Intro

One of the cornerstones of DeFi is liquidity pool provision or liquidity pooling. In the scenario when an investor carefully assesses the possible risks and finds a well-structured strategy, it’s possible to gain a decent yield and start earning within DeFi's financial architecture.

The main point of this article is to decode the liquidity pool investments for our audience. For this reason, we’ve asked Evgeny Lyandres, Professor of Finance and Head of Blockchain Research Institute at Tel Aviv University and a Founder of VirtuSwap, the most efficient decentralized exchange, to answer some crucial questions.

How to Invest in Liquidity Pool Provision?

Liquidity pool provision is an investment strategy that has revolutionized the way trading and borrowing occur on various DeFi platforms. A liquidity pool is a collection of all funds deposited into a smart contract and is available for various operations, such as decentralized trading, lending, etc.

Liquidity pools themselves are made up of funds contributed by users and help provide liquidity to various decentralized exchanges.

Both DeFi platforms and DEX exchanges use automated market makers (AMMs), that is, algorithms that use liquidity pools instead of actual market makers. Their main goal is to provide users with the opportunity to trade cryptocurrency freely and securely. AMMs, in turn, allow users to make deals with smart contracts and not with each other. This is why there is a need for stable and secure DeFi liquidity pools.

Crypto liquidity pools help users exchange one token for another without a trading partner. Instead of buying tokens at high prices from investors, they can be purchased at the market rate that is automatically set on the platform.

Risk Level: Medium

User Involvement: High

Potential Returns: Variable, Potentially High

Automated or not: Not Automated

Potential Risks: Impermanent Loss, Market Volatility, Smart-Contract Risks, Protocol Changes

Key Features: Earning trading fees

Popular Platforms: Uniswap, Balancer, Stargate

How Do You Earn With Liquidity Pool Provision?

As known, DeFi liquidity pools allow users to provide liquidity on crypto exchanges and decentralized financial platforms. User funds are combined into a pool, which consists of two assets, for example, Ethereum and USDT. Pool participants contribute both assets, which become liquidity for a given trading pair.

After providing liquidity to the pool, participants receive LP tokens (liquidity pool tokens) representing their share of the pool.

Q: ‘How the returns from investing in LP are generated?’

A: ‘Returns from liquidity provision are generated from two sources. The first is “organic” returns, i.e. fees paid by traders that remain in the pool, leading to its gradual growth. The second is protocol rewards, paid currently in protocol token, VRSW, that in the future would be complemented by rewards in governance tokens of some of the tokens with liquidity in VirtuSwap pools. The distribution of rewards is governed by VirtuSwap’s proprietary Minerva optimization engine.’

The higher the trading volume and the more stable the price, the higher the reward for providing liquidity.

Why Invest in Liquidity Pool Provision?

Liquidity pools are undoubtedly one of the most important parts of the DeFi sector, as they allow users to do swaps. However, in addition to this, this investment strategy is a great opportunity to receive relatively high rewards. As you know, when providing liquidity, users receive LP tokens representing their share in the pool. The value of such tokens is equal to the number of assets provided, but they cannot be traded on crypto exchanges. However, LP tokens can be used for other purposes, such as exchange between users, staking, or yield farming.

Thus, investing in liquidity pools not only brings users a share of trading fees but also provides the opportunity to receive additional rewards from LP-tokens.

Liquidity pool provision is an investment strategy suitable for experienced users that requires a certain level of involvement and brings fairly high rewards compared to other strategies in the DeFi world. At the moment, the most popular protocols for liquidity pool provision are Balancer, Uniswap, Velodrome, and Stargate.

Q: What are the potential returns for users who invest in LP?

A: These returns vary by pool and are affected by:

-

pool utilization;

-

the price of VRSW;

-

the distribution of “allocation points” among pools, and determining the amounts of VRSW that are transferred to every pool every week.

Returns are higher for liquidity providers who staked VRSW tokens in addition to providing liquidity. Currently, some of the pools receive rewards with APR exceeding 100%.

Liquidity Pool Provision: Risks & Benefits

Q: What are the main pros of LP compared to other DeFi Investment options?

A: Liquidity provision in DeFi can produce high returns. However, because of impermanent loss risk, liquidity provision is a risky proposition. Due to unique pool architecture and liquidity allocation optimization, LPs on VirtuSwap can expect to receive up to 400% higher organic returns relative to providing liquidity in similar pools in a traditional DEX.

We can also mention some other pros such as:

-

Additional profit. In addition to receiving rewards with trading fees, pool participants can also use the received LP tokens to earn additional income.\

-

Decentralization. Since liquidity pools are most often decentralized, this increases security and contributes to the development of the DeFi space.\

-

Market liquidity. Providing your assets to liquidity pools helps strengthen the DeFi system, as well as improve trade execution and reduce price volatility.

Q: What do you think are the main risks of investing in LP? How would you define the risk level for a liquidity pool provision?

A: Firstly, impermanent loss risk, which is present in any AMM pool and is increasing in the volatility of the exchange rate of the pool’s assets.

Secondly, reserve risk. This risk is unique to VirtuSwap architecture. It occurs when native pool assets are sold for assets that enter the pool’s reserves. This risk is small, as there is a strict limit on reserve size; it is managed, as only tokens from the pre-approved allow list can enter the reserves; and it is temporary as reserves are constantly exchanged among pools for their native tokens. Thirdly, smart contracts exploit risk. This risk is low, as VirtuSwap has been on mainnet for 3+ months and its smart contracts have been audited 4 times.

In this article, we will also overview two popular protocols for liquidity pool provision, Balancer and Stargate. We'll look at their distinctive features, and potential rewards, and pay special attention to their advantages and disadvantages. Besides, we will find out what are the best crypto liquidity pools to invest in 2023.

Liquidity Pool Provision With Balancer

Balancer is a decentralized AMM protocol based on Ethereum that encourages interaction between liquidity providers, traders, and pools to find the best price across multiple platforms.

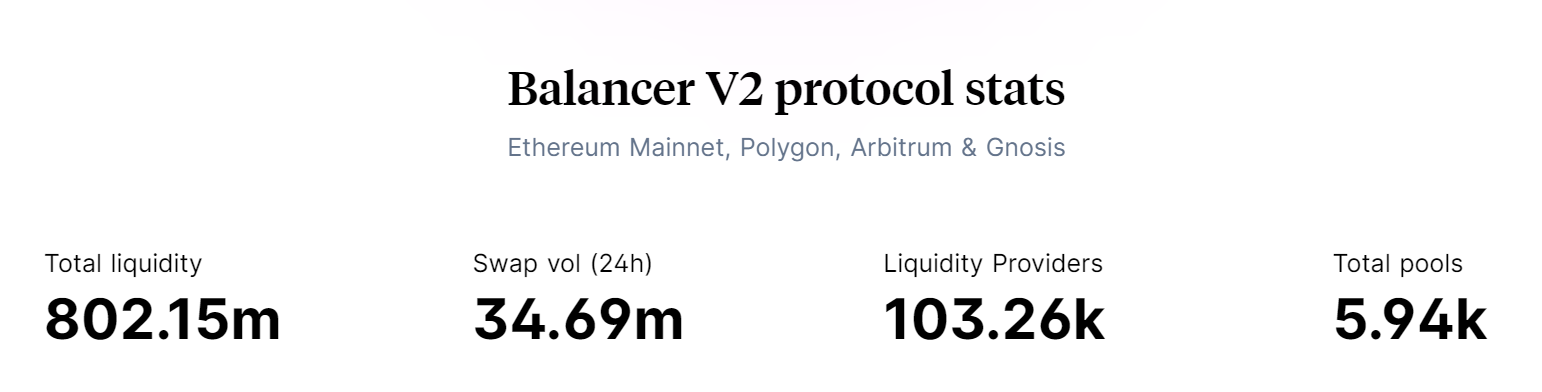

TVL: $829,010,000

Risk Level: Low-Medium

Blockchains: Ethereum Mainnet, Polygon, Arbitrum, Gnosis

Foundation Date: 2018

Balancer uses smart contract-based algorithms to maintain the balance and desired ratio of assets in the liquidity pool. The protocol gives users the opportunity to not only trade tokens but also invest in liquidity pools, as well as create their own to profit from trades.

As of November 2023, the Balancer protocol has more than 103,000 liquidity providers and almost 6,000 pools in total.

Investment Strategies on Balancer

- RDNT / WETH on Arbitrum Total APY - 14.39%, TVL - $54,07m

The RDNT-WETH pool consists of 80% RDNT and 20% WETH. By providing their assets to this liquidity pool, users can receive a reward of 10.81% - 15.33% APR.

- MAGIC / USDC on Arbitrum Total APY - 22.25%, TVL - $797,4k

The MAGIC-USDC pool consists of 50% RDNT and 50% WETH. By providing their assets to this liquidity pool, users can receive a reward of 24.71% - 38.87% APR.

Balancer's Strategies: Pros & Cons

Pros:

-

Automated portfolio management. Balancer allows users to create and manage liquidity pools with multiple tokens and different weights (for example, RDNT-WETH pool with 80% RDNT and 20% WETH). Thus, portfolio management is automated and decentralized.

-

Liquidity provision. The protocol offers enough flexibility for liquidity providers to deposit their assets. Users can choose from a large number of pools and assets supported by the Balancer and earn fees for the liquidity provided.

-

Decentralized structure. Since Balancer runs on the Ethereum blockchain, it is decentralized and secure like the platform itself.

-

Effective token swaps. With Balancer, users can exchange one token for another through their pools and comfortably trade assets without using centralized exchanges.

Cons:

-

Impermanent loss. If the value of the assets in the pool differs, liquidity providers may experience impermanent losses, resulting in lower returns compared to simply holding tokens.

-

Protocol complexity. Newcomers unfamiliar with DeFi concepts may be intimidated by the protocol's more advanced user-oriented flexibility.

-

Risks of smart contracts. Balancer, like all other DeFi protocols, faces smart contract risks. However, the protocol team works to ensure the protocol is as secure as possible.

Why Invest?

Balancer is a medium-risk decentralized finance protocol that offers a huge number of liquidity pools, supported blockchains, and high rewards for providing liquidity.

Liquidity providers receive trading commissions from users trading through Balancer pools, which stimulates users to contribute liquidity.

Liquidity Pool Provision With Stargate

Stargate is a relatively new revolutionary liquidity transport protocol, the distinctive feature of which is complete composability. This protocol also underlies Omnichain DeFi.

-

TVL: $353,520,000

-

Risk Level: Low-Medium

-

Blockchains: Ethereum, Polygon, Avalanche, BSC, Fantom, Optimism, and Arbitrum

-

Foundation Date: 2022

Stargate operates using unified liquidity pools between chains and is famous for its guaranteed transaction completion. Also, the protocol allows users and decentralized applications to transfer native assets cross-chain. In addition to this, they simultaneously gain access to Stargate’s unified liquidity pools.

With Stargate, users can take advantage of several investment strategies - farming, staking, and liquidity provision.

Investment Strategies on Stargate

- USDC on Fantom Total APY - 11.52%, TVL - $3,8m

This liquidity pool provides users with the opportunity to receive stablecoin rewards on the Fantom network. For providing liquidity in the USDC pool, users can receive on average from 9% to 13% APR.

- USDC on Ethereum Total APY - 6.23%, TVL - $34,31m

Adding liquidity to Stargate's Ethereum USDC pool, users also receive stablecoins as a reward for every Stargate transfer. Potential APRs for providing liquidity to this pool range from 5% to 8%.

Stargate's Strategies: Pros & Cons

Pros:

-

Complete composability. Stargate eliminates the need for users to use intermediate tokens because it preserves the native tokens that are sent between chains. This way, users no longer need to use wrapped tokens.

-

Unified liquidity pools. Since Stargate uses unified liquidity pools shared between chains, this gives the user guaranteed finality.

-

Ease of use. Due to the lack of wrapped tokens and a clear user-friendly interface, the protocol is quite easy to use. Moreover, it offers several investment strategies to choose from.

-

Liquidity provision. Stargate has a large number of liquidity pools. Allowing users to receive rewards for depositing stablecoins from different blockchains.

In addition, “liquidity providers can also farm their LP tokens to receive STG token rewards.” - Stargate

-

No impermanent loss. Stargate liquidity pools consist of stablecoins, which significantly reduces risk since they are less volatile compared to other assets. Even the Stargate website itself claims that it is not subject to impermanent loss.

Cons:

-

Smart contract exploits. Like any other protocol on the market, Stargate is also not immune to the risk of smart contracts, which can negatively affect the performance of the project.

-

Security concerns. In March 2022, LayerZero changed the contract for cross-chain use to fix previous security issues. However, the risk of new vulnerabilities still exists.

-

Lack of a strong reputation. Since the protocol has been around relatively recently (since 2022), there is no clarity yet regarding its long-term prospects as it has shown unsustainable high returns. However, analytical data still predicts good chances for the protocol to remain on the market.

Why Invest?

Stargate is a medium-risk liquidity transport protocol that offers a large number of liquidity pools for staking stablecoins on seven different blockchains. Ease of use and relatively high rewards make Stargate one of the best protocols to invest in in 2023.

In addition to receiving rewards for providing liquidity, Stargate protocol users can also farm received LP tokens to get additional STG token rewards.

Notum’s Verdict

Liquidity pool provision is a medium-risk investment strategy that allows users to receive rewards for contributing their assets to liquidity pools. This investment option is suitable for advanced users who want to make high profits and receive additional rewards from LP tokens. By investing in a liquidity pool provision, users can expect a potential profit of 5% to 15% APY.

Balancer and Stargate are decentralized protocols that allow users to provide liquidity to pools on various blockchains. While Balancer is more reliable in terms of reputation as it has been in the market since 2018, Stargate surprises with its fast-growing popularity and low risks due to the minimal volatility of stablecoins.

All in all, if you want to get fairly high profits from your crypto assets and you are not new to the world of DeFi, liquidity pool provision will be one of the most suitable investment strategies for you.

Disclaimer: Notum does not provide any investment, tax, legal, or accounting advice. This article is written for informational purposes only. Cryptocurrency is subject to market risk. Please do your own research and trade with caution.