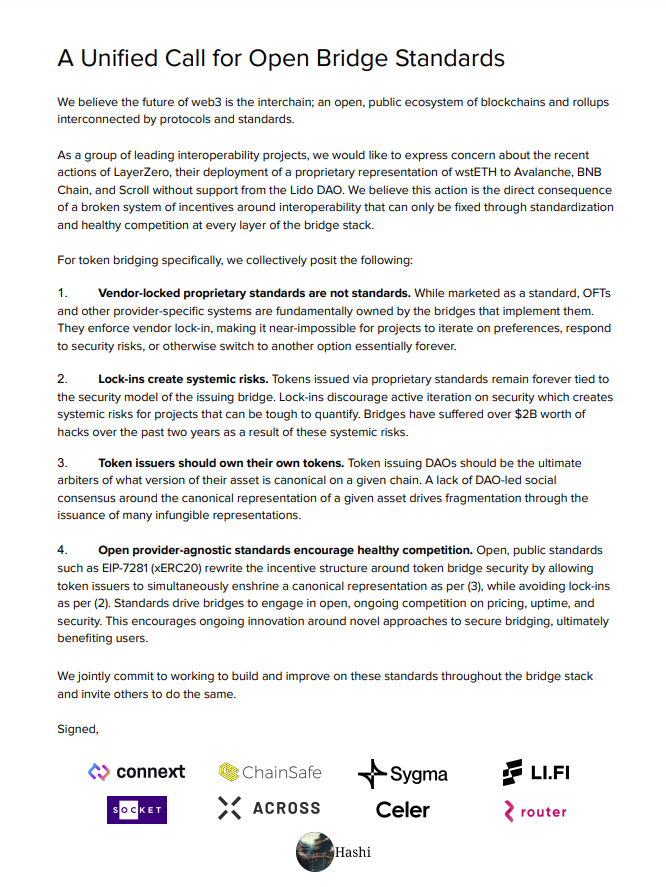

This past week a series of middleware projects that aim to facilitate cross-chain interactions rallied behind a manifesto of sorts. The sudden, reactionary alignment between otherwise competitors would not have happened in the absence of a perceived existential threat. This likely has to do with the biggest Ether accumulator having their token bridged to other chains without express, seemingly expected, blessing. In response, the signatories would have it such that chains, in order to benefit from the presence of various tokens, would need to procure a bespoke franchise. Now, I do not care about Layer0 being a good and bad actor. If their stack is proprietary as claimed, I do not wish them well. I do however care about the following two things.

First, most importantly, I want to say:

(1) “I told you so“,

crypto coins are, as the majority of bridging providers now recognize, DAOs.

(2) I am worried: this instinctive paternalistic reaction needs serious time off.

__________________________________________________________________________________________

(1) On those initial set of default DAO features, the petitioners want to add additional ones as to give issuers (the bank) more power in their relation with users (members). The issuer will gain more control over what a token owner can do with its tokens. This, of course, as always, in the name of security and convenience. To, of course, protect the token, previously owner, now mere user. In practice, what this aims to do is make tokens up-gradable by default as to be governed by their corresponding DAO. Like those exist in practice, at this point in time, and as if DAOs are the sole or most popular type of token issuer or, finally, as if the social consensus they decry is not in fact and by any definition already decentralized governance.

(2) I do not think for a minute that I am exaggerating when I say there is an important shift here the signers are pushing: from assets that users own in the fullest sense of the word to assets that are governed over in common. This distinction is one that the signers seem to totally ignore. Defaulting to the second is highly problematic as it, among other things, could:

-

declare open season to chain sanctioning regime (land of the free will get ideas)

-

restrict permissionless innovation and composeability (slippery slope)

-

push costs on the users under a false assumption of DAO structural maturity

Now, there is nothing wrong with altering the character of a token on comunitarian grounds. There’s nothing in itself evil with central banks changing interest rates. I am by no means an american libertarian nutcase. I abuse such governed tokens daily in mechanism design. But, a line needs to be drawn somewhere when talking defaults. My hot take here is that perhaps giving sanctioning power over assets that have as primary purpose value conservation or speculation seems like a breach of contract.

An Illegitimate imposition I would say. I would also dare to ask as to why is user choice here illegitimate? Is the consent invalid because the implications of the choice are seemingly undisclosed? But how are upgrade-able tokens better in that regard? Isn’t the sense-making burden they introduce much more demanding than the current signal-by-use mechanism? Isn’t it also, given the state of understanding of tokens as DAOs, a centralizing vector that is seriously prone to queen-make the highest briber?