This week Notum is boasting the following strategies that outperformed in term of APY and TVL among the rest displayed on the app.

As for updates in the DeFi universe, there are a couple of news worth coming across. Let’s delve and explore together!

Arbitrum Is on Fire

The trading volume of DEXs in Arbitrum chain surpassed Solana’s trading volume and took the honorable 2nd place with a whopping $2.143B.

As for Notum, we can offer you loads of pools running on the Arbitrum chain. Have a look at these particular ones with an interesting APY and low risk profile.

Uniswap Fee Switch

At the time of writing protocol fees are spread only among LPs but there is a plan to drop a proposal to spread the commission also among UNI stakers.

The Uniswap Foundation proposal regarding commission went through a vote with 100% yes. On the 7th March a vote will be launched with UNI tokens.

Catch a link to participate in voting 👇🏼

You can also count the potential revenue that UNI stakers will get after activation of Revenue Share after voting.

Uniswap LPs earned $640M in fees over the past 365 days.

Let’s assume that 10% of all of the commissions will be now spread by UNI stakers. It’s around $64M in a year. Now there are about $600M of UNI tokens in circulation. Let’s say 60% of all tokens will be staked. This $360M UNI of tokens.

So, $64M will be spread among $360M of UNI tokens in a year. It’s $0.177 in a year for 1 UNI token. If the UNI price was $10, and we invested $10,000, we’d get 1000 UNI.

0.177*1000 = $177 per year for $10,000 invested. It’s 1.77% APR. If revenue share wasn’t 10%, but 30%, then it’s 5.31% APR.

It’s quite low taking into consideration that the fee commission will soar. Swaps through aggregators in terms of liquidity pairs will go to other protocols and this can end up with LPs revenue decreasing due to trading volume reduction.

Will UNI holders defend protocol’s TVL? Time will show.

If you’re among the believers gang, you can lend UNI on Venus and use it as a collateral and use across DeFi 👇🏼

Fraxtal Is LIVE

The major part of L2 protocols Fraxtal (Frax Chain) is now available for all users. ****

The Frax Finance team has also launched a snapshot for accruing scores for Frax Shares (veFXS) holders for FXS staking on Ethereum. In the future, they might be converted into a new token.

Many will bridge and swap FRAX in a new chain and that can pan out with trading volume soar. Check the following FXS pairs 👇🏼

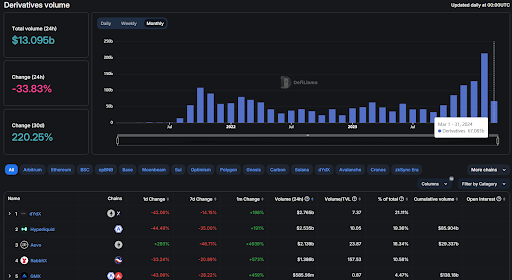

The derivatives of the protocols are picking up, placing ATH (all-time-high) last month and even having a growth rate surpassing the February metrics in March. We are all waiting for the new ATH record.

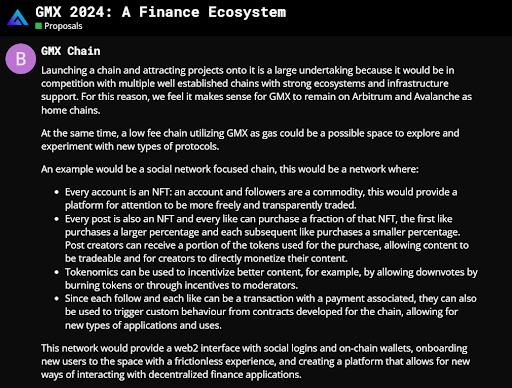

One of the key GMX protocols offered to launch its own social network. It is supposed that the GMX token will be used as a gas but the protocol will continue running on Arbitrum and Avalanche to compete with them. The chain aims to be community-oriented and go viral on socials.

Put to the test our pools with a GMX token 👇🏼

Degens after Bitcoin hits new all-time high this Tuesday be like 👇🏼

Disclaimer: Notum does not provide any investment, tax, legal, or accounting advice. This article is written for informational purposes only. Cryptocurrency is subject to market risk. Please do your own research and trade with caution.