Fintech Journal: Entry (1/?)

Square & its new entity Block has been on my mind a lot lately.

(1) Dorsey has been getting all engaged in the “web 3” discourse. Fun.

(2)The company has been engaging with me and my frens, firstly on a thread @IanRountree started that I was engaging in around how futuristic and epic their design work is (five likes is a big deal for me okay?):

And then my friend Talia had this tweet Square responded to that went pretty viral:

(3) And lest we forget, the stock is trading around its 52 week low* and has been getting hammered. Anyone paying attention to tech growth knows public equities have been bleeding the past few months. Interest rates rising, etc. etc., reversion to historical multiples, who knows. I’d be wading out of my depth if I were to opine. But one of the equity analyst reports caught my attention. The $SQ price target was being lowered partly because of a general recalibration of multiples among its “peer set”. And that got me thinking about what exactly that means.

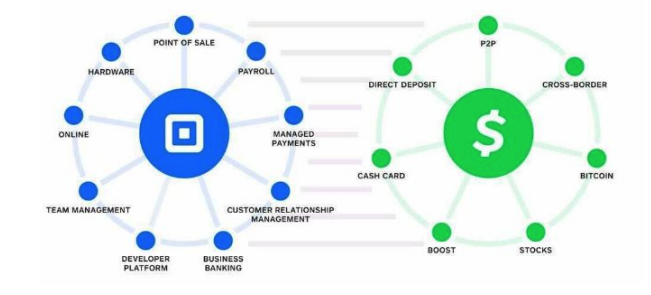

I actually don’t know how you define Square’s peer set. It’s peerless with perhaps the exception of PayPal. Even Stripe, if they want to go the direction of building a network that truly includes consumers, has a ways to go. And people are heralding Stripe’s forthcoming IPO at a $100bn+ valuation (conservatively…though I’ve heard murmurs 2x that). Meanwhile Square is trading $62bn in market cap as of mid-January 2022. Affirm and Shopify are the only other US fintech companies I can think of that are close to building a closed loop network of consumer to business payments. And then I suppose there is Amazon, who has been firing shots across the bow at the major networks, when it announced it would stop accepting Visa in the UK. The sheer scale of the Amazon business and their dominance with 3rd party sellers creates its own gravitational pull and even the card networks aren’t immune. Any way you cut it from a strategic point of view:

Square has quietly pulled off something truly unbelievable. They have a closed loop network that can facilitate transactions between millions of merchants and tens of millions of users in the US.

H/t to Talia’s tweet which subtly references this network that’s forming. A few others have written about it as well, including Dana Stalder from Matrix back in August 2021 when the Afterpay acquisition was announced [1]. But for me, I had this realization a few months ago when I was at a local Cole Valley coffee shop [2]. I went to pay for my almond milk latte and the Square terminal prompted me to basically put away my credit card and instead pay with my Cash App (“Cash App Pay”) [3]. Here’s a POS side representation of how that works; the company rolled it out in September 2021:

Okay, so will anyone use it? Well, the pump is primed:

Cash App was the #4 most downloaded app across iOS & Android in the US in 2021. That places it behind TikTok, Instagram, and Snap (and basically at parity with Snap at its 56M or so downloads) and one spot ahead of Zoom. Um…56M is 1/6 of the entire US population - let alone whatever the US population is that pays for anything with contact-less payments (NFC).

You can discount that figure a number of ways: not every download turns into an active user, not every active user would pay a Square enabled merchant with Cash App, etc., not every merchant is a Square merchant…whatever, potato potatoh. It’s staggering. As of December 2020 (from Square’s annual report released mid-2021), Cash App had 36M active transacting users in the US & Europe (someone who made a txn in the month). That year (2020), Cash App was the #9 most downloaded app on Apple’s App Store and #5 on Google Play. So now it’s climbed to #4 on a blended basis across both app stores in the US and is, as measured by downloads, only less popular than three highly addictive social networking applications. I don’t want to muddle timelines & geographies too much, but it’s clear there are likely mid-tens of millions of monthly active users of Cash App in the US now. A bit of context setting (late 2021): Visa has around 340M and Mastercard 250M credit cards in circulation in the US (and that is multiple cards / unique individual, of course).

Okay, now on the merchant side. I’ll be brief…Square processed $45bn in GPV (Gross Payment Volume) in Q3 2021 ($220bn annualized) for its merchants. It has millions of merchants including Wooden Coffeehouse (the retro coffee shop I will occasionally frequent where I had this epiphany).

Square makes no secret about its network effects. But very few real world payment or consumer fintech implementations stop me in my tracks. Our team at Acrew Capital is fortunate to have invested in many of those, but this isn’t about our portfolio, this is about the incredible execution and really exciting strategic prospects that a lighthouse public company has demonstrated. Case in point: here’s a flywheel from that same mid-2021 annual letter (before the Afterpay acquisition announcement).

Look, there’s so much more to write about this company. (1) You could talk more about online commerce & the Afterpay acquisition. Square is working on merchant/seller omnichannel solutions from offline → online and will now onboard a bunch of online sellers to potentially transact offline. (2) You can talk about payroll and how they can power seller payroll to pay employees. Could those employees get paid via Cash App? Could those employees, who are by definition consumers, decide they want to get paid in crypto (I guess BTC because Block is a BTC maxi)? (3) You can talk about taxes…Square bought Credit Karma’s Tax business. There’s a lot of juice and if not a network, at least a flywheel, in helping sellers and consumers alike to do their taxes. (4) And my eagle eyed (and for this article proofreading) friend Spencer Jaffe, who is a fintech exec and investor, pointed out that Square has an open req for an Engineering Manager for a Bill Pay Product. If you enable Bill Pay and you have millions of merchants, can you build a b2b payments network therein? (5) And, and, and then the whole BTC thing is an x-factor that potentially is jet fuel for Square’s international expansions, maybe starting with cross-border remittances. Ooo new international network effects.

This company is nuts. It’s like five companies in one. And there’s a lot more analysis to do. But it’s getting late and I have actual work to do.

One of my 2022 goals is to put out more content and not be so worried about it being half baked. The good news is I am fortunate to be among some really smart entrepreneurs, VCs, hedge fund investors, and other thinkers. And so I’m sure I’ll learn more from having published this than most will learn from my writing.

Happy Friday, y’all.

Vishal

Notes & Musings & References

*I am a personal investor in the stock and you won’t be seeing any paper hands. Again, this is not investment advice and do your own research.

[1] I take some inspiration from Dana Stalder’s post about the Afterpay acquisition by Square. He prefaces that Afterpay is going to be a key way to cross the b2b and b2c network. True…and it already exists irrespective of Afterpay. Afterpay is about Square’s extension into ecommerce, not physical commerce.

[2] Side bar: on that same street is Zazie and while the wait is really annoying, I think their eggs are among the best in SF