In this post, we’re going to talk about what consumer products might look like in the world of web3.

The last two decades saw the rise of consumer internet platforms. The internet disrupted incumbents across industries and gave birth to products and business models that did not exist before it. Today, many of the companies started during this period have achieved near-monopoly status. Facebook/Meta products dominate how we communicate. Uber gave birth to and dominates the gig economy. AirBnB, Amazon, Google, and others also dominate their respective industries.

The sheer size and scale of big tech is bigger than anything that we have seen before it. Some people think that these companies are now too big to fail and can not be disrupted. However, we only need to look at history to see that change is constant. Web3 is a paradigm shift. Over the next few years, web3 products with enormous scale and innovative business models will emerge.

Now before we begin, I love and use “web2” products just like everyone else. I feel we’re better off with them than without. It is also worth calling out that they have emerged as winners in a free market and haven’t licensed or cornered their way into a monopoly. To be amply clear - this post is not a call for regulators to break up big tech. Web3 is being built on the back of web2.

Why web3 is different

At this point, most people are familiar with the “read-write-own” definition of web3. However, for people on the outside looking in, it looks like a group of people that operate almost like a cult and seem to get a lot of joy from monkey JPEGs. How much web3 fundamentally changes things is often underestimated.

Building for web3 requires unlearning some web2 mindsets.

Open data

When we look at the monopolistic winners of web2, a pattern that keeps emerging is that of free products with ads. Obviously, if the product was actually free those companies would not be worth billions of dollars. You pay with your data. As made famous by the social dilemma, these companies create a model of you based on an insane number of data points. Advertisers pay for the ability to target you with extremely specific and relevant ads. This is very lucrative. The ARPU for a Facebook user is around $40 (this is a global average and varies wildly across countries). Google and Facebook can name their price for targeted ads because no one has more data points on their customers. These companies maintain a competitive advantage only because your data is locked in their platform.

In web3 this model straight up is not possible. User data is on-chain, anyone can see it and use it. You can’t build walled gardens of user data. Most dApps only know you by your wallet ID. There are some ways of fingerprinting wallets based on on-chain activity. However, there are technologies in development that will make this impossible as well. ZK technology and other privacy measures can create a world where no one can have unauthorized access to your data. As the saying goes, Can’t be evil > don’t be evil.

This is not to say that ads are irrelevant in web3. Open data, like decentralization, is not binary. It is a spectrum. There are dApps where everything happens on-chain, but there are also app/dApp hybrids that use a combination of on-chain and off-chain data and storage. An example of this would be the Brave browser. They still show you targeted ads based on your search history but give you a share of the upside (you get paid in Basic Attention Tokens ($BAT)). They also make it easy to opt-out. Obviously Brave does not store all user data on-chain. I don’t think anyone would be happy with their search history being open to all and living forever on the blockchain. This “web 2.5” approach strikes a fine balance between monetization models needed to keep products accessible and sustainable but also empowering consumers with meaningful choices on how their data is used.

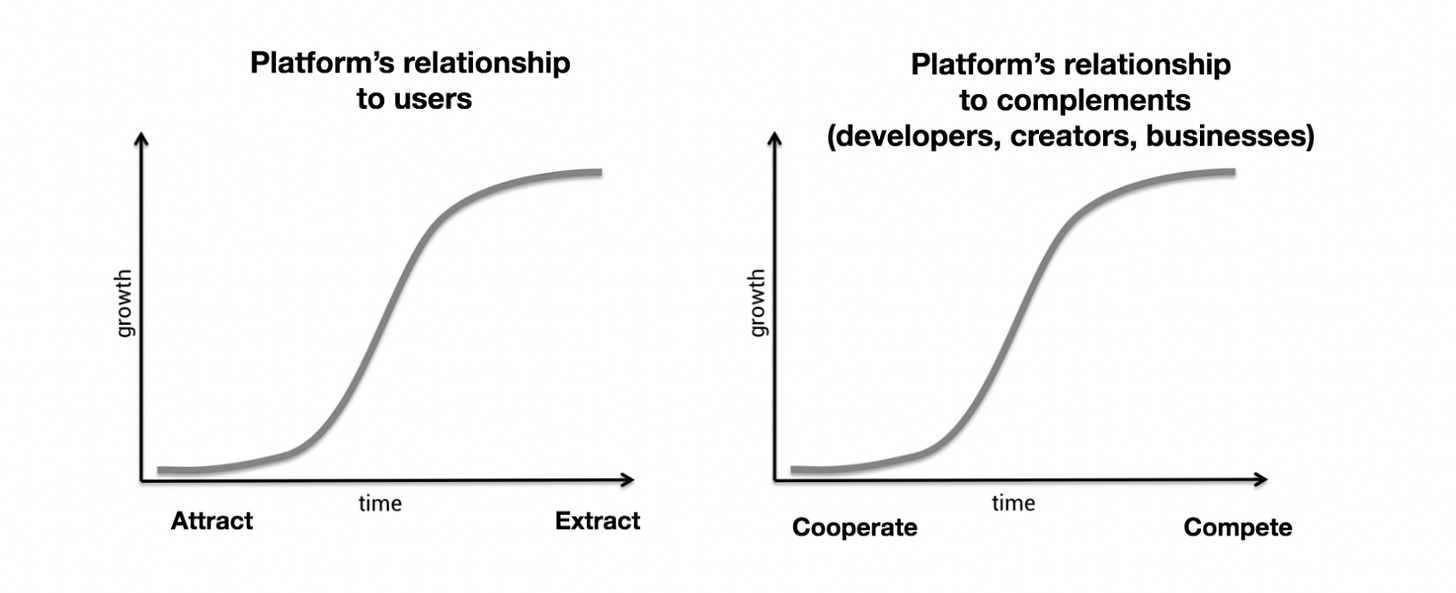

Web2 platforms rely on locking users in. They do this by initially offering a great product at a great price. This initial phase of heavy subsidization is driven by VC money. Remember how cheap Ubers and AirBnBs were? After achieving critical mass and building a defensible network, the platform now moves towards extracting value from consumers and complements. This process of extracting more value from the system without meaningfully improving it is known as rent-seeking.

Rent-seeking is not sustainable in web3. Since data can be accessed by anyone and code is open-source, the barriers to entry are much lower than in web2. dApps that try to rent-seek are going to get forked. More on network effects and how it applies to web3 later.

Permissionlessness

Web2 apps typically don’t want to play well with outsiders. You generally can’t build on top of them without special access. This currently plays out as “developer policy” discussions governed pretty much solely by these platforms. Even when they do open up APIs they hold all the power. They can shut off their APIs at any point, crippling apps and services built on top of it.

There are countless cases of apps deciding to cut off third-party access. A great example of this is Twitter. In the early days of Twitter, anyone could build a client. APIs gave you access to all the core features. Clients that had more features, tools for power users, and better UX than the native app emerged. Some clients like Tweetdeck became extremely popular. One day, Twitter decided to turn its APIs off. The entire ecosystem immediately collapsed. Reddit has also seen waves of opening up and closing down access to the platform. Asking for permission can be a very real detriment to innovation. Smallcase, an Indian startup that helps you build and invest in stock indices, had to grind its way through every single broker integration. This was such a pain that they came up with a feature where you as a user could one-click tweet to your broker requesting a smallcase integration. So many people used it that they had to eventually turn it off, but it got the job done. Most popular brokers are now integrated into smallcase.

“This (closed systems) creates a natural limit to competition and natural suppression of innovation. Any given database is proprietary, controlled by a specific app and siloed off from any other use cases. Only the company that controls that database can build new services or interfaces with it or permit others to do the same. And only in exceptional and intentional cases - one-off integrations or pre-defined APIs - are data shared between products.”

dApps function using code deployed on-chain known as smart contracts. Smart contracts are truly permissionless. You are free to build on top of it. Anyone anywhere can call its functions. Gas costs naturally disincentivize spam. You can even fork it and make it your own.

The combination of open data and permissionlessness forms the basis for one of the most powerful forces in web3- composability.

Composability refers to how you can stack protocols together. One of the earliest practical applications of this was in DeFi, which is why it is often referred to as money legos. You can string together existing protocols, add your own protocols, and create something that would have been impossible to build in a closed system. This post and this post list out several ways how composability unlocks innovation.

Code is law

Smart contracts are immutable. Once deployed, they can never be changed and live as long as the underlying blockchain lives. This is a far cry from the world of A/B testing and the move fast and break things approach. No single centralized group can call the shots.

This does not mean that it is perfect. Code is written by humans, and they often pass on biases and mistakes. However, over time, it tends to become robust.

This also does not mean that you have only one shot to get everything right. Protocols upgrade versions all the time. However, upgrading a protocol means deploying a new smart contract. The previous version will always exist. You need to get all stakeholders to point to the new contract. This may include dApps that use your protocol, people running network nodes(validators), etc.

Products vs Protocols

The internet runs on protocols like HTTPS, FTP and SMTP. Trillion-dollar companies have been built on top of these protocols. However, despite so much value flowing through it, internet protocols have no intrinsic economic value. In web3 this is reversed, thanks to tokens. When value flows through a protocol in web3 the protocol actually accrues value.

This is not to say that web3 apps won’t be valuable, just that protocols will end up being much more valuable. Quoting Sai, the internet saw fat apps and thin protocols. Web3 will see thin apps and fat protocols. While value capture is reversed, usefulness is still tied with apps. As a result, many startups build both the protocol and dApps that users can use to interact with protocols. Protocols may even incentivize dApps to build on top of it with grants and token-based incentives. Protocols need dApps built on top of it to succeed.

A good thread on how bluesky is thinking of building a decentralized social protocol.

The tweet below is a good example of how the “Twitter protocol” - a messaging service where you don’t specify the recipients & “Twitter app” - a discovery service that shows you the “best” content of the Twitter protocol for you, could have been two very different products. In web2 this is bundled into a single app, while in web3 it is often two distinct components.

Before we go further let us reiterate some terms and how they are used in this article

-

Apps: Applications. Centralized. Will not ask you to connect your wallet.

-

Smart contract: Code that lives and runs on a blockchain-based smart contract platform like Ethereum and Solana. Bitcoin can not run smart contracts.

-

Protocols: One or more smart contracts that do a specific task. A protocol could be comprised of other protocols. L1s like Ethereum, Solana, etc. and structures built on top of the L1s like Aave, Fractional, Serum, etc. are both referred to as protocols.

-

dApps: Decentralized apps. Frontend to smart contracts. Will ask you to connect your wallet. dApps are how end-users interact with protocols. A single app may run on multiple protocols. Examples include Matcha, Mirror, Partybid, etc.

How to build a winning protocol in web3

A good way to think of web3 protocols is like a nation-state.

-

The token acts as the currency. It measures the total value (GDP) of the protocol & helps coordinate between all the stakeholders in the ecosystem.

-

dApps built on the protocol act as businesses

-

Users interact with the protocol via dApps.

-

dApps need to pay a “tax” for running their storage and computing on a blockchain. This is known as gas costs.

-

Interactions between the protocol and the underlying blockchain are done in the blockchain’s native token (ETH, SOL, etc.). Interactions with other protocols may require the other protocol’s token.

To build a winning protocol in web3 you need to nail two things

-

Utility

-

Economics

Utility simply means that your protocol needs to be useful. Over a reasonable time horizon, we believe this is the single largest driver of how valuable it is. Some ways of quantifying usefulness are:

-

How much economic value flows through it

-

How many other protocols/dApps need it to function

-

How many users interact with it, directly or indirectly

Economics refers to how your protocol’s token flows in the protocol’s ecosystem. The protocol increases in value when the token price goes up.

Expected future demand & supply is the premise of all price action for anything (BTC, Gold, stocks, etc). ie. you need to grow demand faster than supply. The most powerful forces that drive this (in decreasing order of importance) are

-

Demand for the utility of the token. For example, dApps might need to hold your token to interact with the protocol, spend it to access certain features in your protocols & holders could earn decision-making power by staking.

-

Lowering supply by making the token disinflationary or deflationary. This can be controlled by adjusting the inflation rate, capping supply or burning tokens.

-

Memes

The key to designing the “economy” of your protocol is the aligning of incentives. Behaviours that add value to the protocol should be rewarded and behaviours that are harmful to the protocol must be penalised. Behaviours that consume value could be charged. The token helps tie all of this together and orchestrate your economy.

A good example of this is the Audius token. Here’s an excerpt from their whitepaper:

Audius platform tokens (ticker $AUDIO) have three prongs of functionality within the protocol unlocked by staking:Security, Feature access & Governance. Audius tokens are staked as collateral for a valueadded services. In exchange, stakers earn ongoing issuance, governance weight and access to exclusive features. Audius tokens are staked by node operators to run the Audius protocol, and by artists and curators to unlock exclusive features and services.

Any $AUDIO staked within the protocol is assigned governance weight, used to shape future iterations of the protocol. Audius tokens will serve as collateral for artist-based tooling as well. Early examples incubated by the community include artists tokens, badges and earnings multipliers.

In the future, fans may delegate tokens to specific artists and curators to share in their growth on the platform and the issuance of future tokens. Node operators must stake Audius tokens to operate a discovery node or content node, with a larger stake correlating to a higher probability of being chosen by 4 fan clients. Node operators receive direct upside from seeding in the form of $AUDIO and the possibility for future protocol fees for actively seeding the protocol.

A community goal, via governance, is to ensure that Audius tokens are always being funneled to the most value-added actors by using onchain metrics as a measurement, rather than simply to those staking the most tokens but not actively participating in the ecosystem.

If your protocol does not have a token it may be susceptible to vampire attacks. This is when someone forks your smart contract but integrates a token. Since incentives are better aligned when there is a token, users of your protocol flock to the new protocol. The most famous case of this is the Uniswap/SushiSwap vampire attack. Uniswap was able to stop the bleeding by launching a token of their own. However, Sushi made a lot of headway and is still one of the most valuable crypto projects today.

Hyperstructures

Hyperstructures are the gold standard for protocols in web3 (all credit for coining this term goes to Jacob).

Hyper structures are crypto protocols that can run for free and forever, without maintenance, interruption or intermediaries.

It has the following properties

-

Unstoppable: The protocol can be run as long as the underlying blockchain(s) exists. It is not dependent on any centralized intermediary, infrastructure, or non-hyperstructure protocol.

-

Free: Hyperstructure protocols take zero fees. The only fees required to run it are the gas fees of the underlying blockchain. There is no revenue.

-

Valuable: Despite not having any fees, hyperstructures accrue value based on how useful they are. This is orchestrated by the underlying token appreciating in value.

-

Expansive fees: Hyperstructures may charge fees to enhance the value of the protocol. However, these fees will not go to the people who built the hyperstructure. They will be used to align incentives. They will be designed to incentivize good actors and discourage bad actors. dApps built on top of hyperstructures may charge fees.

-

Permissionless: The code lives on a blockchain. Anyone anywhere can call the protocol. Anyone can build on top of it.

-

Credibly neutral: The protocol does not and can not subjectively discriminate against anything. Code is law.

Since fees are literally zero, hyperstructures are immune to blind forking. There is no way that competition can undercut you. The only reason to fork a hyperstructure is if you want to change the underlying protocol. Over time the most useful protocol with the best incentive structure will emerge as the winner. Some hyperstructures that exist today are Uniswap and Zora.

How to build a winning product in web3

Building dApps is much more similar to building traditional products in web2. They often have revenues similar to traditional companies. dApps may or may not have tokens. If they do, they function similarly to shares in traditional companies(although people try to skirt around this to avoid getting tangled up in securities law).

Since the underlying protocols are open and permissionless, the best product in the market has a real chance of emerging as the winner. The barrier to entry for competitors is typically much lower than in web2. To build a winning app in web3 it is important to nail the following three characteristics

-

UX: This is important in any product but is more important than ever in web3. The main value adds that your dApp offers vs directly interacting with the protocol is to improve the user experience. One great way to do this is to create a “gasless” experience. Most dApps prompt users to approve transactions each time some action takes place. If your dApp can obfuscate interactions with the blockchain and figure out a way to cover gas costs from another revenue source, you can provide a better experience to end-users. A good example of a product that does this well is Mirror.

-

Minimally extractive: As a dApp, it is fair to capture a portion of the value you create. However if your cut is too high, competitors that undercut you might spin up. This happens in traditional businesses as well but in web3 the barrier to entry is much lower. Over time, competitors whose fees are unsustainably low and exploitatively high will die. dApps that fall prey to rent-seeking could be quickly disrupted.

-

Brand: This is a combination of several factors that increase customer trust. Some factors that improve the brand include a proven track record of executing well, a star team, high-profile backers, security audits from reputed firms, marketing (organic and inorganic), etc.

While protocols will end up being more valuable, there will be fewer winners. Individual dApps will be less valuable than protocols but there will be more winners.

Powers in web3

Power: the set of conditions creating the potential for persistent differential returns.

One of the best frameworks for analyzing strategy is the 7 powers framework by Hamilton Helmer. In simple terms, powers are moats- they make your company more valuable and make it harder for competitors to disrupt you. Let’s take a look at how the powers hold up in web3.

Overview of the 7 powers

Let’s understand how these apply to web3 products.

Economies of scale

This refers to marginal cost going down. A good example of this would be in manufacturing, where it is cheaper to produce 10M of something than 10(on a per-unit basis). Software typically scales infinitely and marginal costs tend to zero.

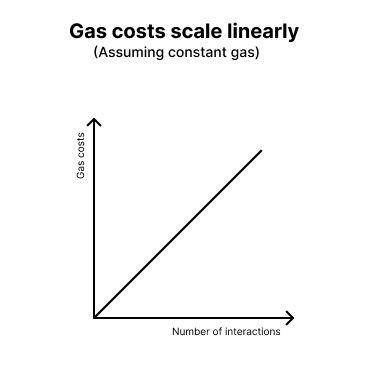

Real-world components (atoms) of a business could benefit from economies of scale. but this does not really apply to web3 products. If anything, it may suffer from the opposite- having a constant marginal cost. Blockchains have gas fees, and gas fees are constant for an interaction. Gas fees don’t depend on the size of the transaction but on the type of transaction. eg. Transferring 1 ETH and 100ETH will cost the same amount of gas.

In practice, gas costs vary wildly and can be very different even within a minute.

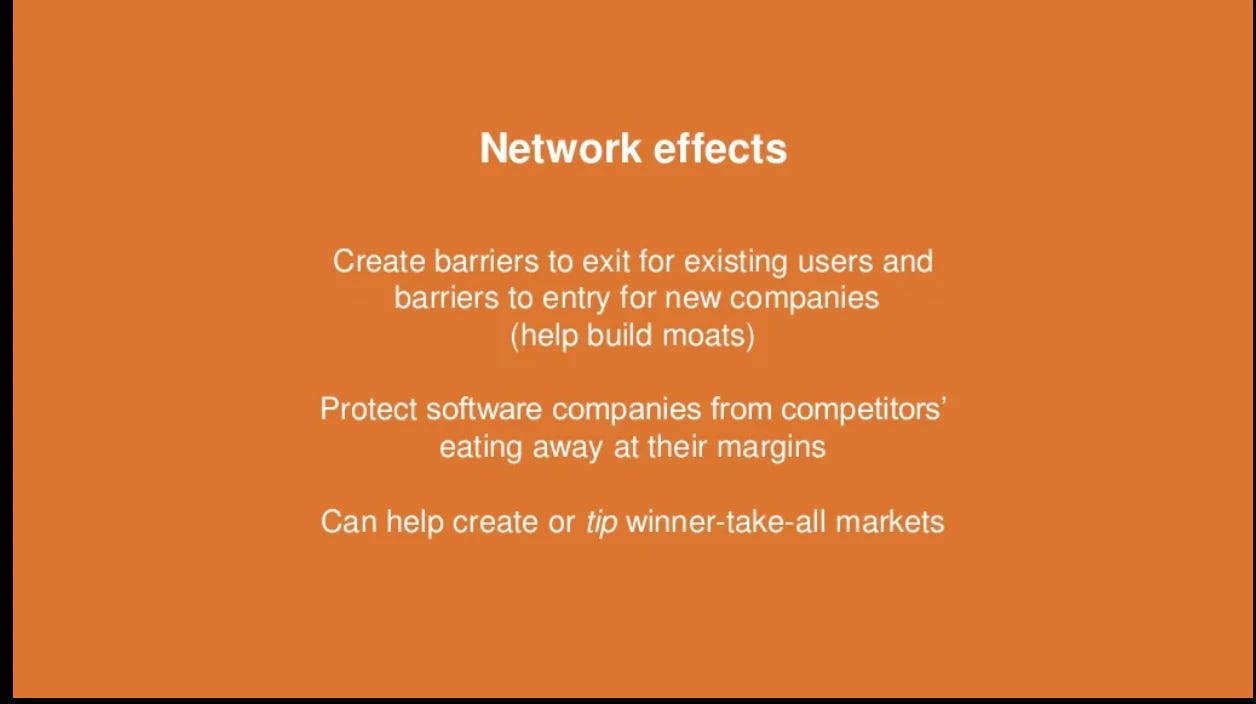

Network effects

This fundamentally changes in web3. A brief summary of network effects is that your product becomes more valuable with each new user. You can read more about network effects here.

The company most famous for its network effects is Facebook/Meta. Facebook products work only when your friends are on them. Early product teams at Facebook obsessed over the 7 friends in 10 days metric. For every new friend of yours who joins, the joy you get out of Facebook increases from no apparent action on your part.

Network effects are one of the most powerful and desired powers. TikTok and YouTube work so well because there are thousands of hours of user-generated content created every day. Network effects are very defensible, it’s really hard to build a competitor for a web2 company with strong network effects.

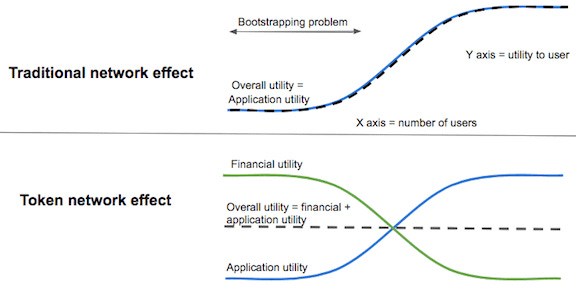

dApps on web3 run on an open data paradigm- data is not owned and walled inside applications but on open blockchains. This means that users have the right to exit with their data. However, web3 still has network effects

-

Layer 1 blockchains have network effects. The most valuable L1 is the one with the most users and best dApps on it. This may fade as cross-chain bridges and modular blockchains catch on. However, it is highly likely that a very small number of chains will emerge as consensus chains due to it having the most network effects. We might even end up with just one consensus chain that acts as the definitive source of truth. Other chains will have to sync with and settle onto consensus chains.

-

Protocols can have network effects. The key difference is that these network effects usually aren’t defensible. What this means is that protocols can be come more valuable with each incremental user, but they are free to take their data and move to another protocol. Protocols and dApps need to incentivize users to stay using other methods. A practical example of this is liquidity pools in DeFi. Pools become more valuable with each new LP(liquidity provider)- the swap experience for the pool improves. However, LPs are free to take their assets and leave. Protocols incentivize them to stay with rewards. Instead of being locked into a platform like in web2, the protocol rewards you the more time you stay with it.

-

Sidechains that don’t commit everything to consensus chains and dApps that store data off-chain could maintain data moats and thereby network effects. dApps may even store encrypted data on-chain and keep the key secret. However, these are risky and controversial approaches. Many web3 users want to maintain the right to exit. A good middle ground might be that all user data and user-generated content be put on-chain, while anything created by the app(like a UI, video editor, or algorithm) be kept off-chain and/or licensed.

When building two-sided marketplaces in web3, token incentives can be used to kickstart network effects and solve the supply side of the cold start problem. You can read more about that here.

Counter positioning

There are two levels of counter positioning in web3

-

Web3 as a whole is counter positioning against web2. Web3 business models can’t be replicated by web2 companies.

-

Within web3 there are entities that counter-position against each other based on differing values. Examples of this are building on one chain vs the other (eg. Wonderland is the Ohm of Avalanche), collateralized vs algorithmic stablecoins, etc.

Switching costs

Across the board, switching costs are much lower in web3 (at least within a chain). You are probably not going to get a web3 SAP that people hate but still use purely because it is too much effort to move to something else

Brand

Brand remains a very important power in web3 (some reasons were mentioned earlier). Brand can’t be forked.

Cornered resources

Web3 gives everyone equal access to all assets on the blockchain. Community and talent might be the only cornered resources in web3. There are some cases of web3 native companies keeping core software components open-source but licensed(eg: Uniswap v3).

Process power

Web3 protocols that function as DAOs could have an advantage over organizations with traditional structures.

-

DAOs tend to be remote-first. This unlocks the global talent pool.

-

Contributing to DAOs is often flexible and has lower barriers of entry than trying to contribute to a traditional organization.

-

DAOs are more transparent and less susceptible to bureaucracy.

Web3 might make it possible to introduce a new power- community. Community ownership gives people early exposure to upside. This aligns incentives really well. Your community really wants your product to succeed as they will economically benefit from it. Community members become your first customers, your best salesmen and your harshest critics. They will spend their time and effort shilling and improving your products. The DAO structure makes it seamless for people to get rewarded for their contributions. If your product relies on user-generated content, members of your community will be your first contributors. Token incentives can members help bootstrap network effects. Community might be the most effective moat in web3.

It is important to note that powers should be pursued only post PMF(product-market-fit). Launching a token too early can make it extremely confusing to separate signal from noise. Also, the “wen moon” comments will be non-stop. A good way to go about this would be to focus on building a great product and reward early contributors post PMF with a retroactive airdrop.

Case studies

Wordcel

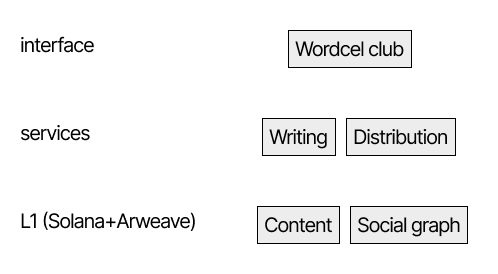

Wordcel aims to be the protocol primitive for on-chain content distribution on Solana. It has two main functions

-

Allows you to seamlessly post content on-chain. Content is hosted on Arweave.

-

You can follow and be followed by others, creating an on-chain social graph.

It is a project by the resident gurudev of Superteam DAO- shek.dev. It won the web3 track at the recent Riptide hackathon.

Let’s take a look at how the wordcel protocol could function. This is purely theoretical. Wordcel currently does not have a token. Shek was not involved in designing this

For the sake of discussion let us assume that the wordcel protocol has a token called $WORD.

Applying the nation-state analogy to wordcel

-

$WORD is the currency

-

Wordcel club is a dApp on the wordcel protocol. Users interact with the protocol through the dApp. Wordcel club acts as a business.

-

Wordcel needs to use other tokens to interact with other nation-states. It uses $SOL to interact with Solana and $AR to interact with Arweave.

-

Users(citizens) are incentivized to perform actions that add value to the protocol and increase the value of $WORD.

As mentioned earlier, protocols should reward actions that add value. In wordcel’s case this would be

-

Posting content. Contributors would be rewarded with $WORD. This can have a fixed base reward and a variable reward. The variable reward is streamed to the contributor based on how much their content is consumed. The base reward incentivizes contributors to increase their frequency of contribution (although it would need to be capped to avoid spamming and farming rewards), ie. quantity. The variable portion rewards quality.

-

Expanding the social graph. Users could get rewarded proportionally to the number of followers they have.

In order for the wordcel protocol to accrue value, $WORD price needs to go up. Without diving too deep into tokenomics here are some things wordcel can do to make number go up.

-

Make $WORD useful

-

$WORD is needed to access gated content.

-

$WORD holders have a stake in governance

-

Requiring people to hold a certain amount of $WORD to post content. This could also help fight spam. However, this needs to be carefully considered so that it does not become exclusionary.

-

-

Make $WORD disinflationary/deflationary:

-

$WORD could have a fixed supply or a decreasing emission schedule

-

Wordcel allows creators to gate content to paid subscribers. A portion of this subscription fee(paid in $WORD) could be burnt.

-

-

Disincentivize trading $WORD for another token. This could be done by offering a decent APY for contributors that don’t withdraw their contributor rewards. Otherwise, contributors might immediately cash out to another token.

-

Create great memes that inspire a cult following on Twitter to put (📚, 📚) next to their username.

The first and third point reduces supply. The second point increases demand. The fourth point probably makes number go up more than everything else combined.

Protocols are often useless without dApps built on top of it. Wordcel club is a dApp built on top of the wordcel protocol. It focuses on long-form written content, kind of like a web3 Substack. Wordcel club is being developed by the core wordcel team.

To build a great long-form written-content platform, you need to crack the following

-

Great creator tools: Editors, version management, collaboration, etc.

-

Great content discovery mechanisms: Feeds, newsletters, etc.

-

Maintain reader <> author relationships.

Web2 platforms like Medium and Substack bundle all of this into a single product.

Web3 splits this up. The wordcel protocol allows you to create content and build a social graph. Wordcel club focuses on one type of content- long-form writing. People are free to build their own content distribution dApp on top of the wordcel protocol. Some examples of this could be a podcast dApp, a dApp that limits written content length(like Twitter), and a short-form video app(like TikTok).

Wordcel club should have its own revenue stream. It can use part of its revenue to subsidize user gas costs and create a seamless UX. Some potential revenue streams for wordcel club are

-

Allowing users to mint their post as an NFT from within the platform, and taking a portion of secondary sales.

-

Allowing users to tip contributors and take a cut.

-

Allowing contributors to have “promoted articles” ie paid ads.

Wordcel club can also set up its own reward structure for user actions that make wordcel club more valuable. Some user actions that can be rewarded include

-

Highlighting parts of posts that are interesting

-

Upvoting and engaging with content

-

Curating content into lists

Conclusion

The next decade of products are going to be built on open-network and accrue value to anyone who contributes to the network. Consumers are going to be more in control of their data. Today’s platforms are going to be split across protocols & dApps. We will probably have a few winning L1 consensus chains. For both protocols and dApps, highly specialized projects will win out over more generic applications.

Peter Theil argues that winning monopoly status is key to providing the runway needed for innovation. ie. Platforms that are monopolies will make a lot of money and invest it into innovation. However, this is like praying for a good ruler in an autocracy. Platforms are free to do whatever they want with their money and most profits will end up in executives’ pockets. There are platforms that have done a lot of good- Facebook created and continues to support several extremely important projects such as React, React Native, Pytorch, Docusaurus, etc. However, we should not rely on monopolies to support digital public goods and innovation. In web3, innovation is more diffused across the ecosystem. Crypto makes capital and human coordination more seamless than ever through DAOs. Open networks make access to data extremely easy. Web3 innovation is unlocked by groups of people united by common goals pooling capital and/or building cool stuff.

Exciting times ahead.

This post was written in collaboration with Aditya from Superteam.

Cover image source here