The Ethereans Organization has been in existence for more than a year and over that time much has changed from the macro economic climate, to the general crypto landscape, to the activity of the Organization itself. Ethereans have witnessed the Terra Luna collapse, the 3AC bankruptcy, and the downfall of FTX, all of which highlight some of the massive problems that come from centralized and poorly regulated crypto entities. During all of this, the Organization we all belong to has hummed along smoothly, fueling an economic engine that empowers citizens through delegations, while allowing them true control over the economics of the protocol in a way no other DAO ever has. Here, we will reflect on the history of the Ethereans Organization and the state of our union.

Economics

The economy of the Ethereans Organization has been humming along steadily since its inception. Powered by routines, the economic system requires no intervention from the team and is capable of running autonomously for many years to come. While the famous examples of farming usually involve crazy APY and sometimes catastrophic crashes, Ethereans Organization has proven that fair inflation is a reliable and long-lasting way to fund development. Inflation is currently set to 8% per year, 30% of which is sent as rewards to the farm to incentivize OS liquidity in a maximum range Uniswap V3 pool. The remaining 70% is sold for ETH and split in the following way.

In this system, a fixed amount of OS is rewarded daily to all farmers. A natural equilibrium emerges. As more liquidity providers join the farm, the APY goes down and disincentivizes additional farmers. At the 8% inflation rate, Ethereans OS token has one of the healthiest TVL to market cap, and TVL to circulating supply ratios on Uniswap. At the time of writing, $OS is ranked #1375 on CoinGecko with ~$4m market cap, yet is ranked 47th on Uniswap by TVL. This responsible and sustainable farming mechanism has funded the Ethereans Labs and provided immense value to the on-chain Ethereans OS Organization since its inception and through tremendous market downturns.

To break down some of the key numbers:

113 ETH has been distributed over four treasury splits to five distinct delegations.

77 ETH has been used to attract liquidity in the dividends farming pool.

71 ETH has been invested through the investment fund.

23 ETH has been placed in the root treasury.

EthereansOS also launched on Optimism! Using Colonies, revenue generated on Optimism is able to be automatically transferred to the treasury splitter on main-net.

All of this during an overall market downturn that has seen many other projects close up shop. We greatly look forward to what an overall market upturn will bring this way.

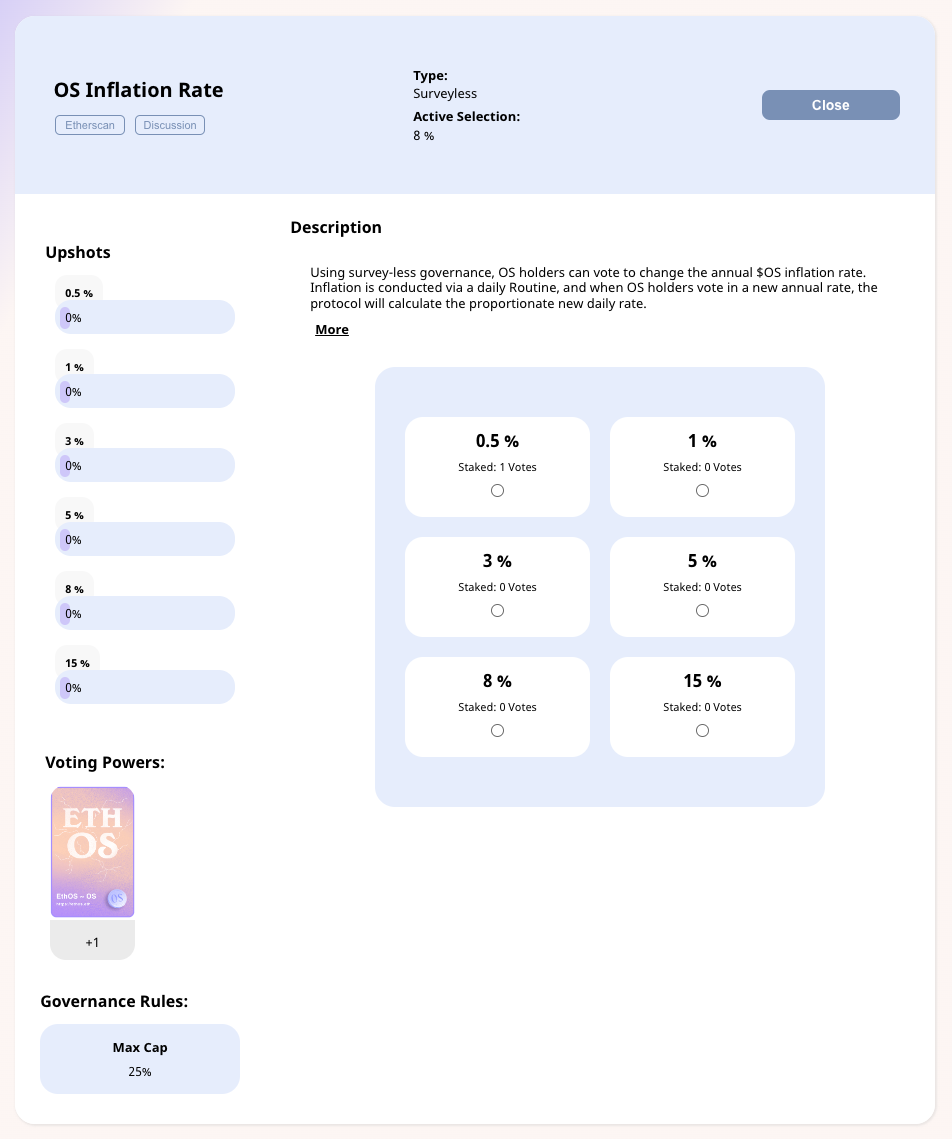

The inflation rate is governed by $OS tokens directly using the Inflation Rate subDAO. The following proposal template restricts the values to those shown, and requires 25% of the circulating $OS supply to change its value. The core team at Ethereans Labs has no control over this parameter, as the power to change it has been delegated solely to the subDAO.

OS-UP’s

Over the past year, there have been four upgrade proposals to the Ethereans Organization. These are proposals to add or change modules attached to the Organization or utilize funds in the public treasury. All upgrade proposals are proposed by Ethereans Labs and then must receive support from token holders in order to be executed.

Voting

The Organization is setup so that each time a root proposal (i.e., not a subDAO proposal) is created by Ethereans Labs through the Proposals Manager, an 8-day voting process occurs. At any time within these 8 days (57600 blocks), if the number of approving votes reaches 15% of the circulating supply of OS (~150k), the proposal can be executed. Otherwise, votes may be counted after the ~6 day voting period (44800 blocks). If a quorum of 10% of the circulating supply is actively voting, the proposal can be executed in favor of the winning vote (approve or refuse).

OS Upgrade Proposals

The first was proposed on February 16th, 2022 and would attach a new delegations manager component to the Organization, opening the pathway for citizens to lead initiatives utilizing funds provided by the Organization. The new version allows an amount of OS to be staked by Delegation owners as collateral, starting at 250 OS, so that in the case of bad acting, a proposal from Ethereans Labs can potentially ban the organization and collect the collateral. This proposal passed with over 157k votes for and none against in under eight hours. The profound consequences of this upgrade deserves its own section.

The second proposal, launched June 29th, 2022, proposed using 100 ETH from the Organization’s public treasury for a token buyback program to fuel rewards for an upcoming campaign. This proposal was a routines contract that would transfer 100 ETH to a team controlled wallet when executed, where the funds would be used to purchase OS from the Uniswap pool. It passed less than two days later with over 158k votes for and 1964 votes against, which is actually the only time we have seen the against votes used for a proposal.

While the first two proposals were proactive, the next two proposals were responses to minor exploits found in two of the Organization’s components. Both of these exploits were noticed in the Dune analytics dashboards, highlighting the key design philosophy of EthereansOS that all actions happen on-chain. This makes Dune analytics an extremely powerful tool to monitor the health of the Organization. When a problem is identified, it is possible to easily identify the Component that needs repair.

The third proposal was to change the components for the inflation and the investment buy and sell routines. Citizen Circle Square found that routing a daily inflation sell through a liquidity pool the executor owned resulted in the executor effectively being able to purchase OS from the protocol well below the market price, robbing the Organization of the revenue of inflation. While only demonstrated with inflation, the investment manager was vulnerable to the same type of attack. This was easily fixed by locking the sell path inflation and the investment manager used in an update to the component factories. The proposal, introduced August 9th, 2022, was passed five days later with 159k votes for and none against.

The latest upgrade also involved a bug fix, this time with how rewards were handled from farming. An unknown exploiter was able to route a single individual’s farming rewards through the Factory of Factories and sell a few dozen tokens to the liquidity pool, profiting around $150. This exploit was caught on the Dune analytics since it routed the tokens as through they were fees, leading to an easy-to-spot anomaly. OS-UP #4 introduced a fix to swap the farming component for an updated version that was not venerable to this same attack. After being introduced October 29th, 2022, it was passed by quorum just over six days later with 113k votes for and none against.

All of these highlight how Organizations can be managed, launching planned upgrades, campaigns, and bug fixes though the system of root proposals where only the components in need of upgrading, adding, or fixing are modified while the other parts remain unchanged. In these, citizens have the ultimate say in how the future of the Organization looks and operates, all of these updates were only executed because of the voting support of the token holders.

Sub-DAO Updates

Recently, citizen and Ethereans Labs member JPN introduced a subDAO proposal to change the tokens bought by the investment fund. After discussion, the updated tokens were selected as rETH, USDC, ENS, and GTC. The proposal was launched and passed in the week before the treasury split that occurred on February 10th, 2023. A tutorial surrounding subDAO proposals was made which included the submission transaction for this proposal.

While the effects of this change likely will not be felt for some time, it proved that the system of economic proposals from the community functioned as intended. These are the tools that empower real decentralized communities to manage the finances of an Organization without a centralized entity.

Delegations

There were three delegations that launched when Delegation first went live: Cyphers, EthereansPL, and Ethereans Community. All three sought to add value to the Organization in their own unique way, ranging from technical bounties, to sparking the interest in a developer community, to promoting and advertising the tools EthereansOS had to offer. The bounty program by Cyphers lead to the creation of the Dune analytics and EthereansPL has motivated developers to begin building using the EthereansOS tools on the Goerli test-net. More recently, NerdDAO formed a delegation and began building fork-able front ends for the factory farming contracts to allow developers to seamlessly include farming management for their projects. Ethereans Community also turned the reigns over to the Ethereans Labs team, who are currently running the delegation as a way to supply rewards for future releases. Most delegations have not spent all the funds they have received so far, meaning new initiatives can come from them at any time with funding already secured.

All of this has occurred in just one year since delegations were launched. There is still vast potential for new delegations to spawn and be able to add value to not only the Ethereans organization, but also to new Organizations that will come.

Future

In reflecting on the state of the Organization, we can see that the economic and governance systems have been working in a way that gives citizens the power to control the Organization. Citizen led campaigns and initiatives, fueled through delegations, have produced tangible value to the Organization and the wider EthereansOS ecosystem. Updates and bug fixes have been proposed and accepted, allowing the Organization to be upgraded through new and updated components while keeping the core architecture untouched, all approved by voting citizens. While we cannot fathom what the future will bring to the global markets, the broader crypto space, or our Organization, I can say with absolute certainty that the state of our union is strong.