28.10.2024||| prepare for a psilocybe

Pre-read.

This is for the crypto curious. This is written as a book. Could consider it like a small brochure of Metis. 13 chapters. History, connection, Aave, Chainlink, DFK, Metis skipping around the timeline.

This is not financial advice, this is me rambling about Metis and crypto. I like Metis and crypto.

1 - α´ Intro

2 - β´ Bitcoin Early Days

3 - γ´ Metis, L2

4 - δ´ Vitalik’s Odyssey

5 - ε´ Tracy

6 - ς´ Toronto

7 - ζ´ Gitcoin

8 - η´ Aave and Link

9 - θ´ DCA into the DAC

10 - ι´ Games and Memes

11 - ια Chainlink / Aave on Metis

12 - ιβ Funding

13 - ιγ Le End

The Read

The first hacker conference was, rather fittingly, in 1984. He says in regards to the future of hardware and software, in a typical poetic fashion, the moving storm of computing leaves many stagnant puddles, each pool is teeming with interesting life.

There will be “the old guys with their Macintosh in 2015 but essentially there will be this new wave of newer and hotter stuff… that will be at a sporadic pace.” He brings up the fact at the time there was the hardware but it was extortionate in price, once it was down to $500, we as a civilisation can talk about reforming education.

He was pointing out that the state of computing, in 1984, was inaccessible and unpractical that schools had out-dated computers. However, he was optimistic that the tomorrow’s software is going to be so different and be accessible, it will see a proliferation of software in daily life.

Xanadu is a hypertext system, an invention from Ted Nelson’s brilliant mind, this was the 1960s. He began at the start of the decade, released a paper called “A File Structure for the Complex, the Changing, and the Indeterminate” in 1965 and formally named the endeavour, Xanadu in 1967. He is a pioneer and his version of the internet did not come to mainstream adoption, yet it did revolutionise information sharing, learning, and connectivity, and formed the foundation of the World Wide Web that Tim Berners-Lee eventually developed in the 80s.

Nelson’s contributions are a part of the tapestry of innovations people have put forth, his were pre-Web1 and he was sort-of already thinking in Web3 terms. He coined the term “micropayments”, users would pay small amounts for accessing or reusing individual pieces of digital content. With his hypertext system, it could show the origins of a document – not identical but this is similar to NFTs. This idea was before the internet, let alone e-commerce.

Sometimes, people’s ideas are too ahead of their time. Sometimes technology is not ready. Then something happens and it unleashes the imagination.

Bitcoin is this agnostic tool that we know as a cryptocurrency, one without borders, simply connect to the internet and you can utilise the Bitcoin network.

As banks have halted access to people’s accounts, as national currencies have inflated, people have seen the necessity are putting their fiat, which they perhaps earned from selling their time, into a currency that does not run through a central bank, that has a hard cap in supply.

Bitcoin has been a way for people to not only store their fiat value but their time.

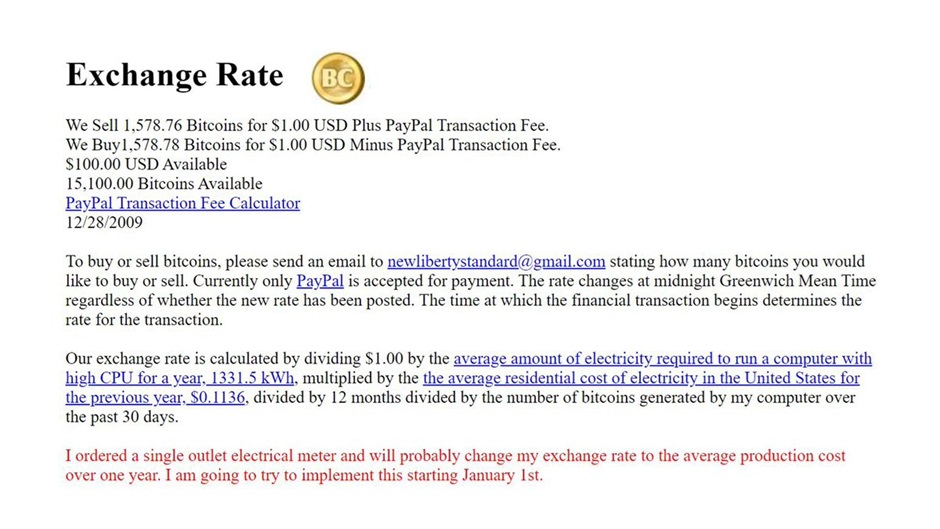

It can be easy to forget the roots of Bitcoin, it can be easy to forget what it was like in the 2000s where phones weren’t dull slabs of screens and fashion was questionable.

Ted Nelson said, paraphrased, that when you have an internet page that does not allow you to annotate and have margin notes, that is because the developer did not programme it. You may think, “well, duh,” the point is not to take function for granted, that just because you have only experienced a web page one way does not mean that is the only way.

Deep in Bitcoin’s code were other potentials. According to Amir Taaki, an early developer on Bitcoin, said Satoshi had half-finished a poker client and there was a marketplace that was removed. In case you do not know, Bitcoin had a scripting language that had potential to provide smart contracts on top of Bitcoin.

A tool is a tool, it is not sentient. It is the imagination of those that wield it that direct the tools usage. Bitcoin attracted Crypto-Anarchists/Cypherpunks, FreeSoft Hackers, Austrian Economist Gold bugs, and Agorists.

Bitcoin was at a crossroads. One option was to allow for programmable functions that go beyond the Bitcoin simply being a currency. Yet, there were vulnerabilities and they were temporarily shut down, never to be switched back on.

Bitcoin became a crypto-anarchists dream, it became the hedge against inflation, it became the exit of the system, it became denounced, it became legitimised, your mum hated it, your dad asks about it…

Regardless of whatever people say it is, it has continued as a peer-to-peer electronic cash system.

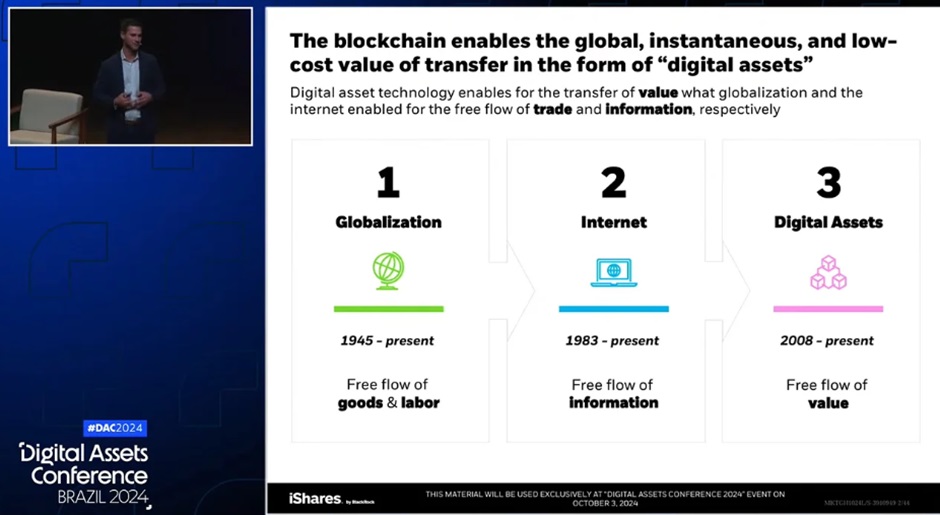

Metis is a layer 2 for Ethereum that was originally an Optimistic Rollup. There is a theme of either optimistic methods or ZK tech used to scale Ethereum. The internet gave us great access to communication and information, Bitcoin opened up a door to techniques and possibilities, and Ethereum gave up the leapfrog to build out dapps. Yet that is not the end.

The purpose of Metis is to help Ethereum scale and to take the Information Internet to the Value Internet.

Personally, I see Metis doing well in the short term but also the long run as it is thinking long-term and the team’s actions align with building long-term, as you will see as I go on.

Back to the rollup idea, Vitalik wrote “Hybrid Layer 2 Protocols” in 2019 and “The Incomplete Guide to Rollups” in 2021.

He discussed Optimistic rollups and ZK rollups, they have trade-offs. Ops use fraud proofs, ZKs use validity proofs. Ops are simpler but have slower withdrawals, ZKs have quicker withdrawals but much more complex and expensive on computation.

Metis decided to say, “why not both?”

The Metis blockchain is becoming a hybrid rollup. With the security of ZK accompanying the ease of use of Optimistic Rollups, without the complexity of ZK and without the dreaded long 7-day withdrawals of Optimistic, which is untenable for DeFi.

In order to accomplish this, MetisDAO launched ZKM. Kevin Liu, a co-founder of Metis, is the CEO and co-founder of ZKM worked with Ming Guo, chief scientist at Metis and co-founder of ZKM, and the team to find a solution.

ZKM came up with zkMIPs. zkMIPS generates validity proofs for computations executed off-chain. MIPS is an old instructional language and the brains at ZKM have devised zkMIPS, allowing any VM to compile into it, any transaction can be processed on this language without changing any code.

The ambition is thinking beyond just devising an L2 with faster withdrawals and security. This is aiming beyond blockchain systems for IoT, VR, decentralised cloud computing, wearables.

Metis is also the first Ethereum layer 2 to have a decentralised sequencer network. Allow me to divulge more on that.

Ethereum can get congested, this has been a reason for layer 2s and, in case you are unfamiliar, a solution is to take tx’s off-chain to batch them in order to make them a single tx, this is where you need a sequencer. This helps to speed up the finality and lower the fees.

All layer 2s have a centralised sequencer, the benefits are that it lowers transaction costs, simpler to maintain and design, and can it reduce latency.

HOWEVER… there is potential for manipulation. With a centralised sequencer, it is possible to manipulate transaction ordering to extract profits from users by engaging in front-running or transaction reordering. Transactions can be censored too, transactions can be removed from a bundle. Furthermore, this introduces a single point of failure,

Layer 2s have experienced downtimes because the sequencer has failed in one way or another.

Therefore, Metis is pioneering the decentralised sequencer. This solution provides a system where the responsibility of ordering, validating, and batching transactions is spread across multiple, independent entities. It is censorship resistant and aligns with the decentralisation ethos of Ethereum.

A great benefit having a decentralised sequencer is a protocol can share the rewards with the community. By incentivising users, this brings more people to the chain and that leads to people contributing, helping, sharing and foster a community.

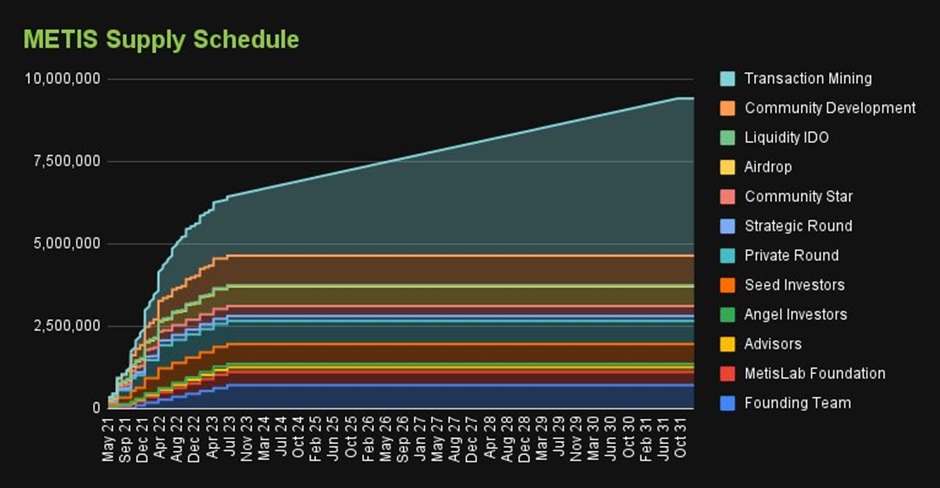

The supply of the token has no more venture capital unlocks, the inflation from rewards to dapps and users is where the project will see inflation but, as highlighted already, this is towards the growth of the users and ecosystem, a net positive.

The community can vote on whether projects enter the chain or not, otherwise known as Community Ecosystem Governance (CEG). A project will make a proposal and the members of the community and developers can cast their vote to come to a conclusion of inclusion or not.

I am no chain maxi; the world is large and the power DLT will have on the economic system is massive. There are other Layer 2s that will be successful, Ethereum will be a global settlement layer and abstraction is the future. I find Metis has been dedicated to developing and kept to the decentralisation ethos whilst having a token for gas and governance.

By scaling Ethereum, Metis provides fast and cheap transactions. By becoming the first hybrid rollup, it evades the shutdowns that have occurred on ZK-rollups whilst improving the security of the rollup. By being the first to have a decentralised sequencer, it ensures trustlessness, transparency and robustness.By coming up with zkMIPS, this has provided a universal zk plug-in, it helps protect against bridge hacks. By enabling DACs, the chain is welcoming to the future of business, Decentralised Autonomous Corporations.

Increase Security. Capital Efficiency. Faster Finality. Meet Metis the hybrid rollup.

At the time the financial system was about to collapse and Satoshi left the Bitcoin Whitepaper on a message board in the corner of the world wide web, Buterin enjoyed playing World of Warcraft. Whilst emergency meetings and bailouts were being conducted, whilst people were being evicted from their homes and moved to living in tents, Buterin had a moment with WoW.

In his own words, “I happily played World of Warcraft during 2007-2010, but one day Blizzard removed the damage component from my beloved warlock’s Siphon Life spell. I cried myself to sleep, and on that day I realized what horrors centralized services can bring. I soon decided to quit.”

This is a guy whose parents were, and still are, computer scientists with economic and business interests. At age 10, he was making his own computer games, once he was bored, he would make another.

Patch 4.0.1 removed his favourite item. If you take this guy’s Siphon Life spell away from him, there will be consequences!

If you are a teen who has had their spell removed, naturally you would establish the largest blockchain that fosters a gazillion of dapps worth the GDP of a small country. However, it does not happen overnight.

Dmitry Buterin listened to a cybersecurity podcast and it brought up Bitcoin. It piqued his interest and he thought it was worth studying, thus he introduced Vitalik to the Bitcoin whitepaper and decentralisation around 2011. Buterin was 17, he initially rejected it but after the WoW-era he was inspired, he wanted to get near as possible to the core of Bitcoin.

He started Bitcoin Weekly, which caught Mihai Alisi’s eye. The pair then co-founded Bitcoin Magazine.

Vitalik’s curiosity made him link up with Bitcoin communities in Toronto, through this initiative he first met Anthony Di Iorio, who had co-founded Bitcoin Alliance of Canada.

If you follow this link, you can read Vitalik at the start of 2013, “After the first two successful Bitcoin conferences that took place in Prague in 2011 and London in 2012, it has been announced that there will in fact be two Bitcoin conferences taking place in 2013. The first, entitled “The Future of Payments”, will take place in San Jose, California on May 17-19, and the second, named “unSYSTEM”, will happen in Vienna on 1-3 November.” bitcoinmagazine.com/industry-events/the-two-bitcoin-conferences-of-2013-1357866416

The year is 2013, Justin Timberlake had promoted MySpace TV, Obama was responding to the NSA PRISM spying scandal, Sergey Brin demoed Project Glass live on TV, and Buterin decided to visit San Jose, California, as there was a conference. An infamous moment occurs where Andreas Antonopoulos explains Bitcoin to a room with 5 people sat down minimum. Andreas clarifies his talk was at the same time as Gavin Andreesen was delivering the "State of the Bitcoin Union" hence most people were listening to Gavin.

There is a video of Bitcoin enthusiasts talking about “The Future of Payments”, you can see that here if you wish - www.youtube.com/watch?v=Ao_HdHyGKDU

Other attendees included the Winklevoss twins, Mike Hearn, Charlie Lee, and Roger Ver. This event made crypto more real for Vitalik and not just a place for internet trolls. Turns out he did attempt to become an intern at Ripple Labs. He applied mid-summer of 2013 and stopped by the offices at the end of the year.

However, it fell through as he could not get the appropriate work visa as and a company needs to have been in business for at least a year if they want to get aa work visa for a summer intern. Ripple had only been a company for nine months.

I wonder how different the crypto-world would have been if he received that visa.

After San Jose, Buterin went to New Hampshire, this is where he came into contact with the Libertarian ‘Free State Project’. PorcFest stands for Porcupine Festival, FSP set this up each year and Eric Vorhees and Vitalik attended. At the festival, some shops accepted bitcoin as payment, they had names like “Revolution Coffee” and “Seditious Soups, Salads, and Smoothies”.

His Bitcoin Magazine fellow Mihai is Romanian and he invited Buterin to Europe as Mihai was working on his Egora project – a decentralised Ebay. The Russian-Canadian booked the ticket and sailed the sky to the old world.

Berlin does boast a mixture of ideas. It has anarchist ideals, famous Room77 was a bar that offered 1 beer for 1 BTC, Gräfestraße was considered Bitcoin Kiez. This spirit intersects with entrepreneurs, government suits, it is an engineering centre and boasts some of Europe’s finest research institutes.

At this Bitcoin Berlin Summer 2013, with the company of Mihai, Vitalik met Yanislav Malahov and Amir Taaki, with a background in professional poker, the Iranian-Brit was living in East Berlin with anti-materialist ideals that coding will change the world.

Taaki is a rather interesting character. A Bitcoin dev from 2010 – 2015 and he embodied the anarchist, anonymity side of Bitcoin, he championed the argument that Bitcoin should not integrate with the banks and instead be its own P2P economy.

He worked with Jaromil. Something unfortunate occurred for Jaromil, he had his laptop stolen in 2011 during a conference and lost his Bitcoin as consequence.

Jaromil added a patch to Bitcoin where people could issue their own cryptocurrencies. This was called Freecoin. This is so ancient and dusty, it was not on Github originally, it was on Gitorious.

Jaromil kept telling Taaki alternative currencies were the future! The seed was there but who was to water it.

See: en.bitcoin.it/wiki/Freecoin / freecoin.ch/

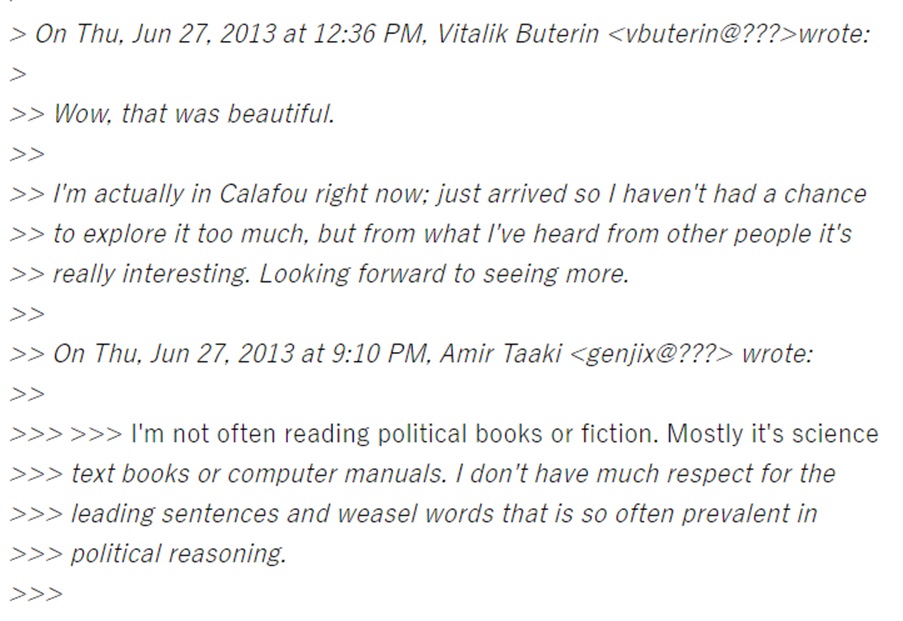

Vitalik enjoyed the Berlin vibe and scoots off to Calafou with Malahov and Taaki.

Here is an email thread that Butern and Amir talk Calafou - lists.dyne.org/lurker/message/20130627.182505.531da7fd.ja.html

Calafou is a post-capitalist camp that was established in 2011. Taaki and Cody Wilson had started unSystem with the goals of technical sovereignty and they found it had a home in the Calafou hacker colony. It is an anarchist hub outside of Barcelona, which is fitting as the Catalan region has anarchist roots, a counterpoint to the Madrid centralists. When Barcelona play Real Madrid in football, it is deeply personal.

This interview of Vitalik is done by Taaki, I believe this is Calafou but I don’t have 100% confirmation - www.youtube.com/watch?v=4oZs6RpLuak&t=1598s

Here is a Calafou presentation from 2013 - media.ccc.de/v/30C3_-_5571_-_en_-_saal_6_-_201312291830_-_calafou_postcapitalist_ecoindustrial_community_-_acracia#t=3

This channel is a trove of early Bitcoin anarchy - www.youtube.com/@BoxxyBrassin/videos

August 9th 2013, for Bitcoin Magazine, Buterin writes an article about Taaki’s Libbitcoin - bitcoinmagazine.com/business/what-libbitcoin-and-sx-are-and-why-they-matter-1376064919

Mihai notes the Calafou environment was a great intellectual challenge for Buterin, Taaki was working on Dark Wallet a project to make Bitcoin transactions and addresses impossible to track.

In this hacklab, they would play with ideas such as Zupass, a zk-ID application, they would use it to vote on things. Amir developed pybitcointools and this inspired Buterin to make a Python Bitcoin library. Buterin had worked at NextThought on an internship as a developer programming python server-side code for technology-assisted education software.

This is an example of Buterin leaning more towards the scripting of Bitcoin rather than the currency.

For the next bit, do forgive me on my timeline of events. I am unsure exactly which order they go in. I am going off what is publicly available and some sources seem contradictory.

Vitalik decides to travel to Amsterdam for another Bitcoin Conference, this is where he would meet American-Israeli Amir Chetrit, who would later become a co-founder of Ethereum, and once again Malahov.

Here is one Bitcoin Mag article around that time - bitcoinmagazine.com/business/how-to-decentralise-the-bitcoin-foundation-1382478074

Amir used to be in real estate and then 2008 decided to change the course of history for many. He was working on Colored Coins when he met Vitalik, Colored Coins was a project attempting to configure Real-World Assets on Bitcoin.

A year prior, there was the Occupy movement in Amsterdam, this is a picture from that time.

And a year before that, Amir Taaki spoke at Amsterdam EPCA. Apparently, after his talk, Gavin Andresen message Amir to tell him to never speak about Bitcoin publicly - www.youtube.com/watch?v=wbqmKIXyqHc

In Bitcoin circles, Taaki was “Anarchist” Amir and Chetrit was “Capitalist” Amir. After Amsterdam, Vitalik went to Israel as he was curious about the crypto scene there, for there were some restaurants that accepted Bitcoin.

Meni Rosenfeld had an idea called Colored Coins. eToro is an Israeli start-up and funded the idea, eToro co-founder Yoni Assia made a blog post March 2012 called, “bitcoin 2.X (aka Colored Bitcoin) — initial specs”. This was to have real world assets represented on Bitcoin. Alex Mizrahi had helped lead development of Colored Coin.

Colored Coins premise was to use Bitcoin’s blockchain as a foundation for issuing, tracking, and transferring tokens that could be “colored” to represent specific assets. Each "colored" Bitcoin or fraction of a Bitcoin would carry additional metadata indicating its association with a particular asset, thereby allowing for new use cases such as digital collectibles, smart contracts, and more.

Amir Chetrit was a co-founder of Colored Coins and linked up with Vitalik once he arrived in Israel. Buterin worked with Malahov on a Colored Coins wallet. Here is some relevant material from that era if you wish to delve in:

bitcoinmagazine.com/business/bitcoin-in-israel-part-3-interview-on-alternative-currencies-1382840361 VB pt3

bitcoinmagazine.com/culture/bitcoin-in-israel-part-4-community-and-startups-1384327722 VB pt4

Vitalik had limited involvement with Colored Coin but he did do some development work with Mastercoin whilst in Israel. The Mastercoin whitepaper came out January 6th, 2012, and was named, “The Second Bitcoin Whitepaper”. It was the first ICO and people simply sent BTC to this address 1EXoDusjGwvnjZUyKkxZ4UHEf77z6A5S4P in order to receive MSC. This was to be built on top of Bitcoin and enable new projects through Mastercoin.

In Vitalik’s own words, “I came up with a draft proposal for something called "ultimate scripting" - a general-purpose stack-based programming language that Mastercoin could include to allow two parties to make a contract on an arbitrary mathematical formula. The scheme would generalize savings wallets, contracts for difference, many kinds of gambling, among other features. It was still quite limited, allowing only three stages (open, fill, resolve) and no internal memory and being limited to 2 parties per contract, but it was the first true seed of the Ethereum idea.

“I submitted the proposal to the Mastercoin team. They were impressed, but elected not to adopt it too quickly out of a desire to be slow and conservative; a philosophy which the project keeps to to this day and which David Johnston mentioned at the recent Tel Aviv conference as Mastercoin's primary differentiating feature.”

This time is Israel enabled Buterin closer examination of Bitcoin code and what was possible to do with it, he did find it clunky and awkward to build out.

Next stop, Vienna. There was the unSYSTEM Bitcoin conference, which Taaki was leading. This is a podcast on that conference where Taaki talks with the hosts, skip to minute 49 if you want to hear an honest Taaki - www.youtube.com/watch?v=Ao_HdHyGKDU&t=2996s

Over to Milan. It appears Buterin is involved with the System Undo Crew or unSYSTEM, this email from Taaki to the group is stating the trip to Milan is to define Dark Wallet. It was already making a buzz that year:www.newyorker.com/business/currency/dark-wallet-a-radical-way-to-bitcoin

Around this time Buterin began drafting what would become the Yellow Paper for Ethereum and did visit Zug in Switzerland, famous for being known as Crypto valley.

This is an important pilgrimage from Vitalik. He had his genius, he had his computer skills, and he had the courage to take this trip to three continents. He met enthusiasts, libertarians, anarchists, capitalists, expert coders, marketers, rebels, corporatists.

Vitalik saw into the belly of Bitcoin. With his ideas and those of the people he met, he came up with a game-changing protocol.

Fiat currency gave cryptographic coders a problem to solve. Bitcoin gave scripters a problem to solve. Before this journey, there was the cypherpunks, their cryptographic heritage, the Bitcoin Blockchain community, then after this trip.

There was Ethereum.

And in the words of John McAfee, “That’s some powerful shit!”

Elena Sinelnikova enthusiastically pointed out that chains advertise themselves as the Ethereum killer yet Ethereum’s keeps TVL growing, for example, the first three Eth-killers came out, the Ethereum TVL grew from $20bn to $80bn. She was speaking at the Blockchain Futurist Conference in 2023.

This conference was founded by Tracy Leparulo. She has a background in business, entrepreneurship, events management, helping community and marketing. She founded Untraceable in 2013 and she helped organise the Bitcoin Conference 2014 in Toronto, if you remember Di Iorio mentioned earlier? This was Di Iorio’s Blockchain Alliance of Canada’s first annual Bitcoin Expo in Toronto. You can see some of the speaker list here - www.globenewswire.com/news-release/2014/02/25/1061379/0/en/Bitcoin-Alliance-of-Canada-Launches-First-Global-Bitcoin-Expo-in-Toronto.html

Vitalik wrote about that conference here - bitcoinmagazine.com/industry-events/bitcoin-alliance-of-canada-announces-bitcoin-expo-2014-1385179236

It was at this conference Vitalik announced the Ethereum network at the Bitcoin Expo 2014 in Toronto Canada.

He had left Toronto in 2013 as a writer, he came back as a founder to what would be the second biggest thing in crypto after Bitcoin.

Around the same time, Vitalik was awarded the Thiel Fellowship from Peter Theil for $100,000 USD and put all of his focus on Ethereum. Here is a clip of a piece of history in Toronto, seen by only 6k people at the time of writing - www.youtube.com/watch?v=XjiJDU4ErlY

Lerparulo is also the founder of the first Ethereum hackathon.

She co-founded EthWaterloo in 2017 and this is where she met the Russian pair Natalia Ameline and Elena Sinelnikova. We will come back to this as I need to mention another important actor.

Toronto.

This city hosts University of Toronto, which as a strong interest in distributed systems, cryptography, and blockchain technology. There is Ryerson University, one of the top-ranked university business incubators in the world, also Tracy was once the Managing Director as she earned her degree from 2009 to 2012.

The Vector Institute a global leader for AI. ConsenSys often uses Toronto as a talent pool. Toronto hosted Bitcoin conferences in 2014, where Ethereum was first announced, it has the Toronto Blockchain Week. 2017, IBM launched an encryption system to deal with high volumes of data called IBM Z, which led to a new IBM Blockchain Global Data Centre in Toronto. It also has the Abelard School.

To just a few women in crypto where Toronto has helped with their success:

Ly Nguyen is the Co-Lead for Accenture Canada's Women Employee Resource Group (ERG).

Hilary Carter is VP of Research for The Linux Foundation, residing in the Greater Toronto area.

Emma Todd, also of Toronto, is a part of WEF Crypto Sustainability Coalition. www.linkedin.com/in/emmatodd/

Louisa Bai has had a positive career, starting in Toronto. She has worked in France and Hong Kong, at Standard Chartered, Credit Suisse, Deloitte, Stellar, and now Head of Stablecoins at Mysten Labs - www.linkedin.com/in/louisabai/details/experience/

And now, I want to zoom in briefly to a couple of characters.

The University of Toronto has hosted them when they were at BUMO Network workshop coaching blockchain applications.

It was Canada’s Acadia Uni where Yuan Su obtained a Bachelor of Computer Science with Honours from Acadia University, graduating in 2005. Computing seems to be a natural calling for Yuan who started coding at 6 years old. After Acadia, he became Software Engineer at IBM Canada, he developed high-quality releases.

He did acquire an MBA in Corporate Strategy and Leadership at the University of Toronto in 2017. He can also boast being a part of the IBM team that worked on the first Hyperledger.

Kevin Liu was the North American Director of BUMO when he was speaking at that workshop.

He also has experience with IBM, he started his career there. He has been a senior investment manager, a StarsChina Tech, he has a business degree and a Master’s in Business Administration.

In 2015, Kevin moved to Toronto to hold the VP position at StarsChina’s Canada office.

With his brain wanting to combine blockchain and businesses, in 2018, he co-founded Token Economy Labs Inc.

Natalia and Elena crossed paths at university

Natalia was born in Kolomna, a town 100 km from Moscow. She had a passion for computer science, she enrolled at age 19 at the National Research University of Electronic Technology.

Elena Sinelnikova grew up in a small town in Russia in a family of a teacher and an engineer, she moved to Moscow to get her degree in Computer Science. In Moscow is where their friendship formed and they have been best friends ever since.

Here is a picture of Natalia with a young Vitalik and Elena with a young Pavel.

For better opportunities, Vitalik’s father Dmitiry Buterin, who has a computer and entrepreneurial background plus a Masters in Computer Science, decided to move to Toronto in 1999 when Vitalik was almost 6.

Elena also went to Toronto at the turn of the millennium. In the land of maple syrup, Natalia worked as a business/financial analysts whilst Elena worked with Canadian Police in Edmonton. Worked as Consultant and worked for Government of Canada. She was helping with systems towards town halls, police, and drug addictions. She developed the architecture for systems that are still used now in these areas.

www.youtube.com/watch?v=01WRqBVpXK0 Ledger – “Vitalik Buterin: The Crypto Genius Behind Ethereum” 2022.

Then Vitalik decided to road trip his way into making a general-purpose Layer 1 called Ethereum. It is around 2017 and Vitalik told Natalia and Elena to install an Ethereum wallet and it took the two computer scientists a few hours to do so. There was hardly any information online and this was the early days of Ethereum.

A light bulb went off. There are going to be others who find this just as tricky and it will be a barrier for crypto. Therefore, Elena and Nat started some meet-ups called Crypto Chicks, this was to help talk and educate about crypto as well as to make it less intimidating to women who perhaps saw it as a male-only industry.

There was an issue when they found out they had to pay a large venue bill and they did not have the money. Alas, they have a friend and ally in Tracy Lerparulo, who helped them organise events for Crypto Chicks and help with sponsors. They received sponsorships from IBM, IBM, Deloitte, Accenture, Microsoft, MaRS supported them, in 2018, Crypto Chicks partnered with ConsenSys, who would help with mentoring, initiatives and events.

Kevin Liu had ideas about bring businesses on-chain, it was through a Crypto Chicks event where Kevin, Yuan and Elena would fatefully meet.

JR Willet conducted the first ICO for Mastercoin by put up a wallet address on a chat room whereby people sent BTC and in return received Mastercoin tokens. This skipped over all of the legacy system funding methods and intermediaries.

The centralised funding systems can gatekeep whereas the open-source model can fork and modify them to existing needs and innovations. Willet changed the crowdfunding game.

Not too long ago, Kevin Owocki delivered a TED Talk on Quadratic Funding. It was titled, “How quadratic funding could finance your dreams” and you can find it on YouTube.

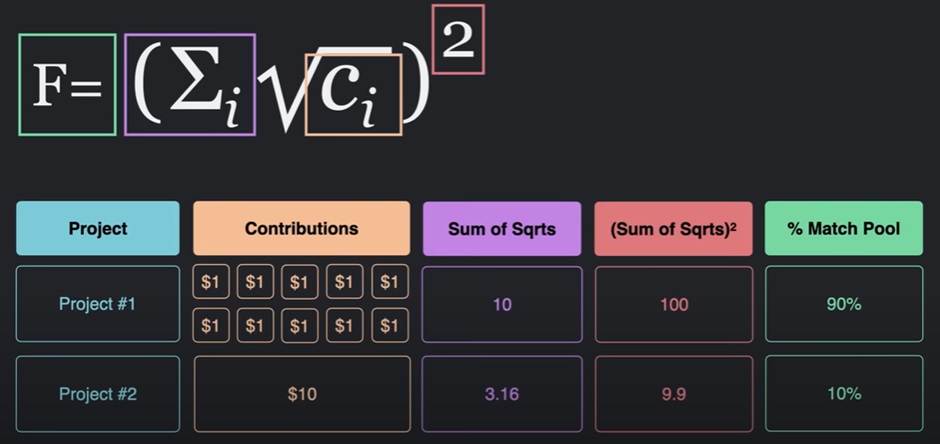

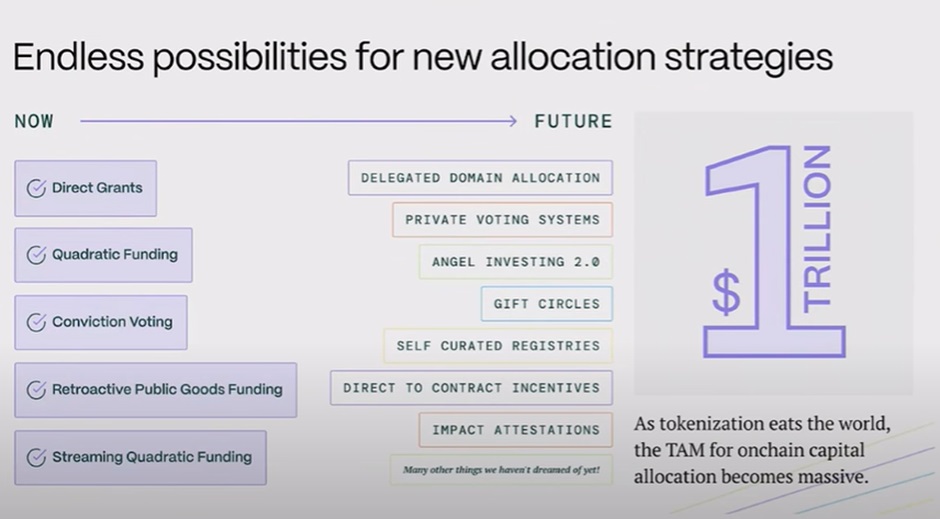

The Gitcoin funding programme has delivered around $60 million in funding across 3715 project raises, with 4.2 million unique donations in Web3.

Gitcoin is a crowd-funding platform, to help communities fund what matters to them, Gitcoin utilise the quadratic funding method. This distributes grant programmes into the ecosystem. They will be going multi-mechanism funding to allow precise capital allocation.

Vitalik, Zoe Hitzig, E. Glen Weyl came up with quadratic funding, there is a paper you can read titled, “A Flexible Design for Funding Public Goods”. This mainly stems from Glen Weyl.

Usually, people lean left on the political spectrum when they are young and get more conservative as they get older but Weyl is not the average person. He had his Ayn Rand phase in middle school but by 17 he was writing about Conservative Liberalism and was becoming more leftist in his thinking. He blasted through Havard and has always held down an eclectic range of intellectual pursuits.

It is in his mid-20s, he travelling in Brazil and seeing the favelas he began questioning how such a thing comes to be. He saw the 1p1v as unfit for the greater good and built upon this. He ended up working at the University of Chicago, where he met professor of law Eric Posner and Weyl pitched the idea of quadratic voting.

2018, Weyl and Posner co-authored the book "Radical Markets: Uprooting Capitalism and Democracy for a Just Society". Before this was released, Buterin received a copy as he had reached out to Weyl on his previous work. Buterin provided a 25-page long email in response to the book and 5,300 word review – rookie numbers - vitalik.eth.limo/general/2018/04/20/radical_markets.html

Buterin provides a foreword to the book, praising the brilliance in challenging the traditional methods of funding, shifting focus on using markets to promote fairness and equality while driving technological and social progress.

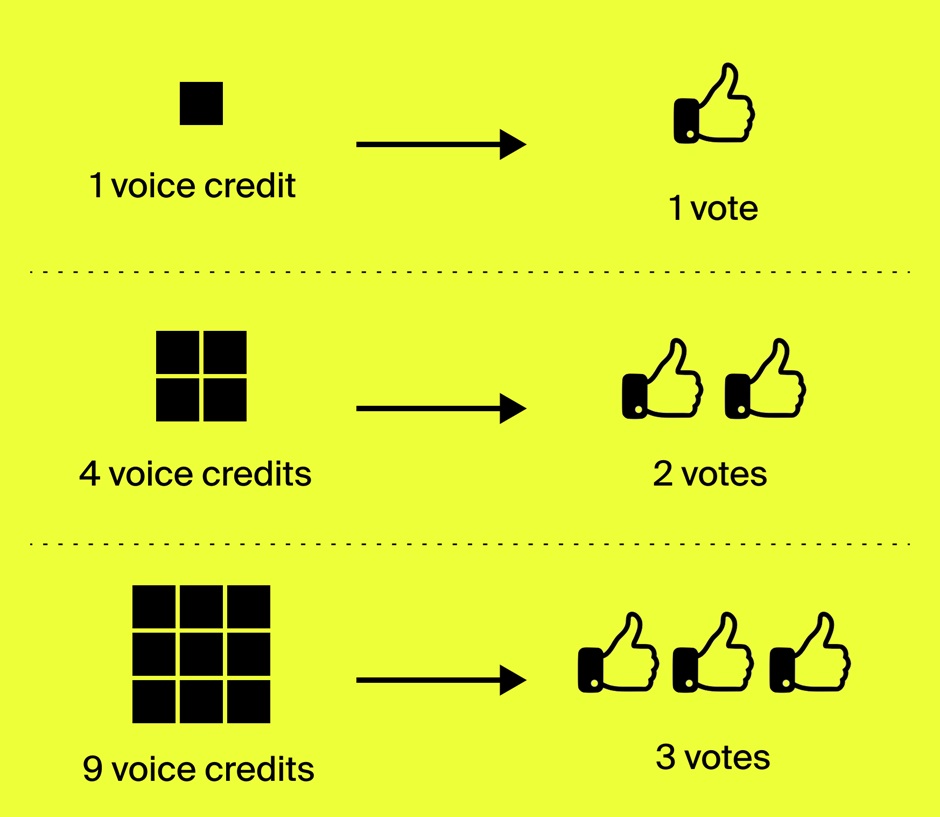

Weyl had a concept of quadrative voting, here is a quick summary:

You get a particular number of voting credits. If you want to give a project one vote, it costs you one credit. If you want to give them two votes, it costs you four credits — because two squared is four. Three votes cost nine credits.

It is a way to get away from one-person-one-vote and to encourage looking across projects, not backing one project. There is a lot to unpack with his ideas, for further reading, see - www.radicalxchange.org/wiki/quadratic-voting/

Vitalik, Zoe and Glen took that principle and released their paper by the end of 2018. As an aside, it wasn’t just Vitalik that reached out to Weyl, Zooko Wilcox of Zcash, an original cypherpunk on the famous mailing list, reached out. Out of this RadicalxChange is formed.

Buterin said this about QF, “Quadratic funding is nice because it’s a thing that you can kind of go off on a corner and try on a small scale, and if it works on a small scale, you can try it in a bigger scale. It’s very radical, but at the same time, you can implement it on pretty much any scale”

Buterin and Owocki have been working together for a few years. Owocki can be considered an open-source maxi and an agorist, much like Cody Wilson who co-founded unSystem with Taaki and is famous for 3D printing guns - agorist.xyz/. Fellow agorist, Rachel-Rose O'Leary, works with Taaki on DarkFi, she uses the term Dark Forest as a metaphor for privacy. When the British would scour Ireland, some Irish would have sanctuary in the forest, therefore the British cut them down, for in a desert it is easier for surveillance.

I digress. Owocki set up Gitcoin late in 2017 to help crowdfunding in response to the ICO mania. There were too many con-jobs and so Gitcoin wanted to support real builders on Ethereum. It would join ConsenSys too.

And with that, as the Weyl, Buterin et al progressed on their quadratic ideas, Gitcoin helped pioneer these ideals and put them into action.

1p1v is great for centralised monopolies, it narrows the choice spectrum. QF is a way to provide more weight to community voting, in other words, an accumulation of smaller donations that adds up to $10 is more powerful than one donor providing the same $10. The fund is boosted by a matching pool. The matching pool adds extra funds based on how many people are supporting the project

Below is a maths equation that may help the more numerically minded among us.

Owoki makes a point at the Web3 Summit that we are still working out new use cases within Web3. As Gitcoin have conducted QF, they have come across realisations. QF is great for democratic allocation of capital. Direct grants are the simple way of providing grants, does what it says on the tin. Retroactive Public Goods Funding (RetroPGF) provides retroactive funding to contributors who establish their impact. When there is no money to build out the digital infrastructure, the infrastructure will crumble, RPGF is one way to reassure quality public goods.

There is Conviction Voting, Self-Curated Registries, and Assurance Contracts too.

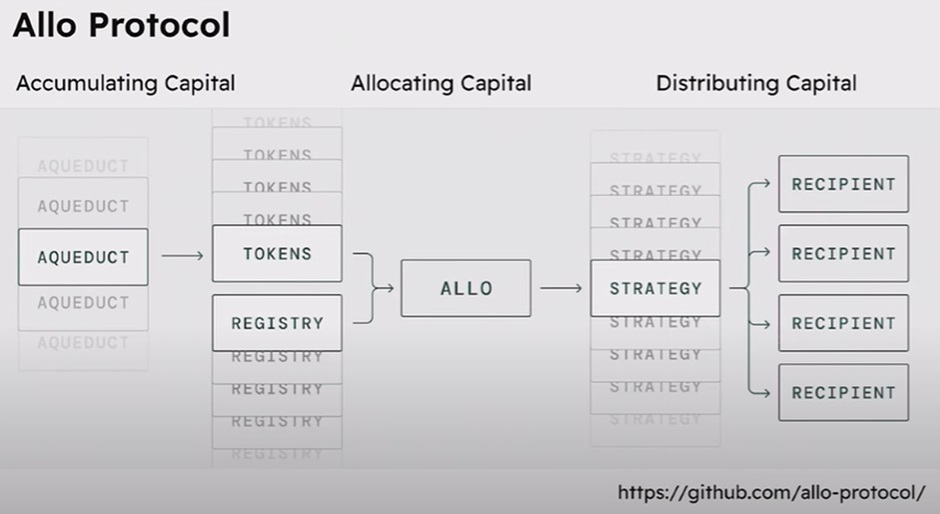

Therefore, Gitcoin are embracing this multi-mechanism model and this can keep scaling and finding new methods. Owoki is doing work with the Allo Protocol, the intention is to, for example, fork Bitcoin grants and reallocate it into the ecosystem.

As this scales, with the likes of Chainlink and Aave, on-chain allocation of capital funding will reach trillions.

Owoki was presenting the idea at TED to the non-crypto millionaires/billionaires, evidence that this will branch out more into everyday life. Gitcoin have set up simplegrants.xyz, this provides open-source tools for people who don’t use crypto and want to use US Dollars or Euros. Also, DLT will imbue with day-to-day life more and more over the next decade and really it seems QF will appear more and more as people begin to understand it.

In the genesis and real early days of Ethereum, protocols were particularly primitive. A DEX was crude by todays standards, it had the buy and sell side but they were not matched. There was very little liquidity.

Vitalik did propose Automated Market-Markers in 2016 as a way to resolve this, he posted on Reddit, “My proposed solution is to use the style of "on-chain automated market maker" used in prediction markets in a decentralized exchange context.” - www.reddit.com/r/ethereum/comments/55m04x/lets_run_onchain_decentralized_exchanges_the_way/

Hayden Adams began to work on the concept, Ethereum Foundation provided $100,000 to Hayden Adams as he began to work on this concept. 2018, Uniswap V1 comes to town with liquidity pools.

Uniswap V2, launched in May 2020. Liquidity shoots up on Ethereum and by September 2020, Uniswap is the first DeFi app to have $2bn in user value, something important to know for context - the entire of TVL of crypto was $2bn at the time of Uniswap V2 launch.

The man from Finland, Stani Kulechov, had an interest in the internet from an early age and as he grew up, he was drawn towards fintech applications and developing apps. From there, he built EthLend, which came out in 2017, as he wanted to build a better version of traditional finance, he wanted to help create a borderless, permissionless market.

2017 saw ICO-mania as lending was hard to accomplish, Stani brought collateral to the smart contract. ETH LEND became the Finnish word for ghost, AAVE, in 2018. It enabled gas optimisation, flash loans, where users access to tens of millions in capital for a tiny fee only for a few seconds, Aave issued $500 million in flash loans over 9 months. It later introduced collateral swaps.

By August 2020, TVL was $1bn in Aave. At the end of the year, Ethereum had $16bn TVL, $2bn of it was on Aave. Near the end of 2021, Aave’s TVL almost topped $20bn.

Aave will be a crucial point for stablecoin adoption. There is a massive opportunity for distribution of stablecoins that provide a stable asset to people with an internet connection.

More stablecoins creates more yield-based products. More collateral. As projects roll-out cards for stablecoins and crypto – for example Baanx, who have a Metamask, 1inch and Mastercard deal, will roll out cards in Europe and Latin America - this will generate an interplay between the day-to-day economy and defi protocols such as Aave.

And something that the West takes for granted, access to more stable currencies when compared to most of the world. With access to the internet, someone can put their currency into Bitcoin or a stablecoin or another asset such as real-estate, art, indexes of crypto projects similar to the S&P500 and so on.

Stablecoins will be a key infrastructure of payment networks.

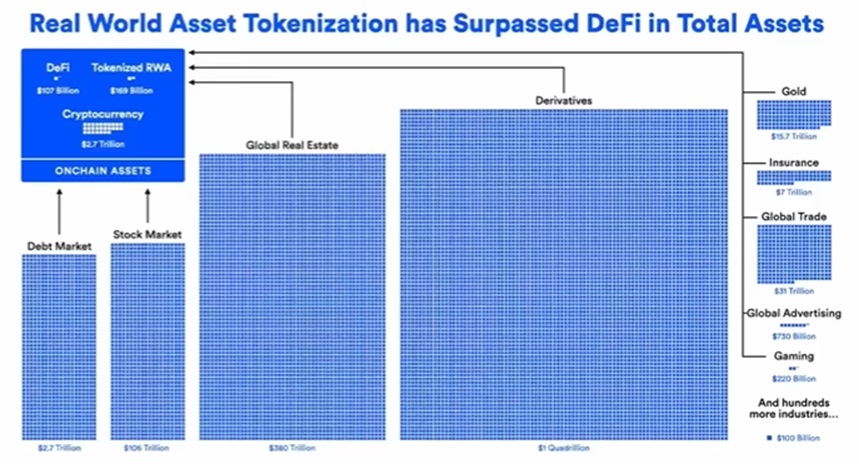

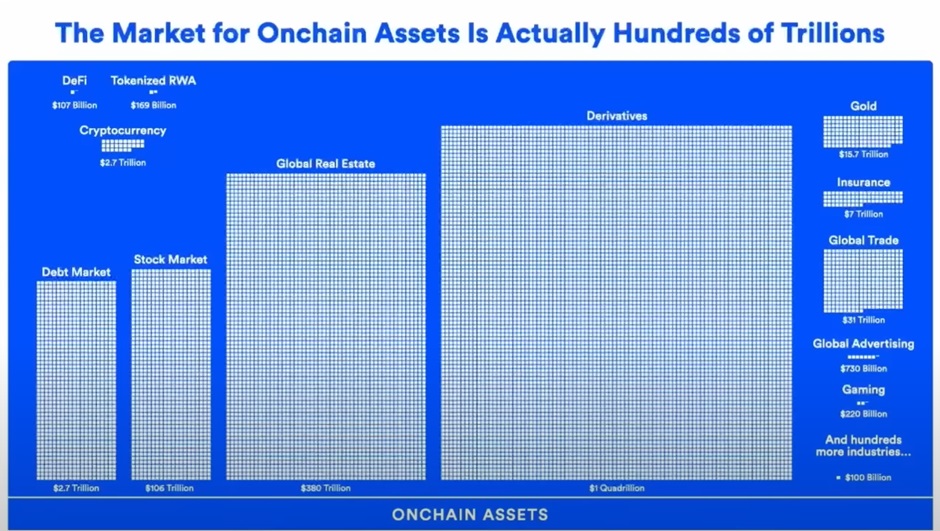

All of the Web3 defi world is where the design patterns have emerged. This is where the most advanced versions of things will come from as it has the least number of limitations. From the mailing lists to Calafou, this has been the soil to the world of 2024 and the oncoming megatrend. As tokenisation opens up assets in waves it also provides a hedge in crypto bear markets as protocols have other sources of revenue.

Aave dominates the DeFi lending market, it also has Aave Arc. This is for institutional investors, this enables a gateway for the TradFi institutions, who need to adhere to compliancy standards, to interact with DeFi.

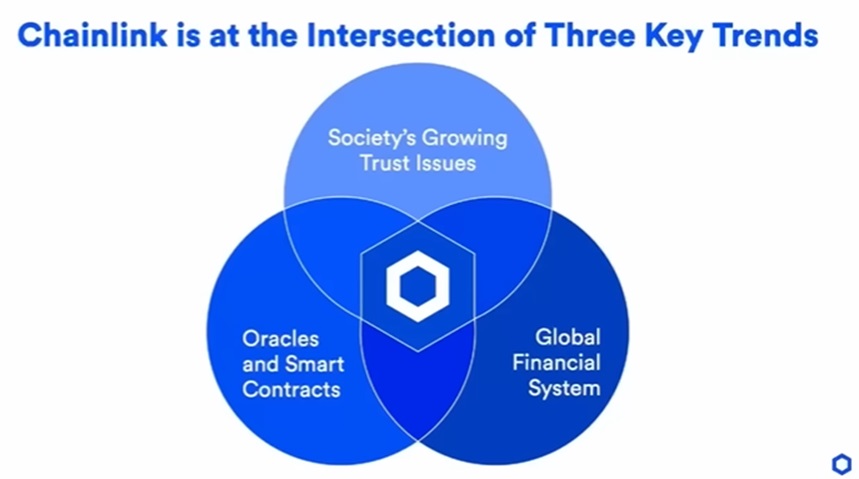

This is what Sergey Nazarov of Chainlink has said on stage with Stani, that the crypto space may be the breeding ground for innovation and creativity – after all, open source has been a fundamental for computing – but these trillion-dollar funds need assurances and security.

Chainlink is assisting hugely in that regard.

Your brain experiences myelination, your neurons get excited and send signals/data/hormones across the synapse and along the axon to other neurons. The axons are vulnerable and over time, from a little before you are born to early adulthood, the axons have a fatty sheath form around them. This is myelination. As you get older, this is why it becomes harder to learn new things but if this did not happen your brain would be a chaotic, slow, mushy electric meat cloud in your skull.

Chainlink is an oracle, it is providing the data feeds to blockchains and the protection between blockchains with CCIP. Their competence in application and the broad network they have cultivated has made them the number one in the oracle space and crucial in the onboarding of Real World Assets.

Objects on chain need to be understood. In order to know the object, you need to know the internal qualities. If the blockchain can have a reliable data feed to update the internal data of an asset, it can speed up efficiency remarkably. Rather than updated yearly, quarterly, or monthly, it is updated by the second. You can see the value of an asset in real-time, therefore, the value of, say, a fund for an asset manager can be shown in real-time too. We have gone from the word of mouth to the speed of electricity. We have gone from shouting on the stock market floor to be able to trade in our own private studies. The crypto market has come from the dirt to mirroring the world digitally. DLT will greatly improve the administration as it really empowers data and attaches to the physical world. It will make data:

-

Structured

-

Timely

-

Accurate

-

Verifiable

-

Secure

-

Updateable

-

Accessible There will be more Security Tokens in the world than Cryptocurrencies unless we memecoin the market to death.

Chainlink is the only one that provides the data, the additional computation and the connectivity across chains in a single platform. This allows assets to prove something about themselves, allows them to move across chain whilst proving those things, and to allow them to remain secure whilst synchronised with existing systems, for the ability to scale.

If you want to make an RWA, you need to inject data into the asset. The more traditional the asset, the more data it needs, the more ID it needs, the more price data, the more NAV data it needs.

To make a RWA compliant, you need many layers of data to go into the asset. By doing this, Chainlink call it the creation of a unified golden record that houses the ownership rights and the data attached to the underlying asset continually updating that smart contract about that asset.

If anything changes about the asset, the underlying data should change to update the smart contract. This unified golden record then allows it to move across chains for purchase power and liquidity.

As the cost of generating a blockchain goes down, all banks and asset management firms will have multiple chains that will need to interact and communicate with one another. On top of this, Chainlink have the Blockchain Privacy Manager, this protects and shields data from prying eyes, which is crucial with large volume transactions.

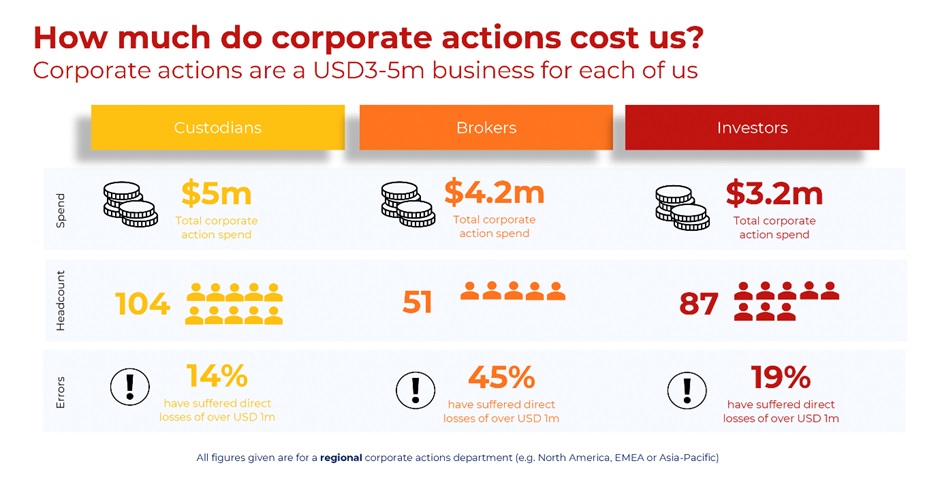

ANZ have $1tn in AUM and they are one of the first participants on this Link Privacy protocol under the MAS Project Guardian. Standard Chartered have a prediction the RWA market cap could hit $30tn. DTCC did a Smart NAV Pilot with Chainlink, read below:

Private banks want in, there will be a massive increase in credit markets on-chain, ParaFi Capital raised $120 million to fund general partner stakes in other crypto funds from institutions as they enter the space, Securitize working with Hamilton Lane and Ares, BCG and Fink have been big on tokenisation for a while. BlackRock and PayPal are moving into tokenised funds and stablecoins, they will do so at an accelerated pace.

A tiny percentage of RWA on chain, with the granular data and fractionalisation that is possible, mixed with DeFi, plus AI, will generate a wider range to the composability of products and protocols.

www.youtube.com/watch?v=AAfmgbmoAgs Chainlink Reveals Groundbreaking Digital Asset Solutions at Sibos 2024 | Sergey Nazarov Keynote

Costs, competing priorities, roadmaps that don’t align. These are criticisms that go against the narrative of emerging unified layer that networks all the existing blockchains. Nazarov counterpoint is as more value migrates into the blockchain format the economic forces will shift the priority towards that.

We had faxes, then email. For the most part, people do not have a choice on the tech – what is efficient for businesses and where the biggest deals are made filters out to the way society transacts. If you were a business leader still on fax whilst a major business deal and communication is being conducted on email, 9 times out of 10 where do you think the conversation is going to take place?

With tech there is always some minor resistance but all in all, as email was more practical and efficient than fax, email prevailed. The PARADIGM SHIFT, says Thomas Kuhn, American physicist and philosopher.

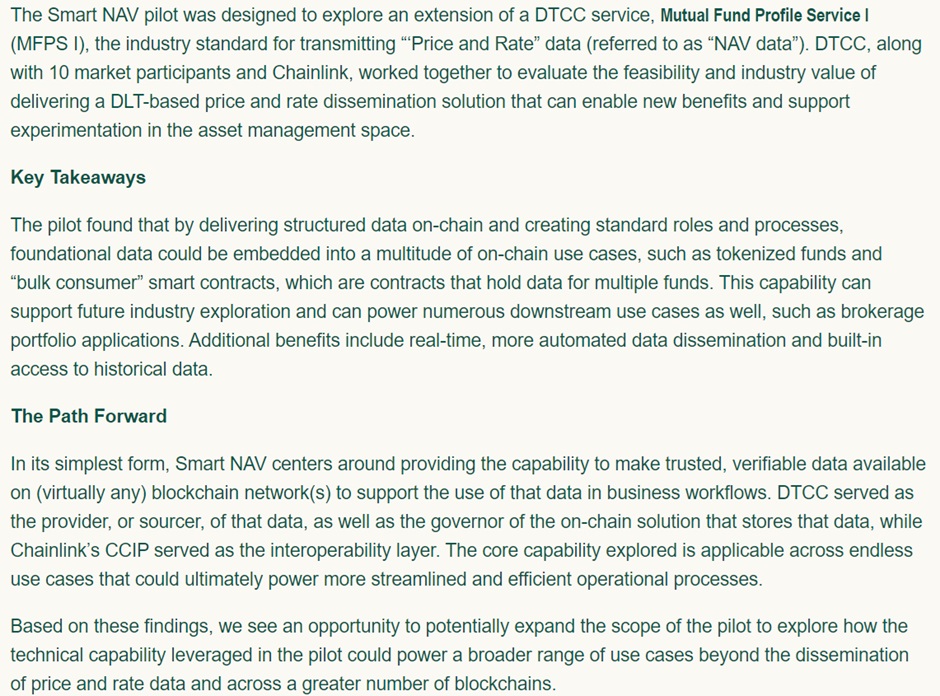

1962, he wrote “The Structure of Scientific Revolutions”, Kevin Liu says the main idea is “new or disruptive technology emerges, either from innovation or a combination of the previous techniques, it will eventually follow the shift circle and cause the old paradigm to be changed to a new one, or a new way of business operation to explain and support the new technology development.”

The World Wide Web was a platform, it coinciding with all sorts of brains from various factions providing new ideas, new tech on top, led to the WWW proliferating in all manners of our life. Web2 has e-commerce, dating apps, reviews, revenue streams for writers/artists/analysts, job markets, and so on. E-commerce global sales were $2.3 trillion in 2017.

It disrupted the competitive landscape. Balaji Srinivasan spoke at Y-Combinator in 2013, Silicon Valley disrupted the Paper Belt. The Paper Belt is LA (Hollywood scripts, music), NY (Maddison Avenue, Wall Street, newspapers, books), Boston (higher education), DC (laws and regulations). Yet, Silicon Valley has disrupted all these cities, Napster was the beginning, each industry has been disrupted by various Web2 sites.

Mobile phones make locations irrelevant. Soon, we will face a post-labour AI world. In 2013, Balaji was positing eXIT: build an opt-in society, outside the US, run by technology. Marc Andreessen sees a future where we have more countries, fuelled by the drive of crypto.

Let’s see how that plays out, Praxis is an attempt to have a city built up from investment of +$500million that is dedicated to the Network State idea. There are private cities around the world that deal in crypto/Bitcoin.

The Governments have been progressing towards blockchain, an example of this is to simply look at the history of R3/Corda co-operating with BIS and government CBDC projects. USA is now realising the power of having the USD dominate stablecoins across the new web. As this these banks, payment rails, credit markets, and more, come onto chain we start seeing where the big deals are, when the big deals are moving around on blockchain, where does that leave businesses, business leaders and consumers?

Various techs converge, then disrupt, and this changes behaviour.

As decentralisation provides trustless protocols that enable counterparties to cooperate, participants can see information more objectively than subjective, the information provides value. Blockchain helps provide automated digital contracts/agreements, the DLT helps elevate the internet from contracts to a value economy.

Before, there was incentive for competition, now there is incentive for co-operation.

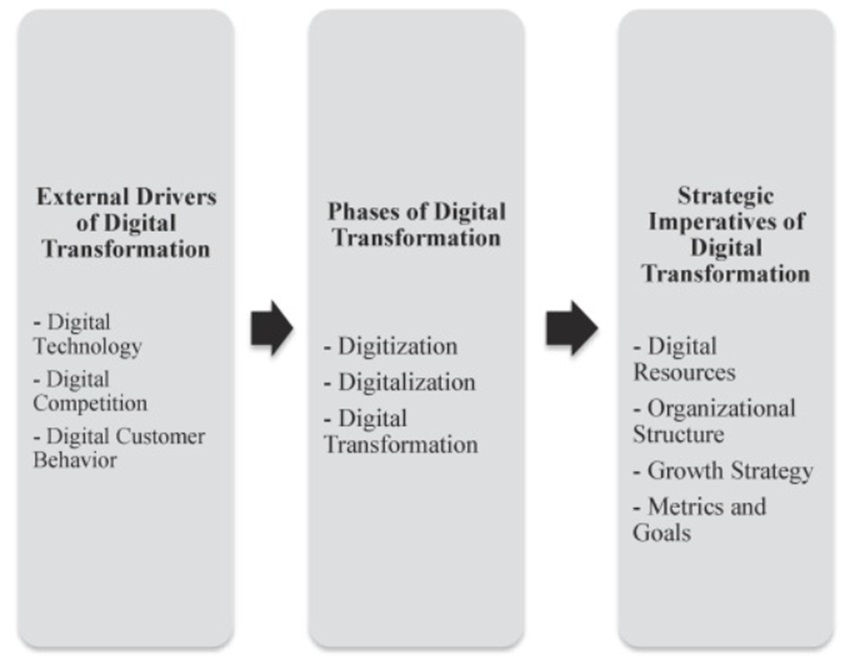

Buterin wrote “DAOs, DACs, DAs and More: An Incomplete Terminology Guide” in 2014. Smart contracts allow for decentralised automation, with that you can have a Decentralised Autonomous Organisation. See: blog.ethereum.org/2014/05/06/daos-dacs-das-and-more-an-incomplete-terminology-guide?ref=hackernoon.com

DACS are Decentralised Autonomous Corporations, a subclass of DAOs, a thought in the stepping stone of ideas when approaching the idea of a Token Economy.

Where DAOs are non-profits, DACs pay dividends and has other payment distribution mechanisms. A DAC has a token economy, the stakeholders collaborate to reach consensus, the business activities are programmable. The smart contract helps take the real-world governance methods to chain and then act out business activities.

The more incentives the more activity and help is provided. Tasks where the participants earn tokens allows them to interact with governance.

This takes companies from a zero-sum game to a communal win game. Incentivised to join the community, to reach a consensus and to contribute.

Metis and ZKM Chief Scientist Ming Guo previously worked in aerospace, graphics and MIPs architecture before working on the idea of DACs in 2017. He said this in an interview:

“Initially, Bitcoin embodied this libertarian ethos, but it soon attracted a lot of speculative behavior. I remember a paper that highlighted how Bitcoin's value seemed tied to congestion in the network - the more congested, the more miners profited. This rent-seeking behavior made it clear that Bitcoin wasn't truly breaking away from traditional economic dynamics.

“DAC Economy - initially called the Self-Sustainable Digital Economy (SSDE) - was born from a need to address these shortcomings. It envisioned an economic system that values community, individual sovereignty, and long-term sustainability, rather than speculative gains. In our current ZKM projects, the technologies we're developing, like zero-knowledge proofs, are aimed at enhancing the core principles of DAC Economy, making this vision a reality.

“…. Bitcoin was imagined as digital cash, but its scarcity - a limited supply of 21 million - has made it more like digital gold. People tend to hoard it rather than use it for day-to-day transactions. The value of a currency must grow with the economy; otherwise, it incentivizes hoarding. This is the limitation with Bitcoin.

“Instead of a static currency, the DAC Economy needs a system that can adapt dynamically to changes in the economic landscape - a currency system that evolves as the economy itself grows and changes. The ultimate goal is for money, as a concept, to fade into the background, allowing value exchange through smart contracts that are seamless, automated, and always aligned with the real value being created in society.

“This means we need to advance our smart contract capabilities to not only handle complex computations but also to ensure that they represent true value in a decentralized way - without being subjected to the rent-seeking and control mechanisms we see in traditional financial systems.”

It is a good interview I recommend reading.

See: www.hozk.io/journal/interview-with-ming-guo-co-founder-and-chief-scientist-at-zkm

See also Kevin’s post: hackernoon.com/time-space-and-dacs-the-way-ahead-yhbo36s8

In Singapore, InvestaX (who also run IX Swap) on the eVCC (Electronic Variable Capital Company) with State Street, UBS, PwC, CMS, STACS and the Tezos Foundation. This was funded by the Monetary Authority of Singapore (MAS) with the MAS FSTI Grant.

A variable capital company is new legal entity form/structure for an investment fund from Singapore. A corporate structure that uses its capital to pay dividends, this entity can have one fund or many sub-funds.

Aside from tokenising the VCC structure, this PoC helped to test regulatory stability and demonstrate how DLT enhances fund operations by simplifying administration, reduce intermediaries, automate record-keeping, and lower operational costs.

Private markets will come on-chain and this opens up wealth to new markets. The stuffy bankers and asset managers that resisted crypto for so long will see the fees they can attain and come in. This is proof of it.

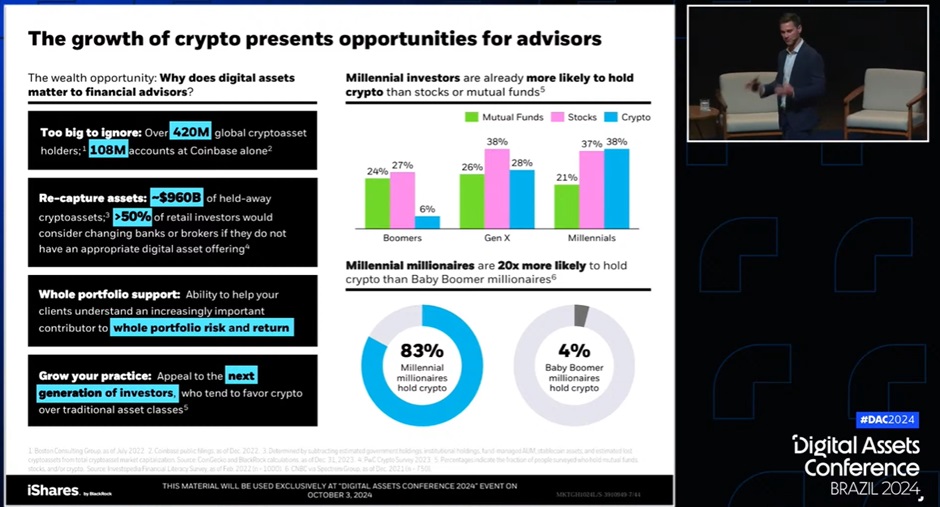

And there will be start-ups coming through on-chain. There will be businesses that will be digitally native. Millennials and Gen Z are the first digitally native generations - their consumptive behaviours are already with disruptive tech - them and subsequent generations will amplify the adoption of blockchain. This is happening faster than the adoption of the internet and cell phones.

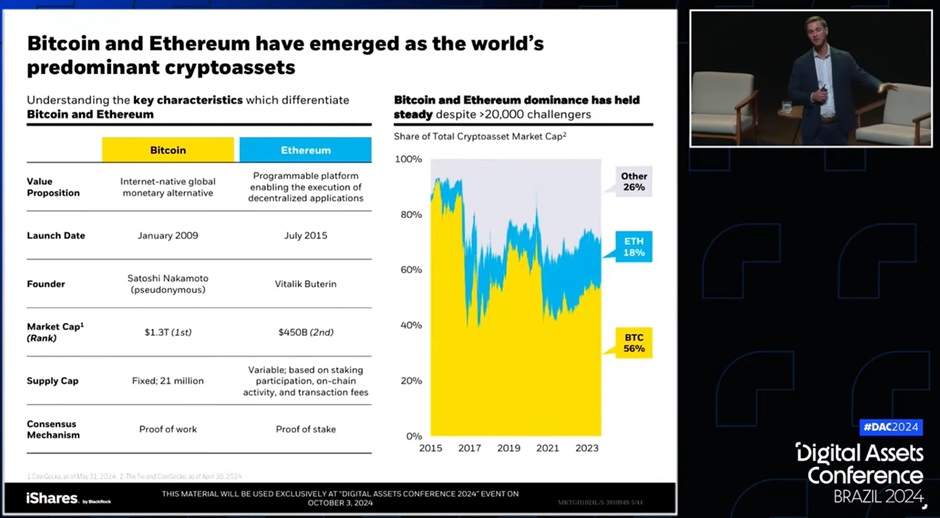

Jay Jacobs of BlackRock was present at Digital Assets Conference in Brazil, October 2024. He is BlackRock’s U.S. Head of Thematic and Active ETFs, his presentation brought home the importance of Bitcoin’s role to hedge against inflation and economic instability.

BlackRock's Bitcoin ETF, $IBIT is the BlackRock EFT for Bitcoin and it managed a major feat. Around 4% of all ETFs have reached the $10bn mark but $IBIT hit the $10 billion line the fastest in just 37 trading days.

Aside from Jacobs explaining Bitcoin is an alternative to existing fiat currencies, gold or treasuries, he explains Ethereum is a bet from further blockchain technology. Also this considering is just the beginning, more ETFs will come as awareness and education of the space grows.

BlackRock decided to put their BUIDL Fund on Ethereum earlier in 2024, a significant moment for blockchain to have the worlds largest asset manager to arrive on-chain, a signal for what is to come.

Andrew O’Neill, Digital Assets managing director at S&P Global Ratings, says the final regulatory approval and launch of ETH ETFs in the US will likely bring new investors to the Ethereum space with one potentially significant use case being as a settlement layer for financial markets.

This will be a narrative that gets stronger as BlackRock rolls out ETFs.

And with all that considered, rewind the clock back to 2018. It is a Crypto Chicks event and Elena meets Kevin Liu and Yuan Su. Kevin Liu had founded the Token Economic Institute (TEI) that year, which had enthusiasts from China, Canada, Israel, and USA involved. The idea for TEI was to have cross-domain collaborations and put the brain power to use, like a decentralised Accenture.

I do want to quickly inject that Ming Guo says he is a co-founder too. It is hard to get a clear picture of when he met the trio, he does play a crucial part in development of Metis and ZKM.

Elena in one interview said Kevin had this idea to bring businesses to chain. Initially, Kevin was a sponsor of Crypto Chicks, Elena then began to work with Kevin as an ambassador. This helped nurture the working relationship, they could disagree and progress still, furthermore they had a shared vision.

Kevin had this goal of bringing diverse complex collaboration but did not have the governance, Yuan Su had worked on IBM Hyperledger wondering how to progress this technology, and Elena wanted to bring people into the decentralised world. It did help that Elena had a great connection with Vitalik, who so happened to build Ethereum, discussed the ideas of DAOs/DACs and subsequently brought about DeFi. His ideas are implemented, such as the DAC, the decentralised sequencer,

Kevin says one of the co-founders suggested the name Metis instead of TEI, I put my money it that being Elena making that suggestion. Metis is the Greek Goddess wisdom, prudence and deep thought. 2021, the whitepaper is released - www.securities.io/metis-whitepaper/

The chain started with the started with the DAC angle, DACs are forming but something to consider is the fact that businesses need regulation and require their governments to provide the framework to enable them to interact with Web3. As there is some more sure footing, there will be a big upcurve in DACs. We still have ground work to do but the game is on for nations to get ahead of one another for blockchain adoption.

In terms of user growth, it can be broken down in three phases, discretionary, necessary and essential. DACs will come. Before the businesses come, there is the regens, degens, gamblers, gamers and traders that come before them.

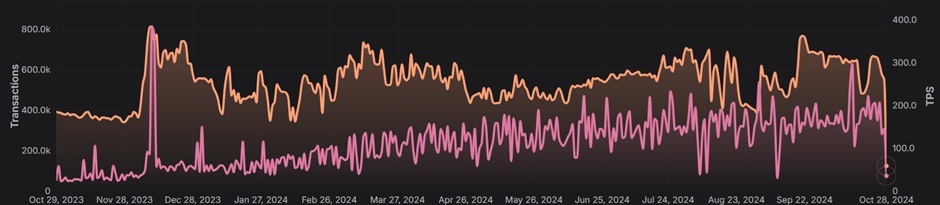

Defi Kingdoms (DFK) is DeFi meets quests and combat and it has found itself on a couple of chains. Originally on Harmony, it had a realm called Serendale, yet a dreaded Harmony bridge hack occurred, something outside of the DFK team’s control. Not to be deterred DFK has grown.

The Serendale realm moved to Klaytn, on this chain they have the JADE token as the main currency and JEWEL can be used for staking and governance.

You can find a kingdom on DFK Chain, which is a subnet on Avalanche, this realm is known as Crystalvale. On this subnet they have CRYSTAL and JEWEL as the currencies, below you can see transaction count in orange and the transaction per second in pink. Over the year the TPS has a healthy incline.

The game aims to have everything be an open economy. You can purchase heroes from other players. If your hero goes out questing and gets fish, you can sell the fish. There is a “Gardens” area where you can make a liquidity pool.

Players can engage other players to have their heroes face off in a turn-based combat. One can have an open public invite where anyone can accept or send a private invite to a player. An exciting development to come is tournaments. The DFK team will put up the prizes for these future tournaments, then further down the line we will see communities able to launch the tournaments and put up prizes themselves.

In December 2024, the Mythic Squad are launching a competitive league, known as the Most Awesome Guild Invitational Cup or The MAGIC for short.

medium.com/@mythicsquad/announcing-the-magic-7b2856d8fbd0

Remember way back I mentioned Vitalik lost his WoW item due to an update? Well, in Web3, you own the item and on top of that, other teams can build something that can utilise the DFK items. You can have interoperability of games.

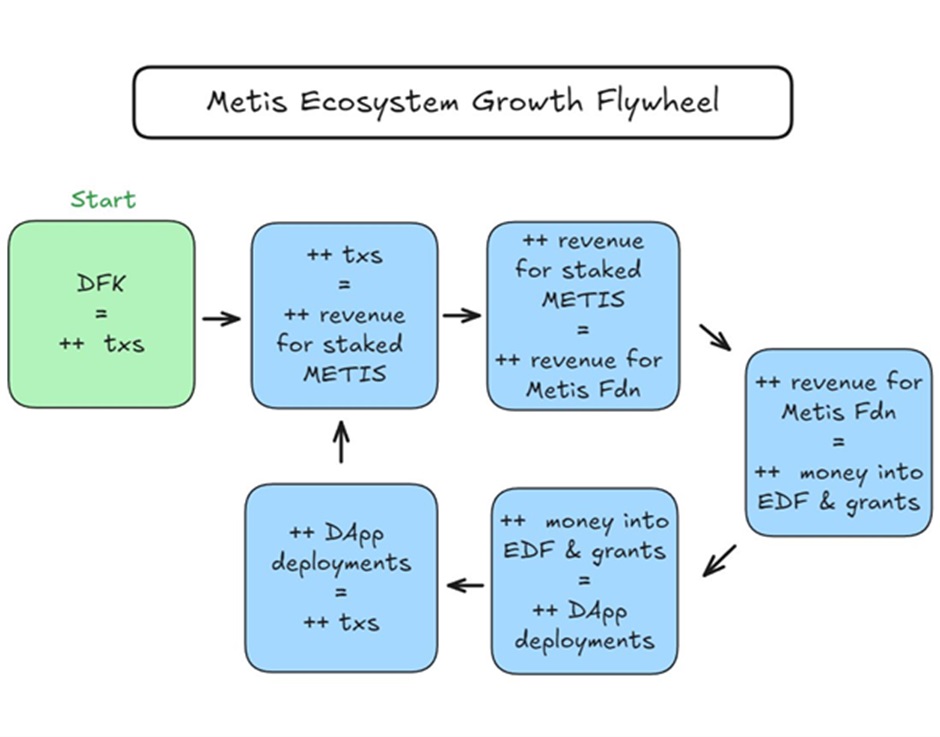

As DFK generates on-chain activity, this brings revenues to staked Metis, which in turn brings demand for staking and that increases the demand for Metis.

Do follow @Stycksintern on Twitter and look out for him on YouTube if you are interested in DFK, he’s a great guy. Another much riskier game is memecoins. Memecoins is a whole can of worms. We can argue all day about memecoins but regardless of what we say, people do memecoins. You can argue that memecoins may be a new Web3 users first experience and they get burned by it, never to return and tell others it is a scam. On the other side of the coin however, memecoins attract new users who then may make gains, may get curious as to what is going on in Web3 and end up building the next Ethereum. Memes can be scams and rugs. A dev from a deprived country gets a quick buck will rug. The important thing if you ever participate in memes is to go in with your eyes wide open – that you may lose it all. Then again memes can create communities that last and go on to do great things. My two initial go-to thoughts with meme coins are:

-

It is gambling, accept that it is gambling and you can lose it all. When you take part you must accept responsibility. Do not think it is easy. If you won, you got lucky. Have discipline, you can lose it all. This is PvP, have your eyes wide open.

-

They are the ICO-mania 2017 just without the pretence of offering utility. Some projects go on to provide utility, some give to charitable organisations. For some, memecoins can help compound gains and lead to life changing results quickly, that appeals to people.

What memecoins have proven time and again is provide an entry point for new users and the vast majority exist on DEXs. People are then required to install wallets and learn how to navigate the Web3 space.

Games like Solitaire helped ingratiate new users to Windows computers. This is no different, whether it be DFK or Shoewifhat memecoin. At the time of writing, there is something coming out on Metis for memes but I cannot really divulge much. I will add that the benefit of decentralised sequencer is a community can own a sequencer and have a stake on the rewards from it…. I won’t say much more. When you are in the future, you will most likely know what I am on about.

Speaking of gambling, games such as poker have been with blockchain since the early days of Bitcoin. The future integration of Chainlink VRF (Verifiable Random Function) is there to help these sorts of game. It is a decentralized solution designed to generate and provide cryptographically secure random numbers on the blockchain. Gambling requires randomness plus tamper-proof to ensure fair game, VRF helps to minimise this risk.

This is another avenue of users utilising Metis, I am unaware of any poker-et-al style projects.

Games, memes and poker are three more hooks that tend to bring entertainment to the chain. What about the people who want to invest in long term projects?

You can catch Aave, Metis and Chainlink on stage together. “Building a MultiChain World” featuring Stani Kulechov CEO & Founder of AAVE, Seena Foroutan Director of Enterprise at Chainlink, and Pavel Sinelnikov Tech & Integration Lead at Metis -

320,000 votes were required, in the end 802,910 votes were cast, all voting yes for Metis. This community vote was to decide on integrating Metis as collateral, allowing users to borrow assets up to 30% of their total METIS collateral. - chainwire.org/2024/08/21/aave-integrates-metis-as-collateral-on-metis-layer-2-network/

One of Aave’s bragging points is the fact it has gone without a single major smart contract-level security incident to date, this is all the while surviving the chaos of FTX, Celcius and Three Arrows Capital.

Avraham Eisenberg attempted to exploit Aave in 2022. However, his cunning rouse was humbled. The DAO froze low-liquidity markets to prevent manipulation and adjusting risk parameters within days to strengthen security. Eisenberg lost $10 million.

With this stubborn nature to succeed it breeds further confidence of large volumes of finance to interact with Aave. As more interact with the protocol, the smoother the entry and exit of positions is for users.

With new users interacting with the space, outside institutions integrating, Aave has V4 on the way, this leans on account abstraction and smart accounts to help form a Unified Liquidity Layer. Added to that is integrating RWAs, building products that utilise GHO.

From October 2023 to October 2024, Aave’s TVL has improved by 84%. With the likes of Bernstein are looking towards DeFi yields for their positions, this TVL will increase.

Earlier in 2024, Aave were the first to integrate Chainlink Price Feeds and CCIP.

Metis has been working with Chainlink for a few years, appearing at conferences together, workshops and cropping up in the same conversations. Back in 2022, Metis became a part of Chainlinks’ Scale Program. Fast forward to August 2024 and Metis has integrated with Chainlink’s CCIP. Something you may or may not know about crypto, a lot of oracles subsidise their feeds as it is a competitive market. LINK had SCALE to help with costs, bring in a large array of blockchains and allow customisation of data feeds.

Decentralised oracle networks took defi from under $100mm industry to over $200bn.

Crypto has been at various stages of maturity and now we have family offices, asset managers, private banks and the institutions knocking on the door.

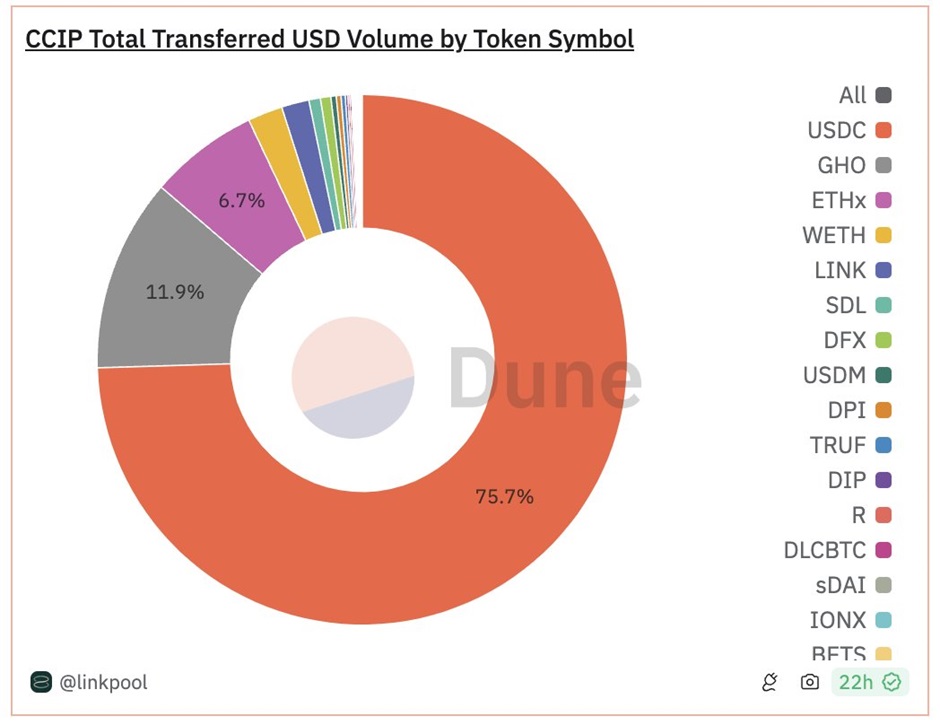

Metis and Chainlink’s relationship will continue to grow as this space progresses, this will be great for Metis as CCIP helps resolve fragmented liquidity. Liquidity is success to a lot of successful applications, Aave’s GHO stablecoin integrated CCIP and is at the time of writing the second largest asset by volume on Links CCIP. GHO was just on Ethereum and now it can transact with many blockchains.

In short, CCIP reads and confirms the state of one chain then validates the data to the other chain. This is just the beginning and CCIP is designed to move trillions. As you can see from the doughnut above, USDC takes up the large majority of liquidity, this also demonstrates liquidity exposure that Metis will continue to have.

CCIP opens new land for developers, example, NFTs can move across different gaming environments or DeFi assets can get access to more fortuitous yields. It allows for data storage optimisation. We can use the term hybrid dapps, in Chainlink’s own words, “combines on-chain infrastructure with off-chain data and computation provided by decentralized oracle networks to create a feature-rich decentralized application”

Therefore, not only does CCIP help connect the plethora of ecosystems liquidity across the Web3 world, it helps ingratiating IoT networks, enterprise backends, insurance, supply chains, and the many, many markets within TradFi.

Hybrid contracts is a possibility down the line for Metis, for now the chain has Link’s price feeds and CCIP.

CCIP’s programmable token transfer feature allows developers to send tokens with embedded commands, automating cross-chain actions like collateralized loans and liquidity staking. This functionality is particularly useful for DeFi protocols aiming to automate and scale complex financial transactions – such as collateralised loans and liquidity staking (LST).

Staking crypto locks the tokens in a network validator. Whilst it is staked, these tokens cannot move. Liquid staking changes this by giving you a "liquid" token that represents your staked asset, which you can use or trade even while your original assets remain staked.

Stake.link is the first LST with native CCIP integration on Metis and this channels liquidity into the realm of Metis.

There will be an increase in native CCIP assets. stLINK is staked Link, this can be wrapped making it wstLINK.

Another development further down the road will be Link’s PROF (Protected Order-Flow) and FSS (Fair Sequencing Services) on Metis. PROF helps batch orders to add a layer of protection in order to prevent individual transactions. These batches are transmitted to FSS.

Through the use of decentralised oracle networks, it receives and orders transactions based on fair criteria – for example, arrival time – and then submit these transactions to the blockchain in the pre-arranged sequence.

PROF and FSS help provide more protection from MEV-related issues by ensuring that transactions are processed in a predictable and equitable order.

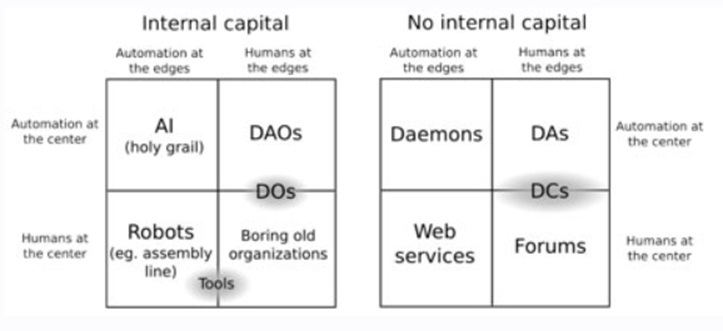

These oracle networks have secured $15tn in transactional value. DTCC want to tokenise on top of Chainlink. Chainlink work with SWIFT, who send over 40 million messages a day. Chainlink and Aave have been working closely with Metis for years and this triumvirate collaborating and co-operating is a huge positive for the Metis ecosystem.

CCIP level 5 security, unified liquidity across chains, seamless asset movement, enhanced capital efficiency with access to broader DeFi opportunities. Developers can create all sorts of products in a secure environment on a chain with cheap and fast transactions; with AI advancing, we are at a point where we don’t know what new products, we will accomplish but we know they are coming.

Here is a class with Metis and Chainlink’s Andrej Rakic - www.youtube.com/watch?v=ysdsgsYmH3I

If you want some insight into tradfi blockchain development, IC3 website can be useful:www.initc3.org/projects www.initc3.org/partners initc3org.medium.com/meet-the-team-behind-boquila-winning-project-of-the-2024-ic3-blockchain-camp-hackathon-3e988be5bebc

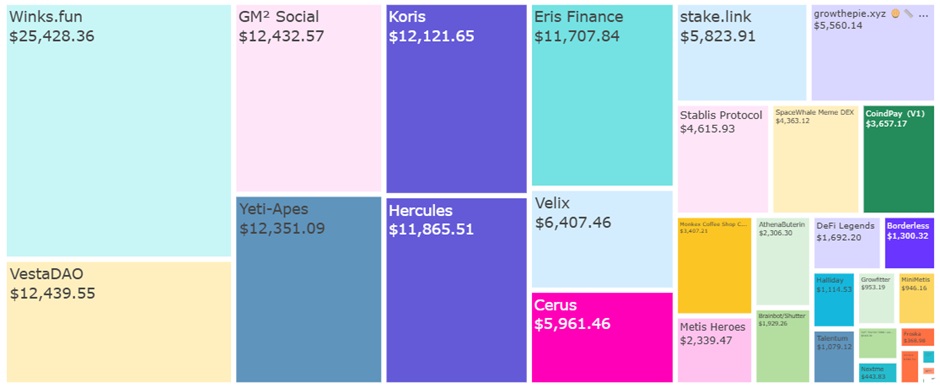

QUADRATIC FUNDING ROUND #1…

… began in onboarding projects from August 29th - September 13th, 2024, this is known as the Curated Round. Then donations opened September 10th – 26th.

The matching pool was 3,000 Metis. Here is a pleasant chart to demonstrate the distribution.

This was the initial funding round, with a focus on RWAs, games, memecoins, and on-chain society projects (identity, attestation, charities).

This is just the beginning for this is a part of a Gitcoin/Metis $4 million annual grant program. This will assist the long-term vision of Metis to have a collaborative ecosystem that the community actively takes part in.

Another grant initiative from Metis is the Thrive Metis STARTathon. This is a 13 week grant programme that mixes hackathon with accelerator. This blends the two environments where a hackathon helps stimulate production and binding it with long-term growth of an accelerator. Since the days of early Crypto Chick hackathons, this is something Elena has been planning for a while, now put into action.

There are two tracks, Local and Global. The Local, through the Metis local incubation partners, can focus on regional markets in Asia. The Global is the track to participant across Web3 sectors.

The grant pool is 5,255 Metis ($200,000) across three bounty categories: Cross-Chain DeFi Solutions and CCIP Track, RWA, and Tokenised Communities and Gamified Social Platforms. Additionally, there is a chance participants will be selected for a Gitcoin funding round to boost contributions to projects with high-potential.

Recently, Metis launched the GameFi Quantum Leap Accelerator Program, this is with ABGA in Partnership with Google Cloud. ABGA stands for Asian Blockchain Gaming Alliance founded in Singapore 2021. Founder and executive president, Kevin Shao has promoted games such as Illuvium in the past.

In April 2024, Yoka, CEO of ABGA, moderated a discussion on “Shaping the Future of Web3 Gaming: A Deep Dive into Infrastructure Perspectives” with Tom Ngo of Metis on the panel. In September 2024, Metis and ABGA, along with Google Cloud, announced their $10 million fund to support Web2 game developers transitioning into the Web3 space. They will receive insight, strategic guidance, partnerships, branding, community engagement, advice on token listing and management strategy.

Google Cloud enables developers to harness the hardware to build, deploy, and scale innovative games with enhanced performance, and global reach.

ON TOP OF THAT is the Thrive and Metis partnership to provide $3.6 million in funding and this goes towards developers as well as supporting content creators.

That is the Gitcoin QF, Startathon, Thrive and GameFi Quantum Leap Accelerator from 2024 but it is not the only funding Metis has announced. At the beginning of 2024, Metis brought the Ecosystem Development Fund (EDF), total it holds 4.6 million Metis, 1.6 million of which is towards ecosystem growth.

With the sequencer being decentralised, Metis have provided tokens to projects hosting a sequencer node to help provide rewards to participants. There are fund grants for new projects to develop, provide liquidity for new launches as well as support existing dapps. Also, to help security of the network and participants, the fund supports audits.

All in all, lots of positive endeavour is pouring into Metis, the first L2 with a decentralised sequencer.

And as the asset managers have BTC ETFs and expanding into ETH ETFs, like most of us when we entered crypto, we got curious of what else is there. Things will expand and I would not surprised if there will be ETFs comprising for ETH L2s. To expand beyond that, with DeFi composability, there will be lots of indexes and baskets that people can invest in much like an ETF but more flexible.

Greyscale are a crypto asset manager and they have announced assets they are considering adding to their portfolio, they seem to have a large list so we shall see but I do think Metis will pop up more and more. After all, it does have the Vitalik connection, talented brains behind it, proponents of the DAC economy, Gitcoin funding, strong collaboration with Chainlink and Aave, DFK is opening a realm, actively nurturing its developer talent and ecosystem.

Metis has helped incubate ZKM and Goat Network, to name just two.

Ming Guo of Metis has a background in MIPS architecture and his brain is being applied to ZKM. Any code written for MIPS architecture gets compiled into a small set of different instructions, adding ZK to it can enable it to execute without revealing the inputs. It is through zkMIPS that Metis can become a hybrid rollup,

zkVM is more versatile than zkEVM, it can create a universal L2 extension. Irrespective of the underlying blockchain network, developers create and execute zero-knowledge applications. Plus, it can also help scale Bitcoin.

This brings me to GOAT Network.

Ming points out that the economy of Bitcoin encourages hoarding and due to its architecture there is less ability to generate yield out of a passive asset unlike ETH. GOAT, co-founded by Kevin Liu, uses the Entangled Rollup and opens up BTC to other blockchains without bridges in order to provide a Unified Liquidity Layer. Therefore, those that utilise it can get a sustainable yield for their Bitcoin.

A veteran of cryptography, Jeroen van de Graaf has written two parts on cross chain asset transfer without a bridge:

Metis stick to their plans and keep funding and developing the apparatus and community time and again.

Vitalik was exposed to a lot of ideas, welded them together and managed to create a pioneering Layer 1. This gave an opportunity to help complex collaboration work, Metis continues to implement the ethos of bringing the world on-chain and contributes to decentralisation, knowing it is the purpose not just an option.

The S&P500 is projected to make just 3% returns each year for the next ten years. Considering the issues of QE, people wanting to protect their wealth and those that want to expand it, these returns are simply not enough.

Countries that provide reliable collaboration have positive commercial relationships that grow an economy. Metis is cultivating an ecosystem for businesses to come to Web3, for game developers to opt into Web3, for the securities and other markets to engage with Web3 trading spaces.

Now the collaborations can be cryptographically guaranteed. We can have more positive-sum games.

Through Metis, we can provide the governance, to steer the ship to a new horizon.

At that first hacker conference, where Ted Nelson said of future developments, “the old guys with their Macintosh in 2015 but essentially there will be this new wave of newer and hotter stuff… that will be at a sporadic pace.”

The pace is now getting faster.