The weekly 🐰 hole (25 June 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (25 June 23) of liquidity movements & DeFi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

We are so fucking back….right? Right??

🐰Content:

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

1. Stablecoin Flows

Total Stablecoin MCAP = 128.74 bil, with 0.35% weekly change.

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

smartBCH

-

RSK

-

Near

-

Waves

-

Karura

Top outflows:

-

Oasis

-

Evmos

-

Crab

-

Canto

-

Hedera

2. Smart Money Movement

Cr: @ozfrox

Top Smart money inflows (including stablecoins):

-

DAI

-

USDT

-

USDC (Arbitrum)

-

Coinbase Wrapped Staked ETH

-

Wrapped BTC

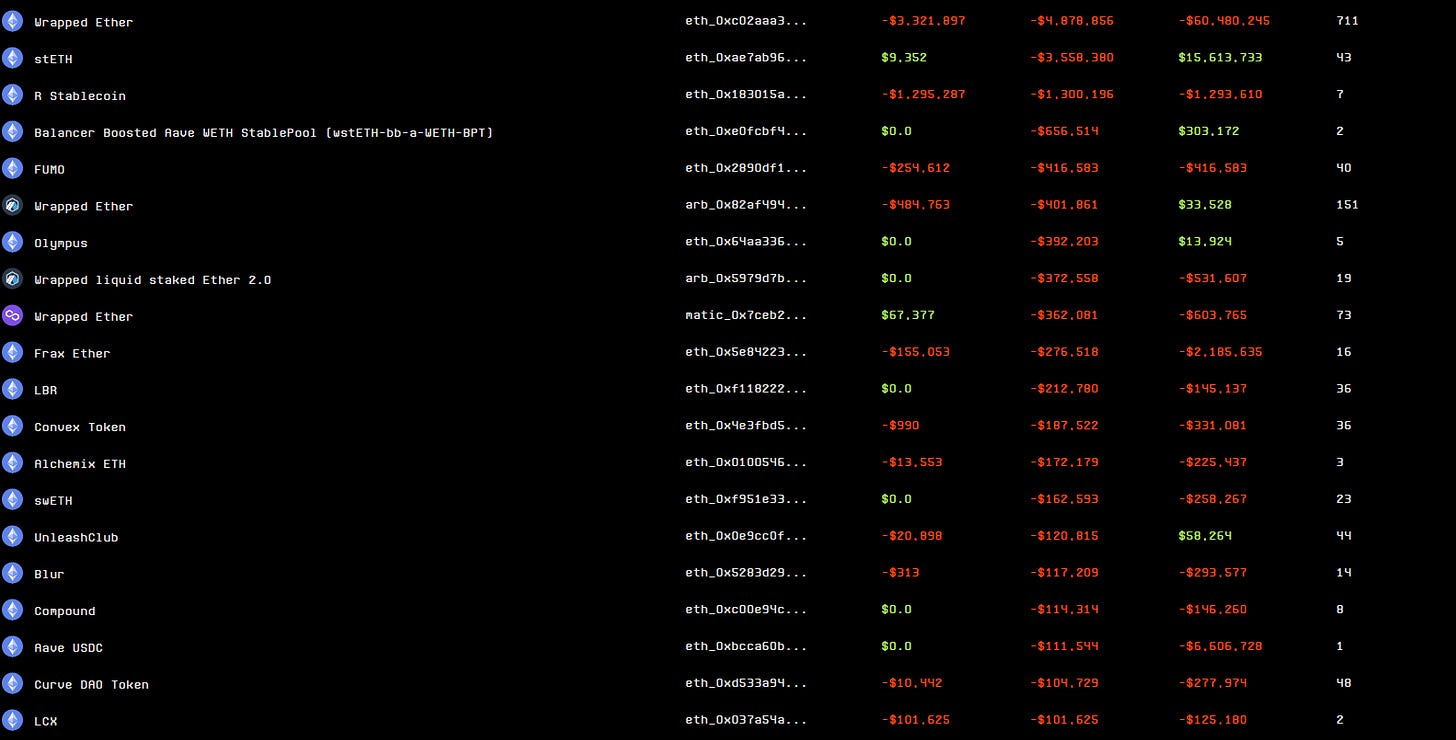

Top Smart money outflows (including stablecoins):

-

USDC

-

MIM

-

Wrapped ETH

-

stETH

-

R stablecoin

Top Smart money inflows (excluding stablecoins):

-

Coinbase Wrapped Staked ETH

-

Wrapped BTC

-

Binance USD

-

Pepe

-

EDU Coin

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

stETH

-

R stablecoin

-

Balancer Boosted Aave WETH StablePool

-

FUMO

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BTC

-

BNB

-

Arbitrum

-

Optimism

Revenue

-

ETH

-

Tron

-

BSC

-

Arbitrum

-

Avalanche

DAUs

-

Tron

-

BNB

-

BTC

-

ETH

-

Polygon

Active Developers

-

ETH

-

Polkadot

-

Cosmos

-

Solana

-

BTC

Code Commits

-

ETH

-

Polkadot

-

Solana

-

Cosmos

-

BTC

4. Top DAPP Financials

Fees-Generated

-

Lido

-

Uniswap

-

GMX

-

Pancakeswap

-

MakerDao

Revenue

-

MakerDAO

-

GMX

-

Convex Finance

-

Lido

-

PancakeSwap

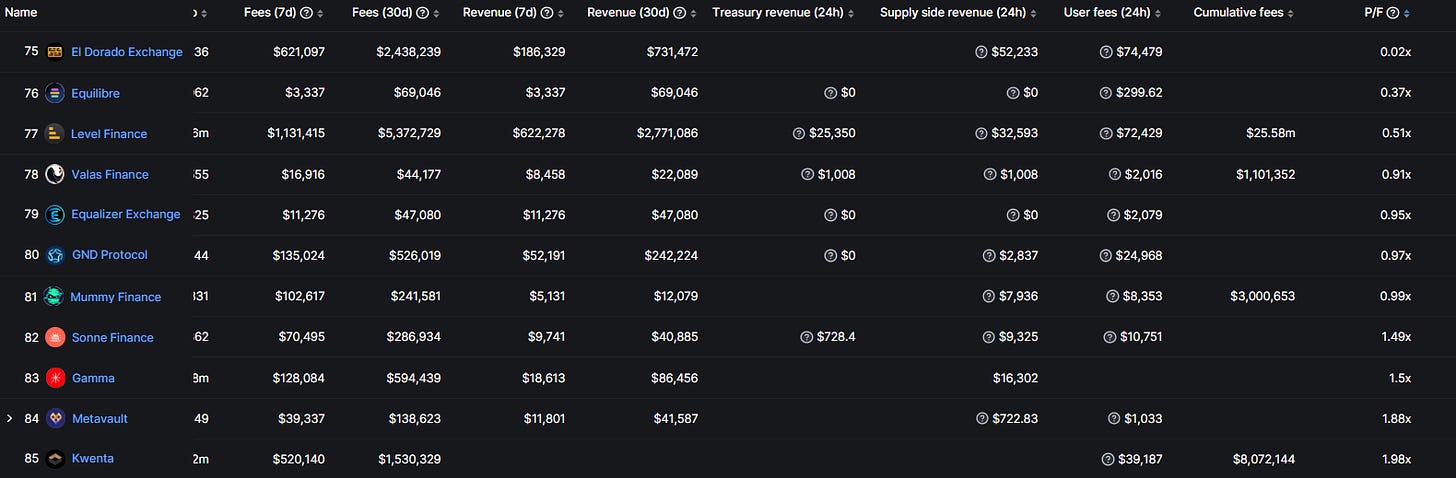

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

El Dorado Exchange

-

Equilibre

-

Level Finance

-

Valas Finance

-

Equalizer Exchange

P/S ratio

FDV Mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

El Dorado Exchange

-

Equilibre

-

Equalizer Exchange

-

Level Finance

-

Valas Finance

Holders Revenue

Cumulative revenue attributable to holders 24 Hours

-

Convex Finance

-

Pancakeswap

-

GMX

-

Synthetix

-

Radiant

DAUs - Daily

-

Pancakeswap

-

Uniswap

-

Stargate

-

0x

-

Metamask

Trending Applications

-

Decentraland

-

Wombat

-

Mirror

-

Synapse

-

Synapse

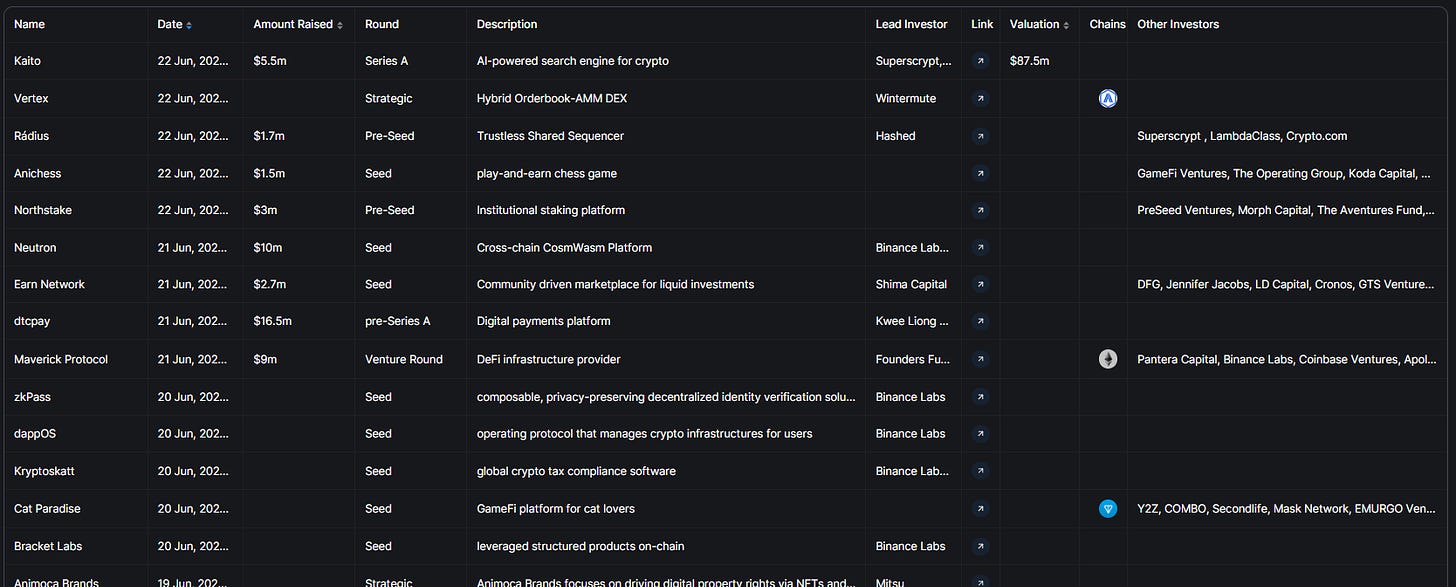

Raises - Recent funding rounds

-

Kaito

-

Vertex

-

Radius

-

Anichess

-

Northstake

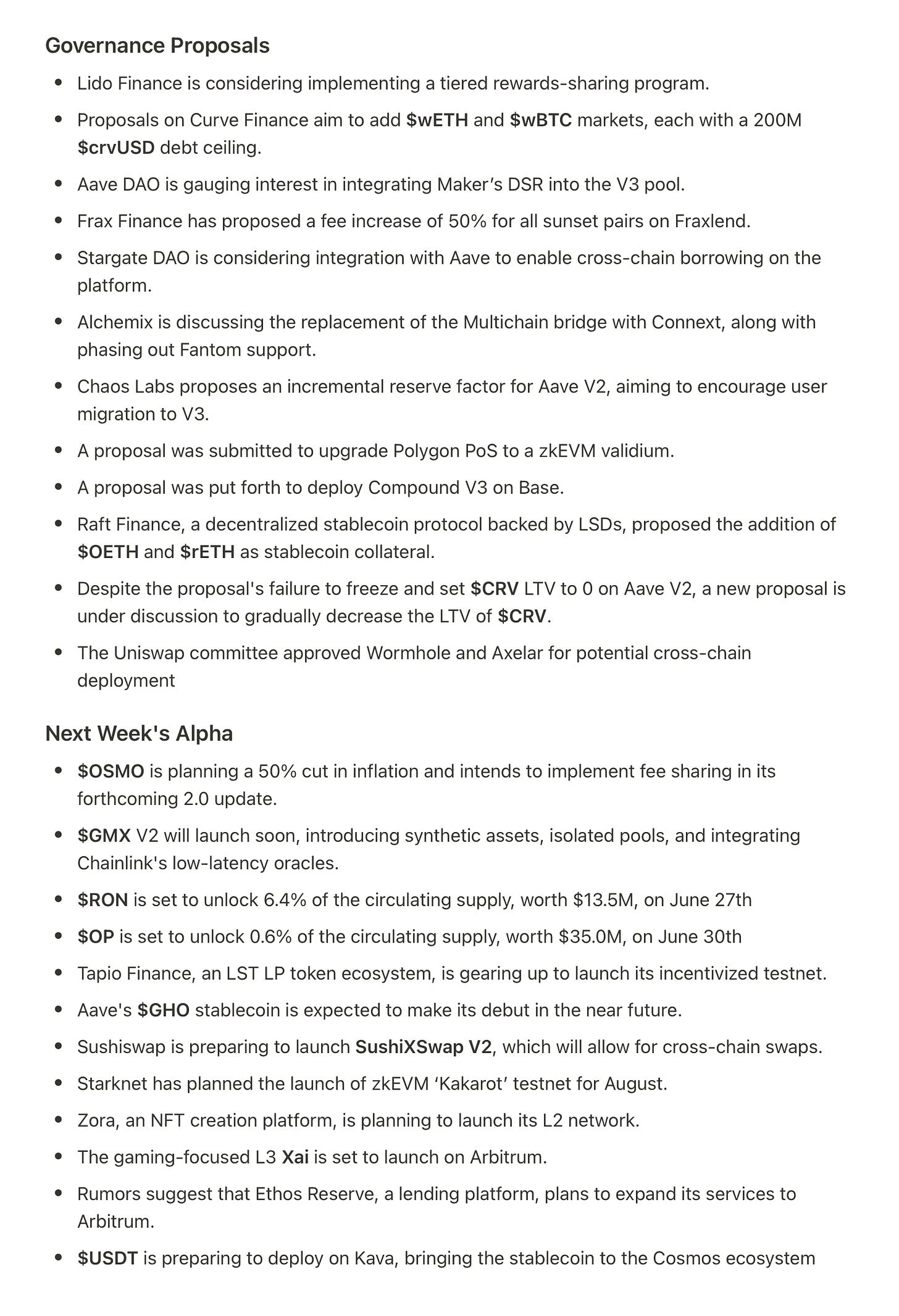

5. Movement Analysis

Stablecoin flows:

-

Total stablecoin market cap increased slightly this week as bullish sentiment dominates CT.

-

smartBCH, RSK and Near saw the largest stablecoin inflows.

-

Oasis, Evmos, Crab saw the largest stablecoin outflows.

Smart Money Movement:

-

Overall Smart Money sentiment has remained risk-off, with stables and ETH occupying top spots in terms of inflows.

-

$Pepe interestingly saw heavy bidding by Smart Money this week. But I suspect this is mostly just trading charts rather than the start of another memecoin season.

L1/L2 movement:

- The majority of Dex Volume is still being transacted on ETH Mainnet, with BSC and Arbitrum trailing behind.

- zkSync Era overtook dominant optimistic L2s like Arbitrum and Optimism in terms of transactions per second.

DAPP movements:

-

MakerDAO continues to rake in Fees and Revenue with the increase in demand for DAI.

-

Convex shot up in Revenue rankings, overtaking Lido as the LSDfi narrative slows down.

-

Decentraland is the top trending application this week.

-

Alpha drop by @apes_prologue

6. TLDR

-

Bull market sentiment is back as BTC breach back up to $31K this week following news of Blackrock BTC ETF filling.

-

However, crypto macro fundamentals still look dismal with falling developer activity, stablecoin market cap and stablecoin transaction volume. But it is heartening to see an increase in user activity in terms of Blockchain Daily Active Addresses.

-

Smart money movement also indicates that these people are not convinced that the current crab market structure has changed to the upside.

-

Personally think this is a short-term pump fueled by traders capitalizing on good news. But I am slowly increasing my portfolio allocation into various quality Alts with sound fundamentals in anticipation of the start of a bull run as we inch closer to the next $BTC halving (9-10 months away).

P.s. I may have positions in the projects discussed in this article. Please note that this article is not intended as financial advice, and I encourage readers to conduct their own due diligence and ape responsibly.

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: