The weekly 🐰 hole (19 Mar 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (19 Mar 23) of liquidity movements & defi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

The fed is pumping liquidity into the system, everything is printing. Could this be the start of the bull market?

PepeCoin on Twitter: "It's Coming! 🐸 PEPE AND GREEN CANDLES 🤑 #pepecoinclub #pepe #bsc #PANCAKESWAP https://t.co/wk5K2nkJPS" / Twitter

-

Stablecoin flows

-

Smart Money Movement (Recontinued with @ozfrox contribution)

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

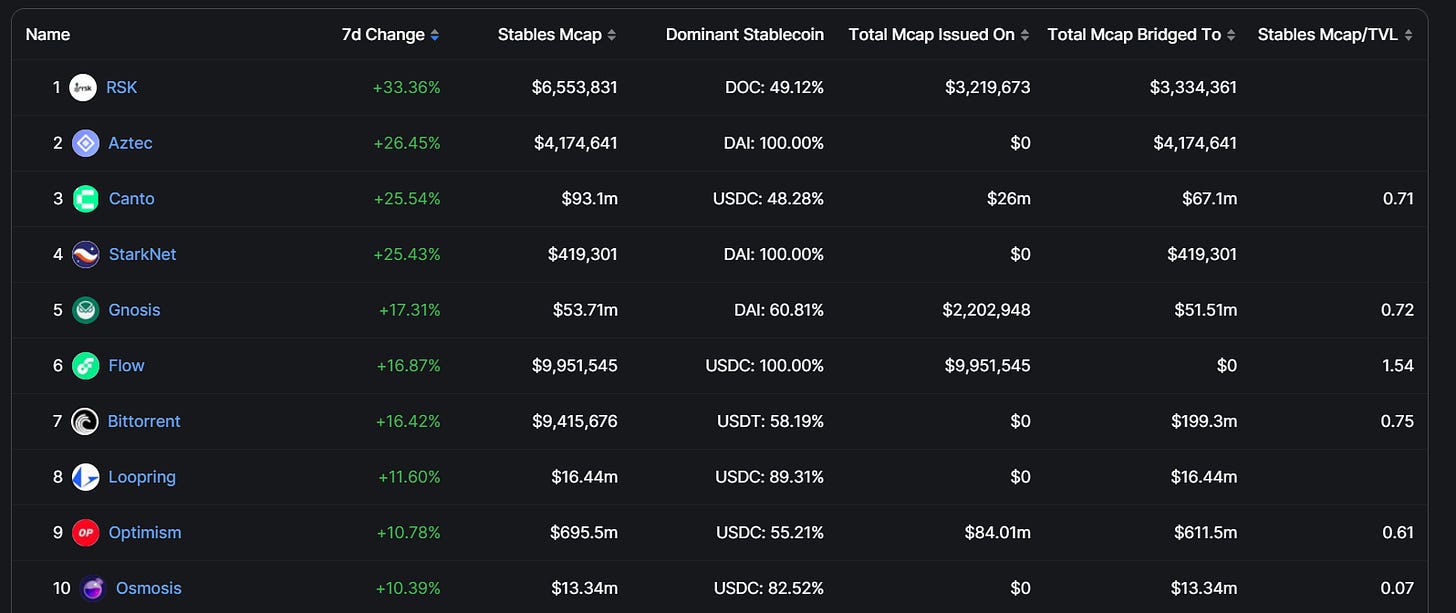

1. Stablecoin Flows

Total Stablecoin MCAP = 133.45 bil, with 1.42% weekly change.

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

RISK

-

Aztec

-

Canto

-

StarkNet

-

Gnosis

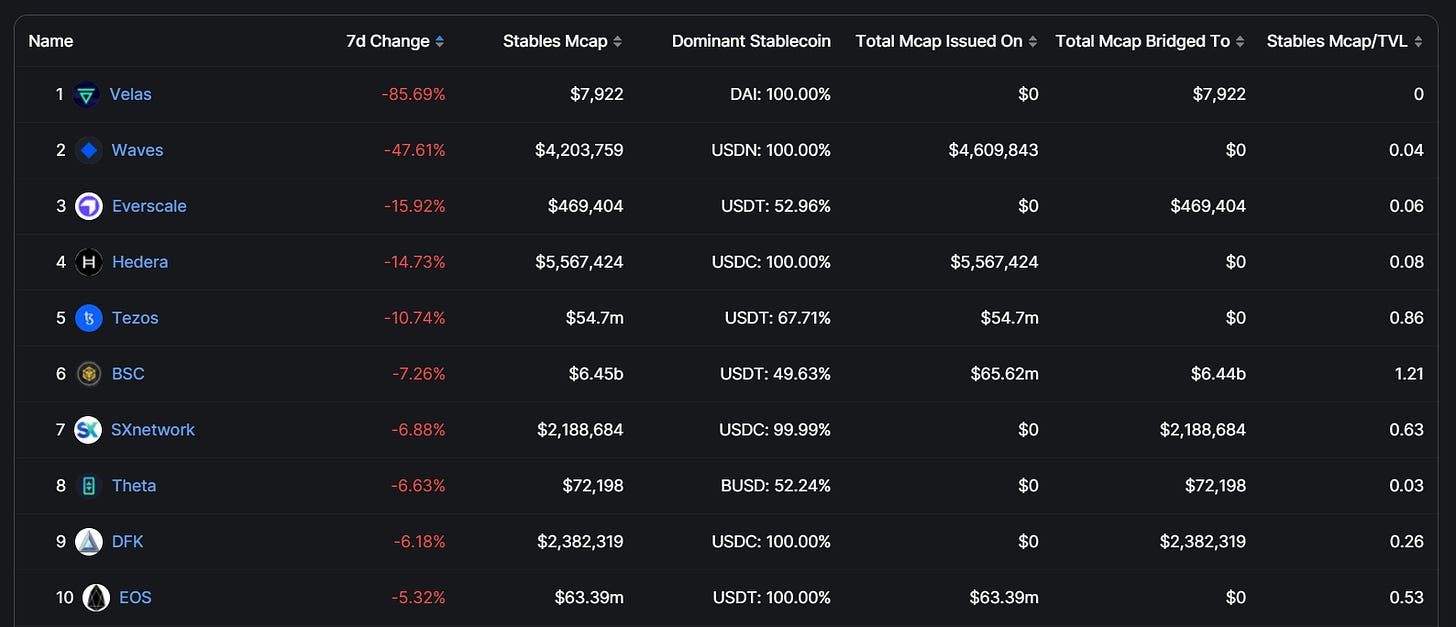

Top outflows:

-

Velas

-

Waves

-

Everscale

-

Hedera

-

Tezos

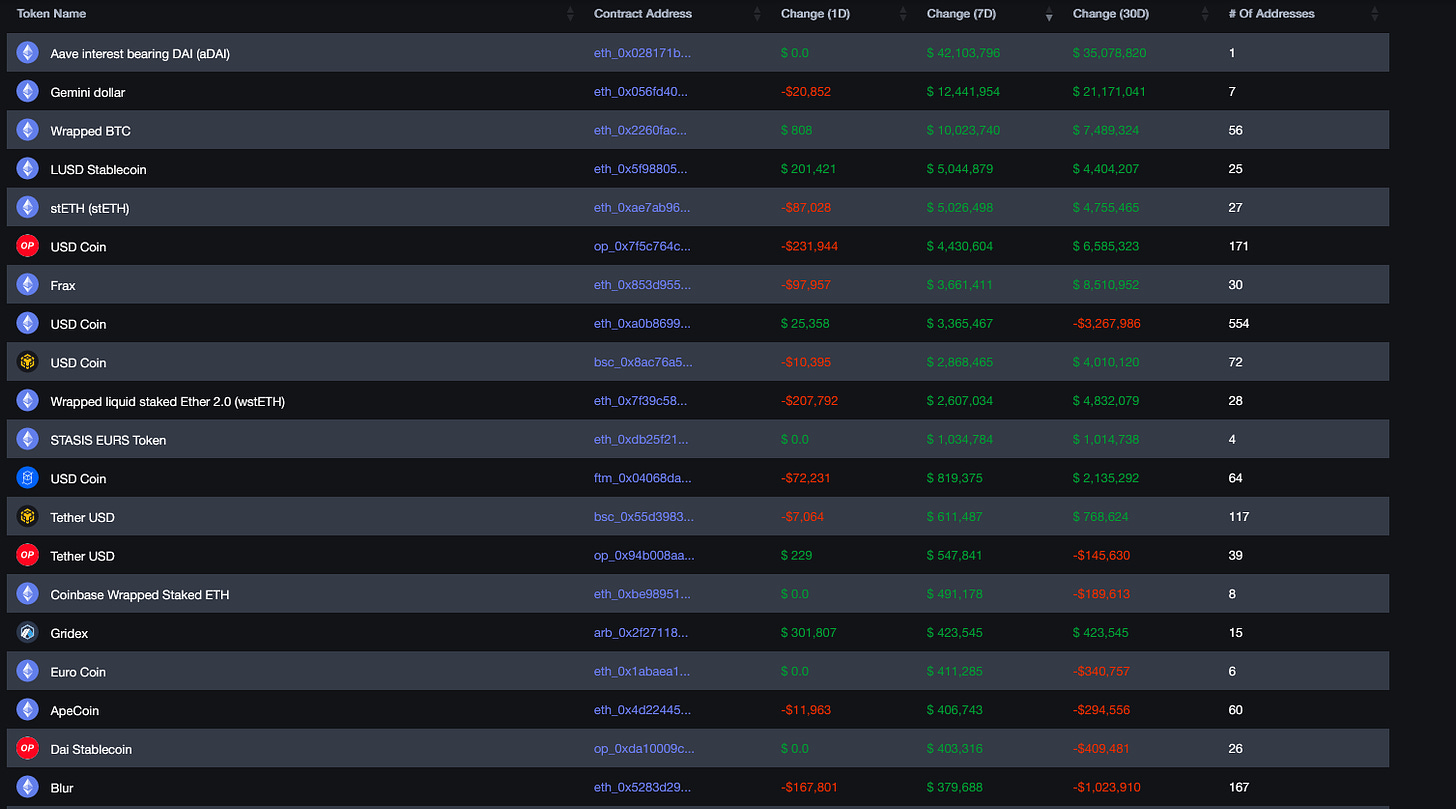

2. Smart Money Movement

Shoutout to @ozfrox from PrimapesDAO for the data.

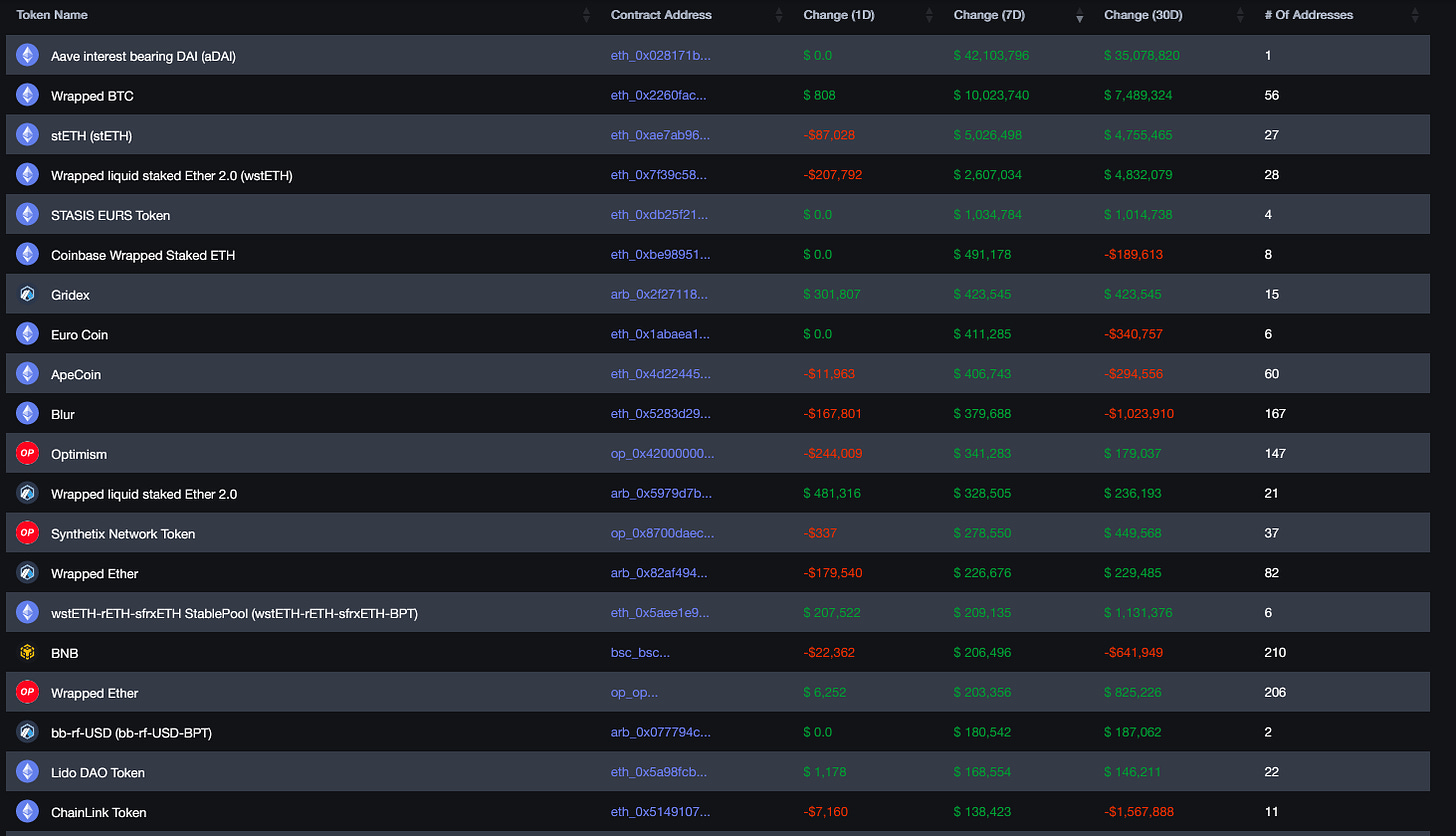

Top Smart money inflows (including stablecoins):

-

aDAI

-

Gemini Dollar

-

WBTC

-

LUSD

-

stETH

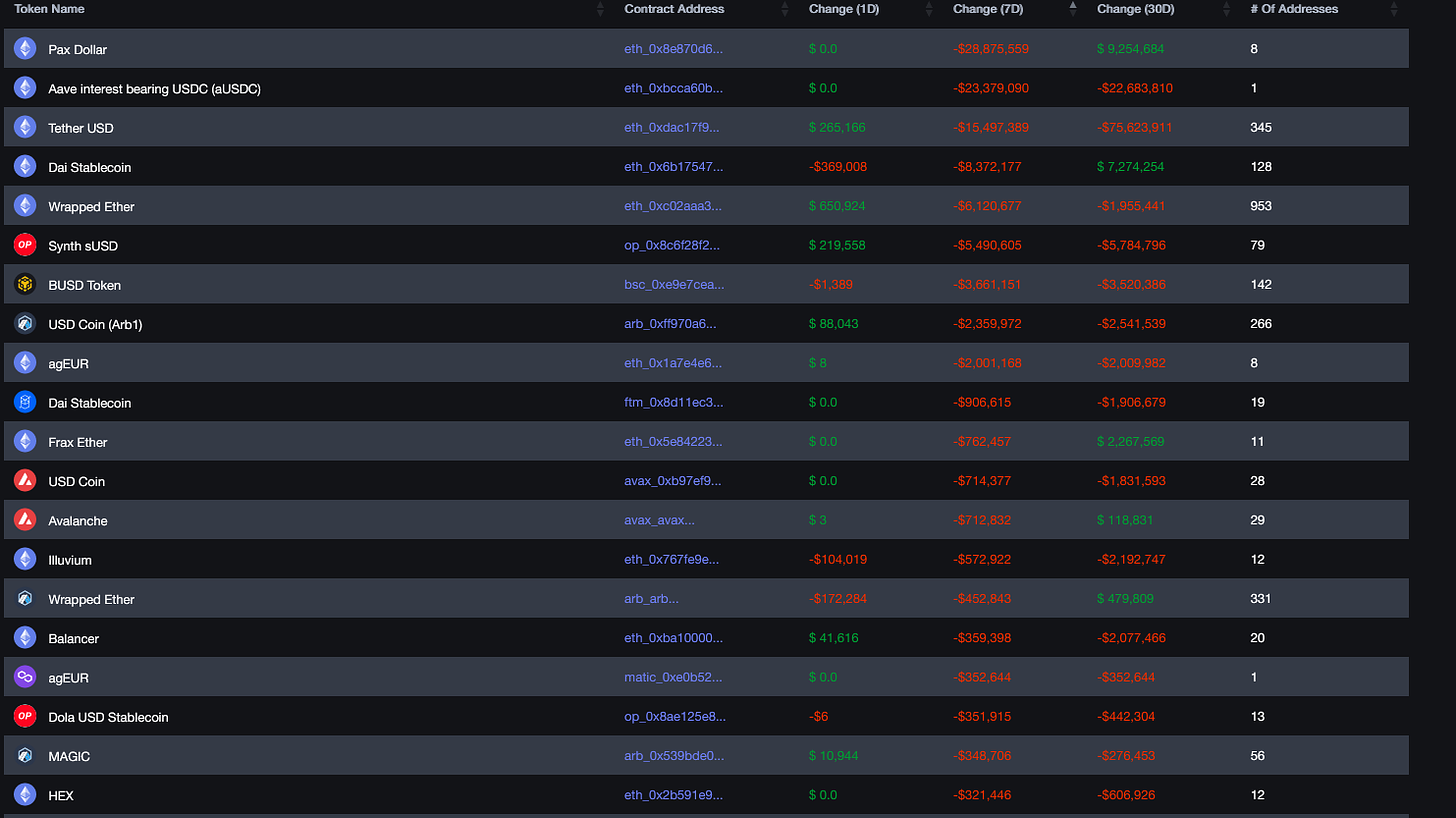

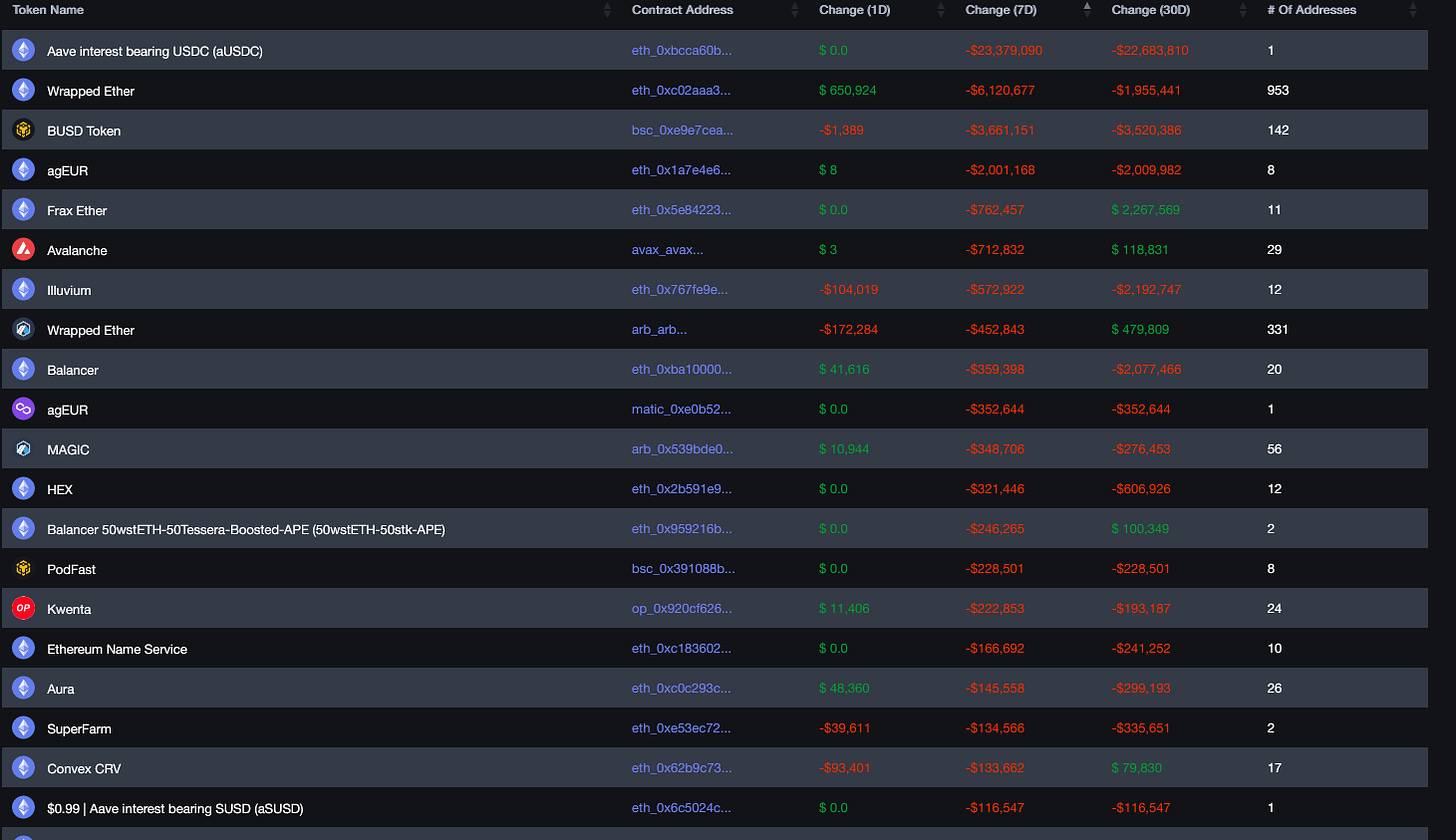

Top Smart money outflows (including stablecoins):

-

Pax Dollar

-

aUSDC

-

USDT

-

Dai

-

WETH

Top Smart money inflows (excluding stablecoins):

-

aDAI

-

WBTC

-

stETH

-

wstETH

-

STASIS EURS token

Top Smart money outflows (excluding stablecoins):

-

aUSDC

-

WETH

-

BUSD

-

agEUR

-

Frax ETH

3. Top L1/L2 Financials

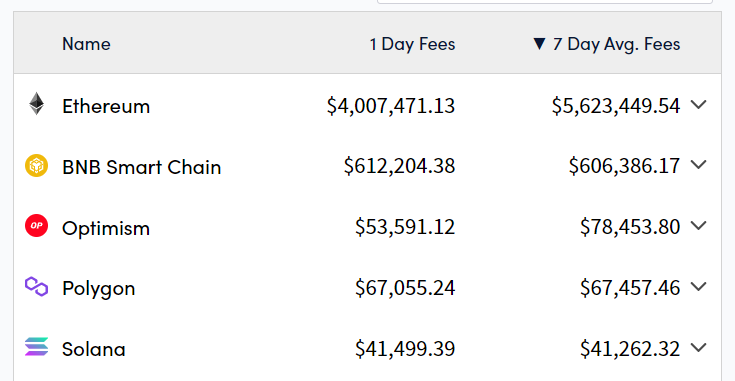

Fees-Generated

-

ETH

-

BNB

-

Optimism

-

Polygon

-

Solana

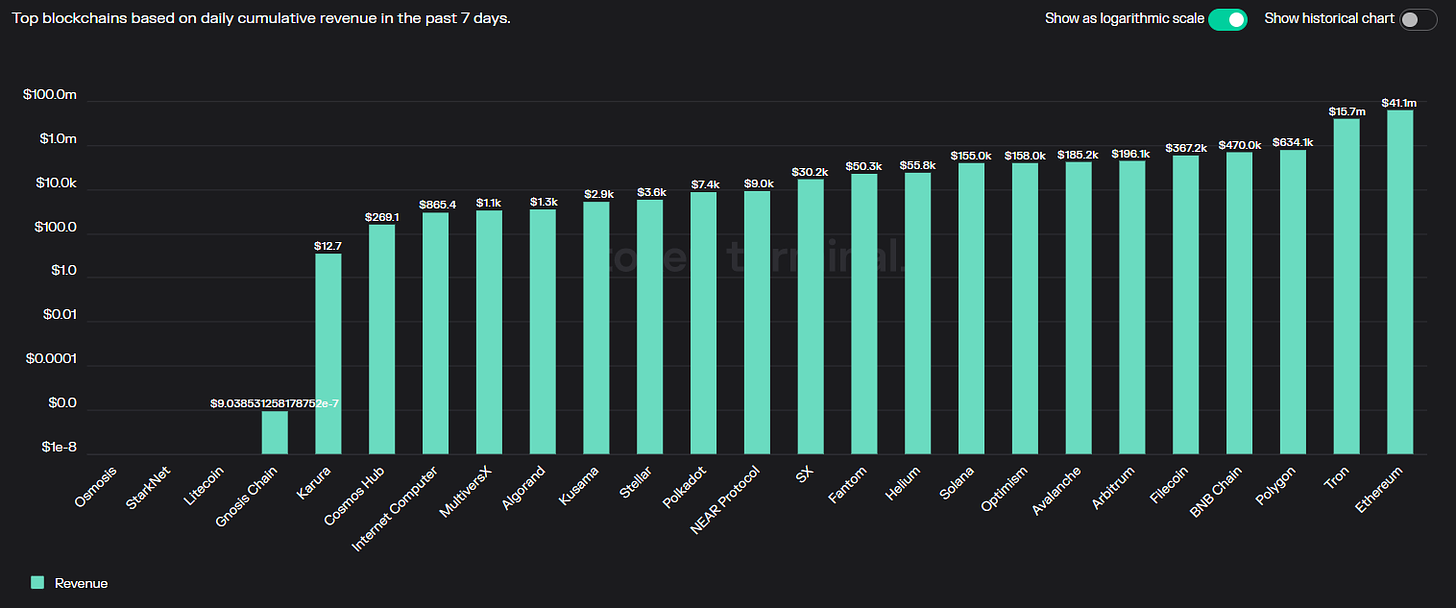

Revenue

-

ETH

-

Tron

-

Polygon

-

BNB

-

Filecoin

Earnings

-

ETH

-

Tron

-

Arbitrum

-

SX

-

Stellar

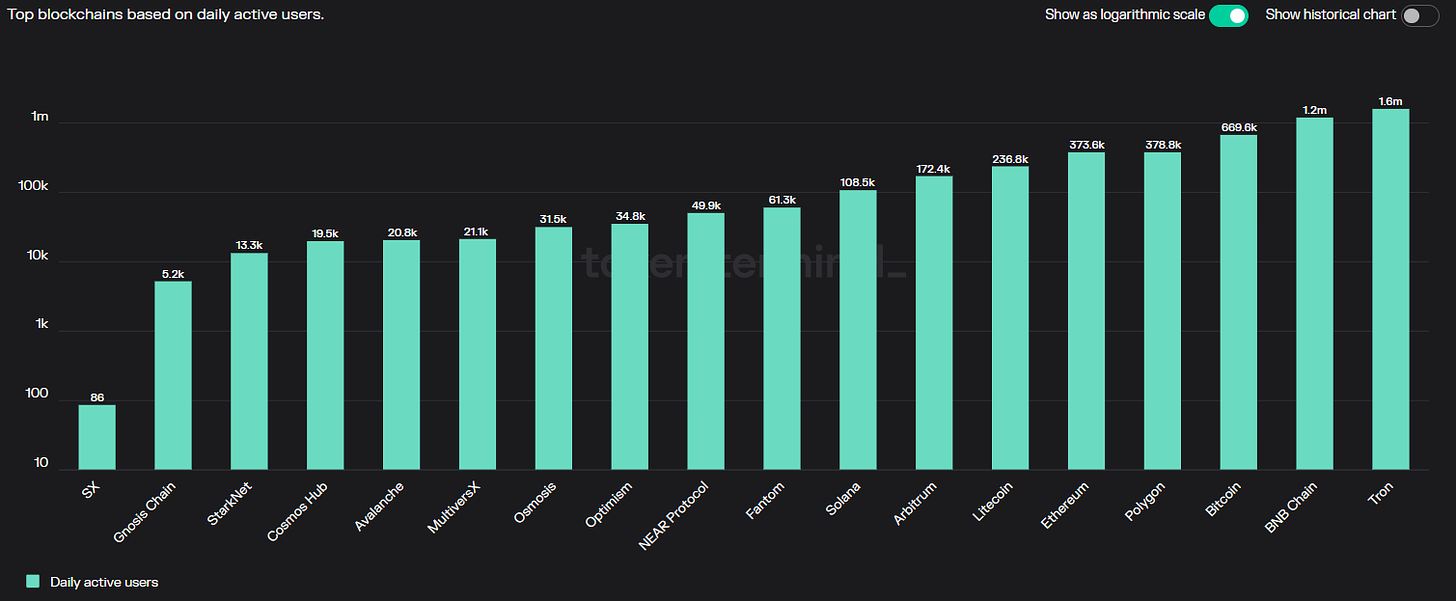

DAUs

-

Tron

-

BNB

-

BTC

-

Polygon

-

ETH

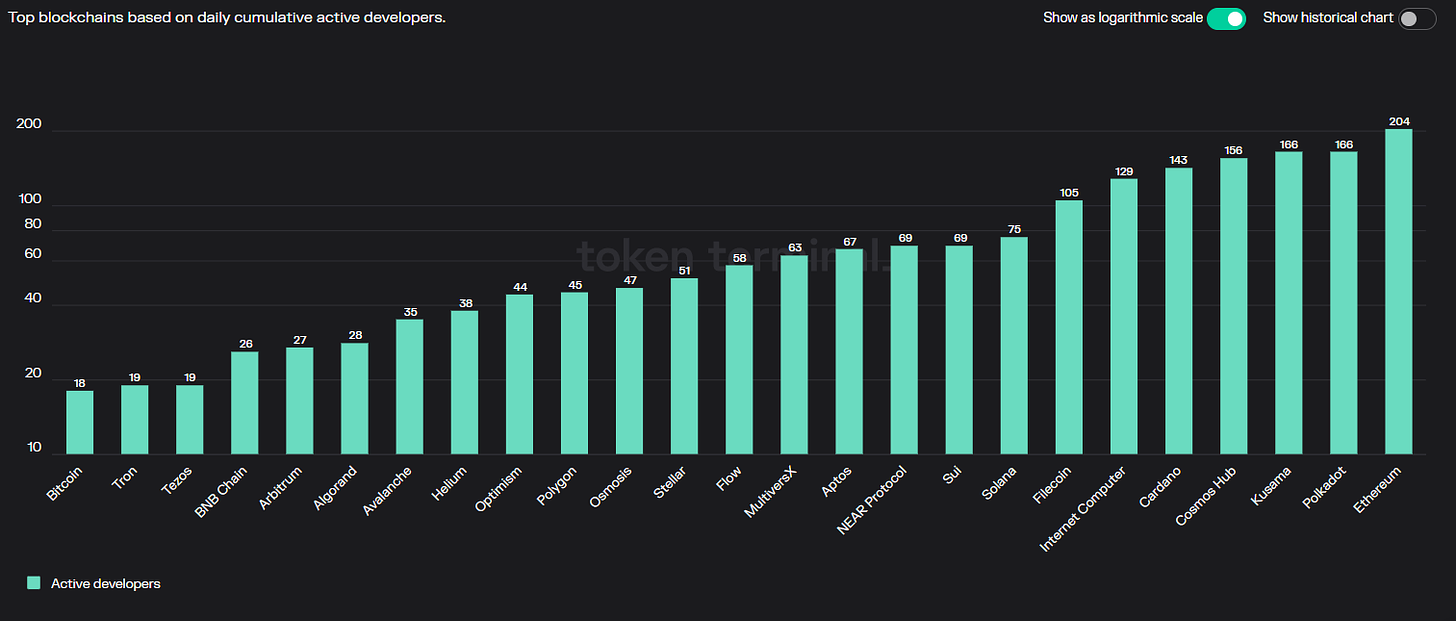

Active Developers

-

ETH

-

Polkadot

-

Kusama

-

Cosmos

-

Cardano

Code Commits

Additional metric to measure how active developers on each chain are.

-

ETH

-

Cardano

-

Internet Computer

-

Polkadot

-

Kusama

4. Top DAPP Financials

Fees-Generated

-

Uniswap

-

Lido

-

GMX

-

Aave

-

dYdX

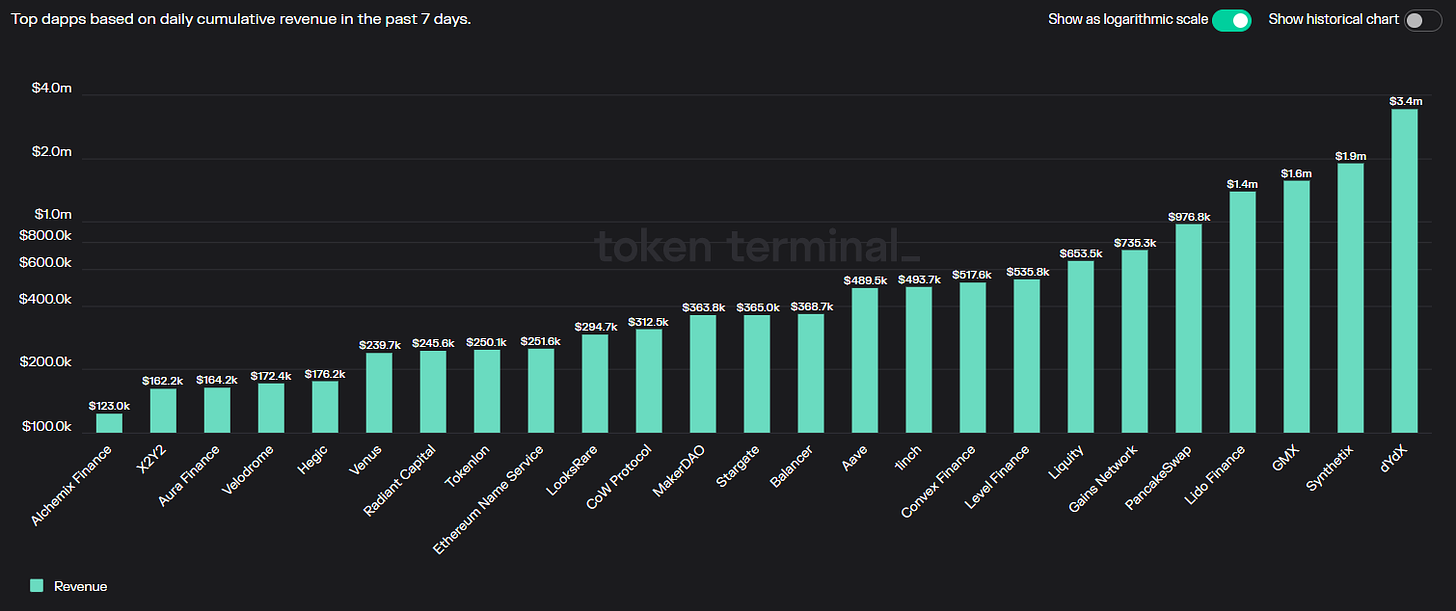

Revenue

-

dYdX

-

Synthetix

-

GMX

-

Lido

-

Pancakeswap

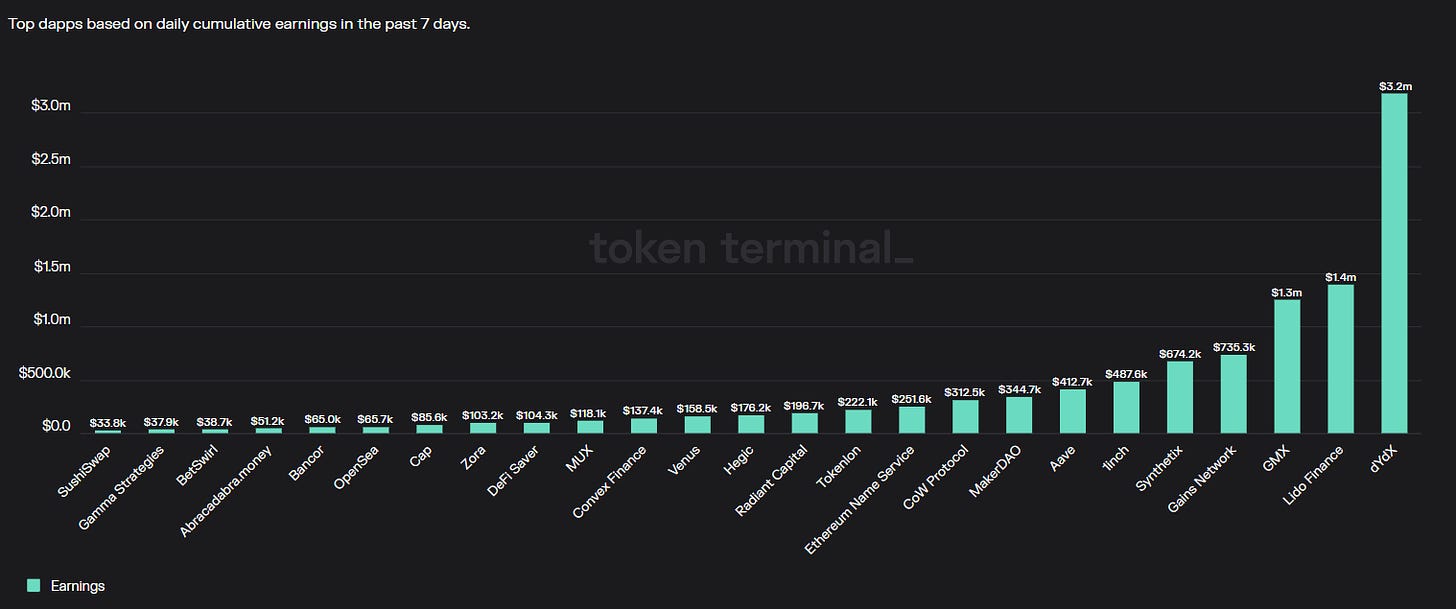

Earnings

-

dYdX

-

Lido

-

GMX

-

Gains

-

Synthetix

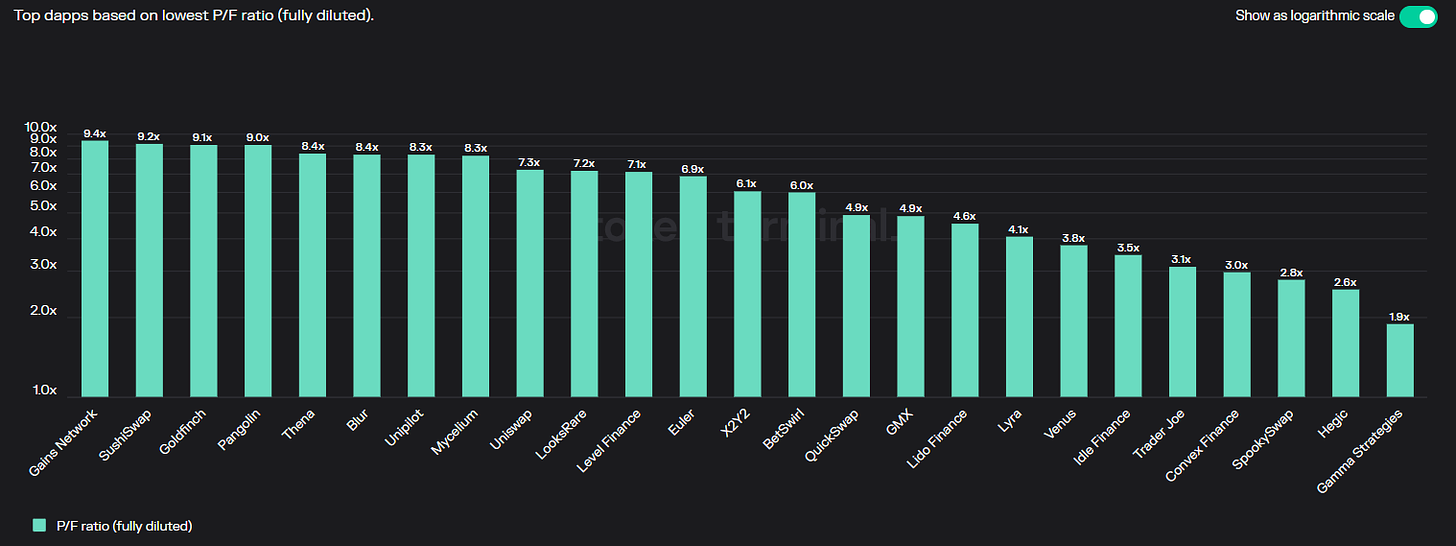

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

Gamma

-

Hegic

-

Spookyswap

-

Convex

-

Trader Joe

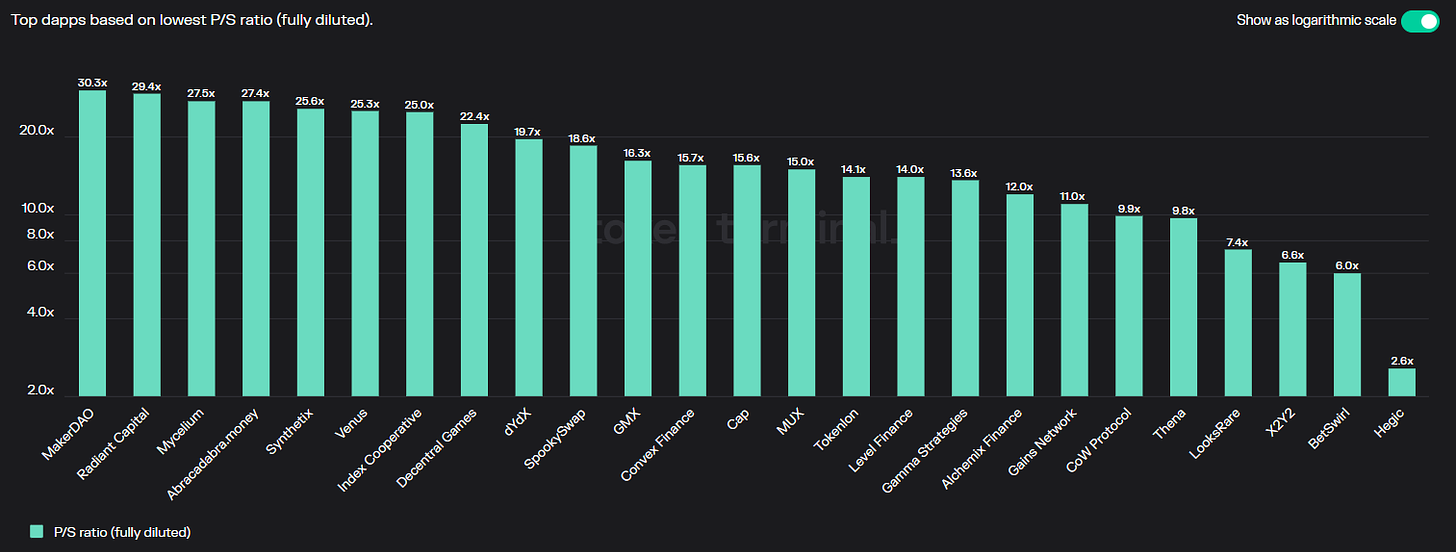

P/S ratio

FDV mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned).

-

Hegic

-

BetSwirl

-

X2Y2

-

Looks

-

Thena

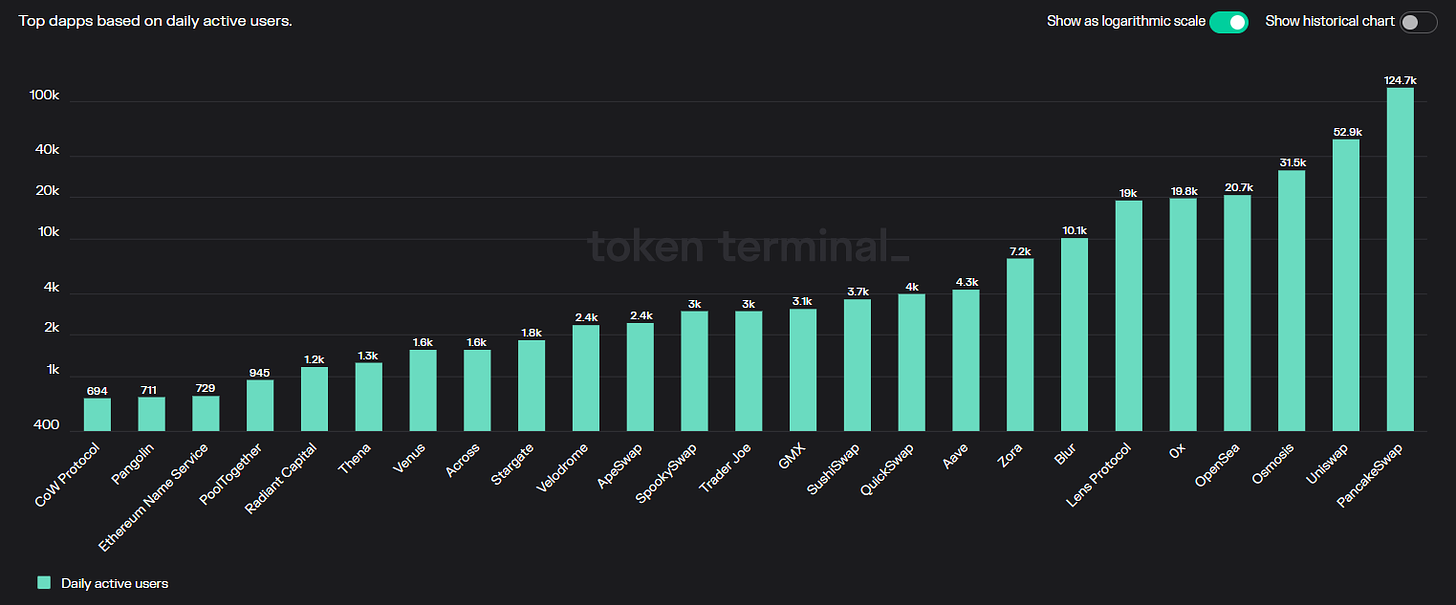

DAUs

-

Pancakeswap

-

Uniswap

-

Osmosis

-

OpenSea

-

0x

5. Movement Analysis

Stablecoin flows:

-

The total Stablecoin market is up 1.42% this week as the Fed turned the money printer back on (albeit indirectly via Bank Term Funding Program).

-

The market is green this week, as risk-on appetite returns to the market in anticipation of Fed’s policy pivot.

-

Arbitrum is receiving large stablecoin inflows this week in response to $ARB airdrop and incentive programme.

Smart Money Movement:

-

Smart money is diversifying their stablecoin holdings among different stablecoins (e.g. Gemini dollar, LUSD, aDAI, etc) in the aftermath of the USDC de-peg last week.

-

There is a general risk-on sentiment with inflows into wBTC and stETH as well as other altcoins.

-

Significant outflows from BUSD as Binance replaces BUSD in the SAFU fund with TUSD and USDT.

https://twitter.com/News_Of_Alpha/status/1636718251127316480?s=20

L1/L2 movement:

-

A majority of L1/L2s are green this week with L2s taking a larger share of liquidity flows with $ARB airdrop announcement.

-

If you missed $ARB, time to look at other upcoming L1/L2s for upcoming airdrops (e.g. ZKsync, Berachain, etc)

DAPP movements:

-

AMM, Perp Dex and LSD protocols are printing this week.

-

Synthetix is seeing huge trading volume as traders farm $OP tokens.

https://twitter.com/DefiantNews/status/1636457329280577536?s=20

-

I am expecting further liquidity inflows into Arbitrum in anticipation of $ARB token incentive program (~42% token supply). With a rising tide lifting all boats, here are a few categories I believe will obtain the majority of the liquidity benefits (NFA):

-

Perp protocols (GMX, Vela, Mux protocol, etc)

-

Native Dexes (Grail, Alien, etc)

-

Solidly Dexes (SolidLizard, Ramses, etc)

-

Lending protocols (Radiant, etc)

-

Gaming protocols (Magic, Trident, etc)

-

Yield Farming protocols (Jones, Plutus, etc)

-

6. TLDR

-

Risk-on sentiment is back, catch your entries on solid protocols while you can.

-

Arbitrum season has started with the airdrop announcement. I expect the majority of native Arbitrum projects to do very well this coming week.

-

If you missed $ARB airdrop, don’t worry as there are other L1/L2s that have yet to release a token. (e.g. ZKsync, Berachain, etc) It is probably a good idea to use $ARB airdrop’s eligibility criteria as a basis to farm other airdrops.

-

Lastly, always remember to take profits while the market is green and greed is rampant.

Conclusion

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source: