Monetising the secondary market

OPEN Ticketing has pivoted to a more efficient, secondary-market-driven approach. Despite high paper fees previously, our old model wasn't delivering the value we envisioned. Now, by focusing on the secondary market—where approximately 8% of all tickets are naturally resold—we've created a model that slashes overhead, scales effortlessly, and channels far more value directly to OPN token holders through token burns and staking rewards. Major partners like CM.com (19M tickets/year) have already joined, while Azerion's upcoming integration promises even greater volume—creating real, recurring revenue from secondary market activity. This lean approach positions OPN to capture continuous value from every ticket resale and financed event, directly tying the token's success to platform usage. Token holders can be confident that big deals will directly benefit the token's economy through efficient, transparent value capture. Read on for a detailed breakdown of this pivot and its benefits, including a comparison between old and new models.

Why we pivoted from the whitelabel model

Under our original whitelabel model, we provided full ticketing systems to partners and charged a 3% fee on primary ticket sales (and similarly on resales) as “fuel.” While this proved the concept of onchain ticketing, it wasn’t delivering the value to holders we envisioned, for several key reasons:

-

High cost overhang: Running bespoke whitelabel platforms for each integrator was resource-intensive. Each new client meant substantial setup, customizations, and support. This heavy overhead ate into the fees collected, diluting the net value that flowed back to OPN holders.

-

Poor product-market fit: Not every ticketing company wants to replace their entire system. The whitelabel approach, though innovative, proved too rigid for many large players, capping adoption at smaller firms.

-

Low net value to holders: Even when partners paid the 3% fee, the benefit to OPN token holders was modest. After covering operational costs, only a small portion ultimately supported the token (via buybacks or staking rewards). The model “failed to fully align usage with token value,” leaving holders justifiably underwhelmed.

In short, the old model had high friction and low yield. It became clear that to empower our community and truly scale, we needed a more efficient, holder-centric approach.

A leaner, scalable model centered on secondary markets

Our new tokenomics model pivots to what works best: the secondary ticket market and onchain services that any ticketing platform can plug into. By focusing on these, we’ve created a system that is lean, scalable, and routes value straight to OPN holders:

Minimal overhead, maximum reach:

Instead of running entire ticketing platforms for others, we now offer API-based tools and smart contracts that integrate with existing systems. This dramatically lowers overhead – no more maintaining dozens of custom whitelabel apps. Any ticketing company can easily connect to our onchain secondary marketplace, so adoption can skyrocket without heavy lifting on our end.

Secondary-market driven:

Every ticket resale now generates value for the ecosystem. Instead of a one-off fee at the initial sale, we collect a small fee each time a ticket is resold. Large ticketers on average see 8% of the primary tickets resold, and popular events can see multiple resales per ticket—turning into significant, ongoing fee volume.

Direct token holder benefits (burns & staking):

Resale and service fees flow directly to OPN tokenomics. A significant portion of each fee is used to buy-and-burn OPN, reducing supply, while the remaining portion goes to OPN stakers. This means every bit of platform activity benefits the community—no inflation or gimmicks, just actual revenue fueling rewards.

Lean = fast and agile:

With the old model’s complexity removed, we can iterate quickly on features that actually drive value—like improved secondary-market tools, user-friendly experiences, and new revenue streams (e.g., event financing). We’re no longer bogged down customizing consumer-facing apps, freeing us to focus on scaling usage—and OPN’s impact—across bigger partners.

In short, this pivot transforms OPEN into a high-throughput, low-cost protocol where usage = token demand. It’s a win-win: partners get blockchain benefits without heavy overhead, and holders get a token that directly captures the value those partners generate.

Real-world traction: major integrators fueling OPN demand

CM.com integration – 19 million tickets onchain

CM.com, a publicly-listed ticketing giant, has integrated OPEN. They recently acquired our pilot platform (GUTS Tickets) and will route 19 million tickets annually through the ecosystem. Soon, these tickets will be minted onchain and their secondary trades will use OPN for fees—creating a seismic boost in OPN demand. Millions of transactions mean corresponding protocol fees, leading to more burns and staking rewards for holders. This is a strategic move guaranteeing recurring volume from a top-tier player.

Azerion expansion

Azerion, a major digital entertainment and media platform, is integrating OPN to issue digital tickets/collectibles for up to 15 football clubs, with 1.8 million onchain assets in the initial phase. Every ticket generates OPN fees when resold, engaging a massive user base of sports and media fans. This showcases our infrastructure's versatility beyond traditional ticketing, enabling new opportunities in gamification and collectible markets.

Growing our onchain ticket network

CM.com and Azerion represent just the beginning of our vision. We're rapidly expanding our network of high-volume ticketing partners, bringing millions more tickets onchain. Each ticket that moves onchain naturally flows into our NFT-powered secondary marketplace, where we can leverage blockchain's native strengths: programmable royalties, secure transfers, and automated payments regardless of payment provider. This infrastructure allows us to capture value from secondary sales at unprecedented scale and reliability.

Bottom line: By bringing more tickets onchain through strategic partnerships, we're creating a powerful network effect. When tickets become NFTs, they unlock the innovative payment rails and controls pioneered during the NFT boom - enabling seamless, trustless secondary market transactions that automatically generate value for the OPN ecosystem.

Progressive scalping tax

A major selling point of onchain ticketing is the ability to discourage or fairly monetize scalping—one of the biggest headaches in live events today. Under traditional ticketing, once a buyer leaves your official platform, you lose visibility and control. Scalpers can flip tickets at huge markups, reaping all the profit while organizers, artists, and official partners see nothing. Even if you impose a nominal fee (like the old 3% approach), most of the secondary market activity happens off-platform, beyond your reach.

Old model = little Control, endless frustration

-

No Visibility: Scalpers resell on external sites, making it impossible to enforce price caps or recapture fees.

-

Organizers miss out: Third-party marketplaces (or scalpers themselves) pocket the resale markups. Venues, artists, and official ticketing providers see almost none of that upside.

-

Fans exploited: Genuine fans pay inflated prices on resale platforms, with no assurance of ticket authenticity or fair pricing.

New model = onchain price tracking & smart fees

By moving ticket issuance and transfers onchain, every resale transaction is recorded transparently. The blockchain automatically logs the resale price, so we know the exact markup above face value. This transparency lets us apply dynamic fees—sometimes called a “progressive scalping tax”—to precisely target scalpers without penalizing fair resales at or near face value.

-

Automatic enforcement: If a ticket is resold for a moderate markup, the fee might be minimal (1–3% of face value). But if the markup is large—say, 2x or 3x the original price—the protocol can automatically apply a higher tax (5–30% on the profit portion).

-

Seamless distribution: Fees are settled and distributed onchain in real time. The event organizer, ticketing partner, and protocol (OPN stakers, burns, treasury) all share in that revenue, rather than letting scalpers or third-party platforms keep it.

-

Organizer freedom: The specific thresholds and rates can be customized by each event owner. If an organizer wants no markups, they can set the system to deny or heavily penalize high resale prices. If they’re okay with resales but want a share of the upside, they can allow it up to certain tiers.

Turning scalping into ecosystem value

Because every transaction is verified onchain, the protocol can enforce these fees without guesswork or relying on external databases. The collected fees then flow back into the ecosystem—40% is burned (boosting the token’s scarcity), 40% goes to stakers (rewarding holders), and 20% supports ongoing development. Meanwhile, the event organizer can also claim a portion of the revenue if desired, converting scalper margins into a direct benefit for themselves and their fans.

Exactly what organizers & ticketing providers wanted

Our original whitelabel product appealed to event organizers because it promised “fair ticketing” and anti-scalping measures. However, implementing it as a fully custom solution for each partner was expensive and cumbersome. By pivoting to a universal, onchain secondary system, we deliver that same anti-scalping value (and more) but with:

-

Lower overhead: No need to build an entire custom whitelabel platform; integrators just tap into our API.

-

Scalable efficiency: The core smart contracts handle millions of ticket resales automatically, with fees flowing back to the ecosystem.

-

Improved transparency: Both fans and event owners can see real-time onchain prices, removing shady off-platform behavior.

-

Direct tokenomics alignment: OPN holders benefit from higher transaction volume and scalper markups because the protocol automatically captures those profits.

In other words, the progressive scalping tax strikes directly at one of the industry’s biggest frustrations—off-platform profiteering—and leverages blockchain’s inherent transparency to do so. Organizers finally have a say in how much scalpers earn, and fans gain a more secure, less exploitative marketplace. The result is a win-win for everyone: fairer pricing for fans, additional revenue for event stakeholders, and direct, recurring value for OPN token holders.

Comparison of old vs new tokenomics models

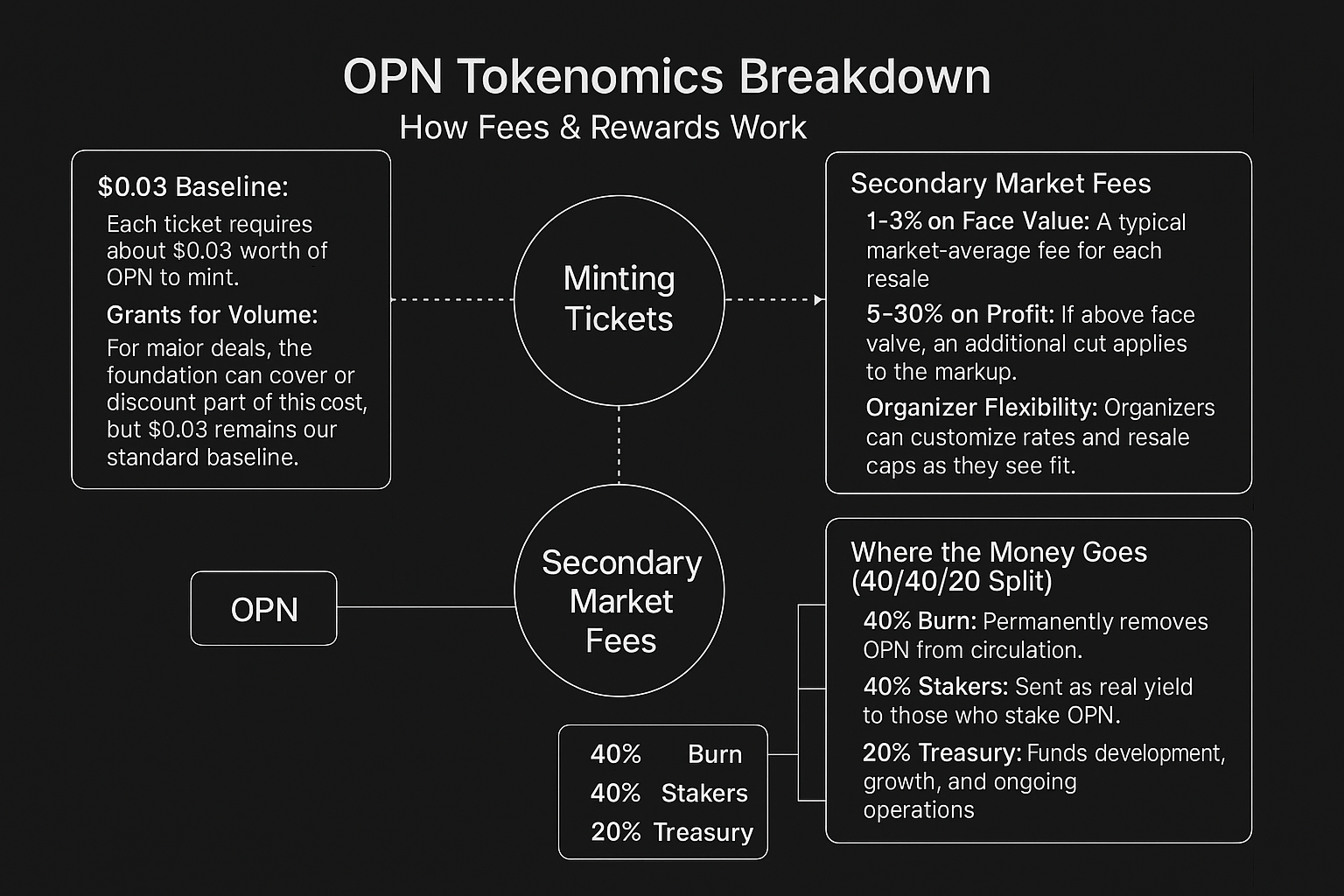

Tokenomics breakdown: how fees & rewards work

We’ve removed the old percentage-based primary fees in favor of a simpler, low-cost flat minting fee plus secondary-market fees tied directly to resale activity.

1. Minting tickets

• $0.03 Baseline: Each ticket requires $0.03 worth of OPN to mint.

• Grants for volume: For major deals, the foundation can temporarily cover or discount part of this cost, but $0.03 remains the standard.

2. Secondary market fees

-

1–3% (as flat fee) of ticket value: Charged per sale of ticket on secondary market. Though labeled 1–3%, in practice this functions like a flat fee per ticket, not a dynamic percentage with indefinite cap. Actual percentages may vary based on transaction costs and average ticket price*.

-

5–30% (Progressive Scalper Tax): Charged only if a ticket is resold above a certain threshold (e.g., a percentage markup over face value). At least 50% of this scalper tax is earmarked for the DAO (pending partner negotiations), ensuring the protocol and its stakeholders benefit from any significant markup (the remaining 50% is for the event organizer and ticketing partner - money makes the world go round).

-

Organizer flexibility: Organizers can customize rates, caps, and thresholds as they see fit—allowing fair resale while discouraging rampant scalping.

*Unlike the old WL model where we had a 55 FTE overhead and the responsibility to provide the scanning and support services - the secondary market infrastructure is much more lean and low cost due to having no support or operational scanning responsibility.

3. Where the money goes (40/40/20 split)

-

40% Burn: Permanently removes OPN from circulation.

-

40% Stakers: Paid out as real yield to OPN stakers.

-

20% Treasury: Funds development, growth, and ongoing operations

In short, each resale collects a modest flat fee and (if above face value) an additional scalper tax. These revenue streams are then routed back into the OPN ecosystem—burning tokens, rewarding stakers, funding development—while also giving event organizers the tools to manage scalping in a fair, transparent manner.

Addressing “Fair Ticketing” concerns

We’re not stepping away from “fair ticketing.” Organizers can enforce resale caps, sell at face value only, or set low fees to discourage scalping. Our platform just provides an official, onchain channel for secondary trades. This approach can protect fans from off-platform scams while still letting event owners capture some of the upside if tickets do resell at a premium.

(Note: If an organizer wants zero markups, our flexible settings make that possible. The fees shown here are the maximum range, giving partners full autonomy.)

Operational flow & lower upfront costs

While the secondary market captures the bulk of our fees, integrators do need OPN for minting each ticket:

-

$0.03 per ticket: This baseline is intentionally low to avoid discouraging issuance and is still enough to create demand.

-

Grants: Large partners can receive foundation grants or engage in bulk purchasing to streamline the process.

-

More accessible: Compared to a 3% primary cut, this drastically lowers the barrier to entry and makes the protocol more attractive—leading to more secondary trades long-term.

The Protocol, the Foundation, and the Vision

A quick clarification about our governance:

-

Foundation-governed: The OPN protocol is maintained by a dedicated foundation that oversees key partnerships and developments. Our mission remains to build a fair, transparent, and inclusive ticketing system—without punishing users with high fees or complicated tech.

-

Team alignment: We hold a substantial amount of OPN ourselves. From Sophon integrations to event financing solutions, everything we develop is aimed at boosting sustainable value for the token and its holders.

-

Flexible yet fair: Nothing in our approach removes the ability to have face-value-only sales or strong anti-scalping measures. Organizers can set the parameters, and the protocol enforces them onchain.

Positive outcomes and the road ahead

The pivot to a secondary-market-driven tokenomics model has re-architected OPEN into a platform where usage and holder value are inextricably linked. By shedding the overhead of the whitelabel model, we’ve built a stronger, more transparent foundation that already resonates with major partners like CM.com and Azerion:

-

Token holder alignment: Each new partnership directly increases OPN demand and transaction volume, funneling fees into token burns and staking rewards. No guesswork or trickle-down—it’s baked into the protocol.

-

Recurring, resilient revenue: Because OPN captures fees from every resale, the protocol doesn’t depend solely on constant primary sales. It’s a more balanced, sustainable system that benefits from ongoing ticket movement.

-

Streamlined growth: We’re continuing to refine these tokenomics, add new integrations, and explore additional utilities (like financing, loyalty systems, or governance features). The key is that all these efforts reward OPN holders in a direct, transparent manner.

Final thoughts

We appreciate the patience and support of our community during this major pivot. The new approach is lean, recurring, and directly benefits token holders—a contrast from our original whitelabel model. With deals like CM.com confirmed and Azerion on the way, we’re seeing real-world validation. We’ll keep you updated as more events, tickets, and partnerships go onchain, driving tangible fee flow back to OPN.