The weekly 🐰 hole (30 Apr 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (30 Apr 23) of liquidity movements & defi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

Hmmm… what if “Sell in May and go away” is all psyops by Beras….

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

1. Stablecoin Flows

Total Stablecoin MCAP = 130.38 bil, with -0.32% weekly change.

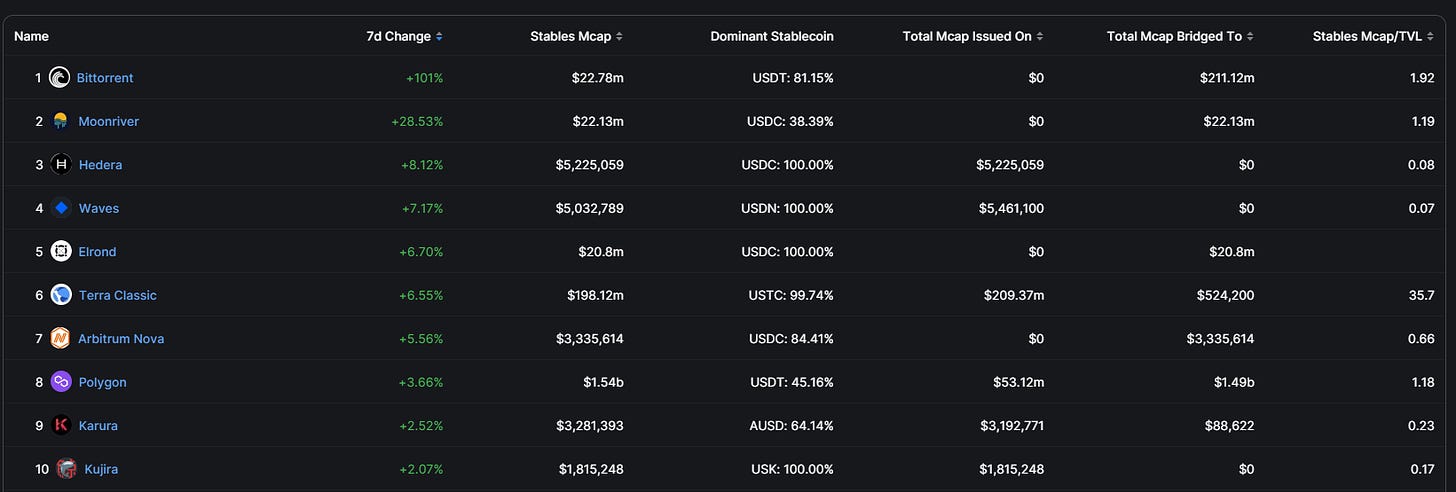

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

Bittorrent

-

Moonriver

-

Hedera

-

Waves

-

Elrond

Top outflows:

-

Everscale

-

RSK

-

Gnosis

-

Kava

-

Aurora

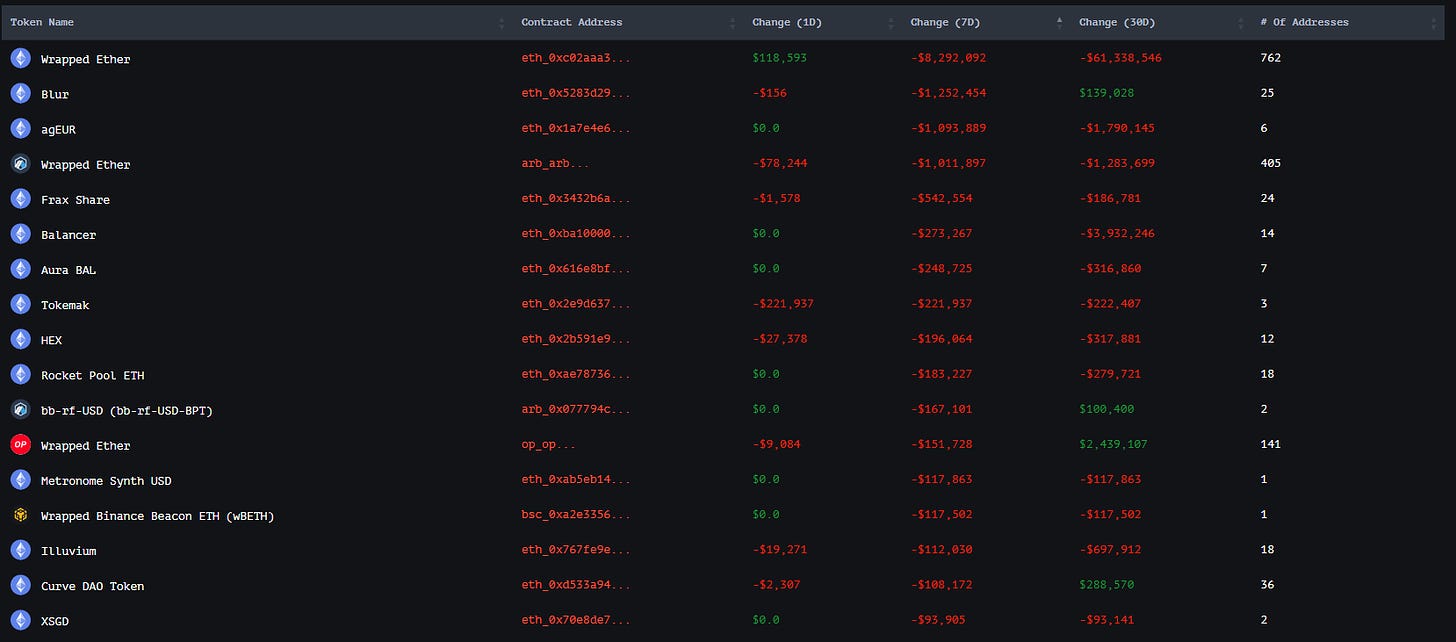

2. Smart Money Movement

Cr: @ozfrox

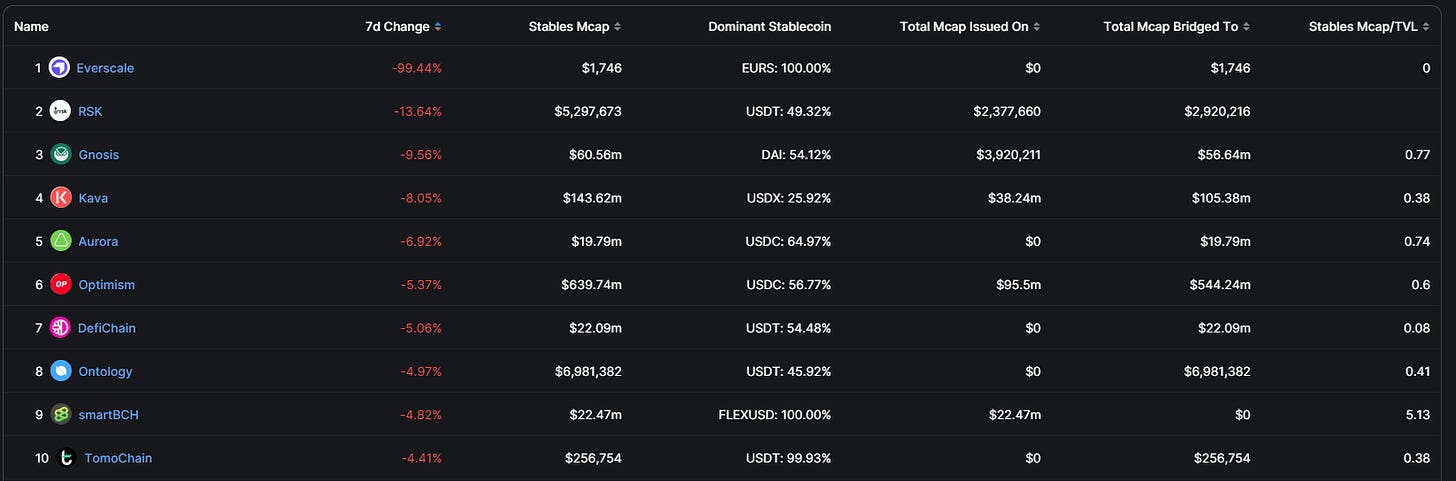

Top Smart money inflows (including stablecoins):

-

Lido Staked ETH

-

USDT

-

Wrapped BTC

-

USDC

-

Coinbase Wrapped staked ETH

Top Smart money outflows (including stablecoins):

-

Wrapped ETH

-

DAI

-

Blur

-

agEUR

-

Wrapped ETH (Arb)

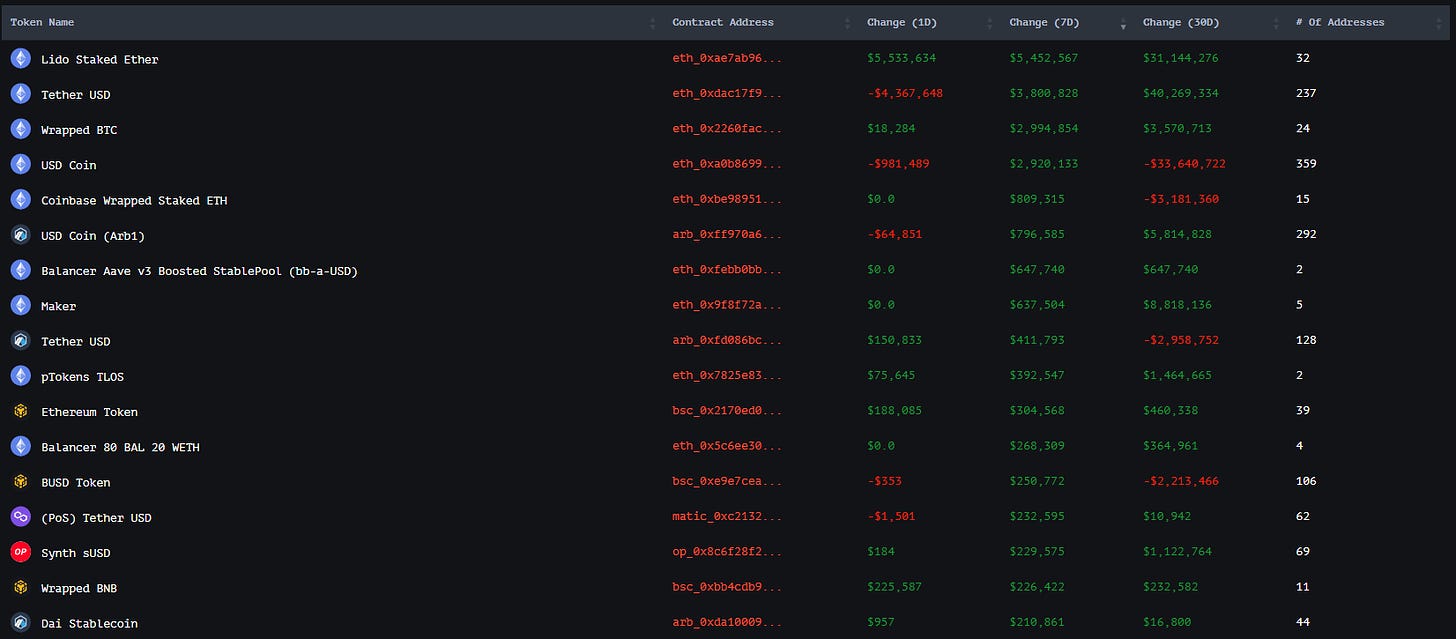

Top Smart money inflows (excluding stablecoins):

-

Lido Staked ETH

-

Wrapped BTC

-

Coinbase Wrapped staked ETH

-

Balancer Aave v3 Boosted Stablepool

-

Maker

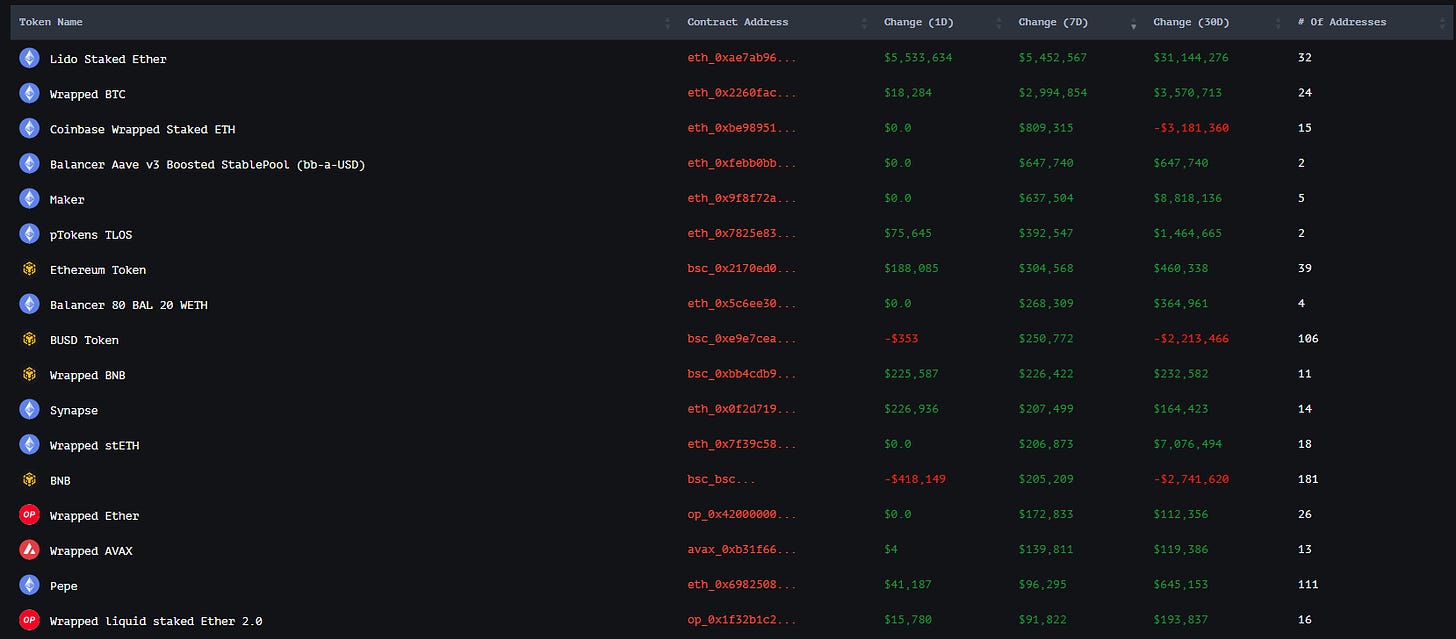

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

Blur

-

agEUR

-

Wrapped ETH (Arb)

-

Frax Share

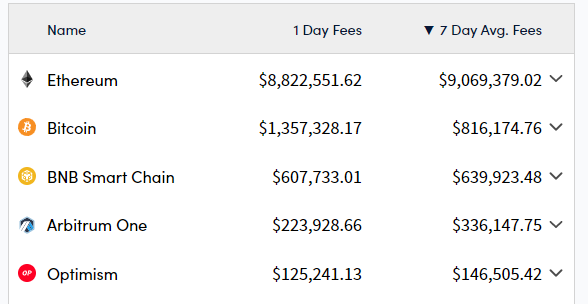

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BTC

-

BNB

-

Arbitrum

-

Optimism

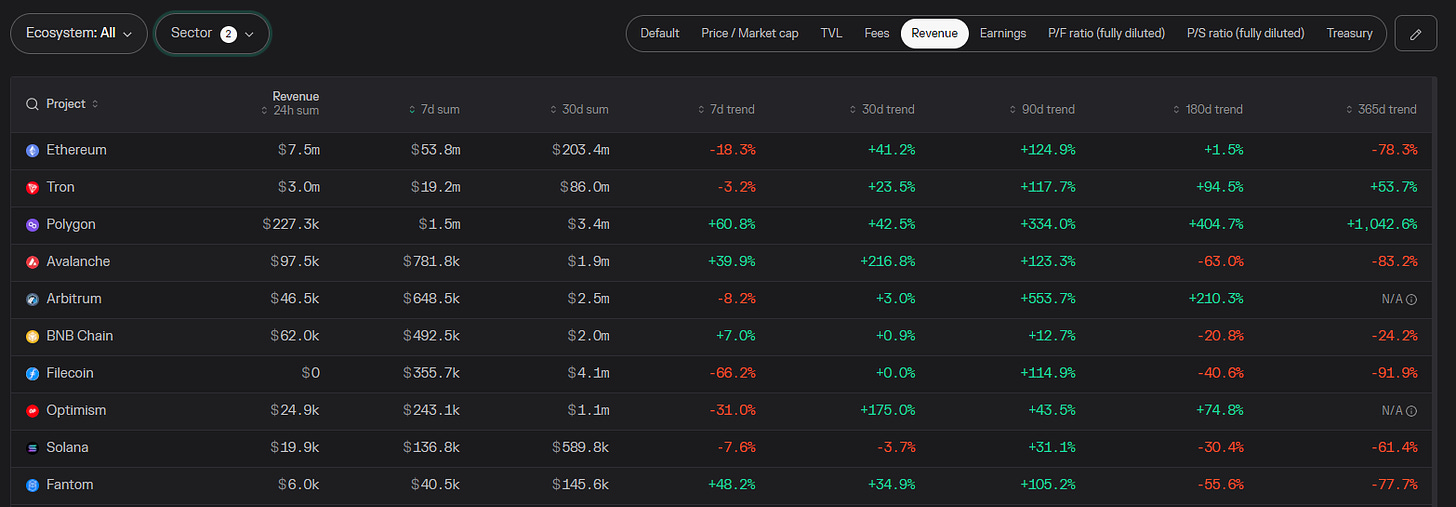

Revenue

-

ETH

-

Tron

-

Polygon

-

Avalanche

-

Arbitrum

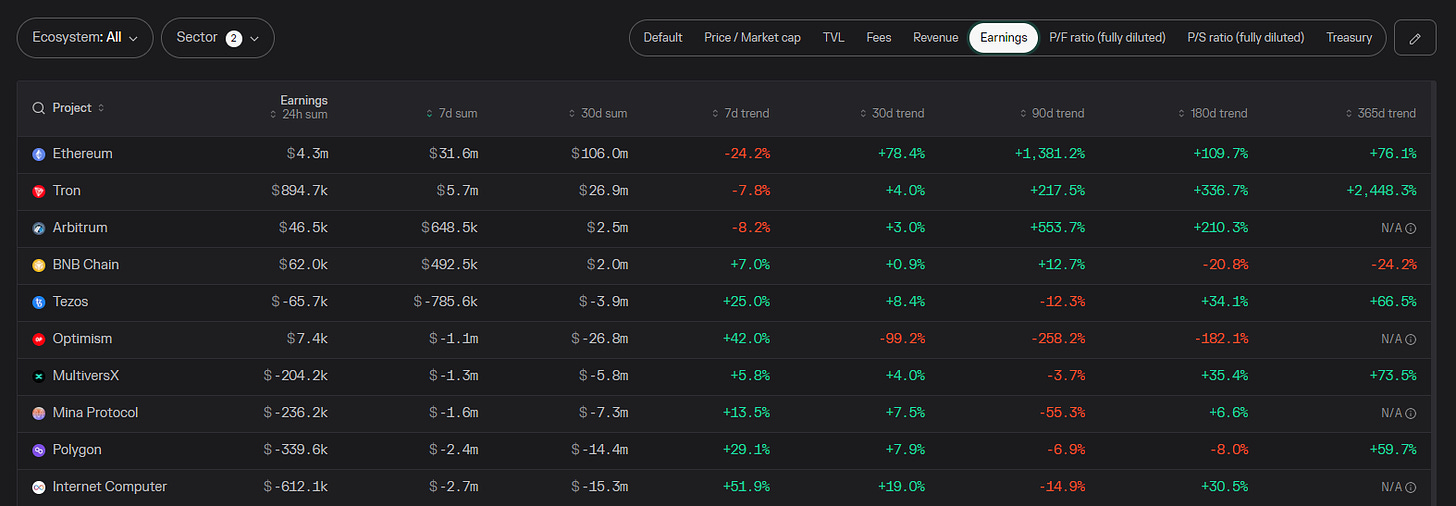

Earnings

-

ETH

-

Tron

-

Arbitrum

-

BNB

-

Tezos

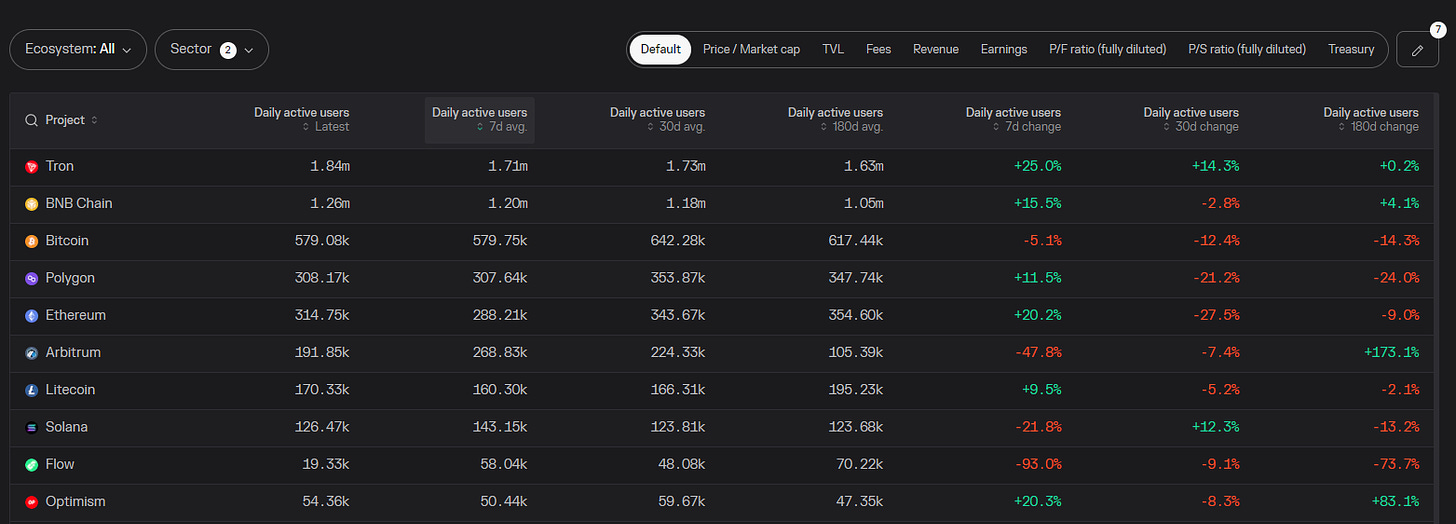

DAUs

-

Tron

-

BNB

-

BTC

-

Polygon

-

ETH

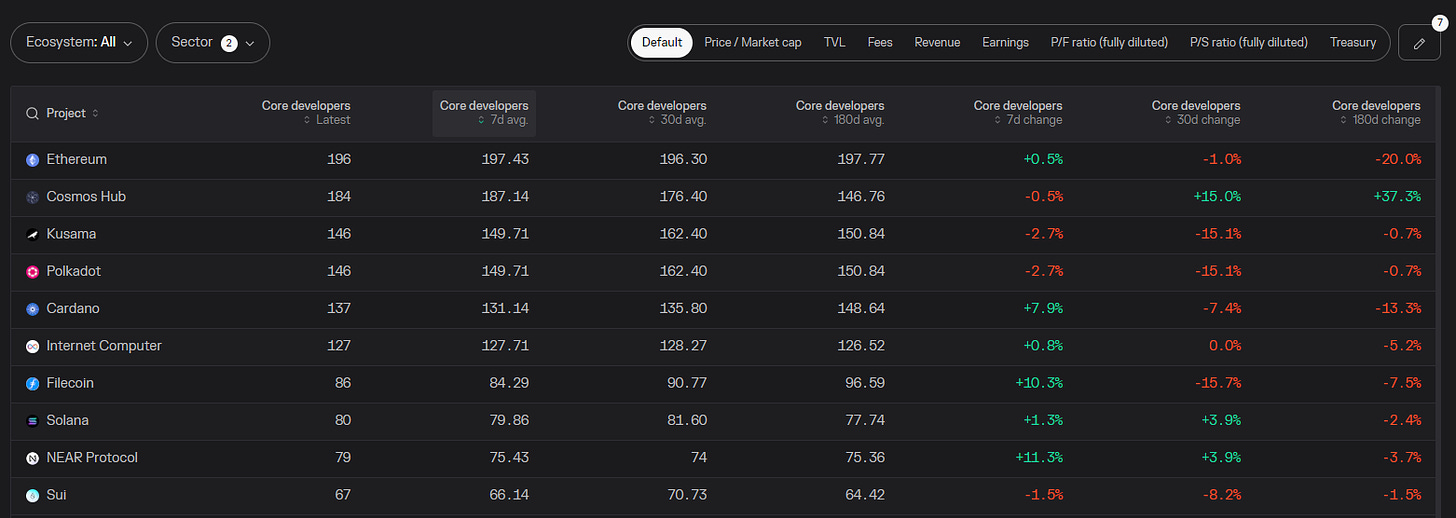

Active Developers

-

ETH

-

Cosmos

-

Kusama

-

Polkadot

-

Cardano

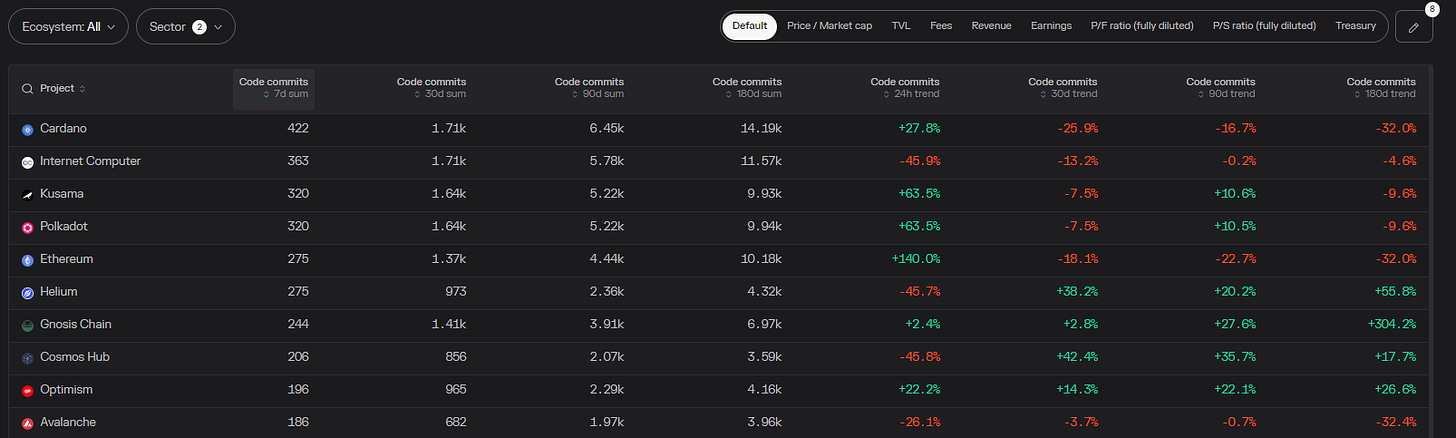

Code Commits

-

Cardano

-

Internet Computer

-

Kusama

-

Polkadot

-

ETH

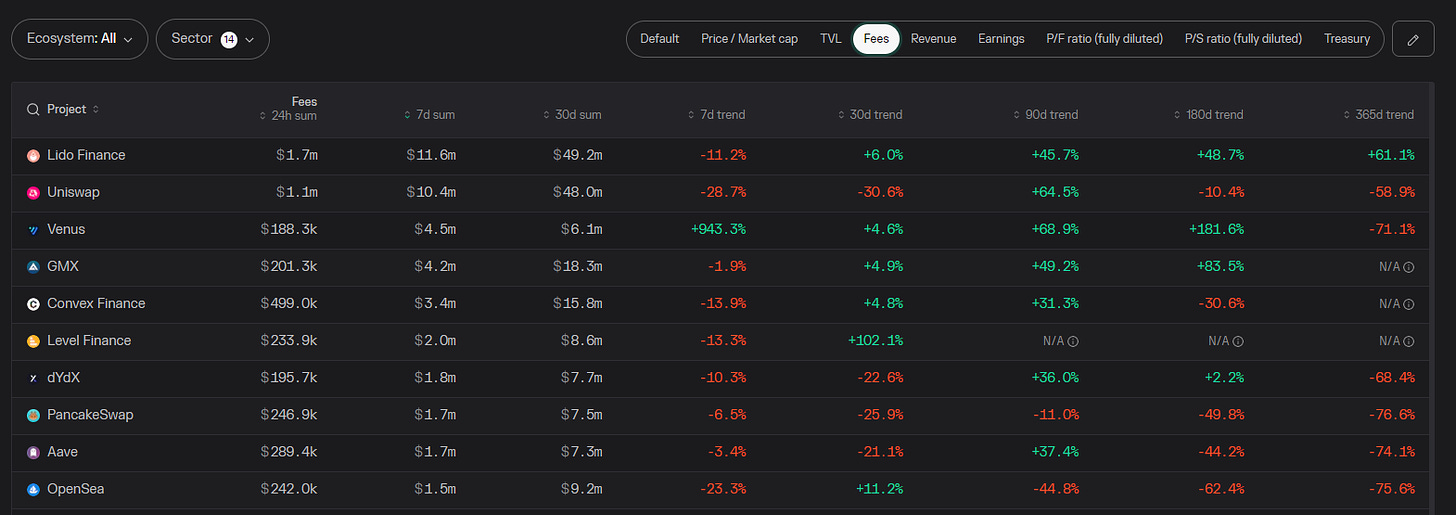

4. Top DAPP Financials

Fees-Generated

-

Lido

-

Uniswap

-

Venus

-

GMX

-

Convex

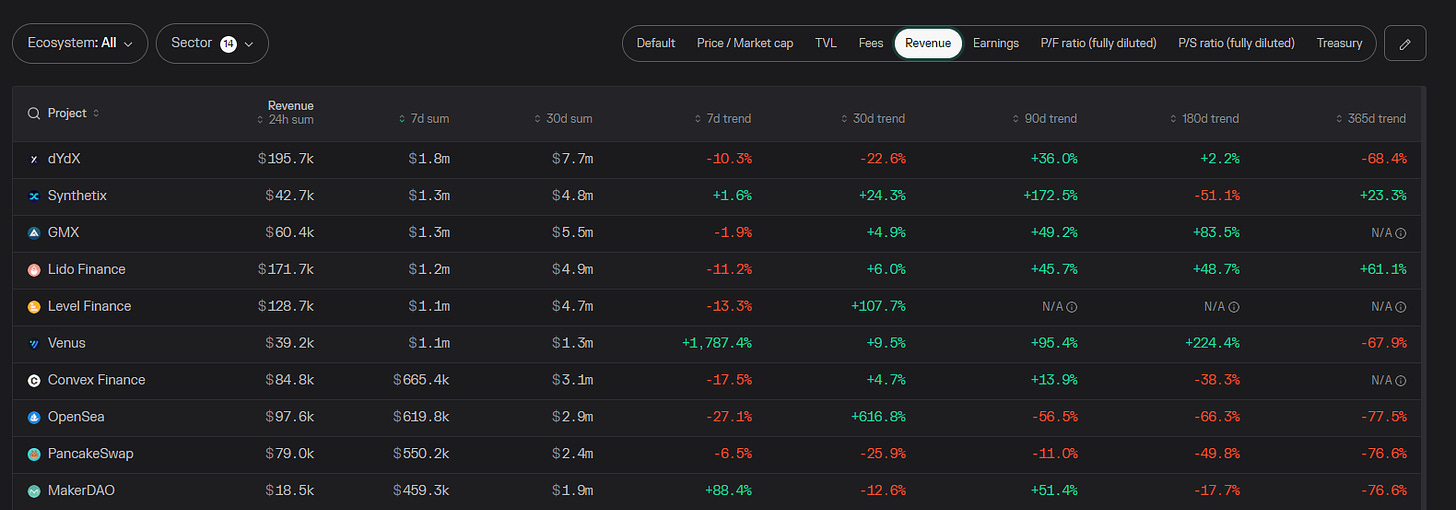

Revenue

-

dYdX

-

Synthetix

-

GMX

-

Lido

-

Level

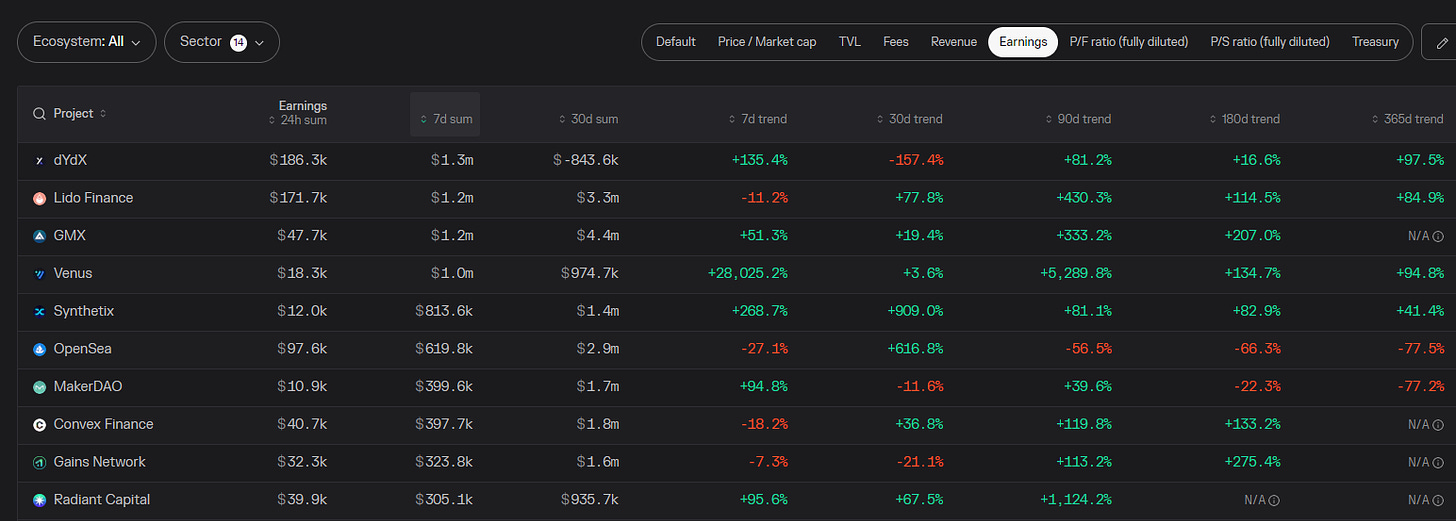

Earnings

-

dYdX

-

Lido

-

GMX

-

Venus

-

Synthetix

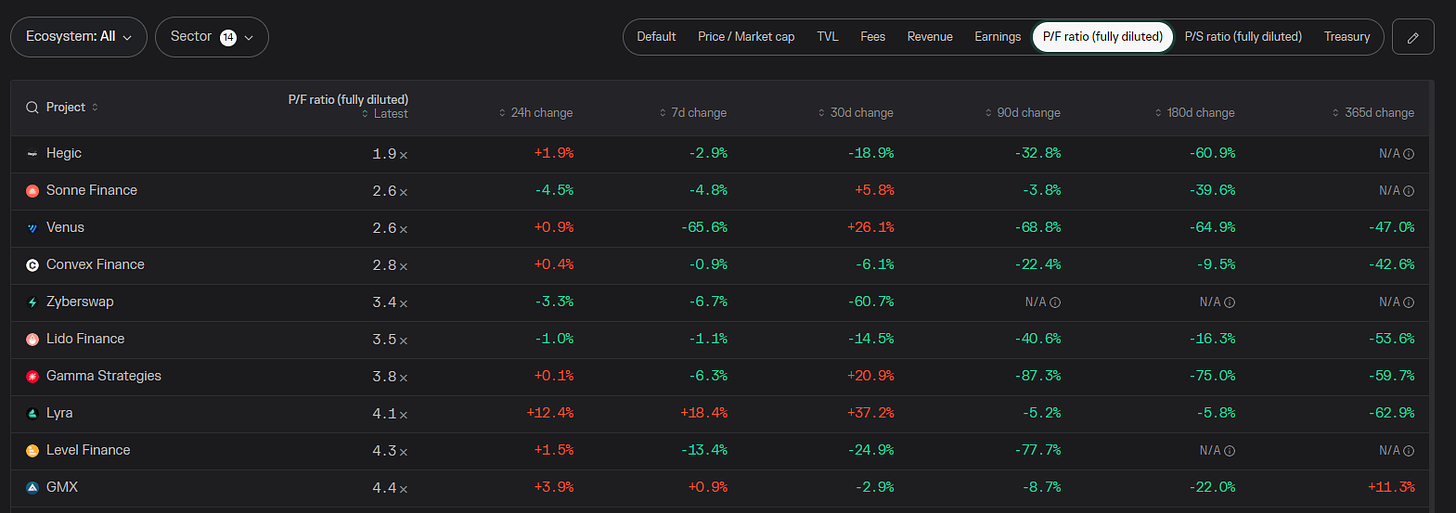

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

Hegic

-

Sonne Finance

-

Venus

-

Convex Finance

-

Zyberswap

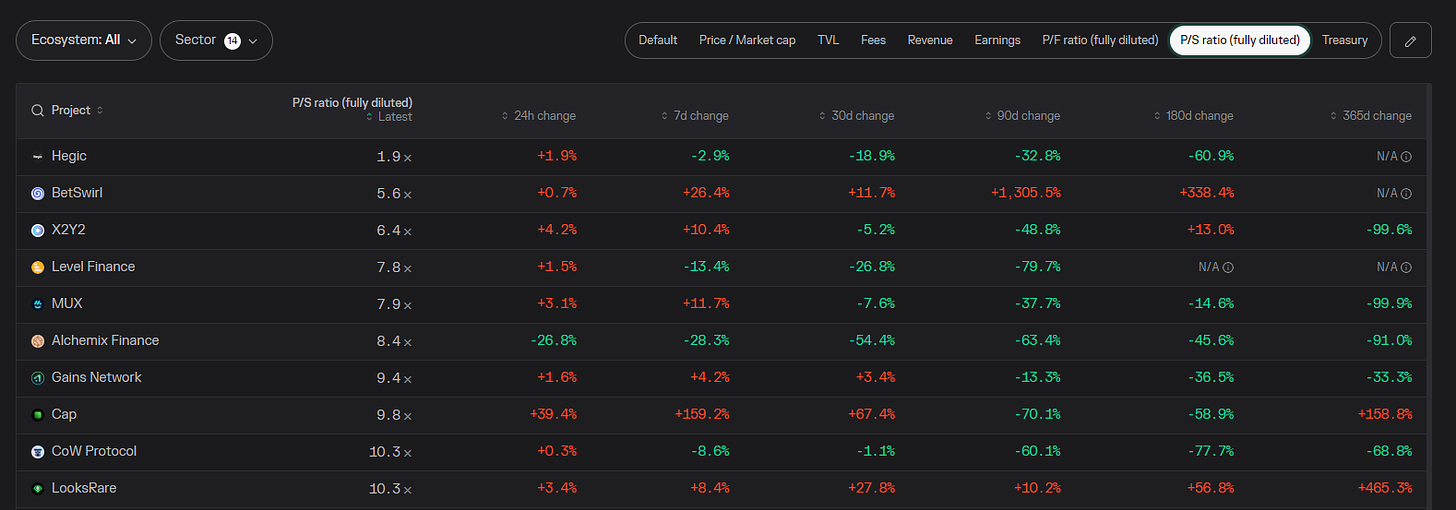

P/S ratio

FDV mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

Hegic

-

BetSwirl

-

X2Y2

-

Level

-

MUX

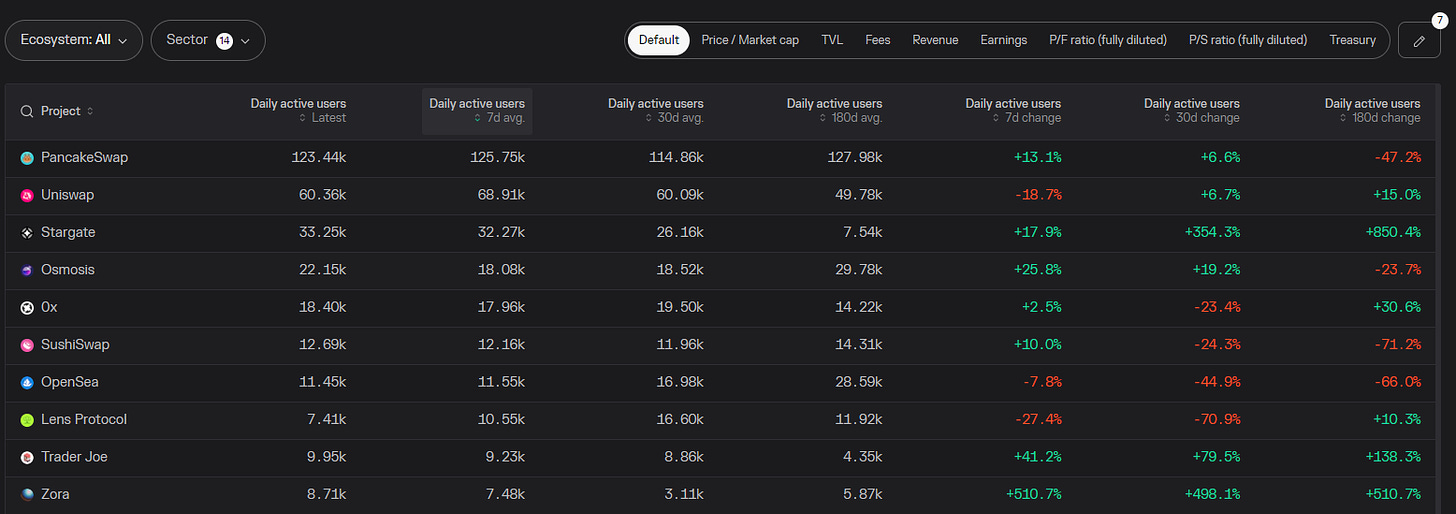

DAUs

-

Pancakeswap

-

Uniswap

-

Stargate

-

Osmosis

-

0x

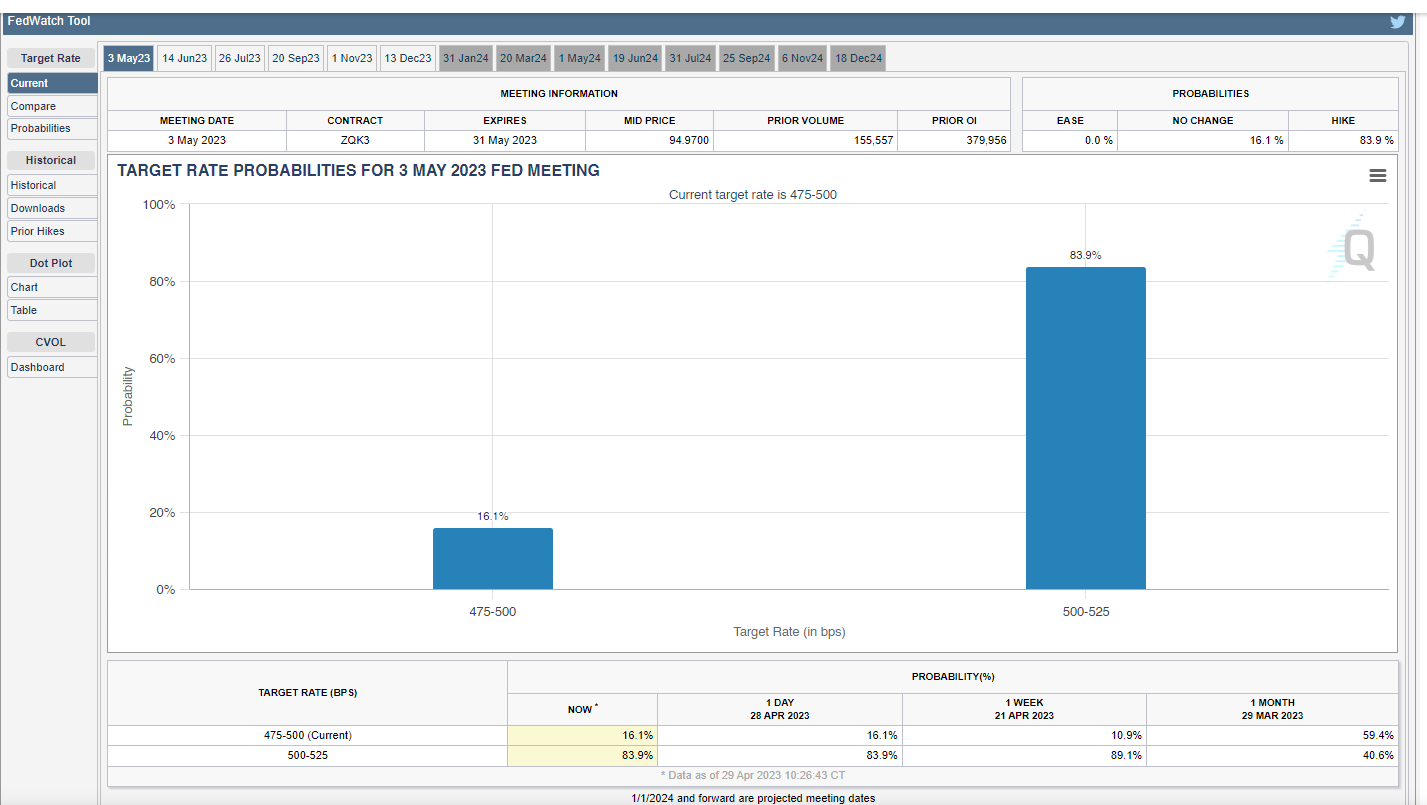

5. Movement Analysis

Stablecoin flows:

-

Total Stablecoin Market continues to drop this week as “Sell in May and go away” narrative takes hold.

-

Stablecoins across top 10 L1/L2 are mixed, with no clear direction.

-

Bittorrent saw a huge spike in USDT inflow this week.

Smart Money Movement:

-

Smart money is reallocating back to stables, BTC and ETH as liquidity and risk appetite is drying up.

-

Smart money is buying Lido Staked ETH as withdrawal risk will be eliminated once Lido V2 goes live, bringing the stETH-ETH peg closer to 1:1.

L1/L2 movement:

-

Arbitrum remains profit-making with positive earnings despite the recent $ARB token distribution to over 100 projects earlier this week.

-

Cosmos’ active developer base continues to increase, overtaking Kusama and Polkadot and fast catching up to ETH. We might see more innovative protocols launching there soon.

DAPP movements:

- Synthetix is crushing the revenue and earnings metrics this week, most likely due to the token incentive program that launched this week.

- Venus Protocol saw a significant increase in active loans this week ~18.3% with an attractive P/F ratio compared to Defi giants like AAVE and Compound.

- Alpha drop by @apes_prologue

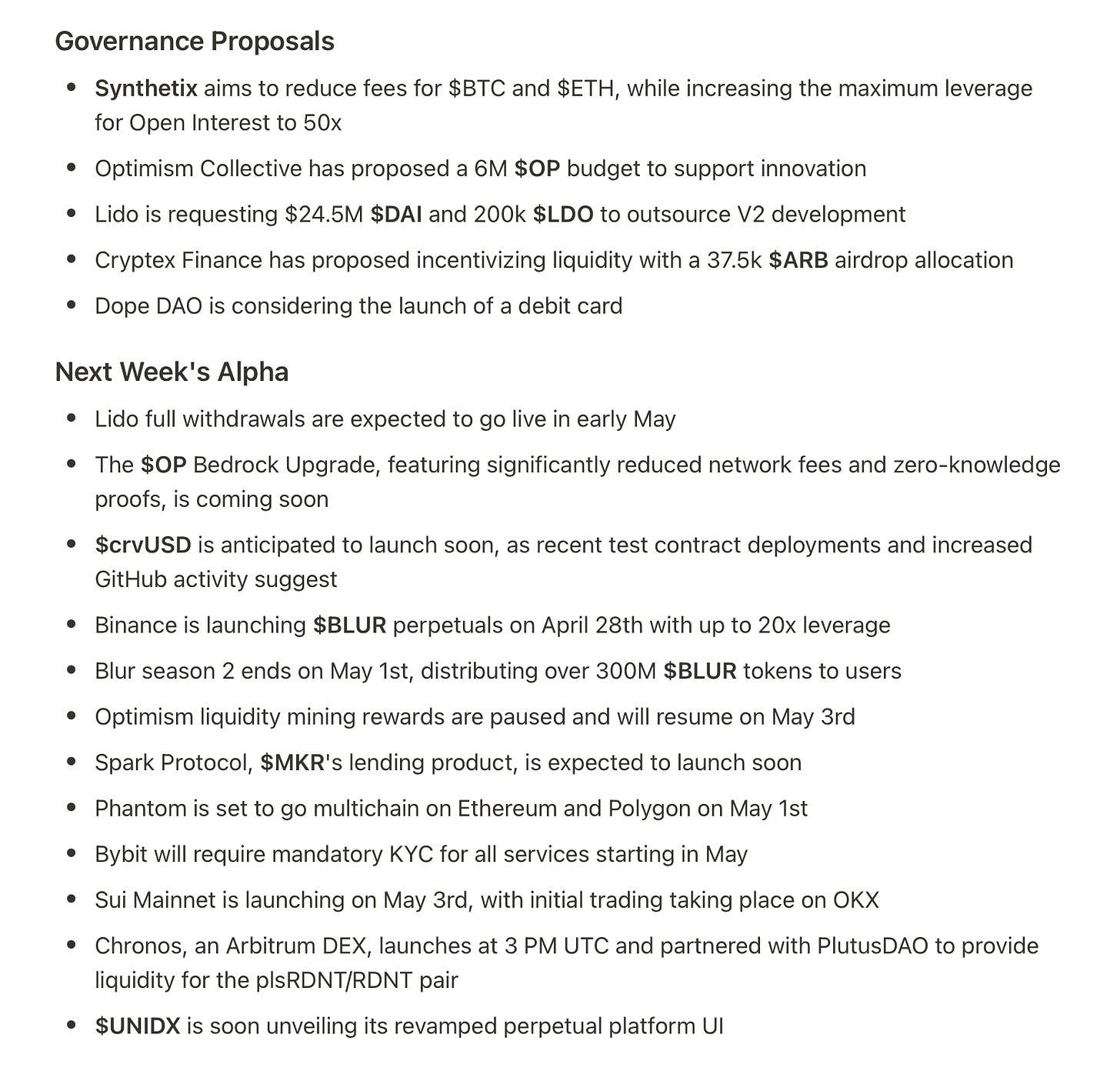

6. TLDR

- Not much movement this week as we continue to crab sideways while waiting for Fed’s policy direction on 3rd May 2023. The market is predicting an 83.9% chance of another 25bps hike, which could drag down crypto prices.

-

Focus on defensive plays (Stables, BTC and ETH) as we head into a volatile quarter.

-

Short-term traders can capitalise on arbitraging ETH derivatives, with a number of them trading below ETH price.

- Start cutting losers/shitcoins and prepare dry powder to buy generational bottoms on cash-generating protocols.

P.s. I may have positions in the projects discussed in this article. Please note that this article is not intended as financial advice, and I encourage readers to conduct their own due diligence and ape responsibly.

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: