The weekly 🐰 hole (12 Mar 23) of liquidity movement & DeFi analysis - by zj.valz

We’ll uncover key trends, insights into the top DeFi protocols, and hidden gems.

Stables are depegging, and everything is going to zero. What a rough week but let’s see what the figures are telling us.

-

Stablecoin flows

-

Smart Money Movement (Discontinued from this week onwards)

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

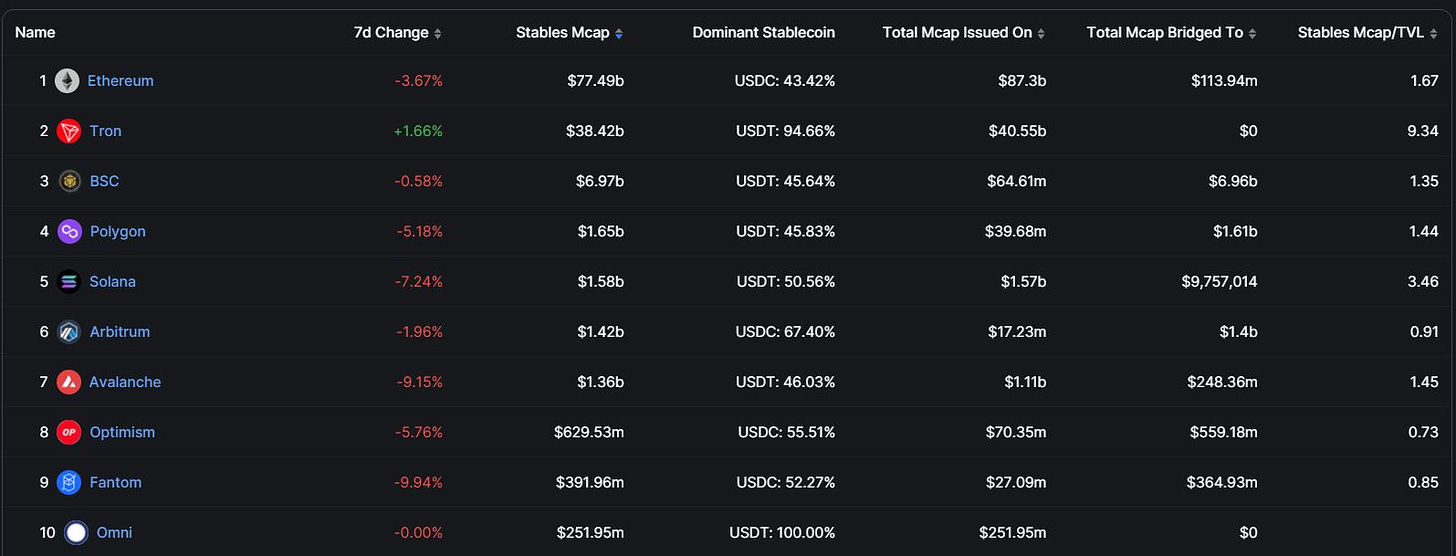

1. Stablecoin Flows

Total Stablecoin MCAP = 131.91B with -2.30% weekly change.

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

Aztec

-

Celo

-

SXnetwork

-

smartBCH

-

Kava

Top outflows:

-

Waves

-

Canto

-

Hedera

-

Wanchain

-

Telos

2. Smart Money Movement

Discontinued cus I am poor and cannot afford Chainedge’s subscription.

3. Top L1/L2 Financials

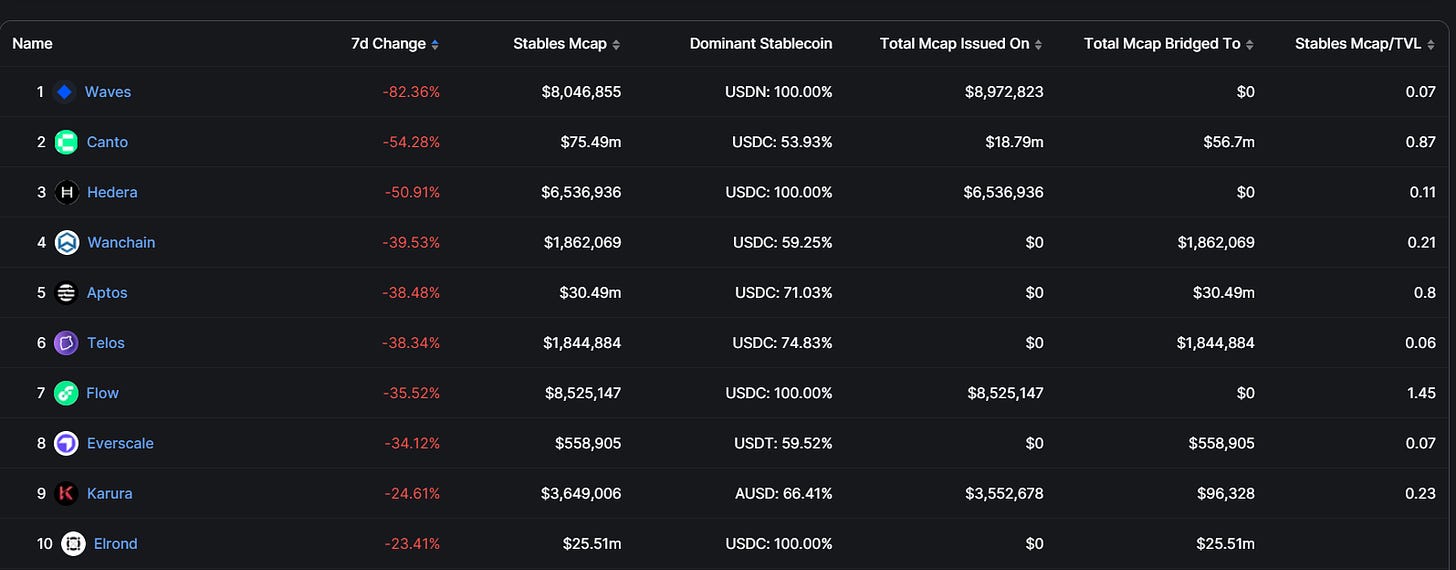

Fees-Generated

-

ETH

-

BTC

-

BNB

-

Optimism

-

Polygon

Revenue

-

ETH

-

Tron

-

Filecoin

-

Polygon

-

BNB

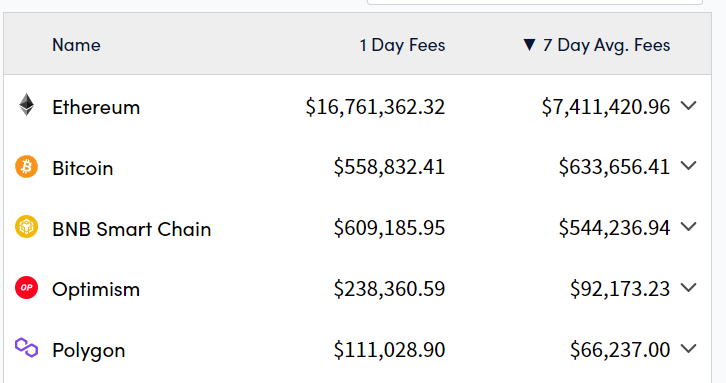

Earnings

-

ETH

-

Tron

-

Arbitrum

-

SX

-

Stellar

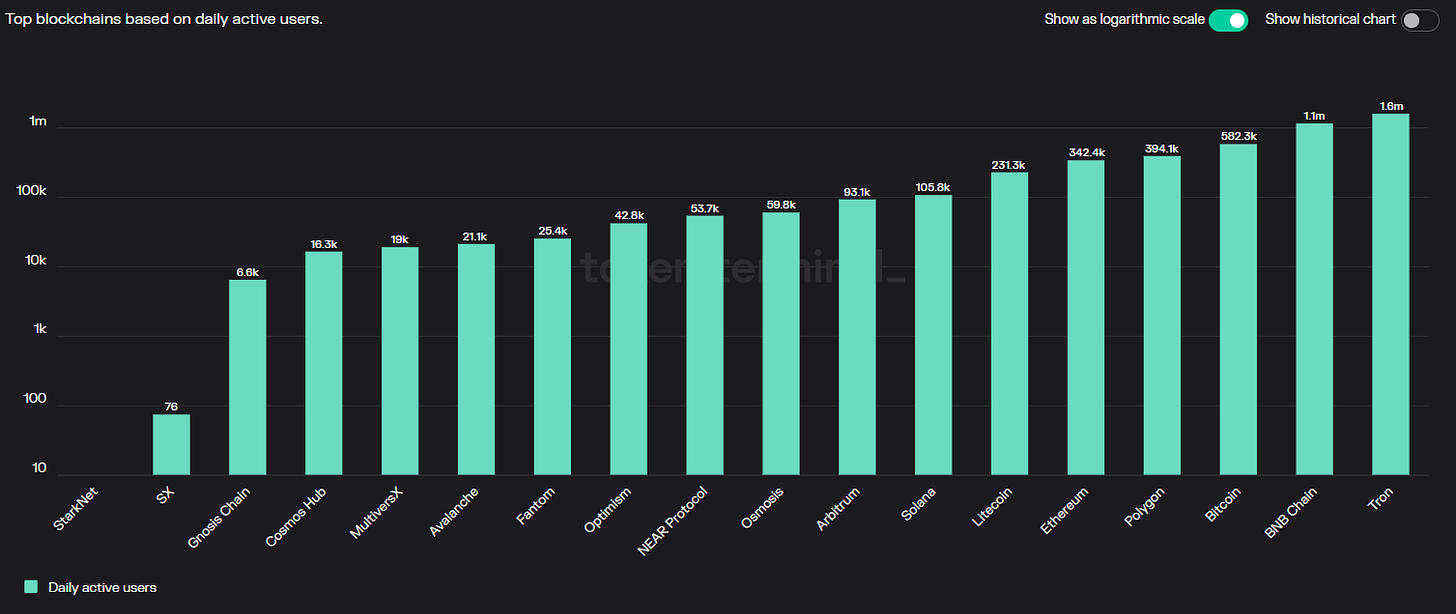

DAUs

-

Tron

-

BNB

-

BTC

-

Polygon

-

ETH

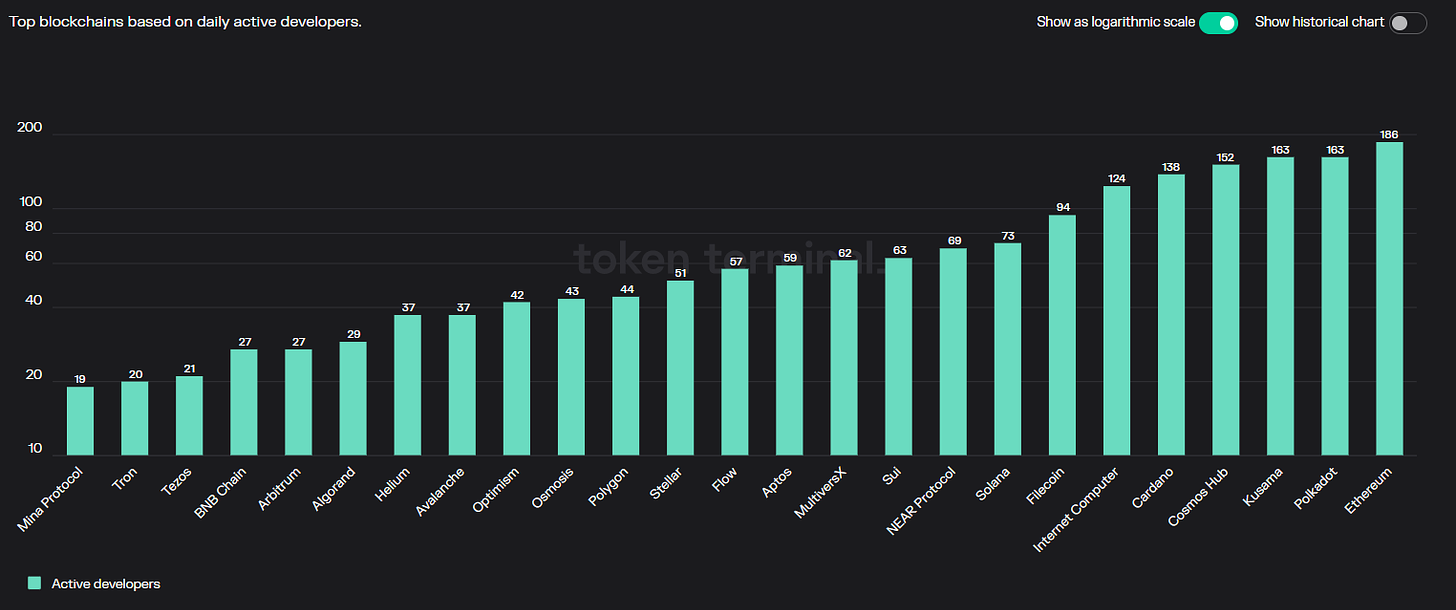

Active Developers

-

ETH

-

Polkadot

-

Kusama

-

Cosmos

-

Cardano

4. Top DAPP Financials

Fees-Generated

-

Uniswap

-

Lido

-

GMX

-

Blur

-

Convex

Revenue

-

dYdX

-

GMX

-

Maker

-

Lido

-

Pancakeswap

Earnings

-

dYdX

-

GMX

-

Maker

-

Gains

-

ENS

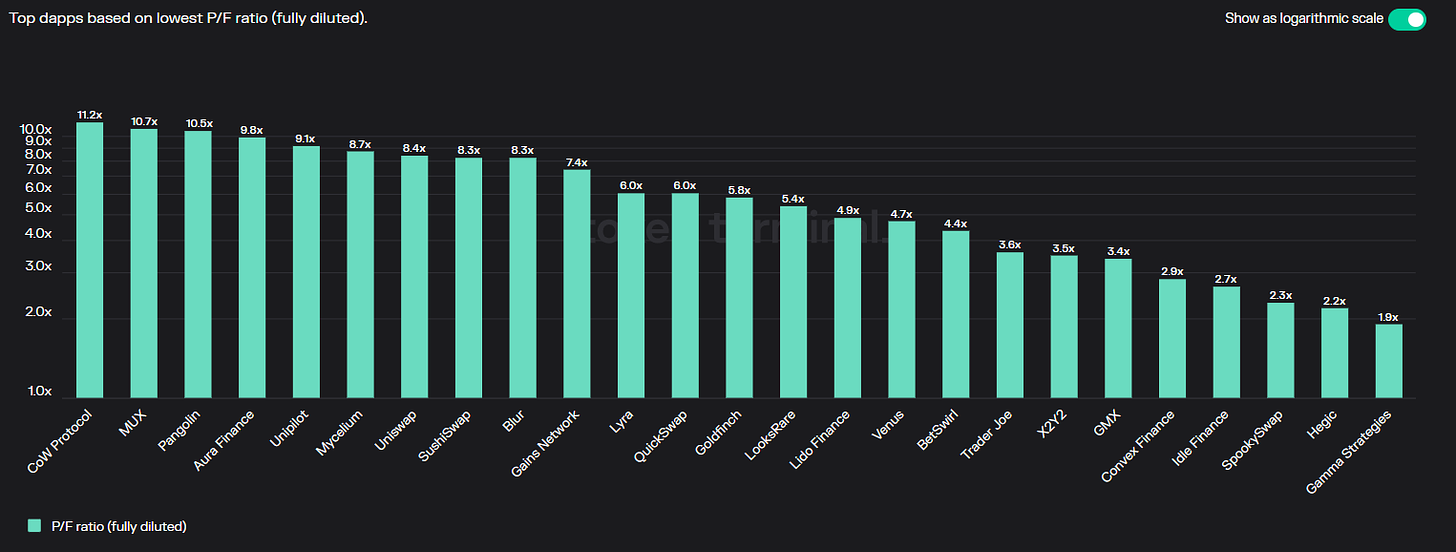

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

Gamma

-

Hegic

-

Spookyswap

-

Idle

-

Convex

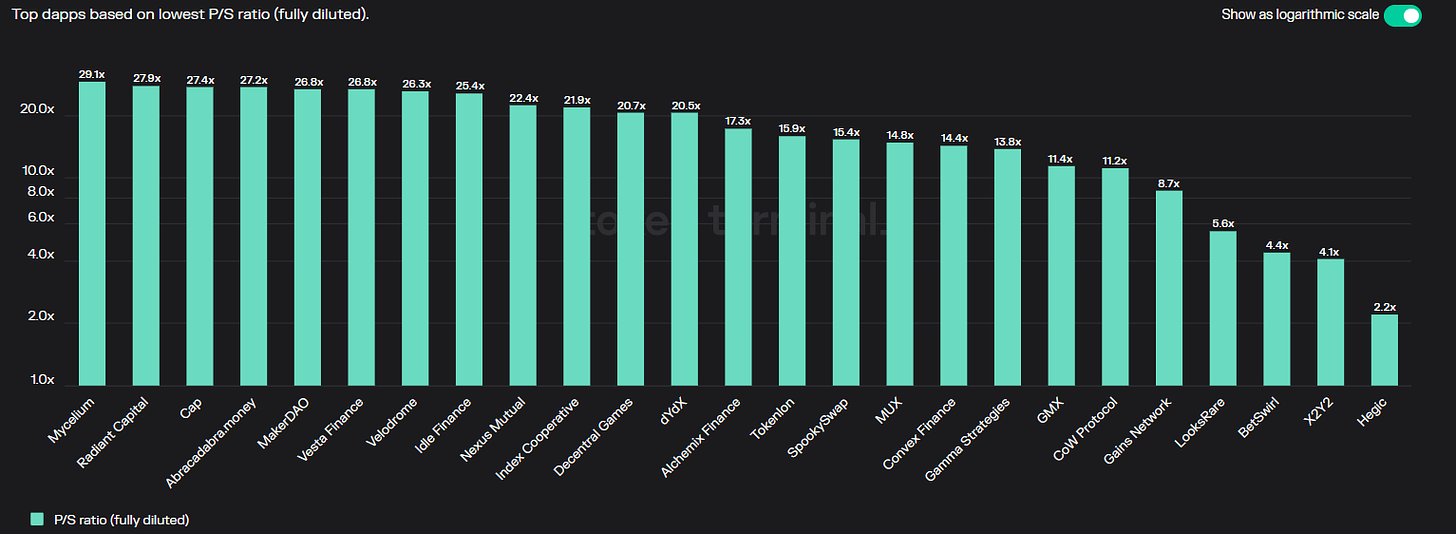

P/S ratio

FDV mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

Hegic

-

X2Y2

-

BetSwirl

-

Looks

-

Gains

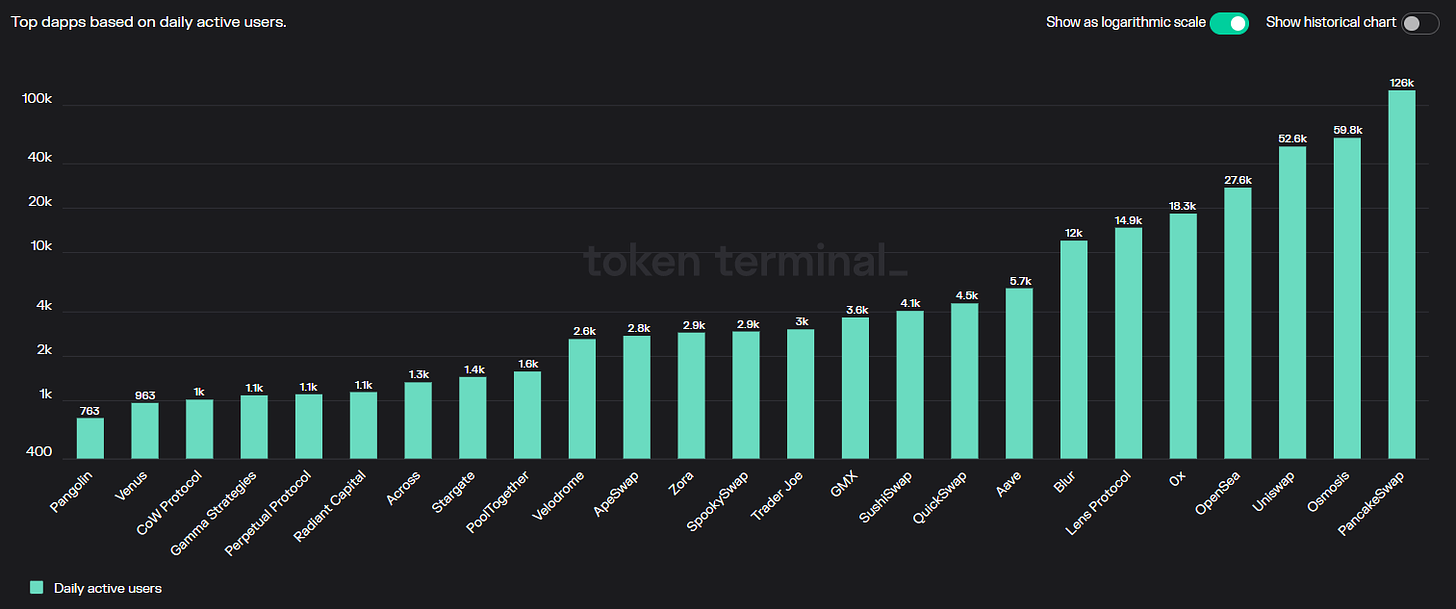

DAUs

-

Pancakeswap

-

Osmosis

-

Uniswap

-

OpenSea

-

0x

5. Movement Analysis

Stablecoin flows:

-

Total Stablecoin market is down -2.30% this week as Tradfi bank run cascaded to the stablecoin market this weekend.

-

All stablecoins, other than USDT and BUSD, have depegged over bank run fears.

-

Circle just released their statement regarding USDC and SVB here: https://www.circle.com/blog/an-update-on-usdc-and-silicon-valley-bank

https://twitter.com/jerallaire/status/1634650432910901249?s=20

Smart Money movements:

- Discontinued from this week onwards

L1/L2 movements:

-

The majority of L1/L2s are red this week with more carnage expected over the next few days while the whole SVB situation gets resolved.

-

BSC has the smallest change as BUSD remains relatively stable.

-

A silver lining from all these is that ETH turned deflationary this week:

DAPP movements:

-

AMMs and PERP dex are printing this week due to the increased volatility from this depeg event.

-

Makerdao’s balance sheet remains relatively strong with enough collateral to back outstanding $DAI.

https://twitter.com/MakerDAO/status/1634410047592620034?s=20

-

While all this carnage ensues, BTC and ETH remain relatively strong all things considered compared to the FTX debacle.

6. TLDR

-

Contagion is spreading from Tradfi to the Crypto markets. Low liquidity weekend exacerbated the issue and caused majority of stablecoins to depeg.

-

Monday (13 Mar 23) will be extremely important, but I am confident Circle will come out ok and USDC will repeg to $1 next week.

-

But as always nothing is confirmed, always play it safe by spreading out your stablecoins to USDT/BUSD/DAI or convert them all to BTC/ETH and wait this out on the sidelines.

-

Stay safe and manage your risk anon, will see you on the other side next week.

Conclusion

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives like this.

Credits: