A look into Redacted’s Hidden Hand, Pirex, and Dinero - by Vorpaxis

Overview

Website: redacted.finance

Newsletter: Redacted Substack

Market Capitalization (01-Feb-23): $55.2m

Redacted

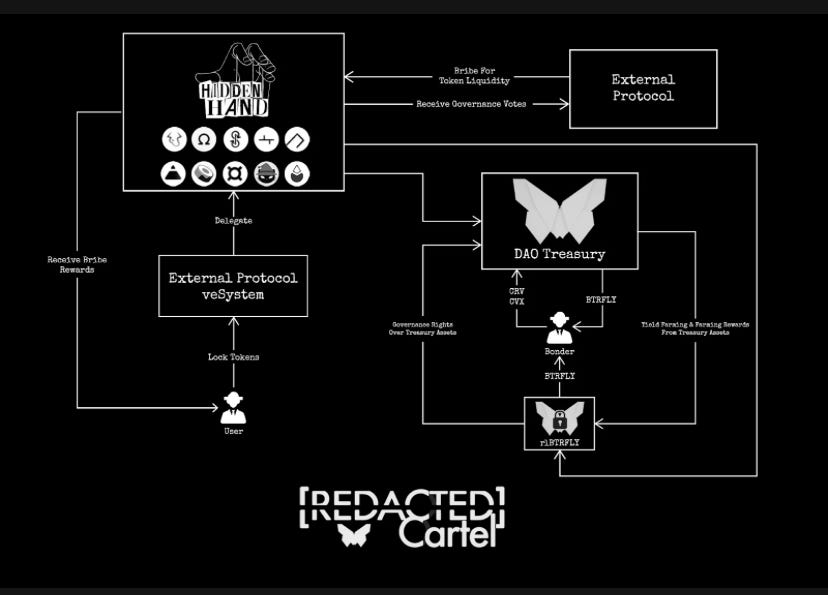

Redacted is a decentralized autonomous organization (DAO) that is building out several different products. Their main features to date are infrastructure type products called Hidden Hand and Pirex, with a decentralized stablecoin named Dinero in development. They most recently ventured into the Arbitrum ecosystem with the launch of Pirex for GMX and GLP assets.

Hidden Hand

Holders of governance tokens (like Curve or Balancer) have control on where to direct emission incentives through governance voting. Hidden Hand is a marketplace built for users and protocols to interact via governance bribes. Bribing is essentially paying money to token holders to vote emissions to their pools. The holders benefit by receiving extra yield from bribes, and bribers acquire or retain the liquidity they seek.

Hidden Hand is currently live on Ethereum Mainnet and generates good revenue for the protocol. Redacted takes a 4% fee on all bribes, however the product is free to use for users. There are over 8 protocols integrated with Hidden Hand with 10+ in the pipeline.

Pirex

Pirex is a product that creates liquid wrappers for staked or locked tokens to enable easy auto-compounding, composability and even the tokenization of future yield. These wrappers also maintain governance power. Currently they offer two products, one for CVX (on Ethereum Mainnet) and one for GMX and GLP (on Arbitrum/Avalanche). For the sake of this article, we will focus on their newest launch: Pirex for GMX on Arbitrum.

Advantages of using Pirex over natively staking on GMX

-

The generated yield esGMX is not transferrable (if staked normally on GMX), in Pirex it is tokenized into liquid pxGMX

-

pxGMX multiplier points are not lost - typically you lose multiplier points if you unstake your GMX, but because you are withdrawing the wrapped version from Pirex, the multiplier points are not reset

-

pxGMX/pxGLP is liquid - in the future you could leverage/borrow against them

Pirex is broken down into three different types: easy mode, standard mode and expert mode.

1. Easy Mode

Easy mode allows frictionless auto-compounding of an asset such as GMX or GLP. Once the user deposits into the vault, their assets are converted into the Pirex wrapper (called pxGMX or pxGLP). They are then issued a vault receipt token representing their assets. The protocol stakes the assets automatically. The yield generated (ETH, and esGMX) are auto-compounded into more of the Pirex wrapper (pxGMX). The user can burn the vault receipt token for the underlying vault asset (for example pxGMX, which includes compounded yield). These are liquid tokens, and Redacted has seeded liquidity for pxGMX on Camelot (Arbitrum) and Trader Joe (Avalanche). pxGLP can be redeemed directly on Pirex for ETH, wBTC, USDC or DAI.

Easy mode has some fees, which are:

-

Withdrawal penalty - 1% (goes to vault receipt token holders)

-

Platform fee - 10%

-

Compound Incentive - 0.3%

2. Standard Mode

Standard mode works similarly to Easy Mode except users are able to claim their yield (as pxGMX or pxGLP). The multiplier points still remain automatically compounded. This allows users the options to withdraw the yield and sell it, rather than continuously compound it. There is a 1% redemption fee and 10% fee on rewards for using standard mode.

3. Expert Mode

Expert mode only exists currently for CVX on Ethereum Mainnet - but it is a novel product that allows users to tokenize future yield or votes. Users can stake pxCVX and tokenize a specific round of gauge votes. The votes can be tokenized as Reward Futures Note (RFN) or Vote Futures Note (VFN). These can be traded on the Pirex Marketplace. This allows the user to obtain future rewards and allows protocols to purchase future voting power.

$DINERO

There is currently no official released documentation on Dinero. However, it is confirmed that it will be an overcollateralized stablecoin that is backed by staked ETH run on Redacted’s validator. While details are somewhat scarce, here is a brief summary of what 0xSami_ mentioned about it on the Tap Talk podcast.

-

0xSami_ views the base layer of Ethereum similar to the bribe markets for veCRV → the product is the block space and people are willing to pay to get spots in the block

-

He notes that Redacted has a significant amount of CVX which gives them the capability to build an overly liquid stablecoin overnight with just the voting power in the treasury

-

Dinero → what is it? It is an overcollateralized stablecoin that’s backed by staked Ethereum that redacted runs on their own validator

-

Instead of putting ETH into Rocketpool or Lido where you get a pegged version (stETH or rETH), you would be getting Dinero

-

There are some limitations until Shanghai is complete but 0xSami_ mentions they ‘found a way to make it work’ before

-

By using obscure EIP’s they would be able to build their own relayer

-

This would allow Dinero to be used as a gas token to route transactions natively to Redacted validators/relayer (like a darkpool)

-

Aside from a normal stablecoin (that will be super liquid) - it has a use case (can pay for gas with it) & earn staked rewards

-

0xSami_ notes that at the start they would obviously not produce most blocks, but still claims Dinero can be used as a gas token (no details)

-

Tapioca host speculates that since the ETH is being swapped for the stablecoin → you can do that on backend and use for gas? (0xSami doesn’t share how it works)

-

Hidden hand and Pirex will both play role in Dinero

There isn’t too much detail out there for now. But if you are into speculation, this thread by MrStiive on Twitter is worth reading.

The Tokenomics

BTRFLY - The governance token of Redacted. Can use to vote on proposals or lock for rlBTRFLY.

rlBTRFLY - stands for ‘revenue locked’ BTRFLY. Allows users to lock BTRFLY for 16-17 weeks to earn revenue generated from Redacted’s products. Also earns ‘pulse’ emissions - paid in BTRFLY to offset inflation for lockers. Revenue is paid out in ETH. Rewards are paid out every two weeks and the user must lock before the epoch begins to qualify.

rlBTRFLY - Revenue distribution breakdown

-

50% of revenue from Hidden Hand

-

42.5% of revenue from Pirex

-

a dynamic percentage of the treasury (shown below)

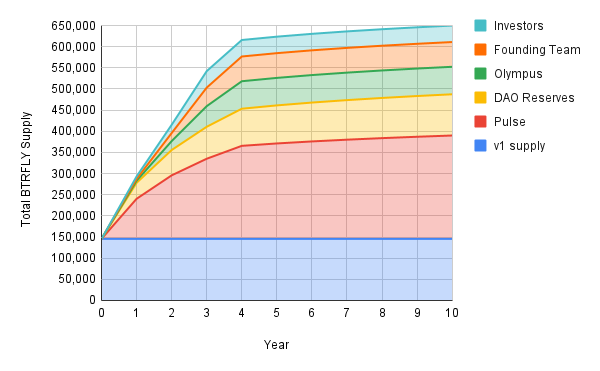

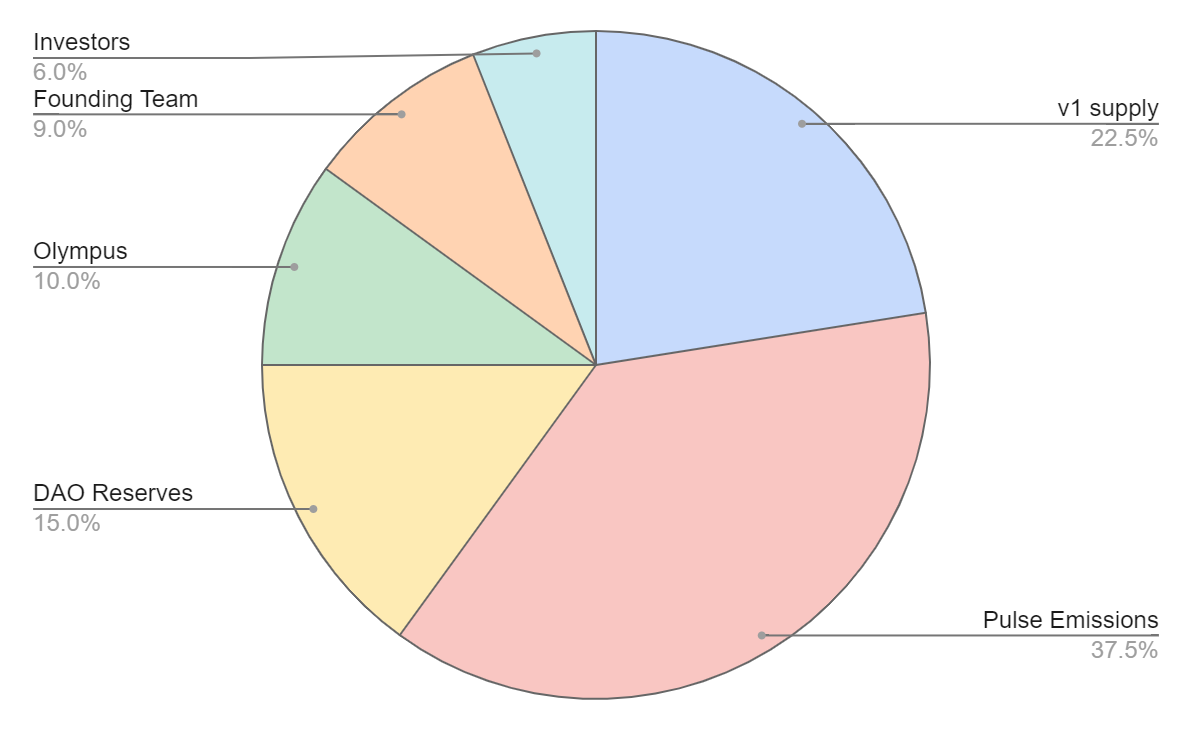

Redacted began with a rebase token design. However, the protocol has upgraded to V2 - and now features a fixed supply cap of 650K.

Here is the upgraded supply curve:

And the current token distribution:

Vesting

The team, investors and Olympus vesting schedules are ‘back weighted’. Each has a 6 month cliff, and then vesting begins quarterly over 3 years. Year 1 = 15% vested, year 2 = 35% and year 3 = 50%.

Treasury

The protocol generates revenue from its suite of products. They are depicted below:

-

Redacted generates a fee (4%) from each bribe. Half is sent to the treasury and half sent to rlBTRFLY holders

-

75% of fees received by Pirex are paid out to Redacted. 42.5% of that goes to rlBTRFLY holders, 42.5% to Treasury and 15% to the DAO reserve

-

They earn revenue on the yield generated from treasury assets

-

In the future, there is potential revenue from Dinero (borrow fee?)

You can view the treasury via Zapper here.

Conclusion

Redacted is a talented team of developers shipping incredibly useful products for DeFi users and protocols. Hidden Hand has found great product market fit; and Pirex provides awesome utility for users. With their upcoming stablecoin Dinero, Redacted looks to transition from a provider of infrastructure, to a DeFi privative. Their expansion onto Arbitrum and partnership with leading protocol GMX, shows how strategic they are in bolstering the revenue potential of their products.