The prices of tokens from various protocols exhibit high volatility and uncertainty due to the reliance on the promise of future yields for much of their value. Despite this, the market often assigns irrational valuations to the governance tokens issued by popular protocols. This is either due to the lack of proper valuation analysis or the indiscriminate investment in technology without considering the protocol's economic dynamics. Such practices hinder the evolution of the decentralized economy and its actors. In this article, I will highlight the most significant disincentives I have identified.

Note: With a high level of admiration for Uniswap and its developers, I will utilize them as a case study due to their prominence and significance. Nonetheless, this analysis can be easily applied to other DeFi protocols.

Actual valuations discourage the activation of sustainable protocol business models

Uniswap is discussing the activation of the Fee Switch which will enable to take a 10% cut from the Pool Fees that are currently being generated on each Swap. This huge step for Uniswap will take it one step closer of being a company equivalent instead of a non-profit DAO, but it also organically lead to the possibility to financially model it as a company.

Despite Bankless having done a previous analysis, I wanted to make my own to be able to guide through it after my exploration. (My Dune analysis dashboard)

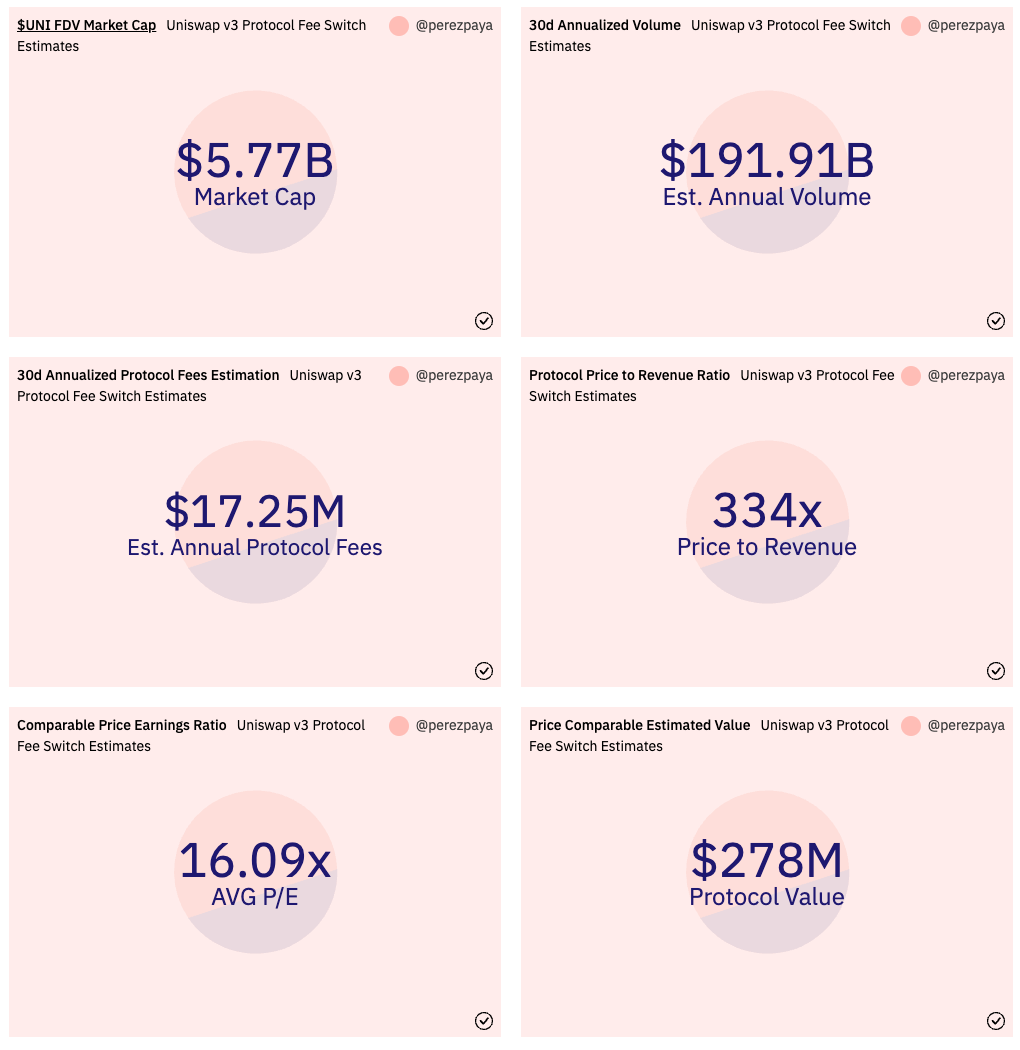

I have annualized the last 30 days total fees from the Uniswap Pools to build an annual estimated revenue for the Uniswap protocol after rewarding its liquidity providers. Uniswap could be making ~$17.25M est. revenue the next 12 months if they activated the 10% Fee Switch today. Taking into account this estimate, **Uniswap trades at a Price to Protocol Revenue Ratio of 334 times.

**By picking some public companies that can act as comparables from more developed markets, I’ve calculated an average Price to Earnings of ~16x. As is not publicly known how much does it cost to run the Uniswap Protocol, I will be taking the revenue as a profit to find a valuation by comparables of $278M, with is almost 21 times smaller than its current fully diluted market valuation of ~$5.8B.

The current value disparity in the token market can be better understood by examining individual tokens. For example, if an investor were to invest $10,000 in $UNI today, they would expect to see a return of approximately $30 after 12 months. This yield, at 0.30%, is significantly lower than the yield of the US 10-year Treasury bond, which currently sits at around 3.5%. This highlights the worse risk/reward ratio by investing in some tokens than traditional investments as US Gov Treasuries.

The Double Dip

Uniswap Labs, which describes itself as “a major contributor to the Uniswap Protocol and now focuses on building a suite of products to support the ecosystem” has recently raised $165M at a $1.66B valuation. In parallel, the recently approved Uniswap Foundation) will sell UNI for a total of $74M to cover a 3 years of operations, where $14M will cover its 12 people team and $60M are budgeted to cover its Uniswap Grants Program.

-

Isn’t this playing both VC and DAO games in parallel?

-

If Uniswap Foundation will be taking the lead of the protocol evolution and has an approved budget for it, what is Uniswap Labs needed for?

-

How will Uniswap Labs, which raised money at a $1.66B valuation create or extract value from the Uniswap Protocol currently valued $5.77B to reward its latest VC investors?

-

Is there any conflict of interest between Uniswap Labs and Uniswap Foundation (or its token holders)?

Party receipt

Currently the joint Uniswap developers have a total cash of ~$240M that will be spent during the following years for the development and growth of the Uniswap Protocol. If we take the target estimate of 3 years for the Uniswap Foundation budget and extend it for the total cash available. We get that the Uniswap promoters will be spending ~$80M per year against the ~17.25M yearly estimated revenue (which will be DAO owned), which will lead to a loss of ~62,4M per year if the DAO holders were paying the party instead of the VC and DAO treasury sponsored promoters.

TL;DR: Uniswap is incurring expenses that will exceed the projected revenue from the fee switch activation.

My two cents

Unrealistic valuations are an incentive to delay the distribution of protocol earnings among token holders. The UNI example illustrates this point. Activating its Fee Switch may put its protocol Total Value Locked at risk, as the fee cut will reduce the incentive for Liquidity Providers to provide liquidity to its pools. It will also lead to the release of its first revenue figures, allowing analysts to calculate its token price in a similar way to a company share price, the “to the moon” narrative falls in favour of the spreadsheet. If we also add to the mix the double dip incentives, we leverage the basket of disincentives to bring solvency to the protocol.

In order to move forward in the space, it is crucial to recognize that current valuations will become more realistic over time and that short-term sacrifices may be necessary for long-term gain. Otherwise upcoming protocols with the right incentives in place and without being tied to keep their unreal valuations will be in a better position to keep driving the innovation and therefore, to take the lead.

And as protocols are implementing revenue-generating mechanisms, it's important to consider what are the most effective structures to maintain incentives for value generation to its stakeholders. Isn't this what we call companies?