The weekly 🐰 hole (4 June 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (4 June 23) of liquidity movements & DeFi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

Ahh yes, $UNI is the “rising crypto king”.

🐰Content:

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

*Quick update: Due to the newly implemented token terminal paywall, I will be adjusting the presentation of this weekly content as I am a broke.

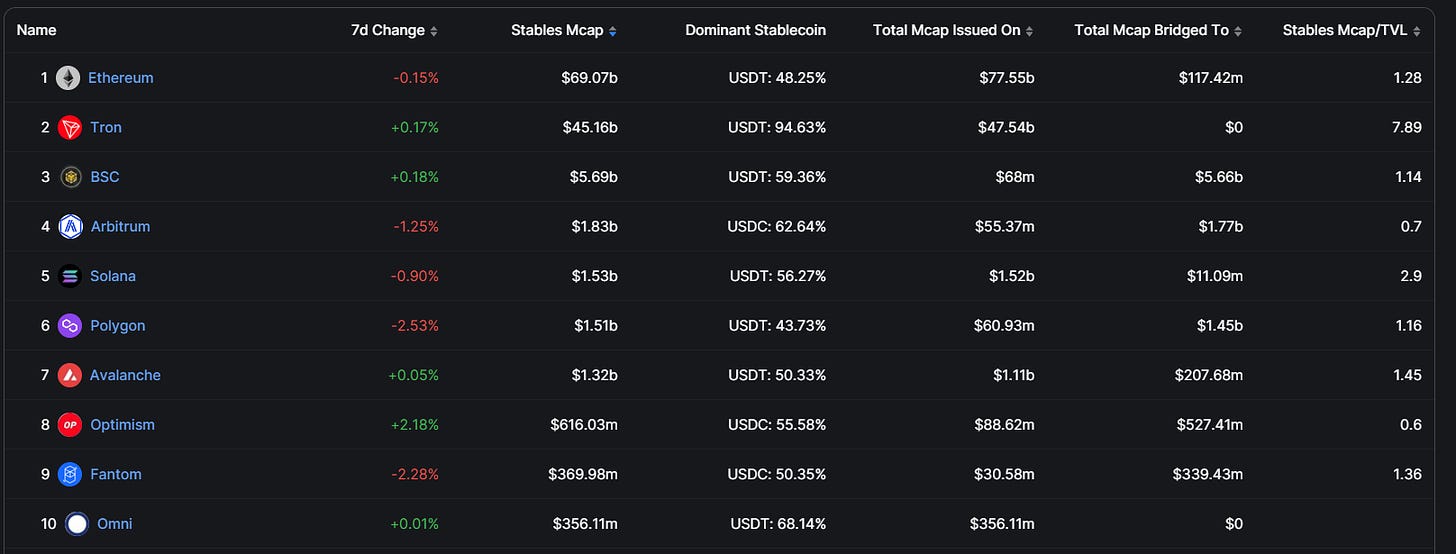

1. Stablecoin Flows

Total Stablecoin MCAP = 129.01 bil, with -0.24% weekly change.

Top 10 Chain (In terms of Stables Mcap):

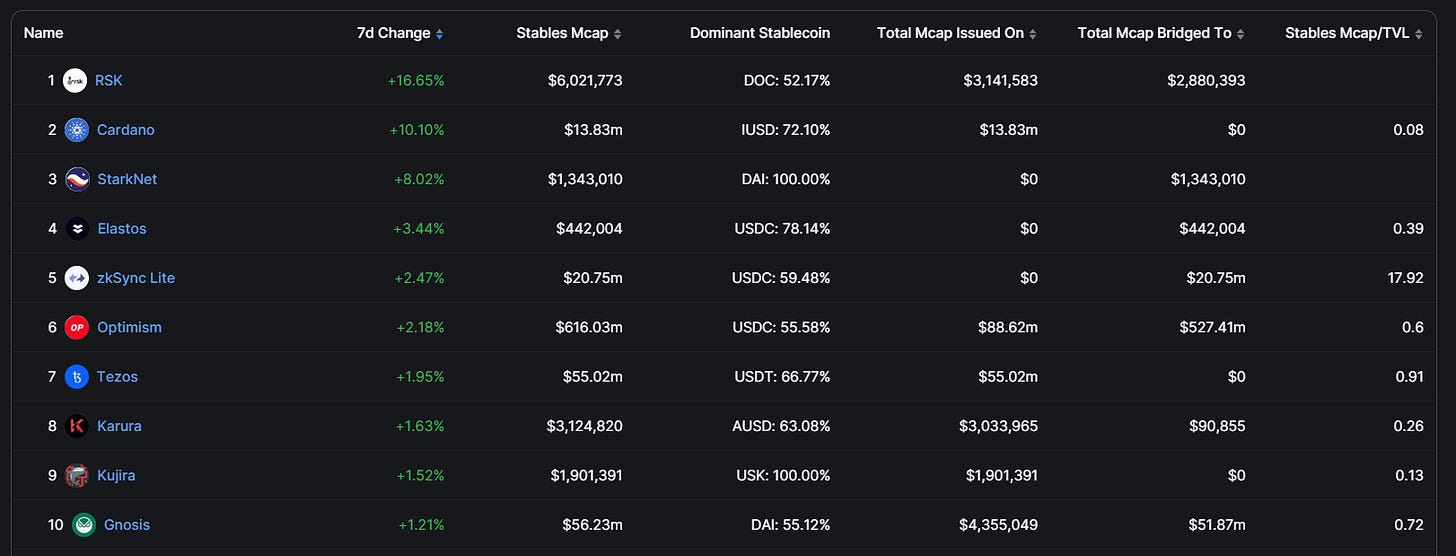

Top inflows:

-

RSK

-

Cardano

-

StarkNet

-

Elastos

-

zkSync Lite

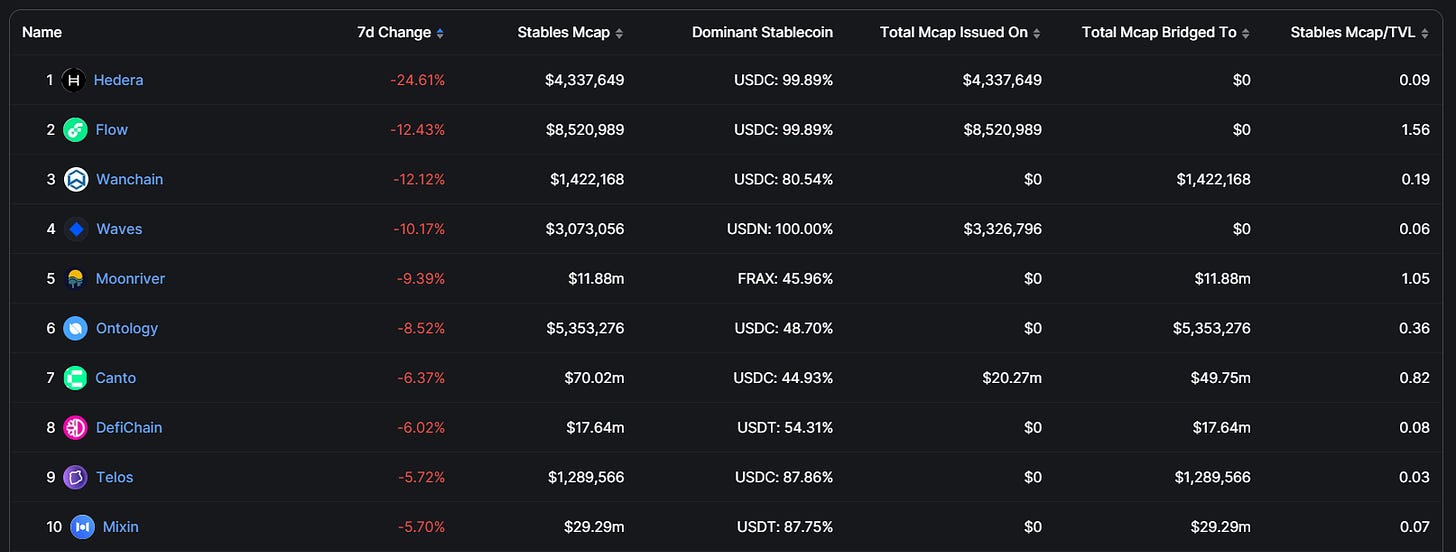

Top outflows:

-

Hedera

-

Flow

-

Wanchain

-

Waves

-

Moonriver

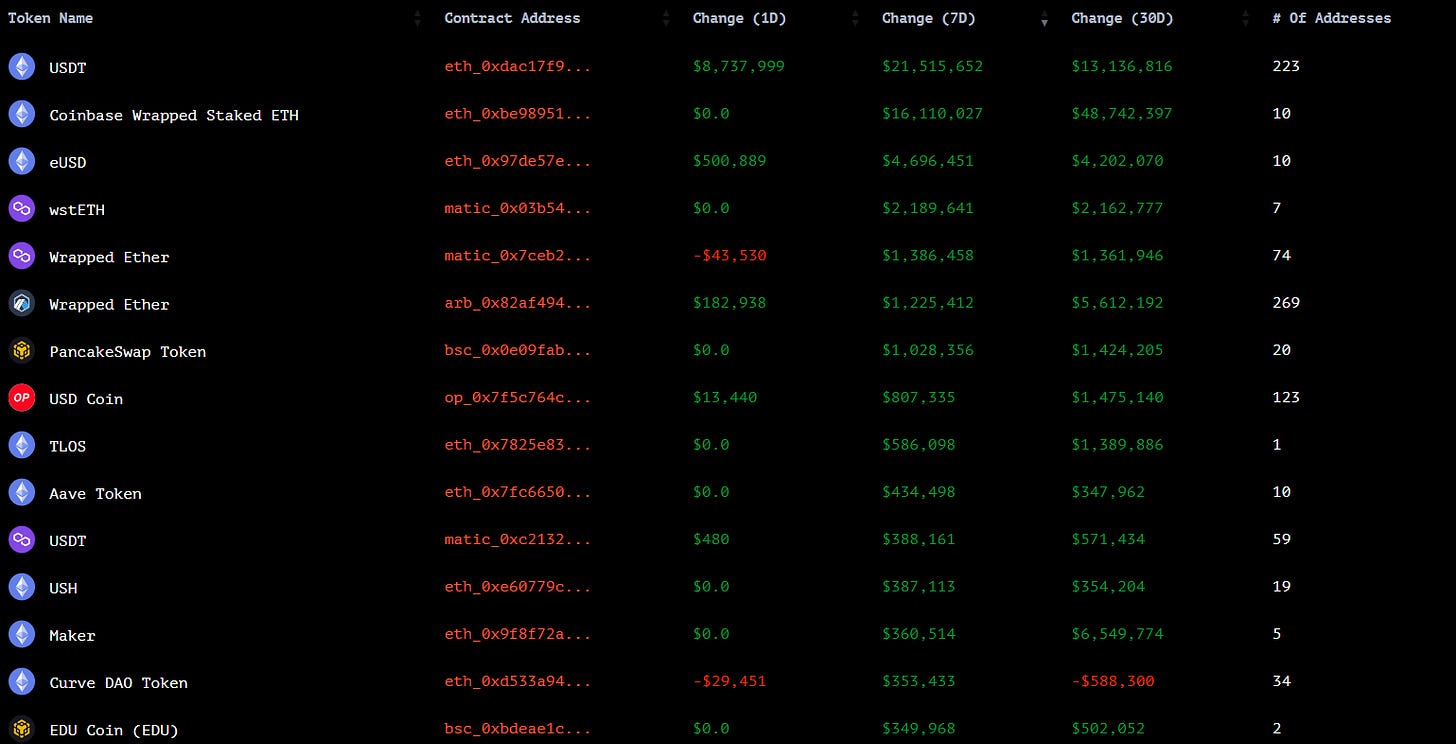

2. Smart Money Movement

Cr: @ozfrox

Top Smart money inflows (including stablecoins):

-

USDT

-

Coinbase Wrapped Staked ETH

-

eUSD

-

wstETH (Polygon)

-

Wrapped ETH (Arbitrum)

Top Smart money outflows (including stablecoins):

-

USDC

-

Wrapped ETH

-

Wrapped BTC

-

stETH

-

Tai reflex index

Top Smart money inflows (excluding stablecoins):

-

Coinbase Wrapped Staked ETH

-

eUSD

-

wstETH

-

Wrapped ETH (Polygon)

-

Wrapped ETH (Arbitrum)

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

Wrapped BTC

-

stETH

-

Tai reflex index

-

wstETH

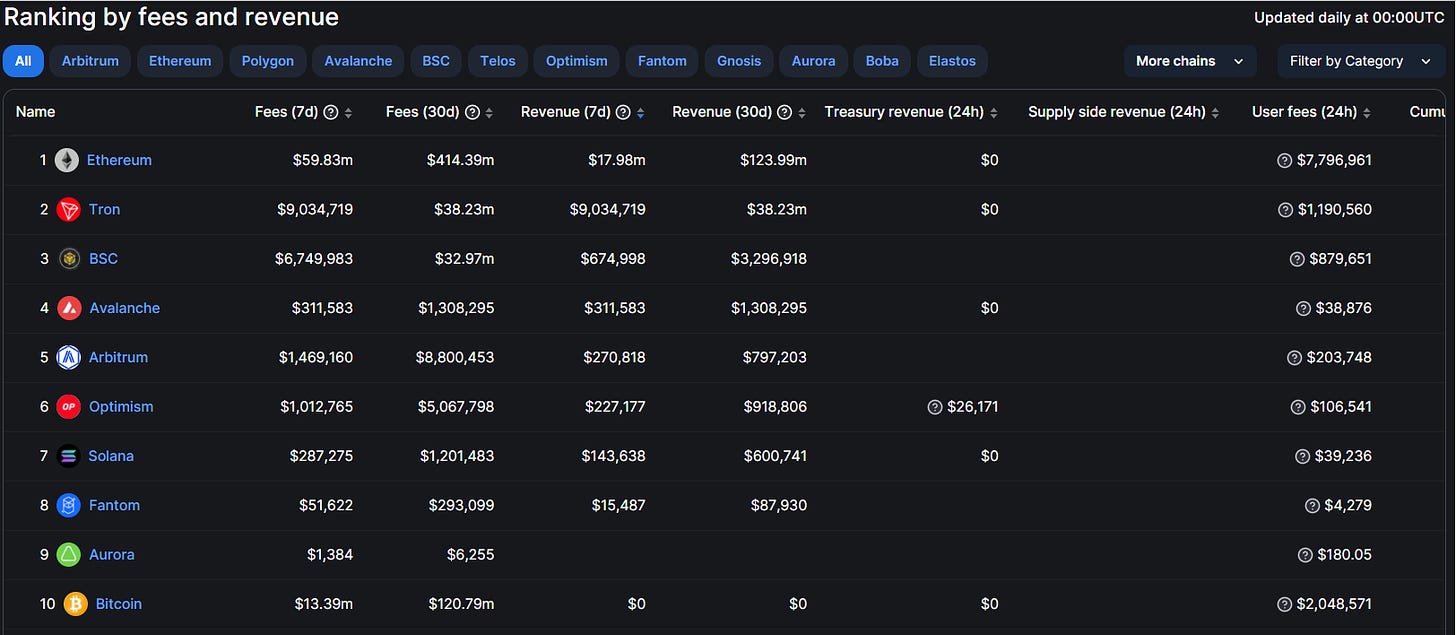

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BNB

-

Optimism

-

Solana

-

Polygon

Revenue

-

ETH

-

Tron

-

BSC

-

Avalanche

-

Arbitrum

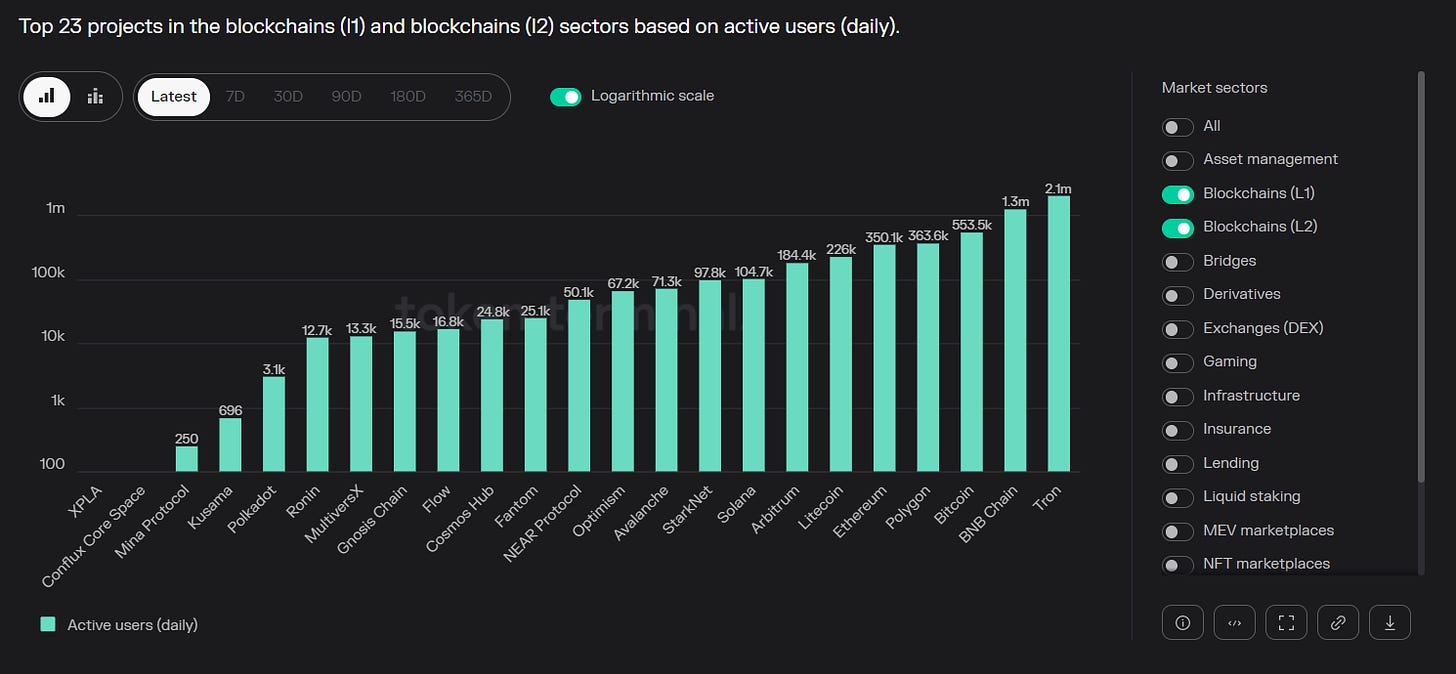

DAUs

-

Tron

-

BNB

-

BTC

-

Polygon

-

ETH

Active Developers

-

ETH

-

Polkadot

-

Cosmos

-

Solana

-

BTC

Code Commits

-

ETH

-

Polkadot

-

Solana

-

Manta Network

-

BNB Chain

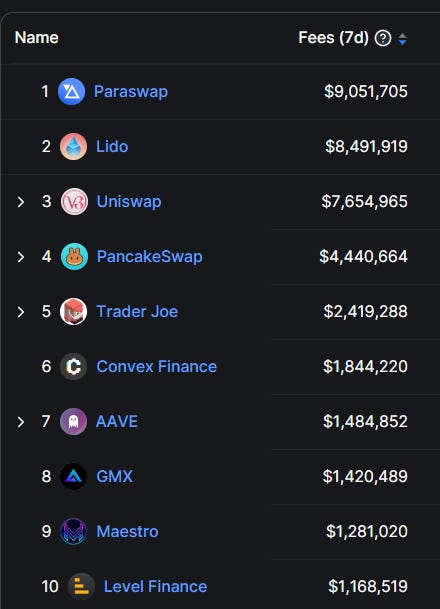

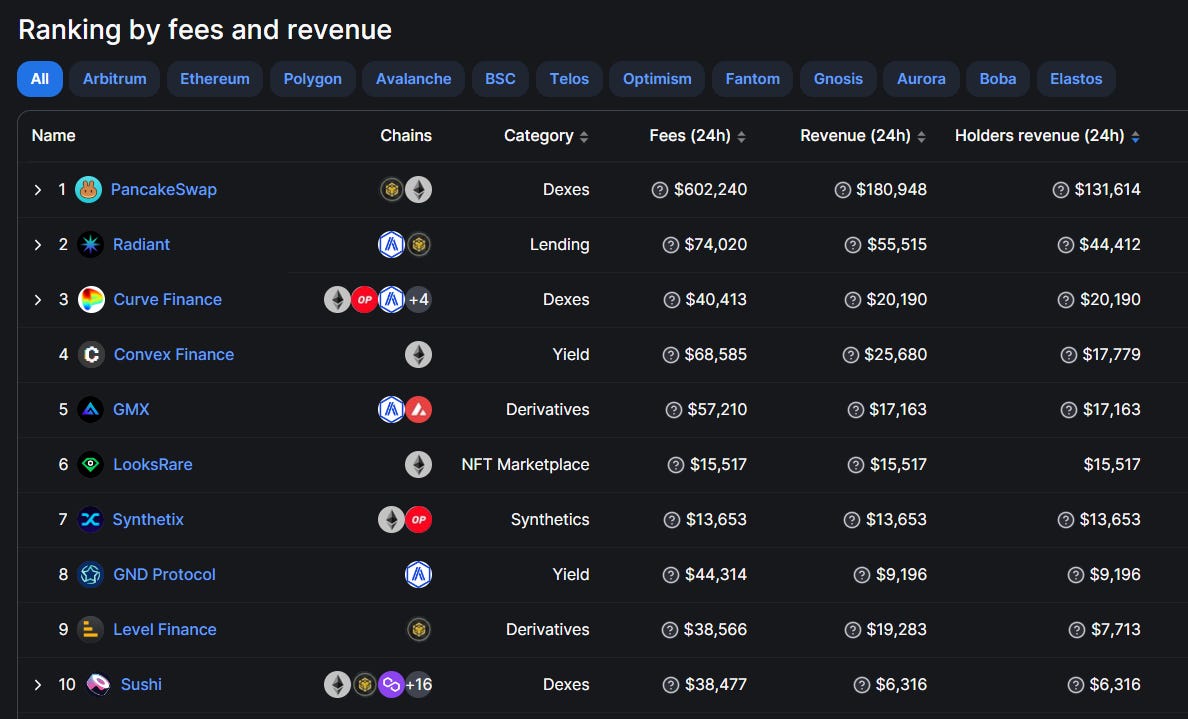

4. Top DAPP Financials

Fees-Generated

-

Paraswap

-

Lido

-

Uniswap

-

Pancakeswap

-

Trader Joe

Revenue

-

Paraswap

-

Maestro

-

Convex Finance

-

PancakeSwap

-

Metamask

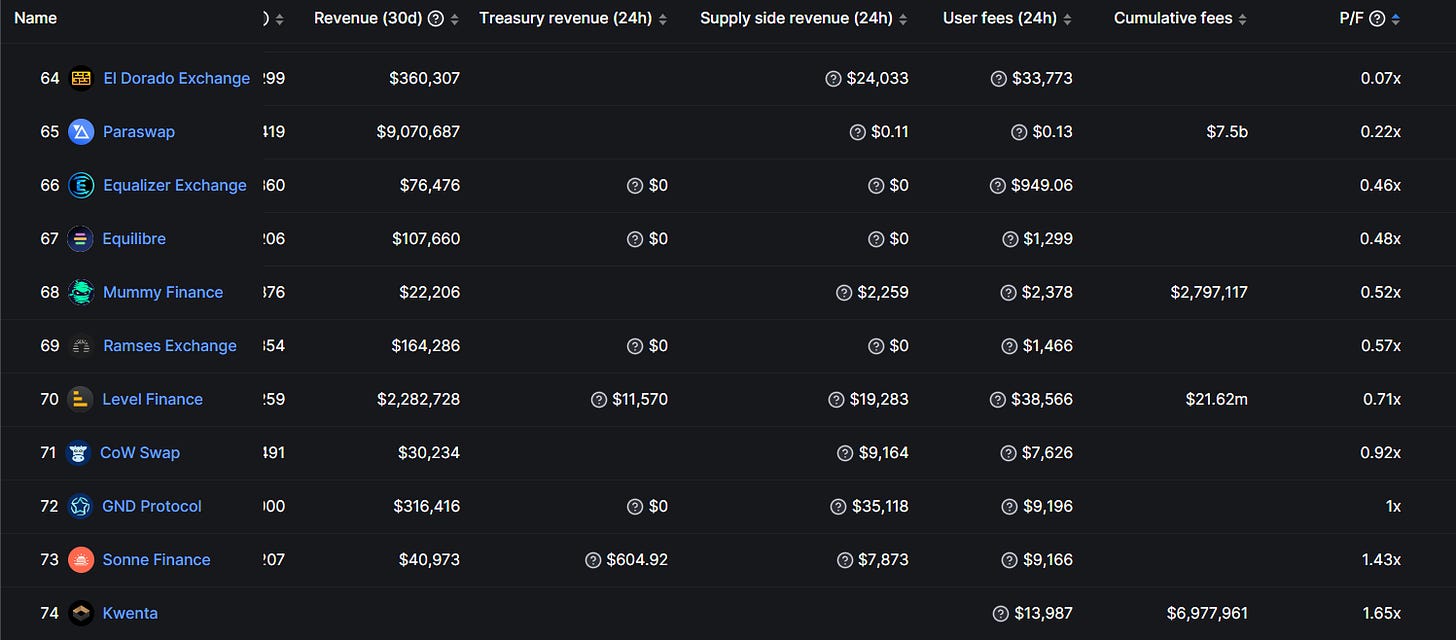

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

El Dorado Exchange

-

Paraswap

-

Equalizer Exchange

-

Equilibre

-

Mummy Finance

P/S ratio

FDV Mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

Paraswap

-

Equalizer Exchange

-

Equilibre

-

Ramses Exchange

-

Level Finance

Holders Revenue

Cumulative revenue attributable to holders 24 Hours

-

Pancakeswap

-

Radiant

-

Curve

-

Convex

-

GMX

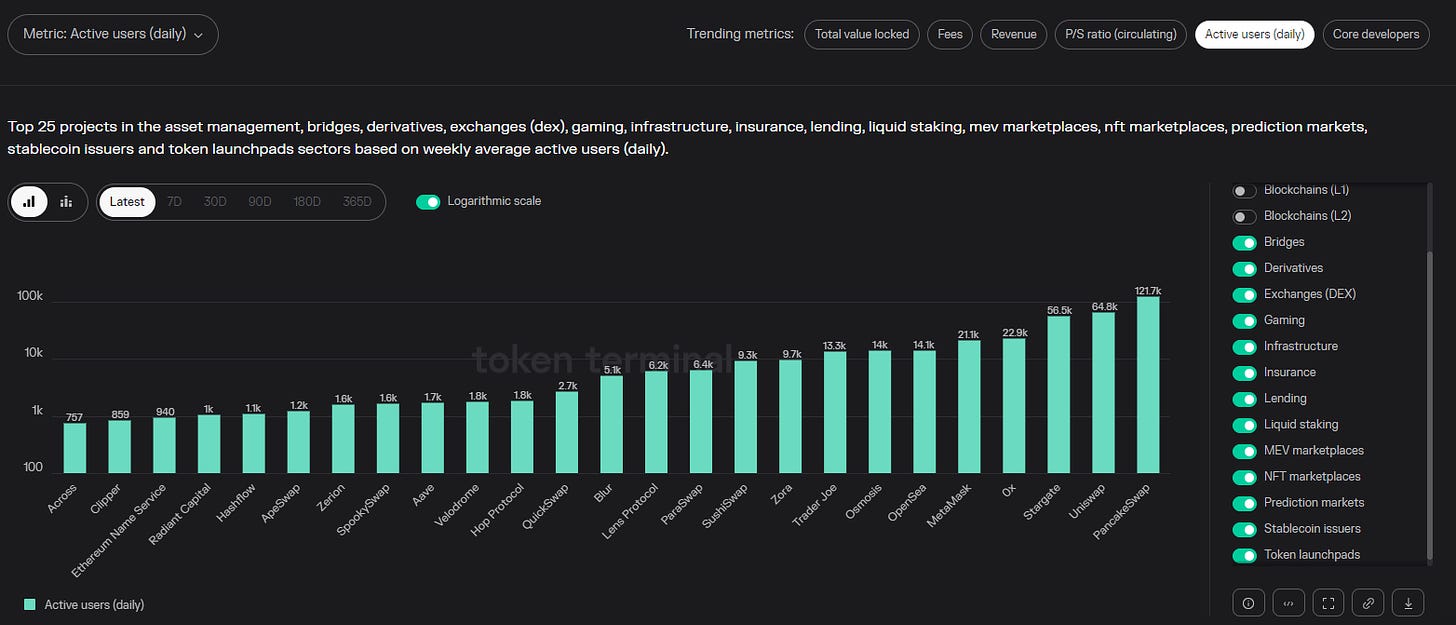

DAUs - Daily

-

Pancakeswap

-

Uniswap

-

Stargate

-

0x

-

Metamask

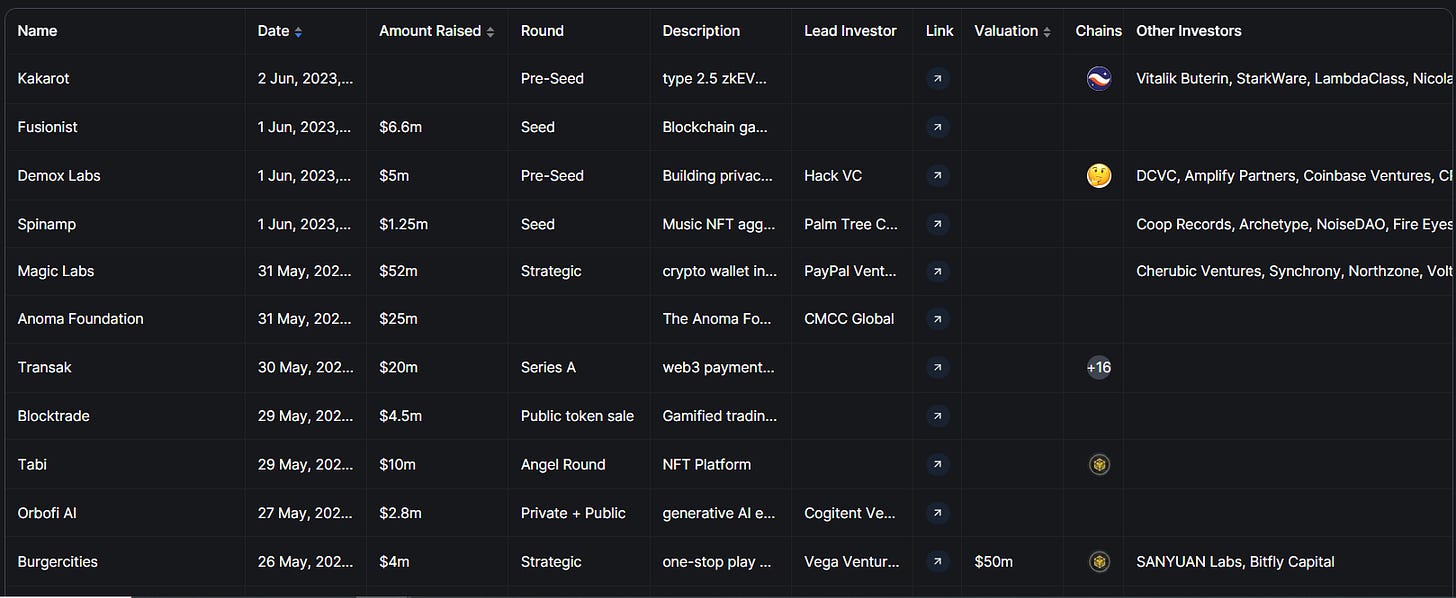

Raises - Recent funding rounds

-

Kakarot

-

Fusionist

-

Demox Labs

-

Spinamp

-

Magic Labs

5. Movement Analysis

Stablecoin flows:

-

Total stablecoin market cap continues its downtrend this week at -0.24%.

-

RSK, Cardano and Starknet saw the largest stablecoin inflows.

-

Hedera, Flow and Wanchain saw the largest stablecoin outflows.

Smart Money Movement:

- Smart money continues to play relatively defensively, with large conversions into USDT and the continued accumulation of ETH and its derivatives.

L1/L2 movement:

-

ETH remains the top fee and revenue-generating L1, its dominance continues to outpace alternate L1s like BNB and Solana.

-

zkSync’s TVL is increasing rapidly to contest with dominant optimistic roll-ups like Optimism and Arbitrum.

DAPP movements:

-

Paraswap overtook Lido as the highest fee and revenue-generating protocol this week.

-

Raises are still happening during this crab market, with the most recent Kakarot receiving Vitalik’s angel investment.

-

Alpha drop by @apes_prologue

6. TLDR

-

zkSync TVL growth outpaces all other L2s thus far. It is probably a good idea to start paying attention to the top protocols in the ecosystem.

-

Fundraising is still happening during this crab market. Keep a look out for these protocols that received top VCs/Angle funding which could do well in the next bull run.

P.s. I may have positions in the projects discussed in this article. Please note that this article is not intended as financial advice, and I encourage readers to conduct their own due diligence and ape responsibly.

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: