By Gary Pesola, Venture Fellow @NEA & IB @GS

How does Society work?

People function in society by producing some sort of value. This could be something as simple as responding to support questions as a customer service representative, or creating a pitchdeck for a client meeting. In the former, increasing customer satisfaction (by providing solutions to customer issues) is the value created, while in the latter, hopefully winning over a client is the value created.

Work is boring. Answering customer questions or creating pitchdecks tends to be dull and monotonous, but we do it because people value that, and we in turn, earn from that.

Work is no fun… I wish I could just play games all day

Games are fun, and top gamers can make a ton of money. Contrary to what many may think, top gamers make money via content creation, not the value created by being good at a game. Content creation can range from streaming on Twitch where streamers (in many cases, top gamers) interact with their audience via live streams or from Gaming Expos / Tournaments where people pay to attend and see their favorite gamers compete.

Gamers are forced to earn via content creation, which is powered by increasing returns to scale meaning the value of outputs increases faster than that of inputs, leading to most of the value going to the very top gamers while most gamers earn little to nothing.

Gamers don’t earn by the value created by being good at a game because they don’t own the digital rewards they receive by advancing in the game. Think of games like Call of Duty, Fortnite, or League of Legends. By completing campaigns, setting records, or collecting rare items, no value is created for gamers because the value is owned by the centralized entities since they retain everything in the game even after you’ve purchased it.

Games, where digital items can be owned by the players after completing some sort of task (e.g. completing a quest, ranking top of a leaderboard, or defeating a monster), allow for earning rights for any player. Games built on the blockchain accomplish this.

Games built on the blockchain

The digital assets in games like Axie Infinity (e.g. the Axies themselves or the SLPs) are owned by the players who win them. In case you’re not familiar with Axie Infinity, I’ll run a quick primer:

Axie Infinity is similar to Pokemon, just replace Pokemon with cute Axies. In order to play, you must buy three Axies (NFTs) and they act as your initial team. You can then choose to play versus CPUs (Player vs. Environment or PVE) or versus other people online (Player vs. Player or PVP). In both cases, you can win Smooth Love Potions (SLPs) which are a form of digital money in the game. You can use SLPs to breed your Axies to make your team stronger.

Great… Now HOW DO I MAKE MONEY?

Players can choose to sell their Axies and earn that way, or convert their SLPs (ERC-20 tokens) to earn. In addition, users can earn the AXE governance token to take part in the game development and implementation of new features. The beauty of user owned games is that gamers can still earn through content creation, although most will play to earn from their digital assets they’ve won in the game.

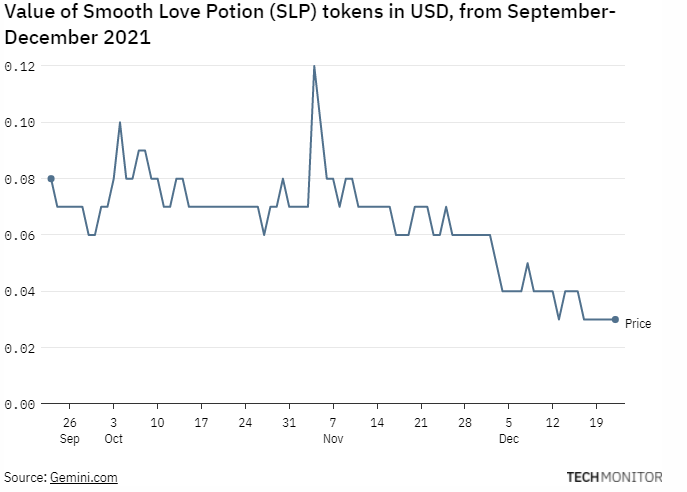

Some gamers have more opportunity to play more and potentially become more efficient in harvesting rewards, while other players may not be as efficient or have the time to play. In this case, many players would be willing to pay for the game assets, and market dynamics would determine the fair value of these different digital assets. Take a look at the price of SLPs for example.

It’s important to note that the starting cost of 3 cheaper Axies can range from $500-$1,000, so the game is not inherently “free to play”. With that said, most people can earn ~$1,000 / month by playing 2-4 hours per day (keep in mind this can fluctuate based on prices).

An entirely new ecosystem is formed by user owned games. People are able to earn a living by playing games they love and enjoy. Axie Infinity has nearly 3 million monthly users already and is continuing to grow at astonishing rates.

With that said, not everything is perfect with blockchain based games. In Axie Infinity, for example, the exorbitant prices of Axies has led many to avoid breeding or trading and instead opt to sell their SLPs. This has resulted in an oversupply of tokens and a steady decline in their value. Meaning players need to earn more SLPs to earn the same amount as before.

Is Play to Earn the future?

More than 3 billion people play video games worldwide. Play to Earn is especially popular in developing nations such as the Philippines or Venezuela where hyperinflation is present and salaries are low. Play to Earn has been so popular in the Philippines that a new tax was introduced for gamers earning money from Play to Earn games.

Currently, most Play to Earn games have terrible graphics to say the least, and the gameplay is lackluster. With that said, major video game publishers like Ubisoft have begun to formally launch blockchain games.

Games like Star Atlas or Cradles: Origin of Species are pushing the boundaries of metaverse graphics though and show extreme promise for Play to Earn development.

NFTs allow for the transfer of digital assets between different worlds. Now that many digital items are becoming NFTs, you have clear and verifiable ownership of the items you win in games. In Pokemon there were “shiny pokemon”, or rare and unique variants of pokemon. Now imagine you caught a shiny Charizard in the Pokemon metaverse. Because your Charizard is an NFT, it is no longer confined to just the Pokemon world, and instead you can bring it to the other metaverse worlds you play in as well. Imagine walking around in a popular metaverse like Decentraland with your incredible Charizard for others to see. The possibilities of cross transferring digital assets is endless and incredibly cool! I’m really excited to see this play out.

A major concern of Play to Earn is the player base it reaches. Play to Earn is exceedingly popular in developing nations for reasons already stated, but $1k / month or $12k / year is really not feasible to live off of in many developed nations. I’ve thought of a few ways to increase potential earnings but the hard part would be finding a common ground so that top players don’t excessively over earn. Another thought process could be increasing elements of RNG, or luck, in attaining digital assets, but once again this runs into the issue of unpredictable cash flow. Unpredictable cash flow means that people wouldn’t be able to rely on Play to Earn as much because one day they could earn $100 while another day could lead to $1.

Scaling Play to Earn games to incentivize players across all socioeconomic classes is incredibly challenging, but more and more developers are jumping into the blockchain space at unprecedented rates. Platforms that are able to entice developed & developing nations to play to earn will completely disrupt the way we create value.