The music industry has experienced a digital revolution over the past decade.

Today, the subscription model contributes to most of the global music industry revenue, allowing services like Spotify to thrive.

However, the advent of NFTs marks the next step in this technological revolution. This article unpacks their potential to disrupt the industry like never before.

Article Outline

-

Background

-

Application of NFTs

-

Future Predictions

-

Closing Remarks

Background

1) Music Industry

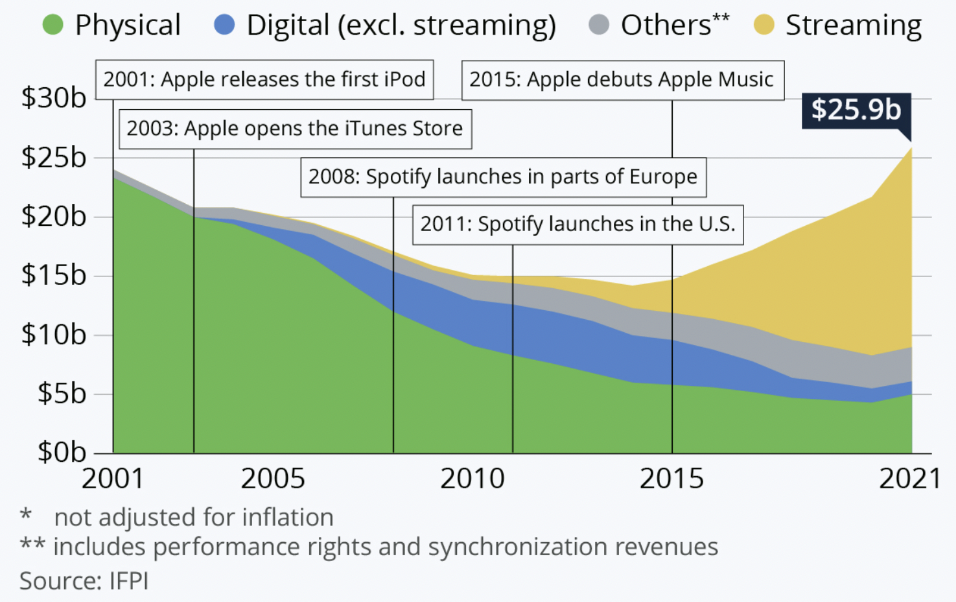

The global music industry is worth $25.9b in annual revenue. As a benchmark, this equates to 39.8% of the global art market revenue, which is valued at $65.1b. It’s clear that the music industry is hot on its heels with the potential to unlock new value using NFTs.

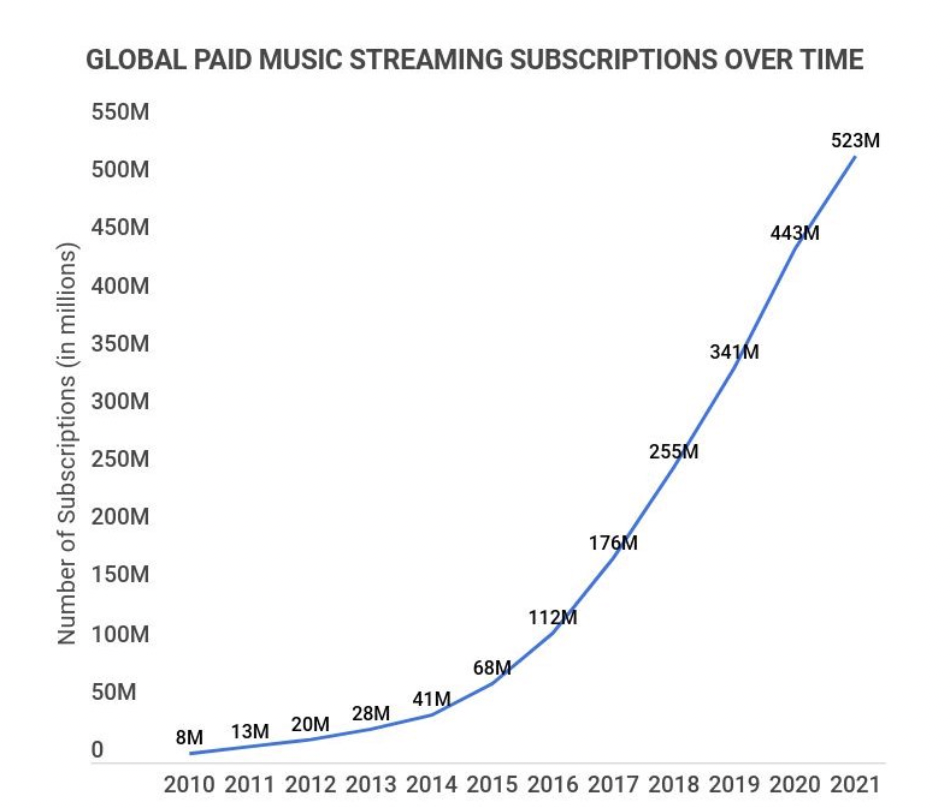

The United States drives most of this music activity. In 2021, the revenue generated by the music industry in the U.S. amounted to $15 billion, showing an increase of 22.9% from the previous year's revenue of $12.2 billion. Additionally, out of the world’s 532 million paid subscribers to music streaming services, 82.1 million are based in the United States.

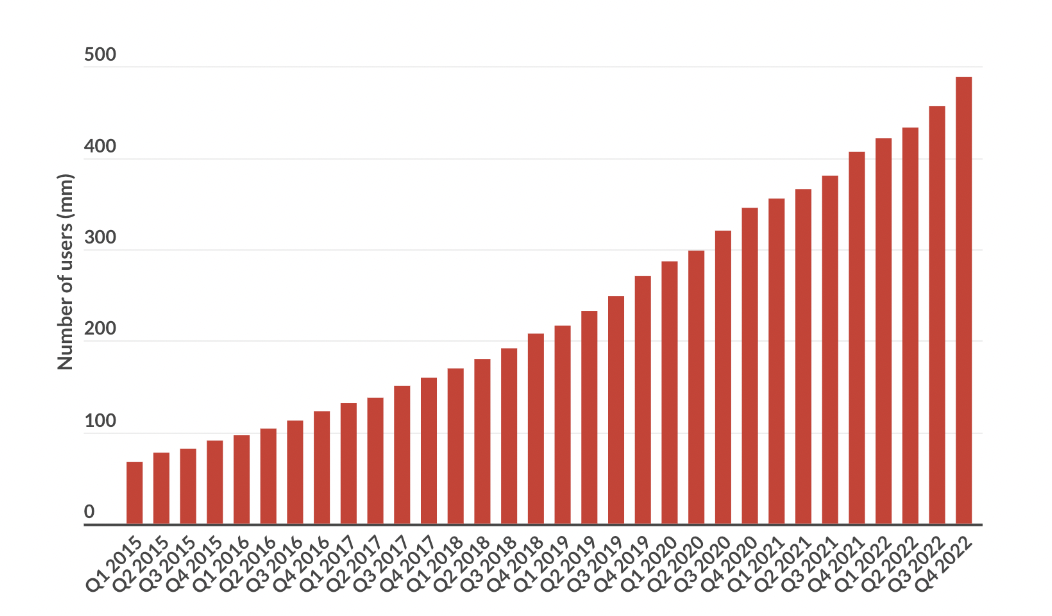

Global paid subscription services have gone through a period of inflection in the past decade, from 8 million subscriptions in 2010 to over 500 million in 2021.

Physical ownership was superseded by downloads with Pirate Bay and Limewire, causing havoc on artist royalties. In fact, physical items only make up for 9% of total music revenue now. This infographic from IFPI illustrates the transition well.

Spotify offered a cost-effective alternative, and superior product, to piracy. Its rapid download speeds encouraged many to move away from the sub-optimal piracy experience.

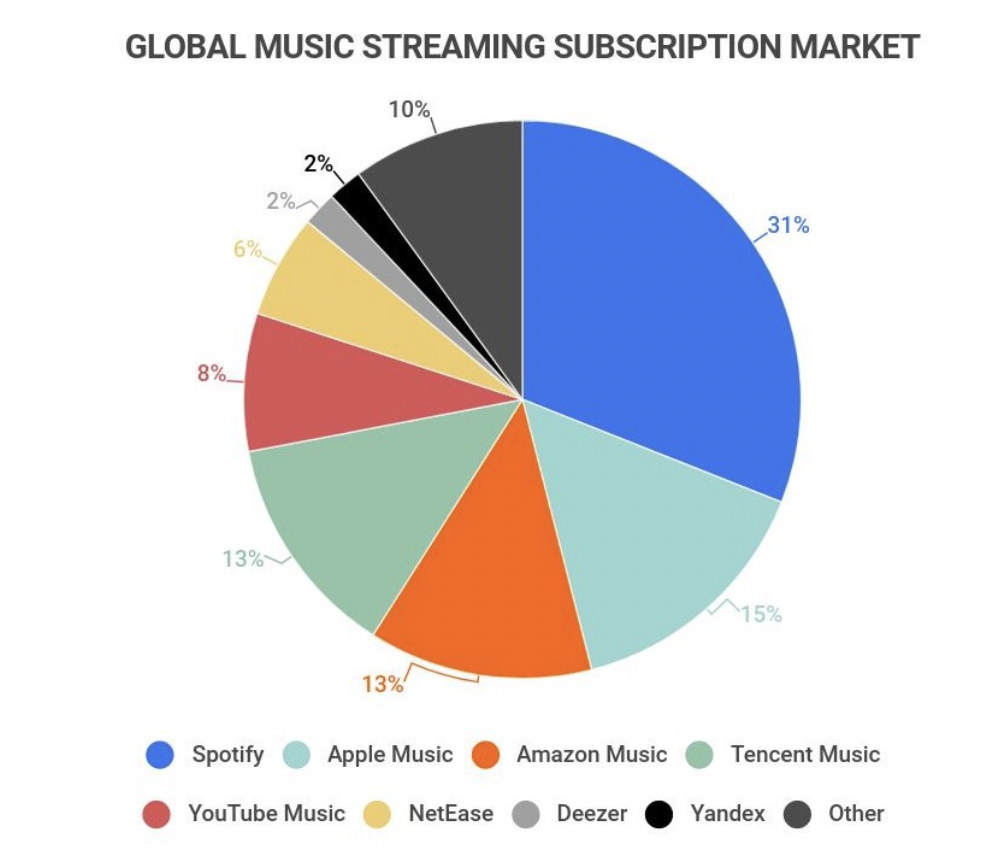

Blockchain technology could facilitate the next phase of this superior product offering by shifting this temporary rental model back to ownership but in a digital form. There are several big players in the music streaming market, but Spotify leads the way with 31% of the market share. This is over double that of its second-place competitor, Apple. Probably a driving factor as to why Apple has blocked the Spotify NFT pilot program, which we will touch on later in the article.

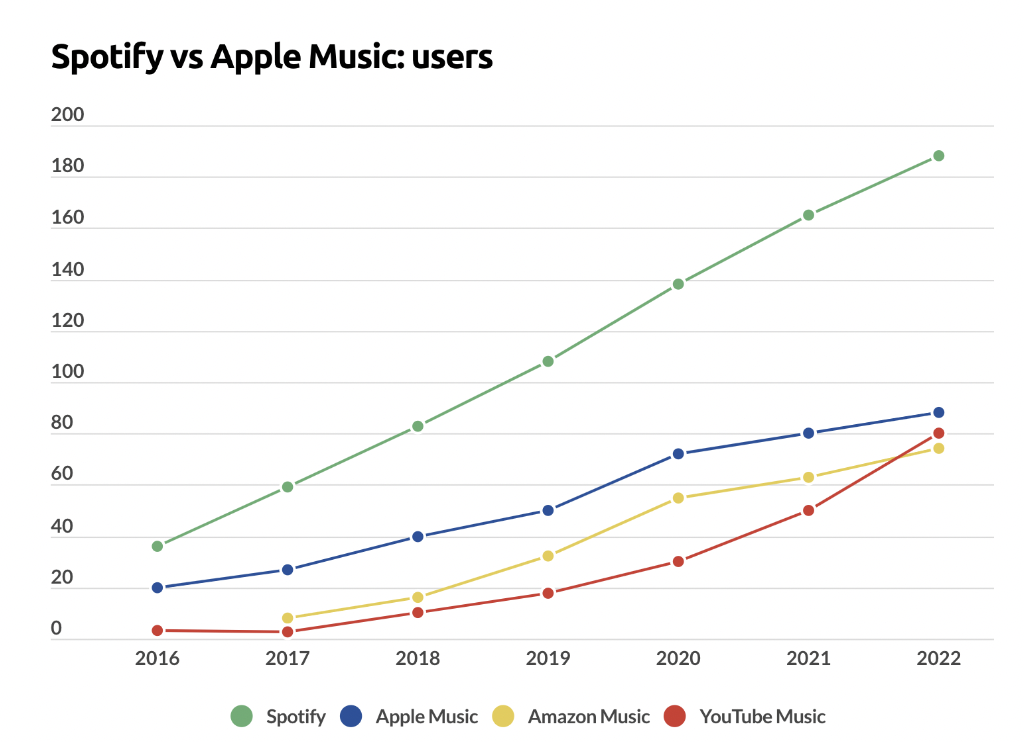

Although growth on most platforms is declining, YouTube seems to be attracting more users at a growing pace.

In fact, if these trajectories continue we could see YouTube flip Spotify on user subscriptions within the next five years. We’ve already examined YouTube’s recent senior executive changes, and what this could mean for a web3 pivot.

If they decide to successfully adopt blockchain technology, drive cost efficiencies and increase user adoption then their user growth flip could happen sooner than we expect. Spotify needs to remain on its game to remain ahead and it’s looking like they are making moves with their recent announcement.

2) Spotify

Spotify is currently the world’s biggest music streaming platform by subscribers with 31% of the streaming market share.

The company was founded in Stockholm in 2006, by Daniel Ek and Martin Lorentzon. The two wanted to create a legal digital music platform to rival online music piracy in the early 2000s. It eventually launched in 2008, gaining rapid user adoption by leveraging Facebook’s established network through a partnership. An early example of the effectiveness of Metcalfe’s and Reed’s laws.

Spotify went public in April 2018, with a market cap of $26.5 billion after the first day of trading.

The application has 488 million monthly users, 205 million of which are paid subscribers. Spotify also prides itself on its wide range of music content, with over 100 million songs and 5 million podcasts.

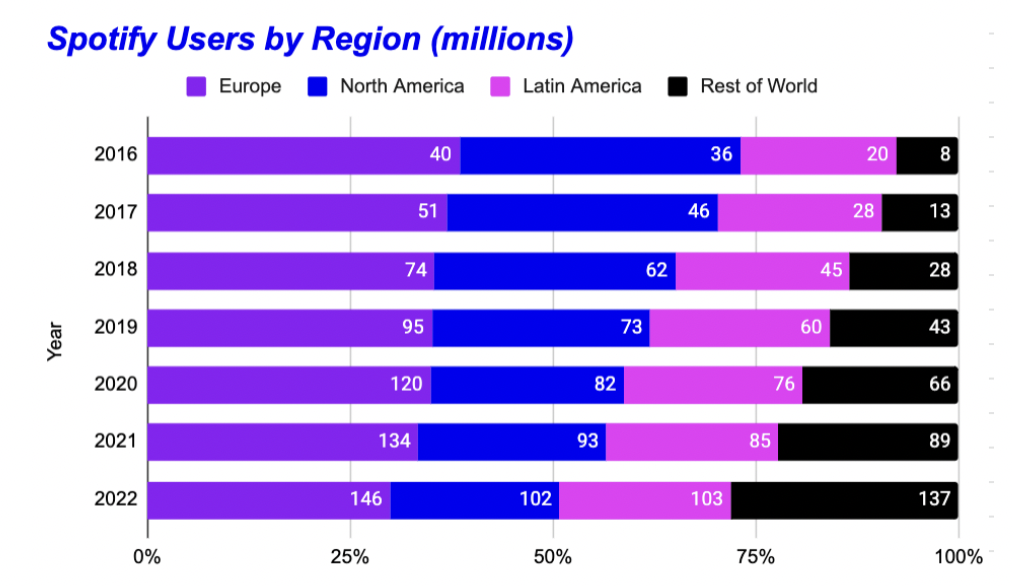

Most of Spotify’s users are based in Europe, despite most of the overall music industry revenue deriving from the U.S.

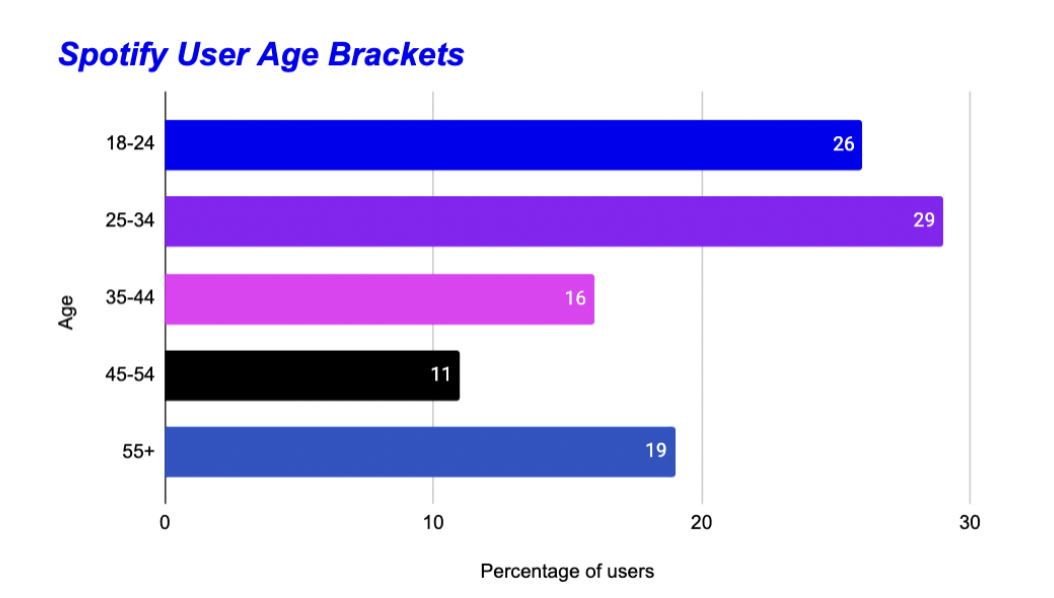

55% of its user base is aged between 18 to 34, which is a heavy overlap with the demographic of NFT users. It is primed for a similar rate of adoption to YouTube, which has 34% of users in this age bracket but a larger user base at 2.1 billion users.

The Spotify user base is moving steadily upwards. The number of subscriptions also appears to be moving in the same direction.

Spotify’s model is free music accessible for everyone, but a paid premium subscription enables higher quality recordings with no adverts.

It all seems positive, right? So why take a risk on NFTs? While companies need to continue innovating to maintain a competitive advantage, Spotify has never turned a profit.

Before diving into the potential solutions involving NFTs, let’s take a look at the challenges facing the industry and those impacting Spotify.

3) The Challenges

Record labels and artists frequently hit the headlines with disagreements over the inequitable split in revenue from royalties.

While we are not there yet in terms of equitable remuneration, a power shift over how creators are rewarded is taking place, enabled through distributed ledger technology and network effects.

The creator economy is booming thanks to the virality of the internet. Empowering individuals and enabling them to reach a wider audience than was previously possible using these network effects. This disintermediation is putting pressure on record labels and corporate intermediaries, as their services become less important to artist reach.

Independent artists earned $1.2 billion in revenue in 2020. That equates to just 2% of the overall annual music industry revenue. It’s estimated that music publishers usually earn 50% of mechanical and residual income from a recorded song and usually take 25% of income for live performances.

Apple’s Stance on NFTs

Apple blocked NFT integration which could become a huge headwind for mass adoption. The software developer covers a large portion of the smartphone market. So preventing downloads of NFT-integrated applications on their platform automatically excludes a significant number (2.2 billion or 31%) of the 7 billion smartphones in circulation.

First Mover Advantage

Many crypto native brands will have a first mover advantage in the space of developing trust and a relationship with their web3 audience. This may prove challenging for Spotify to break into the web3 market given the anti-establishment ethos of many decentralization maxis.

However, their approach to partnering with trusted projects like Creepz, Kingship etc. will be a good method of breaking into the existing market. As the masses enter the space, this will become less of a barrier to entry given they can leverage their brand equity to guide new web3 users.

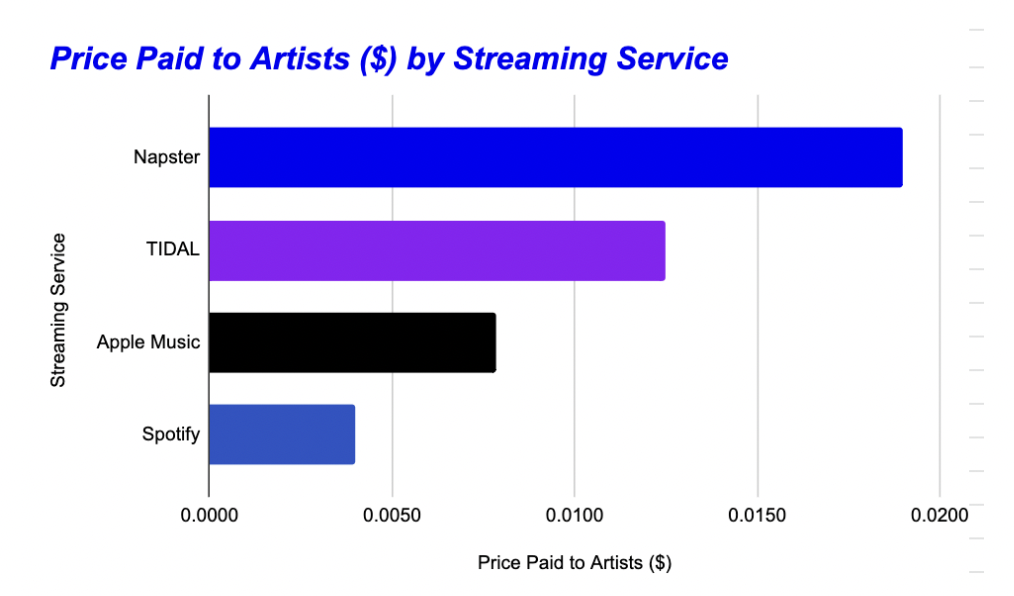

Artist Royalties Per Stream

Spotify pays a quarter of Napster for streaming revenue per download to music artists. Yet it remains unprofitable, so something needs to change for the company to continue operating.

Could blockchain and NFTs drive operational costs down and create a viable business that allows more favorable repatriation of royalties to artists? It’s certainly a possibility worth exploring.

Let’s take a look.

Application of NFTs

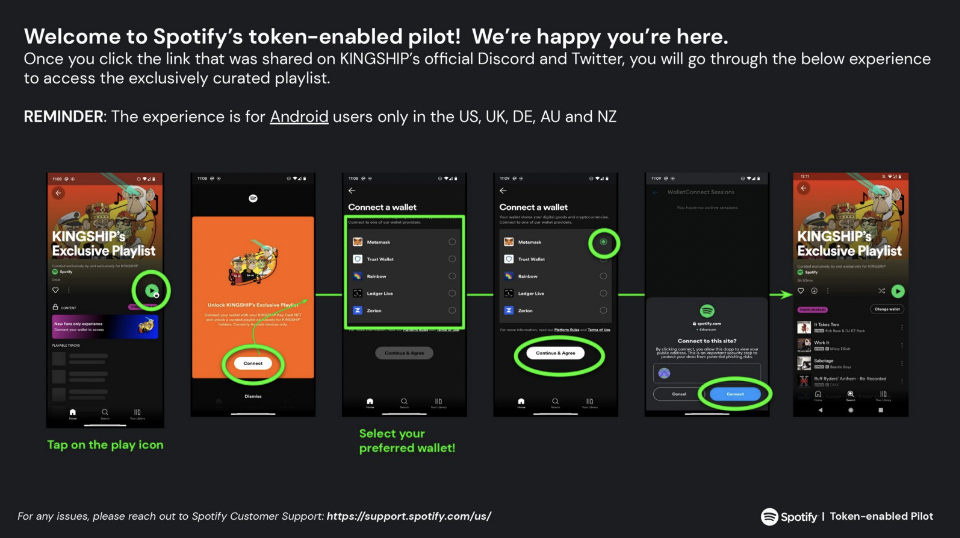

There are several applications of NFTs in the music industry. Spotify is focusing on token-gating content to its Premium members using a crypto wallet integration. Four NFT projects will be included in the pilot program:

-

Kingship (Universal Music Group’s metaverse band)

This type of exclusive content could drive community building with the application. Groups of individuals tend to rally around an idea, cause or agreed set of values. Music can help build community culture, so having token-gated content that’s transferable makes sense as a next step.

1) Stronger Artist-Fan Bond

We’ve seen from the art world that NFTs create a stronger and more direct bond between creators and their fans. Content can be airdropped directly to their most loyal fans creating a direct reward mechanism. The data available on the creator’s fan base is enhanced so curation of ideas and end products can be tailored in real-time as the dynamic market evolves and shifts. This enables a more iterative process in creating their masterpieces, rather than releasing an end product that flops.

2) Tiered Access to Perks

Tiered access to perks such as private backstage passes or meet the musician can be executed for those holding the most valuable or exclusive NFTs.

These could be soulbound based on attendance of specific concerts, or access to additional unseen backstage footage once the event has concluded.

For example holders of Violetta Zironi’s NFTs get access to all her in-person concerts for free in addition to access to Zoom Concerts (digital concerts).

3) POAPs and Attendance Verification

We see many fans boast that they were at a specific renowned concert or event. This verifies that.

In the early stages of the NFT development cycle, we saw Azuki airdrop the Beanz NFT to Azuki holders during the live “Garden” event. There’s no reason this couldn’t be done with artists and their fans at concerts.

4) Exclusive Limited Edition Content

Exclusive benefits could include limited edition content token-gated via the tiered NFT model. If there is a strong user fan base then these could become extremely sought-after collectibles that create additional value for holders that’s beyond what’s possible for the web2 realm.

Some subscription models or premium-tier DVDs have this footage, but this is at a cost to the holder. NFTs enable a resale model so that once the consumer is finished with the product there is some resale value.

5) Artist Monetization

While I suspect the music platform will take a reasonable cut for the innovation, there could be a more direct flow of benefits embedded in the underlying smart contract to go between the fan and musician.

It’s clear that musicians need to reach a decent number of streamers to make a living. To earn $40,000 a music artist would need to receive 10 million downloads on their track.

This allows them another method of monetizing their audience through community building — they will likely receive a larger cut of the proceeds than the subscription model.

6) Piracy Prevention

Music NFTs can help reduce piracy. Each NFT is distinguishable and cannot be replicated, it makes it difficult for people to illegally copy and distribute album art.

7) Unlocking Transactable Value

If the fan holds an NFT and no longer wants to receive the benefits, they can sell this on the open market.

While this reduces the initial proceeds of the sale to the artist, a portion of the secondary sales can be repatriated to the artist as royalties. Both parties benefit and then the artist is continually incentivized to promote that piece after launch — driving continued sales and revenue.

As a holder, I’m more likely to pay for a subscription through an NFT knowing I can recover the cost if I no longer want those benefits.

8) Music NFT DAOs

Decentralized autonomous organizations (DAOs) are reshaping the way music is produced.

Instead of a music label being in charge of an artist’s music direction, DAOs provide a decentralized alternative. This improves the benefits for the artist by removing the interests of an intermediary and focuses on improving the outcomes for the artist and consumer.

Future Predictions

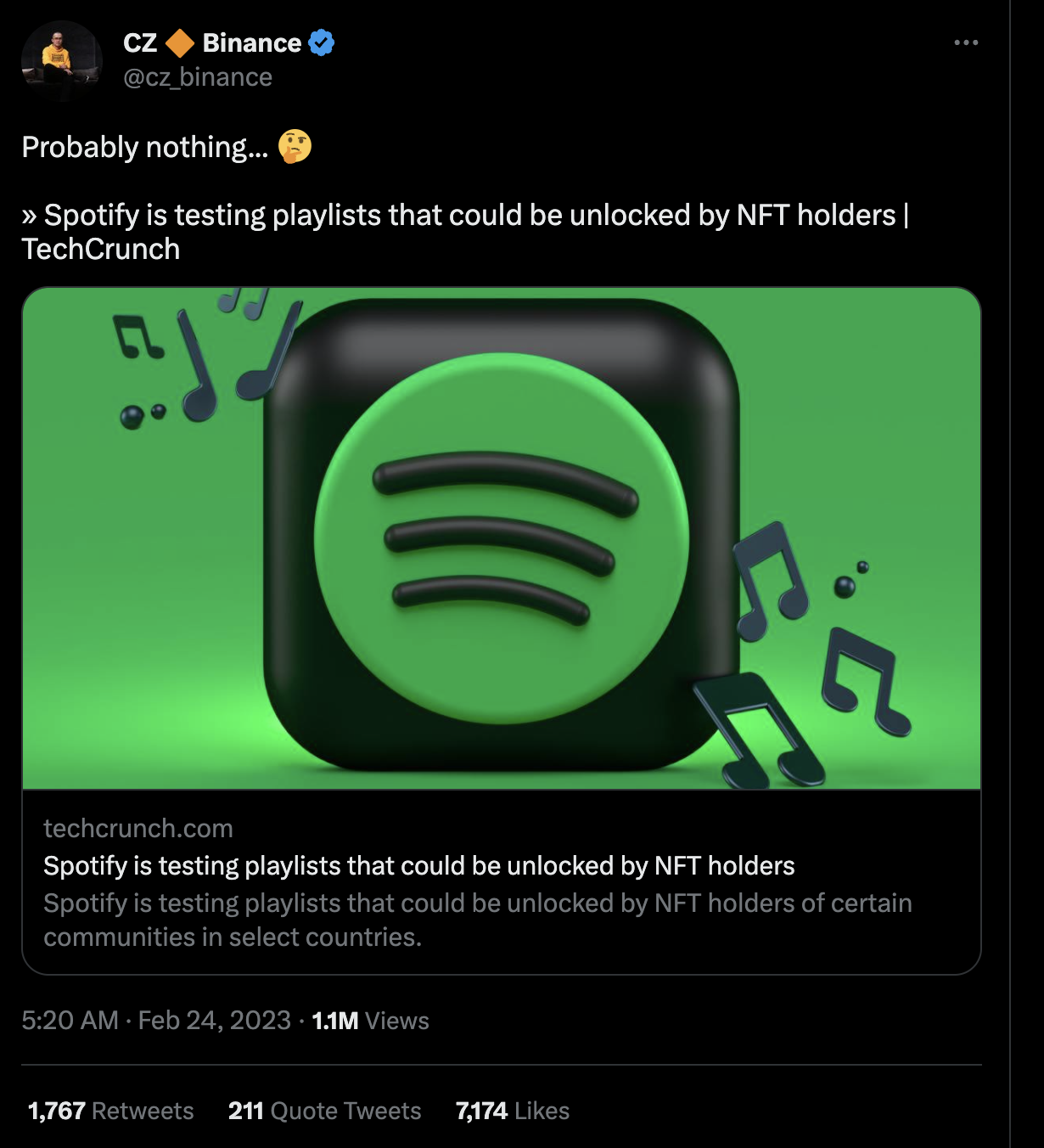

It’s clear some of the big names in crypto see this as a positive step forward. Timelines will be as quick as these tech behemoths decide to ship products.

We’ve seen from experience that network effects can have a parabolic impact on adopting new technology if there is a real use case. Take AI as an example — OpenAI’s ChatGPT drove 100 million users onto their application within a two-month period.

With the adverse macro conditions still looming we are continuing to see tech companies laying off their workforce. This has a stifling effect on innovation but can also refocus the remaining talent onto the avenues with the largest upside.

Spotify’s beta testing is currently underway across four key NFT projects, so we could have the real product rolled out to the wider market within the next six months. The product will only be available to the premium member group so that’s 205 million user exposure.

If just 1% of these users adopted the new feature, this would be 41x the daily active wallets trading NFTs. It’s also important to highlight not to get our hopes up. A Spotify spokesperson said to CoinDesk:

“[Spotify] routinely conducts a number of tests in an effort to improve our user experience,” some of which “end up paving the path for our broader user experience and others serve only as important learnings.”

I’m of the opinion that there will be some headwinds to getting users to integrate crypto wallets, but we could see some innovative tech or seamless user interface (UI) come to fruition through the trial process.

Closing Remarks

Music artists no longer have to relinquish their ownership and music rights to major labels, distributors or streamers.

Musicians and fans can build more direct relationships reducing the costs incurred or revenue lost to the middleman.

The past decade has been a digital revolution, with a paradigm shift from physical to digital through streaming services. Ownership of digital content is the next iteration in the innovation cycle.

Origins Analytics

At Origins we leverage data-driven decision-making, educational resources, and proprietary analytics to remain ahead of the curve with respect to blockchain tech, specifically NFTs. To find out more, please visit our website or Twitter.

To purchase a pass, please visit our Opensea page.