The opacity and complexity of cryptocurrency market making can be daunting. Despite this, ensuring liquidity is critical for the growth and stability of token economies.

This report demystifies the crypto market-making landscape and offers practical insights for founders engaging market makers (MMs). Key considerations include evaluating whether a MM is necessary for your project, MM selection criteria and contract negotiation.

Our research is bolstered by real project contracts and insights from industry experts in quantitative finance and market making.

💡 Note: throughout this paper, we may refer to some technical financial terminology. Please refer to our glossary here for in-depth explanations of each concept.

Market making 101

Market making involves an institution or trader providing liquidity to a market by simultaneously quoting buy (bid) and sell (ask) prices for a security or asset. The bid price represents the highest price a buyer is willing to pay for a security, while the ask price represents the lowest price a seller is willing to accept for the same security. The difference between the bid and ask prices is known as the spread, and it represents the profit margin for the market maker.

MMs are typically incentivised to maintain a narrow spread and provide liquidity to the market, as this attracts more buyers and sellers and leads to higher trading volume. Higher trading volume, in turn, increases the market maker's profits.

Liquidity refers to the ease with which an asset can be bought or sold without affecting its price. A market with high liquidity has many buyers and sellers, so there is always someone willing to buy or sell an asset. A market with low liquidity, on the other hand, has few buyers and sellers, which can lead to large price movements when someone wants to buy or sell a large number of assets.

Great, so now that we know what a market maker is, what is the concern?

The concern lies in the potential misalignment between an MM's profit-seeking short-term focus and a project team's long-term value creation. Our goal is to help founders form synergistic relationships with MMs and avoid structuring deals that enable MMs to extract value at the expense of the project's long-term goals.

Do you need a market maker?

Founders should initially ponder two questions:

Is a market maker necessary at my project's current stage?

MMs are typically needed during a project’s early listing stages. For example, this can be at the IEO stage, where initially there is near-zero trading volume. Established digital assets usually have ample market-provided liquidity, making MMs less beneficial.

How does engaging a MM benefit my project?

In other words: does my protocol require liquidity? For a DeFi protocol where the token is designed to be traded with high volume, liquidity may be vital. Conversely, for governance tokens meant for holding with low velocity, liquidity isn't as crucial.

In the latter case, a simple 50/50 Uniswap pool or other decentralised liquidity pool may suffice. Setting up a pool can be a simple DIY solution and requires far less capital than engaging a MM that charges recurring service fees. Once the protocol has grown significantly (e.g. daily active users are reaching hundreds of thousands or millions), the project can then transition to a centralized exchange such as Binance, Huobi, or Crypto.com.

Evaluating Pros and Cons

When conducting a cost-benefit analysis, founders should consider their specific circumstances, including finances, project timeline, and token purpose:

Benefits

-

Reduced spread - Reduced bid-ask spread makes transactions more attractive, lowering transaction costs for buyers and sellers. A tight spread ensures a better trading experience with minimal fees and slippage.

-

Liquidity creates further liquidity - Initial liquidity fosters further liquidity, attracting more buyers and sellers into the market (“liquidity breeds liquidity”). This creates a loop that further amplifies volume and liquidity.

-

Price discovery - Liquid markets facilitate accurate price discovery, representing the asset's true value based on decisions by numerous market participants.

-

Price stability - High liquidity mitigates drastic price shifts from large orders, promoting investor confidence. To preserve a project’s long-term vision, users ideally price the intrinsic utility and value of the token, instead of purely viewing it as a speculative asset (which can be the case when prices are highly volatile).

Costs

-

Engagement Fees - Market makers may require setup and recurring fees, or token loans. For instance, GSR, a leading crypto market maker, charges setup fees of US $100,000, monthly fees of US $20,000, plus a $1 M BTC and ETH loan.

-

Imbalanced deals - Founders or token issuers typically have weaker negotiation stances due to their low-volume trading pairs (less profitable for MMs). In these cases, MMs can leverage this to strong-arm a more skewed deal.

-

Bad actors - The lack of regulation in the crypto industry can attract fraudulent MMs that engage in deceptive activities such as wash trading, or misuse of token loans. The risks of damage from a MM’s malpractice or default should be considered.

Criteria to select a market maker for a token

There are over 50 major market makers in the crypto/web3 landscape currently. When it comes to choosing a market maker, we propose 5 key criteria:

-

Fees - The sum of setup fees, recurring fees, performance-based fees, and options.

-

Capabilities (volume and spreads) - the quoted volume or spreads that the MM initially provides. MMs may only guarantee quotes between certain hours of the day, whilst some can trade 24/7.

-

Reputation - established firms with a large balance sheet, strong track record (e.g. working with reputable projects, TradFi experience), and experience in delta-neutral market making.

-

Accessibility - the criteria that the MMs themselves set when choosing markets to trade (e.g. MMs who have minimum volume thresholds for assets).

-

Partnerships - reliable connections to leading exchanges (Binance, Huobi, Crypto.com) which may assist with exchange listings. This must be considered cautiously and conservatively.

💡 A list of major market makers in crypto can be found here - link

The terms of a MM contract

The final step is negotiating and finalising the contract which outlines the terms of the market-making agreement, also known as the Liquidity Consulting Agreement (LCA).

Through analysing public and private market-making agreements, we have identified the key elements within an agreement that any project founder should focus on**:**

Compensation

We consider compensation as any form of financial incentive aimed to reward a MM’s positive behaviour. The three main forms of compensation we have identified (from reviewing several MM deals) are:

-

Service fees

-

Options

-

KPI-based fees

Service fees

Fixed fees paid to the MM can be significant sums of fiat for early-stage projects. There are several pricing structures:

-

Setup fees: initial lump-sum payments to the MM at the beginning of the agreement.

-

Retainer fees: recurring fees (e.g. monthly, fortnightly, quarterly) paid to the MM - this is typically at a specified flat rate.

-

Both setup and retainer fees

-

No fees: In bull markets, market makers may forgo fees for a token loan, especially for popular tokens. The supply-demand dynamic governs the overall market making cost. Hyped tokens are profitable enough for MMs to trade without needing further fees.

Founders should be wary that market makers generally have negotiation leverage due to:

-

Abundant Market Options: MMs have an abundance of different markets they can trade on, so losing a deal with a project has a limited impact on their business.

-

Limited Profitability in Early-Stage Projects: For early-stage projects with limited existing volume or liquidity in their native token, MMs see limited profit opportunity and potential risk in providing their services. Market makers utilise high-frequency algorithmic trading to make a profit, and therefore when there is limited trading volume, the opportunity becomes less lucrative for the MM.

Options

Options are common in MM agreements to provide the MM with financial upside through token price performance. This typically gives the MM the option to purchase the tokens after the loan expires for a pre-agreed price between the parties.

The MM is thus incentivised to keep the price above a specific threshold (the option’s strike price), as this gives the MM the ability to exercise the option to buy X amount of tokens at the pre-specified strike price, and immediately sell at the higher current market price for a healthy profit.

MMs leverage options to persuade founders to sign with them, indicating that using options aligns them with the token’s success (i.e. increasing token price). This was particularly common in bull markets, where there was a non-zero probability of an early-stage project token increasing 100x, and MMs pushed harder for option deals (and often succeeded).

However, these options have an expiry date after which they are worthless to the market maker, so such alignment is always short-term in nature.

Employing options as MM compensation is complex and risky due to:

-

Pricing challenge: Determining a reasonable strike price, option tenure, or volatility for a new asset with a limited price history is incredibly difficult and prone to large inaccuracies. In bull markets, MMs aim to negotiate for huge option packages at cheap prices in order to gain exposure to token price upside in a manner analogous to venture capital.

-

Manipulation risk: Founders with limited financial/statistical literacy may fall victim to the manipulation of key parameters which make up the value of the option. They may even be unaware that the options they are offering have a price/implied value attached - this is analogous to the difficulty of pricing the value of a startup’s equity.

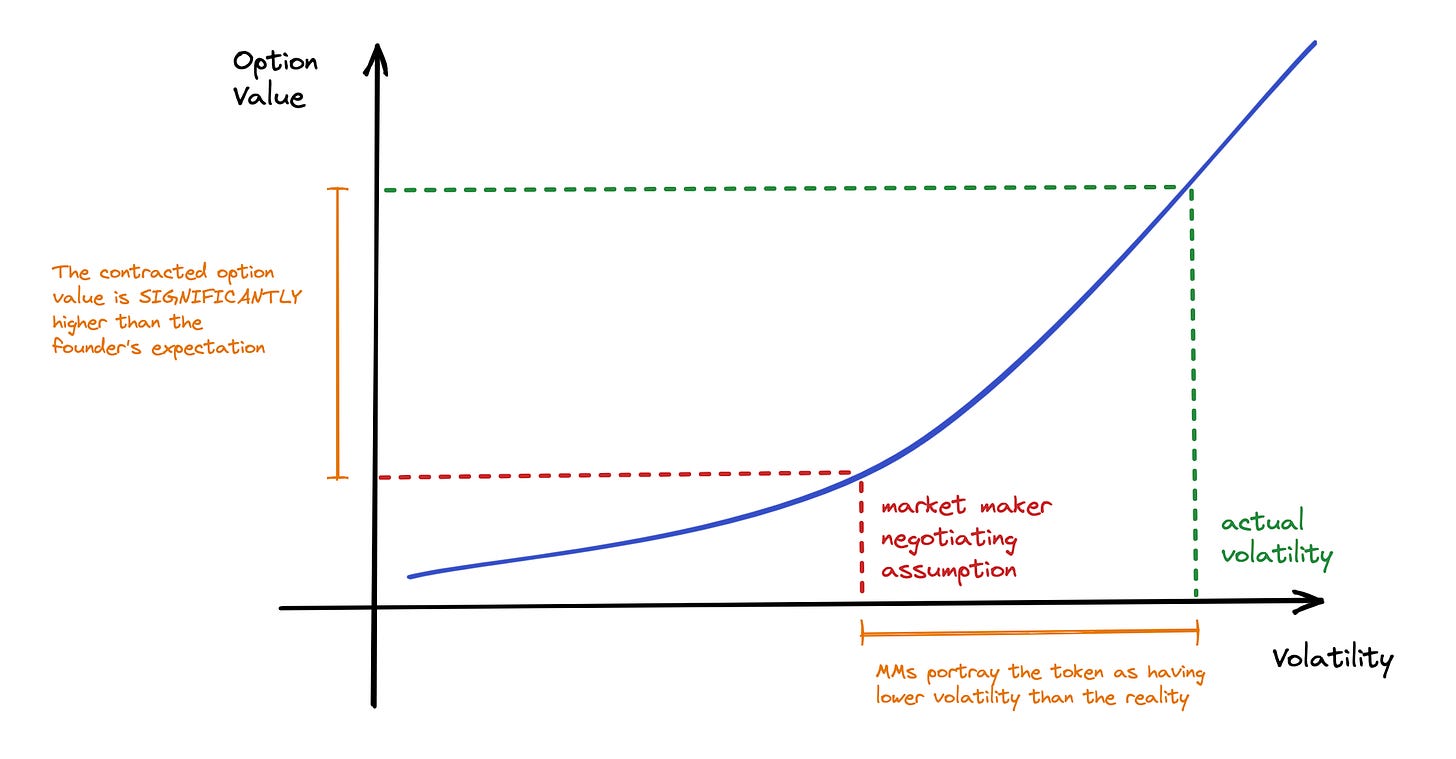

- Unethical MMs can understate token options' actual value using unrealistic assumptions in calculations, causing founders to unknowingly give away more value. This can be done by using unreasonable assumptions (e.g., the token's volatility will be equal to the BTC volatility) that implies the contracted option’s value is significantly lower than in reality.

💡 Whilst token founders do not need to learn complex statistical and options pricing theory, there are certain tools that can be useful to generate a ballpark value for a contracted token option. It is difficult to pinpoint the value of your option deal with great precision, but founders should educate themselves on the value of the offer in order to have a more transparent and informed discussion with the MM.

-

We have produced a basic tool here to assist with the estimating and valuation of your options contracts:

-

There may be price manipulation risks:

-

If the option price is too high, then this encourages MMs to pump the price.

-

If the option price is too low, then the MM (if the loan repayment model is denominated in the quantity of tokens) can maximise profit by shorting the token and ultimately only having to repay a fraction of the principal.

-

One option pricing format which can be used is having “tranches”, where the token issuer provides several options with differing strike prices or expirations. For example, GenesysGo - which contracted with Alameda - presented three tranches, priced with option strike prices of: $1.88/$1.95/$2.05.

Interestingly, tranches have a very minimal impact on the actual service. Nonetheless, there are two reasons why they exist: a) MMs want to make the deal more complex and therefore seem more “legitimate”. b) A MM may want to offer slightly better deals compared to its competitors.

Performance-based fees

KPIs can be used to create performance-based fees that reward the MM for reaching the project’s desired goals. A few performance metrics (alongside our evaluation of them) can be found below:

-

Volume

- Very dangerous as it can incentivise wash trading - this practice is illegal in most markets and is harmful in that it can artificially inflate volume numbers and lead to misleading market data.

-

Price

- A very poor metric that can lead to MMs pumping token prices, and subsequently crashing the ecosystem when the prices unravel.

-

Spread

-

The spread or bid-ask spread is the difference between the prices quoted for an immediate sale and an immediate purchase of stocks. In other words, it is the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to sell for.

-

Generally, a fairly robust KPI, although this needs to be supplemented by metrics that capture market depth (else there is a tight spread but the price is fragile).

-

-

Minimum bid and offer sizes (in USD)

-

The notional bid and offer size refers to the value in USD (of the project token) that the MM is willing to buy and sell respectively.

-

Important KPI as it ensures there is a reasonable buffer against large price swings from sizeable orders. Prevents prices from easily skyrocketing or crashing.

-

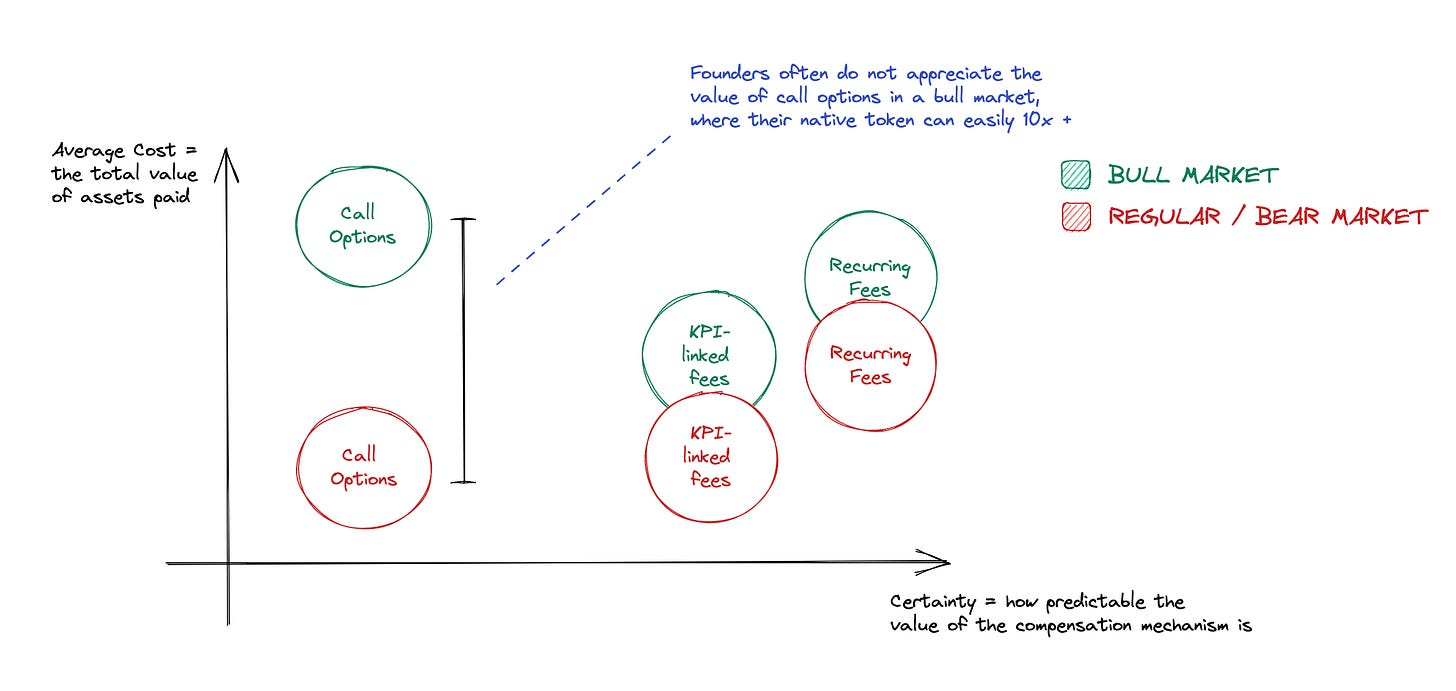

Comparing the types of compensation

The process of deciding on what forms of compensation to opt for in a project is ultimately highly personalised and depends on how much cash the founder has, their goals regarding decentralisation and governance, as well as the stage of the project.

Service fees (setup and monthly recurring) are a balanced arrangement, but may warrant high initial costs for a reputable market maker (MM) to boost project liquidity. However, setting vague targets with these fees is suboptimal. Incorporating performance-based fees with concrete targets, like spread percentages, can better align MM behavior with project goals. However, care should be taken to avoid easily-manipulated KPIs like volume during negotiations.

We recommend risk-averse teams to combine service fees with KPI-based bonuses. Cash-poor projects should aim for small to medium market makers with proven records. Cash-rich projects should contract large, top-tier market makers and negotiate for mostly fixed terms.

Compensating through options can lead to overpayment for MM services and increase risk. Another negative outcome is in governance: if a founder issues options at a low strike price for a significant quantity, an MM could accumulate a significant portion of circulating supply. This compromises the decentralisation of the protocol, especially as MMs will likely vote in a profit-maximising manner rather than aligning with the project’s vision.

Cash-poor, risk-tolerant teams may consider using some amount of options in the package, while being mindful of the present value of the options. However, if the project has significant cash reserves and a loyal user base, then using options is typically inadvisable and requires thorough scenario testing to avoid overpayment.

Below is a summary table of the above:

💡 A framework to understand the risks of a MM deal: As a founder, consider what the market maker would gain or lose if: a. the project token price increased by 1000x. b. the project token price went to zero.

Assuming the MM will always act in a way that maximises their profit and earnings, a team should be able to understand which way the MM is motivated to push the price. In an ideal scenario, a market maker should be neutral to the direction the price moves, as they are simply there to provide liquidity.

Loan Terms

A common arrangement in market-making agreements is for the asset issuer or party requesting liquidity services to provide a loan to the MM for the MM to use to trade and provide liquidity for the token. There are a few attributes of a loan clause that are of significance:

-

Loan period: The loan period is important, as it determines how long the project will have to wait before the MM can return the loaned capital. This should be negotiated on a case-by-case basis depending on the roadmap of the project and the financial needs of the core team.

-

Interest rate: This token loan is made on the basis of a 0% interest rate - this is because the MM would otherwise have to make constant repayments whilst earning a variable return from trading, which is unattractive.

-

Token loan quantity and value: The incentive alignment is stronger if the type of tokens given in the loan are that native to the ecosystem. However, it should be noted that a loan denominated in the number of tokens presents an adverse incentive for MMs, who benefit if the tokens decrease in price, as the value of their repayment will be lower. This type of contract term resembles an “embedded option”, as it gives the MM great upside from price drops before repayment at the expiry date.

-

Repayment issues: Projects should be explicit about the contractual obligations which arise if the MM is unable to return the tokens. Clauses also commonly include paying the amount outstanding in BTC/ETH or stablecoins.

Termination rights

-

Notice period

- Generally, both parties are able to terminate upon written notice delivered some period in advance. As with many commercial agreements, a range of 14 - 30 days is fairly common for a termination notice. However, each issuer should evaluate the difficulty of securing additional market makers based on their personal circumstances and adjust the notice period accordingly.

-

Additional conditions under which either party can terminate

-

The Asset Issuer

- Rights to terminate if any material breaches any of their obligations.

-

The MM: the termination rights which a MM holds are more significant here, as they dictate the conditions under which they are no longer obligated to provide liquidity. We outline 4 types of conditions under which the MM can legally be removed with commentary on key considerations (if applicable) for core teams.

-

Breach of payment terms: issuers should ensure there are safeguards, including the existence of a grace period) to provide the team with buffer time in periods of poor cashflow.

-

Breach of other terms (e.g. Non-Disclosure)

-

Conflict with Terms of Service and regulations enforced by exchanges in which liquidity is being provided

-

Law and regulation: because the regulatory landscape around cryptocurrency is constantly changing, MMs need to protect themselves if the act of performing their obligations suddenly becomes criminalised. One source for potential legal due diligence is understanding the laws around market-making in traditional asset markets, which can set a precedent for future web3 regulation approaches.

-

-

Liability

In most liquidity agreements with MMs, the MM is excluded from any liability surrounding the token’s price fluctuations. This can be expected due to the speculative nature of cryptocurrency, whilst noting that there are endless factors beyond the MM’s control that can dictate token price, thus making it fundamentally unreasonable for MMs to bear the financial consequences of such price movements.

Conclusion

In conclusion, market-making plays a crucial role in ensuring liquidity and stability in the cryptocurrency market. This report aimed to demystify the complexities of market-making in crypto and provide actionable insights for founders considering engaging a market maker. Through an analysis of real-life contracts and insights from industry experts, the report highlighted the importance of considering the necessity of a market maker, selecting the right firm, and negotiating terms.

We hope that this report will serve as a valuable resource for founders and other stakeholders in the cryptocurrency ecosystem, helping them to make informed decisions about market making and to drive the growth and stability of the token economy. We are also happy to help founders navigate this difficult stage of their journey with more personalised advice, so please contact us at contact@paperclip.partners for more information.