New week, new best-performed strategies on the Notum App. Meet the winners of the week that outperformed in terms of TVL and APY.

As for DeFi updates, the market is lively and full of ongoing events, as usual. Let’s look at the most interesting ones that caught Notum’s attention this week.

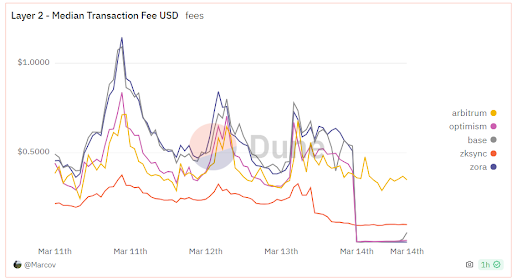

Dencun Upgrade Activated

After Dencun hard fork activation in mainnet, Ethereum’s gas fee shrinks in several times:

This price drop is especially noticeable on Starknet, Base, Optimism, and Metis networks. The average fee soared from $0,1 to a fantastic $0, 001. This might enhance the scaling issue and availability for users.

That’s how EigenLayer tech lead commented on the event:

It’s also possible to claim Consensys NFT on Lenea network 👇🏼

NFT acts here just as memorabilia, but the NFTs that were minted to honor the Shanghai upgrade cost about $200 now. This time the same pattern may happen.

An interesting issue arises — will a total refuse from stablecoins on Tron? OKX will close deposits and withdrawals for the USDC TRC20 token at 3:00 am UTC on March 28, 2024.

Here are Optimism pools you can find on the Notum app, and it seems like a perfect moment to dive into the pool without paying any gas fees 👇🏼

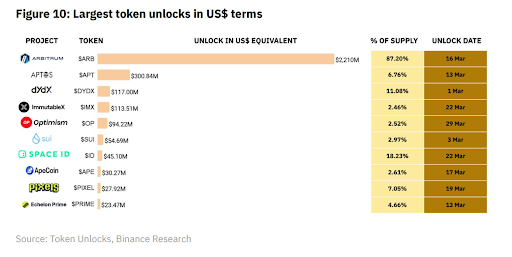

ARB Unlocked

On the 16th of March Arbitrum unlocked $2b of their native tokens. $1.4b went to the Arbitrum team, advisers, and early-bird investors. Since the unlocking event, the token’s price has decreased by 10%.

Check our pool out👇🏼

Why? Because potentially, there is a chance to increase the volume and increase APY after the unlock.

SPACE ID Airdrop

Our old friends from SPACE ID announced creating of SPACE ID Premier club, aiming to unify three or four holders of exclusive symbol domains:

Allocation is $1,843,835 ID tokens (about $3M USD) for 5700 people.

The calculation details are described in their article 👇🏼

Despite the drop, they also promise some rewards from the ecosystem’s partners. It might happen that an ID token would be possible to stake to gain substantial rewards.

Great news for you, as Notum supports SPACE ID domains on the Portfolio page 👇🏼

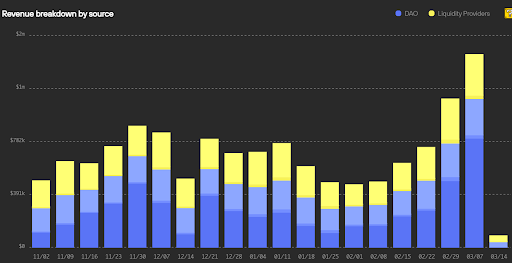

Curve Lend Is Up

Curve has announced about their own lending platform launch called Curve Lend

Could Michael Egorov flip AAVE?

The current market cap of $AAVE $2.1B and $CRV $972M

Curve’s revenue:

AAVE is a cool project but Curve has three products in the ecosystem that strengthen each other. Curve has many perks, such as the following:

-

it’s the home of stableswaps;

-

they upgraded contracts during the bear to support multi-asset pools and improve gas efficiency so there are more trades route through them;

-

new products launching on top of these contracts;

-

the DEX TVL will explode as the value of assets appreciates, new dollar pegged stablecoins, LST, and LRTs onboard;

-

it's the home of the biggest themes in crypto assets;

-

the number of Curve pools keep growing, along with protocols invested in the incentivization strategy with Convex crvUSD is working;

-

crvUSD is steadily growing the number of borrowers, collateral types;

-

borrowing is nearly maxed out at all times;

-

the soft liquidation mechanism makes it far more attractive for borrowers;

-

dynamic interest rates for repegging generate a lot of revenue while successfully maintaining the peg of crvUSD.

Curve Lend is built on the same infrastructure as a crvUSD. They are permissionless markets meaning that all users can add assets.

It seems like everything will end up with a boost of the Curve ecosystem. Check their pools on Notum and delve deeper 👇🏼

Frax Finance Fee Switch

This new offer allows to issue 75% of revenue from fees to veFXS holders:

The coverage ratio of FRAX stablecoin is 98,8%. In view of bullish DeFi market mood, Frax is offering to refund commission to veFXS holders instead of the full focus on obtaining security up to 100%.

But, since it is important to have 100% security, it is proposed to make the balance 75/25, where 25 will go to the protocol treasury.

If the proposal is accepted, Frax will buy FXS from the market and thereby increase activity. Join our FRAX-FXS pool: