Intro

The summer of 2023 was marked by several important events that affected both the cryptocurrency market in general and the DeFi segment in particular. In this report, we will analyze the state of the DeFi market for Q2 2023. These highlights and trends in the industry will help you to have a better understanding of what’s going on shortly.

DeFi Pulse

During Q2 2023 DeFi Market Cap that shows top 100 cryptocurrencies by market capitalization has shrinked by 10,6% which is $42,76 billion.

One of the key DeFi market indicators is DPI-index (or DeFi Pulse Index). DPI consists of a basket of tokens from key DeFi protocols and is a kind of litmus test that reflects the state of the decentralized finance market. DPI yield dynamics compared to BTC and ETH:

BTC and ETH showed higher returns than DPI in Q2 2023. At the same time, the index itself fell by almost 11%. The main reason for such multidirectional price movements of the mentioned assets can be identified as a number of vulnerabilities in smart contracts and related exploits of a number of decentralized exchanges such as Curve and Balancer.

Of particular note is July 2023, which was marked by a good level of profitability for the so-called DeFi 1.0 projects, which we have reviewed in the following article.

DeFi TVL decreased by 16.3% over the summer: from $46.1 billion to $38.58 billion:

In general, TVL in the context of key blockchains for Q2 2023 showed a significant decrease. BSC suffered the most in terms of percentage. Such a dramatic decline can be explained by growing pressure from the SEC towards Binance, which in turn affects all products related to the exchange.

At the same time, Base stands out separately - the recently launched L2 solution from Coinbase. Against the backdrop of rapidly falling TVL of other networks, Base demonstrates steady growth and has already entered the TOP-10 networks in this indicator, overtaking Solana.

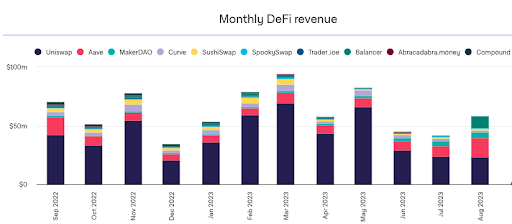

Due to the falling TVL, the revenues of DeFi protocols also notably decreased compared to Q1 2023 and did not exceed $50M on average. The most profitable protocols are still Uniswap and Aave.

The volume of trading on decentralized exchanges has been declining in terms of quantity every month of Q2 2023. Trading statistics by month and key exchanges are displayed below:

Trading volume decline over the period was also observed on CEXs. However, trading volume on DEXs declined at a faster pace, as evidenced by the decline in DEX to CEX Spot Trade Volume. In June it was 16.81%, in July - 16.01%, and in August - 14.13%.

DeFi Events & Cases

Multichain Shutdown

Multichain was founded in 2020 and was previously known as “AnySwap”. The project was one of the largest cross-chain bridges. It supported over 25 different networks and over 1100 tokens for cross-chain exchanges. The protocol started to have problems in May of 2023 when bridge users sent their first complaints about hung transactions after updating the internal network node.

After that, the project team stated that they could not contact their executive director Zhaojun after he was detained by the Chinese police. According to the team, they contacted the family of the head of Multichain and found out that all his computers, phones and hardware wallets were confiscated by law enforcement officers. All this influenced the price of the $MULTI platform token:

The collapse of the protocol exacerbated by the $126M July exploit. Cybersecurity company PeckShield has announced that hackers have stolen assets such as USDC, WBTC, WETH, DAI, UNIDX:

Bridges continue to be one of the weakest sides of DeFi.

Curve Finance Hack

At the end of July, Curve Finance, the largest decentralized exchange, was hacked by hackers as a result of vulnerabilities at the smart contract level in some pools. This event affected a number of protocol pools such as Alchemix, JPEGd, Metronome, Debridge, and Ellipsis. In turn, this immediately affected the price of $CRV, the project's native token:

A large amount of $CRV tokens was owned by Curve’s founder, Mikhail Egorov as collateral for issuing a loan on the lending platforms such as AAVE and Fraxlend. A sharp decline in $CRV price threatened the risk of liquidating Yegorov’s positions, which in turn could end up in a liquidation collapse of the entire DeFi sector. If the liquidation price was reached, a huge amount of $CRV would be released to the open market, and there would be no buyers for such a massive supply.

The situation was successfully resolved by a number of timely actions taken by the Curve team. Particularly, Mikhail increased the provision of open credit positions to increase the liquidation rate and rolled out the CRV/FRAX pool to provide liquidity with increased incentives. In addition, He sold about $30M in $CRV on the OTC (over-the-counter market) market. All these actions prevented the price of $CRV from reaching liquidation levels and the threat of a DeFi collapse has passed.

Delve into a detailed report on what has happened to Curve and how events were unfolding.

Balancer Exploits

Balancer has found a critical vulnerability that affected a number of Balancer V2 pools. Subsequently, the hacker took advantage of the weakness and withdrew about $900K from the protocol. The Balancer team reported the problem on August 22 for the first time; tokens on the Ethereum, Polygon, Arbitrum, Optimism, Gnosis, Avalanche, zkEVM and Fantom networks were at risk. On the day when the announcement of the error appeared, the TVL of Balancer V2 fell from $747M to $546M within 24 hours.

GMX V2 Updates

On August 4, GMX released its second version of the protocol. GMX V2 is available on the Arbitrum and Avalanche networks. The key upgrades include:

For Traders:

-

New assets for trading: SOL, XRP, LTC, and DOGE;

-

Multiple collateral types can be used for trading positions;

-

Faster execution speed and lower slippage;

-

Low-fee swaps of 5-7 bps.

For LP-providers:

-

Isolated pools;

-

Long / Short balancing incentive;

-

Swap incentives

Launching of Base Mainnet

In August, the well-known centralized exchange Coinbase, placed in the top 2 in terms of trading volume, launched its own Layer2 blockchain (L2) on top of the main Ethereum network called Base. The Base is designed to significantly reduce fees on the Ethereum network and level up the transactions’ speed.

Base is a solution based on OP Stack (i.e. based on an optimistic rollup - Optimism). Optimistic rollups are called this way because the confirmation of the transactions validity is processed by the optimistic assumption that the network’s validators act honestly. Only in the event of disputes or dishonest behavior of the validators, rollups turn to the original Ethereum layer to resolve conflicts.

Initially, the project was deployed to the testnet in February, followed by a developer-only release in July, and the launch of the mainnet in August. Since the main launch of the network - the Base’s TVL has been growing rapidly, and has already entered the TOP-8 blockchains, including exceeding Solana’s TVL:

In less than a month after the Base was launched, such popular protocols as Uniswap, Sushiswap, Balancer, DoDo, Odos, 0x, Aave, Compound, QiDao, Magic Eden, etc. have already connected to it.

In terms of implemented technologies, Base doesn’t stand out from its competitors. However, its main killer feature is in the company behind it — Coibase. Coinbase CEX has existed since 2012 and is one of the most popular exchanges with more than 100 million users.

Closing Thoughts

The summer of 2023 turned out to be extremely difficult for DeFi. Obviously, there were many negative events such as the shutdown of the largest cross-chain bridge, Multichain, as well as the exploitation of such giants as Curve Finance and Balancer. All this affected the state of the DeFi market. Trading volumes on DEXs, TVL, and many other key segment metrics have dropped drastically over Q2 2023.

News and events that caused a pessimistic mood in the market are unlikely to radically change the state of the industry. A series of exploits, regulatory pressure, and some uncertainty in the cryptocurrency market.

Nevertheless, there were positive events in the industry, such as important protocol updates (GMX V2, the upcoming Frax V3, etc.), the launch and successful development of Base, and many newly launched L2 solutions.