The NFT royalty debate is a hot topic. It's important to support creators, but how should this be done and what is the right amount to pay?

This article looks at some of the key challenges & provides novel solutions.

Article Outline

-

Background

-

How Much: Mint Price and Royalty Percentage?

-

Future Predictions

-

Solution: Carrot or the Stick?

-

Closing Remarks (TL;DR)

Background

"I thought NFT royalties were embedded as part of the contract? How can people elect to pay or not?!"

Misconception.

They're established at the marketplace level. In a bull market, traders trended towards Opensea and paid. In a bear market, undercutting has been prevalent.

Why has this blown up recently?

In July, Sudoswap announced that royalties can be bypassed on their platform, causing controversy. After all, a rational trader that is struggling to make a buck could list for less on Sudoswap to entice a buyer.

Ethereum Marketplaces

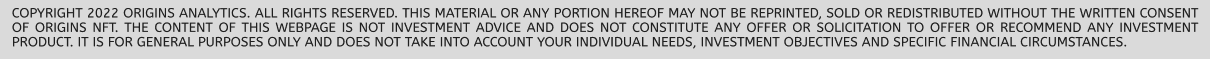

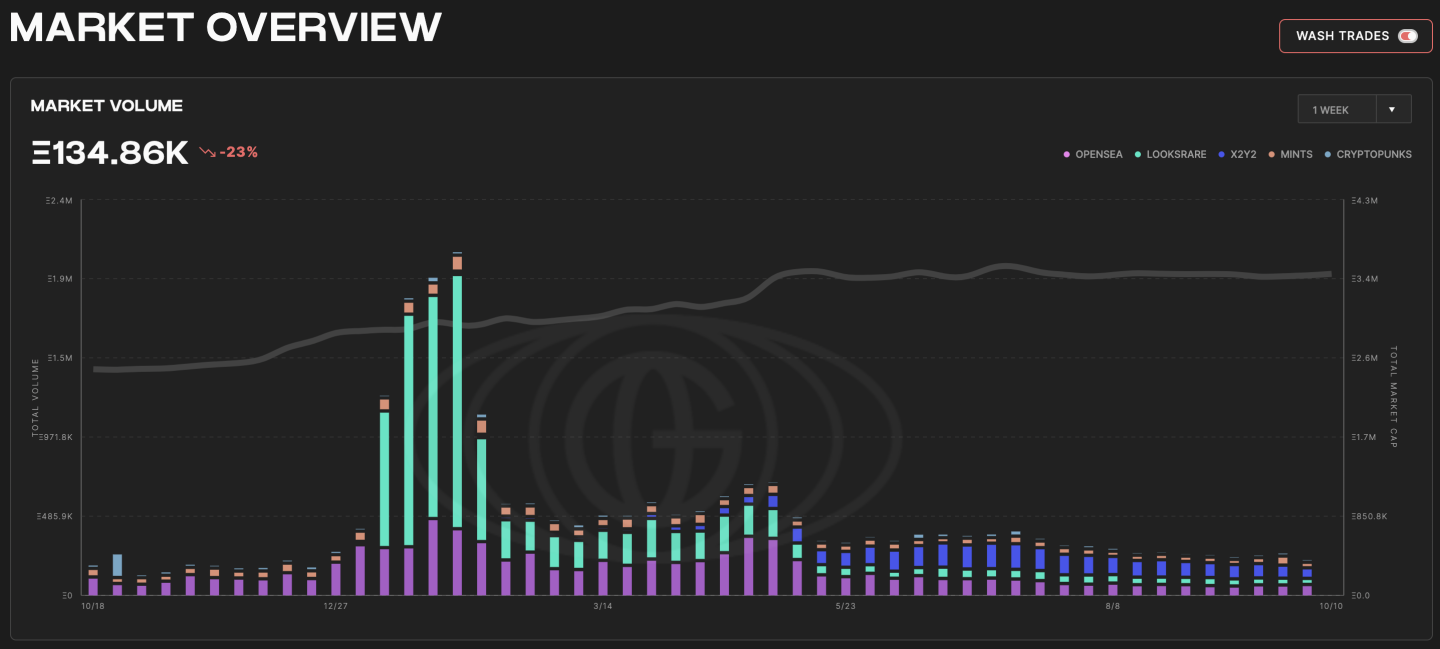

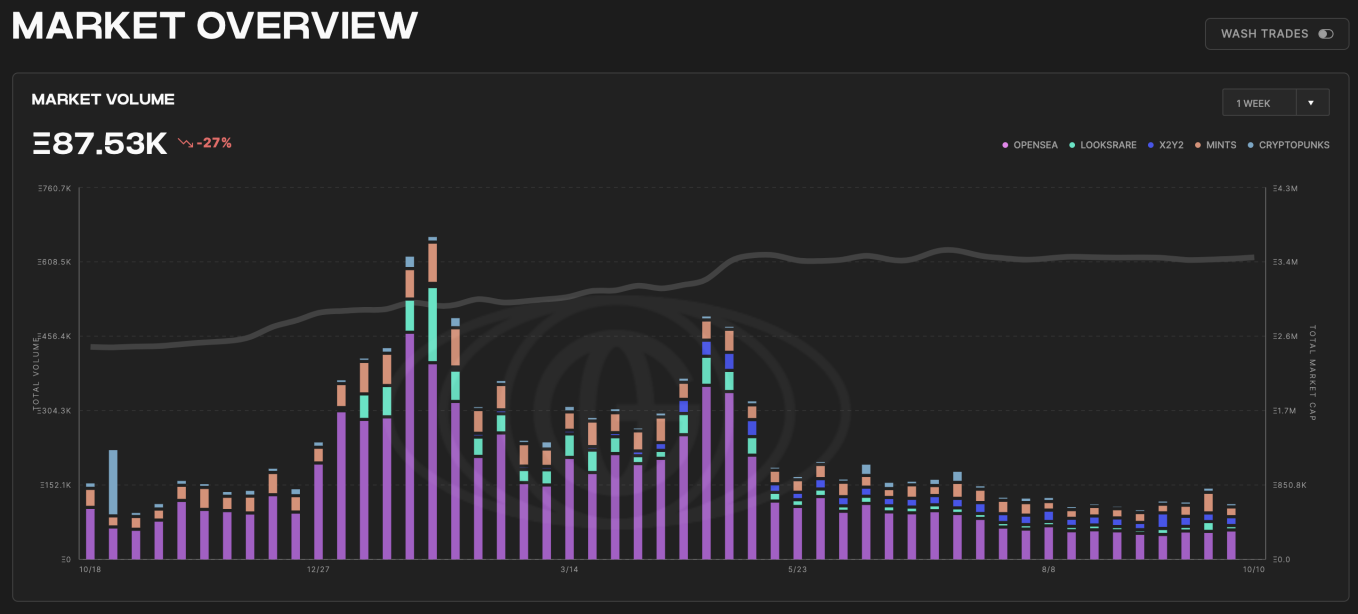

Let's look at Ethereum marketplaces that are rivaling Opensea. Volume ($USD) has certainly picked up on Sudoswap and X2Y2.

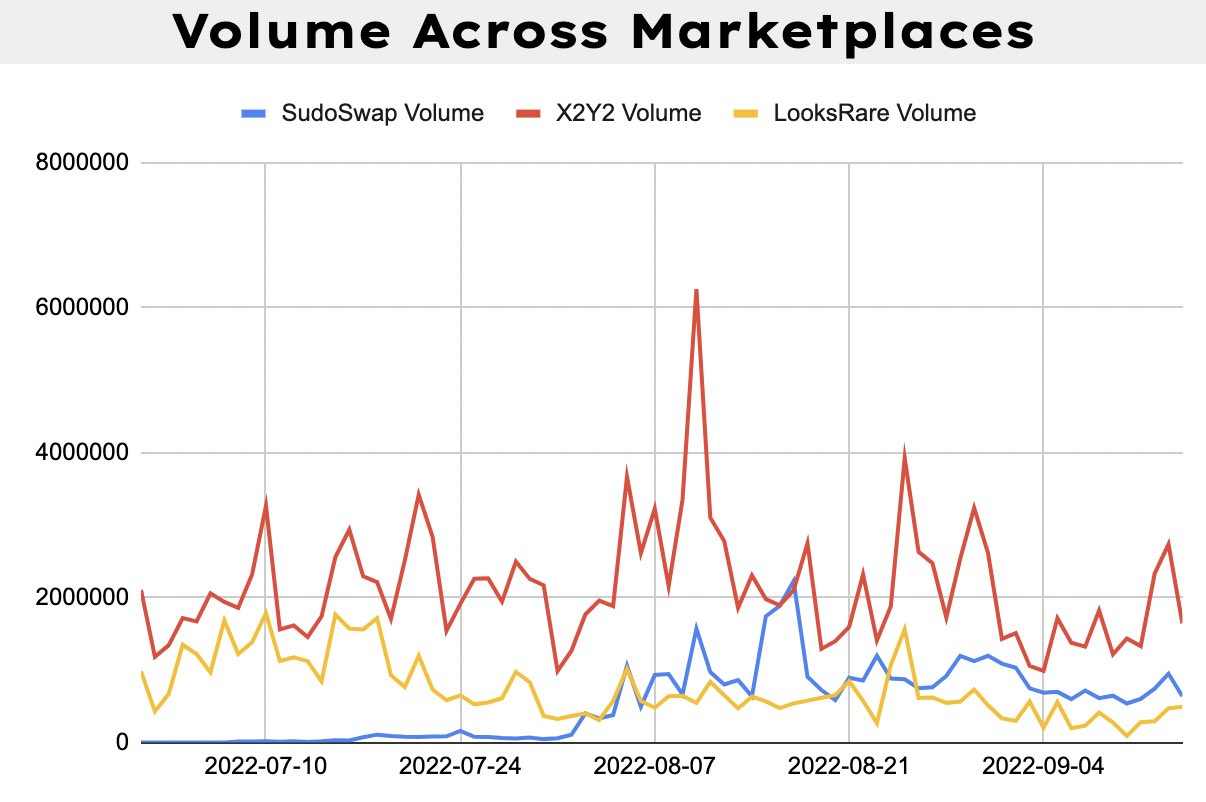

Opensea is still honoring creators, but for how long? If they lose market share, then they, too, will need to revisit their strategy.

This is summarized well by @punk9059. Opensea still dominates royalties paid to artists, with 96.5% market share. But will this change as competition ramps up? Sudoswap volume ($USD) is growing, but royalties are zero, suggesting traders are switching for a reduced cost base.

Bypassing royalties goes against the ethos of empowering creatives. But even if it was embedded at contract level, over the counter (“OTC”) trades could be performed at nil value. The issue is not that smart contracts aren’t enforcing royalties; the issue is incentives are not aligned to facilitate a mutually beneficial arrangement for market participants.

Conflicting Interests

In any capital market there are conflicting interests. Historically, in traditional markets the largest issue has been the Principal Agent theory (aligning the stockholder interests with that of management) with various incentive structures.

NFT projects have been relatively self sufficient without significant external funding— until recently. The royalty income enabled legitimate projects to focus on NFT holders without having to seek external funding from investors. The initial high volume meant many projects were able to sustain their runway during a bull market, but as the macro situation turned, it became apparent that both volume and royalty income were insufficient. We saw fluctuations in mint prices and royalty percentages to counter changes in volume.

Traders have seen their returns diminish as risk-on assets take a hit, putting pressure on marketplaces to follow an optional- or zero-royalty model to maintain market share, at the expense of creators.

NFT marketplaces that advocated for royalties saw their volume go elsewhere, leading to reduced fee revenue.

The current model is broken and is trending to a zero-royalty model that will damage the long term health of the NFT space. But if we look at where royalties have originated, we can see that the current amounts may be too high, particularly in bearish conditions.

Royalties Trend

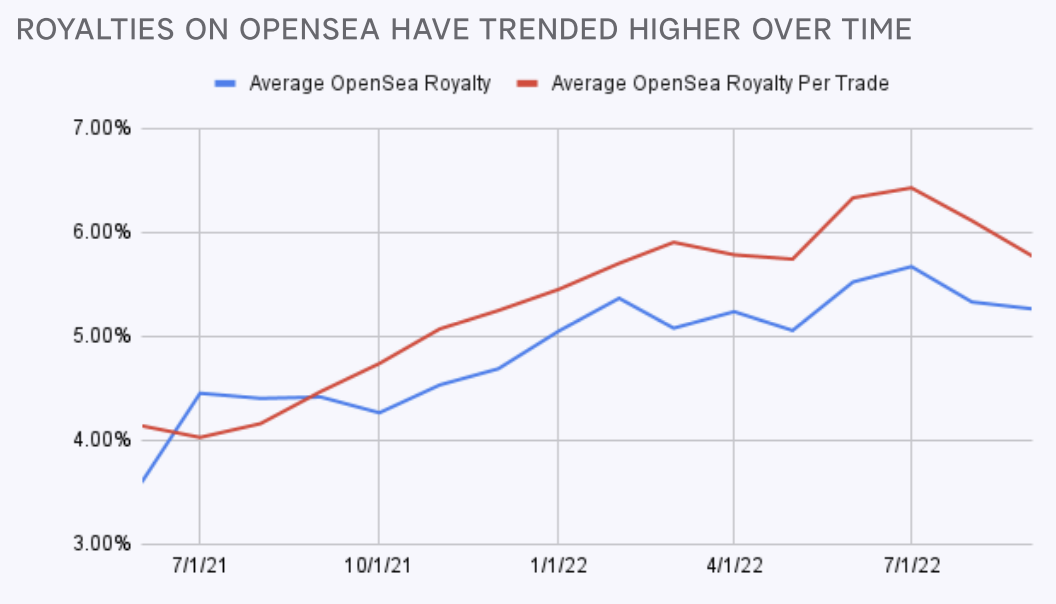

Punk9059 made an insightful observation about the direction of royalties since most key projects launched in early 2021. There has been a gradual uptrend from a low initial royalty percentage, which for most projects equaled around 2.5%:

In a bull market, projects capitalized on the increased volume by raising the royalty amount, without too much pushback from holders. The euphoria of making significant gains meant that an increase of a few percent was a drop in the ocean.

However, now that the market has turned, volume is down and traders are looking to maximize profits in any way possible, including using zero royalty marketplaces.

It’s difficult to establish a reasonable royalty percentage. No one-size-fits-all, and the amount could change depending on the needs or performance of the project.

How Much: Mint Price and Royalty Percentage?

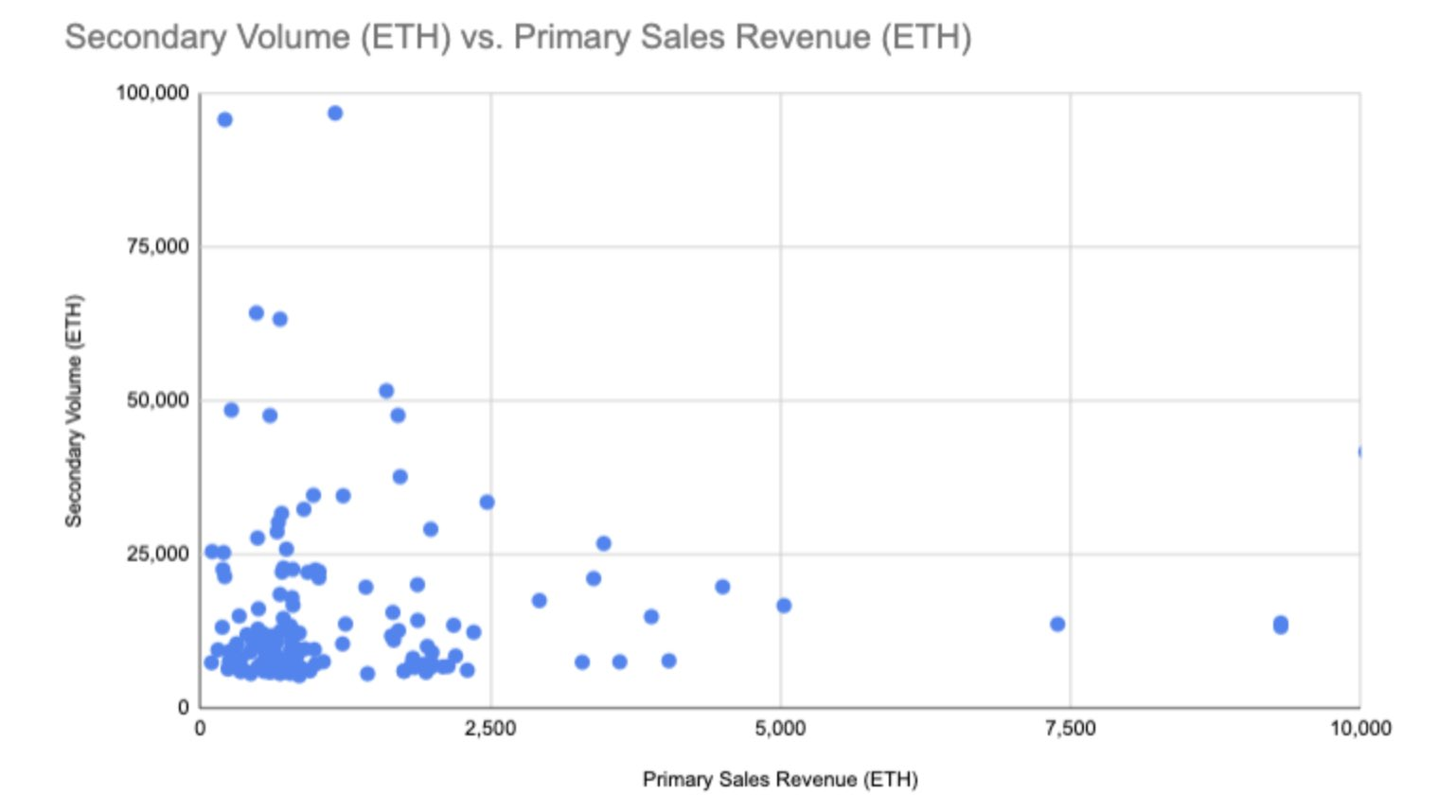

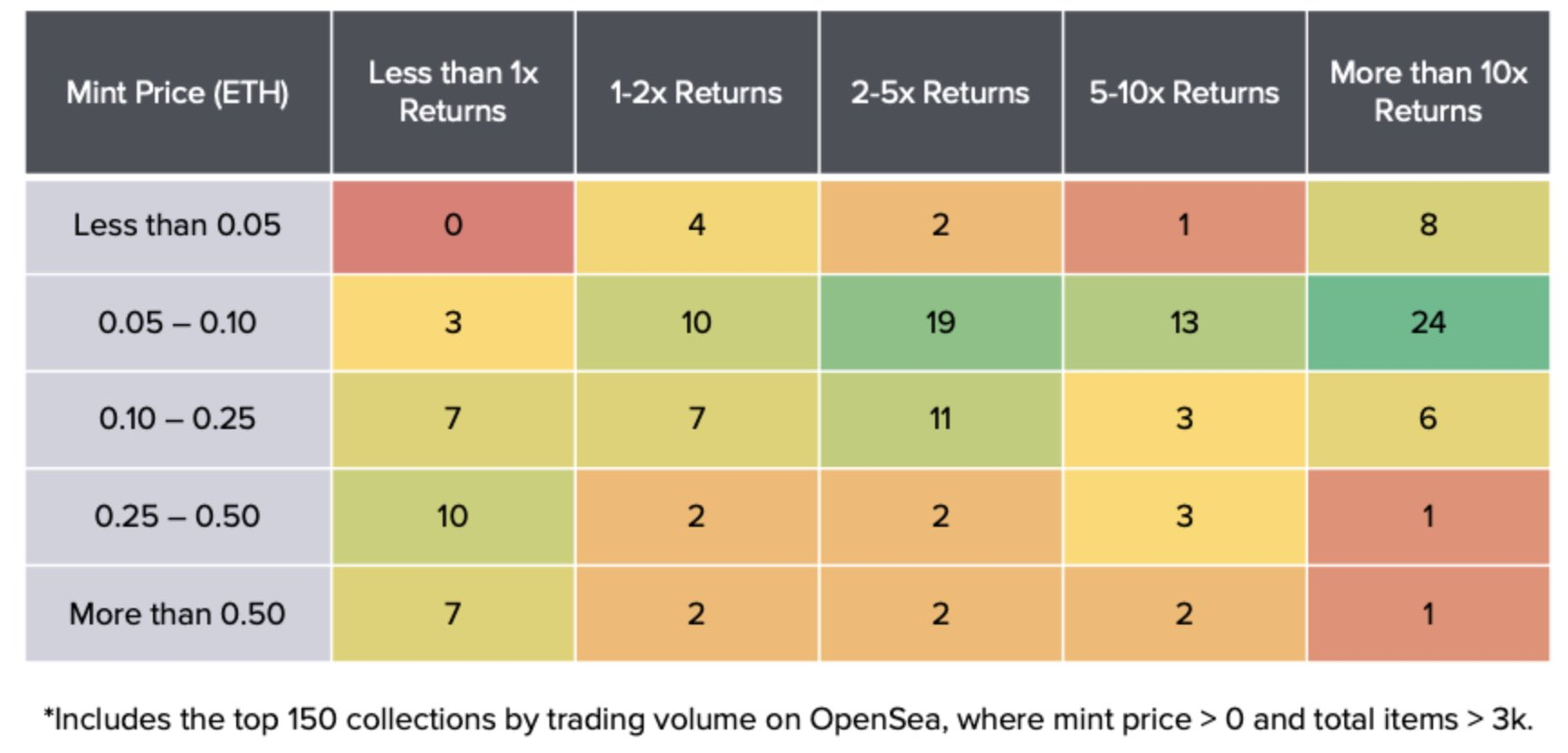

@a16z performed an interesting comparison of primary/secondary sales volumes at different mint prices. Higher mint prices (primary volume) tended to generate lower secondary revenue (derived from royalties).

So the debate: how much to mint? What is an ideal percentage for royalties?

The percentage set depends on:

-

The type of collection - Some may require more to execute.

-

Utility - May require up front cost rather than ongoing, smoothed funding.

-

Target market - The demographic may only be able to afford a certain amount.

-

Macro conditions - Purse strings are tighter in a bear market.

-

Performance - Does the team deserve the royalties set?

Generally a mint price of 0.05-0.1 ETH performed the best on secondary, before shiny object syndrome took attention to the next project.

Many projects involve their community to help decide on an appropriate mint price and percentage on secondary. But a project should forecast a full budget to deliver against their roadmap and then re-evaluate their performance to assess whether they are on track.

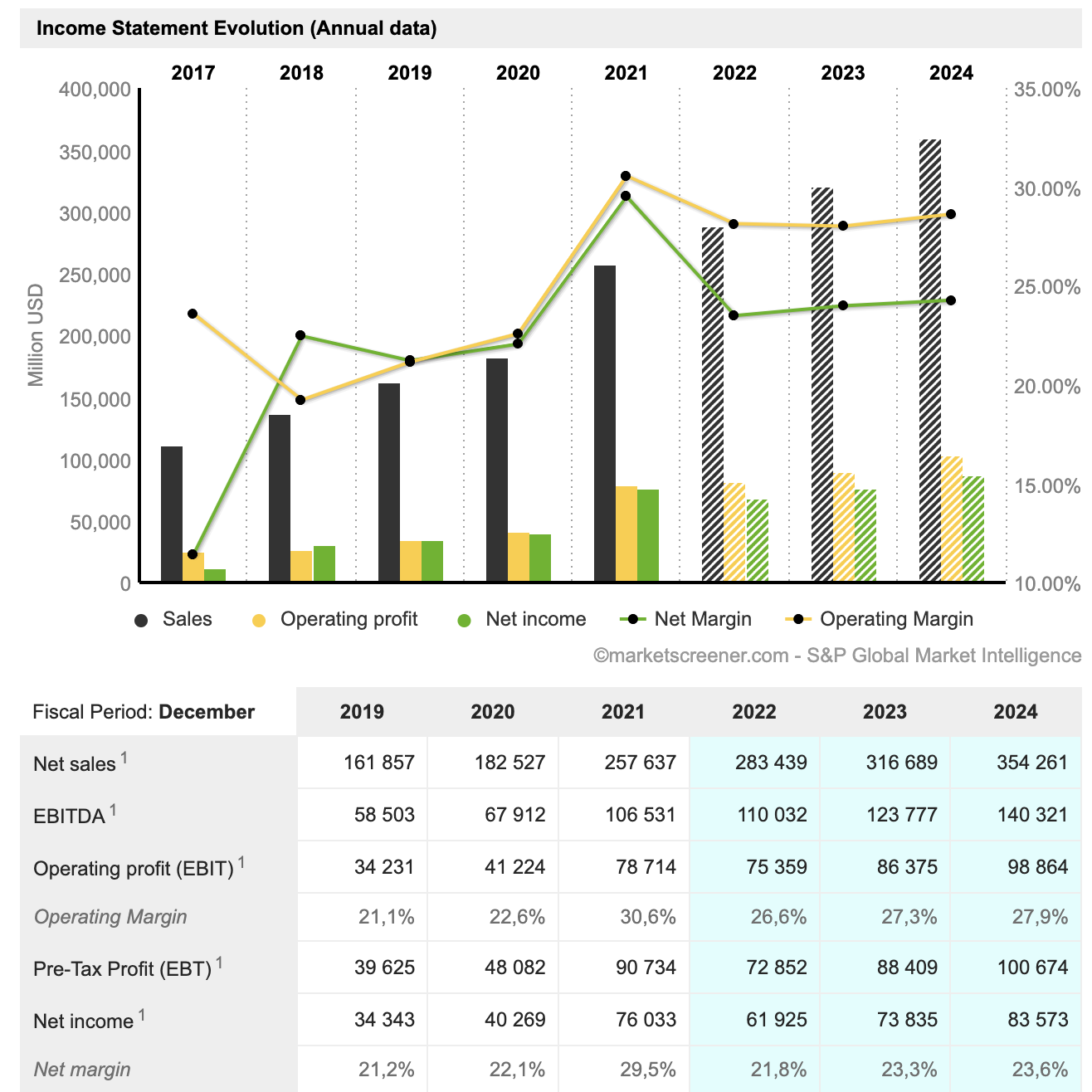

Using Alphabet Inc. analysts forecast as an example we can see the types of analysis that could be used to enable a project to succeed:

If a company or project is loss making to begin with it would need to have some reserves to fund it in the short term until it becomes self sustaining. The runway refers to the amount a project has left in its coffers before it needs to raise capital or generate more revenue to sustain for longer.

There is zero chance a business can succeed without forecasting its profit & loss - an NFT collection is no different. A project should:

1/ Forecast the cost to deliver.

2/ Go to market and assess what the community is prepared to pay.

3/ If there’s a shortfall, then alternative funding may be required.

4/ If not feasible, then state that the roadmap can be completed up until a certain point with these anticipated funds raised. If holders are not comfortable with this, then the project should not be launched.

Once a project has launched, then the performance could be monitored to assess whether the current royalties are appropriate based on execution to date and whether there is sufficient runway in the project treasury.

Monitoring Ongoing Performance

Beeple provides his views in response to the Magic Eden optional royalties announcement. He states that creators should build a loyal base that are willing to pay, and that royalties are moving from a “seller’s FEE to a buyer’s PREMIUM”:

The optionality puts the onus on the creator to continue delivering value to their holder base. But how does one determine value accruing to the holders?

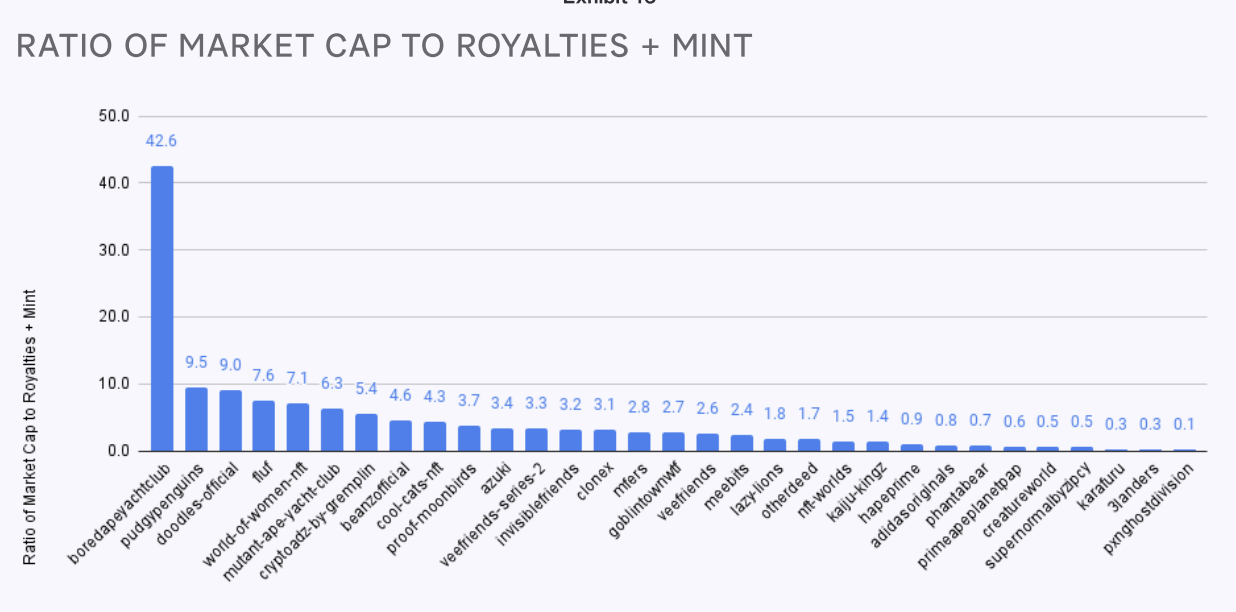

PROOF collective make reference to an interesting metric:

Floor market cap : (Royalties Earned + Mint)

The market cap could be used as a proxy for what the market is willing to pay for it now. If this is in excess of the mint plus revenue earned from royalties then the market is willing to pay more now than the total amount earned by the project founders, ultimately resulting in value creation. The gap could arguably be an intangible asset such as goodwill.

BAYC are clear market leaders in this value accrual, particularly when taking into account airdrops and allowlist allocations:

There are many ways of measuring whether a project is performing well. But this metric of fair value (market cap as proxy) assumes that all this is already priced in according to the efficient market hypothesis.

In traditional markets, one would record a mark-to-market adjustment on the net assets of the project (treasury) to align with the fair value. If market sentiment changes and adversely impacts the project, then this would be marked down accordingly.

So one can assume that the performance of a project is factored into the spot floor price, and holders are generally happy when the price is above what they paid, or if the additional value they’ve received while holding the NFT plus the floor is more than what they have paid.

Flipping the expectation that founders need to continue to work to earn the royalties can be counterproductive for the long-term health of the space if the value received is negligible. Let’s take a look at these adverse impacts.

Adverse Impacts

1/ Brain Drain

The underlying innovation with NFTs is the royalties. It empowers artists to make a living off their work and reduces the cuts taken by traditional auction houses or other intermediaries. If there were no royalties, then there would be a brain drain in the NFT space, with creators seeking alternative sources of income to make a living.

2/ Wash Trading

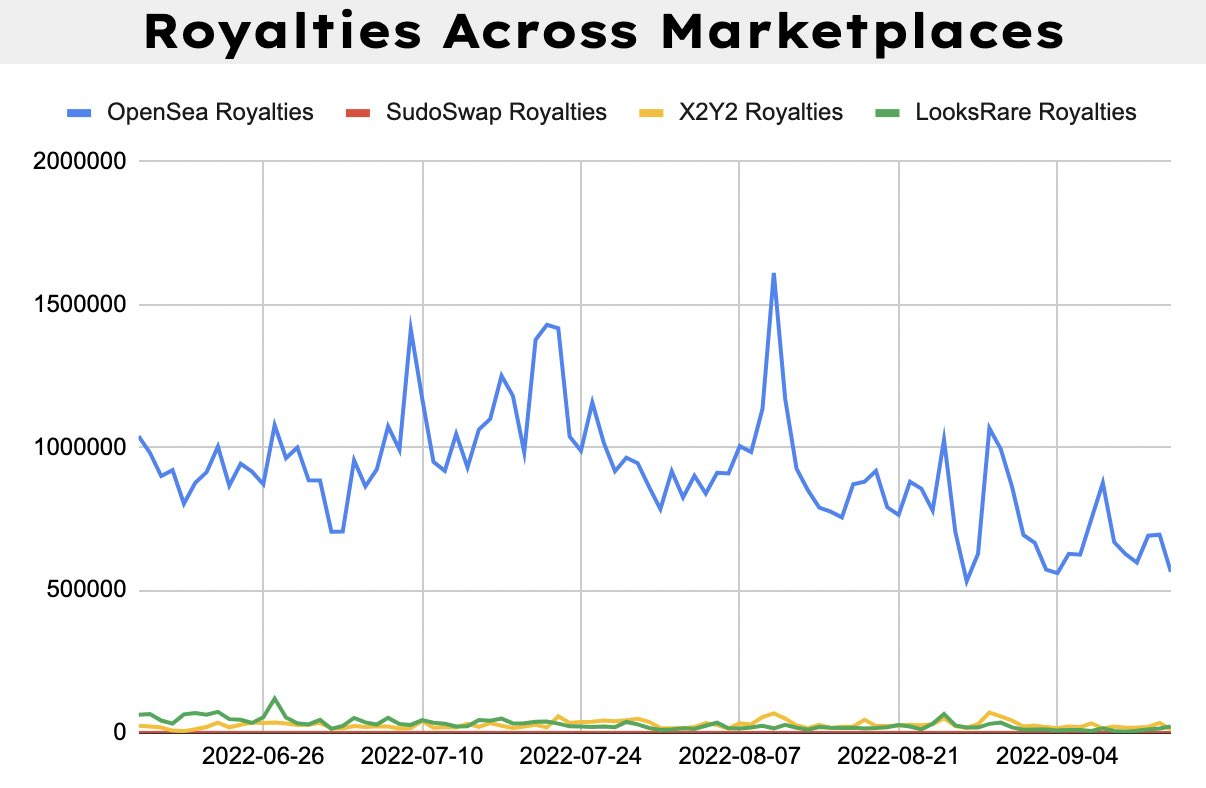

There’s been a huge spike in wash trading (fake volume) on platforms that offer low-to-zero marketplace fees. The effects have been compounded with optional royalties, especially with most traders electing zero.

-

Opensea has removed the analytics for Solana trending collections to protect market participants from acquiring rug collections or wallet drainers given the wash trading.

-

X2Y2 has seen spikes in volume. Unknown collections were blatantly wash traded to the front pages of the marketplace.

Wash trading is prevalent, as can be seen from these before-and-after Origins analytics dashboards.

If no action is taken, where can we see the NFT space trending?

Future Predictions

The royalties discussion has heightened competition between marketplaces.

Waiving mandatory royalties has meant traders have elected to move to cheaper platforms to maximize profits or minimize losses at the expense of founder runway.

Those marketplaces advocating for royalties are receiving support from founders, creators and many participants in the space. But what’s the solution? They’re businesses after all and need adoption to generate revenue to (at least) cover their expenses.

Native Marketplaces

Opensea has dominated market share since it dethroned the Cryptokitties-native marketplace in 2017. It offered a 1% reduction in fees to encourage players to move from the native platform.

i/ Increase in Project Native Platforms

With many projects losing out on royalties, it could justify an investment outlay from projects to build their own native platforms. The added benefit being that these projects could then match the 2.5% fee in place of the royalty. It would then be a question of maintaining volume and adoption. However, if the buyer knew they were contributing to the project runway, then they are more likely to acquire the asset on the native marketplace.

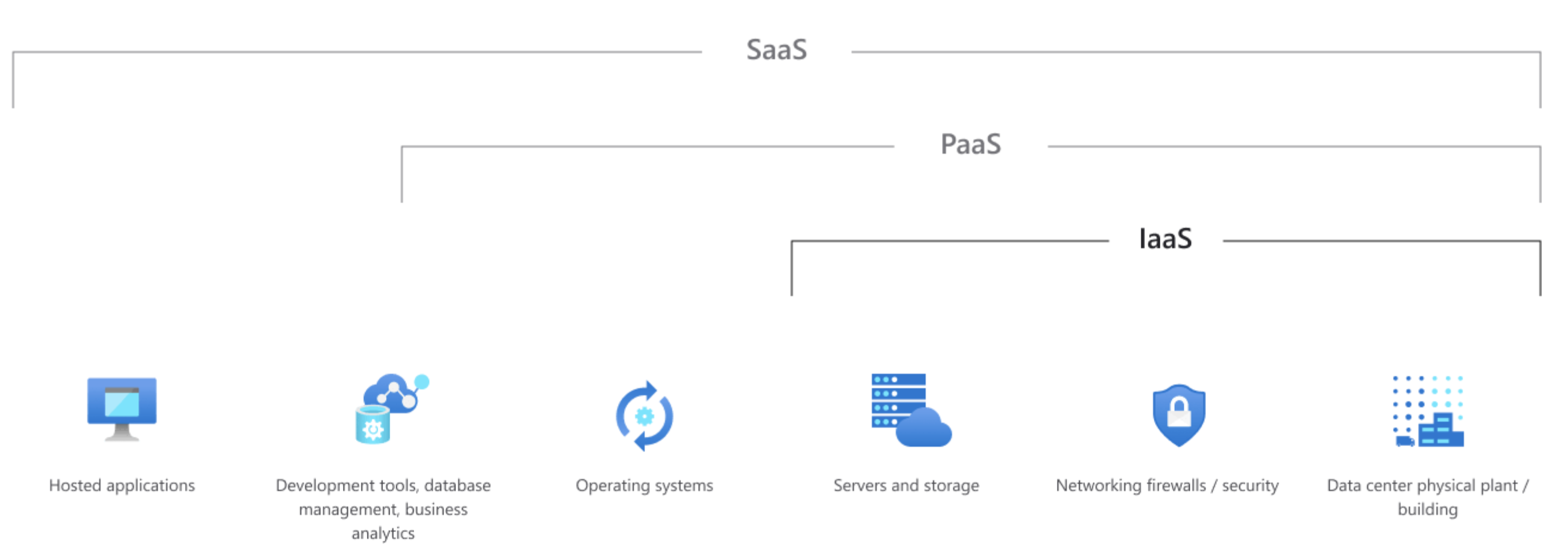

ii/ Infrastructure as a Service

Infrastructure / Platform as a service (“IaaS” / “PaaS”) are not new concepts. Many projects have already built functional marketplaces that could arguably be developed into off-the-shelf packages for projects to acquire or rent. The code from existing marketplaces is available for project developers to use to create their own infrastructure; however, without developer capabilities, this can be difficult to build on efficiently with the small portion of the runway projects have, especially in an adverse market.

The following diagram illustrates this infrastructure in a web2 capacity. Much of the web3 infrastructure would be the blockchain or databases like Arweave.

This IaaS offering would allow projects to set their own marketplace royalties, potentially replacing marketplace fees. A subscription fee could then be paid to the IaaS provider.

Opensea Advocates for Creators:

-

If Opensea were to offer IaaS, then it would create a new subscription revenue stream from projects.

-

It would indirectly reduce its dependence on trading volume and move to more diverse income generation.

-

This would likely be offset by volume reduction on their own centralized marketplace, but would empower projects to build.

-

Opensea would then have more reliability over its cashflows, all while projects would assume the incentive to increase volume on their own marketplace.

-

A stepped subscription model would need to be introduced to appeal to projects of different sizes.

As Beeple mentioned previously, other revenue streams will likely be required to sustain projects going forward.

Other Revenue Streams

Royalties could previously sustain many projects and marketplaces during a bull market. However, this is no longer the case and other traditional revenue streams are now required to supplement the income. Loopify highlights that projects should never be reliant on royalty revenue, given the risk of low secondary volume and direct impacts on income.

It is said that the ideal different income streams is seven. That way if one tap is turned off, the entity can continue. It spreads the risk and reduces the reliance on a single source.

Although seven sources of income for projects may be unlikely, we should see projects and marketplaces adopting several other revenue streams. For instance:

-

Merchandise.

-

Charging for IRL events with a subsidy for members.

-

Subscription services for some internal IP not directly linked to the NFT (E.g. Botting, contract tools).

-

Consultancy services given the knowledge attained.

How projects use the revenue should be a consideration. If the benefits flow back to the NFT holder and there becomes an expectation to receive an income, then there could be regulatory scrutiny from the SEC, particularly if the digital asset no longer complies with the HOWIE test. If a treasury was used to buy back its floor, then it is increasing the capital appreciation of the NFT. Whether this is an effective use of treasury is debatable, as stock buybacks occur in corporate structures all the time. However, if the management of a project is buying back its floor, then arguably it is a sign they are unable to use those funds better elsewhere to create value.

This leads me to several concerns over the topic.

Concerns

1/ Don’t Lose Sight of the Innovation

Empowering creatives was the original focus of NFTs. The automated royalty payment system is the innovation. Creatives have historically struggled to survive from their work; NFTs were intended to change that. I hope we don’t lose sight of this with a regression whereby web2 systems and greed stifle innovation.

2/ Liquidity Extraction

Royalty percentages have been creeping up since the 2021 NFT boom. Mint prices have also become extortionate, with several high profile rugs taking the logic to its extreme. With constant liquidity extraction from the space, it’s not surprising that the market is pushing back on the cost of projects.

It’s all well and good to charge a high price, so long as it’s consistent with the expected value or product delivered. Poof_eth performed an enlightening calculation on the value extracted to date —much of this has left the ecosystem altogether. This activity is not sustainable without new money coming into the space. A zero sum game is not productive either, hence the “Ponzi” label. There are many ideas being produced, however for every awesome project, ten more derivative cash grabs pop up. Celebrities endorsing dead-end projects and scams have been prevalent. This activity needs to change and royalties should be earned by projects that deliver genuine value with good intent.

It’s worth posing the questions:

-

Where do the royalty payments go?

-

What are they used for?

-

Will they re-enter the NFT ecosystem in some capacity?

-

Is the amount I’m paying worth the value I’m receiving?

If you as the purchaser are uncomfortable with the answers to these questions, then you have the right not to participate in that project. If others agree with your view, then the creator will likely need to revisit the amount charged.

Solution: Carrot or the Stick?

There’s been discussion around projects implementing features to prevent investors from boycotting royalties. This can be encouraged through a rewards system or deterred through punishment.

Stick (Punishment):

1/ Metadata Changes

Metadata could change depending on whether royalties were paid or not.

This has been introduced previously on Solana with the blur feature (Metashield) on Magic Eden (“ME”), but was met with backlash. This feature was given to creators to edit the NFT in the event of no royalty being paid. It could be blurred until the royalty amount was paid, then the NFT image reverted.

This feature was viewed by the market as a means of further solidifying their Solana NFT monopoly, by preventing collections from being able to trade on alternative exchanges without royalties being paid. ME has since u-turned on their stance on royalties with the option for buyers to pay zero, allowing ME to remain competitive with other zero-royalty marketplaces.

2/ Creator Protests

There have been indications of services that deactivate NFTs (underlying utility turned off) for buyers that do not pay royalties. This empowers creators by taking a stance against marketplaces and buyers that fail to pay.

3/ Mandate Royalties

One solution could be to mandate royalties, similar to Harberger taxes. However, OTC trades can still be done. But if this is mandated with legal repercussions, this could support the creative industry. Probably not a popular option, though.

4/ Whitelisting

Whitelisting is the ability for creators to enforce NFT Royalties by allowing only compliant NFT marketplaces to trade the creator’s collection. While it limits exposure to the available traders in the space, the more hyped projects should be able to drive sufficient volume to compliant marketplaces. This could have a knock-on effect of reducing marketplace revenue for zero royalty marketplaces and force their hand to reinstate mandated percentages of their business struggles. This would likely require a consortium of projects to pull together to boycott optional royalty marketplaces to have an effect, similar to trade unions.

Carrot (Reward):

1/ Conditional Royalties

The contract could be adjusted to bypass the requirement to pay royalties on NFTs that are sold for a loss. This better aligns trader and creator interests through an increase in price. Currently. any news, particularly controversial, that increases volume can drive more royalties to the founder at the expense of the collector.

2/ Bonus Features

Those that opt to pay royalties could receive additional functionality. Whether this is access to live events or having access to the artist/founder, it justifies the additional payment from the buyer. Some collectors may be happy with the basic offering, but additional benefits that add value could prompt buyers to pay the optional extra.

3/ Marketplace Co-operation: Segmentation

As the market matures, tiering of artists or types of collections could be allocated different percentages. This could be agreed between marketplaces, to protect artists.

It's a culture clash across nations, with countries like the USA accustomed to tipping while others not so much. These cultural norms flow through to the NFT space with respect to paying royalties. We might see marketplaces launch preferred clientele lists with benefits for those who pay royalties. For example, enhanced analytical tools, improved interface experience, or access to trending collections.

4/ Perception Shift

Beeple highlights that creatives need to build a loyal base that are willing to pay, predominantly the investor/collector as opposed to the trader. The market, though, needs all participants for increased liquidity.

This puts the onus on founders to continue to deliver to receive the royalty reward. Delivery will differ depending on the project type. 1/1 art will arguably require less involvement from the creator compared to an NFT game that continually needs to develop new content to retain a player base.

This may be an unpopular perspective, but it shifts the expectation that royalties are to be received into perpetuity for a single event at the beginning of the project. Those buying into a founder, or their project, also have hard-earned money that they want to exchange for another form of value. While DeGods received a significant initial outlay, they reduced their royalties to zero in light of the delays in Y00ts mint. Teams holding themselves accountable improves transparency and maintains loyalty from their followers.

Closing Remarks

TL;DR

-

Support creators, otherwise there’s no future for NFTs.

-

The notion of a buyer's premium versus a seller's fee highlights that royalties have been historically high. Equitable payment for a creator’s work should be earned rather than expected.

-

Collaboration is needed amongst marketplaces and creators. Alignment of market participants’ interests will bridge the gap.

-

Establish your own project requirements and go to market with a realistic price expectation. If unable to obtain the required funding ,then be transparent or revisit the project strategy.

-

Monitor the macro market conditions, market liquidity, and project performance. The royalty percentage may need to be adjusted accordingly. It will reflect well on your reputation to be connected to your fan base.

-

Many projects will need to rely on revenue streams outside of royalties to survive, particularly in adverse economic conditions.

-

We could see significant growth in the number of native marketplaces emerging or IaaS style marketplace offerings available for projects to manage their own trading activity.

-

NFT contracts could be altered to both penalize and reward those wjp pay royalties. Features could be turned on and off depending on the amount a buyer has elected to pay.

-

Liquidity extraction is a huge issue for the NFT space. Royalties have had a part to play in this, with bad actors extracting value out of the ecosystem. This needs to change to a more sustainable model. Similar to dividend policy, a balance extracted as reward to founders and a portion reinvested into improving the projects or wider NFT sector.

-

Regulation should be a welcome change, as this will protect retail investors and creators alike.

Enforcing royalties is not the solution; adapting and aligning interests through reward mechanisms for real value creation is a far better focus than punitive measures. It will be interesting to see how the ecosystem develops over the coming 12 months, but the current model is not fit for purpose.

At OriginsNFT we leverage data-driven decision making, educational resources, and proprietary analytics to remain ahead of the curve with respect to blockchain tech and specifically NFTs. To find out more, please visit our website or Twitter.

To purchase a pass, please visit our Opensea page.