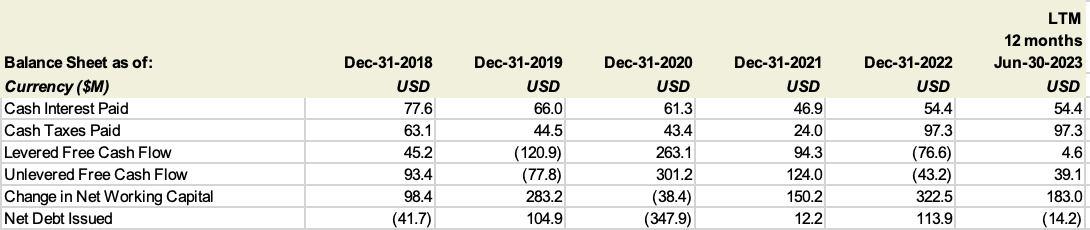

Cash Flow Supplemental Items

⬆️ Cash Flow from Financing Activities up YoY

⬇️ Levered Free Cash Flow down YoY

⬇️ Unlevered Free cash Flow down YoY

⬆️ Change in Net Working Capital up YoY

⬆️ Net Debt Issued up YoY

Amkor has successfully reduced cash interest payments and improved both levered and unlevered free cash flow, signaling improved financial stability and efficiency in generating cash from operations. However, there has been a notable increase in cash taxes paid in the LTM, which may be attributed to changes in tax regulations or increased profitability. Additionally, the change in net working capital has shown fluctuations but ended positively in the LTM, indicating potential adjustments in inventory management and accounts receivable. Lastly, the company has cautiously managed its net debt issuance, resulting in a net decrease in debt levels in the LTM. Overall, while there are areas of financial strength, such as reduced interest expenses and improved cash flow, careful monitoring of cash tax payments and working capital management is warranted.

If you liked what you read please subscribe, share, and follow us on X!